Beruflich Dokumente

Kultur Dokumente

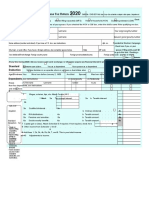

Eric Lesser & Alison Silber - 2013 Joint Tax Return

Hochgeladen von

SteeleMassLiveCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Eric Lesser & Alison Silber - 2013 Joint Tax Return

Hochgeladen von

SteeleMassLiveCopyright:

Verfügbare Formate

, 20

(4) if child

under age 17

qualifying for child

tax credit

(99)

IRS Use Only - Do not write or staple in this space.

OMB No. 1545-0074

For the year Jan. 1-Dec. 31, 2013, or other tax year beginning , 2013, ending

Your social security number

Spouse's social security number

Make sure the SSN(s) above

and on line 6c are correct.

Presidential Election Campaign

City, town or post office, state, and ZIP code. If you have a foreign address, also complete spaces below.

Check here if you, or your spouse

if filing jointly, want $3 to go to

this fund. Checking a box below

will not change your tax or refund.

Boxes checked

on 6a and 6b

No. of children

on 6c who:

(3) Dependent's

relationship to

you

(2) Dependent's social

security number

lived with you

did not live with

you due to divorce

or separation

(see instructions)

(1) First name Last name

Dependents on 6c

not entered above

Add numbers

on lines

above

Certain business expenses of reservists, performing artists, and fee-basis government

officials. Attach Form 2106 or 2106-EZ

310001

12-03-13

Form (2013)

See separate instructions.

1

2

3

4

5

6a

b

Yourself.

Spouse

do not

c Dependents:

d

7 7

8a 8a

b

Taxable

8b Tax-exempt Do not

Attach Form(s)

W-2 here. Also

attach Forms

W-2G and

1099-R if tax

was withheld.

9a 9a

b 9b

10

11

12

13

14

15a

16a

17

18

19

20a

21

10

11

12

13

14

15b

16b

15a

16a

b

b

17

18

19

20b 20a b

21

22 22 total income

23

24

25

26

27

28

29

30

23

24

25

26

27

28

29

30

31a

32

33

34

35

31a

32

b

33

34

35

36

37

36

37 adjusted gross income

1040

You Spouse

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions.

F

o

r

m

Your first name and initial

Last name

If a joint return, spouse's first name and initial

Last name

Home address (number and street). If you have a P.O. box, see instructions. Apt. no.

Foreign country name Foreign province/state/county Foreign postal code

Single

Married filing jointly (even if only one had income)

Married filing separately. Enter spouse's SSN above

and full name here.

Head of household (with qualifying person). If the qualifying

person is a child but not your dependent, enter this child's

name here.

Check only

one box. Qualifying widow(er) with dependent child

If someone can claim you as a dependent, check box 6a ~~~~~~~~~~~~~~~~

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

If more than four

dependents, see

instructions and

check here

Total number of exemptions claimed!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Wages, salaries, tips, etc. Attach Form(s) W-2 ~~~~~~~~~~~~~~~~~~~~~~~~~~

interest. Attach Schedule B if required ~~~~~~~~~~~~~~~~~~~~~~~~~~

interest. include on line 8a ~~~~~~~~~~~

Ordinary dividends. Attach Schedule B if required ~~~~~~~~~~~~~~~~~~~~~~~~~

Qualified dividends ~~~~~~~~~~~~~~~~~~~~~~~

Taxable refunds, credits, or offsets of state and local income taxes~~~~~~~~~~~~~~~~~~

Alimony received

Business income or (loss). Attach Schedule C or C-EZ

Capital gain or (loss). Attach Schedule D if required. If not required, check here

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~ |

If you did not

get a W-2,

see instructions.

