Beruflich Dokumente

Kultur Dokumente

2 Internationalization Patterns in Fashion Retail Distribution Implications For Firm Results 14p 11 PDF

Hochgeladen von

Glenda MeloOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2 Internationalization Patterns in Fashion Retail Distribution Implications For Firm Results 14p 11 PDF

Hochgeladen von

Glenda MeloCopyright:

Verfügbare Formate

Internationalization patterns in fashion retail distribution:

implications for rm results

Alejandro Molla-Descals, Marta Frasquet-Deltoro and Maria-Eugenia Ruiz-Molina

Marketing Department, University of Valencia, Facultad de Economia, Avda Naranjos s/n,

46022 Valencia, Spain

(Received 25 June 2010; nal version received 14 October 2010)

Fashion retailers have been intensively involved in internationalization processes, leading

to an upsurge of some global fashion brands. Notwithstanding, internationalization

processes may differ across retailers and also their results in their overseas ventures.

This paper aims at shedding additional light on fashion retail internationalization,

proposing two objectives: rst, it aims at identifying several internationalization patterns

in fashion retailing. Second, after identifying several retailer proles, we test for

signicant differences in their nancial results. With chi-square automatic interaction

detection analysis, we identify four groups of retailers whose internationalization

patterns, as well as their prots, cash ows and solvency ratios differ signicantly.

Therefore, internationalization does not always guarantee a good performance for

fashion retailers.

Keywords: internationalization; fashion retailers; service companies; rm

characteristics; results

Introduction

One of the most remarkable trends in the evolution of retailing is the increased industry

concentration and business size. Large retailers in search of sustained growth increasingly

decide to expand abroad, responding to and also contributing to the globalization process.

The internationalization of retailing differs greatly from the globalization of production, as

reported by Dawson (1994) and Dawson, Findlay and Sparks (2008), since manufacturing

and retailing businesses differ in their objectives and challenges. These differences make it

unclear to what extent academic concepts are transferable from production to distribution

(Wigley, Moore, & Birtwistle, 2005).

Today, operating internationally is increasingly common, as an option for growth, but

also as a necessity in a scenario in which the domestic market shows increasing levels of

competition and commercial saturation, such as the European Union mature markets

of highly developed economies, e.g. Germany, France and UK (Lopez & Fan, 2009).

This increases the number of companies internationalizing their activities, no longer

limited to big retailers. In this regard, an increasing number of born-global companies

decide to internationalize their businesses from the beginning of their activity, regardless

of the saturation level in the domestic market (Andersson, Gabrielsson, & Wictor, 2006;

Gabrielsson, 2005; Knight & Cavusgil, 2004). However, there are still companies restricted

to their national territory (Dragun, 2003). These behaviours make the retail internationaliza-

tion process complex and further analysis of retailer internationalization patterns is needed.

ISSN 0264-2069 print/ISSN 1743-9507 online

# 2011 Taylor & Francis

DOI: 10.1080/02642069.2011.540754

http://www.informaworld.com

Corresponding author. Email: m.eugenia.ruiz@uv.es

The Service Industries Journal

Vol. 31, No. 12, September 2011, 19791993

Fashion retailers have been recognized among the most prolic and important inter-

national companies (Alexander & Doherty, 2009; Hollander, 1970), especially with the

emergence of fashion retailer super-brands, i.e. brand-name multinationals (Klein,

2006), such as The Gap, Benetton and Gucci (Moore & Burt, 2007). Indeed, the inter-

national expansion of fashion retailers in Europe far outweighs the foreign activities of

retailers commercializing other products (Doherty, 2000). The Spanish fashion retail

industry also reects this trend. In particular, the Spanish fashion retail chain Zara is

the most international Spanish brand and one of the most successful fashion retailers,

representing an example of global expansion (Ferdows, Lewis, & Machuca, 2003;

Lopez & Fan, 2009). Other Spanish fashion store chains such as Mango and Adolfo

Dom nguez have a wide international presence, while other retailers operate exclusively

in their country of origin (Baena, 2008).

In spite of the popularity of internationalization in retailing, research has provided evi-

dence that failures in international ventures are not uncommon (Burt, Dawson, & Sparks,

2003, 2004; Burt, Mellahi, Jackson, & Sparks, 2002; Gandol &Strach, 2009), resulting in

economic or nancial failure and eventual shutdown of operations in a particular market.

In this regard, while research focuses on the geographical dimension of internationaliza-

tion and the degree of adaptation to local market conditions (Burt, Davies, Dawson, &

Sparks, 2008), little attention has been paid to the impact of retail internationalization

intensity on rm results. Although case studies are common in this industry (Lopez &

Fan, 2009), to the best of our knowledge, there are no studies in the fashion industry

exploring the relationships between internationalization patterns and rm results.

Therefore, this paper aims to identify internationalization patterns in retailing and test

for signicant differences in rm results depending on the type of expansion in foreign

markets. In particular, internationalization patterns of Spanish fashion retailers and their

implications for rm results are analysed.

Theoretical framework and research questions

Retailers international efforts are motivated by the desire to increase sales and protabil-

ity (Evans, Bridson, Byrom, & Medway, 2008) and to diversify their customer base (Vida

& Fairhurst, 1998). Notwithstanding, the retail internationalization process is complex and

an increasing number of born-global companies co-exist with local retail brands. Several

rm characteristics may explain the different internationalization patterns in retailing, e.g.

intensity of international expansion, rm size, mode of entry, age of the company, retail

activity or line of trade and the use of e-commerce.

Firm characteristics of international retailers

In general terms, it is easier to internationalize industrial products than commercial ser-

vices. In a similar vein, non-food retailers and those selling in small and specialized

outlets may internationalize easier than food retailers, as the latter have the obstacle of

the strong inuence of culture on food habits and the wider assortments that impede the

achievement of economies of scale in procurement (Alexander & Doherty, 2009; Colla,

2001). In the case of fashion retailing, several factors have been suggested to explain the

success of internationalization (Dawson, 1993; Doherty, 2000; Wigley et al., 2005), e.g.

small format requiring limited capital and management set-up costs, ease of entry and

exit, more suited to franchising than food retailing, economies of replication. Additionally,

since the European Union has suppressed restrictions for the establishment of retailers

1980 A. Molla-Descals et al.

across member countries, retailers are likely to expand to the geographically nearest

countries that also show little economic, political and cultural differences, that is, countries

which showa small psychic distance with the country of origin. Psychic distance, dened as

the distance between the home market and a foreign market resulting from the perception

and understanding of cultural and business differences (Evans, Treadgold, & Mavondo,

2000), has been identied as a key factor in explaining variations in expansion patterns

and rm results. However, there is debate over the psychic distance concept, as OGrady

and Lane (1996) stated that differences do not necessarily lead to unfavourable results

and the perception that a market is similar does not guarantee that the operation will

perform well. In this regard, retailers whose home market enjoys a high level of income

as well as a developed retail structure may perform well, if not better, in a developing

market because of the different opportunities that are available (Evans et al., 2000).

