Beruflich Dokumente

Kultur Dokumente

Loblaw - Wal Mart Case

Hochgeladen von

luckyrobertho0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

667 Ansichten4 SeitenThis document provides an overview of Loblaw, Canada's largest grocery retailer. It discusses Loblaw's mission, history of acquisitions, corporate strategy focused on private labels and distribution, and SWOT analysis. It also covers the threats posed by Walmart's market entry and Loblaw's 2007 review to lower prices, improve inventory, and differentiate store formats in response to increasing competition.

Originalbeschreibung:

Loblaw - Wal Mart case

Originaltitel

Loblaw - Wal Mart case

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides an overview of Loblaw, Canada's largest grocery retailer. It discusses Loblaw's mission, history of acquisitions, corporate strategy focused on private labels and distribution, and SWOT analysis. It also covers the threats posed by Walmart's market entry and Loblaw's 2007 review to lower prices, improve inventory, and differentiate store formats in response to increasing competition.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

667 Ansichten4 SeitenLoblaw - Wal Mart Case

Hochgeladen von

luckyroberthoThis document provides an overview of Loblaw, Canada's largest grocery retailer. It discusses Loblaw's mission, history of acquisitions, corporate strategy focused on private labels and distribution, and SWOT analysis. It also covers the threats posed by Walmart's market entry and Loblaw's 2007 review to lower prices, improve inventory, and differentiate store formats in response to increasing competition.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

Daftar Isi

- Loblaw mission and vision statement

- Loblaw history

- Corporate strategy

- Industry overview

- SWOT analysis

- Wal-Mart Market Entry

- February 2007: 100-day review

- Summary

- Discussion Question

- References

Loblaw mission and vision statement

Loblaws mission is to be Canadas best food, health, and home retailer by exceeding customer

expectations through innovative products at great prices.

Loblaw is committed to a strategy developed under three core themes: Simplify, Innovative and

Grow.

Loblaw history

Loblaw was acquired by George Weston Ltd.

- Loblaw was built as a food empire through the purchase of grocery manufacturers, retails

and wholesalers.

- Credited with inventing premium private brands in North America.

- In 2005, Loblaw was the largest supermarket chain in Canada, with an estimated market

share of 34,9%.

- In 2008, Loblaw has 609 corporate and 427 franchised stores in every province and territory

in Canada (21 banners).

- Loblaws Presidents Choice and name control brands are the 1# consumer packaged good

brands by sales in Canada.

Corporate strategy

Creation of private labels

Consolidated of distribution centers

Closure of unprofitable stores

Maximized the use of Loblaws fleet

Uniform pricing strategy

Standardized store design

Renegotiated union contracts

Introduction of general offerings

Industry overview

- Canadian supermarket industry was valued at $73 billion in 2006.

- The grocery business was les fragmented, more competitive, multicultural and dominated

by nation companies.

- Canada has a well-developed discount grocery sector with very high standards.

- The Provinces of Ontario is a key market in Canada and the biggest market for Loblaw.

Ontarios sales declined 4.3% in 2006.

- Although sales in 2006 grew 2.49%, the growth was slower than the traditional year-to-year

increase of around 4.8%.

- New stores are increasing the average size of supermarkets in Canada.

- National and regional chains are getting a wider range of store innovations and an increased

spotlight on private labels.

SWOT analysis

Strength

- Strong brand name

- Position of market share sales number continue growing

- 7000 private-label products (No Name and Presidents choice)

- Presidents organic product

- Presidents choice bank and its loyalty program

- Large amount of fixed assets versus low amount of debt

- Economy of scale and large knowledge and experience in Canadian market.

- Wide geographic coverage (all Canadian provinces)

- Social responsibility initiatives, close to the community.

Weakness

- Operating margin dropped to 1% in 2006.

- Return on average total assess of only 2.30% in 2006

- Stores are underperforming

- Complicated corporate structure and weak management

- Plagued with problems in its distribution systems: broken buyer-supplier relationships,

delayed delivering goods, out of stocks.