Other gains or (losses). Attach Form 4797 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~

IRA distributions

Pensions and annuities

~~~~~~~ Taxable amount

Taxable amount

~~~~~~

~~~~ ~~~~~~

Rental real estate, royalties, partnerships, S corporations, trusts, etc. Attach Schedule E

Farm income or (loss). Attach Schedule F

~~~~~~~~

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Unemployment compensation ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Social security benefits ~~~~ Taxable amount ~~~~~~

Other income. List type and amount

Combine the amounts in the far right column for lines 7 through 21. This is your !!! |

~~~~~~~~~~~~~~~~~~~~~~~ Educator expenses

~~~~~~~~~~~~~~~~~

Health savings account deduction. Attach Form 8889 ~~~~~~~~

Moving expenses. Attach Form 3903 ~~~~~~~~~~~~~~~

Deductible part of self-employment tax. Attach Schedule SE~~~~~~

Self-employed SEP, SIMPLE, and qualified plans ~~~~~~~~~~

Self-employed health insurance deduction ~~~~~~~~~~~~~

Penalty on early withdrawal of savings ~~~~~~~~~~~~~~~

Alimony paid Recipient's SSN |

IRA deduction

Student loan interest deduction

Tuition and fees. Attach Form 8917

~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~

Domestic production activities deduction. Attach Form 8903 ~~~~~

Add lines 23 through 35 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

!!!!!!!!!!!!!!! | Subtract line 36 from line 22. This is your

|

|

LHA

U.S. Individual Income Tax Return

Filing Status

Exemptions

Income

Adjusted

Gross

Income

1040 2013

! !

!

!

!

!

!

!

!

u

!

!

" "

" "

;

9

p

m

o

B

B

9

! !

ERIC LESSER 133 68 9228

ALISON SILBER 410 43 4252

51 GREENWICH ROAD

LONGMEADOW, MA 01106

X

X 2

X

1

ROSE LESSER 312-89-0051 DAUGHTER X

3

87,488.

95.

644.

525.

33,646.

SILBER & ASSOCIATES 1,500. 1,500.

123,373.

2,483.

1,150.

4,000.

7,633.

115,740.

Reserved

Routing

number

Account

number Type: Checking Savings

Designee's Phone

no.

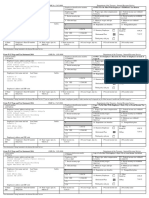

Form 1040 (2013) Page

Standard

Deduction for -

People who

check any box

on line 39a or

39b who can

be claimed as a

dependent, see

instructions.

All others:

Single or

Married filing

separately,

$6,100

Married filing

jointly or

Qualifying

widow(er),

$12,200

Head of

household,

$8,950

If you have

a qualifying

child, attach

Schedule EIC.

Direct deposit?

See

instructions.

name

Personal identification

number (PIN)

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and belief, they are true,

correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Daytime phone number Your signature Date Your occupation

Joint return?

See instructions.

Keep a copy

for your

records.

Spouse's occupation Date Spouse's signature. If a joint return, must sign. If the IRS sent you an Identity

Protection PIN,

enter it here

Check

self-employed

if PTIN Print/Type preparer's name Preparer's signature Date

Firm's name

Firm's EIN

Phone no.

310002

12-03-13

Firm's address

2

38 38

39a You Total boxes

checked 39a Spouse

39b b

or

40

41

42

43

44

45

46

Itemized deductions or standard deduction 40

41

42

43

44

45

46

Exemptions.

Taxable income.

c Tax. a b

Alternative minimum tax.

47

48

49

50

51

52

47

48

49

50

51

52

53 b c a 53

54

55

56

57

58

59a

b

60

61

total credits 54

55

56

57 a b

58

59a

59b

60

61

b c a

total tax

62

63

64

65

66

67

68

69

70

71

72

62

63

64a

65

66

67

68

69

70

71

a

b

Earned income credit (EIC)

64b

a b c d

total payments 72

73

74a

73 overpaid

74

a

b

refunded to you.

c d

75

76

77

applied to your 2014 estimated tax 75

Amount you owe. 76

77

Yes. No

both

Amount from line 37 (adjusted gross income) !!!!!!!!!!!!!!!!!!!!!!!!!!!!!

Check

if:

were born before January 2, 1949, Blind.

was born before January 2, 1949, Blind. ~

If your spouse itemizes on a separate return or you were a dual-status alien, check here " ~~

(from Schedule A) your (see left margin) ~~~~~~~~~~~

Subtract line 40 from line 38 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

If line 38 is $150,000 or less, multiply $3,900 by the number on line 6d. Otherwise, see inst.

