Beruflich Dokumente

Kultur Dokumente

Dimpal J Trivedi Sip

Hochgeladen von

gaurav223barsagadeOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Dimpal J Trivedi Sip

Hochgeladen von

gaurav223barsagadeCopyright:

Verfügbare Formate

1 | P a g e

Section A

Name of Industry :- PUSAD URBAN CO-OPRATIVE BANK

Address of Company :- Head office

Talao Lay-Out,Pusad

Main Branch PusadPusad-442004

Nature of ownership :- Co- Operative Bank

Information about the Group :- Chairman SharadMaind&

CEO : Rajesh Bajaj

Year of establishment :- Company- 2May 1985.

Annual Turnover of company :-

Crore.

Number of employees :- 250 Main Branch

Major customers :- a) Little flower English medium school

b) Student c) Salary person

d) Businessman e) Bajaj Ajancies

Competitors :- Bhari Maind Bank, VijayaLaxmi Bank, HDFC

Bank, ICICI Bank, The Malkapur Urban Bank.

2 | P a g e

Introduction of Pusad Urban Bank, Pusad

The Pusad Urban Co- operative Bank Ltd. Pusad. Was started in 2"

d

May 1985

with Register No. and date -YML/PSD/BNK/0/143784-85 and date and license No.

087 10 7 1985 - UBD MH 439 P. This bank was founded by, Adv.

Mr.ApparaoMaind. He is founder and first chairman of this Bank. While

establishment 211 members are also contributed the paid up share capita] 43800 with

share of Rupees. 1007- cash& authorized share capita! Rupees 5000007-The Bank

acquires their own building for persuading daily transactions. In co-operative Banks

election of the Board of Director elected by every five years. Elected members means

Directors elect chairman & vice chairman.The bank consists 19 directors. The Bank

working under the leadership of shri. Sharad Maind. Sharad Maind is the chairman of

the Pusad Urban co-opp.Bank Ltd,Pusad.

Pusad urban bank is one of the leading and best performing bank in co-opp

banking sector. Bank is working with total 25 branches and Head office in

Pusad,others are Vashi (New Mumbai), Kothrud (Pune), Panvel(Mumbai),Nagpur,

Aurangabad, Amravati, Nanded, Chandrapur, Vasmat, Yavatmal, Umarkhed, Digras,

Ner, Aarni,Vani, Ghatanji, Pandharkavda, Patanbori, Dhanki, Ralegoan, Motinager

(pusad), Mahagoan.The bank branches are catering of all types of banking services

around the week and even Sunday with modern infrastructure facilities and amenities

to the customer such as adequate well furnishes air conditioner premises. The bank

have certificate ISO 9001-2008.

The bank branches are catering all types of banking services, round the week, i.e.

morning, evening, and even on Sunday, with modern infrastructure facilities, and

amenities to the customers such as:

3 | P a g e

Adequate and well furnished, and air-conditioned, premises.

All branches are fully computerized from the day one, and have been interred

connected through interconnectivity.

SMS mobile banking services are available to its customers, free of cost, on

account of which a customer can get the balance in his saving / current

account, and also get last five transactions on his mobile instantly.

Bank has well experienced and trained managerial & qualified employees, to

provide prompt and satisfactory services to the customers.

Bank has provided ATM facilities, to all Branches.

Bank is rated as A grade in audits / Inspections.

On account of its best performance, the Bank has been awarded Best Urban

Co-op Bank awards, and honored with Sahakar Mahashree VasantdadaPatil

Puraskar successively for three years by Maharashtra State Co-op Banks

Association, Mumbai and Vidarbha Co-op Banks Association, Nagpur award

in the year of 2009. The Bank has also been awarded by Banking Frontiers, for

innovation in Decision Support and Excellence in Marketing.

4 | P a g e

What Is Co-Operative Banking?

Co-Operative banking is banking organized on a co-operative basis. By Co-

operative organization,

We mean

Voluntary concern, with equitable participation and control among all concern in any

enterprise.

