Beruflich Dokumente

Kultur Dokumente

Lecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDF

Hochgeladen von

jasminetsoOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Lecture11 - Mar15 Long-Term Assets, Depreciation (Deferred Taxes) PDF

Hochgeladen von

jasminetsoCopyright:

Verfügbare Formate

Long-lived Assets

15.501/516 Accounting

Spring 2004

Professor S. Roychowdhury

Sloan School of Management

Massachusetts Institute of Technology

March 15, 2004

Some Important Matters

Problem sets 5&6

Due April 5

Final exam

May 17, 1.30-4.30

Date and time inflexible set by Sloan School

Please let me know by the end of this week if

there is any conflict

NO GUARANTEES ON FINDING YOU A

ROOM AND TIME THAT WILL SUIT YOU

SO PLAN TO ATTEND EXAM AT

SCHEDULED TIME

Agenda

Understand how the matching principle

influences

the capitalization of long-lived assets

the expensing of capitalized costs to match

revenues generated in the use of long-lived

assets

Understand how differences in book vs.

tax accounting for depreciation lead to

deferred taxes

1

2

3

Review of Matching Principle

Capitalize versus Expense

Capitalized Costs means show it as an Asset on the

Balance Sheet

Assets have future benefits

Expense (i.e., not capitalize) when

benefits are immediate

OR future benefits are too uncertain or immaterial (e.g., R&D)

Assets are consumed (in future) to generate future

revenues

Current Assets like Inventory, Prepaid Rent, and Insurance

Non-current assets like Plant, buildings, machinery

NC Intangible assets like Patents, acquired goodwill

4

The case of non-current

assets: PP&E

Accounting for Non-Current assets:

What is the acquisition cost?

What is the expected useful service life?

What is the salvage value?

What pattern of depreciation should be

used to allocate expense over the useful

life?

Note: Land is the only non-current asset

that is never depreciated / amortized

Determining Acquisition Cost

What is given up to obtain the asset?

Include all costs required to bring the asset into

serviceable or usable condition and location.

Purchased Assets: Purchase price plus cost to

prepare the asset for use (installation, transport)

Case 1: Cash

Case 2: Financing (down payment plus loan/note)

Self-Constructed Assets

Direct costs of construction

Financing costs (interest on funds borrowed to finance

construction)

5

6

Determining the

Acquisition Cost

Purchased Assets: Example 1

Lowery, Inc. purchases new equipment on

1/1/02. The firm

pays $920,000 to the vendor of the machine

pays $62,000 to transport the equipment

pays $10,000 for insurance during transportation

estimates that maintenance will cost $4,000 in the first

year, and will rise by about 20% annually for 10 years

What is the balance sheet effect on 1/1/02?

Asset, Equipment = $992,000 (= 920 + 62 + 10)

Determining the

Acquisition Cost

Purchased Assets: Example 2

Portland Products acquires a work-station on

1/1/02. The firm

pays a $20,000 down payment to the vendor

signs a 3-year note payable for $180,000 at an

annual interest rate of 10%

pays employees $5,500 to configure the work-

station for daily operations and run appropriate

tests

spends $12,000 to train the employees who will

operate the work-station

What is the balance sheet effect on 1/1/02?

Asset, Work station = $205,500 (= 20 + 180 + 5.5)

Determining the

Acquisition Cost

Self-constructed Assets: Example

Myers Manufacturing is constructing a new

production facility. Expected completion date is

6/1/2002.

During 2001, the company

spends $1.2 million for materials

pays $1.6 million to architects and laborers

accrues interest payable equal to 10% of a $1.5 million

construction loan

incurs fees related to zoning, inspection, etc. of $65,000

What is the balance sheet effect as of 12/31/01?

Asset, Factory building construction in progress =

$3,015,000 (= 1,200 + 1,600 + 150 + 65)

7

8

9

Salvage Value and

Useful Life

Determining Salvage Value

Requires managerial judgment

SV = estimated proceeds at disposal, net of

selling costs

What factors can affect this estimate?

Depreciable basis = Acquisition cost - SV

Determining Useful life

Requires managerial judgment

The time period over which the asset will be used

What factors can affect the estimate?

Choose depreciation method

What does GAAP allow?

