Beruflich Dokumente

Kultur Dokumente

(BKAL3063) Introduction

Hochgeladen von

Yong EowOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

(BKAL3063) Introduction

Hochgeladen von

Yong EowCopyright:

Verfügbare Formate

UNIVERSITI UTARA MALAYSIA

COLLEGE OF BUSINESS

SCHOOL OF ACCOUNTANCY

SESSION 2014/2015 SEMESTER 1 A141

BKAL 3063

INTEGRATED CASE STUDY

GROUP 1

CASE 1- BIOVAIL CORPORATION: REVENUE RECOGNITION &

FOB SALES ACCOUNTING

PREPARED BY:

NG MUN WAI 212540

LIM XIAN ZHEN 212719

NG SZE CHUEN 212891

LIM YONG EOW 213047

CHOY HUI NI 213209

PREPARED FOR:

PROF DR. KU NOR IZAH BT KU ISMAIL

INTRODUCTION

Biovail Corporation was one of Canadas largest publicly traded pharmaceutical

companies. For many years, the company had applied advanced drug-delivery

technologies to improve the clinical effectiveness of medicines. The company

commercialized its products, both directly (in Canada) and through strategic partners

(internationally). Its main therapeutic areas of focus had been central nervous system

disorders, pain management, and cardiovascular disease.

Biovails core competency was its expertise in the development and large-scale

manufacturing of pharmaceutical products. It leveraged this expertise by focusing on

(1) enhanced formulations of existing drugs, (2) combination products that

incorporated two or more different therapeutic classes of drugs, and (3) difficult-to-

manufacture generic pharmaceuticals.

Late on 9 October 2003, David Maris, an analyst at Banc of America Securities

(BAS), was trying to interpret the shocking events of the previous few days and finish

the write-up of his first report on the Canadian pharmaceutical firm, Biovail

Corporation. He wanted to make sure he was giving the best advice to his investment

clients in any events.

A few days earlier, Biovail had released guidance for the quarter ended 30 September

2003, indicating that revenues would be in the range of $215 million to $235 million

and earnings per share of $0.35 to $0.45, both below previously issued guidance. The

company stated in its press release that the loss of revenue and income was associated

with a significant in-transit shipment loss of Wellbutrin XL, Biovails antidepressant

product, due to a traffic accident that contributed significantly to this unfavorable

variance. As far as Maris was aware, this was the first time that Biovail had missed its

quarterly guidance.

On 3 October 2003, immediately following the announcement of the truck accident,

Canadian Imperial Bank of Commerce announced that it was cutting its stock rating

on Biovail to Sector Performer from Sector Outperformer and removing the company

from the Special Research Series (SRS), effectively ceasing coverage of the stock.

The reasons given for the downgrade cited ongoing production delays and operational

uncertainties at Biovail.

Following the truck accident, Maris, who had taken over the account from Treppel,

and his team started to do some digging. They called the state trooper handling the

crash investigation, got a copy of the accident report, and talked to someone at the

impound lot where the truck was towed. The trooper estimated that the truck was

about one quarter full and that even 25 pallets would not have filled up a tractor-

trailer of the size involved in the accident.

Maris and his team also talked to the towing company and to a local TV reporter who

had shot the scene. Maria also watched the report on the TV stations website. The

investigation suggested that Biovail might have significantly overestimated the

amount of Wellbutrin XL on the truck. Maris also thought that if there have been $20

million worth of Wellbutrin XL pills on that truck, it would have been full, or nearly

full.

Maris felt that Biovail should not be able to record revenue from the sale of the drugs

in the truck in the third quarter. It just didnt feel right. However, he wanted to make

sure that he really understood the effects of the accident on the firm before he signed

off on his Sell recommendation.

QUESTION 1

How many truckloads of product are actually required to carry $10 million of

product? Show your calculations.