- Loblaw is not doing fresh food as well as the others are right now

- Customers accustomed to prices driven by regular sale promotion

- Customers find difficult to navigate the superstores

- Lack of experience managing general merchandise inventory

- 21 banners

Opportunities

- New management team and dew business plan

- Commitment to strategy: Simplify, Innovative, Grow

- Growing its discount segment, becoming the low-price leader

- Openings to exploit emerging new technologies

- Proven product innovation capabilities

- Large on financial resources to grow the business and pursue promising initiatives

- Four-year contract with unions and elimination of 20% of its administrative workforce

- Lack of customer awareness about general merchandise deep discount pricing strategy

- Joe Fresh Style line of clothing

Threats

- Goodwill is continuously dropped in value

- Market/book ratio has been decreasing since 2002

- Intense competition

- Major Union problems

- Grocery sales are growing slower than others years average

- Canadian market is attracting foreign investors

- Wal-Mart experience in global market has continually pushed its general merchandise

dominance forward while developing its food business.

Conclusions

- Although the Loblaw faced significant hurdles, the company has an attractive set of strength

and resources to restore its profitability and growth.

- We have identified as alarming weak, its problems with distribution system and tolerated

poor management. A retailed stores distribution system and management are key success

factors.

- The major threat is that competitors are growing stronger while Loblaws consumer

satisfaction is decreasing due to the company poor performance.

- Loblaws best opportunity is to capitalize its experience on food market. Loblaws

commitments to simplify, innovate, and grow under the application of a new business plan

is the best opportunity that the company has to be a front-runner again.

Wal-Mart Market Entry

- Wal-Mart poses a serious threat to other grocers

a. Economies of scale and scope

b. Everyday low pricing

c. Supplier influence

d. State-of-art distribution system

- Wal-Mart built a super-centers and rapid expansion forthcoming

a. In 2007 groceries accounted for 31% of total sales

February 2007: 100-day review

We are not delivering the right value for money and we are not getting the credit with the

customer for investments that we do make, said chairman Galen Weston Jr.

Proposed actions by executing and analysts:

- Clear out excess inventory and improve stocking

- Strong offering of private labels, de-emphasize national brands and eliminate redundant

sizes

- Reduce space allocated to general merchandise. Devote more are to food or reduce the size

of stores

- Lower prices for selected items to retain its customers

- Improved differentiation between the smaller conventional Loblaw supermarkets and the

larger discount outlets

- Reconstruction of the famous Maple leaf Gardens in downtown Toronto

Summary

Loblaw has begun to reorganize its business strategy however it is evident that change is imminent.

References

- Canadian Council of Grocery Distribution (CCGD)

http://www.ccgd.ca/home/en/index.html

- Loblaw Companies Limited

http://www.loblaw.com/

- Thompson, A.A.Jr., Stricland, A. J. III, & Gamble, J. E. 2009. Crafting & Executing Strategy:

The Quest for Competitive Advantage: Concepts and Cases, Sixteenth Edition. New York,

N.Y.: McGraw-Hill/Irwin

Das könnte Ihnen auch gefallen

- Marketing Management Worked Assignment: Model Answer SeriesVon EverandMarketing Management Worked Assignment: Model Answer SeriesNoch keine Bewertungen

- Product Line Management A Complete Guide - 2019 EditionVon EverandProduct Line Management A Complete Guide - 2019 EditionNoch keine Bewertungen

- Kasus Bab 6 - Loblaw Companies LimitedDokument3 SeitenKasus Bab 6 - Loblaw Companies LimitedYan_Chii0% (1)

- Loblaw Companies LTD Case Edited FINALDokument4 SeitenLoblaw Companies LTD Case Edited FINALMd.Tanvir HabibNoch keine Bewertungen

- Marketing CaseDokument4 SeitenMarketing CaseAldo Rappaccioli MontealegreNoch keine Bewertungen

- Financial Management E BookDokument4 SeitenFinancial Management E BookAnshul MishraNoch keine Bewertungen

- Drowling Mountain ResortDokument6 SeitenDrowling Mountain ResortrsriramtceNoch keine Bewertungen

- Loblaw'sDokument17 SeitenLoblaw'ssusmadhakal100% (2)