Subtract line 42 from line 41. If line 42 is more than line 41, enter -0- ~~~~~~~~~~~

Check if any from: Form(s) 8814 Form 4972 ~~~~~~~~

Attach Form 6251 ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

"

Add lines 44 and 45 !!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!! |

Foreign tax credit. Attach Form 1116 if required ~~~~~~~~~~~~~

Credit for child and dependent care expenses. Attach Form 2441 ~~~~~~

Education credits from Form 8863, line 19 ~~~~~~~~~~~~~~~

Retirement savings contributions credit. Attach Form 8880 ~~~~~~~~

Child tax credit. Attach Schedule 8812, if required ~~~~~~~~~~~~

Residential energy credits. Attach Form 5695 ~~~~~~~~~~~~~~

Other credits from Form: 3800 8801

Add lines 47 through 53. These are your ~~~~~~~~~~~~~~~~~~~~~~~~~~

Subtract line 54 from line 46. If line 54 is more than line 46, enter -0- !!!!!!!!!!!!!!!!! |

Self-employment tax. Attach Schedule SE ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

4137 8919 ~~~~~~~~~~~ Unreported social security and Medicare tax from Form:

Additional tax on IRAs, other qualified retirement plans, etc. Attach Form 5329 if required ~~~~~~~~~~

Household employment taxes from Schedule H

First-time homebuyer credit repayment. Attach Form 5405 if required

~~~~~~~~~~~~~~~~~~~~~~~~~~~~

~~~~~~~~~~~~~~~~~~~

Form 8959 Form 8960 Taxes from: Inst.; enter code(s)

Add lines 55 through 60. This is your !!!!!!!!!!!!!!!!!!!!!!!!!!! |

Federal income tax withheld from Forms W-2 and 1099 ~~~~~~~~~~

2013 estimated tax payments and amount applied from 2012 return ~~~~

!!!!!!!!!!!!!!!!!!!!!!

Nontaxable combat pay election ~~~~~

Additional child tax credit. Attach Schedule 8812 ~~~~~~~~~~~~

American opportunity credit from Form 8863, line 8 ~~~~~~~~~~~

Reserved ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Amount paid with request for extension to file ~~~~~~~~~~~~~~

Excess social security and tier 1 RRTA tax withheld

Credit for federal tax on fuels. Attach Form 4136

~~~~~~~~~~~

~~~~~~~~~~~~~

Credits from Form: 2439 8885

Add lines 62, 63, 64a, and 65 through 71. These are your !!!!!!!!!!!!! |

If line 72 is more than line 61, subtract line 61 from line 72. This is the amount you ~~~~~~~~~

| !!!!!!!! Amount of line 73 you want If Form 8888 is attached, check here

| | |

Amount of line 73 you want !!!

Subtract line 72 from line 61. For details on how to pay, see instructions ~~~~~~~ |

Estimated tax penalty (see instructions) !!!!!!!!!!!!!!!!

Do you want to allow another person to discuss this return with the IRS (see instructions)? Complete below.

| | |

Tax and

Credits

Other

Taxes

Payments

Refund

Amount

You Owe

Third Party

Designee

Sign

Here

Paid

Preparer

Use Only

! !

! !

!

! ! !

! ! !

! !

! ! !

! ! ! !

!

! !

! !

!

r

q

s

p

m

o 9

9

9

=

9 9

"

9

ERIC LESSER & ALISON SILBER 133-68-9228

115,740.

12,200.

103,540.

11,700.

91,840.

14,768.

14,768.

19.

600.

700.

1,319.

13,449.

4,966.

18,415.

17,993.

4,200.

22,193.

3,778.

3,778.

