Beruflich Dokumente

Kultur Dokumente

ABSTRACT of Labour Law

Hochgeladen von

Aditya SaxenaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ABSTRACT of Labour Law

Hochgeladen von

Aditya SaxenaCopyright:

Verfügbare Formate

ABSTRACT

ON

LAW RELATING TO PAYMENT OF BONUS

SUBMITTED BY- RACHIT GUPTA

500012425

R450210091

SECTION-B, B.A.LLB

AIM

The payment of bonus act was formed with the objective of rewarding the

employees for their good work for the establishment. It is a way by which

the establishment shares the prosperity with its employees. The objective

of this act is to improve statutory liability to pay bonus, to prescribe a

formula for calculating the bonus, to provide set off/ set on mechanism

etc. The payment of bonus is dealt under the act PAYMENT OF BONUS ACT,

1965. There are various matters which are covered under this act such as

Applicability, Eligibility, Calculation of bonus etc. This act deals with

payment of bonus to the workers if there are more than 10 members employed

in a establishment with the aid of power or if there are more than 20

persons employed in a establishment without any aid are to be given bonus

on a compulsory basis. There are various establishments which are not to be

covered under the preview of this act like LIC, UNIVERSITY AND OTHER

EDUCATIONAL ESTABLISHMENT, FINANCIAL CORPORATION etc.

This act also has some other provisions like the condition under which

payment of bonus is not to be done, calculation of bonus of certain kind of

employees, power of inspector, offences and penalties etc. The act

specifically deals with the issue of bonus. The act also deals with the

calculation of gross profit in the case of a banking company under section

4(a) First schedule and calculation of gross profit in the case of non

banking company which is covered under section 4(b) Second schedule.

SYNOPSIS

The points covered under this project are like:-

1. APPLICABILITY OF THE ACT

The act applies where there are 10 or more person employed in a

establishment with the aid of power or where 20 or more persons are

employed in a establishment without the aid of power.

1. ESTABLISHMENT

The establishment includes departments, undertakings and braches etc.

1. COMPUTATION OF AVAILABLE SURPLUS:

These sums shall be deducted from the gross profits as prior charges.

(a) any amount. by way of depreciation admissible in accordance with the

provisions of sub-section (1) of section 32 of the Income-tax Act, or in

accordance with the provisions of the agricultural income-tax law

(b) any amount by way of (development rebate or investment allowance or

development allowance) which the employer is entitled to deduct from his

income under the income-tax Act;

(c) subject to the provision of section 7, any direct tax which the

employer is liable to pay for the accounting year in respect of his income,

profit and gain during that year;

1. COMPONENTS OF BONUS :

Salary or wages includes dearness allowance but no other allowances e.g.

over-time, house rent, incentive or commission.

SA

1. SEPRATE ESTABLISHMENT :

First profit loss accounts are prepared and mainland in respect of any such

department or undertaking or branch, then such department or undertaking or

branch is treated as a separate establishment.

1. DISQUALIFICATION AND DEDUCTION OF BONUS :

On dismissal of an employee for fraud; or

riotous or violent behavior while on the premises of the establishment; or

theft, misappropriation or sabotage of any property of the establishment;

or Misconduct of causing financial loss to the employer to the extent that

bonus can be deducted for that year.

1. COMPUTATION OF GROSS PROFIT :

Banking company deals as per First Schedule and for others as per Second

Schedule.

1. ELIGIABILTY FOR BONUS :

An employee will be entitled only when he has worked for 30 working days in

that year.

1. PAYMENT OF MINIMUM BONUS :

8.33% of the salary or Rs.100 on completion of 5 years after 1st Accounting

year even if there is no profit.

1. ELIGIABLE EMPLOYEES:

Employees drawing wages up to Rs.10000/- per month or less. For calculationpurposes Rs.3500

per month maximum will be taken even if an employee is

drawing up to Rs.3500 per month.

1. TIME LIMIT FOR PAYMENT OF BONUS :

Within 8 months from the close of accounting year.

1. SET OFF AND SET ON :

As per Schedule IV

1. SUBMISSION OF RETURN :

In Form D to the inspector within 30 days of the expiry of time limit.

1. MAINTANANCE OF REGISTERES AND RECORDS :

A register showing the computation of the allocable surplus referred to

clause (4) of section 2, in Form A. A register showing the set-on and

set-off of the allocable surplus, under section 15, in Form B. A register

showing the details of the amount of bonus due to each of the employees,

the deductions under sections 17 and 18 and the amount actually disbursed,

In Form C.

1. NON APPLICABILITY OF THE ACT:

The employees of these establishments are not covered under this act such

as employees of LIC, General Insurance, Dock Yards, Red Cross, Universities

and Educational Institutions, Chambers of Commerce, Social Welfare

Institutions etc.

1. PENALTY :

For contravention of any provision of the Act or the Rules there is a

penalty of Up to 6 months imprisonment or with fine up to Rs.1000.

