Beruflich Dokumente

Kultur Dokumente

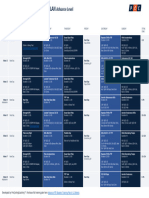

Air Deccan

Hochgeladen von

prateekbapna900 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

285 Ansichten8 SeitenThis document provides an overview of Air Deccan, India's first low-cost airline carrier founded in 1995. It discusses Air Deccan's no-frills, low-cost business model aimed at making air travel affordable for the masses. The document also presents Porter's five forces analysis of the airline industry, a PEST analysis of political, economic, social and technological factors impacting Indian airlines, and an analysis of Air Deccan's cost leadership and differentiation strategies to stay competitive.

Originalbeschreibung:

Air Deccan MIT Case Anaysis

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document provides an overview of Air Deccan, India's first low-cost airline carrier founded in 1995. It discusses Air Deccan's no-frills, low-cost business model aimed at making air travel affordable for the masses. The document also presents Porter's five forces analysis of the airline industry, a PEST analysis of political, economic, social and technological factors impacting Indian airlines, and an analysis of Air Deccan's cost leadership and differentiation strategies to stay competitive.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

285 Ansichten8 SeitenAir Deccan

Hochgeladen von

prateekbapna90This document provides an overview of Air Deccan, India's first low-cost airline carrier founded in 1995. It discusses Air Deccan's no-frills, low-cost business model aimed at making air travel affordable for the masses. The document also presents Porter's five forces analysis of the airline industry, a PEST analysis of political, economic, social and technological factors impacting Indian airlines, and an analysis of Air Deccan's cost leadership and differentiation strategies to stay competitive.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 8

AIR DECCAN

Business Policy and Strategic

Management - Case Discussion

SUBMITTED TO

Dr. Arya Kumar (Instructor In-Charge)

Dr. R. Raghunathan

SUBMITTED BY

Aviral Sharma (2013H149256P)

Rahul Papney (2013H149279P)

Prateek Singh Bapna (2013H149284P)

Vishal Bhandare (2013H149255P)

Introduction:

With the liberalization of Indian economy , deregulation and privatization came up in

aviation sector in India. This led to the emergence of lot of full service carriers . Air Deccan

Aviation , founded by Captain Gopinath in 1995 , was one of those full service carriers with

exception of being a first low cost carrier model in India. Captain Gopinath purchased his

first helicopter from Australia to start operations in India. The carrier aims to provide no-

frills air travel service , which is safe and economical , and provide on time service to its

customers. The airline has played a significant role in making the common mans dream to

fly come true.

Air Deccan was the first Indian airline to follow No -Frills , Low Cost business model .

Although , the business model was in same line as by western countries airlines like

Southwest Airlines and Jet Blue in the United States and Ryanair and wasyJet in Europe , it

differentiated itself by customizing its operation and facilities to suit Indian conditions.

The airlines target passengers comprised leisure , small business and corporate customers

belonging to the middle class and cost-conscious customers of the affluent class. The

airfares were comparable to railfares which prompted many upper class train passengers to

opt for Air Deccan services .

The carriers strategy always aligned with its vision and mission statement . It focused on

providing basic transportation services to its customers in an efficient manner . It devised

strategies to achieve high aircraft utilization in terms of flying hours. Air Deccan also

adopted the concept of Dynamic Pricing to optimize the load factor and the yield.

Problem Statement :

How to stay ahead of the competition in Low Cost Airline Business :

To stay market leader in low cost aviation sector , Air Deccan has to bring out continous

innovation in its strategy to stay ahead of its competitor . With the steady increase in the

number of low-cost players in the aviation industry , an imminent paradigm shift is in the

cards. The distribution models will need to be further enhanced to lower the number of

intermediaries in the chain such as travel agents etc . Online gateway ( Internet Reservation

System ) is one such solution but the penetration level is still low in India . This is one more

focus area for Air Deccan to be the market leader in the low cost airline segment . Other

aspect that Air Deccan need to focus upon is on its extensive growth plans . Air Deccan will

have to focus upon future merger & acquisitions , capital sourcing avenues for

strengthening its position in Indian low cost airline market.

