Beruflich Dokumente

Kultur Dokumente

Australia

Hochgeladen von

Bilal Amjad0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten2 Seitentaxation

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldentaxation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

19 Ansichten2 SeitenAustralia

Hochgeladen von

Bilal Amjadtaxation

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Employee Share Scheme ( Employee Share Scheme ( Employee Share Scheme ( Employee Share Scheme ( ESS ESS ESS

S ESS ) ) ) ) Taxation in Australia Taxation in Australia Taxation in Australia Taxation in Australia

This memo provides a general overview on the Australian tax regulations applicable to Stock Options

(SO) and Restricted Stock Units (RSU) granted by Schlumberger Limited (SLB) to employees

who have worked in Australia (including its surrounding waters and JPDA). In particular, the

document highlights the new rules that are applicable from 1

st

July 2009.

This document serves as a guide to the ESS rules and should not be solely relied upon in

determining the impact of the ESS rules to your personal tax position. All impacted employees are

therefore encouraged to consult with their Accountant or Tax Advisor.

Stock Options Stock Options Stock Options Stock Options

For SOs, the tax and reporting obligations depend on whether the SO was granted pre or post 1

st

July 2009.

Stock Options Granted Pre-1

st

July 2009

For SOs granted pre 1

st

July 2009, the taxing point for Australian taxation purposes is the date

when the SO is exercised.

SOs (granted pre 1

st

July 2009) that vest after entry into Australia AND AND AND AND which are exercised during

your Australian assignment, are subject to taxation in Australia.

The taxable benefit, to be calculated per Australian Tax Office (ATO) rules, is the difference

between the SO exercise price and the market value of SLB stock when sold. Where part of the

vesting occurs prior to the employee commencing assignment in Australia, pro-rata rules may apply

when calculating the taxable benefit.

Stock Options Granted After 1

st

July 2009

For SOs granted after 1

st

July 2009, the taxing point for Australian taxation purposes is the date of

vesting*.

SOs (granted post 1

st

July 2009) that vest while an employee is on assignment in Australia, are

subject to taxation in Australia, in the financial year in which the vesting occurred*.

The taxable benefit, to be calculated per ATO rules, is the higher of the following:

a) Market value of SLB stock on vesting date, less the exercise price; or

b) Value calculated as per Tables 1 and 2 as contained in the Legislation.

Where part of the vesting occurs prior to the employee commencing assignment in Australia, pro-

rata rules may apply when calculating the taxable benefit.

The non-exercise or subsequent exercise of SOs outside Australia does not eliminate the taxability

of SOs vested in Australia.

The ATO rules, inclusive of the above mentioned Tables, can be found at the following URL address:

http://www.comlaw.gov.au/Details/F2010L00318

*) If SOs are exercised less than 30 days after vesting, the taxing point is the exercise date rather

than the vesting date (as per ATO guidelines).

Restricted Stock Units Restricted Stock Units Restricted Stock Units Restricted Stock Units

For RSUs, the taxing point for Australian taxation purposes is the date of vesting. RSUs that vest

while an employee is assigned in Australia, are subject to taxation in Australia, in the financial year

in which the vesting occurred.

The taxable benefit, to be calculated per ATO rules, is the difference between the price paid for the

RSUs (ie NIL) and the market value of SLB stock on vesting date. Where part of the vesting occurs

prior to the employee commencing assignment in Australia, pro-rata rules may apply when

calculating the taxable benefit.

Note, other than for use in the above pro-rata calculation, the RSU grant date does not impact the

Australian tax treatment.

Reporting Reporting Reporting Reporting

The calculated/reportable taxable benefit in respect of SOs and RSUs will be provided on the

annual ESS Statement sent to each employee participating in the ESS. Employees are required to

disclose this taxable benefit in their annual Australian personal income tax return.

With effect from the financial year ended 30

th

June 2010 onwards, Schlumberger is required (by

Law) to report this same taxable benefit data, for each employee, directly to the ATO, who may

match the data against that reported in personal income tax returns.

