Beruflich Dokumente

Kultur Dokumente

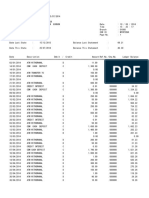

FS Newsletter - October 2014

Hochgeladen von

avishathakkarOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FS Newsletter - October 2014

Hochgeladen von

avishathakkarCopyright:

Verfügbare Formate

The school year has just begun, but we at Finance Society have really

gotten the ball rolling early on! Over the past few weeks weve received

guests from Credit Suisse and provided students with workshops that

promoted an education in finance, exhibited how to build resumes, and

prepared them for interviews. Today were happy to welcome

representatives from Barclays Investment Banking & Global Markets who

will be offering their insights about current industry trends.

Consistent with the last few semesters, we have planned events in

partnership with some top firms on the street that will be coming in to

discuss various topics from investment banking and sales & trading to asset

management and equity research. We want to stress to all of those involved

with FS that our goal is to educate the NYU Stern community about

finance through both professional and academic lenses.

We want to give a big shout out to our Executive Committee that has been

posting interesting articles on our blog, writing op-eds for our newsletter,

and presenting those incredible market updates week in and week out. We

also want to thank the student body at Stern for the great attendance weve

been receiving at our events so far; were trying our best to keep that

momentum going. Keep in mind that this semester the only pre-requisite to

being eligible to apply for E-Committee is attending 6 of our events, and

there will be plenty of opportunities to meet that requirement!

- Matt & Patrick

Throughout the next few weeks we will be hosting events with Evercore,

FINANCE

SOCIETY

NEWSLETTER

October 2014 / Volume XX

MESSAGE FROM THE PRESIDENTS

Get the Picture ISIS and the U.S.

Economy

Federal Reserve Stays

the Course Towards

Higher Interest Rates

Distress in South

Korea

Kevin Tsao gives a short

overview of the recent events

between Ukraine and Russia

Neil Shah offers his thoughts

on the effect the Islamic State

in Syria and Iraq are having on

the U.S. Economy

Rushi Patel analyzes the Feds

current objective and the

implications of a rise in interest

rates

Jag Buddhavarapu provides an

update on South Korean

economic policies and their

effects

Page 2 Page 4 Page 5 Page 6

the

Finance

Society

RECENT NEWS

eBay to spin off PayPal.

The move comes after

activist investor Carl Icahn

pressured management.

Snoop Dogg invested

$50 million in news

aggregator Reddit. He is

joined by musician and

actor Jared Leto, as well as

venure capitalist Marc

Andressen.

Russia's government is

debating whether or not

to impose capital

controls on the ruble as

the currency dropped to

its lowest value since 1998.

The Finance Society 2

GET THE PICTURE

by Kevin Tsao, Class of 2016

Russia over the course of this year has attempted to assert its power once more in a conflict between it and the

European Union. During the earlier part of this year, Russia annexed Crimea and is now attempting to use military

force to coerce Ukraine to Russias Will.

Historically, the area of Crimea and Ukraine has always been part of Russia since the days of the old monarchs to

the rise of communist Russia and the establishment of the USSR. It wasnt until after the fall of the USSR that this

area became somewhat liberated though it still falls under Russias sphere of influence.

The annexation of Crimea began with the Euromaidan movement in late 2013. The movement protested against

pro-Russian President Viktor Yanukovych, advocating for resignation of government officers, and more integration

with the EU. Although this protest occurred in Kiev, the Crimean government supported Yanukovych and

condemned the protests while urging citizens to strengthen ties with Russia. As Yanukovych was removed from

power, troops, most likely from Russian forces, entered into Crimea and aided the establishment of Sergey

Aksyonov as Crimeas new prime minister. Troops and police forces also acted to isolate Crimea from the rest of

Ukraine.

Aksyonov then proceeded to ask Russian President Vladimir Putin for aid. Putin responded by taking over Crimea

with Russian forces. Then, through the efforts of both the pro-Russian Crimean government and Russia, Crimea

was annexed by Russia in March. The UN and the majority of nations do not however, recognize this annexation

and has stated that it is illegal.

