Beruflich Dokumente

Kultur Dokumente

Acct3610 - Ups Ipo

Hochgeladen von

nessawhoOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Acct3610 - Ups Ipo

Hochgeladen von

nessawhoCopyright:

Verfügbare Formate

UPS IPO

1. What are the key success factors and risks for UPS given its business

strategy?

Success factors

Developed technological infrastructure

Integrated ground and air operation

Economies of scale

Market leader

Diversified strategy (delivery solutions and supply chain management)

Human resource management low turnover rate and familial working

culture (promotion from within)

Operational efficiency from rigid operational guidelines (developed by

industrial engineers, rooted in time-motion studies)

Strong financial performance (AAA rating)

70 years of reputation

Risk factors

Competitiveness drives margins lower

Human error late deliveries, damaged or lost packages, worker strikes

Tariffs and political barriers from expanding to international markets

Losing market share in each segment

o Currently leader in ground service (1-6 days) but is losing market share

each year (1990: 87%, 1999: 79%)

o Second largest market share in overnight (1990: 31%, 1999: 25%) and

deferred segment (1990: 40%, 1997: 13%)

2. How is UPS performing? What factors are driving this performance? Is

the current performance likely to be sustained? Why or why not?

Performance

UPS is presenting solid performance. Between 1994 and 1998 net income has

generally risen from $943 to $1,741, and represents a CAGR of 16.6%. UPS also

reported average net profit margins of 6.5% and ROE of 25.2%, compared to its

nearest competitor, FedEx, which reported 2.8% and 10.6% respectively.

Factors driving performance

Riding the wave of the three trends: globalisation, e-commerce and supply-

chain management

1. Globalisation - international trade in 1999 represents of US GDP

compared to 11% in 1970. UPS has acted on this trend by expanding to other

networks to match customers geographic locations and building capacity in

non-U.S. markets (Europe, Asia and Latin America).

2. E-commerce - as e-commerce sales are forecasted to increase, UPS has

strengthened its position in this new market by becoming preferred shipper for

online commerce through offering UPS functionality, pursuing partnerships

with larger e-commerce players such as eBay, and developing a returns model

that allows customers to track and return products with ease.

3. Supply-chain management - different offering compared to other parcel

delivery companies. In a competitive market it is important to distinguish

yourself from others. This segment generated 1B in incremental revenue from

1993 to 1999.

Is the performance likely to sustain?

Performance has been strong however is likely to wane in the future. Exhibit 3 shows

that overnight, deferred and ground market growth rates are forecasted to decrease in

2000-2005. However decrease in market growth will be mitigated by the fact that

UPS is pursuing alternatives to traditional brick and mortar parcel delivery (global

delivery / e-commerce delivery / supply-chain management).

Industry relies heavily on oil but prices will continue to increase in the future.

Margins will decrease.

Increase in digitalization will reduce the demand for sending mail, but not

parcels.

3. How is FedEx performing? How, if at all, does its performance and plans

affect your assessment of the sustainability of UPSs current

performance?

UPS FedEx

Sales growth rate 10.4% 5.7%

NOPAT margin 7.6% 4.1%

WC / Sales 3.2% -0.8%

Long-term assets / sales 33.7% 33.5%

Leverage 21.3% 18.4%

Historically FedEx concentrated on overnight air-express delivery whereas UPS

focused on multiday ground delivery. Over time the business models have converged,

and now FedEx is also looking at international delivery business as a key source of

growth. Whilst currently FedExs operating margins are still lower than UPS, the

company is planning on using contracting drivers and trucks which are significantly

cheaper.

Performance wise net income has increased form $307,777 to $631,333 from 1996 to

1999. This has represented a CAGR of 19.68%, which is greater than UPS.

Based on current trends, FedEx is likely to take market share from UPS.

4. Given your assessment of the companys strategy and the sustainability of

its performance, forecast the key factors for UPSs stock value.

