Beruflich Dokumente

Kultur Dokumente

Serving America'S Neighborhoods For 120 Years: Naifa Members

Hochgeladen von

LonaBrochenOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Serving America'S Neighborhoods For 120 Years: Naifa Members

Hochgeladen von

LonaBrochenCopyright:

Verfügbare Formate

NAIFA MEMBERS:

SERVING AMERICAS

NEIGHBORHOODS FOR

120 YEARS

NATIONAL ASSOCIATION OF INSURANCE AND FINANCIAL ADVISORS

Serving Americas Neigborhoods for Over 120 Years

Since 1890, NAIFA has worked to safeguard the financial interests of the public

and protect the important relationships between agents and their clients.

Q:

Why do consumers

need qualified,

licensed agents to

help them with their

insurance and financial

needs?

A:

NAIFA Member John Ruckel, an insurance agent

for more than 40 years in Nacogdoches, TX, sums

it up best. Nacogdoches is a relatively small town

of 30,000 people, situated just north of Houston.

Its a college town with a large rural population.

I came to college here decades ago and started selling and servicing my clients

while I was finishing up my degree, says Ruckel. I stayed and watched our

families and businesses grow up together. I know them on a personal basis. Our

lives are intertwined, and there is absolutely no way a government institution

could ever replace the security of knowing the person on the other end of the

phone line.

Historically, the agent system has been the principle method of distribution for private

life and health insurance. Agents are the essential link between the consumer and

the insurance company, providing and servicing the products of the insurer while

educating the consumer on how to manage risks and how to make informed choices

regarding their insurance purchases.

Small businesses and individuals also rely on the advice of their agents for

financial and retirement planning. Here are some examples of partnerships that

clearly demonstrate the intimacy of the relationship between agents and their

clients. Consumers want personal, one-on-one service that can only be delivered

by the agent.

Dr. Corinne Zimmerman owns Hearing

Health Care Associates dedicated to

providing the best in hearing health care

services to local residents. HHCA employs

seven staff with branches in Topsham and

Augusta, ME. She turned to her agent,

Michelle Raber, for planning advice.

Small Business Owner

Corinne Zimmerman

Michelle knows me and my business

and what Im trying to accomplish. She

helped us with a simple retirement plan

that works for my employees and is

affordable for me as the employer. Ive

worked with her for eight years. She

watches out for what I need and makes

sure that Im covered appropriately.

How do you put a price tag on that kind

of peace of mind?

NAIFA Member Michelle Raber

As a small business owner myself, I enjoy

working with other small business owners to

help protect what they have worked so hard

to build. It is my job to help look for the

gaps and overlaps in their insurance plans

to ensure they are protected for the risks of

everyday life. Every business owner should

have their own board of directors which

should include a trusted attorney, accountant,

as well as a professional insurance advisor to

help them react and plan for their business.

Not only can an insurance advisor help in risk

management, but also in building assets for

retirement, who will take over the business

at retirement, and how the purchase can be

funded. By understanding what is important

to my clients, I am best positioned to help

them build their business, retain employees,

and protect their future.

Providing Peace of Mind

Offering Invaluable Service and Education

Founded in 2004 and headquartered in

the Silicon Valley in California, Achronix

Semiconductor is a high-tech company. In this

highly competitive, cutting-edge environment,

HR Director Shani Crosby needs her employee

benefits plans to be the least of her worries. Her

health broker, Amy Byrne at Vita Insurance

Associates, Inc. knows this, and understands

the complexities and the importance of the

firms health insurance needs.

