Beruflich Dokumente

Kultur Dokumente

Edu Loan Appla

Hochgeladen von

Casey Jones0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33 Ansichten13 Seitenela

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenela

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

33 Ansichten13 SeitenEdu Loan Appla

Hochgeladen von

Casey Jonesela

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 13

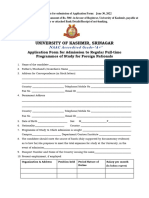

COMMON EDUCATION LOAN APPLICATION FORM FOR LOAN

AMOUNT MORE THAN Rs.4.00 LACS

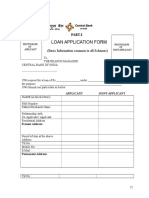

PART-I

LOAN APPLICATION FORM

(Basic Information Part 1)

To,

THE BRANCH MANAGER

-----------------------------------

------------------------------------

I/We request for a loan of Rs.________________ under ___________________ Scheme for the

purpose ________________________________________________________.

I/We furnish our particulars as below.

APPLICANT CO-APPLICANT

NAME (in block letters)

PAN Number( REASON IF YOU DO

NOT HAVE A PAN CARD)

Fathers/Husbands Name

Relationship with

Co-Applicant / Applicant

Residential Address

Present Address: bungalow/Row

House/Flat/Other (if rented please

specify rent/month)

PHOTOGRAPH

OF

CO-APPLICANT

PHOTOGRAPH

OF

APPLICANT

Period of stay at the above

Address

Tel No.:

Mobile No.:

E Mail :

Permanent Address:

bungalow/Row House/Flat/Other

(if rented please specify

rent/month)

Status of present address owned/rented/others owned/rented/others

Tel No.:

E Mail:

Status of Resident Resident/Non Resident Resident/Non Resident

AGE

DATE OF BIRTH( Proof of age)

SEX MALE / FEMALE MALE / FEMALE

MARITAL STATUS MARRIED/UNMARRIED MARRIED/UNMARRIED

Category SC/ST/OBC/GEN/Minority SC/ST/OBC/GEN/Minority

Nationality

No of Dependants

Children

Others

Children

Others

Educational Qualification

DETAILS OF OCCUPATION / PROFESSION / BUSINESS

PARTICULARS

Name of Employer/

Nature of Business/Profession

Address with telephone number of

Employer /Business/Profession

If employed Designation and

Employee number

No of years in present

occupation/Business/profession

Length of service

Date of Retirement

INCOME STATEMENT

Gross salary/Income per month

(salary sheet / I.T. Return, form

No.16 attached)

Deductions Income Tax

Professional Tax

Provident Fund

Insurance Premium

Other statutory deductions

Net Salary / Income p.m.

Other Income if any

(Proof Attached)

DETAILS OF BANK ACCOUNTS

Name of the Bank/Branch

Type/s of the Account

(Savings/RD/FD/Current etc.

please specify)

Account Number/s

Since When

Average credit balance for last 6

months

DETAILS OF EXISTING LOAN FROM A BANK

Name of Bank/Branch

Type of Loan Availed

Amount of loan Availed

Present outstanding

Security Offered

Repayment Plan

Amount of Default if any

DETAILS OF OTHER LIABILITIES

Loans from Employer.

Loans from friends/liabilities.

Materials/Assets purchased from

the seller on credit.

Other liabilities.

Total

IF CREDIT CARD HOLDER/S DETAILS OF CREDIT CARD/S

Name of Issuing Bank/Agency

Credit Card number

Expiry Date

Credit Limit

Present O/S Amount

DETAILS OF ASSETS

Cash

Deposits with Bank

Immovable assets/Properties

with address & value

Movable assets

Investments (Specify each)

Others

(Please specify)

TOTAL

Net worth

PROPOSED PERIOD OF REPAYMENT

I/we declare that all the particulars and information given in the application /annexure are true, accurate,

complete and up to date in all respects and I/We have not withheld any information and same shall form the

basis of the loan Central Bank of India may consider to me/us. Bank is at liberty to take any such action as it may

deem fit if my/our statements are found to be untrue. I/We confirm that the funds will not be used for

speculative/illegal or anti social purposes. I/We confirm that I/we had no insolvency proceedings against me/us

nor have I/We ever been adjudicated insolvent. I/We agree that my/our loan shall be governed by rule of

