Beruflich Dokumente

Kultur Dokumente

Hyflux - Business Strategy

Hochgeladen von

jerrytansgCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Hyflux - Business Strategy

Hochgeladen von

jerrytansgCopyright:

Verfügbare Formate

Page | 1

Table of Contents

Question 1 .................................................................................................................................. 2

Question 2a ................................................................................................................................ 6

Question 2b ................................................................................................................................ 9

Question 3a .............................................................................................................................. 11

Question 3b .............................................................................................................................. 13

Question 4 ................................................................................................................................ 16

Question 5 ................................................................................................................................ 19

Works Cited ............................................................................................................................. 20

Page | 2

Question 1

The external environment presents both opportunities and threats for Hyflux Limited

(Hyflux). It consists of the macro and industry environment, to which PESTEL and Porters 5

Forces will be applied respectively to identify their potential influences on the groups

strategic competitiveness and its ability to earn above-average returns (Johnson, Whittington,

Angwin, Regnr, & Scholes, 2014).

Macro-environment (PESTEL Analysis)

Political-Legal Factors

Globally, water scarcity as a consequence of environmental pollution and rapid economic and

population growth offers greater opportunities for firms to expand into foreign markets. The

potential for growth is further enhanced with government imposition of anti-pollution

standards for wastewater treatment internationally, along with strong financial support from

the same in local R&D and municipal projects to develop sustainable water supply (Buche,

Kroll, Wee, & Chua, 2012, p. 9 & 18).

Economic Factors

The global industrial and municipal water/wastewater markets continue to drive the industry

with a higher proportion from China, India and the MENA region as they represent those

countries that are most affected by the water crisis. Of particular interest is in the area of

water desalination, where the economic potential is enormous. That being said, an economic

downturn can easily dampen the expansion of the water treatment industry. This is evident in

the 2008 global credit squeeze, when many firms were forced to liquidate their assets as a

result of cash flow issue. Typically, only those on municipal projects were spared of the

predicaments (Buche, Kroll, Wee, & Chua, 2012, pp. 3, 4 & 18).

Sociocultural Factors

While the rapid growth in global population and industrialisation has helped fuel the growth

in the municipal and industrial water markets, the drawbacks are also significant, with

associated social costs such as severe water shortages as well as the environmental effects of

pollution affecting numerous cities (Buche, Kroll, Wee, & Chua, 2012, p. 4 & 18). On the

positive side, the fast-growing tertiary sector in China has produced an abundance of

qualified and low-cost engineering talents, providing the necessary resources required to

support companies in their market expansion plans.

Page | 3

Technological Factors

The cost and scope of applying membrane filtration technology for municipal and industrial

use have been greatly improved over the years due largely to technological innovations.

Likewise, alternative innovative methods have also been developed for similar purpose. Also,

while generous R&D budgets are vital to creating innovations, small start-ups often lack the

financial capacity to conduct such activities. Accordingly, the government is providing strong

financial support for local industrial R&D to subsidise costly outlays (Buche, Kroll, Wee, &

Chua, 2012, p. 9).

Conclusion

From the above findings, Hyflux operates in a highly lucrative environment endowed with

abundance of business opportunities. The economic potential is enormous, with high

industrial and municipal demand along with strong government support. Following this, the

subsequent analysis will be to understand the water treatment industry, and it shall be focused

on the Porters 5 Forces to determine its overall attractiveness.

Industry Environment (Porters 5 Forces)

Threat of New Entrants

Threat of New Entrants is LOW when: High Low

Economies of scale are:

Product differentiation is:

Capital requirements are:

Switching costs are:

Ease of access to distribution channels is:

Cost disadvantages are:

Government policies creating barriers are:

The threat of new entrants is low as there are high entry barriers from scale economies,

capital requirements and high switching costs. Essentially, large incumbent firms are able to

exploit large-scale production to produce at lower unit costs which new entrants find hard to

match. Moreover, the start-up costs are high because of the capital-intensive nature of the

industry and this serves to discourage small scale entrants from entering.

Page | 4

Bargaining Power of Suppliers

Power of Suppliers is LOW when: High Low

Concentration of suppliers relative to buyer industry is:

Availability of substitute products is:

Importance of customer to the suppliers is:

Differentiation of the suppliers products and services is:

Switching costs of the buyer are:

Threat of forward integration by the supplier is:

The bargaining power of suppliers is low due largely to the vast number of suppliers with

little differentiation available. Consequently, the switching cost is also low for the same

reason as buyers are able to readily switch their purchasing preference from one supplier to

another.

