Beruflich Dokumente

Kultur Dokumente

HVS - Indonesia Hotel Watch - Indonesia Overview PDF

Hochgeladen von

Harimurti Wij0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

143 Ansichten9 SeitenTourism arrival is expected to increase from the current 250 million in 2012 to an estimated 400 million by 2023 based on a 5% compound annual growth rate. An additional 100,000 guestrooms will be required, translating to an estimated 700 to 800 hotels to be built in the next decade. The concentration of Indonesia's international tourist arrivals still revolves around the nation's capital city Jakarta and the world-renowned destination of Bali.

Originalbeschreibung:

Originaltitel

HVS - Indonesia Hotel Watch - Indonesia Overview (1).pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenTourism arrival is expected to increase from the current 250 million in 2012 to an estimated 400 million by 2023 based on a 5% compound annual growth rate. An additional 100,000 guestrooms will be required, translating to an estimated 700 to 800 hotels to be built in the next decade. The concentration of Indonesia's international tourist arrivals still revolves around the nation's capital city Jakarta and the world-renowned destination of Bali.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

143 Ansichten9 SeitenHVS - Indonesia Hotel Watch - Indonesia Overview PDF

Hochgeladen von

Harimurti WijTourism arrival is expected to increase from the current 250 million in 2012 to an estimated 400 million by 2023 based on a 5% compound annual growth rate. An additional 100,000 guestrooms will be required, translating to an estimated 700 to 800 hotels to be built in the next decade. The concentration of Indonesia's international tourist arrivals still revolves around the nation's capital city Jakarta and the world-renowned destination of Bali.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

HVS Global Hospitality Services |

Indonesia Stock Exchange Building, Tower II, 17

th

Floor

Jl. Jenderal Sudirman Kav 52-53, Jakarta 12190, Indonesia

www.hvs.com

INDONESIA HOTEL WATCH

INDONESIA OVERVIEW

JULY 2013

David Ling

Chairman

HVS China & Southeast Asia

Andree Susilo

Investment Associate

HVS Singapore/Jakarta

Zhihui Yeo

Consulting & Valuation Associate

HVS Singapore

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 2

FIGURE 1: GDP DISTRIBUTION BY PROVINCE, INDONESIA

Province 2010 2011

Jakarta 16.28 % 16.32 %

East Java 14.71 14.68

West Java 14.58 14.30

Central Java 8.40 8.28

Ri au 6.53 6.87

East Kal i mantan 6.08 6.49

North Sumatra 5.21 5.22

Banten 3.24 3.19

South Sumatra 2.98 3.02

South Sul awesi 2.23 2.28

Remai ni ng Provi nces 19.76 19.35

Total 100.00 100.00

Source: Badan Pusat Statistik Indonesia

Unprecedented Growth in Asias Rising Powerhouse

Rich in natural resources and experiencing an era of dynamic economic progress, Indonesia is a market not to be

missed. Tourism arrival is expected to increase from the current 250 million in 2012 to an estimated 400 million by

2023 based on a 5% compound annual growth rate. An additional 100,000 guestrooms will be required,

translating to an estimated 700 to 800 hotels to be built in the next decade, creating tremendous opportunities for

developers, investors, financiers, hotel management groups, airlines companies, travel agencies, consultancies and

other stakeholders.

The concentration of Indonesia's international tourist arrivals still revolves between the nation's capital city

Jakarta and the world-renowned destination of Bali. However, there is growing interest in Indonesia's second and

third tier markets, with many market players taking note of their massive potential. Stakeholders such as hotel

operators, investors, developers and the government sectors are closely following the new investments 'hot spots'

of Indonesia.

Economy to mid-scale hotel properties are the key target segments for many stakeholders' growth expansion

plans in the coming years. Hotel chains such as Accor, InterContinental Hotels Group, as well as Indonesia's

domestic hotel groups such as Archipelago International and Tauzia have indicated their intentions of

strengthening the presence of their economy to mid-scale brands in such emerging markets.

Overall, Indonesias tourism industry, can expect strong long-term potential, bolstered by rising demand for

domestic and regional travel, resulting in a diversification of destinations and hotel product offerings.

Economic Updates

In January 2013, the International Monetary Fund (IMF), forecasted global economic growth at 3.2%, with some major

economies of Asia registering a drop in GDP growth. A combination of five ASEAN countries- Indonesia, Malaysia,

Philippines, Thailand and Vietnam registered 5.7% growth in 2012. Despite the global uncertainty, Indonesia was able

to register a strong growth of 6.3% in 2012, brought

about by robust domestic and regional demand and

investments. Economic activity and foreign direct

investments have increased tremendously throughout

Indonesia, due to the tremendous economic potential

that the vast country holds- on the back of strong GDP

compound annual growth rate (CAGR) of 5.9% from

2008 to 2012.

Indonesias GDP is predominantly generated in Java

which accounts for more than 50% of the countrys GDP.