X

DAVID KALICKA 413-536-8510 01040

ATTORNEY

DAVID KALICKA 03/18/14 P00963044

MEYERS BROTHERS KALICKA, P.C. 04 2713795

330 WHITNEY AVE, SUITE 800 413-536-8510

HOLYOKE, MA 01040

Das könnte Ihnen auch gefallen

- Gene Locke Tax Return, 2006Dokument25 SeitenGene Locke Tax Return, 2006Lee Ann O'NealNoch keine Bewertungen

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDokument3 Seiten2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNoch keine Bewertungen

- Joint Astronomy Centre - Birthday Stars - FinalDokument2 SeitenJoint Astronomy Centre - Birthday Stars - Finalhail2pigdumNoch keine Bewertungen

- Brooklyn Museum 2019 IRS Form 990Dokument64 SeitenBrooklyn Museum 2019 IRS Form 990Lee Rosenbaum, CultureGrrlNoch keine Bewertungen

- 2016 California Resident Income Tax Return Form 540 2ezDokument4 Seiten2016 California Resident Income Tax Return Form 540 2ezapi-351598796Noch keine Bewertungen

- Please Review The Updated Information Below.: For Begins After This CoversheetDokument3 SeitenPlease Review The Updated Information Below.: For Begins After This CoversheetDavid FreiheitNoch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument3 SeitenU.S. Individual Income Tax Return: Filing StatuspyatetskyNoch keine Bewertungen

- 2010 Income Tax ReturnDokument2 Seiten2010 Income Tax ReturnCkey ArNoch keine Bewertungen

- Estimated Tax for IndividualsDokument12 SeitenEstimated Tax for IndividualsJob SchwartzNoch keine Bewertungen

- Hillside Children's Center, New York 2014 IRS ReportDokument76 SeitenHillside Children's Center, New York 2014 IRS ReportBeverly TranNoch keine Bewertungen

- Request For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429Dokument2 SeitenRequest For Copy of Tax Return: Form (March 2019) Department of The Treasury Internal Revenue Service OMB No. 1545-0429DrmookieNoch keine Bewertungen

- File your 1040 tax return onlineDokument2 SeitenFile your 1040 tax return onlineSammi Bowe100% (1)

- 2021 - TaxReturn 2pagessignedDokument3 Seiten2021 - TaxReturn 2pagessignedDedrick RiversNoch keine Bewertungen

- Think Computer Foundation 2009 Tax ReturnDokument10 SeitenThink Computer Foundation 2009 Tax ReturnTaxManNoch keine Bewertungen

- Electronic Filing Instructions For Your 2008 Federal Tax ReturnDokument14 SeitenElectronic Filing Instructions For Your 2008 Federal Tax ReturnjakeNoch keine Bewertungen

- 2009 Income Tax ReturnDokument5 Seiten2009 Income Tax Returngrantj820Noch keine Bewertungen

- Gov. Walz 2019 Federal Tax Return - RedactedDokument11 SeitenGov. Walz 2019 Federal Tax Return - RedactedTim Walz for GovernorNoch keine Bewertungen

- U.S. Departing Alien Income Tax Return: Print or TypeDokument4 SeitenU.S. Departing Alien Income Tax Return: Print or TypeDavid WebbNoch keine Bewertungen

- Please To Do Not Use The Back ButtonDokument2 SeitenPlease To Do Not Use The Back ButtonDavid MillerNoch keine Bewertungen

- 2021-2022 Tax ReturnDokument3 Seiten2021-2022 Tax ReturnMmmmmmmNoch keine Bewertungen

- File Your Taxes Online with Maverick Tax ExpressDokument19 SeitenFile Your Taxes Online with Maverick Tax ExpressVignesh EswaranNoch keine Bewertungen

- MLFA Form 990 - 2016Dokument25 SeitenMLFA Form 990 - 2016MLFANoch keine Bewertungen

- Hong Thien PhuocBui2018Dokument6 SeitenHong Thien PhuocBui2018Thien BaoNoch keine Bewertungen

- Profit or Loss From Business: I I I I I I I IDokument1 SeiteProfit or Loss From Business: I I I I I I I Idolapo BalogunNoch keine Bewertungen

- Individual Tax ReturnDokument6 SeitenIndividual Tax Returnaklank_218105Noch keine Bewertungen

- Desmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDDokument2 SeitenDesmand Whitson 7423 Groveoak Dr. Orlando, Florida 32810: ND NDRed RaptureNoch keine Bewertungen

- Tax Return 2023Dokument2 SeitenTax Return 2023jacksonleah313Noch keine Bewertungen

- Certain Government Payments: Copy B For RecipientDokument2 SeitenCertain Government Payments: Copy B For RecipientDylan Bizier-Conley100% (1)