HR Professional Shani Crosby

Working with Amy and the team at Vita

adds value to our benefits program. At our

inception we worked with a PEO for our

benefits needs, but when I came on board

I choose to make a switch to Vita. They

have assisted us with many aspects of our

employee benefits package, including health

plan selection, cost-sharing provisions,

preparation of easy-to-understand benefits

summaries and compliance with benefit

necessary laws such as ERISA, COBRA,

and HIPAA. As each new employee is hired,

Amy sees to it that they receive a personal

orientation on their health insurance and

other employee benefit plans. Benefit plan

details are reviewed, personal questions

are answered, and enrollment documents

are completed. This knowledge and service

is invaluable. We recognize that the agents

service enhances the value of our employee

benefits plans, and it is highly unlikely that

such a value could ever be replaced by any

government-run health care system. The

bottom line is, she is always just a phone

call away and anxious to assist me with my

most basic or complex needs.

NAIFA Member Amy Byrne

Agents and brokers act as employee

benefits managers for small and mid-sized

employers who may not be large enough to

have a dedicated employee benefits manager.

Vita acts as Acrhonixs benefits consultant,

reviewing their benefit plan options,

assisting with state and federal compliance,

administering their benefit plans on a daily

basis, and structuring affordable programs

for their employees. Simply put, we are their

health insurance advocate.

Branco Enterprises, Inc. is a family owned

apparel company based in Asheboro, NC.

Founded in 1968, Branco has over 40

employees and provides small independent

retailers with promotional branded and non-

branded apparel. They have worked with

their agent, Ron Erickson, for years.

Small Business Owner

Carrie Coleman

If it werent for Ron and the insurance

he recommended for us, my family would

have been out in the cold after my father

died. Thankfully, we had adequate life

insurance and did not have to sell the

family business or his real estate to pay

for the estate taxes. Ron explains things

so we can understand them and has

protected us on things we would normally

not pay attention to. He looks out for what

we need and provides strong guidance

through the process.

NAIFA Member

Ron Erickson

Ive worked with Branco Enterprises for

over 25 years. Years ago, I convinced them

that they needed a succession plan, and we

worked with an attorney to draft a buy-

sell agreement funded with life insurance.

Now Im working with the third generation

with a buy-sell agreement to protect their

heirs and the business as well. During this

process they are trying to keep the family

business in the family.

Giving Personalized Assistance

Brenda Walker is the insurance

clerk for the city of Springdale,

AR. Springdale employs 430

full-time employees and is

located in Northwest Arkansas,

approximately 5 miles north

of Fayetteville. Springdale has

worked with agents Sheron

Harp and Cammie Scott at AFLAC for years.

City Insurance Clerk Brenda Walker

I feel very fortunate to have a local

AFLAC office staff just a phone call away.

Sheron Harp and her staff have been, and

continue to be, extremely helpful to me and

the employees of the City of Springdale

since they have become our insurance Flex

Plan Administrator. As new employees are

hired, Sheron meets with them personally

and answers any questions they may

have and makes sure they are enrolled

in the City of Springdale benefits. Sheron

also works closely with our

payroll director to ensure

that employees benefit

information is communicated

correctly and in a timely

fashion for deduction

purposes. As a large employer,

the City of Springdale

realizes that having a local agents office

is invaluable.

NAIFA Member Sheron Harp

Over the years, I have come to

understand just how important an agent

is in helping clients. This business is

constantly changing. Being able to simplify

and explain the changes brings huge value

to the relationship I have with Brenda

and the City of Springdale. Helping them

address and solve their insurance needs is

my top priority.

Saving Businesses and Keeping Families Together

Terry Jannsen, CPA, of Jannsen &

Company employs 30 people in his firm

in Pewaukee, WI, a suburb of Milwaukee.

His clients are owner-managed small

businesses. Jannsen began working with his

agent, Terry Frett of Frett Barrington, Ltd.,

over 10 years ago to meet his firms health

insurance and group benefits needs, which

include group disability insurance, group

life insurance, and dental insurance.

Small Business Owner

Terry Jannsen

We are always looking for partnerships

to help us and our clients. I trust Terry

Fretts advice for my business and for

my clients businesses as well. He knows

our needs and shops the market for us

to make sure we have the best solution

possible. Hes even gone back to the

insurance company to negotiate a better

rate. We contact him every month

personalized service we could not get

if we had to call an 800 number or a

government agency.