Key factors

Credit rating

Business strategy

Company culture

Historical financial performance

Market outlook

Industry outlook

Competitors business strategy

5. What is your estimate of UPSs value and its multiples?

Given that it its profit margins and ROE are double that of FedEx, and that it the

company has taken measures to mitigate against the decreasing market growth rate,

the multiple should be adjusted higher. Furthermore, UPS has maintained an AAA

credit rating whereas FedEx has maintained a BBB credit rating, thus implying that

UPS should be able to command higher stock prices as it is financially more stable.

FedEx multiples

1. P/E = 19.8

2. P/total revenue = 0.74

3. Market/book value = 2.68

Adjusted multiples (increase factor by 2)

1. P/E = 39.6 Value = 68,943,000,000

2. P/total revenue = 1.48 Value = 16,056,000,000

6. How do your estimates of UPSs PE and PB multiples compare with those

for FedEx? How do they compare with those for the best of breed

companies multiples.

Not sure.

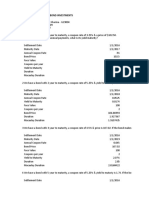

Adjustment for leases

Das könnte Ihnen auch gefallen

- Ups - Case StudyDokument4 SeitenUps - Case StudyMahmood Karim67% (9)

- United Parcel Services IPODokument16 SeitenUnited Parcel Services IPOsriharshakalidasu0% (1)

- KrispyDokument3 SeitenKrispywilliamjone100% (1)

- The Home Depot IncDokument12 SeitenThe Home Depot IncKhushbooNoch keine Bewertungen

- Krispy KremeDokument31 SeitenKrispy KremedrpuneetmehtaNoch keine Bewertungen

- Krispy Donut Case AnalysisDokument7 SeitenKrispy Donut Case Analysisfaraz_soleymani100% (1)

- Ups Written ReportDokument23 SeitenUps Written Reportliselle18Noch keine Bewertungen

- Farrari Case StudyDokument24 SeitenFarrari Case StudyUmair JanNoch keine Bewertungen

- Case of The Missing RaiseDokument2 SeitenCase of The Missing RaiseJasNoch keine Bewertungen

- 7-2 John Holtz (C) Case Study SolutionsDokument14 Seiten7-2 John Holtz (C) Case Study SolutionsAashima Grover100% (1)

- 10 United Parcel Service S IPODokument2 Seiten10 United Parcel Service S IPOcsolutionNoch keine Bewertungen

- West Jet AirlinesDokument2 SeitenWest Jet AirlinesPraeen Kc100% (1)

- Home Depot PresentationfinalDokument42 SeitenHome Depot Presentationfinalpankajkumar631Noch keine Bewertungen

- Ba 194 Final Paper On Universal Robina CorpDokument4 SeitenBa 194 Final Paper On Universal Robina CorpWakei MadambaNoch keine Bewertungen

- Landau CompanyDokument4 SeitenLandau Companyrond_2728Noch keine Bewertungen

- Chemalite Income StatementDokument10 SeitenChemalite Income StatementManoj Singh0% (1)

- Case 16 3 Bill French Case Analysis KoDokument5 SeitenCase 16 3 Bill French Case Analysis KoPankit Kedia100% (1)

- Group 4 Home DepotDokument2 SeitenGroup 4 Home DepotnikhilNoch keine Bewertungen

- Uttam Kumar Sec-A Dividend Policy Linear TechnologyDokument11 SeitenUttam Kumar Sec-A Dividend Policy Linear TechnologyUttam Kumar100% (1)

- 1 Heinz Case StudyDokument8 Seiten1 Heinz Case Studysachin2727100% (2)

- The Home Depot Inc.Dokument13 SeitenThe Home Depot Inc.snazruli67% (3)

- SIEMENSDokument7 SeitenSIEMENSGian Carlos Avila100% (1)

- Delaney Motors Case SolutionDokument13 SeitenDelaney Motors Case SolutionParambrahma Panda100% (2)

- Running Head: FERRARI 2015 IPO CASE STUDY 1Dokument11 SeitenRunning Head: FERRARI 2015 IPO CASE STUDY 1Umair JanNoch keine Bewertungen