Prof. Paul Lambert has defined a Co-operative society as an enterprise formed and

directed by an association of users, applying within itself the rules of democracy and

directly intended to serve both its own members and the community as a whole.

Feature of Co-Operative Banking:

1. A Co-operative organization is an enterprise aiming at a certain business.

2. As an association of users, Co-operative banking is organized by those who

themselves require credit.

3. It works according to the rules of democracy. In other words, it works through

boards of directors. The directors are elected on the basis of one vote per

member, irrespective of the number of share purchased by him.

4. It is intended to serve both

a. Its own members,

b. The community as a whole.

5. Every co-operative bank works for a given objectives like:-

a. Serving the needs of commerce or agriculture.

b. Proletariat, etc

5 | P a g e

PRINCIPLES OF CO-OPERATION:

A) Voluntary & Open Membership:

Co-operative is voluntary organization to all persons able to use their service & willing to

accept & responsibilities of membership without gender social racial political or religion

discrimination.

B) Democratic Member Control:

Co-operative is democratic organization controlled by their members who actively

participate in setting their policies and making decision. FOR THE MEMBER, OF THE

MEMBER, TO THE MEMBER IS THE PRIMARY PRINCIPAL.

C) Autonomy & Independence:

Co-operative is autonomous, self help organization controlled by their members. They

enter into agreement with other organizations including government or raise capital

from State or Central governments participation in share capital.

D) Education Training & Publicity of Information:

Co-operative provides education and training for their directors managers and

employees so that they can contribute effectively to the development of their co-

operative. They inform general public particularly young people and opine, leaders

about the nature and benefits of co-operative.

E) Co-operation Among Co-operative:

Co-operative serves their members most effectively and strengthens the co-operative

movement by working together through local national regional and inters national

structure.

6 | P a g e

Objectives:

Goals & Objectives of the bank is as under:

Area of operation being entire state, of Maharashtra, we propose to open

branches, in other districts in the, in near future.

Bank has opened ATMs.

To achieve planned growth in principal parameters viz. Deposits, Credit,

Profit and to bring down the NPA to Zero %.

To work with complaint free atmosphere, improve loyalty, confidence and

ultimate satisfaction of share holders, depositors, customers and thus getting

excellent rating from the customers.

To develop human resources and to ensure their optimal utilization by

improving productivity for efficient customer service.

To provide the core Banking facility to customers and give access to them

through ATMs of other banks throughout India.

To bring continuous improvement in the system and strive for up-gradation of

technology for operational efficiency.

Quality Policy of the Bank is as under:

Pusad Urban Co-op Bank Ltd, will strive for organizational excellence and

endeavor to provide highest degree of satisfaction to its customers through

services, technology and resources within the framework of co-operative

principles and statutory guidelines.

ATM card : Bank has launched a unique ATM card for its staff account

holder and other state holder.

7 | P a g e

ORGANIZATION CHART.

Chairman

Account

Manager

Cash

Manager

Operation

Manager

Passing

Officer

Vice-

Chairman

Director

8 | P a g e

BOARD OF DIRECTORS 2012-2013

Sr. Name of the Director Post

1 Mr. SharadMaind Chairman

2 Mr. RakeshKhurana Vice Chairman

3 Mr. Adv. ApparaoMaind Director

4 Mr. KrantiKamarkar Director

5 Mr. K.Y. Mirza Director

6 Mr. Deepak Jadhav Director

7 Mr. Dr. Manish Atal Director

8 Mr. NiranjanMankar Director

9 Mr. ChandrashekharJaiswal Director

10 Mr. ShivshankarChopade Director

11 Mr. AvinashAgrawal Director

12 Mr. NilkanthPatil Director

13 Mr. SudhirDeshmukh Director

14 Mr. Sudip Jain Director

15 Mrs. VandanaSharadPatil Director

16 Mrs. SunitaarunThakare Director

17 Mr. BhaiyalalTak Director

18 Mr. UlhasPawar Director

19 Mr. Sanjay Deshmukh Director

20 Mr. Rajesh Bajaj Chief Ex.Officer

21 Mr. P.B. Kadam Manager, Pusad Branch

9 | P a g e

PRODUCT PROFILE

1) Proactive Deposit (Auto Renewal):

The Deposit that renews itself everyone & half month.Uncertain of your deposit

period? No problem with proactive deposit, your deposits renewed automatically

every46 days or, you can withdraw the amount, inclusive of interest for all 46 days.