European retailers not only expand successfully within the European Union but also

into other continents, where formal and informal networks do not act as entry barriers

(Fuller-Love, 2009). This is illustrated by the success of some retail super-brands such

as Gucci or Louis Vuitton (Moore & Burt, 2007), the saturation of domestic markets,

the emergence of market gaps or segments not exploited in other markets and the

expectation of higher returns from foreign markets compared with the national market

(Alexander, 1990, 1997; Treadgold & Davies, 1988).

Furthermore, one factor traditionally used to explain internationalization is rm size.

Although several authors, e.g. Dawson (1993) and Alexander and Doherty (2009), empha-

sized the international potential of small businesses, the small size of traditional small and

medium business establishments has been viewed as an obstacle to internationalization

(Colla, 2001). However, it has been argued that the inuence of this factor is diminishing

(Dawson et al., 2008), and in this regard, Hutchinson, Quinn and Alexander (2005) stated

that a successful international retailer does not need to be large. In contrast to high-cost

market-entry strategies, such as acquisition or stand-alone stores, alternative lower cost

modes of entry have been identied, such as joint venture, franchise and concession

(Palmer, Owens, & De Kervenoael, 2010; Treadgold, 1988), which can be assumed by

small and medium-size businesses with reduced resources. In particular, franchising is

becoming increasingly popular (Doherty, 2007; Petersen & Welch, 2000), since, in

contrast to wholly owned subsidiaries or joint ventures, no equity investment is required.

Additionally, enhancing employee entrepreneurial behaviour through self-efcacy and

coaching may enable the rm to cope more efciently with international competition

(Wakkee, Elfring, & Monaghan, 2010). However, large public-owned companies, with

greater nancial resources, are likely to be present in more countries and continents

than smaller retailers.

Since companies that have accumulated more resources are traditionally those operat-

ing in the market over a long period, older and more experienced companies could be sup-

posed to be more prone to internationalize in comparison to new entrants to the market.

In this regard, experience from ones own retail overseas operations provides a valuable

platform for learning, thus contributing to the success of subsequent international ventures

(Palmer & Quinn, 2005). However, the literature also reports the possible existence of

inertia in older companies that may reduce their likelihood of introducing innovations

(Baptista, 2000; Mitchell, 1992). Johanson and Vahlne (1990) stated that rms tend to

remain domestic unless provoked, pushed, or pulled by an event or market situation,

thus following a reactive strategy.

Additionally, it has been pointed out that there is an increasing number of born-

globals, i.e. companies that decide to internationalize their businesses at or near inception

The Service Industries Journal 1981

(Andersson et al., 2006; Gabrielsson, 2005; Knight & Cavusgil, 2004; Thai & Chong,

2008), showing a proactive approach to internationalization. Examples of these companies

can be found not only among new high-technology rms (Gabrielsson & Kirpalani, 2004;

Warren, Patton, & Bream, 2009), but also in other industries such as fashion (Kuemmerle,

2005; Thai & Chong, 2008). For instance, Boo.com, founded in London in 1998 with the

aim of becoming the rst global fashion e-retailer, set up ofces in the UK, the USA,

France, Sweden, the Netherlands and Germany, offering service in seven languages and

in 18 countries (Kuemmerle, 2005). Although it failed after 18 months, there are also

successful born-global retailers such as Amazon, Net-a-Porter and Barrabes.com.

The type of product commercialized and the retailer positioning may also limit the

internationalization process. In this regard, while technology-based products may be

widely accepted in different countries, foodstuffs or cosmetics seem to be intimately

connected to cultural issues (Gandol & Strach, 2009).

Lastly, electronic commerce has been recognized as an important facilitator of inter-

national expansion, since it provides retailers with a new way of reaching the consumer

(Berry & Brock, 2004; Foscht, Swoboda, & Morschett, 2006) that has even contributed

to modify consumer behaviour (Tsai & Lee, 2009). Although e-commerce is mainly

used in multi-channel distribution in the services industry (Barrutia, Charterina, &

Gilsanz, 2009), it may also provide an opportunity for virtual expansion, especially for

small companies starting their internationalization processes (Alexander & Doherty,

2009). Moreover, since the Internet minimizes location disadvantages (Evangelista,

2005), it enables even small rms to expand beyond their own boundaries from the

beginning of their activity as born-globals (Foscht et al., 2006; Thai & Chong, 2008).

Furthermore, the websites of traditional retailers are becoming important trafc

generators for physical stores. Thus, synergy between on- and off-line stores lies not

simply in searching information before purchasing, but also in integrating both environ-

ments into a broader multi-channel strategy (Colla, 2004).

In view of the above-mentioned evidence, we state the following research question.

RQ1: Are there differentiated groups of retailers regarding their degree of international

expansion and rm characteristics, such as size, age, assortment, legal status and use of

e-commerce?

Internationalization and rm results

One of the main factors explaining international expansion is the search for greater

protability in foreign markets (Alexander, 1990, 1997; Treadgold & Davies, 1988). As

previously argued, internationalization is conceived as a learning process and, therefore,

international and domestic performance is expected to improve as experience in foreign

markets is gained. In this regard, internationalization is considered not only as a key

success factor but also as a key element of survival for large retailers (Dawson et al.,

2008). Additionally, in spite of the large contribution of international sales for some

global retailers such as Ahold or Carrefour (Burt et al., 2008; Nordas, 2008), it has

been argued that internationalization in the retailing sector makes a positive but smaller

contribution to the sales of many other retailers (Etgar & Rachman-Moore, 2008). The

evidence that a retailers competitive advantage and success in its home country is not

necessarily transferable to the host countries is put forward in a group of papers that

explore the issue of failure or divestment in the internationalization of research rms

(Bianchi & Arnold, 2004; Burt et al., 2003).

