Beruflich Dokumente

Kultur Dokumente

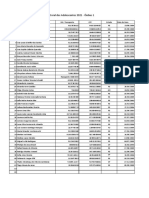

Caurdaneta, San Miguel, and Union Cases

Hochgeladen von

hello_hoarderOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Caurdaneta, San Miguel, and Union Cases

Hochgeladen von

hello_hoarderCopyright:

Verfügbare Formate

CASE: Caurdanetaan vs.

Laguesma

[G.R. No. 113542. February 24, 1998]

CAURDANETAAN PIECE WORKERS UNION, represented by JUANITO P. COSTALES, JR. in his capacity as union president, petitioner,

vs.UNDERSECRETARY BIENVENIDO E. LAGUESMA and CORFARM GRAINS, INC., respondents.

[G.R. No. 114911. February 24, 1998]

CAURDANETAAN PIECE WORKERS ASSOCIATION as represented by JUANITO P. COSTALES, JR., president, petitioner, vs. NATIONAL

LABOR RELATIONS COMMISSION, CORFARM GRAINS, INC. and/or TEODY C. RAPISORA and HERMINIO RABANG, respondents.

FACTS:

-Caurdanetaan Piece Workers Union (CPWU) has 92 members who worked as cargador for CoFarm Grains, Inc. (Cofarm).

- As cargadores, they loaded, unloaded and piled sacks of palay from the warehouse to the cargo trucks and those brought by cargo trucks

for delivery to different places. They were paid by Cofarm on a piece rate basis. When CGI denied some benefits to these cargadores, the

latter organized (CPWU). Upon learning of its formation, CGI barred its members from working with them and replaced [them] with non-

members of the union sometime in the middle of 1992.

-In 1992, CPWU filed a petition for certification election before the DOLE. While this was pending, they also filed a complaint for illegal

dismissal and unlabor practice (among others).

- In 1993, petition for certification was granted. However, the petition for certification election was later dismissed (on motion for recon

filed by Cofarm) by Laguesma for lack of employer- employee relationship.

-On September 14, 1993, Labor Arbiter Rolando D. Gambito issued his decision finding the dismissal of petitioners members illegal. On

appeal by both parties. On appeal, NLRC set aside the appealed decision and remanded the case to the labor arbiter for further

proceedings.

Cofarms contention: Corfarm insists that no E-E relationship exists and it denies that it had the power of control, rationalizing that CPWU

members" were 'street-hired' workers engaged from time to time to do loading and unloading work .There was no superintendent-in-

charge to give orders and there were no gate passes issued, nor tools, equipment and paraphernalia issued by Corfarm for

loading/unloading. Furthermore they contended that employer-employee relationship is negated by the fact that they offer and actually

perform loading and unloading work for various rice mills in Pangasinan. Cofarm asserts that a literal application of such article will result in

absurdity, where CPWUs members will be regular employees not only of COfarm but also of several other rice mills, where they were

allegedly also under service. Finally, Corfarm submits that the OSGs position is negated by the fact that CPWUs members contracted for

loading and unloading services with respondent company when such work was available and when they felt like it.

ISSUES:

Whether or not an employer-employee relationship between the CPWU members and Respondent Cofarm exist? YES.

RULING:

The Four-Fold Test to determine the existence of an E-E relationship

To determine the existence of an employer-employee relation, this Court has consistently applied the four-fold test which has

the following elements: (1) the power to hire, (2) the payment of wages, (3) the power to dismiss, and (4) the power to control -- the last

being the most important element.

The examination of the case records indubitably shows the presence of an employer-employee relationship. Relying on the

evidence adduced by theCPWU, Laguesma himself affirmed the presence of such connection in its First Order finding:

Anent the first issue, we find the annexes submitted by the respondent company not enough to prove that herein petitioner is

indeed an independent contractor. The existence of an independent contractor relationship is generally established by the

following criteria. The contractor is carrying on an independent business; [the] nature and extent of the work; the skill required;

the term and duration of the relationship; the right to assign the performance of a specified piece of work; the control and

supervision over the workers; payment of the contractors workers; the control and the supervision over the workers; the control

of the premises; the duty to supply the premises, tools, appliances, materials and laborers, and the mode, manner and terms of

payment. [Brotherhood Labor Unity Movement of the Philippines vs. Zamora, 147 SCRA 49 (198) [sic] ].