2) Monthly Growth Deposit (Recurring Deposit):

A small deposit every month gets you high annual returns. All you need to do is

deposit a monthly amount of Rs 5.0/- (or more in multiples of Rs 50/-) for a period of

your choice and you will earn a high return on the amount at the end of the deposit

period.

3) N-Cash Deposit (Overdraft Facility):

Get a loan against your deposit. When you open as fix account with bank, you are

automatically entitled to get a loan against your deposit. Banks offer you an over draft

facility of 95% of your deposit. While the original amount continues to earn the same

Interest

4) Cumulative deposit:

Earn interest as high as a Fixed deposit. The cumulative is very highly demanded

deposit from customer. The customer firstly selected a particular period e.g. 1 year &

above period require & customer can get the compound interest.

10 | P a g e

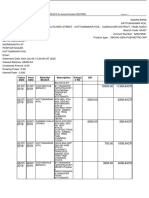

NTEREST RATES

Fixed Deposit Interest Rates

INTEREST RATES of The Pusad Urban Co-Operative Bank

Interest rates * (per cent per annum) w.e.f 01-07-09 Single Deposits of

Maturity period General Patasantha Senior Citizens

30-90 days 5% 6% 5.5%

91days-iSOdays 6%. 7% 6.5%

"I81days-l 3 months 8.5% 9.5% 9%

1 3months-2year 9% 10% 9.5%

Above 2year 8.5% 9.5% 9%

11 | P a g e

Services:

Banking Services

Bank is providing various types of services to the customer such as:

Collection of local / outstation of cheques / Bills

Issuance of Demand drafts/pay-orders

Remittance facilities like RTGS / NEFT / ECS

Locker facility

SMS, mobile banking services

ATM services at selected branches

List of Department

A/c opening

Saving A/c , current A/c

Deposit Department

Cash Department

Cash deposit, cash withdrawal

Loan Department

Locker Department

12 | P a g e

DEPOSTS SCHEMES OF THE PUSAD URBAN CO-OPERATIVE BANK

DEPOSITS:

Types of Deposits:-

Deposits are one of the basic resources for the bank. To attract deposits, the bank has

created a host of innovative banking solution to suit different needs of depositors. The

bank deposits schemes can be broadly classified under two. headsviz; Demand

Deposits and Time Deposits.

1. Demand Deposit by their very definition is deposits payable on demand.

Presently the bank offers the fall scheme as a part of its demand deposits

portfolio. .

E.g.: Current A/C, Saving A/C

2. Time deposits are deposits that are repayable after determined time periods

ranging from 7 days to 10 years. Currently the bank offers the fall schemes under its

time deposit portfolio.

E.g.: Term Deposits/ Cumulative Deposits (Reinvestment) Extra saver Deposit

(liquid)/ N-cash Deposit (Over draft limit) proactive Deposits (Auto-Roll over) /

monthly growth ((Recurring) deposits / certificate of

deposits.

13 | P a g e

1. DEMAND DEPOSITS

Current Account:

Introduction

Current Account deposits are deposits repayable on demand; hence,

these are classified as demand deposits. The deposits are generally kept in a current

account with the bank to meet the business needs of the depositor and to facilitate

high volume of business transactions no interests is paid on current account. ,

Who cannot open a Current Account?

A minor, an illiterate person, pardanashin and a blind person should not be

allowed to open a current account with the bank as a matter of policy.

Deposits:

Customer desirous of opening a current account must bring an initial deposit

of Rs. 2000/- and thereafter, must maintain a minimum average actually

balance of Rs. 2000/- at all times.