Porter Analysis:

Threat of New Entrants (LOW)

It is easy to enter into this sector since there are very few entry barriers

The more new airlines that enter the market, the more saturated it becomes for everyone. Brand

name and frequent flier point also play a role

With the airline industry cruising deeper into red zone and losses mounting, government is planning

to erect a host of checks and balances on entry barriers to permit only serious and financially sound

aviation ventures to take off

Bargaining Power of Suppliers (HIGH)

All suppliers have tremendous bargaining power

There are few fuel providers and no reliable alternative to fuel

There are very few pilots in the job market and planes cannot be flown without pilots

Mechanics for airplanes are in short supply and planes cannot be flown without being serviced

Flight attendants provide services that cannot easily be replaced and customer satisfaction without

flight attendant would be detrimental

Bargaining Power of Buyers (MODERATE)

The bargaining power of buyers is moderate

Either buyer buys the ticket or not, one traveler does not hurt the airline. The demand for more

affordable air travel is quite robust. But still in India buyers power is moderate because some

alternatives are available

Availability of Substitutes (LOW)

When determining this we should consider time, money, personal preference, and convenience in

the air travel industry. No other product domestically competes directly with airlines in terms of

cost and speed of travel

Competitive Rivalry (HIGH)

Competition among players is extremely intense in many aspects.

Highly competitive industries generally earn low returns because the cost of competition is high. This can

spell disaster when times get tough in the economy

PEST ANALYSIS: THE INDIAN AIRLINE INDUSTRY

Political Factors:

Open Sky Policy

o Open Sky Policy is an policy concept that calls for the liberalization of the rules and

regulations of the aviation industry - especially commercial aviation - in order to create a

free-market environment for the airline industry.

o The policy states that the sky is not limited to regional or national carriers alone.

International players are also welcome to operate in India. The examples of the open sky

policy are Virgin Atlantic, Lufthansa, etc. flying in to Delhi.

FDI limits

o Foreign equity up to 100% is allowed by the means of automatic approvals pertaining to

establishment of Greenfield airports.

o Foreign equity up to 74% is allowed by the means of automatic approvals pertaining to the

existing airports.

o Foreign equity up to 100% is allowed by the means of special permission from Foreign

Investment Promotion Board, Ministry of Finance, pertaining to the existing airports.

o 100% tax exemption for airport projects for a period of 10 years.

o Up to 49% of foreign equity is allowed by the means of automatic approvals pertaining to

the domestic air transport services.

o Up to 100% of NRI investment is allowed by the means of automatic approvals pertaining to

the domestic air transport services.

o 74% FDI is permissible in cargo and non-scheduled airlines.

Economic Factors:

Contribution to the Indian economy: Since the industry is operating in Indian economy, the revenue

generated by the company adds to economy.

Rising cost of fuel: The fuel price is rising because the subsidies govt. is providing are being taken

off. Indian airline companies pay one of the highest ATF rates in the world.

Investment in the sector of aviation.

The growth of the middle income group family affects the aviation sector: In today's world with

increasing income of middle class, people prefer to go by air because it saves time at is all new a

different experience.

Business cycles have a wide reaching impact on the airline industry. During recession, airline is

considered a luxury & therefore spending on air travel is cut which leads to reduce prices. During

prosperity phase people indulge themselves in travel & prices increase.

Even the SARS outbreak in the Far East was a major cause for slump in the airline industry.

The Indian carriers are deeply affected when many flights are cancelled due to internal (employee

relations) as well as external problems.

The loss of income for airlines led to higher operational costs not only due to low demand but also

due to higher insurance costs, which increased after the WTC bombing.

Social Factors:

Development of cities leads to better services and airports: Metro cities first had airports but with

development of the country new airports are being built up.

Employment opportunities: The aviation sector provided a lot of employment opportunities

because the industry is so vast that a lot of people can be employed.

Safety regulations.

The changing travel habits of people have very wide implications for the airline industry.

Technological Factors:

The growth of e-commerce and e-ticketing is now adopt the airline companies for the facilities and

services to the customers.

Satellite based navigation system is the most advanced technological factor.

Modernization and privatization of the airports.

Developing green field airports with private sector for example in Bangalore, the Airport

Corporation Limited.

Better airport infrastructure, means better handling of airplanes, which can help reduce

maintenance cost. It also facilitates more flights to such destinations.