However, now Ukraine is under fire by pro-Russian militants. Their constant clash with Ukrainian forces has

wreaked havoc across the nation. Casualties in Ukraine have exceeded 2,200 with many more injured according to

the UN. Rebels actively target civilians attempting to escape the warring areas. Ukrainian forces are also using brutal

methods in order to stomp out potential terrorists. Russia continues to deny aiding the pro-Russian Militants.

So what are the causes and effects?

Many cite the fact that Putin wants to have control of Sevastopol so the Russian navy can have access to the black

sea permanently without worrying that access rights might be withdrawn. Sevastopol gives Russia a port that can be

accessed easily all year round and leads into central Europe. Additionally, the Black Sea potentially contains a lot of

oil and gas resources as firms such as Exxon, Shell, and Chevron have shown interest in exploring the area. Ukraine

itself also contains many natural resources and ports that would be beneficial to Russia.

Ukraine also poses as a buffer for Russia against the west. The vast piece of land gives Russia space between itself

and Poland and Germany. This prevents NATO from encroaching upon its borders anymore as NATO already has

ties to Latvia, Lithuania, and Estonia. Additionally, the buffer may not be just physical, but psychological as well. If

The Finance Society 3

Russia is able to maintain control of Ukraine, it will show the west that it still has the power to play on an

international field.

One of the major incidents that has occurred because of the conflict has been the crash of Malaysian Airlines Flight

17. It was presumed to have been shot down around the Ukrainian-Russian border. 298 people died in the crash,

making it the deadliest airliner shot down in history. The worst part is, aboard the plane were many researchers and

scientists on their way to the 20th International Aids Conference.

Ukraine is also on the brink of collapse. Due to its economic ties with Russia, the conflict has resulted in a recession

caused by a decrease in the countrys exports by 19%. Ukraines GDP is down 5% with industries collapsing and

sales declining at a faster rate than during the financial crisis. The countrys currency, the hryvnia, is also collapsing

due to a large increase in capital outflows as investors take their money out of Ukraine. Inflation is also rising at an

alarming rate and is already above 14% in conjunction with a fall in wages. At the current rate, the nation will

default on its debt.

Russia itself is also facing unrest and economic decline due to the crisis. Protestors have taken to the streets in

Moscow in response to Russias involvement in Ukraine. The protestors are motivated by both the Russian troops

killed in Ukraine and by the unjust military intervention in Ukraine. Economically, the cost of Russias intervention

in Ukraine could be over $70 billion dollars. Additionally, Putin has used over $12 billion to prop up the falling

Russian Ruble as well.

Adding on to the expenses Russia already has to pay, the EU has also imposed economic sanctions upon Russia.

These sanctions aim to prevent all citizens of EU countries from purchasing new debt or stock issues by the

Russian financial sector. It also bars Russian banks from listing new stocks on the European Stock Exchanges. The

EU is also banning any new contracts selling military arms to Russia. The EU is also planning on stopping the sale

of equipment used in fossil fuel extraction in deep-sea drilling, arctic exploration, and shale-oil development. Russia

itself has also initiated an embargo on food imports in retaliation, though this may prove to be more costly than its

worth.

The Russian market index, the MICEX, declined 0.7 percent after the report of new EU economic sanctions, but

rallied the next day as the sanctions were not perceived by Russian investors as tough. Investors do admit

however, if EU imposes stronger sanctions the market would crumble. The Ruble was not so fortunate though, as it

hit a new low against the dollar at 37.64. The Rubles decline due to sanctions is also compounded with the

expectations from investors that the US will raise interest rates making less risky investments more attractive

causing emerging market currencies to plummet. As of right now, EU sanctions have already caused $75 billion in

capital flight this year, pushing the economy slowly into a recession.

Overall Russias determination in acquiring Crimea and conquering Ukraine has caused a major conflict between the

sides of the US and EU versus Russia and its sphere of influence. The political effects of this conflict are still a

mystery though the immediate economic effects are quite obvious. Both the EU and Russia will suffer from the

various sanctions, embargoes, protests, and violence that occur in the region. However, the question to be answered

is, How will this conflict affect long-term economic growth in an increasingly interdependent world?

