Beruflich Dokumente

Kultur Dokumente

What Does A Flattening Yield Curve Mean For Gold

Hochgeladen von

Vincent Lau0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

29 Ansichten7 SeitenYield curve and gold price

Originaltitel

What Does a Flattening Yield Curve Mean for Gold

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenYield curve and gold price

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

29 Ansichten7 SeitenWhat Does A Flattening Yield Curve Mean For Gold

Hochgeladen von

Vincent LauYield curve and gold price

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

What Does A Flattening Yield Curve

Mean For Gold?

January 23rd, 2012 by Sam Kirtley

In this article, we look to analyse the relationship between gold and the U.S.

bond yield curve. The yield curve is an immensely useful economic indicator

and hence can be used as one of the determinants of the gold price.

We have yield curve dynamics, for a refresher the following excerpt should

aid in comprehension of this article.

For those readers who may be unfamiliar with how the yield curve works,

we will provide a brief explanation. Bonds of different maturities have

different yields. By plotting these yields against their maturities we can build

a yield curve. The yield curve becomes steeper if longer term interest rates

increase relative to shorter term interest rates. The yield curve becomes

flatter if longer term interest rates decrease relative to shorter term interest

rates. One way to measure the steepness of the yield curve is to look at the

difference between the yields at two different points on the curve. For

example one may look at the difference between the yields on 2 year

Treasuries compared to the yield on 5 year Treasuries. Such a comparison

will often be referred to as 2s5s and is measured in basis points (bps) by

subtracting the shorter term yield from the longer term yield. So if one says

2s5s are trading at +225 this means that the yield on 5 year bonds is 2.25%

higher than the yield on 2 year bonds. If 2s5s go from +225 to +275 then

the yield curve has steepened between those two maturities. If 2s5s go from

+225 to +175 then the yield curve has flattened between those two

maturities.

Intuitively, one would expect a flattening yield curve to be bullish for gold.

Flatter yield curve = economic weakness = safe haven assets (gold)

becoming more valuable, especially if such weakening in the economy is

followed by monetary easing, or increased expectations of monetary easing.

As with any hypothesis, this one is useless without being tested.

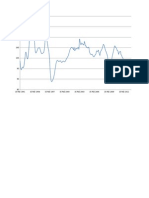

The above graph inversely plots gold against yield curve gradient. The early

trend is clearly quite strong, ie yield curve flattening and gold rising

correspondingly. Around September 2011 the relationship becomes shakier.

From September onwards, the trend seems to take a dramatic reversal,

switching from negative to positive. Trying to explain this reversal is

somewhat a case of speculation. The only thing that can be said with

certainty is that other factors are proving more important in determining the

gold price.

The graph below plots gold against yield curve steepness rather than time,

over the last 12 months.

The trend is

clear. Gold is driven higher when the yield curve flattens, exactly what one

would expect to see. The R

2

value shown of 0.6817 means that 68% of the

variation in the price of gold can be determined by changing yield curve

gradient.

As a trading service, we have a short to medium term focus. As a result the

majority of useful information to us is very timely. For this reason the trends

and relationships we observe must hold not only over the long term, but the

short-medium term also. We cannot afford to wait five years for the market

to return to where a certain model says it should be. As a result the plot

below showing the trend since September is potentially the most important

of this update.

As hinted at, the trend has shifted mildly positive, meaning a steeper yield

curve = gold driven higher. However, the relationship is extremely weak

(shown by an R

2

value of 0.1348) and is too inconclusive for our purposes.

The conclusion is that currently there is no relationship between the

steepness of the U.S. Yield curve and the price of gold. We can safely

assume other factors have been significantly more important in the

determination of the gold price in recent months.

The correlations for differing time frames over the past four years are as

follows:

Note: Correlation (r) is not to be confused with the coefficient of

determination (R

2

).

What we can draw from these results is that over the medium term gold

exhibits a moderate negative relationship with the gradient of the U.S. Yield

curve. True to intuition we still believe a flatter yield curve (usually resulting

from monetary easing) is a bullish signal for gold.

Imagine that the Fed eased further, causing the yield curve to become

flatter still. This is a scenario observable in Japan, a country currently with

an extremely flat yield curve resulting from an extensive period of monetary

easing. As an example, assume 2s10s drop to 50 basis points. What is this

likely to mean for gold? Depending on what model we use the following

values are predicted:

Obviously the most accurate figure depends on ones current assessment of

the relationship between gold and the U.S. yield curve over the relevant

investment period. Our estimation is for a moderate negative relationship to

re-establish itself over the next 12 months. If we were to be proven correct

and the Fed dropped 2s10s to 50bps in the next year, one would expect to

see gold around the $1,923 level shown above. The nature of using a

moderate relationship rather than a strong one to predict a variable is that

the predicted value lies within a very wide range; the stronger the

relationship (R

2

value) the more accurate the prediction.

