Beruflich Dokumente

Kultur Dokumente

Skladacka CNB Neutral EN PDF

Hochgeladen von

skylancer-3441Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Skladacka CNB Neutral EN PDF

Hochgeladen von

skylancer-3441Copyright:

Verfügbare Formate

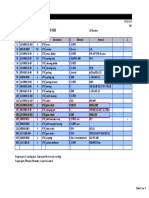

Notes: CNB Czech National Bank, IBEC International Bank for Economic Co-operation, IMF International Monetary Fund,

nd, NBCS National Bank of Czechoslovakia, SBCS State Bank of Czechoslovakia, WB World Bank

<< 28 October 1918 establishment of independent Czechoslovakia

<< 15 March 1939 declaration of Protectorate of Bohemia and Moravia << 1963 establishment of International Bank for Economic Co-operation (IBEC) in Moscow

<< 1 January 1969 establishment of Czechoslovak federation

<< September 1990 Czechoslovakia's IMF/WB membership renewed

<< 1 January 1993 establishment of Czech Republic

<< 12 March 1999 Czech Republic joins NATO

<< 1 May 2004 Czech Republic joins EU

<< 1 July 1944 Czechoslovakia becomes IMF/WB member

<< 8 May 1945 end of Protectorate of Bohemia and Moravia

<< 1954 Czechoslovakia ceases to be IMF/WB member

<< 4 April 1945 declaration of Koice Government Programme aimed at introducing centrally controlled economy

<< 9 March 1950 adoption of Act No. 31/1950 on the Establishment of the State Bank of Czechoslovakia, effective from 1 April 1950

<< 10 November 1965 State Bank of Czechoslovakia is exempted from subordination to Ministry of Finance under Act No. 117/1965 Coll.

<< 1 January 1971 Act No. 143/1970 Coll., on Foreign Exchange Management, and Act No. 44/1970 Coll., on the State Bank of Czechoslovakia, take effect

1 January 1990 Act No. 130/1989 Coll., on the State Bank of Czechoslovakia, and Act No. 158/1989 Coll., on Banks and Savings Banks, take effect >>

2 January 1992 Act No. 22/1992 Coll., on the State Bank of Czechoslovakia, and Act No. 21/1992 Coll., on Banks, take effect >> << 3 February 1993 Act No. 60/1993 Coll., on Currency Separation, takes effect

<< 1 October 1995 Act No. 219/1995 Coll., the Foreign Exchange Act, takes effect

(introducing, among other things, convertibility of koruna)

<< 1 January 2002 under Constitutional Act No. 448/2001 Coll.

the primary objective of the CNB is to maintain price stability

<< 10 April 1919 adoption of Act No. 187/1919 Coll., on the Introduction of the Czechoslovak koruna (K)

<< 14 April 1920 adoption of Act No. 347/1920 Coll., on the Joint-Stock Bank of Issue, effective from 21 May 1920

<< 23 April 1925 adoption of Act No. 102/1925 Coll., on the Establishment of the National Bank of Czechoslovakia, effective from 26 May 1925

<< 16 March 1939 Reichsmark (RM) introduced as legal tender alongside K by order of Adolf Hitler

<< 11 March 1919 Banking Authority at Ministry of Finance starts operation

<< 1 April 1926 National Bank of Czechoslovakia starts operation

<< 23 February 1934 Karel Engli appointed NBCS Governor

<< 27 January 1939 National Bank of Czechoslovakia renamed Czech-Slovak National Bank

<< 10 May 1945 German mark abolished as legal tender

<< 39 March 1919 currency reform and stamping of banknotes

<< 7 November 1929 changeover to gold standard (K 1/44.58 mg Au)

<< 17 February 1934 first devaluation

of koruna (K 1/37.15 mg Au)

<< 9 October 1936 second devaluation of koruna (K 1/31.21 mg Au)

<< 27 January 1939 koruna currency code changed from K to K by government order

National and international timeline

Legislative timeline

Bank timeline

Monetary timeline

<< 31 March 1939 Czech-Slovak National Bank renamed National Bank for Bohemia and Moravia; Ladislav Dvok appointed Governor