The following details are extracted from the case study for calculation purpose:-

1 Wellbutrin XL tablet (300 mg) was estimated to be roughly 0.5 cm

3

with

an additional 1.00cm

3

per tablet for packing space.

The interior dimensions of a typical 18 wheeler trailer :

A wholesale acquisition price per tablet is $2.83 which included 400% markup

for the distributor and a 35% wholesaler margin.

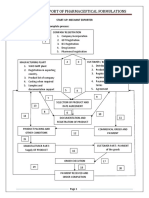

The supply chain on this case study is start from Biovail, the manufacturer.

Biovail will ship its pharmaceutical products to the distributor in huge bulk. The

distributor then will sell it according to the order made by the wholesaler. Next, each

retailer will buys in small or medium bulk from wholesaler. The customer who buys

pharmaceutical products from retail store is the end user on this supply chain. The

supply chain will be illustrated as follow:-

Biovail Distributor Wholesaler Retailer End User (Customer)

The calculation steps are as below:

Step 1: Convert the size of trailer to cubic centimetres (cm

3

), due to the tablet and

trailer are using different units of measurements. 1 cubic metre is equal to 1,000,000

cubic centimetres.

Step 2: Calculate the total volume of Wellbutrin XL tablet(X) that can fit into the

trailer.

We conclude that the total volume of Wellbutrin XL tablet that can fit into

one trailer is 127,500,000 tablets.

Step 3: Determine the revenue of Biovail earned from a single tablet.

Selling price of wholesaler to retailer, 35% wholesaler margin:

Selling price of Biovail to distributor included 400% mark up for the distributor:

The revenue of Biovail earned from a single tablet is $0.37.

Step 4: Determine the size of total tablet for $10 million of product. The equation is as

follow:

Step 5: The equation for the percentage of total truckload required to carry $10million

of product is =21.20%

QUESTION 2

How should the company recognize revenue based upon the two possible FOB

contract structures mentioned in the case? Why?

The company currently is arguing in a situation whereby the company itself retains

that they are using Freight On Board (FOB) shipping point and the buyer retains that

FOB destination should take place in the responsibility. Therefore in these 2 possible

outcomes the company will record their revenue differently depends on the FOB.

(Whether is shipping point or destination).

FOB Shipping Point

If the company is on FOB shipping point, the company will record their revenue once

the goods had left the premise of the company or left the shipping point as the sales

arrangement was satisfied, service rendered and a determinable sales price established.

This is because for FOB shipping point, the responsibility of the goods will be

transfer to the buyer when the goods had left the dock of the seller company. The

buyer will then need to ensure the goods arrive their dock safely at it is all on their

own responsibility.

FOB Destination

If the company is accountability for the FOB destination then the company will need

to record their revenue after the goods had safely arrive at the dock and been transfer

to the hands of the buyer, and before the goods arrive to the buyer hands, the

responsibility will still be in the hands of the seller.

The reason here is because based on FOB destination, the rights of goods only

transfer to the buyer when the goods reached the buyer hands and before that, the

rights of the goods will remain in the hands of the seller. Therefore, when the

responsibility and rights of goods havent transfer to the buyer, the seller cannot

record the goods as revenue.

According to the case the company should recognize revenue via FOB destination

because The agreement between Biovail and the Distributor provided that title to and

risk of loss with respect to the product would not have passed to the Distributor until

the product was delivered to the Distributors facility. According to the case, there

are contrary to the generally accepted accounting principles (GAAP) requirements

where the revenue cannot be recognize as the seller has not done everything required

under the sales agreement. Then, the title and risk of the shipment remain at the

sellers until received by the buyer and GAAP requirement ultimately the Biovail is

liable for shipping incidents.

Question 3

How does the accident affect the stated revenues under the different FOB

contract structures? Explain your reasoning.

By way of answering the question, we shall look thoroughly through Biovails

revenue recognition policy, FOB method as well as the period where the accident took

place respectively. By far, this argument will explain the effectiveness of the FOB and

revenue recognition in relations with the reported revenue specifically during the

quarter.