None of the above criteria exists in the case at bar. The absence of a written contract which specifies the performance of a

specified piece of work, the nature and extent of the work and the term and duration of the relationship between herein

petitioner and respondent company belies the latters [sic] allegation that the former is indeed and [sic] independent contractor.

Also, respondent failed to show by clear and convincing proof that herein respondent has the substantial capital or investment to

qualify as an independent contractor under the law. The premises, tools, equipments [sic] and paraphernalia are all supplied by

respondent company. It is only the manpower or labor force which the alleged contractor supplies, suggesting the existence of a labor

only contracting scheme which is prohibited by law. Further, if herein petitioner is indeed an independent contractor, it should have

offered its services to other companies and not to work [sic] exclusively for the respondent company. It is therefore, clear that the

alleged J.P. Costales, Jr. Cargador Services cannot be considered as an independent contractor as defined by law.

Cofarm is not an independent contractor (with respect to Laguesmas subsequent Order reversing his First Order above, finding no EE

relationship existed) (which was absurd according to the SC)

The standard to determine whether a worker is an independent contractor:

The applicable law is not Article 280 of the Labor Code but Art. 106, which provides:

Art. 106. Contractor or subcontractor. -- Whenever an employer enters into a contract with another person for the performance of the

formers work, the employees of the contractor and of the latters subcontractor, if any, shall be paid in accordance with the provisions of

this Code. xxx There is labor-only contracting where the person supplying workers to an employer does not have substantial capital or

investment in the form of tools, equipment, machineries, work premises, among others, and the workers recruited and placed by such

persons are performing activities which are directly related to the principal business of such employer. In such cases, the person or

intermediary shall be considered merely as an agent of the employer who shall be responsible to the workers in the same manner and extent

as if the latter were directly employed by him. (emphasis supplied)

It is undeniable that petitioners members worked as cargadores for Cofarm. They loaded, unloaded and piled sacks

of palay from the warehouses to the cargo trucks and from the cargo trucks to the buyers. This work is directly related, necessary and

vital to the operations of Corfarm. Moreover, Corfarm did not even allege, much less prove, that CPWUs members have substantial

capital or investment in the form of tools, equipment, machineries, [and] work premises, among others. Furthermore, Cofarm did not

contradict CPWUs allegation that it paid wages directly to these workers without the intervention of any third-party independent

contractor. It also wielded the power of dismissal over petitioners.

Applying Article 280

of the Labor Code, we hold that the CPWU members were regular employees of private respondent. Their

tasks were essential in the usual business of private respondent.

CASE: San Miguel vs. Ople

SAN MIGUEL BREWERY SALES FORCE UNION (PTGWO), petitioner, vs. HON. BLAS F. OPLE, as Minister of Labor and SAN MIGUEL

CORPORATION, respondents.

FACTS

-On April 17, 1978, a collective bargaining agreement was entered into by San Miguel Corporation Sales Force Union (PTGWO), and the

private respondent, San Miguel Corporation(SMC) allowing employees with the appropriate bargaining unit to be entitled to a basic

monthly compensation plus commission based on sales.

-On September 1979, SMC introduced a marketing scheme called Complemetary Distribution System" (CDS) whereby its beer products

were offered for sale directly to wholesalers through San Miguel's sales offices.

-PTGWO then filed a complaint for unfair labor practice on the ground that it violates the collective bargaining agreement as it would

reduce the take home pay of the salesmen and their truck helpers for the company would be unfairly competing with them.

Minister of Labor: dismissed the petition upheld that CDS was a valid exercise of management prerogative.

ISSUE: Whether or not the CDS violates the collective bargaining agreement? NO.

RULING:

CDS was a valid exercise of management prerogatives

Except as limited by special laws, an employer is free to regulate, according to his own discretion and judgment, all aspects of

employment, including hiring, work assignments, working methods, time, place and manner of work, tools to be used, processes to be

followed, supervision of workers, working regulations, transfer of employees, work supervision, lay-off of workers and the discipline,

dismissal and recall of work.

Every business enterprise endeavors to increase its profits. In the process, it may adopt or devise means designed towards that goal.

Even as the law is solicitous of the welfare of the employees, it must also protect the right of an employer to exercise what are clearly

management prerogatives. The free will of management to conduct its own business affairs to achieve its purpose cannot be denied.

