Beruflich Dokumente

Kultur Dokumente

Silabus AIK-BPKP

Hochgeladen von

indri0705890 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten4 SeitenThis course develops and uses tools of fnancial analysis to evaluate the performance and assess the value of companies. You will learn to assess an organization and whether it is creating value for stakeholders. This course covers the theory and practice of corporate and government fnance and valuation.

Originalbeschreibung:

Originaltitel

silabus AIK-BPKP.doc

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis course develops and uses tools of fnancial analysis to evaluate the performance and assess the value of companies. You will learn to assess an organization and whether it is creating value for stakeholders. This course covers the theory and practice of corporate and government fnance and valuation.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

12 Ansichten4 SeitenSilabus AIK-BPKP

Hochgeladen von

indri070589This course develops and uses tools of fnancial analysis to evaluate the performance and assess the value of companies. You will learn to assess an organization and whether it is creating value for stakeholders. This course covers the theory and practice of corporate and government fnance and valuation.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

ANDALAS UNIVERSITY, ECONOMIC FACULTY

ACCOUNTING DEPARTMENT, POST GRADUATE STUDIES

COURSE SYLLABUS

COURSE TITLE : ANALISYS OF FINANCIAL STATEMENT AND

FINANCIAL INFORMATION SEMINAR

LECTURER : Dr. Suhairi, SE, Msi, Ak

Dr. Asniai, SE, MBA, Ak, CA,CSRA

!asniai."ahari#$%ai&.'(%) !*+,-./01,,2*)

BP3P

LECTURE SC4EDULE : M(n5a6, ,-.-* 7 ,/.-*

INTRODUCTION AND COURSE OBJECTIVE:

This course develops and uses tools of fnancial analysis to evaluate the performance and

assess the value of companies in an industry context and government organization. The

course covers various valuation approaches and fnancial analysis needed for project and

organization valuation. You will learn to assess an organization and whether it is creating

value for stakeholders. This will involve applying tools of fnancial analysis and several

valuation methodologies to evaluate a companys and government organization strategic

and competitive positioning, fnancial performance, and strategic alternatives. n

important aspect of this course will !e to !ridge fnancial theory and practice with

valuation, capital structure analysis, and organizations strategy in the context of real

world implications.

This course covers the theory and practice of corporate and government fnance and

valuation. You need the theory to understand why companies and fnancial markets

!ehave the way they do. This course will show you how managers, o"cers and analysts

use fnancial theory to solve practical pro!lems. #ur coverage of the material is designed

to allow you to !ecome comforta!le with the fundamentals so that you can improve your

profciency in participating in future fnancial and strategic discussions within a company

or organization and with external analysts and service providers. mong the course

goals$

To give you the capacity to understand the theory and apply techni%ues in

corporate and government organizations fnance and valuation.

To develop your analytical skills and communication strategies for discussing

fnancial analysis and valuation.

To give you the !ig picture of valuation, so you can understand how things ft

together.

To expose you to the language of fnancial analysis and valuation.

LEARNING OBJECTIVES:

Following completion of the course students will be capable of:

Financial Statement Analysis

&aining profciency in fnancial statement analysis and evaluation of performance

metrics. 'eviewing and assessing a frms fnancial statements utilizing

performance ratios, historical analysis, strategic analysis and overall market

assessment of a frm and government organization. This includes evaluating the

degree to which a frms fnancial statements capture the underlying !usiness

reality. 'ecognizing accounting distortions and(or earnings manipulation and

restating fnancials for purposes of analysis. ssessing )ong Term *arnings and(or

+ash ,low -otential$ ,orecasting a frms fnancial performance. This includes

assessing frms future earning potential and fnancial health .assessing growth,

value drivers and risks/.

Using Valuatin !" Decisin #a$ing

0tilizing and interpreting fnancial data and applying valuation techni%ues to make

decisions a!out courses of action for a frm and government organization. 1aluing

companies using various valuation models and assessing a frms !usiness and

competitive strategy and whether it is creating value for shareholders. 2t is also

applica!le to government organization. 1aluing government organization using

various valuation models and assessing the organization can create value of the

government organization for the !enefts of citizen.