GENERIC STRATEGIES MODEL

Cost Leadership Strategy:

The airline followed a "lean-and-mean" staffing model, aimed at maintaining a low aircraft-to-

employee ratio, thereby reducing the costs.

By using the smaller aircraft (ATR42 - a 48 seater plane) for shorter flights and for regional

destinations, Air Deccan significantly reduced the costs incurred as infrastructure usage fees.

The airline reduced its employees by automating some of its processes, e.g. Online Reservation

System.

The company employees 'no frills, low cost' business model which has helped them to reduce their

fare by approximately 30% as compared to the full service airlines.

Air Deccan's unique pricing model was another strategy which went a long way in optimizing the

airline's yield management and load factor. (In the aviation industry, load factor is the ratio of

revenue passenger (or cargo ton) miles to the available seat (or cargo ton) miles.)

Differentiation Strategy:

Air Deccan has been characterized by two features - Single Class and Narrow Seating. This leads to

an increase in number of seats available, and thus increase the revenue as well.

The airlines had a tie up with Cafe Coffee Day, which would be its single point vendor for food and

beverages.

In order to reach out to a larger customer base, Air Deccan partnered with HPCL Petrol Retail

Outlets and Reliance Web World Retail Outlets.

They thought of offering services to those routes where there were no airline services or those

which did not have adequate flights.

Focus Strategy:

The major target segment of Air Deccan were people who are frequent business travelers and AC

train travelers. There was a huge potential in this market segment.

VALUE CHAIN ANALYSIS

Primary Activities:

1. Operations:

Air Deccan's fleet has both ATR and Airbus which were used to cater to its trunk as well as regional

routes.

Single class seating in the aircrafts offered single fare system, thereby reducing overhead costs.

Air Deccan followed the worldwide low-cost carrier strategy of flying on point-to-point routes.

Aircrafts with less seats (ATR 42-a 48 seater plane).

Route Extension to Airports where there were no airlines available or not adequate facilities

available.

No frills-low cost policy.

The airline reduced the turn-around time and planned other processes for cost reduction.

High aircraft utilization was the first of Air Deccan's strategies as it would directly result in high

revenue generation.

It reduced its operational costs by simplifying its operations, by using technology and by

outsourcing processes that were not core to the business.

2. Distribution:

By introducing several innovations in its distribution channels, the airline succeeded in reducing its

distribution costs substantially.

Air Deccan developed an Internet-based Centralized Reservation System (CRS), which centralized

customers' reservations, through channels such as Internet, call centers and travel agents.

Customers' had a facility to book tickets through mobile phones by just sending in an SMS.

3. Marketing and Sales:

The airline utilized its marketing and promotional programs effectively to highlight the competitive

advantage it enjoyed as a result of its low fares.

The airline customized marketing campaigns for its diverse customer segments.

Air Deccan selected cartoonist R. K. Laxman's famous mascot 'The Common Man' as its brand

ambassador.

Secondary Activities:

1. Procurement:

The airline outsourced the non-core processes.

Outsourcing of several operations offered Air Deccan a distinct advantage.

2. Technology Development:

The CRS was an internet based reservation system was developed which offered variety of activities

ranging from reservations, schedules, fares, payment gateway integration, and departure control

system and document production.

3. Human Resource Management:

The employee strength of the airline is approximately 2600 in June 2006.

The Attrition rate of Air Deccan was 15-20% for the same period.

The airline has relatively flat organizational structure which encouraged employees to be

accountable and develop a sense of ownership and pride in their work.

Recommendation:

In the coming years, both full-service and low cost carriers will have to face many unanswered questions

and explore many novel horizons. However amidst all these uncertainties, there is one certainty . the

Indian aviation sector has immense untapped potential.

Sustainable Growth

As a middle class population constitutes majority of its market, the prospects for low cost airlines seem

bright. By 2010,the low cost airline market share will be 50%,predicts Kapil Kaul,CEO, Centre for Asia

Pacific region(CAPA).These low cost carriers have changed the dynamics of the aviation sector. Full

service airline have also reduced their fares significantly. Full service airlines may initiate price wars by

further reducing their pricing to compete with low-cost airlines. With several low cost entrants into the

industry, an immense paradigm shift is in the cards. The acquisition of another airlines is also a viable

option in the future.