Withdrawals:

With drawls should be allowed by cheque there should be no restrictions on

the number of with drawls on current account.

Cheque books should be issued to account holders on levy of prescribed

service charge. Ordinarily loose cheque should not be issued. However,

emergencies, if a loose cheque is issued prescribed service charge should

berecovered.

14 | P a g e

2) TIME DEPOSI1T

Introduction

Deposit unplayable after a fixed person is called Time deposit

minimum period for acceptance of a time deposit is:

Deposits can be accepted from customer may be individuals (singly/

jointly), Minors, firms, companies, Trust, societies, clubs, P.F. Hindi undivided

families (HUF) etc.

Who cannot open a time deposit account?

As a regular requirement, the branches cannot:

A. Accept interest - free deposits other than in currency account or

paycompensation indirectly.

B. Accept deposit from / at the instance of private financiers or giving of an

authority by power of attorney, nomination or otherwise for such clients

receiving such deposits or maturity.

Types of Time Deposits:

a) Term Deposits.

(Interest payable at monthly, quarterly, half-yearly, yearly intervals).

b) Cumulative Deposits,

(Compound interest payable on maturity),

e.g. -Nirantarthev.

c) Extra Saver Deposits

(Deposits domed to be in multiples of Rs. 100/-).

15 | P a g e

d) N- Cash Deposits

(Term Deposits or Reinvestment Deposits with overdraft facility)

e) Pro - active Deposits.

(Term deposit or cumulative deposit with auto renewal after prescribed

period).

e.g. -Amnolthev.

f) Monthly Growth Deposits.

(Amount deposited in monthly installment).

g) Certificate of Deposit

Common Guidelines/ Features for all types of Time Deposits.

h) Income certificate

1. Monthly Income Certificate - (interest payable at month to month).

2. Quarterly Income Certificate -(interest payable at 3month).

e.g. -Current & Saving.

3. Yearly Income Certificate - (interest payable at year to year).

e.g. -AbhinavThev.,

Interest and T.D.S. on Fixed Deposit.

1) Interest should be paid on time deposits at the contracted rates applicable at

the time of deposits, except in the case of flexible rate deposits.

2) Annual Interest payments accepted to exceed Rs. 10,0007- on all time deposits

held in the same name(s) at each branch will be subject to tax deduction at

sources as per the present Income Tax Rules. T.D.S. is not applicable to the

monthly growth deposits. (Recurring) and certificate of deposits. A reference

should be made to current Income Tax Rules in April each year.

16 | P a g e

SECTION B

1) Name of department head :Mr. P.M. Wanzal.

2) Name of Superviosr: Mr. P.B. Kadam (Branch Manager).

3) Function And Operations Performed by Bank :-

A/c opening Department

Saving A/c:

A deposit account held at a bank that provides principal security and a modest interest

rate (4 %). Depending on the specific type of savings account, the account holder may

not be able to write checks from the account (without incurring extra fees or

expenses) and the account is likely to have a limited number of free

transfers/transactions.

Current A/c:

Current bank account is opened by businessmen who have a higher number of regular

transactions with the bank. It includes deposits, withdrawals, and contra transactions.

It is also known as Demand Deposit Account. It is a non-interest bearing bank

account.

Loan Department

In finance, a loan is a debt evidenced by a note which specifies, among other things,

the principal amount, interest rate, and date of repayment. A loan entails the

reallocation of the subject asset(s) for a period of time, between the lender and the

borrower. in this bank various loans facilities i.e.

Housing / Home Loan:

Home / Housing Loan is sanctioned by the Bank for the following purposes: 1.For

construction of house on developed Plot. 2. For purchase of ready of built up house /

flat. 3. For repairs / renovation of house / flat.

17 | P a g e

Rate of Interest for this loan: As per Banks Loan policy from time to time. At

present it is 13.50% p.a. at reducing rate at monthly rests.