<< 12 November 1944 Czechoslovak Monetary Authority established by presidential decree to act as bank of issue on liberated territory

<< 18 May 1945 activities of NBCS renewed by presidential decree; NBCS Temporary Administration established; Jaroslav Nebes appointed Chairman as from 1 June 1945

<< MayAugust 1945 Czech koruna and Slovak koruna are legal tender in Czechoslovakia

<< 1 November 1945 currency reform implemented by presidential decree; introduction of Czechoslovak koruna Ks

<< 1 June 1953 currency reform implemented under Act No. 41/1953; Currency Liquidation Fund abolished (Ks 1/0.123426 g Au)

<< 1963 introduction of convertible rouble as IBEC unit of account

<< 8 February 1993 currency separation

<< 1998 start of inflation targeting

<< 11 March 1948 NBCS Temporary Administration abolished; Jaroslav Nebes appointed NBCS Governor as from 9 September 1948

<< 1 July 1950 State Bank of Czechoslovakia starts operation; Otokar Pohl appointed General Director; SBCS made subordinate to Ministry of Finance

<< 20 February 1954 Jaroslav Kabe appointed SBCS General Director

<< 16 August 1957 Otokar Pohl appointed SBCS General Director

<< 3 October 1969 Svatopluk Pot appointed SBCS General Director

<< 18 June 1981 Jan Stejskal appointed SBCS Chairman

<< 1 November 1988 Svatopluk Pot appointed SBCS Chairman

<< 29 December 1989 Josef Toovsk appointed SBCS President (Governor from 21 April 1992)

<< 1 January 1993 establishment of Czech National Bank; Josef Toovsk appointed Governor on 20 January

<< 11 February 2005 Zdenk Tma appointed CNB Governor

<< 1 April 1926 Vilm Pospil appointed NBCS Governor

Vilm Pospil Karel

Engli

Ladislav F. Dvok Jaroslav

Nebes

Otokar

Pohl

Jaroslav Kabe Svatopluk Pot Jan Stejskal Josef Toovsk Zdenk Tma

1920 1925 1930 1935 1940 1945 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015

1 December 2000 Zdenk Tma appointed CNB Governor >>

<< 17 December 1997-23 June 1998 Josef Toovsk holds the office of Prime Minister

and the management of the CNB is delegated to Vice-Governor Pavel Kysilka

<< 1 January 1967 price restructuring; changes to koruna's exchange rate known as internal

reproduction price adjustments

Czech National Bank, Na Pkop 28, Praha 1

1 April 2006 integration of financial market supervision into the CNB >>

The current headquarters of the Czech National Bank and its Prague

branch in Na Pkop St.

Brno esk Budjovice Hradec Krlov

Ostrava Plze st nad Labem

Central bank buildings in history

CNB branches

The Czech National Bank:

Current status and role

The Czech National Bank

The Czech National Bank (CNB) is established by the

Constitution of the Czech Republic. It performs its

activities in compliance with the Act on the Czech

National Bank and other legal rules. The CNB's supre-

me governing body is the Bank Board. It consists of

seven members: the Governor, two Vice-Governors

and four other members appointed by the Czech

President for a six-year period. The CNB has its head-

quarters in Prague and seven regional branches in

Prague, st nad Labem, Plze, esk Budjovice,

Hradec Krlov, Brno and Ostrava.

Se

Sets monetary policy

its primary objective is to maintain price stability.

The CNB also supports the general economic policies

of the Government where this does not conflict with

its primary objective. The Bank Board's decisions on

key interest rates are based on current macroeconomic

forecasts and assessments of the risks of non-fulfilment

of those forecasts. By changing interest rates the

central bank affects the price of money on the market

and balances any pressures causing future inflation

to deviate from the target. In the run-up to joining the

euro area, the inflation targets will be directed at

meeting the Maastricht convergence criteria on price

stability and long-term interest rates. On euro adoption,

the CNB will cede independent monetary policy

to the European Central Bank.