Central Bank of India, which may be in force from time to time. The Central Bank of India reserves the right to

reject the loan application without providing any reason. I/We authorize Central Bank of India or its agents to

make references and enquiries relative to the information in the application which Central Bank of India consider

necessary. I/We undertake to inform Central Bank of India regarding change in my/our residence/employment

and to provide any further information that the bank may require. I/we understand that certain particulars given

by me/us are required by the operational guidelines governing Banking Companies. I/we authorize Central Bank

of India to exchange, share, or part with all the information relating to my/our loan details/repayment history /

information to other Central Bank branches / Banks / Financial Institutions / RBI / CIBIL / Credit Bureau /

Agencies / Statutory Bodies as may be required and shall not hold Central Bank of India or/& its agents liable for

use of this information. Central bank of India reserves the right to retain the photographs & documents

submitted with this application and will not return the same to the applicant/s. I/We also declare that I am/we

are not related to any director of the bank or any other Bank. I/We confirm that I/We have not defaulted in

repayment of loan taken from your bank/other banks nor entered in to compromise settlement as

borrower/guarantor.

Place: Signature of the Applicant

Date: Signature of the Co-Applicant

Signature of Guarantor (if required)

BASIC INFORMATION PART-II

Sl Particulars Details

a.

Proposed course of Study

Course approved by

UGC,GOVT,AICTE,AIBMS,ICMR,DEPT OF

ELECTRONICS,OTHERS

DEGREE /DIPLOMA /CERTIFICATE

AWARDED AFTER COURSE COMPITION

DATE OF COMMENCEMENT OF COURSE

WHETHER THE ADMISSION OF COURSE IS

THROUGH ENTERANCE TEST/MERIT

BASED SELECTION

b.

Duration of Course Years Full time Part time

c.

Name and address of the College /

Institution in which the student intends

to join.

d.

Name of the University/Recognised

Authority to which the college/ institute

is affiliated.

e.

Has the student been admitted into the

above College /Institute / University or

accepted for the Course? If so, certified

copy of admission/ acceptance Letter

should be attached

f.

Is the applicant attending any college or

Institute at present? If so, furnish full

particulars.

g.

No. of earning members in the Family &

their total income.

h.

Whether the student has any working

experience? If yes, please give details.

i.

Whether the student will take up any

part-time employment during study? If

yes, please give details.

i.

Year of retirement of father Guardian (if

in service only)

k.

Summary of fees own source and loan

require Year wise

l.

Caution deposit/building fund/refundable

deposit subject to condition that the

amount does not exceed 10% of the total

tuition fee for the entire course.

m.

Please specify in brief how the

completion of the course is going to help

the student in improving his prospects of

earning his livelihood.

1 Expected income per month

2. Anticipated monthly expenses

3.Amount available to repay the loan

STUDENTS ACADEMIC RECORD:

Name of the

examination from

SSC or equivalent

onwards

High School Higher

Secondary

Graduation Post

Graduation

Others

(Please

specify)

Name of the School/

College

Medium of

instruction

Examination

authority

Month & year of

passing

Whether passed in

the first attempt

Aggregate marks

first attempt

Out of total marks

Percentage of marks

Rank/Class/Div

obtained

Scholarship/ Prizes

won for academic

distinction.

PARTICULARS OF FINANCIAL REQUIREMENT (year wise) OF THE COURSE

Studies in India Rs Studies in abroad Rs.

Admission fee Total fees for ______

per year

Term Fee for ___years Books, stationery,

instrument &

equipment

Books, stationery,

instruments, equipment

examination fees

Boarding & lodging @

___________ per year

for _____________

years

Boarding & lodging @

Rs.______ per month for

________ years

Total i.e. Equivalent in

Rs.

Total (enclose evidence) Air passage (one way

only)

Total (enclose evidence)

SOURCE OF FINANCE

1. Non repayable scholarship(s) at Rs._____________ p.a. for

____________ years

Rs.__________________

2. Loan scholarship(s) and or other repayable financial

assistance from other sources

Rs.__________________

3. Contribution of Parent/ Guarding and /or other Members of

the family / relatives towards total expenses

Rs.__________________

4. Amount of loan required from the bank Rs.__________________

5. Earning of the student(if any) Rs.__________________

Total Rs.__________________

Particulars of Insurance Policy (ies) (In the case of father/ guardian/ applicant only)

Names of the insured Policy No Date Date(s) of

Maturity

Amount of

yearly

premium

Date of last

premium

paid

ADDITIONAL INFORMATION TO BE FURNISHED BY STUDENTS UNDERTAKING STUDIES ABROAD

a. Amount of foreign exchange required.

b. Foreign currency

c. Rupee equivalent

d. Have you obtained the necessary passport, /visa etc?