The vicious accident which involved Biovails shipment cargo took place during 30

th

September of 2003. Since Biovails stocks were publicly traded in the New York

Stock Exchange, the company quarterly will issued its financial reports. Now, it

comes to the question how the revenue affected subject to the accident which in fact

does not affect anything at all. The next paragraph will discuss and clarify further why.

If Biovail as initially claimed applying FOB shipping point, which indicates that the

buyer takes responsibility for the goods when the goods leave the seller's premises. At

this particular point, the significant risks and rewards of ownership of the goods have

been transferred to the distributor which means that Biovail will recognize revenue

once delivery or shipment of goods has been made. Now, for the shipment on 30

th

September 2003, under FOB shipping point, Biovail has already recognize the

revenue once the goods loaded into the shipment cargo leaving its manufacturing

facilities in Manitoba, Canada. At this timeframe, the status of ownership had already

passed to the distributor and since revenue had already recognize way before the

accident occurred then its clarify why the accident have no effect to the stated

revenue particularly on the 3

rd

quarter.

On the other hand, if Biovail applying FOB destination, which indicates that, the

seller will hold responsibility for the goods until the delivery is completed to the

buyer. Due to that, Biovail will still bear the risk and ownership of the shipped goods

before the shipment completed respectively. By all means, Biovail will only recognize

the revenue under FOB destination upon delivery completion. Now, for the shipment

on 30

th

September 2003 and the event of accident, the status of ownership had not yet

passed to the distributor as the goods failed to reach to the hand of the distributor in

North Carolina. As no revenue shall be recognized for the shipment on 30

th

September 2003, so we can conclude that the accident once again has no effect to the

stated revenue of Biovail.

In the nutshell, the accident will have no effect on Biovails stated revenue under both

FOB contract. Under FOB shipping point, revenue had been recognized but the

accident will have no effect on it because ownership and risk has already transferred

to the distributor. Meanwhile, under FOB destination, no revenue shall be recognized

before the delivery completion. Thus the accident would have nothing to do with

revenue as delivery failed to be completed.

Question 4

Are you concerned about the companys treatment of analysts who cover the

stock? Would you want to be an analyst covering this company?

Yes. We are concerning about the companys treatment of analysts Treppel who

cover the stock as a recommendation of analyst who play a critical role in interpreting,

analyzing, and disseminating management disclosures to less sophisticated investors

will influence the reaction of investor and contributes changes of stock prices. Stock

recommendation can be considered a summary judgment that incorporates the

analysts assessment of the companys future earnings potential and stock price

appreciation potential. Nonprofessional and unsophisticated investors may suffer if

they overly in such overoptimistic stock recommendations.

Treppel did all the task in correct manner which do not void the code of ethics but yet

still been drag into trouble by Biovail. Treppel was in the dilemma status that whether

to help Biovail to conceal the ugly truth or report the actual and unbiased situation. As

a professional analysts, he has to report the actual and unbiased situation of the

company thus the investor could have more authentic information to understand the

company. End up, he chose to report the actual situation of the company and not to

conceal, but he get himself in trouble and lost his job after he highlighted and

disclosed the fraud.

We would not be the analyst that covering the Biovail because of several issues

happen when we reflected back on the cases and the poor management control and

company culture. First, Biovail are utilizing aggressive accounting method to inflate

their revenue. In this case, we concern about the revenue recognition method. Biovail

record the revenue once the product left the shipping dock (FOB Shipping Point). In

fact, US GAAP required the company only can recognize the revenue only when the

risk had been transfer. Biovail tried to use this method to manipulated and increase

the revenue of the company.

Besides, Biovail also have a low quality of revenue and earnings performance in the

prior period. Biovail did not provide a clear information about how they sustain the

rapid sales growth reported. We believe that Biovail has the intention to hide the

information that affect their company performance and trying to conceal the evidence

that they inflated their revenue. As lacking of these information, we could not

accurately analyze the company performance.