Bargaining Power of Buyers

Power of Buyers is HIGH when: High Low

Concentration of buyers relative to suppliers is:

Switching costs are:

Product differentiation of suppliers is:

Threat of backward integration by buyers is:

Extent of buyers profits is:

Importance of suppliers input to quality of buyers final product is:

While switching costs are high, the bargaining power of buyers remains high as there are

likely to be high buyers concentration. Moreover, their purchases account for the majority of

total sales, and this automatically accords them with high bargaining power.

Threat of Substitutes

Threat of Substitute Products is LOW when: High Low

The differentiation of the substitute product is:

Rate of improvement in price-performance relationship of substitute

product is:

Alternative methods of water treatment are available at higher prices and this makes them

unattractive options. Besides, the higher prices are possibly the result of higher production

Page | 5

costs as they offer no significant advantages. Viewed in this light, the threat of substitutes is

deemed to be low.

Intensity of Competitive Rivalry

Intensity of Competitive Rivalry is HIGH when: High Low

Number of competitors is:

Industry growth rate is:

Fixed costs are:

Storage costs are:

Product differentiation is:

Switching costs are:

Exit barriers are:

Strategic stakes are:

Rivalry is high with the presence of many competitors. Moreover, the intensity is further

accentuated with the associated high costs that dramatically raise the strategic stakes for the

incumbent firms. The only relief stems from the high industry growth rate which helps lower

the level of intensity.

Conclusion

The overall industry for water treatment remains attractive with huge economic potential.

Nevertheless, there are concerns over the high bargaining power of the buyers and the high

intensity of competitive rivalry, as they are likely to have an impact on the firm in the distant

future.

Environmental Analysis

The external environment that Hyflux operates in offers a good mix of challenges and

opportunities. As the industry continues to be highly economically viable, the company

should seek to avert those threats while capitalising on the market opportunities to increase its

bottom line. In the following analysis, the focus will be to assess Hyfluxs internal

environment to identify those core competencies that will provide it with competitive

advantages over its rivals.

Page | 6

Question 2a

Strategic capabilities are those unique combinations of Hyfluxs resources and competences which may provide it with competitive advantages

over its competitors. To identify these strategic capabilities, the focus is on the firms portfolio of resources and competences that will form the

dimensions in which they are configured. Also, to qualify as core competences, these capabilities will have to fulfil a four criteria test which will

be illustrated below in the VRIO framework.

T

h

r

e

s

h

o

l

d

Resources: what we have (nouns) Type Competences: what we do well (verbs)

Water-related infrastructure assets Physical

Owns and operates several water and wastewater treatment plants under BOT

and/or TOT agreements globally

State-of-the-art infrastructure and

facilities

Physical Facilitate conduct of activities in R&D, design, fabrication and assembly

Human Resource Management Human

Access to human resources with both technical and managerial expertise

necessary for global expansion

Conducts regular trainings and job rotations to equip employees with critical

knowledge, skills, and competencies necessary for companys growth strategy

Government grants and fundings Financial

Access to government grants and fundings to subsidise R&D activitie

Protects companies on municipal projects against tough economic climates

Sound financial performance Financial

Maintains high profitability through securing lucrative industrial and municipal

projects

Low gearing through acquiring funds from mainboard listings and HWT

Page | 7

D

i

s

t

i

n

c

t

i

v

e

Branding Physical

Creates high brand awareness through numerous successful large-scale high-

value industrial and municipal projects

In-house product development and

manufacturing

Human

Conducts in-house R&D activities along with designing and manufacturing of

own proprietary filtration membrane products to better control raw materials,

manufacturing costs, product quality and project turnaround time

R&D alliances with research bodies and tertiary institutions to tap to

complementary firms research expertise and facilities to accelerate growth in

membrane technology

Ability to customise solutions to suit clients diverse needs

Culture and leadership Human

Visionary and enterprising leadership with global mind-set

Strong culture of excellence that encourages teamwork, learning, and innovation

Proprietary products and patents Intellectual Wide range of proprietary filtration membrane products

Table 1: Components of strategic capabilities

Table 1 highlights Hyfluxs components of strategic capabilities. From the above analysis, we have identified several of the firms qualities that

qualify as its strategic capabilities. In the following section, we will put them through the four criteria test of the VIRO framework to determine

their ability to provide the firm with sustainable competitive advantages.

Page | 8

Competence Valuable? Rare? Inimitable?

Supported by the

organisation?