Conversely, what would one expect gold to sit at given some miracle

economic recovery and the yield curve becoming significantly steeper?

True to intuition a steep yield curve (similar to 2003-2004 peaks) would see

gold bottom according to our model.

It is important to remember that these scenarios are nothing more than

estimates based on simple mathematical models and past data. Models and

data carry little weight when dealing with an animal such as the commodities

market. With so many variables at play anything could happen. We use

these scenarios and examples to help communicate concepts and give our

readers an understanding of what it means for gold when a flattening yield

curve is observed. In practice and behind the scenes we are definitely not

using weak relationship yield curve regressions to predict the gold price.

It is important to reiterate the yield curve is an indicator for the whole

economy. For our purposes as a trading service the yield curve isnt the best

form of information. It is a reflection of past, present and future expected

events. What is of more use to us is present/future orientated information.

For example say the Fed hints at QE3 or some other form of easing

tomorrow (further easing is very likely to send gold higher); as soon as we

receive this news, our outlook on gold changes on the back of the

announcement. We do not need to wait to see a flatter U.S. yield curve in

the following hours, days or weeks to change our position.

Although we acknowledge the importance of the U.S. yield curve in the

determination of the gold price, it is not the most important factor by any

stretch. The relationship between gold and the yield curve varies in strength

over time, and hence the curves usefulness is somewhat limited. U.S. real

rates are a far better predictor and exhibit a much more constant, direct

relationship to gold.

The crucial point to take away from this article is it is not economic

weakness that drives gold prices higher. It is the policy response to that

economic weakness. A weaker economy and flatter yield curve doesnt

necessarily mean that gold prices will go higher, but if this is going to be

combated by an aggressive easing of monetary policy such as quantitative

easing then gold prices will rise significantly. U.S. real interest rates are

therefore a more effective indicator for gold prices over the medium term,

since they are sensitive to a wider range of policy actions.

There are always multiple factors that drive asset prices in the financial

markets and gold is no exception. One has to incorporate a numerous

variables in ones analysis in order to formulate a view. The yield curve is

just one of these variables and sometimes it gives us valuable insights into

future of gold prices, but it cannot be expected to work 100% of the time.

In our analysis we look at numerous factors to form our view on gold prices,

with the yield curve being just one of these, and we then execute trades

based on these views. Our subscribers get market updates, trading signals

and our model portfolio for less than $1 per day. Our model portfolio

returned 40.95% in 2011, versus a 9.92% return for gold. We trade options

on US markets that can be traded as easily as basic stock options. We now

also issue trading recommendations that are not options based but simply

use ETFs when we feel that that is the optimal way to execute a trade.

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- GBP To USD 1971+Dokument261 SeitenGBP To USD 1971+Vincent LauNoch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Fluctuations in American Business, 1790-1860 (Interest Rate)Dokument19 SeitenFluctuations in American Business, 1790-1860 (Interest Rate)Vincent LauNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- World Bank Commodity Price Data (The Pink Sheet)Dokument166 SeitenWorld Bank Commodity Price Data (The Pink Sheet)Vincent LauNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- World Bank Commodity Price Data (The Pink Sheet)Dokument166 SeitenWorld Bank Commodity Price Data (The Pink Sheet)Vincent LauNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Fluctuations in American Business, 1790-1860 (Security Prices)Dokument88 SeitenFluctuations in American Business, 1790-1860 (Security Prices)Vincent LauNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Metastock CodesDokument229 SeitenMetastock CodesAggelos Kotsokolos0% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- True Strength IndexDokument2 SeitenTrue Strength IndexVincent Lau0% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Fluctuations in American Business, 1790-1860 (Commodity Prices)Dokument215 SeitenFluctuations in American Business, 1790-1860 (Commodity Prices)Vincent LauNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Interest Rate CalculatorDokument4 SeitenInterest Rate CalculatorVincent LauNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Nikkei 225 Index Daily With VolumeDokument808 SeitenNikkei 225 Index Daily With VolumeVincent LauNoch keine Bewertungen