COURSE ASSESS#ENT:

In%i&i%ual Assignment '() *c+a,te" ,"esentatin an% a"ticle "e&ie-.

Class /a"tici,atin 0()

G"u, /"1ect '()

#i%te"m E2am '3)

Final E2am '3)

REFERENCES:

#ain Re!e"ences:

1. John J. Wild dan K. R. Subramanyam, (2009), Financial Statement Analyi, !nternational

"dition# (S)

2. $ahmudi, 200%, (200%), Analii &a'oran Keuan(an )emerintah *aerah, +)) S,!$ -K)..

Su88(rin$ Re!e"ences:

1. )ale'u, /ealy and 0ernanrd., (2001), 0uine Analyi 2 3aluation, 4

nd

"dition, South

Wetern ())

2. $orro5, 3incent., (1991), /andboo6 o7 Financial Analyi 7or 8or'orate $ana(er, )rentice

/all ($)

4. -oun( and 9: 0yrne., (2001), "3A and 3alue 0aed $ana(ement, A )ractical ;uide to

!m'lementation, $c;ra5 < /ill (-)

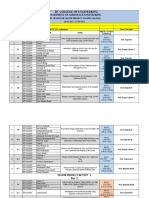

B. COURSE SYLLABUS

,o'ic &ecturer Re7ereni )reenter

1 9=er=ie5 o7 Financial

Statement Analyi and

Strate(y analyi

Suhairi> Aniati S ? 1> Article

2 Financial Re'ortin( and

Analyi

Suhairi> Aniati S ? 2> Article Abdi

(0@12AB9114B9)

A'rio

8ici

4 AnalyCin( Financin(

Acti=itie

Suhairi> Aniati S ? 4> Article Ari

*e=i

*oni

AnalyCin( !n=etin(

Acti=itie

Suhairi> Aniati S ? 1> Article *ian

"7rilia

"rlin

1 AnalyCin( 9'eratin(

Acti=itie

Suhairi> Aniati S ? %> Article "l7itria

/eni

.e=ita

B 8ah Flo5 Analyi Suhairi> Aniati S ? A> Article /ilda

$.SudarDanto

97ni

% 8redit Analyi Suhairi> Aniati S ? 10> Article Rahmat ,anim

Rio

Saliman

"Euity Analyi and

3aluation

Suhairi> Aniati S ? 11> Article Rina

Rober

Siil

A )ro'ecti=e Analyi Suhairi> Aniati S ? 9> Article ,iti

Wahyu Aih

*eni

Return on !n=eted

8a'ital and )ro7itability

Analyi

Suhairi> Aniati S ? @> Article -ul5idia

3era

!ndri

@ $!*,"R$ Suhairi> Aniati

9 8om'reheni=e 8ae

Analyi )reentation

Suhairi> Aniati

10 8om'reheni=e 8ae

Analyi )reentation

Suhairi> Aniati

11 8om'reheni=e 8ae

Analyi )reentation

Suhairi> Aniati

12 Financial Statement

Analyi 7or ;o=ernment

0)K)

14 Financial Statement

Analyi 7or ;o=ernment

0)K)

11 Financial Statement

Analyi 7or ;o=ernment

0)K)

1B Financial Statement

Analyi 7or ;o=ernment

0)K)

1% +AS

;R9+) )R9J"8,F See A''endiG

Das könnte Ihnen auch gefallen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Ib History Command Term PostersDokument6 SeitenIb History Command Term Postersapi-263601302100% (4)

- The Person Environment Occupation (PEO) Model of Occupational TherapyDokument15 SeitenThe Person Environment Occupation (PEO) Model of Occupational TherapyAlice GiffordNoch keine Bewertungen

- Checklist & Guideline ISO 22000Dokument14 SeitenChecklist & Guideline ISO 22000Documentos Tecnicos75% (4)

- 05 x05 Standard Costing & Variance AnalysisDokument27 Seiten05 x05 Standard Costing & Variance AnalysisMary April MasbangNoch keine Bewertungen

- WebLMT HelpDokument12 SeitenWebLMT HelpJoão LopesNoch keine Bewertungen

- Hima OPC Server ManualDokument36 SeitenHima OPC Server ManualAshkan Khajouie100% (3)