Vehicle Loan :

Vehicle loan is considered for purchase of:

Two Wheeler

Four Wheeler

Purchase of Car

Three Wheeler / Five Wheeler / Tempo

Commercial Vehicles Like Truck ,JCB etc

Consumer Loan : The loan is given to the employees. The instrument of loan

is deducted, directly from his / her salary every month. The repayment is

guaranteed by the employer.

Personal Loan :A loan that establishes consumer credit that is granted for

personal use; usually unsecured and based on the borrower's integrity...

18 | P a g e

6. Functions &Operations performed during SIP

To open new savings accounts by convincing customers and to

promote the benefits of those which are provided by the bank.

To open R.D. & deposit by convincing customer to service provided by the

bank.

Get hands on experience of the transaction performed by the bank.

Assists to increase the business of the bank.

19 | P a g e

SECTION C

Experience about SIP

A summer internship programmed was proven to be a golden opportunity for me for

learning practical experience and further career development. My SIP was done in

Pusad Urban Co-opp Bank Ltd, Pusad. I have gained a lot of practiced experience in

45 days. It was really good choice and I am feeling happy that I got the chance in

Pusad Urban Co-opp Bank Ltd, Pusad as an intern.

I got aware about many things during the SIP like A/c opening procedures, Loan and

deposits etc and the information about KYC document & also learned the procedure

of clearing. I got hands on experience regarding Bond maturity, renewal of bonds,

and procedure of Gold loans. I got knowledge of documentation procedures of all

above said procedures through banking software system.

Through Marketing of products, I met various customer for selling bank products and

services like bank account, recurring deposit and other multi investment schemes like

Dam Duppat Yojana, Samruddhi Thev Yojana, Kannyaratna Deposit etc.

While interacting with customer I got knowledge of customer handling and ways of

convincing them. I also acquire some skill during the SIP like time management,

customer service, communication, marketing skills etc.

I had a great time during my one and half month internship in Pusad Urban Co-op

Bank Ltd, Pusad.

20 | P a g e

Reference

Web site: - www.pusadurbanbank.com

Personal Interview with_

P.B. Kadam Sir Branch manager of PUCB

Das könnte Ihnen auch gefallen

- Mba Marketing ProjectDokument67 SeitenMba Marketing ProjectMeer Tanveer100% (1)

- MBA Final Consultancy ProjectDokument47 SeitenMBA Final Consultancy ProjectatifcomputerzNoch keine Bewertungen

- Internship Report On Punjab Provincial Bank LTDDokument15 SeitenInternship Report On Punjab Provincial Bank LTDaon waqasNoch keine Bewertungen

- 7 SDokument8 Seiten7 SVijay Kulal88% (8)

- Report On NABARDDokument15 SeitenReport On NABARDAnkit TiwariNoch keine Bewertungen

- Mis Project (Mis 1)Dokument18 SeitenMis Project (Mis 1)philsonmanamelNoch keine Bewertungen

- Project On: Submitted ToDokument72 SeitenProject On: Submitted ToMohmmad IqbalNoch keine Bewertungen

- Ahmed ReportDokument36 SeitenAhmed Reporthassan_shazaibNoch keine Bewertungen

- Central Co-Operative Bank: A Summer Training Report at "Agriculture Loan"Dokument65 SeitenCentral Co-Operative Bank: A Summer Training Report at "Agriculture Loan"Jasbir RanaNoch keine Bewertungen

- National BankDokument60 SeitenNational BankMridhaDeAlamNoch keine Bewertungen

- Alva'S College, Moodbidri A Unit ofDokument15 SeitenAlva'S College, Moodbidri A Unit ofMass N WSNoch keine Bewertungen

- Internship Report On MCB Bank LimitedDokument40 SeitenInternship Report On MCB Bank Limitedbbaahmad89Noch keine Bewertungen

- Uti BankDokument71 SeitenUti BankRuishabh RunwalNoch keine Bewertungen

- 1.1 Rational of The StudyDokument5 Seiten1.1 Rational of The Studysayed din mohammed agmNoch keine Bewertungen