NAIFA Member

Terry Frett

My relationship

with Terry Jannsen

is similar to all of our

other small business

clients. These firms

do not have a full-

time HR staff so

it is the owner or

another associate of

the firm that has the added task of managing

their employee benefit programs. This task

becomes more complicated as the government

continues to add additional employer

responsibility with a recent example being

the new ARRA COBRA premium subsidy

that was contained in the Stimulus Act. Small

business owners like Terry rely on their

benefit advisor to not only navigate their

way through fringe benefit options but the

ongoing administration of those programs.

Being a member of NAIFA reinforces our

commitment to our industry, our clients, and

our profession as trusted advisors.

Acting as Their Employee Benefits Manager

Laying Out the Best Possible Choice

Jeff Frazier is president of Cellular Today, an

authorized agent for US Cellular. He owns 10

retail cellular stores throughout Missouri and

employs 32 people. Jeff contacted agent Jeff

Hagan to help him sort out his group health

insurance plan.

Small Business Owner

Jeff Frazier

Steve also owns a small

business and understands first-

hand the challenges we face. I

was struggling with the cost of

group health insurance. Steve

came up with several solutions that would

help me retain my quality employees, and

not break the budget. Being able to sit down

face-to-face to discuss solutions made all the

difference in the world. I value that personal

relationship.

NAIFA Member Steve Hagan

My small business clients are

busy doing what they do best.

They rely on me to guide them

through the complexities of

their employee benefit options.

They want to do business with

someone in their community

that they can trust and build

a relationship with. Someone

that can help them solve their business and

financial needs.

Turning Clients into Friends

Adron Ming of Carrollton,

TX, has known his insurance

agent, Tom Currey, for years.

Consumer Adron Ming

As a client, Ive always felt

that Tom was offering me

products that were especially

good for me, not necessarily good for him. Hes

not trying tell sell me something I dont need.

We talk and he gives me his recommendation

for what would be best for me. Above

everything, I appreciate his friendship.

NAIFA Member

Tom Currey

In addition to being my

client, Adron is my best friend

of almost forty years. From a

business standpoint, though,

whether best friend or casual

acquaintance, I take special

care and plenty of time to get to know my

clients. Any recommendations for products

are tailored to meet their needs and goals. My

clients tell me regularly that my personalized

service is worth its weight in gold.

NAIFA Code of Ethics

I Believe It To Be My Responsibility:

s To hold my profession in high esteem and strive to enhance its prestige.

s To fulfill the needs of my clients to the best of my ability.

s To maintain my clients confidences.

s To render exemplary service to my clients and their beneficiaries.

s To adhere to professional standards of conduct in helping my clients to protect insurable

obligations and attain their financial security objectives.

s To present accurately and honestly all facts essential to my clients decisions.

s To perfect my skills and increase my knowledge through continuing education.

s To conduct my business in such a way that my example might help raise the professional

standards of those in my profession.

s To keep informed with respect to applicable laws and regulations and to observe them in

the practice of my profession.

s To cooperate with others whose services are constructively related to meeting the needs

of my clients.

The Value of the Agent

The commission or other compensation earned by insurance agents not

only compensates them for the sale of a product but, in addition, for

performing these other basic services:

s They work with clients to evaluate their needs for insurance protection.