Performs financial market supervision

i.e. supervision of the banking sector, the capital

market, insurance companies, pension schemes,

credit unions and electronic money institutions,

and foreign exchange supervision. The CNB sets rules

safeguarding the stability of the banking sector, capital

market, insurance industry and private pension

market. It systematically regulates, examines, assesses

and, where necessary, imposes penalties for

non-compliance with the rules.

On 1 April 2006, in line with worldwide trends, financial

market supervision was integrated into a single

institution the CNB, which took over the duties

of the Czech Securities Commission, the Finance

Ministry's Office of State Supervision of Insurance

Companies and Private Pension Schemes and

the Office for Supervision of Credit Unions.

Issues banknotes and coins and manages

currency circulation

has the exclusive right to issue banknotes and

coins, including commemorative coins. It promotes

smooth and efficient currency circulation, manages

the stocks of banknotes and coins, withdraws from

circulation and destroys worn banknotes and coins

and exchanges damaged banknotes and coins for

new ones. It is responsible for the technical and

artistic preparation of banknotes and coins, as well as

their production and distribution. It helps to prepare

and implement measures to legally and technically

protect banknotes and coins against counterfeiting.

It examines whether money is genuine and keeps

records of counterfeit and altered banknotes and

coins seized in the Czech Republic.

Administers payments and clearing between

banks and contributes to the development

of payment systems

sets payment rules for banks and non-banks

(in particular settlement time limits), rules for the

issuance and use of electronic payment instruments

(e.g. credit cards) and rules for the safe and sound

operation of payment systems. It operates the CERTIS

interbank payment system and SKD short-term bond

system. It keeps accounts and provides payment

system services to the state and banks.

Is the central bank of the Czech Republic

provides banking services to the state and the

public sector. It keeps accounts for organisations

connected to the state budget, i.e. revenue and

customs authorities, the Czech Social Security

Administration, labour offices, contributory

organisations, state funds, accounts linked to the

EC budget and others. Under authorisation from

the Ministry of Finance it executes

government-security-related transactions.

Manages national foreign exchange

reserves and conducts foreign exchange

market operations

foreign exchange reserves are the central bank's

foreign assets. They safeguard the nation's foreign

exchange liquidity and guarantee the convertibility of

the Czech koruna. The objective of foreign exchange

reserve management is to maintain or increase the

value of the reserves. The reserves consist of securities

denominated in foreign currencies, cash and gold.

Among the largest foreign exchange operations on

the domestic markets are foreign exchange

interventions, which the CNB uses where necessary

to try to steer the koruna's exchange rate against

other currencies.

Represents the state in monetary policy issues

represents the Czech Republic at the meetings of

various international institutions, e.g. the World Bank,

the International Monetary Fund, the European Bank

for Reconstruction and Development, the European

Central Bank and the European Union.

Has the powers of an administrative body

Independently manages the assets entrusted

to it by the state

covers its necessary costs from its revenues. It is

not a state budget expenditure item. It submits

annual financial reports to the Chamber of Deputies

(the lower house of the Czech Parliament).

The first branch of the NBCS in

Bredovskho St. (today Politickch vz St.)

THE CZECH NATIONAL BANK:

PAST AND

PRESENT

www.cnb.cz

Das könnte Ihnen auch gefallen

- Money and Credit 3 PDFDokument38 SeitenMoney and Credit 3 PDFDan CeresauNoch keine Bewertungen

- Central Bank Financial Policy Instruments and Their Impact To CBs (Commercial Banks)Dokument8 SeitenCentral Bank Financial Policy Instruments and Their Impact To CBs (Commercial Banks)Trifan_DumitruNoch keine Bewertungen

- 04 Money Creation and Central BanksDokument4 Seiten04 Money Creation and Central BanksLanphuong BuiNoch keine Bewertungen