Lastly, when referred back to the Treppel, Biovail tried to use the false statement to

drag analyst in trouble. Biovail alleged that Treppel intentionally published

misleading research to gain profit from the decline in their stock price. This led

Treppel into trouble and investigated by several parties. As Biovail has a dishonest

culture, if we as an analyst to revealed the fraud done by Biovail, we would

encountered into the same situation like what Treppel faced, which will be

investigated and defamed. Furthermore, the past treatment of Treppel from Biovail

makes us worry about our employment. This happened right after Treppel doubted

about the information disclosed by Biovail and wrote a sell recommendation.

CONCLUSION

According to the case, the company should recognize revenue via FOB destination

because The agreement between Biovail and the Distributor provided that title to and

risk of loss with respect to the product would not have passed to the Distributor until

the product was delivered to the Distributors facility. The case also shown that there

are contrary to the generally accepted accounting principles (GAAP) requirements

where the revenue cannot be recognize as the seller has not done everything required

under the sales agreement. Then, the title and risk of the shipment remain at the

sellers until received by the buyer and GAAP requirement ultimately the Biovail is

liable for shipping incidents.

The accident will not affect the stated revenues under different FOB contract. Under

FOB shipping point, revenue had been recognized but the accident will have no effect

on it because ownership and risk has already transferred to the distributor. Meanwhile,

under FOB destination, no revenue shall be recognized before the delivery completion.

Thus the accident would have nothing to do with revenue as delivery failed to be

completed.

We will concern about the companys treatment of analysts who cover the stock as a

recommendation of analyst who play a critical role in interpreting, analyzing, and

disseminating management disclosures to less sophisticated investors will influence

the reaction of investor and contributes changes of stock prices.

In this case, Biovail alleged that Treppel intentionally published misleading research

to gain profit from the decline in their stock price. This led Treppel into trouble and

investigated by several parties. Hence, this situation shows that companys actions

will influence the decision made by the financial analyst.

In conclusion, we would not want to be an analyst covering Biovail. Biovail has a bad

and poor management control and company culture. Biovail executive use unethical

action to cope with Treppel when Treppel refuse to retract the report, which showed

us that Biovail has a dishonest culture in the company where financial analyst report

recommendation must not reveal the fraud. So, if we am the financial analyst for

Biovail, we could not provide the report objectively and fairly although there is

sufficient evidence to prove Biovail had provided misleading information. Thus, this

situation will lead me to overlap my professional ethics.

Das könnte Ihnen auch gefallen

- Biovail Case Study AnswerDokument6 SeitenBiovail Case Study AnsweralfredNoch keine Bewertungen

- BiovailDokument6 SeitenBiovailToo YunHangNoch keine Bewertungen

- Biovail - FinalDokument7 SeitenBiovail - FinaldavidremixNoch keine Bewertungen

- BiovailDokument2 SeitenBiovailCliffiandri Adiwibowo100% (1)

- Biovail Case Study Analysis and SolutionDokument3 SeitenBiovail Case Study Analysis and SolutionHervino WinandaNoch keine Bewertungen

- Bio VailDokument22 SeitenBio VailNurAshikinMohamadNoch keine Bewertungen

- Biovail Assignment - Group 5Dokument3 SeitenBiovail Assignment - Group 5Shaarang BeganiNoch keine Bewertungen

- Biovail Case AnswersDokument2 SeitenBiovail Case Answersbhatvinayak750% (4)

- Biovail Corp (Group 2)Dokument11 SeitenBiovail Corp (Group 2)Norhuda Said100% (1)

- Accounting at Biovail ReportDokument7 SeitenAccounting at Biovail ReportimeldafebrinatNoch keine Bewertungen

- Biovail Corporation QuestionsDokument2 SeitenBiovail Corporation QuestionsshwetaitNoch keine Bewertungen