GAAP Depreciation

Methods

Production (Use) Method

Depreciation cost per machine-hour = depreciable

basis/service life (in machine-hours)

Depr. Expense = Actual hours used * hourly rate

Example:

A machine with depreciable basis of $50,000 is

expected to provide 20,000 hours of service. During

Year 1, the machine is used for 2,500 hours.

What is the depreciation expense for Year 1?

$2,500*[50,000/20,000] = $6,250

What is the machines book value at the end of Year

1?

$50,000 - $6,250 = $43,750

GAAP Depreciation

Methods

Straight-line Depreciation

Annual Depreciation Expense = depreciable

basis/service life (in years) = (AC - SV) / Years

Used by an overwhelming majority of US firms

Example:

Hertz acquires cars for its rental fleet for $30,000 each.

It expects to rent each car for 2 years, then sell them

for $15,000 each.

What is the depreciation expense per car for Year 1?

($30,000 - $15,000)/2 = $7,500

What is each cars book value at the end of Year 1?

$22,500

10

11

12

Depreciation Bookkeeping

At the time of acquisition of the asset:

Dr PP&E 30,000

Cr Cash 30,000

Say SV = 15,000

Depreciable basis = (30,000 15,000)

Depreciation = (Depreciable basis)/(useful life)

= 15,000/2 = 7,500

Dr Depreciation Expense 7,500

Cr Accumulated Depreciation 7,500

14

(

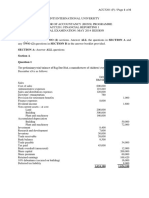

Depreciation Bookkeeping

At the beginning of first year

PP&E

30,000

At the end of first year

PP&E

Acc. Deprecn. Deprecn. Expense RE)

30,000 7,500 7,500

At the end of first year

Gross PP&E 30,000

Less: Acc Deprecn. 07,500

Net PP&E 22,500

Income effect -07,500

GAAP Depreciation Methods

Accelerated Depreciation

Mostly confined to tax reporting

Higher depreciation expense is recognized in the

earlier years of an assets useful life

Differences between Tax depreciation

deductions and Financial Reporting

depreciation expense give rise to Deferred

Tax accounts

More on this at end of lecture

13

15

Depreciation Bookkeeping

What accounts does depreciation affect?

Accumulated depreciation account, contra-

asset account

Retained earnings account, depreciation

expense

Which financial statements are affected?

Balance sheet and income statement

Does depreciation affect cash?

No

16

Das könnte Ihnen auch gefallen

- Long Live AssetsDokument16 SeitenLong Live AssetsLu CasNoch keine Bewertungen

- Review of Chapter 6Dokument54 SeitenReview of Chapter 6BookAddict721Noch keine Bewertungen

- 1 Project AppraisalDokument53 Seiten1 Project AppraisalZara FaryalNoch keine Bewertungen

- 3Dokument45 Seiten3Alex liaoNoch keine Bewertungen

- CA IPCC Nov 2010 Accounts Solved AnswersDokument13 SeitenCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNoch keine Bewertungen

- Non-Current Assets: TypesDokument4 SeitenNon-Current Assets: Typesbakhtawar soniaNoch keine Bewertungen

- Chapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlDokument42 SeitenChapters 8 and 9: Capital Budgeting: Ppts To Accompany Fundamentals of Corporate Finance 6E by Ross Et AlAbel100% (1)

- Quickbooks AssignmentDokument11 SeitenQuickbooks AssignmentTauqeer Ahmed100% (1)

- ACC 1100 Days 14&15 Long-Lived Assets PDFDokument25 SeitenACC 1100 Days 14&15 Long-Lived Assets PDFYevhenii VdovenkoNoch keine Bewertungen

- LECTURE NOTES - DepreciationDokument28 SeitenLECTURE NOTES - Depreciationhua chen yuNoch keine Bewertungen

- Plant, Assets, Natural Resources and Intangible AssetsDokument31 SeitenPlant, Assets, Natural Resources and Intangible AssetsNatya Nindyagitaya100% (1)

- CH 06 Investment EvaluationDokument47 SeitenCH 06 Investment Evaluationkemelew AregaNoch keine Bewertungen