The Finance Society 4

ISIS AND THE U.S. ECONOMY

by Neil Shah, Class of 2016

A few months ago, President Obamas words echoed throughout the

nation as he announced, our troops are heading home. Parents,

children, and friends of all demographics had high hopes to spend time

with their beloved soldiers and enjoy the new era of peace that was

expected to begin.

But this so-called era of peace was brief, as a small Iraqi affiliate of Al -Qaeda emerged. Within a few months,

ISIS (Islamic State in Iraq and Syria) distorted boundaries in the Middle East and provoked a United States

bombing campaign. And now, President Obama has recalled his troops and is strategizing an optimal way to

prevent the terrorist group from gaining further momentum.

While it is evident that the news of heading back into war is heartbreaking to numerous families, a topic that should

also gain attention is the financial implications this war may have on the economy and the markets.

According to reporters, the war is expected to cost approximately $20 billion per year. To put this number in

perspective, America has been spending nearly $200 billion per year on Afghanistan and Iraq since 2001. Evidently,

in purely a cost-basis, the U.S can afford this war. However, the question to delve deeper into is: Is cost the only

thing we should consider?

Surprisingly, the US economy and the financial markets have not been damaged so far. Investors are frolicking as

the S&P500 and Dow Jones Industrial Average are hitting record levels every week. And this is probably due to the

fact that the concern over ISIS has not negatively impacted oil, a major commodity. In fact, crude oil has dropped

by more than $10 in the last two months, allowing US stocks to rally as lower energy prices have decreased

operating costs for businesses. In terms of the bond market, treasury yields have remained extremely low. This is

primarily because the demand for U.S. government debt has increased in times of fear, thereby increasing bond

prices and lowering interest rates. Perhaps, the situation with ISIS has actually helped equities so far. Low bond

yields are not only making equities appear as attractive investments but also encouraging businesses to raise more

debt and pursue additional investment endeavors.

While the details above make the markets look attractive, investors should definitely not undermine the potential

impact of the terrorist regime. As previously mentioned, oil prices have still not risen and it seems that domestic

energy production has allowed the US economy to continue its recovery. However, if ISIS maintains its growth rate

and expands its presence, oil flows from Iran and the Arabian Peninsula will be disturbed and the US certainly

cannot rely on its own production to fill the gap. As oil supply diminishes, a domino effect will occur - oil prices

will rise, investor confidence will fall, earnings will drop, and the markets will inevitably decline.

And lets not forget another major possibility were talking about a terrorist group that has a strong hatred

towards the United States. Keep in mind that when the US was in war with Al-Qaeda in 2003, our troops killed the

parents and family members of countless 8 year-olds; it is these 8 year-olds that have become adults and want

vengeance on the United States and it is these adults that certainly will not give up without a fight.

Ultimately, as potential investors, this situation should not be overlooked. ISIS has vowed to make an effort to

attack American soil in some manner. God forbid it does not happen; however, if our military fails to end the

terrorist regime and ISIS continues to maintain its threat, our recovering economy and record-high markets will

plummet. Im not saying investors should exit their investments and stash their returns; Im simply saying we must

be cautious, as a dramatic turnaround is certainly a looming possibility.

The Finance Society 5

FEDERAL RESERVE STAYS THE COURSE TOWARDS HIGHER INTEREST RATES

by Rushi Patel, Class of 2017

On September 17, the Federal Reserve Open Market Committee made the decision to cut its bond-buying program

by another $10 Billion dollars and continue to hold near-zero interest rates for a considerable time. With the

reduction in bond purchases, the Fed is expected to stimulate the economy with $15 Billion during October, after

which it will likely move to end QE completely. Investor reaction was positive in response to Fed Chair Janet

Yellens declaration that the Fed would continue on its previously defined course of maintaining low interest rates

and raising them in the future. The Dow responded with a 0.6% increase, with both the S&P 500 and NASDAQ

following suit with similar rises.