1982 A. Molla-Descals et al.

Since retailers operate in ever more distant countries and internationalize a growing

number of activities of the value chain, several stakeholders are involved, e.g. employees,

suppliers, customers, owners, competitors and governments. All this increases the

complexity and the risk of failure; in fact, success in the home country does not directly

transfer to the host countries if the degree of adaptation of the retail process is not properly

managed. In this regard, several international retailers have experienced important

difculties in some foreign markets (e.g. Burt et al., 2003, 2004; Burt et al., 2002; Gandol

& Strach, 2009), resulting in a negative nancial impact and eventual shutdown of

operations in that particular market.

Dragun (2003), however, argued that the relationship between internationalization

intensity and results is nonlinear. In particular, companies that perform better are either

global enterprises or companies that have only expanded within their country of origin,

rather than companies in a stage of intermediate international expansion.

In order to clarify the relationship between rm results and internationalization, we

enunciate the following research question.

RQ2: Are there signicant differences in retailers results depending on their degree of

international expansion?

Methodology

Spanish fashion retailers are examined through quantitative research using secondary

sources of information. Spanish fashion retailers share the main characteristics and chal-

lenges of textile and clothing companies in other European countries (Lopez & Fan, 2009)

and include some successful international retail chains, e.g. Zara and Mango, that have

received attention in the literature (e.g. Ferdows et al., 2003; Lopez & Fan, 2009;

Mazaira, Gonzalez, & Avendano, 2003). The Spanish retail market, despite a later

development, now shows trends similar to other European countries, such as Italy,

Great Britain, France and Germany. These trends are highly concentrated distribution

channels, increasing internationalization, emergence of international competitors,

outsourcing and re-evaluation of the business models to adapt to customers changing

tastes (Lopez & Fan, 2009; Tokatli & Kizilgun, 2009). We therefore expect the results

for Spanish fashion retailers to be also generalizable to other European countries.

Table 1 shows the main characteristics of the research.

The database of fashion retailers has been obtained from the available secondary infor-

mation. In particular, we have selected retail companies with the highest value of assets for

each retail merchandise or line of trade. The retailers have been located from the National

Classication of Economic Activities and/or the Tax on Economic Activities codes in the

SABI database, which contains nancial data from the last annual reports of major Spanish

companies, as well as rm characteristics such as number of employees, legal status and

the age of the company. The websites of retail brands and franchise directories (e.g.

Tormo.es and Franquiciashoy.es) provided information on the number of foreign countries

and continents in which the retail chain is present under a stand-alone and/or franchise

basis, the number of franchised stores and the total number of stores of the retailer and

the use of e-commerce.

The unit of analysis is the retail chain, and business groups not offering detailed results

for each retail chain have been excluded. Data from 64 retail chains have been collected,

where 8 chains (i.e. Zara, Bershka, Massimo Dutti, Stradivarius, Pull & Bear, Oysho,

Kiddys Class and Uterque) belong to the same company (Inditex Group). Doing the

analysis at the level of the chain and not the company may have implications for nancial

The Service Industries Journal 1983

performance, such as allocation of corporate overheads. However, analysis at the chain

level will allow us to identify the internationalization patterns of the different retail

chains, and it would be extremely interesting to analyse how chains in the same

company are classied according to their internationalization strategy. Additionally,

since they amount to only 12.5% of the total sample and are grouped in the same

segment, mean calculations may dilute the effect of corporate overheads allocations, and

thus, comparisons with other groups may not be signicantly affected by the chain

versus the company approach.

With these data, an automatic interaction detection (AID) analysis is conducted con-

sidering international expansion (measured as the number of foreign countries where

the retailer is present with, at least, one store) as the key variable in the segmentation

process and a set of rm characteristics as explanatory variables. The AID is a nonpara-

metric statistical analysis technique used to study the relation of dependency between a

dependent variable and several predicting variables (independent or explanatory variables)

operating sequentially through analysis of variance (ANOVA). In each step, the AID

algorithm identies the independent variables that contribute the most to explaining the

variability in the dependent variable (Kass, 1980). In particular, the CHAID (chi-square

AID) procedure subdivides a data set into exclusive and exhaustive segments that are com-

pared through the chi-square statistic (Magidson, 1993). CHAID has been commonly used

in Social Sciences, especially in market research (MacLachlan & Johansson, 1981).

In the present study, CHAID has been used to characterize fashion retailers based on

their internationalization pattern. This analysis is expected to provide heterogeneous

segments that differ signicantly not only in the dependent and independent variables,

but also regarding other variables.

The resulting segments are compared through an ANOVA regarding other variables,

such as business results. In this way, we aim to determine whether the companies belong-

ing to each group behave in a signicantly different way regarding variables that have not

been considered for the CHAID. Finally, the distinguishing features of the fashion retailers

segments are identied.

Results

In order to classify fashion retailers based on their international expansion pattern and

their rm characteristics, a CHAID algorithm is used considering the number of foreign

Table 1. Technical details of the research.

Universe Fashion retailers selling: adult and childrens clothing,

underwear, footwear, accessories

Geographical scope Spain

Unit of analysis Retail chain

Sample size 64 biggest retail chains

Data sources SABI

Tormo.es

Franquiciashoy.es

Retailers websites

Statistical techniques Descriptive analysis

Contingency tables

CHAID

Analysis of variance (ANOVA)

Statistical software SPSS version 17.0

1984 A. Molla-Descals et al.

countries where the retailer has presence as the dependent variable and several rmcharac-

teristics as independent variables, i.e. number of continents in which it is present, rm size

measured as total assets, operating turnover, number of employees and number of shares;

entry mode measured as the percentage representing franchised stores over the total

number of retailer stores; age of the company, retail merchandise or line of trade, the

use of e-commerce and legal status. The results obtained from the CHAID analysis are

shown graphically in Figure 1 and numerically in Table 2.

As can be seen, the CHAID algorithm generates four nal groups of fashion retailers.

In order to further characterize each nal segment, we test the signicance of the differ-

ences between segments regarding the number of foreign countries where the retailer is

present and rm characteristics. Average values for each segment and ANOVA test

values are shown in Table 3.

Regarding the dependent variable for the CHAID algorithm, i.e. number of foreign

countries where the retailer is present, it is observed that the rst group of retailers

shows a signicantly higher average value in comparison to the other segments. Retailers

in this segment are characterized by having stores in a high number of foreign markets.

In contrast to this group, the second group of retailers has no presence abroad, being

restricted to the national market. Similarly, the third group shows a reduced expansion to

foreign markets, while the fourth segment of retailers adopts an intermediate position

between the rst cluster and retailer groups 2 and 3.