CDS was not an indirect way of busting the union

So long as a company's management prerogatives are exercised in good faith for the advancement of the employer's interest and not for

the purpose of defeating or circumventing the rights of the employees under special laws or under valid agreements, this Court will uphold

them.

San Miguel Corporation's offer to compensate the members of its sales force who will be adversely affected by the implementation of the

CDS by paying them a so-called "back adjustment commission" to make up for the commissions they might lose as a result of the CDS

proves the company's good faith and lack of intention to bust their union.

CASE: Union vs. Vivar

G.R. No. 79255 January 20, 1992

UNION OF FILIPRO EMPLOYEES (UFE), petitioner, vs.

BENIGNO VIVAR, JR., NATIONAL LABOR RELATIONS COMMISSION and NESTL PHILIPPINES, INC. (formerly FILIPRO, INC.), respondents.

Union of Filipro Employees v. Vivar

Facts:

-Filipro Inc. (now Nestle Philippines, Inc.) had excluded sales personnel from the holiday pay award and changed the divisor in the

computation of benefits from 251 to 261 days.

-In the case for voluntary arbitration, Vivar directed Filipro to pay its monthly paid employees holiday pay pursuant to Article 94 of

the Code, subject only to the exclusions and limitations specified in Article 82 and such other legal restrictions as are provided for in the

Code.

-Filipro filed a motion for clarification seeking (1) the limitation of the award to 3 years, (2) exclusion of its sales personnel (consisted by

salesmen, sales representatives, truck drivers, merchandisers and medical representatives) from the award of the holiday pay, and (3)

deduction from the holiday pay award of overpayment for overtime, night differential, vacation and sick leave benefits due to the use of

251 divisor.

-Vivar issued an order declaring that the effectivity of the holiday pay award shall retroact to November1, 1974, the date of effectivity of

the labor Code. However, he adjudged the sales personnel are field personnel and, as such, are not entitled to holiday pay. He likewise

ruled that the divisor should be changed from 251 to 261 due to the grant of 10 days holiday pay and ordered the reimbursement of

overpayment for overtime, night differential, vacation and sick leave pay due to the use of 251 days as divisor. Treating the motions for

partial reconsideration of the parties.

-Vivar forwarded the case to the NLRC, which remanded the case to Vivar for lack of jurisdiction.

Unions contention: - They contended that the award should be made effective from the date of effectivity of the Labor Code, their sales

personnel are not field personnel and are therefore entitled to holiday pay, and the use of 251 as divisor is an established employee benefit

which cannot be diminished.

ISSUE #1. Whether or not Nestles sales personnel are entitled to holiday pay?

Under Article 82, field personnel are not entitled to holiday pay. Said article defines field personnel as non-agricultural employees who

regularly perform their duties away from the principal place of business or branch office of the employer and whose actual hours of work in

the field cannot be determined with reasonable certainty.

It is undisputed that these sales personnel start their field work at 8:00 a.m. after having reported to the office and come back to the office

at 4:00 p.m. or 4:30 p.m. if they are Makati-based. However, the Union maintains that the period between 8:00 a.m. to 4:00 or 4:30 p.m.

comprises the sales personnels working hours which can be determined with reasonable certainty. However, the court does not agree. The

law requires that the actual hours of work in the field be reasonably ascertained. The company has no way of determining whether or not

these sales personnel, even if they report to the office before 8:00 a.m. prior to field work and come back at 4:30 p.m., really spend the

hours in between in actual field work. Moreover, the Court fails to see how the company can monitor the number of actual hours spend

infield work by an employee through imposition of sanctions on absenteeism.

The requirement that "actual hours of work in the field cannot be determined with reasonable certainty" must be read in conjunction with

Rule IV, Book III of the Implementing Rules which provides:

Rule IV Holidays with Pay

Sec. 1. Coverage This rule shall apply to all employees except:

xxx xxx xxx

(e) Field personnel and other employees whose time and performance is unsupervised by the employer . . . (Emphasis supplied)

Rule IV (above) did not add another element to the Labor definition of field personnel

Contrary to the contention of the petitioner, the Court finds that the aforementioned rule did not add another element to the Labor Code

definition of field personnel. The clause "whose time and performance is unsupervised by the employer" did not amplify but merely

interpreted and expounded the clause "whose actual hours of work in the field cannot be determined with reasonable certainty." The

former clause is still within the scope and purview of Article 82 which defines field personnel. Hence, in deciding whether or not an

employee's actual working hours in the field can be determined with reasonable certainty, query must be made as to whether or not such

employee's time and performance is constantly supervised by the employer.