- The European Monetary System, The Maastricht Treaty, Birth of The Euro and Its FutureDokument41 SeitenThe European Monetary System, The Maastricht Treaty, Birth of The Euro and Its FutureSharon NunesNoch keine Bewertungen

- Euro Moneda SDokument69 SeitenEuro Moneda SterrenosranNoch keine Bewertungen

- FXReg PolandDokument10 SeitenFXReg PolandAlexanderNoch keine Bewertungen

- Chronological Order PF The History of Philippine Central BankDokument2 SeitenChronological Order PF The History of Philippine Central BankAbigail FormaranNoch keine Bewertungen

- Act de Infiintare Banca Centrala in CehiaDokument31 SeitenAct de Infiintare Banca Centrala in CehiaNicusor TeodorescuNoch keine Bewertungen

- SailashreeChakraborty 13600921093 FM405Dokument10 SeitenSailashreeChakraborty 13600921093 FM405Sailashree ChakrabortyNoch keine Bewertungen

- 2023 CLC CH 2Dokument33 Seiten2023 CLC CH 2Ngọc Quỳnh Anh NguyễnNoch keine Bewertungen

- Project: - The European Central BankDokument11 SeitenProject: - The European Central BankAndreea ApostoiuNoch keine Bewertungen

- EU Politics and EconomicsDokument4 SeitenEU Politics and Economicscondesemma7Noch keine Bewertungen

- Lucru IndividualDokument26 SeitenLucru IndividualOlgutZa BoianNoch keine Bewertungen

- Eu EmsDokument3 SeitenEu Emsnataliiakaravanska16Noch keine Bewertungen

- B. - BceDokument8 SeitenB. - BceMiguel RuizNoch keine Bewertungen

- Blockchain: The Ultimate Guide to Understanding the Technology Behind Bitcoin and CryptocurrencyVon EverandBlockchain: The Ultimate Guide to Understanding the Technology Behind Bitcoin and CryptocurrencyBewertung: 5 von 5 Sternen5/5 (1)

- European Central BankDokument24 SeitenEuropean Central Bankchhadwaharshit50% (2)

- Stojanovski - 2006. Nezavisnost NB Makedonije (Eng)Dokument7 SeitenStojanovski - 2006. Nezavisnost NB Makedonije (Eng)MrSusumigaNoch keine Bewertungen

- European Monetary IntegrationDokument32 SeitenEuropean Monetary IntegrationFlower Power100% (1)

- 1880 - 1914 - The BNR and It's Issue of Banknotes Between Necessity and PosibilityDokument36 Seiten1880 - 1914 - The BNR and It's Issue of Banknotes Between Necessity and PosibilityBadea MariusNoch keine Bewertungen

- Qui Sommes-Nous 2017 - E S2Dokument12 SeitenQui Sommes-Nous 2017 - E S2edwodNoch keine Bewertungen

- A Brief History of Central Banking in AlbaniaDokument32 SeitenA Brief History of Central Banking in AlbaniaRezwanah KhalidNoch keine Bewertungen

- Ems, Emu and EuroDokument16 SeitenEms, Emu and EuroKapil DhingraNoch keine Bewertungen

- The European Central BankDokument51 SeitenThe European Central BankHendra Xiao LongNoch keine Bewertungen

- National Bank of Moldova (NBM)Dokument9 SeitenNational Bank of Moldova (NBM)Druța DanielaNoch keine Bewertungen

- Bangko Sentral NG PilipinasDokument214 SeitenBangko Sentral NG Pilipinasmaenn javier100% (1)

- With Good Page Num DocumentDokument24 SeitenWith Good Page Num Documenttanwir13Noch keine Bewertungen

- History of The EuroDokument20 SeitenHistory of The EuroMagda AugustynNoch keine Bewertungen

- 6.internatonal Monetary ReformsDokument15 Seiten6.internatonal Monetary ReformsPakki Harika MeghanaNoch keine Bewertungen

- Chronology of EventsDokument3 SeitenChronology of EventsMonicaShayneVillafuerteNoch keine Bewertungen