Competitive implications

Water-related infrastructure

assets

Yes Yes No Yes Temporary competitive advantage

State-of-the-art infrastructure

and facilities

Yes Yes No Yes Temporary competitive advantage

Human Resource Management Yes Yes No Yes Temporary competitive advantage

Government grants and

fundings

Yes No No Yes Competitive parity

Sound financial performance Yes No No Yes Competitive parity

Branding Yes Yes Yes Yes Sustained competitive advantage

In-house product development

and manufacturing

Yes Yes Yes Yes Sustained competitive advantage

Culture and leadership Yes Yes Yes Yes Sustained competitive advantage

Proprietary products and

patents

Yes Yes Yes Yes Sustained competitive advantage

Table 2: The VRIO framework

Table 2 illustrates the use of the VIRO framework to assess Hyfluxs level of competitiveness sustained in its strategic resources. As observed

from the above, branding, in-house product development and manufacturing, culture and leadership, and proprietary products and patents

form the strategic competencies that have satisfied the four criteria test. Hyfluxs ability to capitalise on these strengths has provided it with

sustainable competitive advantages over its rivals. That being said, the others are equally important to the companys success, but they are

unable to provide sustainable advantages over the rest.

Page | 9

Question 2b

The SWOT analysis offers a summary of the preceding analyses of Hyfluxs external and

internal environment. Essentially, it highlights its key strengths, weaknesses, opportunities

and threats, which are useful in generating strategic options and assessing future courses of

action.

SWOT Analysis

Strengths Weaknesses

Visionary and enterprising leader with

global mind-set

Strong culture of excellence that

encourages teamwork, learning, and

innovation

Possesses wide range of proprietary

filtration membrane products

In-house product development and

manufacturing allow better control of raw

materials, manufacturing costs, product

quality and project turnaround time

Ability to customise solutions to suit

clients diverse needs

High brand awareness through numerous

successful large-scale high-value

industrial and municipal projects

Small market size and saturated

domestic market resulting in intense

rivalry

Aggressive market expansion strategies

outpace internal organisation growth

Capital-intensive BOT/TOT market

segment present great risk

Human resource issues in international

ventures due to language barriers and

cultural differences

Opportunities Threats

Government imposition of anti-pollution

standards and rapid economic and

population growth drive up demand for

water and waste management

internationally

Emerging countries such as China, India

and the MENA region provide greatest

opportunities for water treatment industry

Global economic crisis hurts demand for

water and waste management

Substitute products (General Electric &

UV pure) offering alternative filtration

solutions present threats to incumbent

firms in industry

Currency risk which is prevalent in

international business undertakings

Page | 10

Availability of large pool of engineering

talents from China

Strong government support and funding

for local R&D and municipal projects

Table 3: SWOT Analysis

Based on the above findings, developing economies such as China, India and the MENA

region offer immense potential for growth. Nevertheless, Hyflux will have to address the

human resource issues along with currency risk for effective expansion into these culturally

and politically diverse regions. With this understanding, the next section will focus on

evaluating its corporate strategy as we attempt to identify the strategic options where Hyflux

has capitalised its strengths on.

Page | 11

Question 3a

A corporate strategy represents a firms strategic directions in consideration to diversify its

product and services into new markets, products or services (Johnson, Whittington, Angwin,

Regnr, & Scholes, 2014). For Hyflux, it pursued 3 pathways to growth during its lifetime:

market penetration, market development and product development.

Market Penetration

In 1992, Hydrochem (later renamed Hyflux) established its foothold in Singapore and the

neighbouring markets by growing its market share through providing water treatments with

traditional membrane technology (MT) brought in from overseas. While it attained

reasonable success in Singapore, it was constrained by the countrys small market size along

with facing considerable competition from several MNCs for the same customer base.

Confronted with domestic saturation within the country, Hydrochem set out to expand its

operations overseas with eyes first set on the China market.

Market Development

In 1993, Hydrochem ventured into China with its existing MT. Through this, the company

was able to enjoy scale economies in its operations. Its business particularly took off when

the Chinese authorities stipulated the compulsory installation of water recycling facilities for

all foreign-owned factories within the country. Along with time, Hydrochem was able to

garner a sizeable client base in China as it began to lay eyes on the municipal water market.

Renamed Hyflux, its first stop was Singapore, as it banked on its MT to leverage on the

governments initiative towards sustainable water supply. Consequently, with its huge

success in municipal projects in Singapore, it paved way for more opportunities into the

overseas market as it went on to secure other municipal projects in China as well as in new

markets such as the MENA region.

Product Development

Hyflux is able to achieve success via its design capabilities in developing its MT for

innovative applications. Through in-house R&D activities and alliances, the company has

developed numerous proprietary filtration membrane systems, which are installed in plants all

over the world. Besides membrane filtration, Hyflux has also acquired new strategic

capabilities through M&E, which allows it to undertake the whole value chain of the water-

related infrastructure. Nonetheless, as project magnitudes and scope grew, the company will

Page | 12

have to be mindful of the project management risk, as new undertakings of large scale and

new ventures regularly run the risk of cost over-runs and delays.