The capital city, Jakarta accounted for the largest

distribution of the countrys GDP at 16.32% in 2011,

followed by East Java at 14.68%

.

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 3

Indonesia at a Glance

International Arrivals (2005 2012)

-10%

-5%

0%

5%

10%

15%

20%

0

1

2

3

4

5

6

7

8

9

2005 2006 2007 2008 2009 2010 2011 2012

G

r

o

w

t

h

A

r

r

i

v

a

l

s

(

M

i

l

l

i

o

n

s

)

International

Arrivals

% Change International Arrivals

Source: Badan Pusat Statistik Indonesia

Top 5 Feeder Markets - Country of Origin, 2011

Singapore

20%

Malaysia

17%

Australia

12%

China

8%

Japan

5%

Others

38%

Source: Badan Pusat Statistik Indonesia

Tourism Receipts (2006 2012)

-20%

-10%

0%

10%

20%

30%

40%

50%

0

1,000

2,000

3,000

4,000

5,000

6,000

7,000

8,000

9,000

10,000

2006 2007 2008 2009 2010 2011 2012

P

e

r

c

e

n

t

a

g

e

C

h

a

n

g

e

(

%

)

T

o

u

r

i

s

m

R

e

c

e

i

p

t

s

(

B

i

l

l

i

o

n

U

S

D

)

Tourism Receipts (Billion USD) % Growth

Source: Ministry of Tourism and Creative Economy

Seasonality of Arrivals (2008 2012)

300,000

350,000

400,000

450,000

500,000

550,000

600,000

650,000

700,000

750,000

800,000

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2008 2009 2010 2011 2012

Source: Badan Pusat Statistik Indonesia

International arrivals have grown on average by

7.0% between 2005 and 2012.

Consistent growth from 2005 to 2012 due to strong

branding of Indonesia as a tourist destination.

Tourism receipts reached USD9,121 billion in 2012, a

7% growth over 2011.

Tourism receipts grew by a compound average rate of

13% between 2006 and 2012, and strong growth is

expected to continue.

International arrivals are relatively stable

throughout the different months of the year.

High season demand occurs during the Christmas

period and the summer months.

The Ramadan month tends to be the low season

period.

The main driver behind overall demand growth was

constituted by the Asia market (80% of total arrivals

in 2011).

Singapore is the largest arrival source market to

Indonesia (20%).

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 4

FIGURE 2: INTERNATIONAL VISITOR ARRIVALS- TOP 10 PORT OF ENTRIES WITH HIGHEST VOLUME IN 2012

Port of Entry 2011 2012 YOY % Change

Ngurah Rai 2,788,706 2,902,125 4.1%

Soekarno-Hatta 1,933,022 2,053,850 6.3%

Batam 1,161,581 1,219,608 5.0%

Tanjung Uban 337,353 336,547 -0.2%

Pol oni a 192,650 205,845 6.8%

Juanda 185,815 197,776 6.4%

Husei n Sastranegara 115,285 146,736 27.3%

Tanjung Bal ai Kari mun 104,397 107,499 3.0%

Tanjung Pi nang 106,180 103,785 -2.3%

Tanjung Pri ok 65,171 66,168 1.5%

Indonesia Total 7,649,731 8,044,462 5.2%

Source: Badan Pusat Statistik Indonesia

Tourism Market Performance and Trends

Tourism concluded strongly for Indonesia in 2012 as international visitor arrivals surpassed the target

set for the year of eight million, achieving a record breaking 8.04 million international arrivals last year;

this translates to a 5.16% increase over from 2011. Of this, Balis Ngurah Rai International Airport saw

2.9 million international tourist arrivals and Jakartas Soekarno-Hatta International Airport registered

2.0 million international tourist arrivals.

Thus, the concentration of Indonesias international tourist arrivals still revolve between the nations

capital city Jakarta and the world-renowned beach destination Bali. Port of entry Bandung Husein

Sastranegara registered the highest year-on-year growth in 2012, followed by Yogyakarta Adisucipto and

Balikpapan Sepinggan, achieving 27.3%, 22.4%, 7.8% growth respectively.

Domestic tourist arrivals saw 245 million trips made in 2012, an increase of 3.48% from 2011.

The year 2013 is set to be an even better year for Indonesias tourism with the Ministry of Tourism and

Creative Economy targeting nine million international visitors; a 12% increase from 2012. Furthermore,

255 million of domestic trips are expected in 2013, an increase of 4.08% from 2012. Indonesia will be

under the spotlight this year with the hosting of a string of prolific international events such as the APEC

summit, WTO Ministerial Meeting and the Miss World Pageant.

Since 2005, Indonesias international arrivals have seen consistent year-on-year growth of at least 5%

except for 2009. From five million international arrivals in 2005, to now 8.04 million in 2012, this

translates to a CAGR of 7.0%. In 2009, the tourist arrival figures of most cities were affected negatively by

the global economic downturn. However, the Indonesia tourism market remained resilient and registered

an increase of 1% from 2008. The global economic crisis in 2008 and 2009 saw less people travelling long

distance, resulting in the country focusing its tourism efforts on short and medium-haul markets.