- 1647 0 Marketing Resource and Strategic Management in PracticeDokument11 Seiten1647 0 Marketing Resource and Strategic Management in PracticeMuhammad Faraz HasanNoch keine Bewertungen

- United Cereal Case Study E2 2Dokument5 SeitenUnited Cereal Case Study E2 2Dinhkhanh NguyenNoch keine Bewertungen

- Rigmens ViewxDokument3 SeitenRigmens Viewxmruga_123Noch keine Bewertungen

- Marketing Mix of LLoydsDokument8 SeitenMarketing Mix of LLoydsAmit SrivastavaNoch keine Bewertungen

- The Seven Domains Model - JabDokument27 SeitenThe Seven Domains Model - JabpruthirajpNoch keine Bewertungen

- 261 A Syllabus Spring 2012 Full VersionDokument17 Seiten261 A Syllabus Spring 2012 Full VersionMikhail StrukovNoch keine Bewertungen

- Li Fung Case AnalysisDokument26 SeitenLi Fung Case AnalysisNaman Ladha100% (1)

- Relative Cost AnalysisDokument4 SeitenRelative Cost AnalysisShekhar YadavNoch keine Bewertungen

- AG. - Barr PDF FINAL PDFDokument13 SeitenAG. - Barr PDF FINAL PDFsarge1986Noch keine Bewertungen

- NCM Sworkit & BetterbackDokument10 SeitenNCM Sworkit & BetterbackNarula PrashantNoch keine Bewertungen

- Group AssignmentDokument12 SeitenGroup Assignmentgaurab_khetan789Noch keine Bewertungen

- 4 Ps For TouchéDokument13 Seiten4 Ps For TouchéShivangi TanejaNoch keine Bewertungen

- Sealed Air Diversey Merger Acquisition Presentation Slides Deck PPT June 2011Dokument40 SeitenSealed Air Diversey Merger Acquisition Presentation Slides Deck PPT June 2011Ala BasterNoch keine Bewertungen

- Baxter Company 2012Dokument58 SeitenBaxter Company 2012Kelly ExoNoch keine Bewertungen

- MFS CaseDokument2 SeitenMFS CaseTushar ChaudhariNoch keine Bewertungen

- Q1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?Dokument6 SeitenQ1. What Inference Do You Draw From The Trends in The Free Cash Flow of The Company?sridhar607Noch keine Bewertungen

- APM Ilyas W 1Dokument23 SeitenAPM Ilyas W 1Azhar HassanNoch keine Bewertungen

- Sec A Group 9 When A New Manager StumblesDokument13 SeitenSec A Group 9 When A New Manager StumblesKpvs NikhilNoch keine Bewertungen

- Vers Hire Company Study CaseDokument11 SeitenVers Hire Company Study CaseAradhysta SvarnabhumiNoch keine Bewertungen

- Developing Future Leaders: The Contribution of Talent ManagementDokument21 SeitenDeveloping Future Leaders: The Contribution of Talent ManagementNor AmalinaNoch keine Bewertungen

- Baiju Radhakrishnan Assignment 5 Force On Pepsico PDFDokument6 SeitenBaiju Radhakrishnan Assignment 5 Force On Pepsico PDFSree IyerNoch keine Bewertungen

- Organizational Theory (A Case of Coca Cola) - 54078Dokument4 SeitenOrganizational Theory (A Case of Coca Cola) - 54078MuhAzmiNoch keine Bewertungen

- ERGONOMICA CONSULTING AND SOLLTRAM HOTELS-SummaryDokument5 SeitenERGONOMICA CONSULTING AND SOLLTRAM HOTELS-SummaryHitesh Singh RajpurohitNoch keine Bewertungen

- Becton DickinsonDokument3 SeitenBecton Dickinsonanirudh_860% (2)

- PDFDokument50 SeitenPDFM Ali RazaNoch keine Bewertungen

- Microsoft Word - Possibilities For Arla in Pakistan.Dokument59 SeitenMicrosoft Word - Possibilities For Arla in Pakistan.reha0038Noch keine Bewertungen