- Financial Management AssignmentDokument53 SeitenFinancial Management Assignmentmuleta100% (1)

- Process Econ S1 2021 Evaluation of Alternatives Wk14Dokument16 SeitenProcess Econ S1 2021 Evaluation of Alternatives Wk14Farhan MuhamadNoch keine Bewertungen

- Session 6 Long Term Assets - HandoutDokument18 SeitenSession 6 Long Term Assets - HandoutPranav KumarNoch keine Bewertungen

- FA1 Chapter 3 EngDokument24 SeitenFA1 Chapter 3 EngNicola PoonNoch keine Bewertungen

- Faculty Name - Sandeep Bhatiya: Financial Accounting FundamentalDokument34 SeitenFaculty Name - Sandeep Bhatiya: Financial Accounting FundamentalNamrata PrasadNoch keine Bewertungen

- B215 AC08 Mochi Kochi 6th Presentation 19 June 2009Dokument46 SeitenB215 AC08 Mochi Kochi 6th Presentation 19 June 2009tohqinzhiNoch keine Bewertungen

- Capitalized CostDokument6 SeitenCapitalized CostAriel PadinNoch keine Bewertungen

- Ekonomi TeknikDokument10 SeitenEkonomi Teknikcraembouse100% (1)

- Income Statement: Results of Operating Performance: 15.501/516 Accounting Spring 2004Dokument59 SeitenIncome Statement: Results of Operating Performance: 15.501/516 Accounting Spring 2004Ashish ChiraniaNoch keine Bewertungen

- What Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodDokument23 SeitenWhat Are The Main Types of Depreciation Methods?: #1 Straight-Line Depreciation MethodShamarat RahmanNoch keine Bewertungen

- Can you depreciate an asset in one yearDokument10 SeitenCan you depreciate an asset in one yearbalucbe35Noch keine Bewertungen

- More ConceptsDokument47 SeitenMore ConceptsGurkirat Singh100% (1)

- CHAPTER 10 - PROPERTY, PLANT AND EQUIPMENT (v2)Dokument20 SeitenCHAPTER 10 - PROPERTY, PLANT AND EQUIPMENT (v2)VerrelyNoch keine Bewertungen

- DepreciationDokument8 SeitenDepreciationMida FataNoch keine Bewertungen

- Transcript of PFS: Financial Aspect - Investment CostsDokument7 SeitenTranscript of PFS: Financial Aspect - Investment CostsBjoy DalisayNoch keine Bewertungen

- ACCT604 Week 6 Lecture SlidesDokument26 SeitenACCT604 Week 6 Lecture SlidesBuddika PrasannaNoch keine Bewertungen

- ACTG101 Adjusting EntriesDokument63 SeitenACTG101 Adjusting EntriesPrincess Ann PunoNoch keine Bewertungen

- Chapter 4Dokument36 SeitenChapter 4Berihu GirmayNoch keine Bewertungen

- Capital Budgeting Report FinalDokument15 SeitenCapital Budgeting Report FinalCezar SabladNoch keine Bewertungen

- IAS16 Notes Property-Plant-And-Equipment - 23 Feb 2024 (1)Dokument23 SeitenIAS16 Notes Property-Plant-And-Equipment - 23 Feb 2024 (1)Katlego BafanaNoch keine Bewertungen

- 10a IAS 16Dokument30 Seiten10a IAS 16Ian chisema100% (1)

- MODULE 8 Capital BudgetingDokument9 SeitenMODULE 8 Capital BudgetingLumingNoch keine Bewertungen

- Measuring Financial Performance with Income StatementsDokument4 SeitenMeasuring Financial Performance with Income StatementsbullshittttNoch keine Bewertungen

- DepreciationDokument97 SeitenDepreciationsoniaNoch keine Bewertungen

- Capital and RevenueDokument9 SeitenCapital and Revenuenazusmani2Noch keine Bewertungen

- Afw 1000 Final Q s1 2014Dokument17 SeitenAfw 1000 Final Q s1 2014Mohammad RashmanNoch keine Bewertungen

- Construction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22Dokument22 SeitenConstruction Contracts-IAS 11 & Rev Rec & Journals-EY-PG22varadu1963Noch keine Bewertungen