Indonesia will continue to focus its expansion of tourists from these source markets until the year 2015.

The top source markets for Indonesia have remained consistent over the years, with ASEAN accounting

for the majority of visitor arrivals. In 2011, visitor arrivals from the Middle East grew by the largest

percentage at 19% from 144,661 arrivals in 2010 to 175,885 in 2011. This large increment can be

attributed to the growing popularity of Indonesia, especially in areas such as West Java, to Middle Eastern

visitors.

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 5

FIGURE 3: ANNUAL GROWTH- ESTABLISHMENTS AND ROOMS, INDONESIA, 2008-12

CAGR Establ i shments 2008-2012 8.6%

CAGR Rooms 2008-2012 8.6%

Source: Badan Pusat Statistik Indonesia

0%

5%

10%

15%

20%

25%

30%

2008 2009 2010 2011 2012

Establishment Room

FIGURE 4: TOP FIVE PROVINCES WITH HIGHEST NUMBER OF CLASSIFIED ESTABLISHMENTS AND ROOMS IN 2012

Province Establishments Rooms Establishments Rooms

DKI Jakarta 162 28,783 175 30,135

West Java 199 16,732 208 18,643

Central Java 131 8,736 139 9,756

East Java 90 9,311 98 10,039

B a l i 199 22,794 218 24,215

Indonesia Total 1,489 142,481 1,623 155,740

Source: Badan Pusat Statistik Indonesia

2012 2011

Arrivals from ASEAN countries grew by 8% from 2010, accounting for approximately 43% of arrivals in

2011, while arrivals from the rest of Asia grew by 13%, to account for approximately 37% of total arrivals

in 2011. China has quickly become one of the largest feeder markets for Indonesia, growing at a

compound annual growth rate of 36% between 2002 and 2011, and accounted for approximately 8% of

total international arrivals into Indonesia making it the fourth largest source market, followed by Japan at

5%.

Indonesia Hotel Market Supply

From 2008 to 2012, Indonesias classified establishments and subsequent rooms supply have been

consistently growing between 5% to 14%, which translates to a CAGR of 8.6% for both the number of

establishments and the number of rooms. The opening of new hotel developments surged in 2011, when

both establishments and rooms grew at approximately 14% each, compared to the year before.

DKI Jakarta, West Java, Central Java, East Java and Bali are the top five provinces with the highest number

of classified establishments and rooms in Indonesia in 2012. Jakarta, the capital of Indonesia presents

with the highest at 172 rooms per establishment, while Indonesia registers 96 rooms per establishment.

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 6

FIGURE 5: TRAVEL AND TOURISM CONTRIBUTION, INDONESIA, 2002-2013F

Year

Travel & Tourism Contribution

(in Billion Rupiah) % of GDP

2002 208,881 11.4

2003 213,582 10.6

2004 240,217 10.4

2005 287,572 10.3

2006 322,953 9.6

2007 385,990 9.7

2008 491,608 9.9

2009 561,240 10

2010 588,845 9.1

2011 659,246 8.8

2012 736,259 8.9

2013F 835,268 9.0

CAGR

2002-12 13.4%

Source: World Travel & Tourism Council

FIGURE 6: TOURISM INVESTMENTS, INDONESIA, 2006-2012

-40%

-20%

0%

20%

40%

60%

80%

100%

0

200

400

600

800

1000

2006 2007 2008 2009 2010 2011 2012

P

e

r

c

e

n

t

a

g

e

G

r

o

w

t

h

T

o

t

a

l

I

n

v

e

s

t

m

e

n

t

s

(

U

S

D

m

i

l

l

i

o

n

)

Foreign Direct Investments(USD million)

Domestic Direct Investments (USD million)

% Growth

Source: Indonesia Investment Coordinating Board

Indonesias Tourism Economy

According to the World Travel and

Tourism Council, the total

contribution of travel and tourism to

Indonesias GDP was IDR736,259

billion or 8.9% of GDP in 2012. The

total contribution of travel and

tourism encompasses revenue

generated from hotels, airlines,

airports, travel agents and various

services that deal directly with

tourists, investments made in the

tourism industry such as the

construction of new hotels,

government initiatives such as

tourism marketing and supply chain

of the travel and tourism industry.

Between 2002 and 2012, the total contribution of travel and tourism grew at a compound average annual

growth rate of 13.4%. This strong growth can be attributed to increased marketing promotion by the

Ministry of Tourism, higher discretionary spending by a strongly growing middle-class in the region and

in the county, as well as a rapidly growing route network by international and domestic flight carriers. By

2013, this contribution is forecasted to rise by 8.3% to IDR835,268 billion and tourism employment will

be anticipated to comprise 8.0% of total employment in Indonesia.