- Detyr Kursi AnglishtDokument7 SeitenDetyr Kursi AnglishtOrestja AliajNoch keine Bewertungen

- European Moneytary System - LapDokument13 SeitenEuropean Moneytary System - LapThanh phong HồNoch keine Bewertungen

- Bangko Sentral NG Pilipinas (Overview)Dokument5 SeitenBangko Sentral NG Pilipinas (Overview)Thremzone17Noch keine Bewertungen

- 1923 - 1950 Turkish Banking SectorDokument26 Seiten1923 - 1950 Turkish Banking SectorBarış EğilliNoch keine Bewertungen

- Towards A Single Currency: A Brief History of EMUDokument6 SeitenTowards A Single Currency: A Brief History of EMUSimona OanaNoch keine Bewertungen

- European Central BankDokument51 SeitenEuropean Central BankJunwil TorreonNoch keine Bewertungen

- The History of Money in Montenegro: Nikola FabrisDokument14 SeitenThe History of Money in Montenegro: Nikola FabrisMarko PetrovicNoch keine Bewertungen

- Concept of Central BankingDokument42 SeitenConcept of Central BankingJean PrudenteNoch keine Bewertungen

- Central Bank: Public FinanceDokument21 SeitenCentral Bank: Public FinancezohadNoch keine Bewertungen

- An Overviewofthe Sveriges Riksbank Swedens Central BankDokument12 SeitenAn Overviewofthe Sveriges Riksbank Swedens Central Bankmin - radiseNoch keine Bewertungen

- Main Functions: The Maintenance of Price StabilityDokument16 SeitenMain Functions: The Maintenance of Price StabilityMariana PopaNoch keine Bewertungen

- Overview of The BSPDokument22 SeitenOverview of The BSPelaineNoch keine Bewertungen

- Module 2 Central Banking in The Philippines History Functions AdministrationDokument62 SeitenModule 2 Central Banking in The Philippines History Functions AdministrationMaxene GabuteraNoch keine Bewertungen

- Raport BNRDokument247 SeitenRaport BNRmadsheep01Noch keine Bewertungen

- 1 Over View of Viet Nam SO NEWW 1123Dokument12 Seiten1 Over View of Viet Nam SO NEWW 1123Nguyễn Đặng Ái ViNoch keine Bewertungen

- Eurozone AssignmentDokument7 SeitenEurozone AssignmentMuhammad Taha AmerjeeNoch keine Bewertungen

- A Brief History of International Banking: International Banking by Jane Hughes and Scott MacdonaldDokument29 SeitenA Brief History of International Banking: International Banking by Jane Hughes and Scott MacdonaldToàn VănNoch keine Bewertungen

- World BankingDokument8 SeitenWorld BankingFiras ZahmoulNoch keine Bewertungen

- Introduction To Monetary Policy and Central BankingDokument18 SeitenIntroduction To Monetary Policy and Central BankingcarsongoticosegalesNoch keine Bewertungen

- Macro ProjectDokument16 SeitenMacro ProjectRatnesh SinghNoch keine Bewertungen

- Analysis of Appointment To Office of Central BankDokument15 SeitenAnalysis of Appointment To Office of Central BankExecutive Engineer LohiaheadNoch keine Bewertungen

- Bank Structure and Regulation in The EuDokument43 SeitenBank Structure and Regulation in The EuSabiha Farzana MoonmoonNoch keine Bewertungen

- The European Central Bank Powerpoint PresentationDokument14 SeitenThe European Central Bank Powerpoint PresentationRavi ChidarNoch keine Bewertungen

- The Martial Law in Ukraine Was Introduced From February 24, by The President Decree For ADokument4 SeitenThe Martial Law in Ukraine Was Introduced From February 24, by The President Decree For AAndriy MarenychNoch keine Bewertungen

- The Structure and Development of Ethiopia's Financial SectorDokument14 SeitenThe Structure and Development of Ethiopia's Financial SectorHenry DunaNoch keine Bewertungen

- Banking History PakistanDokument15 SeitenBanking History Pakistanmuhdajmal1131Noch keine Bewertungen