ISSUE #2. Whether or not, related to the award of holiday pay, the divisor should be changed from 251 to261 days and whether or not

the previous use of 251 as divisor resulted in overpayment for overtime?

The divisor assumes an important role in determining whether or not holiday pay is already included in the monthly paid employee's salary

and in the computation of his daily rate.

The use of 251 days divisor by Filipro indicates that holiday pay is not yet included in the employees salary, otherwise the divisor should

have been 261.It must be stressed that the daily rate, assuming there are no intervening salary increases, is a constantfigure for the

purpose of computing overtime and night differential pay and commutation of sick and vacation leave credits. Necessarily, the daily rate

should also be the same for computing the 10 unpaid holidays.

The respondent Arbitrators order to change the divisor from 251 to 261 days would result in a lower daily rate which is violative of the

prohibition or non-diminution of benefits found in Article 100 of the Labor Code. To maintain the same daily rate if the divisor is adjusted to

261 days, then the dividend, which represents the employees annual salary, should correspondingly be increased too incorporate the

holiday pay.

Moreover,the divisor to be used in computing holiday pay shall be 251 days and the reckoning period for the application of the holiday

award is October 23, 1984 and not November 1, 1974.

Das könnte Ihnen auch gefallen

- Agrarian Reform Law and Soc LegDokument100 SeitenAgrarian Reform Law and Soc Leghello_hoarderNoch keine Bewertungen

- Gerardo B. Concepcion, Petitioner, vs. Court of Appeals and MA. THERESA ALMONTE, RespondentsDokument9 SeitenGerardo B. Concepcion, Petitioner, vs. Court of Appeals and MA. THERESA ALMONTE, Respondentshello_hoarderNoch keine Bewertungen

- Brotherhood Labor Unity Movement Vs ZamoraDokument2 SeitenBrotherhood Labor Unity Movement Vs Zamorahello_hoarder100% (1)

- San Miguel Brewery Sales Force UnionDokument1 SeiteSan Miguel Brewery Sales Force Unionhello_hoarderNoch keine Bewertungen

- San Juan vs. NLRCDokument1 SeiteSan Juan vs. NLRChello_hoarderNoch keine Bewertungen

- Jose Rizal Colleges Vs NLRCDokument1 SeiteJose Rizal Colleges Vs NLRChello_hoarderNoch keine Bewertungen

- Durabuilt Vs NLRCDokument1 SeiteDurabuilt Vs NLRChello_hoarder100% (1)

- Pollution Adjudication Board vs. CADokument1 SeitePollution Adjudication Board vs. CAhello_hoarder100% (2)

- Calinisan vs. RoaquinDokument1 SeiteCalinisan vs. Roaquinhello_hoarderNoch keine Bewertungen

- Jose Rizal Colleges Vs NLRCDokument1 SeiteJose Rizal Colleges Vs NLRChello_hoarderNoch keine Bewertungen

- Krivenko Vs ROD ManilaDokument1 SeiteKrivenko Vs ROD Manilahello_hoarderNoch keine Bewertungen

- Hon. Executive Vs SouthwingDokument2 SeitenHon. Executive Vs Southwinghello_hoarder100% (4)

- Nacionalista Vs AngeloDokument1 SeiteNacionalista Vs Angelohello_hoarder50% (2)

- Power of Supervision and ControlDokument1 SeitePower of Supervision and Controlhello_hoarder100% (3)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Role of Women in Trade Unions and Nation BuildingDokument18 SeitenThe Role of Women in Trade Unions and Nation BuildingSneha KanitCar Kango100% (1)

- Supply Chain and Logistics Management: Distribution PoliciesDokument8 SeitenSupply Chain and Logistics Management: Distribution PoliciesKailas Sree ChandranNoch keine Bewertungen

- Case Study On Piramal Healthcare Acquiring 5.5% Stake in VodafoneDokument10 SeitenCase Study On Piramal Healthcare Acquiring 5.5% Stake in Vodafonegilchrist123Noch keine Bewertungen

- Malaysian Business Law Week-11 Lecture NotesDokument3 SeitenMalaysian Business Law Week-11 Lecture NotesKyaw Thwe TunNoch keine Bewertungen