Yes/No.(if yes, give reference)

e. Do you intend to take up any part time employment during

the course of studies abroad? If so, give particulars.

f. What are your likely Prospects on your return to India?

DECLARATION

We hereby declare that the information furnished against the foregoing items is true to the best of

our knowledge and belief.

We also undertake to inform the bank immediately any change in our employment details, address,

telephone number including mobile no. etc. for both local and permanent address,

Signature of Father/Guardian

Place Signature of student

Date Signature of Guarantor (if required)

PHOTOGRAPH OF

GUARANTOR

I___________________________________S/o Shri________________________am giving my

consent for giving guarantee to Shri__________________________S/o Shri__________________

For education loan of Rs.________________

My details are as under:-

Particulars Guarantor-I Guarantor-II

Name

Address

Occupation

Net worth

Amount of guarantees already

given

INCOME STATEMENT

Gross salary/Income per month

(salary sheet / I.T. Return, form

No.16 attached)

Deductions: Income Tax

Professional Tax

Provident Fund

Insurance Premium

Other statutory deductions

Net Salary / Income p.m.

Other Income if any (Proof to be

attached)

DETAILS OF BANK ACCOUNTS

Name of the Bank/Branch

Type/s of the Account

Account Number/s

Since When

Average credit balance for last 6

months

DETAILS OF EXISTING LOAN FROM CENTRAL BANK/OTHER BANKS

Name of Bank/Branch

Type of Loan Availed

Amount of loan Availed

Present outstanding

Security Offered

Repayment Plan

Amount of Default if any

DETAILS OF OTHER LIABILITIES

Loans from Employer.

Loans from friends/liabilities.

Materials/Assets purchased from

the seller on credit.

Other liabilities.

IF CREDIT CARD HOLDER/S DETAILS OF CREDIT CARD/S

Name of Issuing Bank/Agency

Credit Card number

Expiry Date

Credit Limit

Present O/S Amount

DETAILS OF ASSETS

Cash

Deposits with Bank

Immovable assets/Properties

With address & value

Movable assets

Investments (Specify each)

Others

(Please specify)

TOTAL

Net worth

DETAILS OF COLLATERAL SECURITY OFFERED:

Description of Property

(With full Postal Address)

Owner of the Property Value of Property

DETAILS OF COLLATERAL SECURITY OTHER THAN PROPERTY

Place

Date Signature of Guarantor

Documents required at the time of processing and sanction

Education Loan(Loan above Rs.4.00 lacs)

1. Application Form in Part-I and Part-II-All columns to be filled in properly.

2. Identity proof Passport / PAN card / Voters card / Driving License (Any one of above)

3. Residential Proof (should not be older than three months): Passport/ Driving License/

Electricity Bill/Any official Communication (Any one)

4. Educational Qualification Certificates: Marks sheet of class X, XII, Graduation, Post

Graduation etc.

5. Estimation/fee structure of college-Proforma Invoice/Bill of Laptop/Motor cycle, if required.

6. Proof of income-Salary certificate/ IT returns last 3 years/Assessment orders (of the

Parents/Guardian/Co-Applicant, where applicable).

7. Caste certificate in case of SC/ST/Minority student, if wishes to avail interest concession.

8. Passport size photograph 3 numbers

9. Copy of admission or selection letter in college /educational institute with year wise and item

wise break up of expenditure.

10. Course approved by UGC, GOVT., AICTE, AIBMS, ICMR, DEPARTMENT OF ELECTRONICS,

OTHERS (i-20 for abroad).

11. Statement of Bank Account for last 6 months - parent and guarantor(s) (if required).

12. Passport/visa (if required).

12. Copy of letter confirming scholarship/Free ship, student ship etc.

13. Duration of course (document evidence).

14. Details of collateral security offer to secure loan (if required).

15. Asset and liability statement of parents/guarantor (if required).

16. Consent letter of Guarantor for giving Guarantee in favour of the borrower.

17. Kindly bring with you one copy of above documents, duly singed by you along with the

originals for verification.