- Internship Report On MCB Bank LimitedDokument42 SeitenInternship Report On MCB Bank Limitedbbaahmad89Noch keine Bewertungen

- Bank of Punjab Internship UOGDokument38 SeitenBank of Punjab Internship UOGAhsanNoch keine Bewertungen

- Raj Bank PPT 2003Dokument32 SeitenRaj Bank PPT 2003Sunny Bhatt100% (1)

- Bank of Maharashtra ProjectDokument39 SeitenBank of Maharashtra Projectchakshyutgupta76% (21)

- Chapter 2Dokument15 SeitenChapter 2Pratik SamarthNoch keine Bewertungen

- Internship Report ON "The Bank of Punjab"Dokument31 SeitenInternship Report ON "The Bank of Punjab"ZIA UL REHMANNoch keine Bewertungen

- Co-Operative Banks: NKGSB Co-Op Bank LTDDokument33 SeitenCo-Operative Banks: NKGSB Co-Op Bank LTDFaiz Bakali100% (2)

- Study of Non Performing Assets in Bank of Maharashtra.Dokument74 SeitenStudy of Non Performing Assets in Bank of Maharashtra.Arun Savukar60% (10)

- Introduction To The Study: Shivaji University, KolhapurDokument63 SeitenIntroduction To The Study: Shivaji University, KolhapurAshokupadhye1955Noch keine Bewertungen

- Introduction To The Study: Definition: "Retail Banking Is Nothing But Banking Catering To The Multiple Requirements ofDokument63 SeitenIntroduction To The Study: Definition: "Retail Banking Is Nothing But Banking Catering To The Multiple Requirements ofAshokupadhye1955Noch keine Bewertungen

- Saroj Intern ReportDokument47 SeitenSaroj Intern ReportAwshib BhandariNoch keine Bewertungen

- A Project Report ON Axis Bank Projects and ServicesDokument82 SeitenA Project Report ON Axis Bank Projects and ServicesBharatSirveeNoch keine Bewertungen

- Projects - "CUSTOMER RELATIONSHIP MANAGEMENT IN BANKS WITH REFERENCE TO CORPORATION BANKDokument38 SeitenProjects - "CUSTOMER RELATIONSHIP MANAGEMENT IN BANKS WITH REFERENCE TO CORPORATION BANKRahul Singh100% (2)

- Jamuna ReportDokument31 SeitenJamuna Reporttafsir163Noch keine Bewertungen

- Final Internship Report On Bop New 2003Dokument65 SeitenFinal Internship Report On Bop New 2003Saba RiazNoch keine Bewertungen

- UBI Summer RepotDokument58 SeitenUBI Summer RepotAkanksha Pamnani100% (1)

- Final Report Part 2Dokument14 SeitenFinal Report Part 2Megh Nath Regmi100% (2)

- FM - Madhyasth Bank Amreli - 3Dokument74 SeitenFM - Madhyasth Bank Amreli - 3jagrutisolanki01Noch keine Bewertungen

- Mis ReportDokument33 SeitenMis Reportginish12Noch keine Bewertungen

- Cooperative Banking Is Retail and Commercial BankingDokument8 SeitenCooperative Banking Is Retail and Commercial Bankingbabu kumavatNoch keine Bewertungen

- City Bank Is One of BangladeshDokument4 SeitenCity Bank Is One of BangladeshFarhana Rashed 2035196660Noch keine Bewertungen

- The Bank of Punjab Latest Internship Report With Three Years Financial DataDokument23 SeitenThe Bank of Punjab Latest Internship Report With Three Years Financial DataMuhammad Taif KhanNoch keine Bewertungen

- Atm MaintenanceDokument59 SeitenAtm MaintenanceRanjeet RajputNoch keine Bewertungen

- Rajkot People's Co-Op - Bank Ltd.Dokument72 SeitenRajkot People's Co-Op - Bank Ltd.Kishan Gokani100% (1)