- of Thesis ProjectDokument2 Seitenof Thesis ProjectmoonNoch keine Bewertungen

- Benevisión N15 Mindray Service ManualDokument123 SeitenBenevisión N15 Mindray Service ManualSulay Avila LlanosNoch keine Bewertungen

- Pengaruh Profitabilitas, Leverage, Dan Growth Terhadap Kebijakan Dividen DenganDokument23 SeitenPengaruh Profitabilitas, Leverage, Dan Growth Terhadap Kebijakan Dividen Denganindri070589Noch keine Bewertungen

- Auditing Standard ASA 320Dokument19 SeitenAuditing Standard ASA 320indri070589Noch keine Bewertungen

- Financial Accounting Past Present and FutureDokument12 SeitenFinancial Accounting Past Present and Futureindri070589Noch keine Bewertungen

- Conc Framework, Revisiting The Fasb Conc FrameworkDokument14 SeitenConc Framework, Revisiting The Fasb Conc Frameworkindri070589Noch keine Bewertungen

- PyhookDokument23 SeitenPyhooktuan tuanNoch keine Bewertungen

- Powerpoint Speaker NotesDokument4 SeitenPowerpoint Speaker Notesapi-273554555Noch keine Bewertungen

- Lesson PlanDokument2 SeitenLesson Plannicole rigonNoch keine Bewertungen

- Farmer Producer Companies in OdishaDokument34 SeitenFarmer Producer Companies in OdishaSuraj GantayatNoch keine Bewertungen

- Objective & Scope of ProjectDokument8 SeitenObjective & Scope of ProjectPraveen SehgalNoch keine Bewertungen

- Prelim Examination MaternalDokument23 SeitenPrelim Examination MaternalAaron ConstantinoNoch keine Bewertungen

- Theory GraphDokument23 SeitenTheory GraphArthur CarabioNoch keine Bewertungen

- CAT 320D2: Hydraulic ExcavatorDokument5 SeitenCAT 320D2: Hydraulic Excavatorhydeer 13Noch keine Bewertungen

- Aleksandrov I Dis 1-50.ru - enDokument50 SeitenAleksandrov I Dis 1-50.ru - enNabeel AdilNoch keine Bewertungen

- Existential ThreatsDokument6 SeitenExistential Threatslolab_4Noch keine Bewertungen

- Chapter3 Elasticity and ForecastingDokument25 SeitenChapter3 Elasticity and ForecastingGee JoeNoch keine Bewertungen

- OZO Player SDK User Guide 1.2.1Dokument16 SeitenOZO Player SDK User Guide 1.2.1aryan9411Noch keine Bewertungen

- Chemistry: Crash Course For JEE Main 2020Dokument18 SeitenChemistry: Crash Course For JEE Main 2020Sanjeeb KumarNoch keine Bewertungen

- Recommendations For Students With High Functioning AutismDokument7 SeitenRecommendations For Students With High Functioning AutismLucia SaizNoch keine Bewertungen

- Module 1: Overview of Applied Behaviour Analysis (ABA)Dokument37 SeitenModule 1: Overview of Applied Behaviour Analysis (ABA)PriyaNoch keine Bewertungen

- C - Amarjit Singh So Bhura SinghDokument5 SeitenC - Amarjit Singh So Bhura SinghRohit JindalNoch keine Bewertungen

- QP December 2006Dokument10 SeitenQP December 2006Simon ChawingaNoch keine Bewertungen

- Spesifikasi PM710Dokument73 SeitenSpesifikasi PM710Phan'iphan'Noch keine Bewertungen

- Week 7Dokument24 SeitenWeek 7Priyank PatelNoch keine Bewertungen

- Review1 ScheduleDokument3 SeitenReview1 Schedulejayasuryam.ae18Noch keine Bewertungen

- Android Developer PDFDokument2 SeitenAndroid Developer PDFDarshan ChakrasaliNoch keine Bewertungen

- Blue Prism Data Sheet - Provisioning A Blue Prism Database ServerDokument5 SeitenBlue Prism Data Sheet - Provisioning A Blue Prism Database Serverreddy_vemula_praveenNoch keine Bewertungen