Conclusion

In summary, Hyflux based its corporate strategy to suit its growth needs. However, it is

noteworthy that the company only seeks to expand its business within the boundaries of

related diversification, and not some unfamiliar territory. Consequently, the company is

highly profitable as a result, with its businesses revolving around its capability of being a

provider of integrated solutions.

Page | 13

Question 3b

As earlier discussed, Hyfluxs decision to expand its business globally stems vastly from a

saturated domestic market. Inferring from the case, the company is likely to have pursued

transnational strategy as its international entry mode and the focus is to assess its level of

effectiveness and success.

International Strategy

Transnational strategy involves companies seeking to maximise both local responsiveness

and global integration (Johnson, Whittington, Angwin, Regnr, & Scholes, 2014). For Hyflux,

the high need for local responsiveness stems from the need to tailor solutions to the specific

requirements of customers from different countries along with an understanding of the host

countries macro-environment conditions. Conversely, the high need for global integration is

observed through its exploitation of scale economies by locating majority of its facilities in

China while organising its value-chain activities on a global scale.

Market Selection

For market selection, Hyflux targets those countries with high growth potential based on their

relative attractiveness in relation to the macro environment, competitive threats as well as

multidimensional measures of distance. Accordingly, China was chosen for its similarities in

language, history, culture and interests, as well as economic potential. India and the MENA

region, on the other hand, were likely selected for their economic viability.

Mode of Entry

Hyfluxs entry into the international arena occurred predominantly through a staged

expansion process. Essentially, it entered into the new markets gradually and sequentially to

acquire the necessary knowledge and expertise whilst effectively diffused its risk exposure.

Through licensing, which represented the first step to its business venture, the firm was able

to obtain some local knowledge when it secured the rights to distribute membranes and

membrane filtration plants in Singapore and the neighbouring markets. Accordingly, it also

provided it with the lowest degree of resource commitment.

As Hyfluxs knowledge and experience grew, it began to set its sight on the municipal water

market. However, due to the large project scale, most would only allow firms with robust

financial standings and records to make the tender offer. Hence, Hyflux went around looking

Page | 14

for partners to form joint ventures. Aside from increasing its likelihood of securing the

municipal contracts, it also allowed the complementary firms to tap to each others labour,

finance, technology and management expertise.

Hyflux entered into Chinas municipal water market through wholly-owned subsidiary,

which allowed for full integration of activities across different countries. While it exposed the

firm to tax and currency risk, it was able to effectively transfer them to the investors through

its strategic launch of the Hyflux Water Trust (HWT).

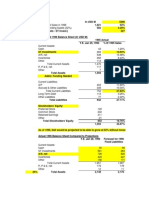

Figure 4: Net Profit Overview

Level of Success

In terms of its level of success, the growth of Hyflux between 2000 and 2008 was

phenomenal. The company had scored high in net profit between year 2000 and 2005 due to

its rapid expansion into China. While the figures plummeted considerably in 2006, it was

largely the result of huge investments in infrastructure in the MENA region which saw a

tremendous increase in its expenses. Nonetheless, its net profit continued to rise sequentially,

reaching a total of $62 million, an impressive increase of 1260% from year 2000.

Conclusion

In summary, Hyflux had performed tremendously well in its international ventures. Through

effective use of its core competencies, the firm was able to offer usage of wide services to the

global markets at attractive prices. Nevertheless, while the overseas markets offered

Page | 15

expansive opportunities, the economic and political risks were unforeseeable, and this may

affect it adversely. That being said, Hyflux was able to understand the geographical markets

through alliances with its various partners, and this formed an essential constituent to making

strategic actions during times of tough economic climate.

Page | 16

Question 4

Innovation and entrepreneurship play an important role in driving the process of economic

development. Indeed, the society would often benefit from synergies between the two. For

Hyflux, its commitment towards environmental innovation has been instrumental in bringing

cost efficiency and innovation to the water treatment industry.

Market Pull

Hyflux identified alternative use for the traditional membrane technology (MT) in

environmental applications. This prompted the company to conduct extensive R&D which

gave rise to the development of a wide range of proprietary filtration membrane products.

Product Innovation

The traditional MT was limited in its applications when Hyflux first brought it into Singapore.

Consequently, the firm focused extensively on product innovation to improve its quality and

expanded its application to other usage.

Process Innovation

Hyflux located its research and manufacturing facilities in China to take advantage of scale

economies. This indicates that the dominant design had already been established and Hyflux

was shifting its focus towards process innovation.

Open Innovation

R&D alliances with research bodies and tertiary institutions were formed to tap to

complementary firms research expertise and facilities to accelerate growth in MT and at the

same time, minimised risky research investments and lengthy development processes.