- Rushikesh Giranje 9930Dokument51 SeitenRushikesh Giranje 9930oms390688Noch keine Bewertungen

- Analysis of Customer Satisfaction in Banking Sector of Jammu Kashmir BankDokument88 SeitenAnalysis of Customer Satisfaction in Banking Sector of Jammu Kashmir BankOwais ShiekhNoch keine Bewertungen

- Internship ReportDokument40 SeitenInternship ReportAneeka ShahzadNoch keine Bewertungen

- MCBDokument84 SeitenMCBTari Baba100% (2)

- Research Paper On Cooperative Banks in IndiaDokument8 SeitenResearch Paper On Cooperative Banks in Indiagz45tyye100% (1)

- Executive Summary: Siddheswar Co-Operative Bank, BijapurDokument13 SeitenExecutive Summary: Siddheswar Co-Operative Bank, BijapurSachin UmbarajeNoch keine Bewertungen

- Presentation (Old)Dokument117 SeitenPresentation (Old)Md. Saiful IslamNoch keine Bewertungen

- Acknowledgment: Mustafa Mir " For His Continues, Valuable and Informative Support and Kind PieceDokument14 SeitenAcknowledgment: Mustafa Mir " For His Continues, Valuable and Informative Support and Kind Pieceayesha_121Noch keine Bewertungen

- Bank of Maharastra Project ReportDokument33 SeitenBank of Maharastra Project ReportBiswakesh Pati100% (1)

- Abhi ProjctDokument59 SeitenAbhi ProjctRaju ToleNoch keine Bewertungen

- Economics Board ProjectDokument24 SeitenEconomics Board ProjecttashaNoch keine Bewertungen

- Jamuna Bank Recruitment ProcessDokument99 SeitenJamuna Bank Recruitment ProcessTanvir80% (5)

- The Bank of Punjab: Internship ReportDokument65 SeitenThe Bank of Punjab: Internship ReportNaveen FatimaNoch keine Bewertungen

- Soneri Bank LimittedDokument24 SeitenSoneri Bank LimittednawidscribdNoch keine Bewertungen

- FM - Amreli Nagrik Bank - 2Dokument84 SeitenFM - Amreli Nagrik Bank - 2jagrutisolanki01Noch keine Bewertungen

- Summer Training Report OF Bank of India (Relation Ship Beyond Banking)Dokument20 SeitenSummer Training Report OF Bank of India (Relation Ship Beyond Banking)Varsha NakraNoch keine Bewertungen

- Nithin STRDokument44 SeitenNithin STRNITHINNoch keine Bewertungen

- A Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Dokument70 SeitenA Study of Bank Operations and Loans Given by Nawanagar Co-Operative Bank Ltd''.Umang Vora0% (1)

- Raj BankDokument93 SeitenRaj BankKishan GokaniNoch keine Bewertungen

- State Bank of IndiaDokument37 SeitenState Bank of IndiarooappuNoch keine Bewertungen

- Saraswat Bank Full & FinalDokument15 SeitenSaraswat Bank Full & FinalPratik RevankarNoch keine Bewertungen

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Von EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)Noch keine Bewertungen

- Marketing of Consumer Financial Products: Insights From Service MarketingVon EverandMarketing of Consumer Financial Products: Insights From Service MarketingNoch keine Bewertungen

- Financial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeVon EverandFinancial Inclusion for Micro, Small, and Medium Enterprises in Kazakhstan: ADB Support for Regional Cooperation and Integration across Asia and the Pacific during Unprecedented Challenge and ChangeNoch keine Bewertungen

- Namma Kalvi Economics Unit 6 Surya Economics Guide emDokument33 SeitenNamma Kalvi Economics Unit 6 Surya Economics Guide emAakaash C.K.Noch keine Bewertungen

- Tata Steel 09 Balance SheetDokument1 SeiteTata Steel 09 Balance SheetGoNoch keine Bewertungen

- Chapter:-1: Vision of The CompanyDokument64 SeitenChapter:-1: Vision of The CompanyRavi ShettyNoch keine Bewertungen