- Biocon LimitedDokument4 SeitenBiocon LimitedMukesh SahuNoch keine Bewertungen

- Coracle: Water Purifier For Small Pool Owners: Proposal Presented To: Retailers, Pool Clarifier Market, United StatesDokument6 SeitenCoracle: Water Purifier For Small Pool Owners: Proposal Presented To: Retailers, Pool Clarifier Market, United StatesAnkita AgrawalNoch keine Bewertungen

- Biocon CaseDokument2 SeitenBiocon CaseDinaraNoch keine Bewertungen

- T o R e C o R D C o S: Cases Revenue Recognition Case 1Dokument3 SeitenT o R e C o R D C o S: Cases Revenue Recognition Case 1Tio SuyantoNoch keine Bewertungen

- Case RecomendDokument6 SeitenCase RecomendFull Hui HuiNoch keine Bewertungen

- Chapter 16 - Accessible - Case - PPTDokument20 SeitenChapter 16 - Accessible - Case - PPTKamran MemmedovNoch keine Bewertungen

- ACC2001 Lecture 2Dokument42 SeitenACC2001 Lecture 2michael krueseiNoch keine Bewertungen

- Acct For ConsignmnetDokument12 SeitenAcct For Consignmnetsamuel debebe100% (1)

- Assignment Evaluating Biovail-1Dokument4 SeitenAssignment Evaluating Biovail-1parikh.jiteshNoch keine Bewertungen

- Abbott LawsuitDokument52 SeitenAbbott LawsuitAnn DwyerNoch keine Bewertungen

- FAQs For Comparator Sourcing ServiceDokument3 SeitenFAQs For Comparator Sourcing ServicebilcareNoch keine Bewertungen

- CH 06Dokument66 SeitenCH 06Rabie HarounNoch keine Bewertungen

- MNCGeneric US 11172020Dokument6 SeitenMNCGeneric US 11172020Er GaNoch keine Bewertungen

- Caso Biovail Corportation - RespuestasDokument6 SeitenCaso Biovail Corportation - RespuestasSergioNoch keine Bewertungen

- Report SDMDokument16 SeitenReport SDMPraveen PrabhakarNoch keine Bewertungen

- Problem Set 1Dokument3 SeitenProblem Set 1Liz ParkerNoch keine Bewertungen

- Bkaa2013 Final Case Study-StudentDokument15 SeitenBkaa2013 Final Case Study-StudentRubiatul AdawiyahNoch keine Bewertungen

- Sample Injunction ComplaintDokument25 SeitenSample Injunction ComplaintIML2016100% (3)

- Project On Export of Pharmaceutical FormulationsDokument15 SeitenProject On Export of Pharmaceutical FormulationsRehan PatelNoch keine Bewertungen

- CAC2203201205 Audit ProcessDokument5 SeitenCAC2203201205 Audit Processleeroybradley44Noch keine Bewertungen

- Practice Exam Chapter 6-9Dokument4 SeitenPractice Exam Chapter 6-9John Arvi ArmildezNoch keine Bewertungen

- Litigation Against Valeant SECDokument12 SeitenLitigation Against Valeant SECWilliam TsediNoch keine Bewertungen

- BKK Study Report PDFDokument7 SeitenBKK Study Report PDFShafeeraNoch keine Bewertungen

- Distribution Model For FMCGDokument20 SeitenDistribution Model For FMCGRahul Gupta100% (1)

- National Institute of Transport (Nit)Dokument7 SeitenNational Institute of Transport (Nit)ally jumanneNoch keine Bewertungen

- Import FinalDokument5 SeitenImport FinalRaza AliNoch keine Bewertungen

- Supply Chain 1Dokument13 SeitenSupply Chain 1AthiraNoch keine Bewertungen

- Biocon Case StudyDokument12 SeitenBiocon Case StudyVaibhavee KatialNoch keine Bewertungen