Consistently, groups 2 and 3 are mainly focused on the European continent, while

stores in segments 1 and 4 are distributed in an average of three continents. Consistent

with the wide international expansion of retailer group 1, the companies are signicantly

larger in terms of total assets, operating turnover and number of employees, in comparison

with the other clusters. A wide international presence, however, is not restricted to big

retailers, since group 4 also shows a global internationalization approach, with all their

Figure 1. Classication tree generated by CHAID algorithm.

The Service Industries Journal 1985

retailers present in three continents, although they are similar in size to the retailers in

groups 2 and 3.

The wide international presence of retailers in group 4 might be explained by the use of

franchise in their growth strategy, since 37.41% of their stores are franchised in compari-

son with 22.70% in the case of the retail chains in group 1. Nevertheless, differences in the

percentage of franchised stores are not signicant across groups of retailers.

The number of countries in which retailers are present is directly related to company

age, although no signicant differences are observed across the four groups. In a similar

vein, differences between retailer groups regarding number of shares in the rm capital are

not signicantly different.

Regarding the participation of companies in each group, all Inditexs chains have been

classied in the rst nal segment, i.e. the segment including the retail chains with the

Table 3. CHAID variables: average values and signicant differences.

1 2 3 4 F

Differences

between groups

Dependent variable

Number of foreign

countries

32.00 0.00 2.67 14.43 15.26

12, 13, 14

Independent variables

Number of

continents

2.89 1.00 1.39 3.00 102.43

12, 13, 23,

24, 34

Total assets

(thousand euros)

335,060.78 12,753.25 11,143.79 15,877.93 9.61

12, 13, 14

Operating turnover

(thousand euros)

386,758.17 22,909.00 17,605.58 27,003.23 11.61

12, 13, 14

Number of

employees

2513.61 148.90 106.74 219.25 7.71

12, 13, 14

Number of shares 7.47 1.58 2.79 2.36 1.29

Franchised stores

on total stores (%)

22.70 24.60 27.99 37.41 0.60

Age of the company

(years)

26.66 19.48 20.64 22.15 1.34

Number of chains (%) 19 (29.7) 12 (18.7) 19 (29.7) 14 (21.9)

Number of companies 13 12 19 14

In order to test the signicance of the differences between the types of retailers, the Tukey post hoc multiple

comparison test is used. Only statistically signicant differences between groups at the 5% level are shown.

Statistically signicant at 1%.

Table 2. Descriptive statistics of nal nodes.

Node Final segment Size %

Number of foreign

countries average

Standard

deviation Characteristics

2 1 19 29.7 32.00 23.83 Total assets . 58,299

3 2 12 18.7 0.00 0.00 Total assets 58,299

Number of continents 1

4 3 19 29.7 2.67 2.09 Total assets 58,299

Number of continents: (1, 2]

5 4 14 21.9 14.43 16.72 Total assets 58,299

Number of continents . 2

Note: Risk estimate: 221.134. Standard error: 67.464.

1986 A. Molla-Descals et al.

widest presence in foreign countries, except for Uterque, the newest chain in the company,

operating since 2008, that has been included in group 4. Therefore, we infer that all chains

in the Inditex group follow the same expansionist pattern and in a few years Uterque will

probably achieve a wider international presence in parallel with the other Inditex chains.

In order to complete the characterization of the groups of fashion retailers, in Table 4,

we show the percentages or relative frequencies of the group and category in the total

sample (e.g. 21.9% of retailers belong to segment 1 and sell adult wear), and the

chi-square statistic to test independence between retail group and the corresponding

categorical variable.

As can be inferred from Table 4, adult wear is the predominant line of trade in the four

groups of retailers, although it is more relevant in segments 1 and 3, and the percentage of

footwear retailers is relatively higher in segments 2 and 3. There is a predominant presence

of clothing retailers in all four clusters.

No signicant differences are detected regarding the use of e-commerce across

retail segments. Therefore, while all retailers included in the sample have their own

website to provide information on their latest collections and store location, the number

of store brands offering online purchase and payment facilities in the four groups is

still small.

Lastly, international expansion might be helped by funds attracted from investors,

since there is a signicantly higher presence of Public Limited Companies in relation to

Private ones in the most internationalized segments, i.e. groups 1 and 4. In group 1,

Public Limited Companies represent more than ve times the number of Private

Limited Companies (25.0% in relation to 4.7%), and in group 4, the number of Public

and Private Limited Companies is the same, whereas in groups 2 and 3 privately owned

companies represent a higher proportion in relation to public companies.

Table 5 summarizes the characterization of the four groups of fashion retailers ident-

ied on the basis of the variables with statistically signicant differences.

The CHAID algorithm grouped retailers in four segments with similar numbers of

retailers but differentiated characteristics. The rst segment, which we have labelled as

Big global chains, gathers 29.7% of the sample of retailers. It mainly includes very big

retailers that have adopted a Public Limited Company status and have expanded in

several countries and continents.

Table 4. Retailer characteristics.

Categorical variables 1 2 3 4 Chi square

Retail line of trade 13.87

Adult wear (%) 21.9 10.9 20.3 14.1

Baby and childrens wear (%) 3.1 1.6 0.0 3.1

Underwear (%) 1.6 1.6 0.0 0.0

Footwear (%) 1.6 4.7 6.3 0.0

Accessories (%) 1.6 0.0 3.1 4.7

E-commerce 0.58

Yes (%) 6.3 4.7 9.4 6.3

No (%) 23.4 14.1 20.3 15.6

Legal status 10.23

Private Limited Company (%) 4.7 12.5 17.2 10.9

Public Limited Company (%) 25.0 6.3 12.5 10.9

Statistically signicant at 5%.

Statistically signicant at 10%.

The Service Industries Journal 1987

In contrast to this rst segment, the second group, that we have named National

retailers, represents the smallest group, i.e. 18.7%, of the sample, and even if there are

no signicant differences in age and percentage of franchised stores in comparison to

the rst segment, the retailers are signicantly smaller and have not entered foreign

markets, focusing only on the domestic market. They are mainly Private Limited

Companies which are mostly still owned by the founder.