This may involve substantial research and fact finding about the clients

needs. This is an ongoing process since needs continuously change as a

persons family and employment situations change.

s They educate by explaining the various plans available and provide appropriate cost in-

dexes.

s They make specific recommendations that suit the clients objectives and budget. Often an

insurance plan is designed by the agent to fit a clients special needs.

s They encourage the client to act in a timely manner to assure that the proper coverages are

in place when they are needed. They also see to it that accurate and complete information

is provided to the insurer to make sure that the client gets the very best premium available.

s They keep in touch with the client and review or update coverage on a periodic basis. They

suggest changes when appropriate and counsel clients on ways to reduce costs. Often they

must assist their client in reviewing the need for legal and tax compliance, recommending

other professional assistance when necessary.

s They assist with claims, answer questions and serve as ombudsmen in helping their clients

deal with insurance companies. Agents often spend a great deal of time helping clients as-

semble the proper documentation needed to file or follow up on a claim. This is especially

true with seniors who receive Medicare benefits.

s They assist business owners in communicating their benefit package to their employees, often

directly assisting the employee in seeing how the benefits coordinate with their personal financial

programs, as well as those provided by government entities.

All agents are licensed and regulated by their state insurance departments. Prospective agents

receive extensive training about insurance and applicable insurance law prior to taking a

written exam leading to licensing. In addition, a majority of states now require continuing

education in order for agents to maintain their licenses.

NATIONAL ASSOCIATION OF INSURANCE

AND FINANCIAL ADVISORS

2901 Telestar Court | Falls Church, VA 22042-1205

703/770-8100 | www.naifa.org

Revised 05/10

About NAIFA:

NAIFA comprises more than 700 state and local associations representing the interests of

approximately 200,000 agents and their associates nationwide. NAIFA members focus their

practices on one or more of the following: life insurance and annuities, health insurance

and employee benefits, multiline, and financial advising and investments. The Associations

mission is to advocate for a positive legislative and regulatory environment, enhance business

and professional skills, and promote the ethical conduct of its members.

Das könnte Ihnen auch gefallen

- Life Insurance Selling Guide-EnglishDokument134 SeitenLife Insurance Selling Guide-EnglishPrasanna Venkatesan83% (6)

- Fast Track Training Financial AdsvisorDokument46 SeitenFast Track Training Financial AdsvisorAstalavista ADios100% (1)

- How To Attract and SellDokument38 SeitenHow To Attract and SellMaria Gracia Tejero100% (3)

- The Generational Wealth System: A Holistic Approach to Preserving Your Wealth and LegacyVon EverandThe Generational Wealth System: A Holistic Approach to Preserving Your Wealth and LegacyNoch keine Bewertungen

- Success BasicsDokument11 SeitenSuccess BasicsMoses Oryema0% (1)

- The UnCaptive Agent: How to Escape Limitations, Build Incredible Income & Wealth, and Create the Life of Your Dreams by Starting and Operating Your Independent Insurance AgencyVon EverandThe UnCaptive Agent: How to Escape Limitations, Build Incredible Income & Wealth, and Create the Life of Your Dreams by Starting and Operating Your Independent Insurance AgencyNoch keine Bewertungen

- Insurance Agency 4.0: Prepare Your Agency for the Future; Develop Your Road Map for Digitization; Increase Profit, Scalability and TimeVon EverandInsurance Agency 4.0: Prepare Your Agency for the Future; Develop Your Road Map for Digitization; Increase Profit, Scalability and TimeNoch keine Bewertungen

- Servant Leadership at The Speed of TrustDokument10 SeitenServant Leadership at The Speed of TrustWade EtienneNoch keine Bewertungen

- The ABC's of Forming a Non Profit With a Step By Step Guide to Filling Out Form 1023Von EverandThe ABC's of Forming a Non Profit With a Step By Step Guide to Filling Out Form 1023Noch keine Bewertungen

- Non ProfitDokument13 SeitenNon ProfitArpit Uppal100% (4)

- I Love Annuities...And You Should Too!: See How the Modern “Annua” Can Fit into Your Retirement Portfolio and Other Retirement IdeasVon EverandI Love Annuities...And You Should Too!: See How the Modern “Annua” Can Fit into Your Retirement Portfolio and Other Retirement IdeasNoch keine Bewertungen