Das könnte Ihnen auch gefallen

- Roop Kunwar Kumar IDokument179 SeitenRoop Kunwar Kumar IBilal AmjadNoch keine Bewertungen

- Pillar Gridding in PETRELDokument14 SeitenPillar Gridding in PETRELHenry Reynolds DarcyNoch keine Bewertungen

- Chapter 11 - History MatchingDokument14 SeitenChapter 11 - History MatchingBilal AmjadNoch keine Bewertungen

- Chapter 01 - Making A Fluid ModelDokument9 SeitenChapter 01 - Making A Fluid ModelMuzakkir MohamadNoch keine Bewertungen

- 12.) Defining Fluid ContactsDokument21 Seiten12.) Defining Fluid ContactsdmullNoch keine Bewertungen

- SandRose Jan2021Dokument21 SeitenSandRose Jan2021Bilal AmjadNoch keine Bewertungen

- Fiber Optic Distributed Temperature Analysis BookDokument75 SeitenFiber Optic Distributed Temperature Analysis BookBilal AmjadNoch keine Bewertungen

- Introduction To PetrelDokument7 SeitenIntroduction To PetrelMHGolestanNoch keine Bewertungen

- Week 3Dokument7 SeitenWeek 3favou5Noch keine Bewertungen

- Week 4Dokument17 SeitenWeek 4favou5Noch keine Bewertungen

- Week 2Dokument20 SeitenWeek 2Bilal AmjadNoch keine Bewertungen

- Geometrical Property Modeling: 8.1 Creating A Bulk Volume PropertyDokument4 SeitenGeometrical Property Modeling: 8.1 Creating A Bulk Volume PropertyBilal AmjadNoch keine Bewertungen

- Chapter 1 PetrelDokument5 SeitenChapter 1 PetrelmydealiaNoch keine Bewertungen

- PETREL - Fault ModelingDokument33 SeitenPETREL - Fault ModelingVeronica ArrigoniNoch keine Bewertungen

- The Role of Women Towards The System of WilayatDokument32 SeitenThe Role of Women Towards The System of WilayatBilal AmjadNoch keine Bewertungen

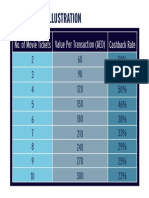

- Movie Spend IllustrationDokument1 SeiteMovie Spend IllustrationBilal AmjadNoch keine Bewertungen

- Spwla 2004 RRRDokument11 SeitenSpwla 2004 RRRBilal AmjadNoch keine Bewertungen

- Article - Respiratory System Is The DoorDokument1 SeiteArticle - Respiratory System Is The DoorBilal AmjadNoch keine Bewertungen

- About Kia Motors Corporation: The All-New KiaDokument17 SeitenAbout Kia Motors Corporation: The All-New KiaTypical GamesNoch keine Bewertungen

- Glimpses of Shiism Musnad Ibn HanbalDokument46 SeitenGlimpses of Shiism Musnad Ibn HanbalgrantsinchakNoch keine Bewertungen

- Water PipelinesDokument8 SeitenWater PipelinesBilal AmjadNoch keine Bewertungen

- VAT Manual English 16 NovDokument22 SeitenVAT Manual English 16 Novharyani100% (2)

- 20 Healthy Habits That Will Upgrade Your Nutrition During Weight Loss and ForeverDokument17 Seiten20 Healthy Habits That Will Upgrade Your Nutrition During Weight Loss and ForeverBilal AmjadNoch keine Bewertungen

- Origin of HCDokument2 SeitenOrigin of HCBilal AmjadNoch keine Bewertungen

- Origin of HCDokument2 SeitenOrigin of HCBilal AmjadNoch keine Bewertungen

- Uthmaniyah CO2 EOR Demonstration Project - Global Carbon Capture and Storage InstituteDokument3 SeitenUthmaniyah CO2 EOR Demonstration Project - Global Carbon Capture and Storage InstituteBilal AmjadNoch keine Bewertungen

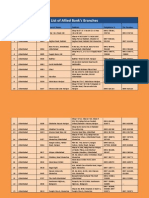

- List of ABL Branches July 2014 969Dokument77 SeitenList of ABL Branches July 2014 969Muneeb Ur RehmanNoch keine Bewertungen

- SPE Salary Survey 2014Dokument10 SeitenSPE Salary Survey 2014Bilal AmjadNoch keine Bewertungen

- Outlook - Oil Production Set To Reach Record 130,000 BPD - The Express TribuneDokument2 SeitenOutlook - Oil Production Set To Reach Record 130,000 BPD - The Express TribuneBilal AmjadNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Coa Circular No. 2024 - 007 - 0001Dokument21 SeitenCoa Circular No. 2024 - 007 - 0001nieves.averheaNoch keine Bewertungen

- Value Investor May 2011Dokument23 SeitenValue Investor May 2011KC Loh Kwan ChuanNoch keine Bewertungen