The third group includes companies similar in size to National retailers but with

a presence in several countries, mainly in Europe. It may gather retailers that have

recently started their international expansion in a group of selected markets with similar

characteristics to the national market; therefore, we have denominated this segment

Selective international retailers. This idea comes from the observation that companies

in this group are younger (average age: 20.64 years) than more internationalized retailers,

i.e. companies in segments 4 and 1 (average age: 22.15 and 26.66 years, respectively)

and it is also supported by the presence in this segment of some upscale retailers with

a long tradition in the Spanish market, e.g. Acosta, Mascaro or Sita Murt, that have

recently established in a small number of distant markets such as Russia, China and

Saudi Arabia.

Finally, the fourth group is similar in size to segments 2 and 3, but differs from the

latter in its clearly global strategic approach. The companies included in this group are

present in several countries in an average of three continents. Thus, their expansion is

not restricted to culturally similar countries but also to different markets where Spanish

clothing and accessories might be welcome. We have named this segment Small global

retailer.

The analysis of the internationalization patterns in fashion retailing is completed with

the study of the differences in rm results across the four groups of retailers. In this regard,

Table 5. Characterization of fashion retailer groups.

Variable

Group 1: big

global chain

Group 2:

national retailer

Group 3: selective

international retailer

Group 4: small

global retailer

Number of foreign

countries

High Null Low Medium

Number of

continents

High Low Medium High

Volume of assets High Low Low Low

Operating turnover High Low Low Low

Number of

employees

High Low Low Low

Legal status Mainly public Mainly private Mainly private 50% private/50%

public

Retail activity (line

of trade)

Adult wear Adult wear Adult wear Adult wear

Baby and

childrens

wear

Baby and

childrens

wear

Footwear Baby and

childrens wear

Underwear Underwear Accessories Accessories

Footwear Footwear

Accessories

Number of retail

chains (%)

19 (29.7) 12 (18.7) 19 (29.7) 14 (21.9)

Number of

companies

13 12 19 14

1988 A. Molla-Descals et al.

we aim at testing if rm average results in the last three available years, i.e. 20062008,

differ depending on the retailer internationalization approach (Table 6).

As a result, generally speaking, Big global chains are those obtaining the best nancial

results both in absolute terms and in ratios. While their superior absolute results might be

explained because of their bigger size, their high prot margin, return on capital employed

and solvency ratios denote their excellent performance. In contrast, retailers in the third

group (Selective international retailers) are showing modest prots and cash ows in

comparison with segments of similar size, i.e. 2 and 4, and the lowest prot margin and

return on capital employed.

These results support Dragun (2003), who argued that the relationship between inter-

nationalization and rm results is nonlinear. Similar to this author, we obtain evidence

supporting the superior results of the most internationalized retailers and those focused

on their country of origin, in contrast to retailers with an intermediate degree of

international expansion. However, the inferior business results of Selective international

retailers and Small global retailers might be explained by their relatively recent intro-

duction in some markets and their nancial effort to expand in foreign markets, sacricing

short-term prot for the sake of a wider international presence.

These ndings also support the psychic distance paradox defended by OGrady and

Lane (1996), since although Big global chains are present in quite different markets in

comparison to their home country, they show better results than the other retail chain

groups, which may be present in less distant markets.

Conclusions, limitations and further research avenues

Internationalization is an option that has been widely considered by fashion retailers,

although it is more complex for retailing than for manufacturing companies (Dawson,

1994; Dawson et al., 2008). Our results reect this complexity as they identify signi-

cantly different patterns of retail market expansion, where rm size constitutes a sufcient

but not necessary condition to explain the retailers presence in international markets.

Table 6. Firm results: average values (20062008) and signicant differences.

1: Big

global

chain

2:

National

retailer

3: Selective

international

retailer

4: Small

global

retailer F

Differences

between

groups

Prot (loss) before tax

(thousand euros)

46,904.96 1277.85 564.54 227.99 10.49

12, 13,

14

Cash ow (thousand

euros)

44,346.89 1487.18 725.16 1247.35 10.86

12, 13,

14

Return on shareholders

funds (%)

36.99 24.09 42.29 26.71 0.49

Prot margin (%) 12.80 19.54 20.65 3.22 1.27

Return on capital

employed (%)

38.01 6.49 1.31 14.20 3.92

13

Solvency ratio (%) 54.91 42.43 24.38 9.74 2.69

Number of companies

(%)

19 (29.7) 12 (18.7) 19 (29.7) 14 (21.9)

In order to test the signicance of the differences between the types of retailers, the Tukey post hoc multiple

comparison test is used. Only statistically signicant differences between groups at the 5% level are shown.

Statistically signicant at 1%.

Statistically signicant at 5%.

The Service Industries Journal 1989

In this regard, while all the biggest fashion retailers are currently established in foreign

markets, many smaller retailers have also decided to take their collections across the

Spanish borders. In particular, four groups of fashion retailers are identied and labelled

as Big global chains, National retailers, Selective international retailers and Small global

retailers. Big global chains mainly adopt Public Limited Company status and differ from

the others because they are larger in size, while smaller retailers show signicantly

different international expansion patterns.

We can conclude from our analysis that the differentiated approaches towards interna-

tionalization explain differences in rm results, as both intensive international expansion

(Big global chains) and concentration in the national market (National retailers) provide

better results than other approaches, thus supporting the ndings of Dragun (2003). In con-

trast, intermediate rm expansion provides the weakest results. However, we understand

those retailers classied as Selective international retailer or Small global retailer are on

the way to achieving wider internationalization, maybe they are would-be global retailers.

This nding suggests to retailers seeking internationalization that the initial steps may

not be protable and that internationalization should be a carefully planned long-term

strategy. Going further in the process of internationalization can bring about economies

of scales in sourcing and logistics as well as economies of scope in managements

systems and the application of technologies.

This evidence about low protability initially in internationalization and subsequent

increases in performance links with the ndings on international retail learning (Palmer

& Quinn, 2005). Notwithstanding, for big retailers, international expansion may represent

a low nancial leverage that allows management to experiment and learning without

enormously damaging the overall protability of the group (Palmer & Quinn, 2005).

Additionally, in the context of international retail joint ventures, Palmer (2006) pointed

out that a selective strategy can be successful provided that the reputation of the

international retailer is well established and appeals the partner in the selection process.

Moreover, when local management has strong retail operation credentials, franchised

stores operating with greater autonomy may actually lead to more positive results.

If retailers are aware of the advisability of becoming truly global and the relatively low

inuence of psychic distance as per the paradox argued by OGrady & Lane (1996),

increased competition can be expected in this industry. Thus, we nd support for the

emergence of international competitors that are restructuring the textile and clothing

sector, as pointed out by Lopez and Fan (2009), and fashion retailers should get ready

to cope with increasing competition both in international markets as well as in their

home market. Differentiation, customization and quick response to demand with the

help of technologies may be key factors to avoid failure in this hypercompetitive

environment (Tokatli & Kizilgun, 2009).