- Old Post Office Request For Proposals - CDC Staff Report FINALDokument18 SeitenOld Post Office Request For Proposals - CDC Staff Report FINALThe Daily LineNoch keine Bewertungen

- Compensation & BenefitsDokument9 SeitenCompensation & BenefitsJahid HasanNoch keine Bewertungen

- Chapter 9 ControllingDokument25 SeitenChapter 9 ControllingRicky TambuliNoch keine Bewertungen

- Copy and Paste Profile ContentDokument14 SeitenCopy and Paste Profile ContentAl Bruce100% (1)

- American Dream: Interviews with Industry-Leading ProfessionalsVon EverandAmerican Dream: Interviews with Industry-Leading ProfessionalsBewertung: 4 von 5 Sternen4/5 (1)

- Executive Summary For HomecareDokument27 SeitenExecutive Summary For Homecareindracjr50% (2)

- Own Cloud Admin ManualDokument170 SeitenOwn Cloud Admin ManualLonaBrochenNoch keine Bewertungen

- Pacific Cultural Competencies FrameworkDokument22 SeitenPacific Cultural Competencies FrameworkSándor TóthNoch keine Bewertungen

- Workplace SafetyDokument259 SeitenWorkplace Safetydinhlap237100% (1)

- Finding Your Financial Advisor: How to Understand the Industry and Confidently Hire the BestVon EverandFinding Your Financial Advisor: How to Understand the Industry and Confidently Hire the BestNoch keine Bewertungen

- Pain Free Dental Deals: An Entrepreneurial Dentist's Guide To Buying, Selling, and Merging PracticesVon EverandPain Free Dental Deals: An Entrepreneurial Dentist's Guide To Buying, Selling, and Merging PracticesNoch keine Bewertungen

- TM Sap ConfigDokument154 SeitenTM Sap ConfigbheemgiriNoch keine Bewertungen

- HRM in Insurance SectorDokument80 SeitenHRM in Insurance SectorBhagyesh Dongare84% (45)

- Work Immersion Module 3Dokument6 SeitenWork Immersion Module 3EinrEv Gee Lpt100% (3)

- Chapter 8Dokument50 SeitenChapter 8Amirul Izan100% (1)

- Aloha Financial Advising: Doing Good to Do Better for Your Clients and YourselfVon EverandAloha Financial Advising: Doing Good to Do Better for Your Clients and YourselfNoch keine Bewertungen

- Let Us Guide You: Inform Prepare CommunicateDokument5 SeitenLet Us Guide You: Inform Prepare CommunicateDA MoralesNoch keine Bewertungen

- BL Insurance Agency - Brand Avatar ReportDokument5 SeitenBL Insurance Agency - Brand Avatar ReportArsal KhanNoch keine Bewertungen

- HIBS - Employee BenefitsDokument3 SeitenHIBS - Employee BenefitsDeepak MendirattaNoch keine Bewertungen

- The Advisor's Guide to Group Life and AD&D InsuranceVon EverandThe Advisor's Guide to Group Life and AD&D InsuranceNoch keine Bewertungen

- Building An Engaged OrganizationDokument7 SeitenBuilding An Engaged OrganizationEli Ben ANoch keine Bewertungen

- 2012 WCMS Corporate SponsorsDokument11 Seiten2012 WCMS Corporate Sponsorsjana7980Noch keine Bewertungen

- E-Portfolio Term Project - Provider Relations Manager Bret Gashler - FinalDokument9 SeitenE-Portfolio Term Project - Provider Relations Manager Bret Gashler - Finalapi-325641098Noch keine Bewertungen

- Iiflar2011 12Dokument106 SeitenIiflar2011 12Aisha GuptaNoch keine Bewertungen

- Success in Incorporating Small Businesses: (Twelve Cardinal Steps to Establish a Business in New York)Von EverandSuccess in Incorporating Small Businesses: (Twelve Cardinal Steps to Establish a Business in New York)Noch keine Bewertungen