- EMA M6 Ktunotes - inDokument31 SeitenEMA M6 Ktunotes - inKaushik VijayNoch keine Bewertungen

- Capital and Revenue Income and ExpenditureDokument31 SeitenCapital and Revenue Income and ExpenditureMahesh Chandra Sharma100% (2)

- Conceptual Framework and Accounting ConceptsDokument44 SeitenConceptual Framework and Accounting ConceptsLAI WEI,Noch keine Bewertungen

- Topic 4 - Assets - NotesDokument39 SeitenTopic 4 - Assets - Notesalbus.sevarus.2024Noch keine Bewertungen

- Acounting Aacounting Aacounting Aacounting ADokument8 SeitenAcounting Aacounting Aacounting Aacounting AFrankyLimNoch keine Bewertungen

- Lyceum of The Philippines University-Cavite Engineering Economy April 18, 2020 SaturdayDokument8 SeitenLyceum of The Philippines University-Cavite Engineering Economy April 18, 2020 SaturdayKenneth Rodriguez HerminadoNoch keine Bewertungen

- BAM 103 - Week 3 - DOUBLE ENTRY SYSTEM - PART 2Dokument26 SeitenBAM 103 - Week 3 - DOUBLE ENTRY SYSTEM - PART 2Trixy013Noch keine Bewertungen

- ACCT2019 - April 14, 2020: The Seller's Depreciation Doesn't Affect The Buyer at AllDokument4 SeitenACCT2019 - April 14, 2020: The Seller's Depreciation Doesn't Affect The Buyer at AllBritania RanqueNoch keine Bewertungen

- Financing Feasibility Analysis - PresentationDokument42 SeitenFinancing Feasibility Analysis - PresentationabulyaleeNoch keine Bewertungen

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Engineering Economics Lecture Week 10-11: Huma Fawad Hitec, Taxila SEP, 2018 - JAN, 2019Dokument19 SeitenEngineering Economics Lecture Week 10-11: Huma Fawad Hitec, Taxila SEP, 2018 - JAN, 2019Sohaib IrfanNoch keine Bewertungen

- Fa4e SM Ch03Dokument82 SeitenFa4e SM Ch03michaelkwok1Noch keine Bewertungen

- Financial Accounting BasicsDokument24 SeitenFinancial Accounting BasicsMonirHRNoch keine Bewertungen

- Definition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesDokument8 SeitenDefinition and Explanation:: (1) - Adjusting Entries That Convert Assets To ExpensesKae Abegail GarciaNoch keine Bewertungen

- Applied Corporate Finance. What is a Company worth?Von EverandApplied Corporate Finance. What is a Company worth?Bewertung: 3 von 5 Sternen3/5 (2)

- 1271683293-IAS16 Preparation For StudySession PDFDokument13 Seiten1271683293-IAS16 Preparation For StudySession PDFmohedNoch keine Bewertungen

- Investment AppraisalDokument24 SeitenInvestment AppraisalDeepankumar AthiyannanNoch keine Bewertungen

- Engineering Economic AnalysisDokument16 SeitenEngineering Economic AnalysisAnyela Yulissa100% (1)

- CA 51014 - Strategic Cost Management Capital BudgetingDokument9 SeitenCA 51014 - Strategic Cost Management Capital BudgetingMark FloresNoch keine Bewertungen

- Cost & Managerial Accounting II EssentialsVon EverandCost & Managerial Accounting II EssentialsBewertung: 4 von 5 Sternen4/5 (1)

- The Entrepreneur’S Dictionary of Business and Financial TermsVon EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNoch keine Bewertungen

- Bs en Iso 1 1:2012 4064Dokument32 SeitenBs en Iso 1 1:2012 4064jasminetsoNoch keine Bewertungen

- International Standard: Risk Management - GuidelinesDokument24 SeitenInternational Standard: Risk Management - Guidelinesjasminetso100% (14)

- Inspect The BuildingDokument5 SeitenInspect The BuildingjasminetsoNoch keine Bewertungen

- The Next Normal in ConstructionDokument90 SeitenThe Next Normal in ConstructionRodrigo Giorgi100% (1)