- A History of Interest Rates, 4th Edition (Homer & Sylla)Dokument7 SeitenA History of Interest Rates, 4th Edition (Homer & Sylla)Vincent Lau0% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Fluctuations in American Business, 1790-1860 (Public Land Sales)Dokument13 SeitenFluctuations in American Business, 1790-1860 (Public Land Sales)Vincent LauNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- HK Hang Seng Index 4 Year CyclesDokument36 SeitenHK Hang Seng Index 4 Year CyclesVincent LauNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Benner Cycle and Hang Seng IndexDokument1 SeiteBenner Cycle and Hang Seng IndexVincent LauNoch keine Bewertungen

- Phi & Pi and The Solar SystemDokument4 SeitenPhi & Pi and The Solar SystemVincent LauNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shanghai Stock Exchange Composite Cycle AnalysisDokument4 SeitenShanghai Stock Exchange Composite Cycle AnalysisVincent LauNoch keine Bewertungen

- Business Cycle and Securities PricesDokument6 SeitenBusiness Cycle and Securities PricesVincent LauNoch keine Bewertungen

- The Monetary Crisis and Political-Economic Ideology of Early 19th Century ChinaDokument8 SeitenThe Monetary Crisis and Political-Economic Ideology of Early 19th Century ChinaVincent LauNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- US 11 Year Sunspot CycleDokument13 SeitenUS 11 Year Sunspot CycleVincent LauNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- China Real Estate Development IndexDokument16 SeitenChina Real Estate Development IndexVincent LauNoch keine Bewertungen

- Shibor DailyDokument35 SeitenShibor DailyVincent LauNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Business Cycle and Securities PricesDokument6 SeitenBusiness Cycle and Securities PricesVincent LauNoch keine Bewertungen

- HK CPI - Monthly From 1974Dokument63 SeitenHK CPI - Monthly From 1974Vincent LauNoch keine Bewertungen

- Historical Statistics For The World Economy 1-2003 ADDokument253 SeitenHistorical Statistics For The World Economy 1-2003 ADVincent LauNoch keine Bewertungen

- Business Cycle and Securities PricesDokument6 SeitenBusiness Cycle and Securities PricesVincent LauNoch keine Bewertungen

- Shibor DailyDokument35 SeitenShibor DailyVincent LauNoch keine Bewertungen

- China GDP - Yearly 1952Dokument32 SeitenChina GDP - Yearly 1952Vincent LauNoch keine Bewertungen

- Excel Geocentric EphemerisDokument1.187 SeitenExcel Geocentric EphemerisVincent LauNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Heliocentric EphemerisDokument1.458 SeitenHeliocentric EphemerisVincent Lau100% (1)

- Case StudyDokument28 SeitenCase StudyNCP Shem ManaoisNoch keine Bewertungen

- RPP Commitment LetterDokument5 SeitenRPP Commitment LetterSara MessinaNoch keine Bewertungen

- Interest Rate Swaps and Currency SwapsDokument21 SeitenInterest Rate Swaps and Currency SwapsDhananjay SinghalNoch keine Bewertungen

- Razor Financial PrincipalsDokument373 SeitenRazor Financial PrincipalsoptimisteveNoch keine Bewertungen

- Modern Portfolio TheoryDokument28 SeitenModern Portfolio Theorycantorband8234Noch keine Bewertungen

- Bocconi1 LMM AwesomeDokument54 SeitenBocconi1 LMM AwesomeSubrat VermaNoch keine Bewertungen

- Chap 1Dokument26 SeitenChap 1Trình Lan AnhNoch keine Bewertungen

- 2019 Level I Mock C (AM) QuestionsDokument22 Seiten2019 Level I Mock C (AM) QuestionsshNoch keine Bewertungen

- Debt Instruments Bank LoansDokument42 SeitenDebt Instruments Bank Loansprakhar singh100% (4)

- UIPA Response To SLC Letter On PIDDokument6 SeitenUIPA Response To SLC Letter On PIDThe Salt Lake TribuneNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Disposal of Real PropertyDokument24 SeitenDisposal of Real Propertypogiman_01100% (1)

- Swaps - Interest Rate and Currency PDFDokument64 SeitenSwaps - Interest Rate and Currency PDFKarishma MittalNoch keine Bewertungen

- Chapter 6: International Business and TradeDokument3 SeitenChapter 6: International Business and Tradegian reyesNoch keine Bewertungen

- JPMorgan Asia Pacific Equity Strategy 20100903Dokument36 SeitenJPMorgan Asia Pacific Equity Strategy 20100903iamdennismiracleNoch keine Bewertungen