For these low cost airlines distribution models will evolve further to remove intermediaries, such as travel

agents, and will focus of direct selling and other alternative options such as retail stores etc. The

progressive growth of airline industries will lead to enhanced salaries and hence increased airline budgets.

Introducing IPO

To have additional financial flexibility to ensure its long-term growth introducing IPO is a good option for

Air Deccan. This will establish a relationship of airlines with the capital markets to expand its fleet and

enhance engineering and operational capabilities. This will also enhance Air Deccans Brand image among

common man.

Captain Gopinath realized that Air Deccan had pioneered the low-cost air carrier business model in India,

and that many innovations contributed to its success. At the same time, because of its success, Captain

Gopinath realized that he had many new competitors and many more potentially waiting to enter with

even more innovations.

Das könnte Ihnen auch gefallen

- 007: The Stealth Affair ManualDokument11 Seiten007: The Stealth Affair Manualcodigay769Noch keine Bewertungen

- The Secret of Forgiveness of Sin and Being Born Again by Pastor Ock Soo Park 8985422367Dokument5 SeitenThe Secret of Forgiveness of Sin and Being Born Again by Pastor Ock Soo Park 8985422367Justinn AbrahamNoch keine Bewertungen

- Lesson Plan 2 BasketballDokument3 SeitenLesson Plan 2 Basketballapi-313716520100% (1)

- Pipe Support Reference 8-29-14Dokument108 SeitenPipe Support Reference 8-29-14HITESHNoch keine Bewertungen

- Business Model For Airline Industry Hub and Spokes Booz AllenDokument8 SeitenBusiness Model For Airline Industry Hub and Spokes Booz Allenmshah kinggNoch keine Bewertungen

- Pit Viper 351Dokument6 SeitenPit Viper 351Sebastian Robles100% (2)

- The Economics of Low Cost Airlines - The Key Indian Players and Strategies Adopted For Sustenance.Dokument51 SeitenThe Economics of Low Cost Airlines - The Key Indian Players and Strategies Adopted For Sustenance.Suyog Funde100% (2)

- Jet AirwaysDokument11 SeitenJet AirwaysAnonymous tgYyno0w6Noch keine Bewertungen

- Ummah Airways - Business PlanDokument71 SeitenUmmah Airways - Business PlanDr. Syed MasrurNoch keine Bewertungen

- RFP For Jet Airways v2Dokument17 SeitenRFP For Jet Airways v2rahulalwayzzNoch keine Bewertungen

- Lesson 5 Flight of Projectile, Air Resistance Neglected: OverviewDokument7 SeitenLesson 5 Flight of Projectile, Air Resistance Neglected: OverviewNadjer C. AdamNoch keine Bewertungen

- Term Paper On Strategic Management Topic Strategies Followed by Low-Cost Airline-IndigoDokument25 SeitenTerm Paper On Strategic Management Topic Strategies Followed by Low-Cost Airline-Indigoroshansorly50% (2)

- Manufacturing Finance With SAP ERP Financials: Subbu RamakrishnanDokument33 SeitenManufacturing Finance With SAP ERP Financials: Subbu RamakrishnanKhalifa Hassan100% (1)

- Reducing Motor Vehicle Crashes in B.C.Dokument260 SeitenReducing Motor Vehicle Crashes in B.C.Jeff NagelNoch keine Bewertungen

- Yield Management in Budget AirlinesDokument5 SeitenYield Management in Budget AirlinesMaliha EssamNoch keine Bewertungen

- Competitive Airlines-An Analysis of The Strategies Followed by Airlines in India With Special Focus On Low-Cost AirlinesDokument53 SeitenCompetitive Airlines-An Analysis of The Strategies Followed by Airlines in India With Special Focus On Low-Cost AirlinesAMIT KUMAR90% (10)

- Code Sharing in International AirlinesDokument14 SeitenCode Sharing in International AirlinesPrashant RampuriaNoch keine Bewertungen

- AirAsia India Economic ProspectsDokument28 SeitenAirAsia India Economic ProspectsKr SimantNoch keine Bewertungen

- The Impact of Low-Cost Carriers PDFDokument16 SeitenThe Impact of Low-Cost Carriers PDFSohaib EjazNoch keine Bewertungen

- 7 Principles of Supply Chain Management ExplainedDokument4 Seiten7 Principles of Supply Chain Management Explainedprateekbapna90Noch keine Bewertungen