Closed Innovation

Aside from open innovation, Hyflux also invested in closed innovation. Through in-house

R&D, acquisition of proprietary technology (CEPAration) and technology collaboration

(STW), the company was able to protect its intellectual property and avoid the issue of free

riding from competitors.

Page | 17

Innovation Diffusion

Supply side affecting diffusion

Experimentation conducted pilot plant trials to demonstrate capability and effectiveness

of MT to encourage consumer adoption

Degree of improvement developed in-house membrane which were significantly better

and cheaper than existing ones in the market

Demand side affecting diffusion

Market awareness created high brand awareness through numerous successful large-

scale high-value industrial and municipal projects

Diffusion S-Curve

Timing of the tipping point secured orders for larger membrane filtration systems from

industrial clients in 1998 due to pilot plant trials and its first integrated water treatment

system project for an MNC joint venture manufacturing facility in Singapore

First Mover Advantage (FMA)

Experience curve benefits accrued to Hyflux in the form of greater expertise accumulated

through experience

Scale benefits in the form of scale economies as a consequence of mass production and

bulk purchasing

Reputation and credibility enhanced through numerous successful large-scale high-value

industrial and municipal projects

Stages of Entrepreneurial Growth

Start-up Hyflux began as a small trading company distributing water treatment

equipment in Singapore and the neighbouring markets. Its fortune turned in 1993 when it

decided to venture into China as a result of a domestic saturation in the local market.

Growth while in China, the company was able to leverage on the countrys locational

advantages of low labour and production cost. Additionally, the potential for growth is

enormous, due mainly to its population size. To add on, the lack of water treatment

facilities and expertise within the country had allowed Hyflux to enjoy FMA. Hence,

when the Chinese authorities imposed anti-pollution standards for wastewater treatment

Page | 18

for all foreign companies operating within the country, Hyflux was in a particularly

favourable position as it was already there to take full advantage of the opportunity.

Maturity Hyflux continued to develop new competences around its proprietary MT.

Accordingly, the firm was able to improvise their membrane structure and customised

them to suit the customers requirement. Besides MT, Hyflux also expanded into other

areas of related diversification. Some of which include waste oil recycling as well as

production of specialty materials and energy.

Exit To free up funds to further expand its operations, Hyflux announced an initial

public offering (IPO) of the HWT. Through its launch, the firm was able to diversify part

of the asset ownership risk to the investors as well as obtain funds for acquiring water-

related infrastructure assets and other business undertakings.

Conclusion

Hyflux's ability to identify and capitalise on the MT has vested it with many FMAs. As the

company continues to enhance on the quality, features and deliverability of its MT to

differentiate itself, it is set to enjoy continued success and accelerated growth in the industry.

Page | 19

Question 5

Hyflux's earlier successes were very much hinged on its design capabilities to develop

leading edge MT for innovative water treatment application. Nevertheless, as it continues its

aggressive expansionary policy, it should also review its internal procedures to ensure its

overall robustness to keep pace with the company's strategic direction.

As highlighted in the earlier SWOT analysis, Hyflux is faced with the challenge of having to

develop its internal organisation to keep pace with its expansion. In this sense, the company

may wish to re-examine its internal processes to identify those activities that are not

delivering values. One way is to set up work improvement teams to regularly review the

various workflows and to implement business process reengineering (BPR) wherever

necessary. This will not only help in cost reduction but also aid in eliminating inefficiencies

or redundancies.

Besides re-examining its internal processes, the company should also strengthen its human

resource functions, particularly in its recruitment. Stringent criteria must be set to ensure that

only those with the requisite competencies to meet the demands of the company be selected.

In terms of retention, Hyflux could revise its pay structure as well as explore the option of

incentivising those who have contributed positively and who are still with the company.

Incentives may range from stock options to gainsharing to motivate and reward these

incumbent.

Hyflux is facing intense rivalry in its home country. To resolve this, the company can

consider acquiring some of its rivals. Besides eliminating competition, it can also acquire

their accompanying competencies as well as water treatment projects which effectively

expands its business portfolio.

Finally, to resolve the currency risk inherent in internationalisation, Hyflux should look into

hedging its funds to smoothen out the fluctuations which may ultimately hurt its profit.

Page | 20

Works Cited

1. Buche, I., Kroll, M., Timothy, C., & Wee, B. (2012). Hyflux Limited and Water

Sustainability: threading blue oceans. The Asian Business Case Centre, Nanyang Business

School, Nanyang Technological University, 1-26.

2. Johnson, G., Whittington, R., Angwin, D., Regnr, P., & Scholes, K. (2014). Exploring

Strategy. United Kingdom: Pearson Education, Limited.