- FD 941 Apr-Jun 2017 PDFDokument3 SeitenFD 941 Apr-Jun 2017 PDFScott WinklerNoch keine Bewertungen

- Employee Paystub EditedDokument1 SeiteEmployee Paystub EditedSandra ChrisNoch keine Bewertungen

- Windward Fund's 2018 Tax FormsDokument49 SeitenWindward Fund's 2018 Tax FormsJoe SchoffstallNoch keine Bewertungen

- Payroll Register PD01-31-13 PDFDokument26 SeitenPayroll Register PD01-31-13 PDFJoseph ManriquezNoch keine Bewertungen

- Profit or Loss From Farming: Schedule FDokument2 SeitenProfit or Loss From Farming: Schedule FJacen BondsNoch keine Bewertungen

- 1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Dokument2 Seiten1098-T Copy B: 12,589.34 University of Oklahoma 1000 ASP AVE ROOM 105 Norman OK 73019 (405) 325-9000Lane ElliottNoch keine Bewertungen

- Ahtasham Ahmed Case - CompressedDokument19 SeitenAhtasham Ahmed Case - CompressedarsssyNoch keine Bewertungen

- 2011 Income Tax ReturnDokument4 Seiten2011 Income Tax Returnsalazar17Noch keine Bewertungen

- Individual Tax ReturnDokument4 SeitenIndividual Tax ReturnmacNoch keine Bewertungen

- Tabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingDokument3 SeitenTabliga Gerwin Andres Agusti Marissa Calzado: Application For Vehicle FinancingJerikah Jec HernandezNoch keine Bewertungen

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Dokument7 SeitenItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNoch keine Bewertungen

- U.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010Dokument6 SeitenU.S. Individual Income Tax Return: Victor K LIU 090-54-3760 090-54-2005 1720 El Camino Real 200 Burlingame CA 94010victor liuNoch keine Bewertungen

- Tax ReturnDokument4 SeitenTax ReturncykablyatNoch keine Bewertungen

- File Your 2014 Tax ReturnDokument4 SeitenFile Your 2014 Tax ReturnShakilaMissz-KyutieJenkins100% (1)

- 2019 Chandler D Form 1040 Individual Tax Return - Records-ALDokument7 Seiten2019 Chandler D Form 1040 Individual Tax Return - Records-ALwhat is thisNoch keine Bewertungen

- Hall Tax Services Hall Tax Professionals Chicago Heights Il 60411Dokument34 SeitenHall Tax Services Hall Tax Professionals Chicago Heights Il 60411Rendy MomoNoch keine Bewertungen

- Lance Dean 2013 Tax Return - T13 - For - RecordsDokument57 SeitenLance Dean 2013 Tax Return - T13 - For - Recordsjessica50% (4)

- Young Acc 137 Kongai, Tsate 1040Dokument26 SeitenYoung Acc 137 Kongai, Tsate 1040Kathy YoungNoch keine Bewertungen

- 2013 Tax Return (Shep-Ty DBA Embrace)Dokument24 Seiten2013 Tax Return (Shep-Ty DBA Embrace)Game ChangerNoch keine Bewertungen

- 2016 Merrill Taxes PDFDokument8 Seiten2016 Merrill Taxes PDFholymolyNoch keine Bewertungen

- Semir Demiri 50 14Th ST North Edgartown Ma 02539Dokument2 SeitenSemir Demiri 50 14Th ST North Edgartown Ma 02539SemirNoch keine Bewertungen

- Bruce Byrd 2013 Tax Return - T13 - For - Records PDFDokument69 SeitenBruce Byrd 2013 Tax Return - T13 - For - Records PDFjessica50% (2)

- PUA 1099G tax form summaryDokument1 SeitePUA 1099G tax form summaryClifton WilsonNoch keine Bewertungen

- ECDC 2009 Tax ReturnDokument27 SeitenECDC 2009 Tax ReturnNC Policy WatchNoch keine Bewertungen

- Form1095a 2017 PDFDokument8 SeitenForm1095a 2017 PDFTina ReyesNoch keine Bewertungen

- Instructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDokument72 SeitenInstructions For Form IT-203: Nonresident and Part-Year Resident Income Tax ReturnDiego12001Noch keine Bewertungen