Economists and analysts continue to project that rate hikes will begin late in 2015, a sentiment which seems to make

a great deal of sense given current market conditions. The Fed slightly lowered its growth projections for the

economy as national inflation numbers continued to undershoot Fed targets. This combination of slower than

expected growth and less than 2% inflation make it seem as if the committee does not want to prematurely dial up

rates.

We can expect that the Fed, when the time comes, will raise interest rates in a slow and methodical manner. To

avoid throwing the economy into the twilight zone of perpetually low inflation, it makes sense that the central bank

will be cautious in slowing down the growth and movement of the money supply through increased rates.

Economists widely regard low (not zero) and stable inflation as a major economic goal. Near-zero inflation means

that a buffer from deflation will not exist. Deflation results in lower investment, consumption, and other effects that

depress an economy. This is something that the Fed will want to avoid at all costs, and keeping manageable inflation

is necessary to do so.

The bigger question that must be asked is whether ending the expansive monetary policy is the right action now, or

whether it simply too early to do so. Janet Yellen and other loud voices in the Federal Reserve System seem to think

that declines in the unemployment rate and decent growth are enough to signal that the Fed has done enough and

needs to step back. The consequence of stepping back too late is overheating of the economy, but stepping back

too early will essentially cause deadweight loss. If low interest rates could have been responsible for the creation of

many new jobs and rates are raised before those jobs are created, then those jobs will essentially never be created.

Yellen has faced this dilemma in her short tenure and it has likely been the discussion among members of the Fed in

recent months. Yellen and her colleagues seem convinced by the plethora of knowledge and information at their

disposal that it is time for the Fed to let the economy return to a state of normality. What will that new normal bring

with it?

We can expect to see a slowdown in the growth of developing countries. High interest rates in the US will cause

money that has been deployed in foreign investment to return home, where it will draw relatively higher risk

The Finance Society 6

adjusted returns. This will moderately reduce the development of these growing economic powers. Furthermore, an

increased interest rate will strengthen the dollar and allow it more purchasing power when it comes to imports. This

will come at the cost of decreased exports, which will cost jobs in manufacturing and other labor-intensive, low

skilled industries. A greater trade balance deficit will be inevitable when interest rates rise.

Fed action will also significantly affect the Federal Government and its budget management goals. The rock bottom

interest rates that came about following the financial crisis have assisted the government in maintaining low interest

expenses. Several economists have gone as far to say that the government was the single largest beneficiary of Fed

policy in that it was able to spend such a great amount at sometimes-negative real interest rates. It is clear that

higher interest rates will shock the government budget and force a more realistic discussion about fiscal

responsibility.

Finally, all eyes will be on the stock market and major financial institutions. Recent discussion about an asset-

bubble has prompted the bears of Wall Street to claim that new Fed policy will pop inflated stock prices. As

interest rates increase, we may find that the stock market was overvaluing companies during the easy money era.

Interest rates will also have an effect on M&A activity and company financing. The amount of M&A activity may

decrease, but we can be more certain that fewer deals with be funded primarily with debt as it becomes more

expensive to borrow. This more persistent use of cash instead of debt will also translate into the daily operations

and expansion of companies. Corporations with large cash balances like Apple will be more prone to tapping their

bank accounts to expand operations or invest than they would have previously. All of this will have strong

implications for how investors, financiers, and managers operate in their respective positions and interact with one

another.

I am not very hawkish when it comes to inflation rates nor am I a member of the increased transparency/End the

Fed movement. The Federal Reserve System has done much for the economy since the Financial Crisis. Although

one can argue that the Fed played a role in the crisis occurring in the first place, it is hard to deny that the Fed and

how it implemented its monetary policy stabilized a world economy that was ready to implode. As an institution,

like all other institutions, the Fed has gone through a trial and error process and has evolved into the powerful and

capable entity it is today. If I had been the Chairman, I may have waited a little longer to raise interest rates simply

because I do not believe that the unemployment numbers are representative of the true state of the economy.