Tourism Investment

Tourism investment in Indonesia grew by more than 210% from 2011 to 2012. The growth in tourism

investment in aligned with the countrys positive economic growth. Additionally, the Indonesian

government has been instrumental in streamlining investment procedures and promoting investment

opportunities and potential of Indonesia within the region, resulting in a favourable investment

environment.

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 7

Foreign direct tourism investments grew by 225% between 2011 and 2012, or at an annual compound

average growth rate of 38% between 2006 and 2012. Indonesias tourism investments are mainly focused

on the development of fully-integrated resort sites, as such properties help to boost the construction of

tourist facilities such as hotels and the development of the surrounding environment through social and

cultural aspects. Mid-tier resort and city hotel investments are at the moment still predominantly

domestically driven, however, that is changing rapidly in the short term.

Transportation Infrastructure

In line with Indonesias IDR4,000 trillion Accelerated and Expansion of Indonesias Economic

Development Plan (MP3EI), the countrys transport infrastructure will undergo several improvements

and additions to boost the countrys infrastructure and connectivity. Part of these improvements include

improving inter-island connectivity and to upgrade the countrys railways, roads, airports and seaports.

This new round of developments will be focused on less-densely populated areas, particularly eastern

Indonesia, as opposed to more densely populated areas such as Jakarta and Bali.

Air Transportation

Indonesia boasts good international accessibility, with the major ports of entry being the Soekarno-Hatta

International Airport in Jakarta and the Ngurah Rai International Airport in Bali. The country has more

than 300 airports, most of which are operated the state-owned PT Angkasa Pura I and PT Angkasa Pura II.

As part of the governments MP3EI initiative, a total of 24 new airports will be opened by 2015. In 2013,

12 new airports spread across the archipelago will begin operations, with the majority of the new

projects to be located in eastern Indonesia. North Sumatra will see the opening of the Kuala Namu

International Airport, which will replace the Polonia International Airport in Medan, while Indonesias

prime diving destination Raja Ampat in Papua will benefit from the opening of the Waisai Airport. Other

new but smaller airports slated to open in 2013 include Muara Bungo Airport in Jambi, Saumlaki Baru in

Maluku, the Pekon Serai Krui Airport in Lampung, Bawean Airport on Bawean island near East Java

amongst others.

Several existing airports will be upgraded later this year, including the expansion of the Soekarno-Hatta

International Airport in Jakarta and the construction of a new terminal at Ngurah Rai International

Airport in Bali which will be able to handle 25 million passengers per annum upon completion in June.

Other airport upgrades will include the expansion of the Juanda International Airport in Surabaya and the

Komodo Airport in Flores on East Nusa Tenggara.

Cruise Tourism

Cruise sector in Indonesia is becoming one of the major contributions to the development of tourism

economy and infrastructure in Indonesia. As the worlds largest archipelago, this attributes to the many

wonders of gateways that Indonesia is able to leverage through its cruise industry. With over 17,000

islands forming the nation, cruises are able to access the many remote exotic islands throughout the

archipelago when it is currently still restricted by land or air transport.

Cruise calls and passengers figures have significantly firmed up over the past years in Indonesia, and are

still targeted to soar even higher in the coming years. A total of 306 cruise calls have been confirmed for

INDONESIA HOTEL WATCH INDONESIA OVERVIEW | PAGE 8

FIGURE 7: CRUISE CALLS, INDONESIA, 2009-2013F

Year Cruise Calls Passengers

2009 135 68,566

2010 189 94,166

2011 176 112,412

2012 214 113,781

2013 Forecast 306 145,936

CAGR 2009-2013(F) Cal l s Forecast 23%

CAGR 2009-2013(F) Passengers Forecast 21%

Source: Ministry of Tourism and Creative Economy

FIGURE 8: 16 TOURISM DESTINATIONS, INDONESIA

Area Province

Lake Toba North Sumatra

Kepul auan Seri bu - Thousl and Isl ands Jakarta

Ol d Town Jakarta

Borobudur Central Java

Bromo-Tennger-Semeru East Java

Ki ntamani -Lake Batur Bal i

Menjangan, Pemuteran Bal i

Kuta, Sanur, Nusa Dua Bal i

Ri njani West Nusa Tenggara

Komodo Isl and East Nusa Tenggara

Ende-Fl ores East Nusa Tenggara

Tanjung Putti ng Central Kal i mantan

Toraja South Sul awesi

Bunaken North Sul awesi

Wakatobi Southeast Sul awesi

Raja Ampat West Papua

Source: Ministry of Tourism and Creative Economy

2013, an astonishing 43% increase

from 2012; bringing about the highest

record of 146,000 passengers, a 28%

increase from 2012. The Ministry of

Tourism and Creative Economy has

committed to 320 calls in 2014, and

thus targeting 500,000 passengers by

2015.