- U.S. Individual Income Tax Return: Filing StatusDokument2 SeitenU.S. Individual Income Tax Return: Filing StatusRobert M Hamil.Noch keine Bewertungen

- Default AshxDokument17 SeitenDefault Ashxanon-3445500% (1)

- 2007 Federal ReturnDokument2 Seiten2007 Federal ReturnbradybunnellNoch keine Bewertungen

- 2012 MBD Fed State Returns PWDokument25 Seiten2012 MBD Fed State Returns PWRachel E. Stassen-BergerNoch keine Bewertungen

- U.S. Individual Income Tax Return: See Separate InstructionsDokument4 SeitenU.S. Individual Income Tax Return: See Separate InstructionsNewsTeam20100% (1)

- Form 1040A Tax Credit DetailsDokument3 SeitenForm 1040A Tax Credit DetailsYosbanyNoch keine Bewertungen

- Brian Steele Undergrad TranscriptDokument1 SeiteBrian Steele Undergrad TranscriptSteeleMassLiveNoch keine Bewertungen

- West Springfield Proposed Retail Pet Sale OrdinanceDokument5 SeitenWest Springfield Proposed Retail Pet Sale OrdinanceSteeleMassLiveNoch keine Bewertungen

- Brian Steele Grad TranscriptDokument1 SeiteBrian Steele Grad TranscriptSteeleMassLiveNoch keine Bewertungen

- Interfaith Clergy Letter in Support of Somerville 18Dokument2 SeitenInterfaith Clergy Letter in Support of Somerville 18SteeleMassLiveNoch keine Bewertungen

- Debra Boronski's Statement of Financial InterestsDokument11 SeitenDebra Boronski's Statement of Financial InterestsSteeleMassLiveNoch keine Bewertungen

- Nathan Bech's Pre-Election Campaign Finance ReportDokument18 SeitenNathan Bech's Pre-Election Campaign Finance ReportSteeleMassLiveNoch keine Bewertungen

- Commonwealth v. Hernandez - Blank Juror QuestionnaireDokument24 SeitenCommonwealth v. Hernandez - Blank Juror QuestionnaireSteeleMassLiveNoch keine Bewertungen

- Boston Mayor Tom Menino's FBI FileDokument29 SeitenBoston Mayor Tom Menino's FBI FileWGBH NewsNoch keine Bewertungen

- UMass CED Report On 150 Front St.Dokument60 SeitenUMass CED Report On 150 Front St.SteeleMassLiveNoch keine Bewertungen

- West Springfield State Rep. Candidate Nathan Bech's 2014 Pre-Primary Financial ReportDokument23 SeitenWest Springfield State Rep. Candidate Nathan Bech's 2014 Pre-Primary Financial ReportSteeleMassLiveNoch keine Bewertungen

- State Rep. Michael J. Finn's Pre-Election Campaign Finance ReportDokument8 SeitenState Rep. Michael J. Finn's Pre-Election Campaign Finance ReportSteeleMassLiveNoch keine Bewertungen

- Guide To Obtaining A Permit in West Springfield, MADokument4 SeitenGuide To Obtaining A Permit in West Springfield, MASteeleMassLiveNoch keine Bewertungen

- West Springfield State Rep. Mike Finn's 2014 Pre-Primary Financial ReportDokument12 SeitenWest Springfield State Rep. Mike Finn's 2014 Pre-Primary Financial ReportSteeleMassLiveNoch keine Bewertungen

- Scott Brown Campaign Letter To Lawrence Lessig Re: Lobbying ClaimsDokument1 SeiteScott Brown Campaign Letter To Lawrence Lessig Re: Lobbying ClaimsSteeleMassLiveNoch keine Bewertungen

- Draft of West Springfield Medical Marijuana Ordinance (Subject To Change)Dokument10 SeitenDraft of West Springfield Medical Marijuana Ordinance (Subject To Change)SteeleMassLiveNoch keine Bewertungen

- Proposed Regulations For Dangerous Animals & Cat Colonies in West SpringfieldDokument11 SeitenProposed Regulations For Dangerous Animals & Cat Colonies in West SpringfieldSteeleMassLiveNoch keine Bewertungen