- Jetblue AirwaysDokument6 SeitenJetblue AirwaysranyaismailNoch keine Bewertungen

- Dubai International AirportDokument19 SeitenDubai International AirportelcivilengNoch keine Bewertungen

- Case Study of AirlineDokument6 SeitenCase Study of AirlineAmjed YassenNoch keine Bewertungen

- Low Cost Strategy 040405Dokument40 SeitenLow Cost Strategy 040405Ranjan JosephNoch keine Bewertungen

- Jet Airways Marketing AssignmentDokument11 SeitenJet Airways Marketing AssignmentJagtar Singh Bhinder0% (1)

- Hex 33 X 80Dokument1 SeiteHex 33 X 80PurchaseNoch keine Bewertungen

- Low Cost Airline Treminals PDFDokument269 SeitenLow Cost Airline Treminals PDFapplesgary100% (1)

- Marketing Plan AirlinesDokument11 SeitenMarketing Plan AirlinesSourav SinhaNoch keine Bewertungen

- Marketing Plan of AirblueDokument30 SeitenMarketing Plan of AirblueIbrahim Zaman50% (2)

- Common Airline Business ModelsDokument12 SeitenCommon Airline Business ModelsGianne Sebastian-LoNoch keine Bewertungen

- Supply Chain Management For Higher EducationDokument15 SeitenSupply Chain Management For Higher Educationprateekbapna90Noch keine Bewertungen

- Indigo AirlinesDokument34 SeitenIndigo AirlinesRavi Jaisinghani100% (1)

- 5S Poka Yoke KaizenDokument20 Seiten5S Poka Yoke Kaizenprateekbapna90Noch keine Bewertungen

- Ryanair Industry Analysis - A Case StudyDokument21 SeitenRyanair Industry Analysis - A Case StudyAnkona MondalNoch keine Bewertungen

- How Low Cost Airlines Gain Competitive AdvantageDokument7 SeitenHow Low Cost Airlines Gain Competitive AdvantageCheapestPapers100% (1)

- Kingfisher Airline Fall Case StudyDokument14 SeitenKingfisher Airline Fall Case Studycbhawsar100% (1)

- Low Cost Airlines PROJECT: RYANAIR V/S AIRBERLINDokument13 SeitenLow Cost Airlines PROJECT: RYANAIR V/S AIRBERLINROHIT SETHINoch keine Bewertungen

- Analysis of EasyJet and Indian Low Cost Airlines StrategiesDokument14 SeitenAnalysis of EasyJet and Indian Low Cost Airlines StrategiesNitika MishraNoch keine Bewertungen

- Vikash Marketing Plans of SpicejetDokument9 SeitenVikash Marketing Plans of SpicejetvikashpgdmNoch keine Bewertungen

- Porter's Five Force Model MASDokument6 SeitenPorter's Five Force Model MASDaeng BireleyNoch keine Bewertungen

- Indigo Airlines ReportDokument20 SeitenIndigo Airlines ReportMriganga Barman100% (1)

- Group B7 - SM - LOW-COST CARRIERS IN INDIA-Spicejet's PerspectiveDokument11 SeitenGroup B7 - SM - LOW-COST CARRIERS IN INDIA-Spicejet's PerspectiveAyush100% (1)

- Competition & Strategy: Indigo AirlinesDokument21 SeitenCompetition & Strategy: Indigo AirlinesAhmed Dam100% (1)

- Air DeccanDokument50 SeitenAir DeccanAngita KumariNoch keine Bewertungen

- Indigo Airlines MarketingDokument15 SeitenIndigo Airlines MarketingAbhiroop MukherjeeNoch keine Bewertungen

- Brand Audit-Buddha AirDokument31 SeitenBrand Audit-Buddha AirNischal KcNoch keine Bewertungen

- Dmgs Dip 27092 FinalDokument11 SeitenDmgs Dip 27092 FinalEsa BhattacharyaNoch keine Bewertungen

- IndiaAirline Tejas Mar17Dokument21 SeitenIndiaAirline Tejas Mar17Manoj JosephNoch keine Bewertungen

- SIA B - Case StudyDokument2 SeitenSIA B - Case StudyDhanashree GharatNoch keine Bewertungen