- Bank Principl Ch-2Dokument7 SeitenBank Principl Ch-2Ermias TadeleNoch keine Bewertungen

- Luat NHNN 1997Dokument20 SeitenLuat NHNN 1997Chi Hue NguyenNoch keine Bewertungen

- Priests of Prosperity: How Central Bankers Transformed the Postcommunist WorldVon EverandPriests of Prosperity: How Central Bankers Transformed the Postcommunist WorldNoch keine Bewertungen

- Code of Money and Credit PDFDokument45 SeitenCode of Money and Credit PDFAntoine KreidyNoch keine Bewertungen

- A 215067 PARAMETRIC CERs FOR REPLENISHMENT REPAIR PARTS - Us Armry Helicopters and Armored Vehicles July 1989Dokument32 SeitenA 215067 PARAMETRIC CERs FOR REPLENISHMENT REPAIR PARTS - Us Armry Helicopters and Armored Vehicles July 1989skylancer-3441Noch keine Bewertungen

- Small Wars Journal - The World Is On Fire - Where Is The U.S. Army - (Updated) - 2014-10-04Dokument7 SeitenSmall Wars Journal - The World Is On Fire - Where Is The U.S. Army - (Updated) - 2014-10-04skylancer-3441Noch keine Bewertungen

- Evaluation of 8090 and Weldalite-049 Aluminum-Lithium AlloysDokument39 SeitenEvaluation of 8090 and Weldalite-049 Aluminum-Lithium Alloysskylancer-3441Noch keine Bewertungen

- Bradley M2 IFV Procedure Guides: EvaluationDokument101 SeitenBradley M2 IFV Procedure Guides: Evaluationskylancer-3441100% (1)

- 2012 - Status of SMR Design NENP NPTDS PDFDokument90 Seiten2012 - Status of SMR Design NENP NPTDS PDFskylancer-3441Noch keine Bewertungen

- CVF Ski-Jump Ramp Profile Optimisation For F-35B 3324 - COLOURDokument7 SeitenCVF Ski-Jump Ramp Profile Optimisation For F-35B 3324 - COLOURskylancer-3441Noch keine Bewertungen

- G 11H MLL 4: Examining Revolution in WarfareDokument59 SeitenG 11H MLL 4: Examining Revolution in Warfareskylancer-3441Noch keine Bewertungen

- Navedtra 14310 PDFDokument346 SeitenNavedtra 14310 PDFskylancer-3441Noch keine Bewertungen

- Dcma Inst 8210 2 PDFDokument115 SeitenDcma Inst 8210 2 PDFskylancer-3441Noch keine Bewertungen

- 2004.12.01 Revolution in WarDokument227 Seiten2004.12.01 Revolution in Warcao-shNoch keine Bewertungen

- 2006 Team 1 T30Dokument136 Seiten2006 Team 1 T30skylancer-3441Noch keine Bewertungen

- MCWP 3-25.8 Marine Air Traffic Control Detachment Handbook PDFDokument92 SeitenMCWP 3-25.8 Marine Air Traffic Control Detachment Handbook PDFskylancer-3441Noch keine Bewertungen

- Editor: Lalsangliana Jt. Ed.: H.Dokument4 SeitenEditor: Lalsangliana Jt. Ed.: H.bawihpuiapaNoch keine Bewertungen

- Boundary ScanDokument61 SeitenBoundary ScanGéza HorváthNoch keine Bewertungen

- LINEAR INDUCTION MOTOR 6981660.ppsxDokument56 SeitenLINEAR INDUCTION MOTOR 6981660.ppsxFalley FasterNoch keine Bewertungen

- 114 The Letter S: M 'TafontDokument9 Seiten114 The Letter S: M 'TafontHarry TLNoch keine Bewertungen

- Legend Of Symbols: Chú Thích Các Ký HiệuDokument9 SeitenLegend Of Symbols: Chú Thích Các Ký HiệuKiet TruongNoch keine Bewertungen