Das könnte Ihnen auch gefallen

- Teacher Manual Economics of Strategy by David BesankoDokument227 SeitenTeacher Manual Economics of Strategy by David BesankoCéline van Essen100% (4)

- Strategy - Chapter 5Dokument5 SeitenStrategy - Chapter 532_one_two_threeNoch keine Bewertungen

- Project Report Ratio Analysis of P&GDokument16 SeitenProject Report Ratio Analysis of P&Gvedprakashyadav5053100% (1)

- Saudi Arabia Projects 2013Dokument1 SeiteSaudi Arabia Projects 2013chandirandelhi100% (1)

- Komatsu's Global Leadership StrategyDokument11 SeitenKomatsu's Global Leadership StrategyAmit AhujaNoch keine Bewertungen

- The Seven Domains Model - JabDokument27 SeitenThe Seven Domains Model - JabpruthirajpNoch keine Bewertungen

- International Competitive StrategyDokument18 SeitenInternational Competitive Strategydrlov_20037767Noch keine Bewertungen

- DanfossDokument25 SeitenDanfossalirrehmanNoch keine Bewertungen

- Dell Working CapitalDokument12 SeitenDell Working Capitalsankul50% (1)

- Internationalization of ExxonmobilDokument4 SeitenInternationalization of ExxonmobilJuan FernandoNoch keine Bewertungen

- Business Level Strategy: The Five Generic Competitive StrategiesDokument51 SeitenBusiness Level Strategy: The Five Generic Competitive StrategiesBona PutraNoch keine Bewertungen

- Ryanair Internal & External AnalysisDokument11 SeitenRyanair Internal & External Analysisjerrytansg83% (6)

- PricingDokument4 SeitenPricingEmy MathewNoch keine Bewertungen

- Inventory Management Assignment "World Class Manufacturing" Submitted To Sir Raja KhalidDokument15 SeitenInventory Management Assignment "World Class Manufacturing" Submitted To Sir Raja KhalidFatimah KhanNoch keine Bewertungen

- Presentation Almarai CompanyDokument1 SeitePresentation Almarai CompanyMuhamad Sazeli Mohd Nazir50% (2)

- AssgmintDokument4 SeitenAssgmintArooj HectorNoch keine Bewertungen

- Defensive StrategyDokument10 SeitenDefensive Strategysmile xiiiNoch keine Bewertungen

- Soap ManufacturingDokument15 SeitenSoap ManufacturingErrol FernandesNoch keine Bewertungen

- Five Forces Analysis of Chevron CorporationDokument4 SeitenFive Forces Analysis of Chevron CorporationAnurag ChadhaNoch keine Bewertungen

- 2016 SUPPLY CHAIN Strategy Objectives WAD 02-12-16Dokument15 Seiten2016 SUPPLY CHAIN Strategy Objectives WAD 02-12-16Ivanov VivasNoch keine Bewertungen

- Hyflux Limited: Capital Structure and Financial DistressDokument11 SeitenHyflux Limited: Capital Structure and Financial DistressMizanur RahmanNoch keine Bewertungen

- Competitive IPA Analysis of Wildlife ParkDokument9 SeitenCompetitive IPA Analysis of Wildlife ParkJOHN DEVIN JUNIOR SIMATUPANGNoch keine Bewertungen

- Concept Paper SampleDokument3 SeitenConcept Paper SampleLovely Mae RimaNoch keine Bewertungen

- Assignment On HyfluxDokument11 SeitenAssignment On HyfluxJosephiney92Noch keine Bewertungen

- Business Model CanvasDokument3 SeitenBusiness Model CanvasRaniag PwdNoch keine Bewertungen

- Project Presentation ON: Paper Rock PicturesDokument18 SeitenProject Presentation ON: Paper Rock PicturesMunish PathaniaNoch keine Bewertungen

- Case Study PresentationDokument2 SeitenCase Study PresentationAmith KumarNoch keine Bewertungen

- Case Study - Hyflux NewaterDokument6 SeitenCase Study - Hyflux NewaterAnshita SinghNoch keine Bewertungen

- Case of HyfluxDokument6 SeitenCase of HyfluxMai NganNoch keine Bewertungen

- Accounting Analysis HyfluxDokument2 SeitenAccounting Analysis HyfluxNicholas LumNoch keine Bewertungen

- Contracts Award Report 30th September-16Dokument8 SeitenContracts Award Report 30th September-16Priya MadanaNoch keine Bewertungen

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDokument3 SeitenBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsChristina ApriliaNoch keine Bewertungen

- Segment and Target Markets for GrowthDokument18 SeitenSegment and Target Markets for GrowthAtulSinghNoch keine Bewertungen

- Work Equivalent LoadsDokument2 SeitenWork Equivalent LoadsjjdavidNoch keine Bewertungen

- Strategic Analysis Presentation of HyfluxDokument71 SeitenStrategic Analysis Presentation of HyfluxjuststitchNoch keine Bewertungen