Das könnte Ihnen auch gefallen

- Home Loan Application FormDokument4 SeitenHome Loan Application FormSudeep ChatterjeeNoch keine Bewertungen

- Loan Application Form: Part-I Cent VidyarthiDokument8 SeitenLoan Application Form: Part-I Cent VidyarthiSandeep ChowdhuryNoch keine Bewertungen

- SBI Scholar Loan - Application FormDokument4 SeitenSBI Scholar Loan - Application FormHimansh RakhejaNoch keine Bewertungen

- Employee Details:: Application Form For "Award of Scholarship & Reimbursement of Admission and Tuition Fee"Dokument4 SeitenEmployee Details:: Application Form For "Award of Scholarship & Reimbursement of Admission and Tuition Fee"KbNoch keine Bewertungen

- University of Kashmir, Srinagar: NAAC Accredit Ed Grade - A+'Dokument3 SeitenUniversity of Kashmir, Srinagar: NAAC Accredit Ed Grade - A+'Junaid HamidNoch keine Bewertungen

- Home Loan Application FormDokument2 SeitenHome Loan Application Formanon_300020848Noch keine Bewertungen

- SEED Application FormDokument4 SeitenSEED Application FormPratik V PandhareNoch keine Bewertungen

- LoanformDokument4 SeitenLoanformShreyans ShahNoch keine Bewertungen

- Cent VidyarthiDokument3 SeitenCent Vidyarthigcadvisers100% (1)

- Indianoil Educational Scholarship Scheme - 2013 (General Instructions On Submission of Documents by Applicants)Dokument3 SeitenIndianoil Educational Scholarship Scheme - 2013 (General Instructions On Submission of Documents by Applicants)flower87Noch keine Bewertungen

- IPMApplicationForm2014 19batchDokument4 SeitenIPMApplicationForm2014 19batchVikas BhardwajNoch keine Bewertungen

- Education Loan FormDokument6 SeitenEducation Loan FormPradeep Singh PanwarNoch keine Bewertungen

- Certificate From The Sindh Bank Limited Branch ManagerDokument7 SeitenCertificate From The Sindh Bank Limited Branch ManagerSumair KhanNoch keine Bewertungen

- Cent VidyarthiDokument4 SeitenCent VidyarthiKrish BhoutikaNoch keine Bewertungen

- Appln Part IIDokument3 SeitenAppln Part IIAakash GargNoch keine Bewertungen

- Academic and Financial Acceptance 20201027Dokument1 SeiteAcademic and Financial Acceptance 20201027Sb thangNoch keine Bewertungen

- Loan Application Template PDFDokument5 SeitenLoan Application Template PDFaslan firstNoch keine Bewertungen

- Application FormDokument3 SeitenApplication FormsmilealwplzNoch keine Bewertungen

- Application Form For Endowment Scholarship PDFDokument4 SeitenApplication Form For Endowment Scholarship PDFnompk100% (10)

- Scholar Loan Brochure IIIT2682022Dokument8 SeitenScholar Loan Brochure IIIT2682022Tilak RaazNoch keine Bewertungen

- Quaid-I-Azam University Office of The Students' Financial AsistanceDokument5 SeitenQuaid-I-Azam University Office of The Students' Financial AsistancebookieNoch keine Bewertungen

- Ind Loan FormDokument2 SeitenInd Loan FormVaradaraja PerumalNoch keine Bewertungen

- APPLN Part IDokument5 SeitenAPPLN Part IAakash GargNoch keine Bewertungen

- Apr.12 - 871 App Nri FormDokument10 SeitenApr.12 - 871 App Nri FormsnkrmNoch keine Bewertungen

- Manasvi Merit Applicaiton FormDokument7 SeitenManasvi Merit Applicaiton FormAnil KumarNoch keine Bewertungen

- Certificate FormatsDokument12 SeitenCertificate FormatsrajkalamaeroNoch keine Bewertungen

- LHS ExemptionForm Final-1Dokument6 SeitenLHS ExemptionForm Final-1rayghanaachmatNoch keine Bewertungen

- Canara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDokument3 SeitenCanara Bank 1 Floor, Gulmohar Building, Central Area, IIT Bombay, Powai Campus, Mumbai - 400076, IndiaDesikanNoch keine Bewertungen

- University of Sahiwal, Sahiwal: Fee Concession/Financial Assistance FormDokument4 SeitenUniversity of Sahiwal, Sahiwal: Fee Concession/Financial Assistance FormSajid MunirNoch keine Bewertungen

- IMD Alumni Scholarship Program Form Spring 2024Dokument3 SeitenIMD Alumni Scholarship Program Form Spring 2024Inam HassanNoch keine Bewertungen