Cruise ships will be covering some 115

locations this year in Indonesia

including new destinations like Sabang

in Aceh, Belawan in North Sumatra;

compared to covering only 70 locations

in 2012. West and East Nusa Tenggara

are the most popular destinations, followed by Bali and Java; with 75, 45 and 38 cruise calls respectively.

The nation is currently developing 15 harbours as cruise ports in locations such as in Aceh (Sabang);

Ambon; Bali (Benoa, Celukan); Belawan; Jakarta; Karimunjawa; Komodo Island; Kumai; Lombok

(Lembar); Makassar; Semarang and Surabaya. The cruise port in Benoa Bali is undergoing development

to be a turn-around port which can accommodate international cruise to the Island.

Government Initiatives

Indonesias Ministry of Tourism and Creative Economy has spearheaded a new initiative to focus on 16

key tourism markets and seven segments of special interest within the country until 2014.

These destinations will be developed to help maximize the growth of tourism and to improve the quantity

and quality of international tourists coming to Indonesia. These destinations will be highlighted at

various travel tradeshows and sales missions, while familiarisation trips for travel consultants and media

will be organised. Additionally, the Ministry of Tourism and Creative Economy will increase marketing

efforts pertaining to these areas through traditional and social media channels.

.

HVS Global Hospitality Services |

Indonesia Stock Exchange Building, Tower II, 17

th

Floor

Jl. Jenderal Sudirman Kav 52-53, Jakarta 12190, Indonesia

www.hvs.com

About HVS

HVS is the worlds leading consulting and services organization focused on the hotel, mixed-

use, shared ownership, gaming, and leisure industries. Established in 1980, the company

performs 4500+ assignments each year for hotel and real estate owners, operators, and

developers worldwide. HVS principals are regarded as the leading experts in their respective

regions of the globe. Through a network of more than 30 offices and 450 professionals, HVS

provides an unparalleled range of complementary services for the hospitality industry.

Superior Results through Unrivalled Hospitality Intelligence. Everywhere.

About the Authors

David Ling, MSc, MSISV, AAPI is Chairman of HVS China & Southeast Asia responsible for valuation, consulting

and investment advisory services. David completed the Master of Science in Urban Land Appraisal from

University of Reading, United Kingdom and Bachelor of Business (with Distinction) from Curtin University of

Technology, Perth, Australia. David is a Member of the Australian Property Institute (AAPI) and the Singapore

Institute of Surveyors and Valuers (MSISV). He is also a Licensed Appraiser registered with the Inland Revenue

Authority of Singapore.

Andree Susilo is an Investment Associate with HVS Singapore and Jakarta, providing advisory on hotel

investment financing and sales. Prior to HVS, he was a Revenue Manager at Marriott International Headquarter

in Bethesda, MD. He holds a BA (Distinction Honours) in Hospitality, Finance and Revenue Management from

Glion Hotel School, Switzerland. Andree has provided investment advice and sales, conducted feasibility studies

and market analysis across Asia and the United States. He also organises HVSs Indonesia Hospitality & Tourism

Investment Conference.

Zhihui Yeo is an Associate with HVS Singapore, specialising in hotel valuation and consultancy. She joined HVS

after graduating with a Bachelor of Science (Honours) degree in International Hospitality Management with a

Finance Specialisation from cole htelire de Lausanne, Switzerland. Zhihui provides market research analysis

and has conducted development feasibility studies and hotel valuations for projects across Asia Pacific. She also

organises HVSs Indonesia Hospitality & Tourism Investment Conference.

Das könnte Ihnen auch gefallen

- Practice Set OwnDokument51 SeitenPractice Set OwnAngela Dane Javier100% (1)

- Bank of Kigali Investor Presentation Q1 & 3M 2012Dokument43 SeitenBank of Kigali Investor Presentation Q1 & 3M 2012Bank of Kigali100% (1)

- Tourism IndustryDokument51 SeitenTourism IndustrySanketShahNoch keine Bewertungen

- Theories of Dividend Policy PDFDokument12 SeitenTheories of Dividend Policy PDFShweta ShrivastavaNoch keine Bewertungen

- Feasibility Report On HotelDokument25 SeitenFeasibility Report On Hotelca_akrNoch keine Bewertungen

- Analysis of Foreign Direct Investment Environment in MalaysiaDokument15 SeitenAnalysis of Foreign Direct Investment Environment in MalaysiaThe IjbmtNoch keine Bewertungen

- Mosque StandartDokument20 SeitenMosque StandartHarimurti WijNoch keine Bewertungen

- Tourism and Hospitality IndustryDokument9 SeitenTourism and Hospitality IndustryIqbal singhNoch keine Bewertungen

- Industry Analysis of Travel and Tourism IndustryDokument8 SeitenIndustry Analysis of Travel and Tourism Industrysharadsingh23100% (2)

- Tourism Industry in IndiaDokument21 SeitenTourism Industry in Indiaj_sachin09Noch keine Bewertungen