- DLL - Mapeh 6 - Q2 - W8Dokument6 SeitenDLL - Mapeh 6 - Q2 - W8Joe Marie FloresNoch keine Bewertungen

- Health Problems Vocabulary Esl Matching Exercise Worksheet For KidsDokument2 SeitenHealth Problems Vocabulary Esl Matching Exercise Worksheet For KidsTarisubhNoch keine Bewertungen

- Rumah Cerdas Bahasa Inggris Belajar Bahasa Inggris Dari Nol 4 Minggu Langsung BisaDokument3 SeitenRumah Cerdas Bahasa Inggris Belajar Bahasa Inggris Dari Nol 4 Minggu Langsung BisaArditya CitraNoch keine Bewertungen

- Tyba S4 Syntax PDFDokument107 SeitenTyba S4 Syntax PDFIndahNoch keine Bewertungen

- AIC - AirROCT35 - Spare Parts ManualDokument153 SeitenAIC - AirROCT35 - Spare Parts ManualMuhammad Arqam Al Ajam67% (3)

- Curriculum VitaeDokument7 SeitenCurriculum VitaeRossy Del ValleNoch keine Bewertungen

- EMV Card Reader Upgrade Kit Instructions - 05162016Dokument6 SeitenEMV Card Reader Upgrade Kit Instructions - 05162016Shashi K KumarNoch keine Bewertungen

- Titan GelDokument6 SeitenTitan GelVladi Salas100% (1)

- Kulkarni Shilpa A.Dokument148 SeitenKulkarni Shilpa A.MSKCNoch keine Bewertungen

- Astm D974-97Dokument7 SeitenAstm D974-97QcHeNoch keine Bewertungen

- The Gingerbread Man-1 EnglishareDokument40 SeitenThe Gingerbread Man-1 EnglishareamayalibelulaNoch keine Bewertungen

- Unit 3 InfiltrationDokument5 SeitenUnit 3 InfiltrationHRIDYA MGNoch keine Bewertungen

- Benefits of OTN in Transport SDNDokument9 SeitenBenefits of OTN in Transport SDNGhallab AlsadehNoch keine Bewertungen

- Foldable HelmetDokument16 SeitenFoldable Helmetharsha kotewarNoch keine Bewertungen

- Brainedema 160314142234Dokument39 SeitenBrainedema 160314142234Lulu LuwiiNoch keine Bewertungen

- Module 02 Connect Hardware Peripherals EndaleDokument49 SeitenModule 02 Connect Hardware Peripherals EndaleSoli Mondo100% (1)

- Etl 213-1208.10 enDokument1 SeiteEtl 213-1208.10 enhossamNoch keine Bewertungen

- Thermobaric Effects Formed by Aluminum Foils Enveloping Cylindrical ChargesDokument10 SeitenThermobaric Effects Formed by Aluminum Foils Enveloping Cylindrical ChargesAnonymous QFUEsUAnNoch keine Bewertungen

- Magical ExercisesDokument5 SeitenMagical ExercisesAnonymous ytxGqZNoch keine Bewertungen

- Vegetable Rates - 02-01-2021Dokument454 SeitenVegetable Rates - 02-01-2021Saurabh RajputNoch keine Bewertungen

- American Pile Driving Equipment Equipment CatalogDokument25 SeitenAmerican Pile Driving Equipment Equipment CatalogW Morales100% (1)

- Knowledge /28 Application / 22 Thinking / 12 Communication / 9Dokument8 SeitenKnowledge /28 Application / 22 Thinking / 12 Communication / 9NmNoch keine Bewertungen

- EndressHauser HART CommunicatorDokument1 SeiteEndressHauser HART CommunicatorGhafur AgusNoch keine Bewertungen

- Uav Based Plant Disease Detection SystemDokument14 SeitenUav Based Plant Disease Detection SystemTakudzwa MatangiraNoch keine Bewertungen

- Barium SulphateDokument11 SeitenBarium SulphateGovindanayagi PattabiramanNoch keine Bewertungen