Das könnte Ihnen auch gefallen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

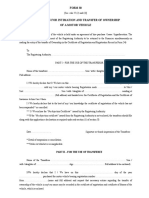

- FORM-30 For Vehicle Transfer of Ownership in RajasthanDokument2 SeitenFORM-30 For Vehicle Transfer of Ownership in RajasthanAditya SaxenaNoch keine Bewertungen

- Information TechnologyDokument14 SeitenInformation TechnologyAditya SaxenaNoch keine Bewertungen

- Synopsis On Company LawDokument1 SeiteSynopsis On Company LawAditya SaxenaNoch keine Bewertungen

- Gattu Material EnvironmentDokument9 SeitenGattu Material EnvironmentAditya SaxenaNoch keine Bewertungen

- Synopsis On The Topic: Conflicts of Jurisdiction in Making Custody Order For Cross-Border Children: Search For A Uniform RuleDokument1 SeiteSynopsis On The Topic: Conflicts of Jurisdiction in Making Custody Order For Cross-Border Children: Search For A Uniform RuleAditya SaxenaNoch keine Bewertungen

- Perumal Nadar (Dead) by L.R.S Vs PonnuswamiDokument5 SeitenPerumal Nadar (Dead) by L.R.S Vs PonnuswamiAditya SaxenaNoch keine Bewertungen

- Indira Gandhi AssasinationDokument3 SeitenIndira Gandhi AssasinationAditya SaxenaNoch keine Bewertungen

- Legal Personality Legal Personality Legal Personality Legal Personality Legal PersonalityDokument21 SeitenLegal Personality Legal Personality Legal Personality Legal Personality Legal PersonalityAditya SaxenaNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Utility Powertech Limited: Notice Inviting E-TenderDokument3 SeitenUtility Powertech Limited: Notice Inviting E-Tenderashishntpc1309Noch keine Bewertungen

- V-5. G.R. No. 33637 - Ang Giok Chip v. Springfield Fire & Marine Insurance CoDokument8 SeitenV-5. G.R. No. 33637 - Ang Giok Chip v. Springfield Fire & Marine Insurance CoMA. CECILIA F FUNELASNoch keine Bewertungen

- Factors That Facilitate The Transit of Lawless Elements Through The Borders of Tawi-TawiDokument55 SeitenFactors That Facilitate The Transit of Lawless Elements Through The Borders of Tawi-TawiJudeRamosNoch keine Bewertungen

- Ma Meilleure Amie - Jess Jardim-WedepohlDokument11 SeitenMa Meilleure Amie - Jess Jardim-WedepohlNathalie VanVrNoch keine Bewertungen

- MEMO DraftDokument15 SeitenMEMO DraftSatvik ShuklaNoch keine Bewertungen

- ITrainer Golf v. SwingbyteDokument6 SeitenITrainer Golf v. SwingbytePatent LitigationNoch keine Bewertungen

- PolygamyDokument4 SeitenPolygamyShayan ShahidNoch keine Bewertungen

- LAW034 - Case LawsDokument7 SeitenLAW034 - Case LawsHASYA ADRIANA SOPHIAN NIZANoch keine Bewertungen

- Kunwar Shri Vir Rajendra Singh V UOIDokument12 SeitenKunwar Shri Vir Rajendra Singh V UOIkhushi soniNoch keine Bewertungen

- Ang V PacunioDokument12 SeitenAng V PacunioSherlene Joy C. AQUITANoch keine Bewertungen

- People vs. JaranillaDokument2 SeitenPeople vs. JaranillaJustin IsidoroNoch keine Bewertungen

- Gumban Vs - GorechoDokument4 SeitenGumban Vs - GorechoMaria LopezNoch keine Bewertungen

- Amarga Vs AbbasDokument5 SeitenAmarga Vs AbbasJoseph LawaganNoch keine Bewertungen

- In Forma Pauperis Fraud by The Judiciary of The County of Lancaster and The Common Pleas Court October 9, 2015Dokument65 SeitenIn Forma Pauperis Fraud by The Judiciary of The County of Lancaster and The Common Pleas Court October 9, 2015Stan J. Caterbone33% (3)

- Solid Waste Landfill Design ManualDokument632 SeitenSolid Waste Landfill Design ManualJhon Jairo Mazuera Guzman100% (8)

- 03.1 CIVPRO - Rules 1 - 6Dokument34 Seiten03.1 CIVPRO - Rules 1 - 6Myco MemoNoch keine Bewertungen

- Globe Telecom Vs NTCDokument2 SeitenGlobe Telecom Vs NTCJ. LapidNoch keine Bewertungen

- Corporate Attorney in Minneapolis MN Resume William EnobakhareDokument2 SeitenCorporate Attorney in Minneapolis MN Resume William EnobakhareWilliamEnobakhareNoch keine Bewertungen

- Physics 3Dokument97 SeitenPhysics 3Trí Toàn100% (1)

- In The Matter Relating To: I T H ' SDokument15 SeitenIn The Matter Relating To: I T H ' Ssanket jamuarNoch keine Bewertungen

- SDS - Hi 7071Dokument3 SeitenSDS - Hi 7071hafisjNoch keine Bewertungen

- PecDokument1.270 SeitenPecAshley WinchesterNoch keine Bewertungen

- EPC392-08 v5.0 SDD Mandate Layout GuidelinesDokument14 SeitenEPC392-08 v5.0 SDD Mandate Layout GuidelinesDimack MehtaNoch keine Bewertungen

- Criminal JurisprudenceDokument17 SeitenCriminal JurisprudenceChristopher PjunatasNoch keine Bewertungen

- Is 15636 2012Dokument34 SeitenIs 15636 2012विनय शर्माNoch keine Bewertungen

- Appraisal of The Nigeria Labour LawDokument37 SeitenAppraisal of The Nigeria Labour LawAndy Domnic100% (2)

- Legal - RecitationDokument2 SeitenLegal - RecitationMay ross RoldanNoch keine Bewertungen

- The United States Vs Ah Chong DigestDokument2 SeitenThe United States Vs Ah Chong DigestLizzie GeraldinoNoch keine Bewertungen

- AmlaDokument1 SeiteAmlaMaria Izza Perez KatonNoch keine Bewertungen

- Cedgr 2Dokument3 SeitenCedgr 2Daniyar KussainovNoch keine Bewertungen