- Pkfas Application Format RenewalDokument5 SeitenPkfas Application Format Renewalmanisegar100% (1)

- PDF Application Form of IIMDokument7 SeitenPDF Application Form of IIMSagar RajpuraNoch keine Bewertungen

- Employment Pass / S Pass Appeal FormDokument6 SeitenEmployment Pass / S Pass Appeal FormHso Hwa KyaingNoch keine Bewertungen

- 2012 Application FormDokument3 Seiten2012 Application FormSaran Dass ReddyNoch keine Bewertungen

- Service Agreement - Usa 1Dokument4 SeitenService Agreement - Usa 1safwaanahmedNoch keine Bewertungen

- Seicom DeledDokument6 SeitenSeicom Deledapi-243792732Noch keine Bewertungen

- Indian Bank - Education Loan Application FormDokument2 SeitenIndian Bank - Education Loan Application Formabhishek100% (4)

- Bob Education Loan Cheklist of Documetns Application FormDokument8 SeitenBob Education Loan Cheklist of Documetns Application FormVISHESHA SADUNoch keine Bewertungen

- Application Form Application Form: Gateway Toa Bright Career....Dokument4 SeitenApplication Form Application Form: Gateway Toa Bright Career....Ankit TiwariNoch keine Bewertungen

- Sample Dsa Application FormDokument4 SeitenSample Dsa Application FormANUJ KUMAR100% (2)

- Admission Form For Institute of Actuaries of India (IAI)Dokument5 SeitenAdmission Form For Institute of Actuaries of India (IAI)UtsavSabharwalNoch keine Bewertungen

- Nmims New LeafletDokument2 SeitenNmims New LeafletGagan kr. SinghNoch keine Bewertungen

- For Office Use Only: Last Date of Receipt: 5.00 PM On 31 OCTOBER 2007Dokument10 SeitenFor Office Use Only: Last Date of Receipt: 5.00 PM On 31 OCTOBER 2007mrgkkNoch keine Bewertungen

- Non Face To Face Account Opening FormDokument10 SeitenNon Face To Face Account Opening FormAlvin Samuel PandianNoch keine Bewertungen

- Gautam Buddha University: Application FormDokument4 SeitenGautam Buddha University: Application FormAakashNoch keine Bewertungen

- Data2 Dapimage 1409021911 CreditCardApplication1409021911Dokument4 SeitenData2 Dapimage 1409021911 CreditCardApplication1409021911Michel ThompsonNoch keine Bewertungen

- Application Form: 1. Personal DetailsDokument10 SeitenApplication Form: 1. Personal DetailsMahi Nidhi ManojNoch keine Bewertungen

- Name of The Post - Pay Scale Rs. - Employment Notice No.Dokument6 SeitenName of The Post - Pay Scale Rs. - Employment Notice No.ramniranjan88Noch keine Bewertungen

- Financial Grant Application Form New Students AUSDokument6 SeitenFinancial Grant Application Form New Students AUSFarah JebrilNoch keine Bewertungen

- Highlights of Education Loan To Iim StudentsDokument4 SeitenHighlights of Education Loan To Iim StudentsChinkal NagpalNoch keine Bewertungen

- SBI HSG Loan Application FormDokument5 SeitenSBI HSG Loan Application Formrajesh.bhagiratiNoch keine Bewertungen

- Resostart Class VDokument2 SeitenResostart Class VSwapan Kumar MajumdarNoch keine Bewertungen

- Vidya Lakshmi Common Education Loan Application FormDokument4 SeitenVidya Lakshmi Common Education Loan Application FormPondy UnionNoch keine Bewertungen

- NSF Application Form 2011Dokument11 SeitenNSF Application Form 2011PrateekAgarwalNoch keine Bewertungen

- Application Form For Admission As A Recognised Student 2013-14Dokument14 SeitenApplication Form For Admission As A Recognised Student 2013-14Celia MillerNoch keine Bewertungen

- Application GPSCDokument9 SeitenApplication GPSCpednekarprakashNoch keine Bewertungen

- Clerk (Income Maintenance): Passbooks Study GuideVon EverandClerk (Income Maintenance): Passbooks Study GuideNoch keine Bewertungen

- Study Permit: Working While Studying, Exemptions & How to ApplyVon EverandStudy Permit: Working While Studying, Exemptions & How to ApplyNoch keine Bewertungen

- Insurance Broker: Passbooks Study GuideVon EverandInsurance Broker: Passbooks Study GuideNoch keine Bewertungen