- Health Insurance Cover Letter SampleDokument4 SeitenHealth Insurance Cover Letter Samplec2znbtts100% (1)

- Silver & Silver Attorneys at Law Featured in Suburban Life MagazineDokument3 SeitenSilver & Silver Attorneys at Law Featured in Suburban Life MagazineMike Silver, EsqNoch keine Bewertungen

- 3 Reasons Why Shifting Careers To Insurance Can Give You Assurance Kalibrr Where Jobs Find YouDokument1 Seite3 Reasons Why Shifting Careers To Insurance Can Give You Assurance Kalibrr Where Jobs Find YouLaurence Mil Tan, MDNoch keine Bewertungen

- The Investment Advisor’s Compliance Guide, 2nd EditionVon EverandThe Investment Advisor’s Compliance Guide, 2nd EditionNoch keine Bewertungen

- What If I Want To Recruit A Key EmployeeDokument2 SeitenWhat If I Want To Recruit A Key EmployeeDave SeemsNoch keine Bewertungen

- Online Benefits Technology: The Strategic Broker's GuideVon EverandOnline Benefits Technology: The Strategic Broker's GuideNoch keine Bewertungen

- Sunrise Biztech System.1990Dokument1 SeiteSunrise Biztech System.1990Yatish N GowdaNoch keine Bewertungen

- Dental Wealth Nation: 7 Steps to Decrees Taxes, Increase Impact, and Leave Your Lasting LegacyVon EverandDental Wealth Nation: 7 Steps to Decrees Taxes, Increase Impact, and Leave Your Lasting LegacyNoch keine Bewertungen

- Seguros Pepín: Charina Sosa 14-1132 As'fraya Castellanos 15-0178Dokument18 SeitenSeguros Pepín: Charina Sosa 14-1132 As'fraya Castellanos 15-0178Manaury MoriceteNoch keine Bewertungen

- Quality of Work Life: Organizational MembershipDokument8 SeitenQuality of Work Life: Organizational MembershipSonali TalwarNoch keine Bewertungen

- MidUSA Credit Union 2015 Busine - Kayla ManuelDokument45 SeitenMidUSA Credit Union 2015 Busine - Kayla ManuelChizitere OnyeNoch keine Bewertungen

- "Perspective" in Employee Benefits: From a Professional PractitionerVon Everand"Perspective" in Employee Benefits: From a Professional PractitionerNoch keine Bewertungen

- Peace & Possibilities: Creating Peace of Mind in RetirementVon EverandPeace & Possibilities: Creating Peace of Mind in RetirementNoch keine Bewertungen

- Risk Management for Financial Planners, 2nd EditionVon EverandRisk Management for Financial Planners, 2nd EditionNoch keine Bewertungen

- Step 1: Screening InterviewDokument29 SeitenStep 1: Screening Interviewrakeshrawal186Noch keine Bewertungen

- Brian Vaughn Testimony On The Patient Protection and Affordable Care ActDokument10 SeitenBrian Vaughn Testimony On The Patient Protection and Affordable Care ActU.S. Chamber of CommerceNoch keine Bewertungen

- CcisbiographystaffDokument3 SeitenCcisbiographystaffccisinsNoch keine Bewertungen

- Retirement Financial Expert Ryan Skinner - A Step Above The RestDokument3 SeitenRetirement Financial Expert Ryan Skinner - A Step Above The RestRyan SkinnerNoch keine Bewertungen

- Diana VermeireDokument1 SeiteDiana VermeirePrice LangNoch keine Bewertungen

- The Gold Standard: Nine Steps to Effectively Managing Your Workers' Compensation ProcessVon EverandThe Gold Standard: Nine Steps to Effectively Managing Your Workers' Compensation ProcessNoch keine Bewertungen