- UniCreditUpdate2015RD (English) PDFDokument224 SeitenUniCreditUpdate2015RD (English) PDFAuristene Dos Anjos CostaNoch keine Bewertungen

- Reviewer in Intermediate Accounting (Midterm)Dokument9 SeitenReviewer in Intermediate Accounting (Midterm)Czarhiena SantiagoNoch keine Bewertungen

- Business Economics CIMA - Study - Notes PDFDokument136 SeitenBusiness Economics CIMA - Study - Notes PDFDixie CheeloNoch keine Bewertungen

- Practice Examination in Audit.Dokument22 SeitenPractice Examination in Audit.shiela ignacioNoch keine Bewertungen

- Structured ProductDokument14 SeitenStructured Productabhipawar376Noch keine Bewertungen

- Ryanair Cadet Scheme FAQs-3Dokument4 SeitenRyanair Cadet Scheme FAQs-3Devanshu JhaNoch keine Bewertungen

- Paper 3 PDFDokument6 SeitenPaper 3 PDFWashim Alam50CNoch keine Bewertungen

- Quantitative Problems Chapter 3Dokument5 SeitenQuantitative Problems Chapter 3Deng JuniorNoch keine Bewertungen

- JP Morgan Guide - To - Mutual - Fund - InvestingDokument12 SeitenJP Morgan Guide - To - Mutual - Fund - InvestingAnkit KanojiaNoch keine Bewertungen

- Common Stock and Preffered Stock1Dokument5 SeitenCommon Stock and Preffered Stock1mengistuNoch keine Bewertungen

- Checklistand Sample Forms FinalDokument46 SeitenChecklistand Sample Forms FinalDK DalusongNoch keine Bewertungen

- Mock Exam 2023Dokument7 SeitenMock Exam 2023Hương NguyễnNoch keine Bewertungen

- Bond Markets: Financial Markets and Institutions, 10e, Jeff MaduraDokument38 SeitenBond Markets: Financial Markets and Institutions, 10e, Jeff MaduraYoga AdiNoch keine Bewertungen

- Acc501-Data Bank 2018Dokument21 SeitenAcc501-Data Bank 2018Fun NNoch keine Bewertungen

- Mobilisation Saving Through Mutual FundDokument82 SeitenMobilisation Saving Through Mutual FundAniket ShawNoch keine Bewertungen

- Problem Solving 1Dokument3 SeitenProblem Solving 1Heap Ke XinNoch keine Bewertungen

- AP Biology Premium, 2024: Comprehensive Review With 5 Practice Tests + an Online Timed Test OptionVon EverandAP Biology Premium, 2024: Comprehensive Review With 5 Practice Tests + an Online Timed Test OptionNoch keine Bewertungen

- Digital SAT Prep 2024 For Dummies: Book + 4 Practice Tests Online, Updated for the NEW Digital FormatVon EverandDigital SAT Prep 2024 For Dummies: Book + 4 Practice Tests Online, Updated for the NEW Digital FormatNoch keine Bewertungen

- GMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)Von EverandGMAT Prep 2024/2025 For Dummies with Online Practice (GMAT Focus Edition)Noch keine Bewertungen

- AP World History: Modern Premium, 2024: Comprehensive Review with 5 Practice Tests + an Online Timed Test OptionVon EverandAP World History: Modern Premium, 2024: Comprehensive Review with 5 Practice Tests + an Online Timed Test OptionBewertung: 5 von 5 Sternen5/5 (1)

- AP Physics 2 Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticeVon EverandAP Physics 2 Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticeNoch keine Bewertungen

- AP English Language and Composition Premium, 2024: 8 Practice Tests + Comprehensive Review + Online PracticeVon EverandAP English Language and Composition Premium, 2024: 8 Practice Tests + Comprehensive Review + Online PracticeNoch keine Bewertungen

- AP Microeconomics/Macroeconomics Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticeVon EverandAP Microeconomics/Macroeconomics Premium, 2024: 4 Practice Tests + Comprehensive Review + Online PracticeNoch keine Bewertungen

- GMAT Foundations of Verbal: Practice Problems in Book and OnlineVon EverandGMAT Foundations of Verbal: Practice Problems in Book and OnlineNoch keine Bewertungen

- Digital SAT Reading and Writing Practice Questions: Test Prep SeriesVon EverandDigital SAT Reading and Writing Practice Questions: Test Prep SeriesBewertung: 5 von 5 Sternen5/5 (2)