Notwithstanding, these results should be understood as a rst approach to this issue,

since only 64 Spanish fashion retailers were analysed. As other studies in the services

industry acknowledge (e.g. Devlin, 2010), there may be similarities as well as differences

with retailers in other countries, and therefore, this research should be replicated in other

contexts before drawing conclusive links between internationalization patterns and rm

results.

Furthermore, the causality suggested between the identied categories and the nan-

cial results may be inuenced by other mitigating factors, such as the percentage of

non-domestic sales. Unfortunately, this information was not duly available for all retail

chains in secondary information sources. Primary data collection from retailers through

a questionnaire may enable the analysis of additional variables potentially inuencing

1990 A. Molla-Descals et al.

the relationship between internationalization patterns and nancial results. Collecting

primary information will also allow to explore the relationship between perceived

psychic distance and the performance of international retailers, as suggested by Evans

et al. (2000).

Additionally, fashion retailing is a complex industry that includes several types of

companies in terms of product commercialized (e.g. adult/childrens clothing, underwear,

accessories, footwear) and brand strategy, such as chain retailers (e.g. Zara, Mango),

designer retailers (e.g. Adolfo Dom nguez, Custo, V&L) and multi-brand retailers (A

rea

Interior). A bigger sample of retailers might provide an opportunity to examine differences

in internationalization patterns also regarding the type of fashion retailer.

Finally, the selection of retailers was made based on their volume of assets in 2008 and

their presence in retailing directories. In this regard, the possible effects of the global

economic recession and its unequal impact on different fashion sub-industries and

market segments should be taken into account. A study that takes a longitudinal approach

could overcome the effects of analysing data from a single moment in time.

Thus, further research should focus on building a theoretical framework to explain

factors for retail internationalization and how and to what extent retail procedures,

systems and operations are adapted to the different cultures in foreign markets. In parti-

cular, it should be explored how to generate customer loyalty in foreign markets and,

then, how to turn intangible loyalty into tangible prots, as suggested by Chen, Shen

and Liao (2009). All in all, according to Dawson (2006), we understand that in order to

shed additional light on the retail internationalization process, further progress is

needed in research to consider what type of knowledge is transferred, in which direction,

by whom and what are the results of internationalization.

Acknowledgement

This research has been nanced by the Spanish Ministry of Education and Science

(Project ref.: ECO2009-08708).

References

Alexander, N. (1990). Retailers and international markets: Motives for expansion. International

Marketing Review, 7(4), 7585.

Alexander, N. (1997). International retailing. Oxford: Blackwell.

Alexander, N., & Doherty, A.M. (2009). International retailing. Oxford: Oxford University Press.

Andersson, S., Gabrielsson, J., & Wictor, I. (2006). Born Globals foreign market channel strategies.

International Journal of Globalisation and Small Business, 1(4), 223237.

Baena, V. (2008). La expansion internacional de la franquicia espanola: descripcion del momento

actual. Proyecto Social: Revista de relaciones laborales, 12(12), 4164.

Baptista, R. (2000). Do innovations diffuse master within geographical clusters? International

Journal of Industrial Organization, 18, 515535.

Barrutia, J.M., Charterina, J., & Gilsanz, A. (2009). E-service quality: An internal, multichannel and

pure service perspective. The Service Industries Journal, 29(12), 17071721.

Berry, M.J., & Brock, U. (2004). Marketspace and the internationalisation process of the small rm.

Journal of International Entrepreneurship, 2(3), 187216.

Bianchi, C.C., & Arnold, S.J. (2004). An institutional perspective of retail internationalization

succes: Home Depot in Chile. The International Review of Retail, Distribution and

Consumer Research, 14(2), 149169.

Burt, S., Davies, K., Dawson, J., & Sparks, L. (2008). Categorizing patterns and processes in retail

grocery internationalisation. Journal of Retailing and Consumer Services, 15, 7892.

Burt, S.L., Dawson, J., & Sparks, L. (2003). Failure in international retailing: Research propositions.

International Review of Retail, Distribution and Consumer Research, 13(4), 355373.

The Service Industries Journal 1991

Burt, S.L., Dawson, J., & Sparks, L. (2004). The international divestment activities of European

grocery retailers. European Management Journal, 22(5), 483492.

Burt, S.L., Mellahi, K., Jackson, T.P., & Sparks, L. (2002). Retail internationalization and retail

failure: Issues from the case of Marks and Spencer. International Review of Retail,

Distribution and Consumer Research, 12(2), 191219.

Chen, Y.-C., Shen, Y.-C., & Liao, S. (2009). An integrated model of customer loyalty: An empirical

examination in retailing practice. The Service Industries Journal, 29(3), 267280.

Colla, E. (2001). La grande distribution europeenne. Paris: Vuibert.

Colla, E. (2004). The outlook for European grocery retailing: Competition and format development.

International Review of Retail, Distribution and Consumer Research, 14(1), 4769.

Dawson, J. (1993). The internationalization of retailing. In R.D.F. Bromley & C.J. Thomas (Eds.),

Retail change, contemporary issues (pp. 1540). London: UCL Press.

Dawson, J. (1994). Internationalization of retailing operations. Journal of Marketing Management,

10, 267287.

Dawson, J. (2006). Scoping and conceptualising retailer internationalisation. Journal of Economic

Geography, 7, 373397.

Dawson, J., Findlay, A., & Sparks, L. (Eds.). (2008). The retailing reader. Abingdon, VA:

Routledge.

Devlin, J. (2010). The stakeholder product brand and decision making in retail nancial services. The

Service Industries Journal, 30(4), 567582.

Doherty, A.M. (2000). Factors inuencing international retailers market entry mode strategy.

Journal of Marketing Management, 16, 223245.

Doherty, A.M. (2007). The internationalization of retailing: Factors inuencing the choice of fran-

chising as a market entry strategy. International Journal of Service Industry Management,

18(2), 184205.

Dragun, D. (2003). Stuck in the middle or in the muddle? Europes leading retailers in the global

value landscape. European Retail Digest, 38, 6270.

Etgar, M., & Rachman-Moore, D. (2008). International expansion and retail sales: An empirical

study. International Journal of Retail Distribution and Management, 36(4), 241259.

Evangelista, F. (2005). Qualitative insights into the international new venture creation process.