- Ministry of Social Services and DevelopmentDokument4 SeitenMinistry of Social Services and DevelopmentAriane Manalo CerezoNoch keine Bewertungen

- MTTI EBB PDFonly FinalDokument59 SeitenMTTI EBB PDFonly FinalEstudio 664Noch keine Bewertungen

- Financial Representative Position StatementDokument1 SeiteFinancial Representative Position Statementapi-313525390Noch keine Bewertungen

- What If I Am The Sole Owner and Worried About ContinuityDokument2 SeitenWhat If I Am The Sole Owner and Worried About ContinuityDave SeemsNoch keine Bewertungen

- Amend Modify Restrictive CovenantsDokument45 SeitenAmend Modify Restrictive CovenantsLonaBrochenNoch keine Bewertungen

- Autodesk Navisworks 2013 Service Pack 2 ReadmeDokument10 SeitenAutodesk Navisworks 2013 Service Pack 2 ReadmeLonaBrochenNoch keine Bewertungen

- Disaster Preparedness of VP 2008Dokument25 SeitenDisaster Preparedness of VP 2008LonaBrochenNoch keine Bewertungen

- My City Houston Map Viewer Web Site: A B o U T M y C I T yDokument8 SeitenMy City Houston Map Viewer Web Site: A B o U T M y C I T yLonaBrochenNoch keine Bewertungen

- Manual Motor ControllersDokument2 SeitenManual Motor ControllersLonaBrochenNoch keine Bewertungen

- Federal Motor Carrier Safety Administration: State of California Department of California Highway PatrolDokument4 SeitenFederal Motor Carrier Safety Administration: State of California Department of California Highway PatrolLonaBrochenNoch keine Bewertungen

- 2014 Federal Income Guidelines For Determining CHIP Eligibility For All ChildrenDokument1 Seite2014 Federal Income Guidelines For Determining CHIP Eligibility For All ChildrenLonaBrochenNoch keine Bewertungen

- Emv-The Catalyst For A New Us Payment EcosystemDokument12 SeitenEmv-The Catalyst For A New Us Payment EcosystemLonaBrochenNoch keine Bewertungen

- Chiropractic Subluxation Diagnosis/Condition: ICD-9 CodesDokument4 SeitenChiropractic Subluxation Diagnosis/Condition: ICD-9 CodesLonaBrochenNoch keine Bewertungen

- Check Writing Tips: Financial InstitutionDokument12 SeitenCheck Writing Tips: Financial InstitutionLonaBrochenNoch keine Bewertungen

- Travelling Fellowship Application Form: Checklist of Items To Be Included With ApplicationDokument2 SeitenTravelling Fellowship Application Form: Checklist of Items To Be Included With ApplicationLonaBrochenNoch keine Bewertungen

- Guidelines For Effective Business Writing: Concise, Persuasive, Correct in Tone and "Inviting To Read"Dokument7 SeitenGuidelines For Effective Business Writing: Concise, Persuasive, Correct in Tone and "Inviting To Read"LonaBrochenNoch keine Bewertungen

- Module 8Dokument5 SeitenModule 8LonaBrochenNoch keine Bewertungen

- Writing Guide 2011 2012Dokument40 SeitenWriting Guide 2011 2012LonaBrochenNoch keine Bewertungen

- RM NCC RN 8.0 CHP 21Dokument21 SeitenRM NCC RN 8.0 CHP 21LonaBrochenNoch keine Bewertungen

- Saturday, 27th September 2014 /5 Asvina 1936 (SAKA)Dokument4 SeitenSaturday, 27th September 2014 /5 Asvina 1936 (SAKA)LonaBrochenNoch keine Bewertungen

- Baker Hill Pancake House Lunch SpecialsDokument1 SeiteBaker Hill Pancake House Lunch SpecialsLonaBrochenNoch keine Bewertungen

- Final Publishable JRP ReportDokument6 SeitenFinal Publishable JRP ReportLonaBrochenNoch keine Bewertungen