However, I am positive that the men and women of the Federal Reserve were informed, competent, and acting in

the best interest of the American people when they made their decisions.

This being said, investors, financial institutions, companies, and governments must begin making changes in their

operations for a world after zero interest rates. Classical economists are saying that the party is ending while

Keynesians are patting themselves on the back for a job well done. Either way, a rise in interest rates goes beyond

economic engineering into the realm of symbolism. When Janet Yellen announces the first-rate hike sometime next

year, rest assured that the Financial Crisis and Housing Bubble are behind us. Whether we face continued growth or

another disaster on the horizon is for the future to decide.

DISTRESS IN SOUTH KOREA

by Jag Buddhavarapu, Class of 2016

The South Korean economy has seen some ups and downs in the past year, so I

thought it would be interesting to recap come of the recent events and provide an

opinion on the future of one the worlds most advanced economies. Exports are one

of the key contributors to South Koreas economic growth, and the recent numbers

The Finance Society 7

seem to be encouraging. Exports in July rose 5.7% from a year earlier,

following 2.5% gain in June and a 1% drop in May. The growth of exports

in July actually beat median estimates, which called for a 4.6% increase.

South Korean shipments rose in July primarily because of a pick-up in

demand from advanced economies. Exports to the United States rose

19.4% from a year earlier, and shipments to Europe and Japan also

increased during this period.

Although this gain in exports is a good sign, there are still some concerns

that need to be addressed in South Korea. Exports to advanced

economies have been positive, but exports to emerging countries such as

China have been worrisome. China consumes almost one fourth of South

Koreas exports, and these exports fell 7% in July, and have consistently

been falling for three straight months. This is a huge concern, as Chinas

economy is expected to continue slowing down in the near future. Other

concerns going forward include slowing exports of computers and

petrochemical products, as well as 5.8% growth of imports in the country.

This overall decline of the worlds fourth largest economy was caused by a

few recent developments. One of the major factors is the slowing down of

the Chinese and Japanese economies, which have led to a decrease in

South Korean exports. Another major incident was the sinking of the

Sewol ferry in April, which dampened consumer spending on travel and

leisure in the past few months. Over 300 hundred people died on the

ferry, and government officials have been struggling to convince

consumers to revert back to spending on travel. Another long-term

concern for officials has also been the increasing household debt. South

Koreas household debt has almost doubled to $1 trillion over the past

decade, and legislators now fear the possibility of a high default rate on

the outstanding loans. Nomura economist Kwon Young-sun is

concerned that the Korean economy could fall into a debt trap.

In order to combat the potential decline in the South Korean economy,

the government has begun to roll out some initiatives. In July, the South

Korean government announced a $40 billion dollar stimulus package in

order to boost the slowing economy. Major provisions include a relaxation

of limits on mortgage loans, in order to kick start he stagnant property

market. South Koreas Central bank also cut interest rates in August, to

increase borrowing and, in turn, consumer spending. I am wary of these

stimulus programs, especially since they could potentially lead to

household debt further increasing. An overall improvement in the South

Korean economy must stem from bordering nations like China as a result

of the countrys high dependency on exports. As can be seen, the situation

in South Korea exemplifies the interdependency between the worlds

major economies.

Contact Us

The Finance Society

40 West Fourth Street

New York, NY 10012

Finance.Society@stern.nyu.edu

http://www.nyufinancesociety.com

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- 7Dokument101 Seiten7Navindra JaggernauthNoch keine Bewertungen

- Palm Manual EngDokument151 SeitenPalm Manual EngwaterloveNoch keine Bewertungen

- Toa Valix Vol 1Dokument451 SeitenToa Valix Vol 1Joseph Andrei BunadoNoch keine Bewertungen

- Digital Documentation Class 10 NotesDokument8 SeitenDigital Documentation Class 10 NotesRuby Khatoon86% (7)

- Presentation - Prof. Yuan-Shing PerngDokument92 SeitenPresentation - Prof. Yuan-Shing PerngPhuongLoanNoch keine Bewertungen