Journal of International Entrepreneurship, 3(3), 179198.

Evans, J., Bridson, K., Byrom, J., & Medway, D. (2008). Revisiting retail internationalisation:

Drivers, impediments and business strategy. International Journal of Retail Distribution

and Management, 36(4), 260280.

Evans, J., Treadgold, A., & Mavondo, F.T. (2000). Psychic distance and the performance of

international retailers. A suggested theoretical framework. International Marketing Review,

17(4/5), 373391.

Ferdows, K., Lewis, M., & Machuca, J.A.D. (2003). Zara. Supply Chain Forum, 4(2), 6267.

Foscht, T., Swoboda, B., & Morschett, D. (2006). Electronic commerce-based internationalization of

small Niche-oriented retailing companies: The case of Blue Tomato and the Snowboard

industry. International Journal of Retail and Distribution Management, 32(7), 556587.

Fuller-Love, N. (2009). Formal and informal networks in small businesses in the media industry.

International Entrepreneurship and Management Journal, 5(3), 271284.

Gabrielsson, M. (2005). Branding strategies of born globals. Journal of International

Entrepreneurship, 3(2), 199222.

Gabrielsson, M., & Kirpalani, V.H.M. (2004). Born globals: How to reach new business space

rapidly. International Business Review, 13, 555571.

Gandol, F., & Strach, P. (2009). Retail internationalization: Gaining insights from the Wal-Mart

Experience in South Korea. Review of International Comparative Management, 10(1),

187199.

Hollander, S.C. (1970). Multinational retailing. East Lansing: Michigan State University Press.

Hutchinson, K., Quinn, B., & Alexander, N. (2005). The internationalisation of small to medium-sized

retail companies: Towards a conceptual framework. Journal of Marketing Management,

21(12), 149179.

Johanson, J., & Vahlne, E. (1990). The mechanism of internationalization. International Marketing

Review, 7(4), 1124.

Kass, G.V. (1980). An exploratory technique for investigating large quantities of categorical data.

Applied Statistics, 29, 119127.

1992 A. Molla-Descals et al.

Klein, N. (2006). The discarded factory: Degraded production in the age of the superbrand. In

V. Shalla (Ed.), Working in a global era: Canadian perspectives (pp. 151176). Toronto,

ON: Canadian Scholars Press.

Knight, G.A., & Cavusgil, S.T. (2004). Innovation, organizational capabilities, and the born-global

rm. Journal of International Business Studies, 35(1), 124141.

Kuemmerle, W. (2005). The entrepreneurs path to global expansion. MIT Sloan Management

Review, 46(2), 4149.

Lopez, C., & Fan, Y. (2009). Internationalisation of the Spanish fashion brand Zara. Journal of

Fashion Marketing and Management, 13(2), 279296.

MacLachlan, D.L., & Johansson, J.K. (1981). Market segmentation with multivariate aid. Journal of

Marketing, 45(1), 7484.

Magidson, J. (1993). SPSS for windows: CHAID, release 6.0. Chicago: SPSS.

Mazaira, A., Gonzalez, E., & Avendano, R. (2003). The role of market orientation on company per-

formance through the development of sustainable competitive advantage: The Inditex-Zara

case. Marketing Intelligence & Planning, 21(4), 220229.

Mitchell, W. (1992). Are more good things better, or will technical and market capabilities conict

when a rm expands? Industrial and Corporate Change, 1, 327346.

Moore, C., & Burt, S. (2007). Developing a research agenda for the internationalization of fashion

retailing. In T. Hines & M. Bruce (Eds.), Fashion marketing: Contemporary issues

(pp. 89106). London: Butterworth-Heinemann.

Nordas, H.K. (2008). Gatekeepers to consumer markets: The role of retailers in international trade.

The International Review of Retail, Distribution and Consumer Research, 18(5), 449472.

OGrady, S., & Lane, H. (1996). The psychic distance paradox. Journal of International Business

Studies, 27(2), 309333.

Palmer, M. (2006). International retail joint venture learning. Service Industries Journal, 26(2),

165187.

Palmer, M., Owens, M., & De Kervenoael, R. (2010). Paths of the least resistance: Understanding

how motives form in international retail joint venturing. The Service Industries Journal,

30(6), 965989.

Palmer, M., & Quinn, B. (2005). An exploratory framework for analysing international retail learning.

International Review of Retail, Distribution and Consumer Research, 15(1), 2752.

Petersen, B., & Welch, L.S. (2000). International retailing operations: Downstream entry and

expansion via franchising. International Business Review, 9(4), 479496.

Thai, M.T., & Chong, L.C. (2008). Born-global: The case of four Vietnamese SMEs. Journal of

International Entrepreneurship, 6(2), 72100.

Tokatli, N., & Kizilgun, O

. (2009). From manufacturing garments for ready-to-wear to designing

collections for fast fashion: Evidence from Turkey. Environment and Planning A, 41,

146162.

Treadgold, A. (1988). Retailing without frontiers. Retail and Distribution Management, 16(6), 812.

Treadgold, A., & Davies, R.L. (1988). The internationalization of retailing. Harlow: Longman.

Tsai, D., & Lee, C. (2009). Demographics, psychographics, price searching and recall in retail

shopping. The Service Industries Journal, 29(9), 12431259.

Vida, I., & Fairhurst, A. (1998). International expansion of retail rms: A theoretical approach for

future investigations. Journal of Retailing and Consumer Services, 5(3), 143151.

Wakkee, I., Elfring, T., & Monaghan, S. (2010). Creating entrepreneurial employees in traditional

service sectors. The role of coaching and self-efcacy. International Entrepreneurship and

Management Journal, 6(1), 121.

Warren, L., Patton, D., & Bream, D. (2009). Knowledge acquisition processes during the incubation

of new high technology rms. International Entrepreneurship and Management Journal,

5(4), 481495.

Wigley, S.M., Moore, C.M., & Birtwistle, G. (2005). Product and brand: Critical success factors in

the internationalisation of a fashion retailer. International Journal of Retail & Distribution

Management, 33(7), 531544.

The Service Industries Journal 1993

Copyright of Service Industries Journal is the property of Routledge and its content may not be copied or

emailed to multiple sites or posted to a listserv without the copyright holder's express written permission.

However, users may print, download, or email articles for individual use.