- Supply Chain Design and ManagementDokument6 SeitenSupply Chain Design and ManagementjaveriaNoch keine Bewertungen

- Principle of Management. Case StudyDokument15 SeitenPrinciple of Management. Case StudyYan Gu33% (3)

- Dynamics Capabilities Modelo PPT MomoDokument44 SeitenDynamics Capabilities Modelo PPT MomoluanasimonNoch keine Bewertungen

- Li FungDokument24 SeitenLi Fungabhilash53840% (1)

- Foxy Originals Case StudyDokument7 SeitenFoxy Originals Case StudyJoshua NyabindaNoch keine Bewertungen

- Mondelez Research Note 1Dokument1 SeiteMondelez Research Note 1api-249461242Noch keine Bewertungen

- Frito Lay PresDokument8 SeitenFrito Lay PresAmber LiuNoch keine Bewertungen

- Porter S 5 Forces PEST Analysis Value Chain Analysis BCG MatrixDokument10 SeitenPorter S 5 Forces PEST Analysis Value Chain Analysis BCG MatrixPrajakta GokhaleNoch keine Bewertungen

- Marketing Management Case StudiesDokument7 SeitenMarketing Management Case StudiesBo RaeNoch keine Bewertungen

- VirginDokument10 SeitenVirginMahqueNoch keine Bewertungen

- OLI ParadigmDokument12 SeitenOLI Paradigmankushkumar2000Noch keine Bewertungen

- Introduction To VC Business ModelDokument3 SeitenIntroduction To VC Business ModelMuhammad Shahood JamalNoch keine Bewertungen

- Starbucks PDFDokument32 SeitenStarbucks PDFGilang MatriansyahNoch keine Bewertungen

- Deep Change Referee ReportDokument3 SeitenDeep Change Referee ReportMadridista KroosNoch keine Bewertungen

- PGBM152 Assignment 2021Dokument8 SeitenPGBM152 Assignment 2021Ayesha WaheedNoch keine Bewertungen

- Milking The CAP: How Europe's Dairy Regime Is Devastating Livelihoods in The Developing WorldDokument34 SeitenMilking The CAP: How Europe's Dairy Regime Is Devastating Livelihoods in The Developing WorldOxfamNoch keine Bewertungen

- TDC Case FinalDokument3 SeitenTDC Case Finalbjefferson21Noch keine Bewertungen

- ENGG4104 - Assignment 3 - 46129286Dokument4 SeitenENGG4104 - Assignment 3 - 46129286saif haqueNoch keine Bewertungen

- Strategic ManagentDokument2 SeitenStrategic Managentmurtaza259Noch keine Bewertungen

- Dabbawallahs of MumbaiDokument8 SeitenDabbawallahs of MumbaiAishu KrishnanNoch keine Bewertungen

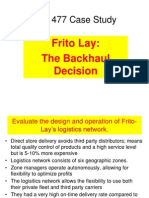

- TO 621: Short Case Assignment 2 Frito-Lay: The Backhaul Decision Due: March 26Dokument1 SeiteTO 621: Short Case Assignment 2 Frito-Lay: The Backhaul Decision Due: March 26srinath_meduri0% (1)

- AMUL-STP N SWOTDokument9 SeitenAMUL-STP N SWOTAmol Gade100% (2)

- S2 CS TOCE MapleLeaf 14p Organizational ChartDokument14 SeitenS2 CS TOCE MapleLeaf 14p Organizational ChartCosminaa Matei0% (1)

- Jeep Chrysler Corporation Marketing PlanDokument5 SeitenJeep Chrysler Corporation Marketing PlanJaswani R.L Rana100% (1)

- Final Case AnalysisDokument10 SeitenFinal Case AnalysisArmanbekAlkinNoch keine Bewertungen

- Cbs Case Competition GLOBAL 2022Dokument48 SeitenCbs Case Competition GLOBAL 2022Riya MathurNoch keine Bewertungen

- Mba 5501 Advanced Maketing SyllabusDokument11 SeitenMba 5501 Advanced Maketing SyllabusMissJes05_467622164Noch keine Bewertungen