- Impact of GDP and Exchange Rate On Foreign Direct Investment in MalaysiaDokument6 SeitenImpact of GDP and Exchange Rate On Foreign Direct Investment in MalaysiaAdnan KamalNoch keine Bewertungen

- Hospitality IndustryDokument32 SeitenHospitality IndustryNikhil MehtaNoch keine Bewertungen

- Marktano'S Personal Reviewer 2018 ©: Foreign CorporationDokument8 SeitenMarktano'S Personal Reviewer 2018 ©: Foreign CorporationMark TanoNoch keine Bewertungen

- Indonesia Country Report 2012 PDFDokument5 SeitenIndonesia Country Report 2012 PDFHarimurti WijNoch keine Bewertungen

- Causality Between Foreign Direct Investment and Tourism: Empirical Evidence From IndiaDokument14 SeitenCausality Between Foreign Direct Investment and Tourism: Empirical Evidence From IndiaravikumarbvNoch keine Bewertungen

- Based On The World Travel and Tourism Council IndonesiaDokument3 SeitenBased On The World Travel and Tourism Council Indonesiadania lailiNoch keine Bewertungen

- TourismDokument5 SeitenTourismSheetal BhattNoch keine Bewertungen

- Indian Tourism SectorDokument56 SeitenIndian Tourism SectorMithun NairNoch keine Bewertungen

- 3755 7326 1 SMDokument12 Seiten3755 7326 1 SMamane chanNoch keine Bewertungen

- Santoso Copyedit v3Dokument20 SeitenSantoso Copyedit v3GABRIELA ESTEFANIA SIGUENZA LOJANoch keine Bewertungen

- III. Tourism Industry in IndonesiaDokument8 SeitenIII. Tourism Industry in IndonesiaAditya TegarNoch keine Bewertungen

- Hospitality Industry: A Key Revenue Generator To Indian Economy As A Part of Tourism IndustryDokument4 SeitenHospitality Industry: A Key Revenue Generator To Indian Economy As A Part of Tourism IndustrySunnyVermaNoch keine Bewertungen

- 23 Thanhquang.pDokument12 Seiten23 Thanhquang.pLương Nguyễn ThịNoch keine Bewertungen

- ID Analisis Aliran Investasi Dan Perdagangan Pariwisata IndonesiaDokument29 SeitenID Analisis Aliran Investasi Dan Perdagangan Pariwisata Indonesiadrive fotoNoch keine Bewertungen

- ID Analisis Aliran Investasi Dan Perdagangan Pariwisata IndonesiaDokument9 SeitenID Analisis Aliran Investasi Dan Perdagangan Pariwisata Indonesiaandr 007Noch keine Bewertungen

- Sri LankaDokument6 SeitenSri Lankasladjanapaunovic11Noch keine Bewertungen

- IIPC NY BrochureDokument2 SeitenIIPC NY BrochureArita SoenarjonoNoch keine Bewertungen

- Visit Patterns Analysis of Foreign Tourist in Indonesian Territory Using Frequent Pattern Growth (FP-Growth) AlgorithmDokument1 SeiteVisit Patterns Analysis of Foreign Tourist in Indonesian Territory Using Frequent Pattern Growth (FP-Growth) AlgorithmM Egip PratamaNoch keine Bewertungen

- Tour SimDokument5 SeitenTour SimHari KrishnaNoch keine Bewertungen

- STUDY OF HOTEL INDUSTRY IN KHANDESH REGION by P A ANAWADE PDFDokument11 SeitenSTUDY OF HOTEL INDUSTRY IN KHANDESH REGION by P A ANAWADE PDFanawade100% (1)

- GingerDokument12 SeitenGingermerin_meNoch keine Bewertungen

- New Age Ad Assignment - Blog ContentDokument28 SeitenNew Age Ad Assignment - Blog ContentharshaNoch keine Bewertungen

- A Foreign Country Study Report ON "Tourism Sector" AT ThailandDokument5 SeitenA Foreign Country Study Report ON "Tourism Sector" AT ThailandDeepak ChauhanNoch keine Bewertungen

- BKPM 2015Dokument43 SeitenBKPM 2015Poull SteeadyNoch keine Bewertungen

- TRendsDokument3 SeitenTRendsVishnu SivanandanNoch keine Bewertungen

- Hospitality: Industry OverviewDokument3 SeitenHospitality: Industry OverviewJohn JebarajNoch keine Bewertungen

- Tourism in SingaporeDokument29 SeitenTourism in SingaporeSaurav GoyalNoch keine Bewertungen

- Contribution of Tourism Sector To Indonesia's GDP: (Billion)Dokument3 SeitenContribution of Tourism Sector To Indonesia's GDP: (Billion)LaksmiTitisAstrytaDewiNoch keine Bewertungen