- Planter Nut Case Analysis PDF FreeDokument2 SeitenPlanter Nut Case Analysis PDF Freesidra imtiaz50% (2)

- UK Gilts CalculationsDokument10 SeitenUK Gilts CalculationsAditee100% (1)

- Midland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5Dokument13 SeitenMidland Energy Resources WACC20052006Average$11.4B/$18.3B = $13.2B/$21.4B = $14.6B/$24.2B =62.3%61.7%60.3%61.5killer dramaNoch keine Bewertungen

- Home Depot CaseDokument11 SeitenHome Depot CaseVishal PatelNoch keine Bewertungen

- Beta Company-Three ExamplesDokument15 SeitenBeta Company-Three ExamplesDilip Monson83% (12)

- Burton SensorsDokument4 SeitenBurton SensorsAbhishek BaratamNoch keine Bewertungen

- Filene's BasementDokument10 SeitenFilene's BasementChapter 11 DocketsNoch keine Bewertungen

- MidlandDokument9 SeitenMidlandvenom_ftw100% (1)

- Symphony Orchestra Case StudyDokument3 SeitenSymphony Orchestra Case StudyBrandon ElkinsNoch keine Bewertungen

- Case StudyDokument10 SeitenCase StudyEvelyn VillafrancaNoch keine Bewertungen

- Microsoft Financial Reporting Strategy-CaseDokument1 SeiteMicrosoft Financial Reporting Strategy-CaseJack Welch100% (1)

- Strategic Acquisitions and Accelerated Integration of Those AcquisitionsDokument13 SeitenStrategic Acquisitions and Accelerated Integration of Those AcquisitionsTUHIN GHOSALNoch keine Bewertungen

- Amaranth Disaster: How One Trader Lost $6B in 30 DaysDokument15 SeitenAmaranth Disaster: How One Trader Lost $6B in 30 DaysRani ZahrNoch keine Bewertungen

- Ferrari IPO Valuation Using DCF MethodDokument11 SeitenFerrari IPO Valuation Using DCF MethodThe Brain Dump PH100% (1)

- Ferrari IPO PricingDokument2 SeitenFerrari IPO Pricingutkarsh rohilla0% (2)

- Krispy Kreme Growth Forecast AnalysisDokument4 SeitenKrispy Kreme Growth Forecast AnalysisThomas PrinceNoch keine Bewertungen

- Strategy and The Business Landscape - Hurtigruten - Final ExamDokument4 SeitenStrategy and The Business Landscape - Hurtigruten - Final ExamMine SayracNoch keine Bewertungen

- Frequent FliersDokument4 SeitenFrequent Fliersarchit_shrivast908467% (3)

- Acova Radiateurs SolutionDokument14 SeitenAcova Radiateurs Solutionsubramanyad20% (5)

- Grennell Farm Balance Sheet AnalysisDokument6 SeitenGrennell Farm Balance Sheet AnalysisMichael TorresNoch keine Bewertungen

- USX corporate strategy evaluationDokument2 SeitenUSX corporate strategy evaluationDavidBudinas0% (3)

- Week 2 - The Battle For Value, 2004 QuestionsDokument2 SeitenWeek 2 - The Battle For Value, 2004 QuestionsLucasNoch keine Bewertungen

- UPS Vs FedEx - FinalDokument15 SeitenUPS Vs FedEx - Finaltharrah1100% (1)

- Running Head: Strategic Management 1Dokument11 SeitenRunning Head: Strategic Management 1Fizah aliNoch keine Bewertungen

- United Parcel Service, Inc: Revenue by SegmentDokument37 SeitenUnited Parcel Service, Inc: Revenue by SegmentRenyi PanNoch keine Bewertungen

- 7QQMM300: Dhruv ShahDokument22 Seiten7QQMM300: Dhruv ShahDhruv ShahNoch keine Bewertungen

- FedEx UPS Case StudyDokument31 SeitenFedEx UPS Case Studysyahiirah.ariffin0% (1)