- Sterling Bank PLC and Equitorial Trust Bank LTD Merger: The Business CaseDokument23 SeitenSterling Bank PLC and Equitorial Trust Bank LTD Merger: The Business CaseSterling Bank PLCNoch keine Bewertungen

- Business Combination ActivityDokument5 SeitenBusiness Combination ActivityAndy LaluNoch keine Bewertungen

- 01activity Borrowing WorkbookDokument12 Seiten01activity Borrowing WorkbookMatthewNoch keine Bewertungen

- Three Stage Dividend Discount ModelDokument6 SeitenThree Stage Dividend Discount ModeljibranqqNoch keine Bewertungen

- Aswath Damodara - Talk - PPT PDFDokument34 SeitenAswath Damodara - Talk - PPT PDFRavi OlaNoch keine Bewertungen

- Mutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToDokument43 SeitenMutual Funds: Answer Role of Mutual Funds in The Financial Market: Mutual Funds Have Opened New Vistas ToNidhi Kaushik100% (1)

- 1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesDokument2 Seiten1) Assess The Current Financial Health and Recent Financial Performance of The Firm. Identify Any Strengths or WeaknessesJane SmithNoch keine Bewertungen

- Book Value Per Common Share - BVPS Definition - InvestopediaDokument5 SeitenBook Value Per Common Share - BVPS Definition - InvestopediaBob KaneNoch keine Bewertungen

- Audit of Insurance CompaniesDokument20 SeitenAudit of Insurance CompaniesJoseph BarreraNoch keine Bewertungen

- Bond and Stock Valuation: Lembar Jawaban Lab 4 IpmDokument4 SeitenBond and Stock Valuation: Lembar Jawaban Lab 4 IpmIcal PahleviNoch keine Bewertungen

- MicroCap Review Q2 2022Dokument97 SeitenMicroCap Review Q2 2022Planet MicroCap Review Magazine100% (3)

- The Millionaire in You PDFDokument9 SeitenThe Millionaire in You PDFPomija0% (1)

- Financial Institutions 1Dokument27 SeitenFinancial Institutions 1Afshan ShehzadiNoch keine Bewertungen

- DT Ebook BasicTrainingforFutureTradersDokument13 SeitenDT Ebook BasicTrainingforFutureTradersZen Trader100% (1)

- Agriculture Scheme of Work For Junior Secondary School JSS 3Dokument6 SeitenAgriculture Scheme of Work For Junior Secondary School JSS 3Iwuanyanwu VictorNoch keine Bewertungen

- 3.the Acme Blivert Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczDokument1 Seite3.the Acme Blivert Company-Fundamentals of Financial Management-James C. Van Horne and John M. WachowiczRajib Dahal100% (1)

- Infrastructure: Defining Matters, DR Larry Beeferman and DR Allan WainDokument36 SeitenInfrastructure: Defining Matters, DR Larry Beeferman and DR Allan WainDr Allan Wain100% (1)

- 01 Prospectus OBA 02 ENGDokument112 Seiten01 Prospectus OBA 02 ENGLenin narayanan MNoch keine Bewertungen

- A Legal Perspective On Technology and The Capital Markets - Joshua MittsDokument50 SeitenA Legal Perspective On Technology and The Capital Markets - Joshua MittsJuan Eduardo Gómez LondoñoNoch keine Bewertungen

- Cash MGTDokument18 SeitenCash MGTHai HaNoch keine Bewertungen

- Global Derivatives 2010Dokument14 SeitenGlobal Derivatives 2010bezi1985Noch keine Bewertungen

- Regulation of Marchet BankerDokument3 SeitenRegulation of Marchet BankerAayush NamanNoch keine Bewertungen

- ING Group 2Dokument4 SeitenING Group 2Puneet JainNoch keine Bewertungen

- Finlatics Investment Banking Experience Program Project 2Dokument6 SeitenFinlatics Investment Banking Experience Program Project 2Aaisha ShahNoch keine Bewertungen

- RBI Annual Report 2010-11Dokument208 SeitenRBI Annual Report 2010-11Aparna PandeyNoch keine Bewertungen

- Theories of International InvestmentDokument2 SeitenTheories of International InvestmentSamish DhakalNoch keine Bewertungen

- Seshadripuram Educational Trust Seshadripuram College Post Graduate Department of Commerce and ManagementDokument1 SeiteSeshadripuram Educational Trust Seshadripuram College Post Graduate Department of Commerce and ManagementNilesh S.D.Noch keine Bewertungen

- Rolex Rings Limited: ListingDokument3 SeitenRolex Rings Limited: ListingAkhil SakethNoch keine Bewertungen