- Role of Tourism Industry in India GDPDokument1 SeiteRole of Tourism Industry in India GDPkrishnambikapkNoch keine Bewertungen

- Strategi Pemerintah Menarik Kunjungan Turis MancanegaraDokument16 SeitenStrategi Pemerintah Menarik Kunjungan Turis MancanegaraPurwo Adi WibowoNoch keine Bewertungen

- Economics Project On Hotel IndustryDokument23 SeitenEconomics Project On Hotel IndustrySomyata Rastogi100% (1)

- Author: V. Sowkarthika Asst. Prof. - Dept. of Catering Science Sri Krishna Arts & Science College, Coimbatore - 42. Email Id: Sowkarthikav@skasc - Ac.in Mobile: 9500689324Dokument6 SeitenAuthor: V. Sowkarthika Asst. Prof. - Dept. of Catering Science Sri Krishna Arts & Science College, Coimbatore - 42. Email Id: Sowkarthikav@skasc - Ac.in Mobile: 9500689324multipurpose shopNoch keine Bewertungen

- To Study The Market Feasibility of 5 Star HotelsDokument20 SeitenTo Study The Market Feasibility of 5 Star Hotelsanuradha0% (1)

- Changing Face of Indonesian HospitalityDokument31 SeitenChanging Face of Indonesian HospitalityAngelaNoch keine Bewertungen

- Hotel Industry Study - Malaysia 2013Dokument43 SeitenHotel Industry Study - Malaysia 2013manishpandey1972Noch keine Bewertungen

- Chapter 1 - Proposal Thesis - Rizky PriyandaniDokument15 SeitenChapter 1 - Proposal Thesis - Rizky PriyandaniRizky PriyandaniNoch keine Bewertungen

- Analisis Investasi Asing Langsung Dan Faktor-Faktor Yang Mempengaruhinyadi IndonesiaDokument15 SeitenAnalisis Investasi Asing Langsung Dan Faktor-Faktor Yang Mempengaruhinyadi IndonesiaSalismaa SalismaaNoch keine Bewertungen

- An Economic Impact of The Tourism Industry in IndiaDokument5 SeitenAn Economic Impact of The Tourism Industry in IndiaApurva WaikarNoch keine Bewertungen

- EN Tourism Investment Supply and Demand inDokument4 SeitenEN Tourism Investment Supply and Demand inmaghfirah maghfirahNoch keine Bewertungen

- 2011 Annual Report Final DraftDokument57 Seiten2011 Annual Report Final DraftKristi DuranNoch keine Bewertungen

- Factors and Competitiveness of Malaysia As A Tourist Destination: A Study of Outbound Middle East TouristsDokument7 SeitenFactors and Competitiveness of Malaysia As A Tourist Destination: A Study of Outbound Middle East TouristsMageshri ChandruNoch keine Bewertungen

- Industry Dynamics T&TDokument23 SeitenIndustry Dynamics T&TvidahaniNoch keine Bewertungen

- Hotels Sector Analysis Report: SupplyDokument7 SeitenHotels Sector Analysis Report: SupplyArun AhirwarNoch keine Bewertungen

- IdusryDokument2 SeitenIdusryVeronika VasilevaNoch keine Bewertungen

- A Report On Tourism Industry in India by Boda Nithin Goud Enrollment number:20FMUCHH010093 ICFAI Business School, HyderabadDokument10 SeitenA Report On Tourism Industry in India by Boda Nithin Goud Enrollment number:20FMUCHH010093 ICFAI Business School, HyderabadkranthiNoch keine Bewertungen

- Market Feasibility of Indian Hotel IndustryDokument10 SeitenMarket Feasibility of Indian Hotel Industryzarin_singh12Noch keine Bewertungen

- The Movement Control Order (MCO) For COVID-19 Crisis and Its Impact On Tourism and Hospitality Sector in MalaysiaDokument7 SeitenThe Movement Control Order (MCO) For COVID-19 Crisis and Its Impact On Tourism and Hospitality Sector in Malaysiananthini kanasanNoch keine Bewertungen

- Various Countries Foreign Direct Investment (Fdi) in India and Its Impact On Gross Domestic Production (GDP) of IndiaDokument11 SeitenVarious Countries Foreign Direct Investment (Fdi) in India and Its Impact On Gross Domestic Production (GDP) of IndiaIAEME PublicationNoch keine Bewertungen

- Analisa Faktor Faktor Yang Berpengaruh TDokument22 SeitenAnalisa Faktor Faktor Yang Berpengaruh TNova NovaNoch keine Bewertungen

- Tourism and HospitalityDokument10 SeitenTourism and HospitalityShreya RungtaNoch keine Bewertungen

- What Is Blocking Development of Indonesia's Tourism Industry?Dokument3 SeitenWhat Is Blocking Development of Indonesia's Tourism Industry?Reiner ImranNoch keine Bewertungen