- UPS Marketing Plan to Gain Market Share in Express Shipping and Expand InternationallyDokument8 SeitenUPS Marketing Plan to Gain Market Share in Express Shipping and Expand InternationallymaverickgmatNoch keine Bewertungen

- Case 04 NotesDokument5 SeitenCase 04 Noteswjk4261936Noch keine Bewertungen

- Introduction For UPSDokument19 SeitenIntroduction For UPSteju_690% (1)

- Running Head: TERM PROJECT 1: Student's Name Institution's Affiliation DateDokument9 SeitenRunning Head: TERM PROJECT 1: Student's Name Institution's Affiliation DateCalvi JamesNoch keine Bewertungen

- FedEx Vs UPS - Hong KongDokument29 SeitenFedEx Vs UPS - Hong KongtenglumlowNoch keine Bewertungen

- PWC 12 Reporting TipsDokument28 SeitenPWC 12 Reporting Tipssathyasai1972Noch keine Bewertungen

- Word Note Battle For Value FedEx Vs UPSDokument9 SeitenWord Note Battle For Value FedEx Vs UPSalka murarka100% (1)

- Company Name-Red Mobiles LTD.: Cesim Simulation GameDokument13 SeitenCompany Name-Red Mobiles LTD.: Cesim Simulation GameRajdeep Nayak100% (1)

- The Battle For Value Fedex Vs UPSDokument10 SeitenThe Battle For Value Fedex Vs UPSAbdul Wajid Zafar100% (1)

- LEGT2751 Business Taxation Sem 1 2012Dokument4 SeitenLEGT2751 Business Taxation Sem 1 2012nessawhoNoch keine Bewertungen

- Legt2751 s1 2009 Final ExamDokument7 SeitenLegt2751 s1 2009 Final ExamYvonne ChanNoch keine Bewertungen

- TABL2751 Tutorial NotesDokument48 SeitenTABL2751 Tutorial Notesnessawho50% (2)

- TABL2751/LAWS3147 Assignment QuestionDokument4 SeitenTABL2751/LAWS3147 Assignment Questionnessawho100% (1)

- ACCT3610 - Inventec Case StudyDokument6 SeitenACCT3610 - Inventec Case StudynessawhoNoch keine Bewertungen

- Short Concise TORTS NotesDokument1 SeiteShort Concise TORTS NotesnessawhoNoch keine Bewertungen

- TABL 2751 Course OutlineDokument19 SeitenTABL 2751 Course OutlinenessawhoNoch keine Bewertungen

- AOL's Success and Future Challenges in the Growing Online IndustryDokument3 SeitenAOL's Success and Future Challenges in the Growing Online Industrynessawho100% (1)

- Acct3708 Finals, Sem 2, 2010Dokument11 SeitenAcct3708 Finals, Sem 2, 2010nessawhoNoch keine Bewertungen

- TABL2741 Case NoteDokument7 SeitenTABL2741 Case NotenessawhoNoch keine Bewertungen

- Walmart ValuationDokument24 SeitenWalmart ValuationnessawhoNoch keine Bewertungen

- FINS1612 Quiz 3 NotesDokument3 SeitenFINS1612 Quiz 3 NotesnessawhoNoch keine Bewertungen

- FlashDokument33 SeitenFlashnessawhoNoch keine Bewertungen

- ACCT 2542 Course Outline Part A S2 2013Dokument18 SeitenACCT 2542 Course Outline Part A S2 2013nessawho0% (1)

- Final Stats Project 2012 ECON1203Dokument6 SeitenFinal Stats Project 2012 ECON1203nessawhoNoch keine Bewertungen

- FINANCIAL MANAGEMENTDokument3 SeitenFINANCIAL MANAGEMENTAlelie dela CruzNoch keine Bewertungen

- Philippine Economic Zone Authority (PEZA)Dokument7 SeitenPhilippine Economic Zone Authority (PEZA)LeaNoch keine Bewertungen

- Financial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDDokument4 SeitenFinancial Management Assignment: Cash Flow Analysis OF Kwality Dairy LTDishant7890Noch keine Bewertungen