- Brand Discovery - Lxme02Dokument4 SeitenBrand Discovery - Lxme02brindadesignerNoch keine Bewertungen

- Module 7 - MarketingDokument23 SeitenModule 7 - MarketingAnkit AgrawallaNoch keine Bewertungen

- FutureBrand CBR 17 18 ESP PDFDokument44 SeitenFutureBrand CBR 17 18 ESP PDFRicardo GBNoch keine Bewertungen

- 2000 Management Report Brands enDokument36 Seiten2000 Management Report Brands enOwais MahmoodNoch keine Bewertungen

- Nghiên cứu khoa học - Thanh TuyềnDokument27 SeitenNghiên cứu khoa học - Thanh TuyềnTuyền ThanhNoch keine Bewertungen

- Engaging Today's Fans in Crypto and CommerceDokument17 SeitenEngaging Today's Fans in Crypto and Commercerytenband100% (1)

- Healthy: Take The PledgeDokument26 SeitenHealthy: Take The PledgeCodrut AndreiNoch keine Bewertungen

- Roman - Desember2019 - EcatalogDokument218 SeitenRoman - Desember2019 - EcatalogErrika Ratna KadarwantoNoch keine Bewertungen

- Rafhan Custard Powder - FinalDokument34 SeitenRafhan Custard Powder - FinalAli Mohsin33% (3)

- SME ReportDokument81 SeitenSME ReportBridgetNoch keine Bewertungen

- WestsideDokument13 SeitenWestsideSaurabh GuptaNoch keine Bewertungen

- Effectiveness of Social Media-24022022-1Dokument9 SeitenEffectiveness of Social Media-24022022-1Roy CabarlesNoch keine Bewertungen

- Matching Dell Final AlvarodelaGarzaDokument4 SeitenMatching Dell Final AlvarodelaGarzaÁlvaroDeLaGarza50% (2)

- RAJNEESH AWASTHI MINI PROJECT Final - RAJNEESH AWASTHI MBA 1st Semester RSMTDokument37 SeitenRAJNEESH AWASTHI MINI PROJECT Final - RAJNEESH AWASTHI MBA 1st Semester RSMTrajawasthi7133Noch keine Bewertungen

- Effectiveness of Social Media MarketingDokument10 SeitenEffectiveness of Social Media MarketingPRATIK KEJRIWALNoch keine Bewertungen

- Brand ExtensionDokument12 SeitenBrand ExtensionWaseem AsgharNoch keine Bewertungen

- Emarketer Brand Interactions On Social NetworksDokument22 SeitenEmarketer Brand Interactions On Social NetworksJose LazaresNoch keine Bewertungen

- Black - The Branding of Higher EducationDokument10 SeitenBlack - The Branding of Higher EducationJoana SoaresNoch keine Bewertungen

- Holistic Marketing Tasnim BegumDokument7 SeitenHolistic Marketing Tasnim BegumFahim RezaNoch keine Bewertungen

- Nike Marketing PlanDokument31 SeitenNike Marketing Planapi-339018690Noch keine Bewertungen

- T.Q.M ASSIGMENT SEMESTER 5thDokument20 SeitenT.Q.M ASSIGMENT SEMESTER 5thSahibzada Azmat UllahNoch keine Bewertungen

- GEntrep Chapter 7Dokument47 SeitenGEntrep Chapter 7Xyrelle NavarroNoch keine Bewertungen

- Venture Marketing SummaryDokument43 SeitenVenture Marketing SummaryLaura Aussems PrivéNoch keine Bewertungen

- FerreroDokument9 SeitenFerrerosnowgulNoch keine Bewertungen

- Star Kombucha Internet MarketingDokument16 SeitenStar Kombucha Internet Marketingtramlee5102Noch keine Bewertungen

- Pantone 485: Design With SubstanceDokument9 SeitenPantone 485: Design With Substanceapi-196003998Noch keine Bewertungen

- Case Study Koalect PDFDokument4 SeitenCase Study Koalect PDFAkash ChaudharyNoch keine Bewertungen

- Impact of Rera On Real State in EldicoDokument94 SeitenImpact of Rera On Real State in EldicosalmanNoch keine Bewertungen