- Project Report On Jet Airways CitrixDokument9 SeitenProject Report On Jet Airways CitrixvithanibharatNoch keine Bewertungen

- Project On Airlines SECTORDokument29 SeitenProject On Airlines SECTORaayushilodha100% (1)

- Pia'S Management: Submitted To:-Submitted ByDokument36 SeitenPia'S Management: Submitted To:-Submitted Bymr.shah0% (1)

- Top 10 Airline Industry ChallengesDokument5 SeitenTop 10 Airline Industry Challengessaif ur rehman shahid hussain (aviator)Noch keine Bewertungen

- Sabre AirVision Marketing and Planning Overview FINALDokument28 SeitenSabre AirVision Marketing and Planning Overview FINALSchutzstaffelDH100% (1)

- Introduction To Air Transport Economics From Theory To Applications 201 372Dokument172 SeitenIntroduction To Air Transport Economics From Theory To Applications 201 372Alessio TinerviaNoch keine Bewertungen

- D8B-B1 (Operator Authorisation For ILS Cat-IIIIIAB Operations)Dokument16 SeitenD8B-B1 (Operator Authorisation For ILS Cat-IIIIIAB Operations)JohnNoch keine Bewertungen

- SWOT Ryanair Air-ScoopDokument6 SeitenSWOT Ryanair Air-Scooptushar_02Noch keine Bewertungen

- Quiz 1 Air DeccanDokument4 SeitenQuiz 1 Air DeccanAbdul Rehman RashidNoch keine Bewertungen

- Emirates AirlineDokument3 SeitenEmirates AirlineLeena SaleemNoch keine Bewertungen

- Bhawan Bhatta - BB AirwaysDokument23 SeitenBhawan Bhatta - BB Airwaysmamannish7902Noch keine Bewertungen

- Strategic Management of IndigoDokument25 SeitenStrategic Management of IndigoKamal GuptaNoch keine Bewertungen

- Service of The Kingfisher AirlinesDokument8 SeitenService of The Kingfisher AirlinesKAUSTUBHDLL100% (1)

- Air IndiaDokument52 SeitenAir IndiaAashish Gupta100% (1)

- Air India ExpressDokument10 SeitenAir India ExpressGia TrungNoch keine Bewertungen

- Kingfisher AirlinesDokument19 SeitenKingfisher AirlinesNeha SthawarmathNoch keine Bewertungen

- Branding Strategy and Market Share: A Case Study of Jet AirwaysDokument8 SeitenBranding Strategy and Market Share: A Case Study of Jet Airwaysakshat mathurNoch keine Bewertungen

- AirAsia - Business StrategyDokument22 SeitenAirAsia - Business StrategyAnhbonnieNoch keine Bewertungen

- Air Cargo (Assignment 1)Dokument5 SeitenAir Cargo (Assignment 1)Sara khanNoch keine Bewertungen

- Global Megatrends and Aviation: The Path to Future-Wise OrganizationsVon EverandGlobal Megatrends and Aviation: The Path to Future-Wise OrganizationsNoch keine Bewertungen

- Corporate Strategy PDFDokument27 SeitenCorporate Strategy PDFaryan singhNoch keine Bewertungen

- Case Analysis - Flying High With Low FrillsDokument18 SeitenCase Analysis - Flying High With Low FrillsDr Rahul Mirchandani100% (18)

- Consumer Behavior Chapter 8Dokument26 SeitenConsumer Behavior Chapter 8prateekbapna90Noch keine Bewertungen

- The Impact of Brand Equity On Customer Acquisition, Retention, and Profit MarginDokument51 SeitenThe Impact of Brand Equity On Customer Acquisition, Retention, and Profit Marginprateekbapna90Noch keine Bewertungen

- Consumer Behavior Chapter 6Dokument38 SeitenConsumer Behavior Chapter 6prateekbapna90Noch keine Bewertungen

- Schiff CB Ce 05Dokument41 SeitenSchiff CB Ce 05Sami UllahNoch keine Bewertungen

- Consumer Behavior Chapter 1 AppendixDokument26 SeitenConsumer Behavior Chapter 1 Appendixprateekbapna90Noch keine Bewertungen

- Eight Problems in Indian EducationDokument3 SeitenEight Problems in Indian Educationprateekbapna90Noch keine Bewertungen