- JM Financial - Navin Fluorine Ltd. - Fluorinating Across The Value Chain (Initiating Coverage) (BUY)Dokument31 SeitenJM Financial - Navin Fluorine Ltd. - Fluorinating Across The Value Chain (Initiating Coverage) (BUY)darshanmadeNoch keine Bewertungen

- Characteristics and Functions of MoneyDokument2 SeitenCharacteristics and Functions of MoneyAndroid HelpNoch keine Bewertungen

- Final Account VdaDokument12 SeitenFinal Account VdaShobhit SrivastavaNoch keine Bewertungen

- What is feasibility studyDokument36 SeitenWhat is feasibility studyrohanthokale08Noch keine Bewertungen

- Company RegistrationDokument2 SeitenCompany RegistrationTsitsi AbigailNoch keine Bewertungen

- Handbook of Country Risk 2008 2009 PDFDokument559 SeitenHandbook of Country Risk 2008 2009 PDFKmt_AeNoch keine Bewertungen

- Honeywell Question 1&2Dokument6 SeitenHoneywell Question 1&2anon_909027967Noch keine Bewertungen

- Accounting TerminologyDokument215 SeitenAccounting TerminologyJyoshna Reddy50% (2)

- App eDokument14 SeitenApp emorry123Noch keine Bewertungen

- What Is Financial AccountingDokument3 SeitenWhat Is Financial AccountingrcpascNoch keine Bewertungen

- One-year rate sensitivity test assetsDokument6 SeitenOne-year rate sensitivity test assetsAnton VelkovNoch keine Bewertungen

- Introduction to Management Science TechniquesDokument211 SeitenIntroduction to Management Science TechniquesrahuljiitNoch keine Bewertungen

- Securities and Exchange G.R. No. 164197 Commission, Petitioner, PresentDokument24 SeitenSecurities and Exchange G.R. No. 164197 Commission, Petitioner, PresentMariam BautistaNoch keine Bewertungen

- SWOT Analysis For A BankDokument2 SeitenSWOT Analysis For A BankAndrew Hoth KangNoch keine Bewertungen

- The Search for the Best Financial Performance MeasureDokument10 SeitenThe Search for the Best Financial Performance MeasuremariaNoch keine Bewertungen

- Accenture Corporate Crisis ManagementDokument16 SeitenAccenture Corporate Crisis Managementmukosino100% (1)

- Panasonic vs. CIRDokument6 SeitenPanasonic vs. CIRLeBron DurantNoch keine Bewertungen

- Business Contacts Bulletin - May Sri LankaDokument19 SeitenBusiness Contacts Bulletin - May Sri LankaDurban Chamber of Commerce and IndustryNoch keine Bewertungen

- Manufacturing Shampoo Project ProfileDokument2 SeitenManufacturing Shampoo Project Profilevineetaggarwal50% (2)

- MSOP Project ReportDokument3 SeitenMSOP Project Reportcsankitkhandal0% (2)

- Spinning Mill CostingDokument12 SeitenSpinning Mill CostingKrithika Salraj50% (2)

- SBI family floater mediclaim policy renewal detailsDokument4 SeitenSBI family floater mediclaim policy renewal detailsApoorva KashyapNoch keine Bewertungen

- Aveva Corporate OverviewDokument23 SeitenAveva Corporate Overviewarun varmaNoch keine Bewertungen

- Fdi and FiiDokument19 SeitenFdi and FiiManju TripathiNoch keine Bewertungen

- CH 2 Indian Financial SystemDokument46 SeitenCH 2 Indian Financial Systemmaheshbendigeri5945Noch keine Bewertungen

- Performance Evaluation and Ratio Analysis - Meghna Cement - R1Dokument11 SeitenPerformance Evaluation and Ratio Analysis - Meghna Cement - R1Sayed Abu Sufyan100% (1)

- Traders Checklist PDFDokument17 SeitenTraders Checklist PDFJay Sagar0% (1)