- Searching Pubmed With MeshDokument3 SeitenSearching Pubmed With MeshLonaBrochenNoch keine Bewertungen

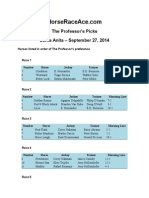

- The Professor's Picks Santa Anita - September 27, 2014Dokument3 SeitenThe Professor's Picks Santa Anita - September 27, 2014LonaBrochenNoch keine Bewertungen

- Principles of MGT 1301 ShortDokument120 SeitenPrinciples of MGT 1301 ShortAbdul Ahad ChowdhuryNoch keine Bewertungen

- Ministry of Industry and Trade - Socialist Republic of Viet Nam Independence-Freedom-HappinessDokument7 SeitenMinistry of Industry and Trade - Socialist Republic of Viet Nam Independence-Freedom-HappinesskhuelvNoch keine Bewertungen

- Contemporary Issues in ManagementDokument11 SeitenContemporary Issues in ManagementDuane EdwardsNoch keine Bewertungen

- Sssea v. Ca DigestDokument1 SeiteSssea v. Ca DigestCZARINA ANN CASTRONoch keine Bewertungen

- 5SDokument66 Seiten5SDaria D'souzaNoch keine Bewertungen

- Communication AuditDokument4 SeitenCommunication AuditNavpreet KaurNoch keine Bewertungen

- Practicum Case Digest Nisnisan Dawn GelianneDokument12 SeitenPracticum Case Digest Nisnisan Dawn GelianneArvie Donan PepitoNoch keine Bewertungen

- Tin Daily Time Record CSC TemplateDokument5 SeitenTin Daily Time Record CSC Templatetin del rosarioNoch keine Bewertungen

- Reahs Corporation v. NLRCDokument4 SeitenReahs Corporation v. NLRCbearzhugNoch keine Bewertungen

- Myra PowerpointDokument12 SeitenMyra PowerpointJepoy dizon Ng Tondo Revengerz gangNoch keine Bewertungen

- Background of The CompanyDokument5 SeitenBackground of The CompanyKathlene JaoNoch keine Bewertungen

- 10gfghhj OdtDokument3 Seiten10gfghhj OdtAkhila FrancisNoch keine Bewertungen

- Managing StressDokument22 SeitenManaging StressKumar DeepakNoch keine Bewertungen

- SXMDokument4 SeitenSXMJuanMiguelTorralvoNoch keine Bewertungen

- Premium Pay and Overtime PayDokument42 SeitenPremium Pay and Overtime PayJustin Paul Vallinan0% (2)

- A Case Study of MotivationalDokument7 SeitenA Case Study of MotivationalGarvit JainNoch keine Bewertungen

- Electrical Accident Risks in Electrical WorkDokument181 SeitenElectrical Accident Risks in Electrical WorkPatricia KCNoch keine Bewertungen

- Music Industry QuizDokument49 SeitenMusic Industry QuizAlexandraLehmannNoch keine Bewertungen

- Session 1 - Intro To Managing People - 5f41fd1b67eb4Dokument27 SeitenSession 1 - Intro To Managing People - 5f41fd1b67eb4IreshaNadeeshaniNoch keine Bewertungen

- Gender Issues and ConcernsDokument13 SeitenGender Issues and ConcernsGing Plaza BagasbasNoch keine Bewertungen

- Untitled13 PDFDokument22 SeitenUntitled13 PDFErsin TukenmezNoch keine Bewertungen

- Final Essay: Gender Wage Gap 1Dokument13 SeitenFinal Essay: Gender Wage Gap 1Alexis MastonNoch keine Bewertungen

- Groups & Teams in OrganizationsDokument28 SeitenGroups & Teams in OrganizationsVIBHOR JUNEJA EPGDIB On Campus 2022-23Noch keine Bewertungen