- Albert Robins - Trade ReceivablesDokument12 SeitenAlbert Robins - Trade ReceivablesAveenashNoch keine Bewertungen

- AKD cpt05Dokument79 SeitenAKD cpt05Anisha RosevitaNoch keine Bewertungen

- Pharmacutical IndustryDokument59 SeitenPharmacutical Industrysunil188patel_983482Noch keine Bewertungen

- ZoeconDokument6 SeitenZoeconokaibe100% (3)

- CH 05Dokument79 SeitenCH 05WailNoch keine Bewertungen

- Administering Subsidiary Accounts and Ledgers PDFDokument33 SeitenAdministering Subsidiary Accounts and Ledgers PDFnigus78% (9)

- Strategic Management CIA - 3: Assignment On Company AnalysisDokument8 SeitenStrategic Management CIA - 3: Assignment On Company AnalysisThanish Sujaudeen 2027716100% (1)

- Introduction BiomabDokument3 SeitenIntroduction BiomabUttam MNNoch keine Bewertungen

- Financial Accounting: Accounting For Merchandise OperationsDokument84 SeitenFinancial Accounting: Accounting For Merchandise OperationsAnnie DuolingoNoch keine Bewertungen

- Assess Boston Chicken's Business Strategy by Identifying Its Critical Success FactorsDokument4 SeitenAssess Boston Chicken's Business Strategy by Identifying Its Critical Success FactorsArindam PalNoch keine Bewertungen

- Khiron Corporate Presentation - July 2021 LongDokument28 SeitenKhiron Corporate Presentation - July 2021 LongRaúlMonroyZamarripaNoch keine Bewertungen

- Features of PAC IndustryDokument3 SeitenFeatures of PAC Industry22165228Noch keine Bewertungen

- Sample Business PlanDokument8 SeitenSample Business PlanClarise Marciano100% (9)

- Recall Is A Difficult DecisionDokument7 SeitenRecall Is A Difficult DecisionAbdallah QtaishatNoch keine Bewertungen

- Unilever Case StudyDokument4 SeitenUnilever Case StudyKyron JacquesNoch keine Bewertungen

- General Mills V Chobani Complaint 16-Cv-00052Dokument23 SeitenGeneral Mills V Chobani Complaint 16-Cv-00052JimHammerandNoch keine Bewertungen

- BioconDokument3 SeitenBioconRajdeep BasuNoch keine Bewertungen

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsVon EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNoch keine Bewertungen

- The Food Truck Handbook: Start, Grow, and Succeed in the Mobile Food BusinessVon EverandThe Food Truck Handbook: Start, Grow, and Succeed in the Mobile Food BusinessBewertung: 5 von 5 Sternen5/5 (1)

- ELTU2012 - 1b - Job Application Letters (Student Version) - August 2017Dokument22 SeitenELTU2012 - 1b - Job Application Letters (Student Version) - August 2017Donald TangNoch keine Bewertungen

- Fabrication of Portable Noodle Making Ma Fd82a2eeDokument4 SeitenFabrication of Portable Noodle Making Ma Fd82a2eeankush belkarNoch keine Bewertungen

- Business Result Elementary - Student's Book Audio ScriptsDokument16 SeitenBusiness Result Elementary - Student's Book Audio ScriptsAcademia TworiversNoch keine Bewertungen

- DMCI ConstructionDokument3 SeitenDMCI ConstructionMara Ysabelle VillenaNoch keine Bewertungen

- DNV Iso 9001 2015 Checklist (Ing)Dokument25 SeitenDNV Iso 9001 2015 Checklist (Ing)Janeiro OusaNoch keine Bewertungen

- Covid-19 Pandemic: Challenges On Micro, Small and Medium Enterprises of The City of Dapitan, Philippines Background of The StudyDokument2 SeitenCovid-19 Pandemic: Challenges On Micro, Small and Medium Enterprises of The City of Dapitan, Philippines Background of The StudyShein Batal BayronNoch keine Bewertungen