- Example Research ProposalDokument8 SeitenExample Research ProposalMarco BarretoNoch keine Bewertungen

- NEC Certificate PrinciplesDokument1 SeiteNEC Certificate PrinciplesjasminetsoNoch keine Bewertungen

- Graduate STEM Education For The 21st CenturyDokument203 SeitenGraduate STEM Education For The 21st CenturyJuan PobleteNoch keine Bewertungen

- 01 GasolineDokument9 Seiten01 GasolineYarin HernandezNoch keine Bewertungen

- Note For Finance CommitteeDokument8 SeitenNote For Finance CommitteejasminetsoNoch keine Bewertungen

- WorldGBC ANZ Status Report 2021 - FINALDokument25 SeitenWorldGBC ANZ Status Report 2021 - FINALjasminetsoNoch keine Bewertungen

- BIM International Edition 2020Dokument36 SeitenBIM International Edition 2020Edward C100% (1)

- Revised RODP 500x500Dokument1 SeiteRevised RODP 500x500jasminetsoNoch keine Bewertungen

- PHP Error opening fileDokument2 SeitenPHP Error opening fileSofia VelásquezNoch keine Bewertungen

- The Ultimate Guide To Benchmarking Construction WorkflowsDokument13 SeitenThe Ultimate Guide To Benchmarking Construction WorkflowsjasminetsoNoch keine Bewertungen

- NEC Collaboration CLLB Ti: Practice NotesDokument122 SeitenNEC Collaboration CLLB Ti: Practice NotesCT0011Noch keine Bewertungen

- NEC3 Delegate Handbook v2 - Sept2018Dokument39 SeitenNEC3 Delegate Handbook v2 - Sept2018jasminetsoNoch keine Bewertungen

- 01 Nec Ecc PN V1.0 201610 PDFDokument120 Seiten01 Nec Ecc PN V1.0 201610 PDFghjtyu0% (1)

- Sample Format of Grand Summary of The Activity Schedule / Bill of Quantities in NEC ECC ContractsDokument1 SeiteSample Format of Grand Summary of The Activity Schedule / Bill of Quantities in NEC ECC ContractsjasminetsoNoch keine Bewertungen

- 11 Sample Template of WI Preambles To Specifications V1.0 201610Dokument5 Seiten11 Sample Template of WI Preambles To Specifications V1.0 201610Bruce WongNoch keine Bewertungen

- 13 Sample Template For BQ Preambles V1!1!201703Dokument7 Seiten13 Sample Template For BQ Preambles V1!1!201703Jasmine TsoNoch keine Bewertungen

- CWDCS Web Basic 20210129Dokument1.050 SeitenCWDCS Web Basic 20210129jasminetsoNoch keine Bewertungen

- Appendix To The General Conditions of Tender Correction Rules For Tender Errors (General Conditions of Tender Clause GCT 11)Dokument15 SeitenAppendix To The General Conditions of Tender Correction Rules For Tender Errors (General Conditions of Tender Clause GCT 11)Jasmine TsoNoch keine Bewertungen

- ICNIRPemfgdl 1Dokument38 SeitenICNIRPemfgdl 1lukiNoch keine Bewertungen

- Contract Clause "Hired and Hire-Purchase Constructional Plant". The Project Offices ShouldDokument17 SeitenContract Clause "Hired and Hire-Purchase Constructional Plant". The Project Offices ShouldjasminetsoNoch keine Bewertungen

- Emp 1201Dokument12 SeitenEmp 1201jasminetsoNoch keine Bewertungen

- Bim 2019Dokument4 SeitenBim 2019jasminetso100% (1)

- CWDCS Web Basic 20210129Dokument1.050 SeitenCWDCS Web Basic 20210129jasminetsoNoch keine Bewertungen

- RICS Hong Kong Mediator RegisterDokument3 SeitenRICS Hong Kong Mediator RegisterjasminetsoNoch keine Bewertungen

- Experiments with ElectrostaticsDokument1 SeiteExperiments with ElectrostaticsjasminetsoNoch keine Bewertungen

- Architecture Design Handbook - Fundamentals - Radio Frequency ShieldingDokument1 SeiteArchitecture Design Handbook - Fundamentals - Radio Frequency ShieldingjasminetsoNoch keine Bewertungen