- Rationalization of StaffDokument7 SeitenRationalization of StaffMuhammad AshrafNoch keine Bewertungen

- Final PPT-version 6Dokument23 SeitenFinal PPT-version 6Jai PaulNoch keine Bewertungen

- IPE Report "The Other Side of Apple II"Dokument46 SeitenIPE Report "The Other Side of Apple II"devin6768Noch keine Bewertungen

- ALBADokument3 SeitenALBAChristine ButlerNoch keine Bewertungen

- Brown BagDokument7 SeitenBrown BagDeepika Pandey100% (1)

- ORION Systems Case Study: Improving Project Management StructureDokument12 SeitenORION Systems Case Study: Improving Project Management StructureKandarpGuptaNoch keine Bewertungen

- Comparative Analysis of Cooch Behar and Bangalore Airports PPP ModelsDokument6 SeitenComparative Analysis of Cooch Behar and Bangalore Airports PPP ModelspratsieeNoch keine Bewertungen

- ASSIGNMENT 1 Case Study-United Sugar CompanyDokument4 SeitenASSIGNMENT 1 Case Study-United Sugar CompanyMehereen AubdoollahNoch keine Bewertungen

- Total Quality ManagementDokument5 SeitenTotal Quality ManagementMuraliAbdullahNoch keine Bewertungen

- Distribution ChannelDokument3 SeitenDistribution ChannelDayittohin JahidNoch keine Bewertungen

- PEST AnalysisDokument15 SeitenPEST AnalysisAbinash BiswalNoch keine Bewertungen

- Apple Case Write-Up FinalDokument13 SeitenApple Case Write-Up FinalNgọc Anh VõNoch keine Bewertungen

- Dell's Working Capital ManagementDokument12 SeitenDell's Working Capital ManagementShashank Kanodia100% (2)

- HyfluxDokument158 SeitenHyfluxboroy1670Noch keine Bewertungen

- Orascom ProfileDokument10 SeitenOrascom ProfileCarlos Valdecantos100% (1)

- Leading A Supply Chain TurnaroundDokument18 SeitenLeading A Supply Chain TurnaroundNeeraj GargNoch keine Bewertungen

- Tender Analysis Report - 2008: Sl. No. Description Result RemarksDokument3 SeitenTender Analysis Report - 2008: Sl. No. Description Result RemarksPradeep SukumaranNoch keine Bewertungen

- SCM OF AppleDokument8 SeitenSCM OF AppleSai VasudevanNoch keine Bewertungen

- Process Destart Date Duration End DateDokument3 SeitenProcess Destart Date Duration End DateRakesh KundraNoch keine Bewertungen

- Aditya Birla Group - BPSM For MbaDokument27 SeitenAditya Birla Group - BPSM For Mbasagar77_l86% (7)

- Energy Profile EgyptDokument4 SeitenEnergy Profile EgyptLe Diacre KNoch keine Bewertungen

- Case Analysis: Chapter: OneDokument14 SeitenCase Analysis: Chapter: OneSai Teja AnnalaNoch keine Bewertungen

- Dabhol Power Project - Indian Power SectorDokument11 SeitenDabhol Power Project - Indian Power SectorGiridharan ArsenalNoch keine Bewertungen

- ERP (Group Week 1)Dokument14 SeitenERP (Group Week 1)Nguyên Nguyễn KhôiNoch keine Bewertungen

- Tata Nano Case MemoDokument6 SeitenTata Nano Case MemositanshubindraNoch keine Bewertungen

- HaldiramsDokument6 SeitenHaldiramssanjanasingh290% (1)

- Colgate PalmoliveDokument6 SeitenColgate PalmoliveMilind AhireNoch keine Bewertungen

- Brand Managment Management: December 17, 2016 Final Presentation For Sir Kashif FarhatDokument39 SeitenBrand Managment Management: December 17, 2016 Final Presentation For Sir Kashif FarhatKashif KhanNoch keine Bewertungen

- Group6 SectionA MFFVLDokument6 SeitenGroup6 SectionA MFFVLAparnaSinghNoch keine Bewertungen

- Group Presentation On Strategic Evaluation of Procter & Gamble''Dokument22 SeitenGroup Presentation On Strategic Evaluation of Procter & Gamble''faria sobnom munaNoch keine Bewertungen

- NETFLIX PR DISASTER: HOW TO REGAIN CUSTOMER TRUSTDokument4 SeitenNETFLIX PR DISASTER: HOW TO REGAIN CUSTOMER TRUSTsumbulNoch keine Bewertungen

- GEP Gameplan 2022 BschoolDokument16 SeitenGEP Gameplan 2022 BschoolDiva SharmaNoch keine Bewertungen