- Key Fact Sheet (HBL PersonalLoan) - July 2018Dokument1 SeiteKey Fact Sheet (HBL PersonalLoan) - July 2018pakistan jobs100% (1)

- Depository System and Its Role in Stock MarketDokument9 SeitenDepository System and Its Role in Stock Marketlokesh chandra ranjanNoch keine Bewertungen

- Sbi BranchesDokument14 SeitenSbi BranchesvinaisharmaNoch keine Bewertungen

- BABATUNDE MATTHEW OGUNLEYE Done StatementDokument8 SeitenBABATUNDE MATTHEW OGUNLEYE Done StatementAleesha AleeshaNoch keine Bewertungen

- Rajesh Maske 2Dokument3 SeitenRajesh Maske 2Ashok MantreNoch keine Bewertungen

- ISIN ListDokument32 SeitenISIN ListMirza Haseeb Ahsan100% (1)

- 1receipt For Payment PDFDokument2 Seiten1receipt For Payment PDFAnn SCNoch keine Bewertungen

- Particulars Fees: Citymaxx American Express CardDokument4 SeitenParticulars Fees: Citymaxx American Express Cardsifat islamNoch keine Bewertungen

- Lic PPT FMSDokument56 SeitenLic PPT FMSRam Kishen KinkerNoch keine Bewertungen

- StatementOfAccount 225476905 Jan06 133048 PDFDokument7 SeitenStatementOfAccount 225476905 Jan06 133048 PDFmannarmannanNoch keine Bewertungen

- FM - Madhyasth Bank Amreli - 3Dokument74 SeitenFM - Madhyasth Bank Amreli - 3jagrutisolanki01Noch keine Bewertungen

- Harvard Risk Management Career OpportunityDokument7 SeitenHarvard Risk Management Career OpportunityLeo Kolbert100% (1)

- OPRC Final PDFDokument486 SeitenOPRC Final PDFGaurav GhaiNoch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument3 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing Balancemailvipinck123Noch keine Bewertungen

- Credit TransactionDokument22 SeitenCredit TransactionAnalynNoch keine Bewertungen

- Banking Law Negotiable Instruments ActDokument3 SeitenBanking Law Negotiable Instruments Actrizofpicic100% (2)

- FIDIC Vs MOWUDDokument26 SeitenFIDIC Vs MOWUDHayelom Tadesse Gebre100% (4)

- RESOLUTION 2018 - 045: Rowelyn D. Manalo Secretary-GeneralDokument2 SeitenRESOLUTION 2018 - 045: Rowelyn D. Manalo Secretary-GeneralKhurmhely SantosNoch keine Bewertungen

- CPP Market SurveyDokument13 SeitenCPP Market Surveypradhan13Noch keine Bewertungen

- Banco de Oro vs. Equitable Banking Corp. 157 SCRA 188, Jan. 20, 1988Dokument1 SeiteBanco de Oro vs. Equitable Banking Corp. 157 SCRA 188, Jan. 20, 1988David Lawrenz SamonteNoch keine Bewertungen

- MD-Motion For Leave To Perpetuate Evidence FinalDokument23 SeitenMD-Motion For Leave To Perpetuate Evidence FinalTodd WetzelbergerNoch keine Bewertungen

- Assignment (ERD) : Cairo University Faculty of Computers and Information Information Systems Department Database Systems 1Dokument4 SeitenAssignment (ERD) : Cairo University Faculty of Computers and Information Information Systems Department Database Systems 1Apricot BlueberryNoch keine Bewertungen

- Efficient: Packers & MoversDokument6 SeitenEfficient: Packers & MoversRishi AsthanaNoch keine Bewertungen

- DPC Act 1971Dokument26 SeitenDPC Act 1971ShivendraMoreNoch keine Bewertungen

- Proof of Cash - DiscussionDokument4 SeitenProof of Cash - DiscussionJoyce Anne GarduqueNoch keine Bewertungen