Das könnte Ihnen auch gefallen

- MarkerMaking Users AEDokument57 SeitenMarkerMaking Users AEJorge Espinosa100% (1)

- Relnot AEDokument37 SeitenRelnot AEGlenda MeloNoch keine Bewertungen

- Confignotes AEDokument21 SeitenConfignotes AEJulio PaucarNoch keine Bewertungen

- OrderEntry Users AEDokument168 SeitenOrderEntry Users AEGlenda MeloNoch keine Bewertungen

- Artigo Glenda e IveteDokument22 SeitenArtigo Glenda e IveteGlenda MeloNoch keine Bewertungen

- Gravura em MetalDokument3 SeitenGravura em MetalGlenda MeloNoch keine Bewertungen

- CH 1 PDS and AccuMark - Gerber Pattern Design 2000 - 1Dokument25 SeitenCH 1 PDS and AccuMark - Gerber Pattern Design 2000 - 1Ovidiu Boboc75% (4)

- CH 1 PDS and AccuMark - Gerber Pattern Design 2000 - 1Dokument25 SeitenCH 1 PDS and AccuMark - Gerber Pattern Design 2000 - 1Ovidiu Boboc75% (4)

- Art Folder PDFDokument1 SeiteArt Folder PDFGlenda MeloNoch keine Bewertungen

- CH 1 PDS and AccuMark - Gerber Pattern Design 2000 - 1Dokument25 SeitenCH 1 PDS and AccuMark - Gerber Pattern Design 2000 - 1Ovidiu Boboc75% (4)

- We Will Rock You - PartituraDokument1 SeiteWe Will Rock You - PartituraGlenda MeloNoch keine Bewertungen

- Art Folder PDFDokument1 SeiteArt Folder PDFGlenda MeloNoch keine Bewertungen

- Deth and Dying in Contemporany SocietyDokument9 SeitenDeth and Dying in Contemporany SocietyGlenda MeloNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Book CaseDokument11 SeitenBook CaseW HWNoch keine Bewertungen

- Om Unit IVDokument16 SeitenOm Unit IVJagadish MaturuNoch keine Bewertungen

- Consolidated Teaching Timetable For September - December 2023 SemesterDokument76 SeitenConsolidated Teaching Timetable For September - December 2023 Semesterjudepettersson18Noch keine Bewertungen

- Australian Optometry TAM Stands at $4.2bnDokument5 SeitenAustralian Optometry TAM Stands at $4.2bnabeNoch keine Bewertungen

- Merger Sem 8Dokument13 SeitenMerger Sem 8Sukrit GandhiNoch keine Bewertungen

- Kgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGDokument10 SeitenKgs Per Does Kgs Per Buck: Cost Per Each Weight in Kgs Rate Per KGPradeep Kumar VaddiNoch keine Bewertungen

- Prelim Quiz 1-Problem SolvingDokument3 SeitenPrelim Quiz 1-Problem SolvingPaupauNoch keine Bewertungen

- Chap 13Dokument53 SeitenChap 13axl11Noch keine Bewertungen

- Trident's Expertise V1.5Dokument17 SeitenTrident's Expertise V1.5tridentNoch keine Bewertungen

- CRESDokument3 SeitenCRESAvijit ChakrabortyNoch keine Bewertungen

- Maybank Market Strategy For InvestmentsDokument9 SeitenMaybank Market Strategy For InvestmentsjasbonNoch keine Bewertungen

- Robbins mgmt14 PPT 18bDokument19 SeitenRobbins mgmt14 PPT 18bAmjad J AliNoch keine Bewertungen

- A Study of Impact of Macroeconomic Variables On Performance of NiftyDokument3 SeitenA Study of Impact of Macroeconomic Variables On Performance of NiftyMamta GroverNoch keine Bewertungen

- Final 2 ManagementDokument9 SeitenFinal 2 ManagementLeah Mae NolascoNoch keine Bewertungen

- Marketing StrategyDokument3 SeitenMarketing Strategyakakaka2402Noch keine Bewertungen

- Ricardo Pangan ActivityDokument1 SeiteRicardo Pangan ActivityDanjie Barrios50% (2)

- Tên Học Phần: Tiếng Anh Thương Mại 1 Thời gian làm bài: 45 phútDokument4 SeitenTên Học Phần: Tiếng Anh Thương Mại 1 Thời gian làm bài: 45 phútUyên HoangNoch keine Bewertungen

- Torres Kristine Bsa 2BDokument4 SeitenTorres Kristine Bsa 2Bkristine torresNoch keine Bewertungen

- The Challenges and Opportunities For Sustainable BDokument10 SeitenThe Challenges and Opportunities For Sustainable BThabaswini SNoch keine Bewertungen

- Unit 4-Urban Planning & Urban Renewal-Urban Renewal 2 PDFDokument14 SeitenUnit 4-Urban Planning & Urban Renewal-Urban Renewal 2 PDFPradhayini PrathuNoch keine Bewertungen

- Franchise AccountingDokument17 SeitenFranchise AccountingCha EsguerraNoch keine Bewertungen

- Who Is An Entrepreneur? Distinguish Between Owner Manager and EntrepreneurDokument7 SeitenWho Is An Entrepreneur? Distinguish Between Owner Manager and EntrepreneurShyme FritsNoch keine Bewertungen

- Chapter 03 PPT 3Dokument39 SeitenChapter 03 PPT 3kjw 2Noch keine Bewertungen

- Assignement - Case Study - Fortis & ABN AMRODokument3 SeitenAssignement - Case Study - Fortis & ABN AMROMuhammad Imran Bhatti86% (7)

- Limitations of Mfrs 136Dokument3 SeitenLimitations of Mfrs 136Ros Shinie BalanNoch keine Bewertungen

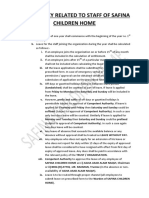

- Leave Policy Related To Staff of Safina Children HomeDokument2 SeitenLeave Policy Related To Staff of Safina Children HomehamzaNoch keine Bewertungen

- Latif Khan PDFDokument2 SeitenLatif Khan PDFGaurav AroraNoch keine Bewertungen

- Struktur Organisasi Personil OC-2 KOTAKU SumutDokument1 SeiteStruktur Organisasi Personil OC-2 KOTAKU SumuttomcivilianNoch keine Bewertungen

- RHDdqokooufm I1 EeDokument14 SeitenRHDdqokooufm I1 Eedeshdeepak srivastavaNoch keine Bewertungen

- Second Grading Examination - Key AnswersDokument21 SeitenSecond Grading Examination - Key AnswersAmie Jane Miranda100% (1)