- Industry DescriptionDokument9 SeitenIndustry DescriptionHarold Sargado LascuñaNoch keine Bewertungen

- Strategic Elements of Competitive Advantage Session 5-6: by Dr. Jitarani Udgata Ph.D. IIFT-DDokument41 SeitenStrategic Elements of Competitive Advantage Session 5-6: by Dr. Jitarani Udgata Ph.D. IIFT-Dcastro dasNoch keine Bewertungen

- SBM Chapter 1 ModelDokument43 SeitenSBM Chapter 1 ModelArunjit SutradharNoch keine Bewertungen

- Hyflux - Business StrategyDokument20 SeitenHyflux - Business StrategyjerrytansgNoch keine Bewertungen

- Project ManagementDokument31 SeitenProject ManagementjerrytansgNoch keine Bewertungen

- CRM - Korean AirlineDokument21 SeitenCRM - Korean AirlinejerrytansgNoch keine Bewertungen

- Business NegotiationDokument19 SeitenBusiness Negotiationjerrytansg100% (1)

- Leadership Roles by Kuk-Hyun MoonDokument3 SeitenLeadership Roles by Kuk-Hyun MoonjerrytansgNoch keine Bewertungen

- Operations ManagementDokument20 SeitenOperations ManagementjerrytansgNoch keine Bewertungen

- Study NotesDokument71 SeitenStudy NotesTimothy JeffersonNoch keine Bewertungen

- Group 8 PDFFFDokument70 SeitenGroup 8 PDFFFTrixy RodriguezNoch keine Bewertungen

- Strategy Integration - Vermont Teddy BearDokument0 SeitenStrategy Integration - Vermont Teddy BearlinahuertasNoch keine Bewertungen

- VGSM Manufacturing Strategy - Jan 2011Dokument405 SeitenVGSM Manufacturing Strategy - Jan 2011Ignacio Gutierrez NarvaezNoch keine Bewertungen

- Case GalanzDokument7 SeitenCase GalanzLeonard LiNoch keine Bewertungen

- Challenges Faced by Management at Ufone PakistanDokument23 SeitenChallenges Faced by Management at Ufone PakistanHareem Sattar0% (2)

- Lesson - 05 - Retail Market StrategyDokument56 SeitenLesson - 05 - Retail Market StrategyPham HoangNoch keine Bewertungen

- Principles of MarketingDokument30 SeitenPrinciples of MarketingMayette ChiongNoch keine Bewertungen

- MAG661 Dess Ch01 PPT Strategic Management Creating Competitive AdvantageDokument35 SeitenMAG661 Dess Ch01 PPT Strategic Management Creating Competitive AdvantageNUR AFFIDAH LEENoch keine Bewertungen

- Effective Management Case Study 1 (Unit 1)Dokument6 SeitenEffective Management Case Study 1 (Unit 1)Yogi GandhiNoch keine Bewertungen

- TEAol OgyDokument25 SeitenTEAol OgyronaakradNoch keine Bewertungen

- Proposal On HSBCDokument14 SeitenProposal On HSBCsuhag603Noch keine Bewertungen

- Screen Graphics Created By: Jana F. Kuzmicki, Ph.D. Troy UniversityDokument35 SeitenScreen Graphics Created By: Jana F. Kuzmicki, Ph.D. Troy UniversityYohana OliviaNoch keine Bewertungen

- Tanga Cement Case StudyDokument25 SeitenTanga Cement Case StudyAli Suleiman Mrembo86% (7)

- Strategic Issues of Information TechnologyDokument23 SeitenStrategic Issues of Information TechnologySamiksha SainiNoch keine Bewertungen

- IIM-K EPGP 11 CS-B S7-8 2019-20 Comp Dynamics StrategyDokument40 SeitenIIM-K EPGP 11 CS-B S7-8 2019-20 Comp Dynamics Strategysumantra sarathi halderNoch keine Bewertungen

- Strategic Management Concepts and Cases Rothaermel Rothaermel 1st Edition Solutions ManualDokument16 SeitenStrategic Management Concepts and Cases Rothaermel Rothaermel 1st Edition Solutions ManualJoannFreemanwnpd100% (41)

- Griffin Chap 08Dokument35 SeitenGriffin Chap 08dikpalakNoch keine Bewertungen

- Business Model AssignmentDokument5 SeitenBusiness Model AssignmentVictor DeleclozNoch keine Bewertungen

- Sustainable Production and Consumption: Thanh Tiep Le, Muhammad IkramDokument12 SeitenSustainable Production and Consumption: Thanh Tiep Le, Muhammad Ikramturk.vivienNoch keine Bewertungen

- Business Concept AssignmentDokument2 SeitenBusiness Concept Assignmentjabrix09100% (1)