- Determination of Fund RequirementsDokument5 SeitenDetermination of Fund RequirementsHerman GiananNoch keine Bewertungen

- A Study On HDFC Mutual FundDokument88 SeitenA Study On HDFC Mutual FundSagar Paul'gNoch keine Bewertungen

- PWC Basel III Capital Market Risk Final RuleDokument30 SeitenPWC Basel III Capital Market Risk Final RuleSara HumayunNoch keine Bewertungen

- Fortune Wealth ManagementDokument27 SeitenFortune Wealth Managementjagadeesh0907Noch keine Bewertungen

- Test Bank AnswersDokument118 SeitenTest Bank AnswersHiếu Phạm MinhNoch keine Bewertungen

- Statement of Cash Flows Quiz Set ADokument5 SeitenStatement of Cash Flows Quiz Set AImelda lee0% (1)

- Purchasing Objectives and ResponsibilitiesDokument10 SeitenPurchasing Objectives and ResponsibilitiesSanskar AgrawalNoch keine Bewertungen

- 101 Powerful Money Secrets-What The Rich.... & Life - Alex OoiDokument35 Seiten101 Powerful Money Secrets-What The Rich.... & Life - Alex OoiwobblegobbleNoch keine Bewertungen

- AccountingDokument7 SeitenAccountingAnnaNoch keine Bewertungen

- Strategic Financial Management Chapter IIDokument14 SeitenStrategic Financial Management Chapter IIAnish MittalNoch keine Bewertungen

- Case Study - ACI and Marico BDDokument9 SeitenCase Study - ACI and Marico BDsadekjakeNoch keine Bewertungen

- Full PFRS Illustrative Financial Statements 2018Dokument126 SeitenFull PFRS Illustrative Financial Statements 2018Jake Aseo BertulfoNoch keine Bewertungen

- Sonata Manufacturing Corporation Decided To Expand Its Operations and OpenDokument1 SeiteSonata Manufacturing Corporation Decided To Expand Its Operations and OpenTaimour HassanNoch keine Bewertungen

- Chapter 13Dokument11 SeitenChapter 13Maya HamdyNoch keine Bewertungen

- Efficient InefficiencyDokument2 SeitenEfficient InefficiencymcampuzaNoch keine Bewertungen

- Chap 019Dokument36 SeitenChap 019skuad_024216Noch keine Bewertungen

- Analisis Laporan Keuangan PT Blue BirdDokument4 SeitenAnalisis Laporan Keuangan PT Blue BirdSedih BerasaNoch keine Bewertungen

- Kumo TraderDokument3 SeitenKumo Traderhenrykayode4Noch keine Bewertungen

- Reading 53: Portfolio Risk and Return: Part IIDokument37 SeitenReading 53: Portfolio Risk and Return: Part IIAlex PaulNoch keine Bewertungen

- Revision 1Dokument3 SeitenRevision 1MATTHEW (FIA2183) KANNANNoch keine Bewertungen

- Chapter 4 Reviewer in OmDokument2 SeitenChapter 4 Reviewer in Omelle gutierrezNoch keine Bewertungen

- IFM AssignmentDokument3 SeitenIFM AssignmentUsmanNoch keine Bewertungen

- Full Download Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions ManualDokument36 SeitenFull Download Cornerstones of Financial Accounting Canadian 1st Edition Rich Solutions Manualcolagiovannibeckah100% (30)

- SEFL AnnexureDokument1 SeiteSEFL AnnexureBalakrishna AnkayyaNoch keine Bewertungen

- NBAD GCC Fund Term SheetDokument12 SeitenNBAD GCC Fund Term SheetgaceorNoch keine Bewertungen

- Activity-Based Costing and Customer Profitability AnalysisDokument26 SeitenActivity-Based Costing and Customer Profitability Analysisgembel mlithiNoch keine Bewertungen

- MW Petroleum Corporation (A)Dokument6 SeitenMW Petroleum Corporation (A)AnandNoch keine Bewertungen

- ACC3201Dokument6 SeitenACC3201natlyhNoch keine Bewertungen

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDokument5 SeitenQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerCA Dipesh JainNoch keine Bewertungen