- Chromebook Acceptable Use PolicyDokument7 SeitenChromebook Acceptable Use PolicySteeleMassLiveNoch keine Bewertungen

- Money TimesDokument20 SeitenMoney TimespasamvNoch keine Bewertungen

- DiCeglie052521Invite (30959)Dokument2 SeitenDiCeglie052521Invite (30959)Jacob OglesNoch keine Bewertungen

- CP575 1372187182568Dokument3 SeitenCP575 1372187182568vinie davisNoch keine Bewertungen

- Tugas Bab 15Dokument3 SeitenTugas Bab 15IndahNoch keine Bewertungen

- US Internal Revenue Service: F1040sab - 1992Dokument2 SeitenUS Internal Revenue Service: F1040sab - 1992IRSNoch keine Bewertungen

- Datatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 386Dokument4 SeitenDatatreasury Corporation v. Wells Fargo & Company Et Al - Document No. 386Justia.comNoch keine Bewertungen

- BD 060123Dokument179 SeitenBD 060123venkii VenkatNoch keine Bewertungen

- FAQs: Utah SNAP Benefits and The CoronavirusDokument3 SeitenFAQs: Utah SNAP Benefits and The CoronavirusAdam ForgieNoch keine Bewertungen

- Largest Banks and Thrifts in The US by Total AssetsDokument4 SeitenLargest Banks and Thrifts in The US by Total Assetsht5116Noch keine Bewertungen

- Safari TrangDokument40 SeitenSafari Trangvanpth20404cNoch keine Bewertungen

- DatabaseDokument4 SeitenDatabaseMikey MessiNoch keine Bewertungen

- Form Accepted Federal 2019 PDFDokument10 SeitenForm Accepted Federal 2019 PDFRandy PettersonNoch keine Bewertungen

- S&P CDO Deal List Through 041202Dokument104 SeitenS&P CDO Deal List Through 041202api-3742111Noch keine Bewertungen

- Treasury Bond ResultsDokument4 SeitenTreasury Bond ResultsDennis OndiekiNoch keine Bewertungen

- A 241Dokument1 SeiteA 241AnuranjanNoch keine Bewertungen

- Computation of Income TaxDokument10 SeitenComputation of Income TaxPageduesca RouelNoch keine Bewertungen

- Sample Exam QuestionsDokument7 SeitenSample Exam QuestionsQian LuNoch keine Bewertungen

- Books by CEOsDokument3 SeitenBooks by CEOsMishaNoch keine Bewertungen

- 10000018673Dokument10 Seiten10000018673Chapter 11 DocketsNoch keine Bewertungen

- NYPIRG Gov Fundraising 10 7 2014Dokument11 SeitenNYPIRG Gov Fundraising 10 7 2014Christopher RobbinsNoch keine Bewertungen

- Membership List: Russell 3000® IndexDokument33 SeitenMembership List: Russell 3000® IndexFuboNoch keine Bewertungen

- q22023 Macro-Outlook PortalDokument14 Seitenq22023 Macro-Outlook PortalM. Fatah YasinNoch keine Bewertungen

- Long-Term Rating Grades Mapping TableDokument1 SeiteLong-Term Rating Grades Mapping TableSidrah ShaikhNoch keine Bewertungen

- Michael Burry - Bloomberg TranscriptDokument26 SeitenMichael Burry - Bloomberg TranscriptFinanceTrendsNoch keine Bewertungen

- W 2Dokument1 SeiteW 2Raj SharmaNoch keine Bewertungen

- ASCE - Member ListDokument4 SeitenASCE - Member ListJohn WickNoch keine Bewertungen

- F 1040 SeDokument2 SeitenF 1040 SepdizypdizyNoch keine Bewertungen

- W21225760934 0 PDFDokument2 SeitenW21225760934 0 PDFAnonymous czHLQeLPB4Noch keine Bewertungen

- e-StatementBRImo NEW 1Dokument3 Seitene-StatementBRImo NEW 1dealut123456Noch keine Bewertungen

- Brand Product List with Prices and InventoryDokument544 SeitenBrand Product List with Prices and InventorySachinSamNoch keine Bewertungen