- Additional Data Can Be Added (Optional)Dokument4 SeitenAdditional Data Can Be Added (Optional)prateekbapna90Noch keine Bewertungen

- Higher Education in India - Issues, Challenges and SuggestionsDokument19 SeitenHigher Education in India - Issues, Challenges and Suggestionsprateekbapna90Noch keine Bewertungen

- Key Concepts of Supply Chain Management: Chapter - 1Dokument19 SeitenKey Concepts of Supply Chain Management: Chapter - 1Dilip NareNoch keine Bewertungen

- Trade Union ActDokument4 SeitenTrade Union Actprateekbapna90Noch keine Bewertungen

- Educational Supply Chain Management: A Case StudyDokument13 SeitenEducational Supply Chain Management: A Case Studyprateekbapna90Noch keine Bewertungen

- Radio Frequency Identification (RFID) : Airbus Business RadarDokument6 SeitenRadio Frequency Identification (RFID) : Airbus Business Radarprateekbapna90Noch keine Bewertungen

- Description Features: Maximizing IC PerformanceDokument1 SeiteDescription Features: Maximizing IC Performanceledaurora123Noch keine Bewertungen

- EEE Sofware Lab Experiment 1, PDFDokument11 SeitenEEE Sofware Lab Experiment 1, PDF240 Sadman ShafiNoch keine Bewertungen

- Ecological Consideration of Site AnalysisDokument20 SeitenEcological Consideration of Site AnalysisAUST BNoch keine Bewertungen

- Modal Verbs EjercicioDokument2 SeitenModal Verbs EjercicioAngel sosaNoch keine Bewertungen

- R820T Datasheet-Non R-20111130 UnlockedDokument26 SeitenR820T Datasheet-Non R-20111130 UnlockedKonstantinos GoniadisNoch keine Bewertungen

- FTP Booster Training Plan OverviewDokument1 SeiteFTP Booster Training Plan Overviewwiligton oswaldo uribe rodriguezNoch keine Bewertungen

- JICA Helmya DCC Building FFDokument4 SeitenJICA Helmya DCC Building FFMuhammad ElbarbaryNoch keine Bewertungen

- Level 2 Online BPDokument98 SeitenLevel 2 Online BProbertduvallNoch keine Bewertungen

- Particle FilterDokument16 SeitenParticle Filterlevin696Noch keine Bewertungen

- Fulltext PDFDokument454 SeitenFulltext PDFVirmantas JuoceviciusNoch keine Bewertungen

- Landis+Gyr Model EM5300 Class 0.5 Electricity Meter 14-2-63Dokument5 SeitenLandis+Gyr Model EM5300 Class 0.5 Electricity Meter 14-2-63kulukundunguNoch keine Bewertungen

- EASA CS-22 Certification of SailplanesDokument120 SeitenEASA CS-22 Certification of SailplanessnorrigNoch keine Bewertungen

- Unit-4.Vector CalculusDokument32 SeitenUnit-4.Vector Calculuskhatua.deb87Noch keine Bewertungen

- 3rd Year. PunctuationDokument14 Seiten3rd Year. PunctuationmawarNoch keine Bewertungen

- Logical Database Design ModelingDokument2 SeitenLogical Database Design ModelingGio Agudo100% (1)

- National Industrial Policy 2010 (Bangla)Dokument46 SeitenNational Industrial Policy 2010 (Bangla)Md.Abdulla All Shafi0% (1)

- Fatty AcidsDokument13 SeitenFatty AcidsRaviraj MalaniNoch keine Bewertungen

- D2 1 PDFDokument148 SeitenD2 1 PDFsubas khanalNoch keine Bewertungen

- Prishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLDokument12 SeitenPrishusingh Blogspot Com 2024 03 Digital-Marketing-Course HTMLsudharaj86038Noch keine Bewertungen

- A Randomised Clinical Trial Comparing Myoinositol and Metformin in PCOSDokument7 SeitenA Randomised Clinical Trial Comparing Myoinositol and Metformin in PCOSAtika NajlaNoch keine Bewertungen

- Chapter - 1 - Digital - Systems - and - Binary - Numbers EE228 15-16Dokument81 SeitenChapter - 1 - Digital - Systems - and - Binary - Numbers EE228 15-16mohamed hemdanNoch keine Bewertungen