- Presentation On SBU Analysis of Bashundhara GroupDokument16 SeitenPresentation On SBU Analysis of Bashundhara Groupmanagement 149100% (3)

- POINTERS TO REVIEW IN GENERAL MATHEMATICS - 2nd QuarterDokument2 SeitenPOINTERS TO REVIEW IN GENERAL MATHEMATICS - 2nd QuarterVergel BautistaNoch keine Bewertungen

- Final Ac Problem1Dokument12 SeitenFinal Ac Problem1Pratap NavayanNoch keine Bewertungen

- B2B PDFDokument343 SeitenB2B PDFSagar AnsaryNoch keine Bewertungen

- Carriculum Vitae Jeffrey MathipaDokument3 SeitenCarriculum Vitae Jeffrey MathipaanzaniNoch keine Bewertungen

- SMRP GUIDELINE 3.0 Determining Leading and Lagging IndicatorsDokument6 SeitenSMRP GUIDELINE 3.0 Determining Leading and Lagging IndicatorsJair TNoch keine Bewertungen

- 104 Law of ContractDokument23 Seiten104 Law of Contractbhatt.net.inNoch keine Bewertungen

- Gautam Resume PDFDokument4 SeitenGautam Resume PDFGautam BhallaNoch keine Bewertungen

- Construction Management (CENG 260) : Lecturer: Raed T. Jarrah Lecture 11a - Cost ControlDokument19 SeitenConstruction Management (CENG 260) : Lecturer: Raed T. Jarrah Lecture 11a - Cost ControlHusseinNoch keine Bewertungen

- Jawaban Soal 2 Variabel CostingDokument1 SeiteJawaban Soal 2 Variabel CostingFitriNoch keine Bewertungen

- A1-Cash and Cash Equivalents - 041210Dokument28 SeitenA1-Cash and Cash Equivalents - 041210MRinaldiAuliaNoch keine Bewertungen

- The Smart Car and Smart Logistics Case TOM FinalDokument5 SeitenThe Smart Car and Smart Logistics Case TOM FinalRamarayo MotorNoch keine Bewertungen

- ISA TR840003 (Testing) PDFDokument222 SeitenISA TR840003 (Testing) PDFmohammed el erianNoch keine Bewertungen

- Assignment 1 2019 PDFDokument2 SeitenAssignment 1 2019 PDFAlice LaiNoch keine Bewertungen

- Distribution Strategy: Rural MarketingDokument47 SeitenDistribution Strategy: Rural MarketingpnaronaNoch keine Bewertungen

- Mou System: SPS Solanki AGM (CP)Dokument82 SeitenMou System: SPS Solanki AGM (CP)SamNoch keine Bewertungen

- (PAPER) Oskar Lange - The Role of Planning in Socialist Economy PDFDokument16 Seiten(PAPER) Oskar Lange - The Role of Planning in Socialist Economy PDFSyahriza RizaNoch keine Bewertungen

- Bureau VeritasDokument2 SeitenBureau VeritasewfsdNoch keine Bewertungen

- Marketing PaperDokument29 SeitenMarketing PaperAzzahra DartamanNoch keine Bewertungen

- Entrep Pretest 2022-2023Dokument3 SeitenEntrep Pretest 2022-2023kate escarilloNoch keine Bewertungen

- Pineda Vs Court of AppealsDokument12 SeitenPineda Vs Court of AppealsKalvin OctaNoch keine Bewertungen

- Embroidery Cost AnalysisDokument13 SeitenEmbroidery Cost Analysisequanimity1913Noch keine Bewertungen

- 654 AsfjhbhbDokument26 Seiten654 AsfjhbhbNandini Busireddy50% (2)

- Allied Banking Corporation vs. OrdoñezDokument13 SeitenAllied Banking Corporation vs. Ordoñezcncrned_ctzenNoch keine Bewertungen