- Proposal For Chemical Shed at Keraniganj - 15.04.21Dokument14 SeitenProposal For Chemical Shed at Keraniganj - 15.04.21HabibNoch keine Bewertungen

- Agreement Deed BangladeshDokument8 SeitenAgreement Deed BangladeshVabna EnterpriseNoch keine Bewertungen

- Rehabilitation and Retrofitting of Structurs Question PapersDokument4 SeitenRehabilitation and Retrofitting of Structurs Question PapersYaswanthGorantlaNoch keine Bewertungen

- Projects: Term ProjectDokument2 SeitenProjects: Term ProjectCoursePinNoch keine Bewertungen

- Purchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsDokument4 SeitenPurchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsSiva SankariNoch keine Bewertungen

- Review of Accounting Process 1Dokument2 SeitenReview of Accounting Process 1Stacy SmithNoch keine Bewertungen

- ReviewerDokument2 SeitenReviewerAra Mae Pandez HugoNoch keine Bewertungen

- Bank Statement SampleDokument6 SeitenBank Statement SampleRovern Keith Oro CuencaNoch keine Bewertungen

- Small Signal Analysis Section 5 6Dokument104 SeitenSmall Signal Analysis Section 5 6fayazNoch keine Bewertungen

- List of People in Playboy 1953Dokument57 SeitenList of People in Playboy 1953Paulo Prado De Medeiros100% (1)

- In Partial Fulfillment of The Requirements For The Award of The Degree ofDokument66 SeitenIn Partial Fulfillment of The Requirements For The Award of The Degree ofcicil josyNoch keine Bewertungen

- PW Unit 8 PDFDokument4 SeitenPW Unit 8 PDFDragana Antic50% (2)

- Introduction Into Post Go-Live SizingsDokument26 SeitenIntroduction Into Post Go-Live SizingsCiao BentosoNoch keine Bewertungen

- SPC Abc Security Agrmnt PDFDokument6 SeitenSPC Abc Security Agrmnt PDFChristian Comunity100% (3)

- Salem Telephone CompanyDokument4 SeitenSalem Telephone Company202211021 imtnagNoch keine Bewertungen

- Creative Thinking (2) : Dr. Sarah Elsayed ElshazlyDokument38 SeitenCreative Thinking (2) : Dr. Sarah Elsayed ElshazlyNehal AbdellatifNoch keine Bewertungen

- Safety Data Sheet: Fumaric AcidDokument9 SeitenSafety Data Sheet: Fumaric AcidStephen StantonNoch keine Bewertungen

- Sciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithDokument10 SeitenSciencedirect: Jad Imseitif, He Tang, Mike Smith Jad Imseitif, He Tang, Mike SmithTushar singhNoch keine Bewertungen

- Vice President Enrollment Management in Oklahoma City OK Resume David CurranDokument2 SeitenVice President Enrollment Management in Oklahoma City OK Resume David CurranDavidCurranNoch keine Bewertungen

- Item Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptDokument1 SeiteItem Description RCVD Unit Price Gross Amt Disc % Ta Amount DeptGustu LiranNoch keine Bewertungen

- Descriptive Statistics - SPSS Annotated OutputDokument13 SeitenDescriptive Statistics - SPSS Annotated OutputLAM NGUYEN VO PHINoch keine Bewertungen

- Allplan 2006 Engineering Tutorial PDFDokument374 SeitenAllplan 2006 Engineering Tutorial PDFEvelin EsthefaniaNoch keine Bewertungen

- AutoCAD Dinamicki Blokovi Tutorijal PDFDokument18 SeitenAutoCAD Dinamicki Blokovi Tutorijal PDFMilan JovicicNoch keine Bewertungen

- Durga Padma Sai SatishDokument1 SeiteDurga Padma Sai SatishBhaskar Siva KumarNoch keine Bewertungen

- Majalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFDokument1 SeiteMajalah Remaja Islam Drise #09 by Majalah Drise - Issuu PDFBalqis Ar-Rubayyi' Binti HasanNoch keine Bewertungen