- Information Security NotesDokument15 SeitenInformation Security NotesSulaimanNoch keine Bewertungen

- E 10Dokument7 SeitenE 10AsadNoch keine Bewertungen

- BPI Lesson 1 - Surveys & Investigation PDFDokument60 SeitenBPI Lesson 1 - Surveys & Investigation PDFMayNoch keine Bewertungen

- Tan Vs PeopleDokument1 SeiteTan Vs PeopleGian Tristan MadridNoch keine Bewertungen

- Lesson Agreement Pronoun Antecedent PDFDokument2 SeitenLesson Agreement Pronoun Antecedent PDFAndrea SNoch keine Bewertungen

- On Islamic Branding Brands As Good DeedsDokument17 SeitenOn Islamic Branding Brands As Good Deedstried meNoch keine Bewertungen

- Battletech BattleValueTables3.0 PDFDokument25 SeitenBattletech BattleValueTables3.0 PDFdeitti333Noch keine Bewertungen

- Folio BiologiDokument5 SeitenFolio BiologiPrincipessa FarhanaNoch keine Bewertungen

- Hedge Fund Ranking 1yr 2012Dokument53 SeitenHedge Fund Ranking 1yr 2012Finser GroupNoch keine Bewertungen

- 2b22799f-f7c1-4280-9274-8c59176f78b6Dokument190 Seiten2b22799f-f7c1-4280-9274-8c59176f78b6Andrew Martinez100% (1)

- Coral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascDokument1 SeiteCoral Dos Adolescentes 2021 - Ônibus 1: Num Nome RG / Passaporte CPF Estado Data de NascGabriel Kuhs da RosaNoch keine Bewertungen

- Assignment F225summer 20-21Dokument6 SeitenAssignment F225summer 20-21Ali BasheerNoch keine Bewertungen

- EDUC - 115 D - Fall2018 - Kathryn GauthierDokument7 SeitenEDUC - 115 D - Fall2018 - Kathryn Gauthierdocs4me_nowNoch keine Bewertungen

- Engineering Management Past, Present, and FutureDokument4 SeitenEngineering Management Past, Present, and Futuremonty4president100% (1)

- Noah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFDokument358 SeitenNoah Horwitz - Reality in The Name of God, or Divine Insistence - An Essay On Creation, Infinity, and The Ontological Implications of Kabbalah-Punctum Books (2012) PDFGabriel Reis100% (1)

- Nurlilis (Tgs. Bhs - Inggris. Chapter 4)Dokument5 SeitenNurlilis (Tgs. Bhs - Inggris. Chapter 4)Latifa Hanafi100% (1)

- A Study On Mobilization of Deposit and Investment of Nabil Bank LTDDokument68 SeitenA Study On Mobilization of Deposit and Investment of Nabil Bank LTDPadamNoch keine Bewertungen

- SLP Application For Withdrawal of Case From Supreme Court On SettlementDokument2 SeitenSLP Application For Withdrawal of Case From Supreme Court On SettlementharryNoch keine Bewertungen

- Dua AdzkarDokument5 SeitenDua AdzkarIrHam 45roriNoch keine Bewertungen

- Pre Project PlanningDokument13 SeitenPre Project PlanningTewodros TadesseNoch keine Bewertungen

- Botvinnik-Petrosian WCC Match (Moscow 1963)Dokument9 SeitenBotvinnik-Petrosian WCC Match (Moscow 1963)navaro kastigiasNoch keine Bewertungen

- E Commerce AssignmentDokument40 SeitenE Commerce AssignmentHaseeb Khan100% (3)

- 1 Introduction Strategic Project Management (Compatibility Mode)Dokument39 Seiten1 Introduction Strategic Project Management (Compatibility Mode)Pratik TagwaleNoch keine Bewertungen

- QBE 2022 Sustainability ReportDokument44 SeitenQBE 2022 Sustainability ReportVertika ChaudharyNoch keine Bewertungen

- Basavaraju Reservation Under The Constitution of India Issues and PerspectivesDokument9 SeitenBasavaraju Reservation Under The Constitution of India Issues and PerspectivesK ThirunavukkarasuNoch keine Bewertungen

- Final Test 1 Grade 10Dokument4 SeitenFinal Test 1 Grade 10Hường NgôNoch keine Bewertungen