- CRITISM - Indonesia Economic Outlook 2018Dokument25 SeitenCRITISM - Indonesia Economic Outlook 2018Fajarina AmbarasariNoch keine Bewertungen

- Hospital Architectural Planning and DesigningDokument4 SeitenHospital Architectural Planning and DesigningHarimurti WijNoch keine Bewertungen

- Gsa Constr Criteria WarehouseDokument3 SeitenGsa Constr Criteria WarehouseHarimurti WijNoch keine Bewertungen

- Tourism RT Responsible Tourism ManualDokument128 SeitenTourism RT Responsible Tourism ManualHarimurti WijNoch keine Bewertungen

- Valuation of BondsDokument7 SeitenValuation of BondsHannah Louise Gutang PortilloNoch keine Bewertungen

- Fnce 220: Business Finance: Lecture 6: Capital Investment DecisionsDokument39 SeitenFnce 220: Business Finance: Lecture 6: Capital Investment DecisionsVincent KamemiaNoch keine Bewertungen

- 12th SP Paper Time Management March 2022Dokument17 Seiten12th SP Paper Time Management March 2022Sharvari PatilNoch keine Bewertungen

- Old Finance ReferencesDokument4 SeitenOld Finance Referencesnicholas_john_freeNoch keine Bewertungen

- Business Ownership and Operations Types of Business OwnershipDokument30 SeitenBusiness Ownership and Operations Types of Business OwnershipRingle JobNoch keine Bewertungen

- Term Paper MKT 101Dokument23 SeitenTerm Paper MKT 101Saiful HasanNoch keine Bewertungen

- Zahra Et Al. (2003)Dokument18 SeitenZahra Et Al. (2003)Guilherme MarksNoch keine Bewertungen

- Analyzing and Improving Management PerformanceDokument25 SeitenAnalyzing and Improving Management PerformanceSerena Van Der Woodsen100% (1)

- VipDokument6 SeitenVipVipin KushwahaNoch keine Bewertungen

- SFM (New) ICAI SM For May 2021Dokument670 SeitenSFM (New) ICAI SM For May 2021Sri PavanNoch keine Bewertungen

- Corporate Finance Case StudyDokument26 SeitenCorporate Finance Case StudyJimy ArangoNoch keine Bewertungen

- Foreign Currency Translation Method Choice Insights From Game TheoryDokument10 SeitenForeign Currency Translation Method Choice Insights From Game TheoryShashi LuphntaNoch keine Bewertungen

- Chapters 1 Thru 8 Review Questions Rev 2Dokument108 SeitenChapters 1 Thru 8 Review Questions Rev 2wilchaNoch keine Bewertungen

- Chapter Two: Strategy, Organization Design, and EffectivenessDokument9 SeitenChapter Two: Strategy, Organization Design, and EffectivenessberitahrNoch keine Bewertungen

- Chapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksDokument25 SeitenChapter Six: Managerial Economics, 8e William F. Samuelson Stephen G. MarksAli EmadNoch keine Bewertungen

- Dutch Accounting Standards For Large and Medium-Sized Legal Entities 2011Dokument0 SeitenDutch Accounting Standards For Large and Medium-Sized Legal Entities 2011Nicoleta MihaiNoch keine Bewertungen

- 5 Methods of Project AppraisalDokument17 Seiten5 Methods of Project AppraisalayushNoch keine Bewertungen

- Solved Assignment For Annamalai University MBA SECOND YEAR 2019Dokument30 SeitenSolved Assignment For Annamalai University MBA SECOND YEAR 2019palaniappann25% (4)

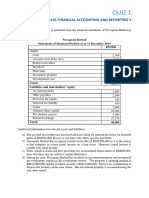

- QUIZ 1 Deferred Taxes SolutionDokument3 SeitenQUIZ 1 Deferred Taxes SolutionMohd NuuranNoch keine Bewertungen

- Galaxy Surfactants - Update - Jan20 - HDFC Sec-202001170612407324133Dokument7 SeitenGalaxy Surfactants - Update - Jan20 - HDFC Sec-202001170612407324133flying400Noch keine Bewertungen

- THE 12 Rs of OPPORTUNITY SCREENINGDokument1 SeiteTHE 12 Rs of OPPORTUNITY SCREENINGMaria AngelaNoch keine Bewertungen

- CorporationDokument18 SeitenCorporationErika Mae IsipNoch keine Bewertungen

- Project ReportDokument9 SeitenProject ReportYod8 TdpNoch keine Bewertungen

- Sbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanDokument9 SeitenSbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanvvpvarunNoch keine Bewertungen

- Ee Announcement Presentation FinalDokument31 SeitenEe Announcement Presentation Finalkoundi_3Noch keine Bewertungen

- Sustainable Banking With The PoorDokument8 SeitenSustainable Banking With The PoorramiraliNoch keine Bewertungen

- 2022-07-16 IFR AsiaDokument42 Seiten2022-07-16 IFR AsialeenaNoch keine Bewertungen