Beruflich Dokumente

Kultur Dokumente

Why You Should Never Be A Trader

Hochgeladen von

Victoriano AbanaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Why You Should Never Be A Trader

Hochgeladen von

Victoriano AbanaCopyright:

Verfügbare Formate

Why You Should Never Be

a Trader

Because we always have new members in the TrulyRichClub, I need to defne terms here

Investors buy stocks and dont sell for six months to 20 years.

Traders buy stocks and sell them after a few hours or days.

Heres another difference: Investors buy only the giants we recommend in our list below. Traders buy

anything, especially penny stocks, because theyre more volatile, and thus give them more opportunity to earn

more money (theoretically).

Here are 3 Reasons why you should never become a trader:

1. Traders Pay More Fees.

Every time you buy and sell stocks, you pay a fee.

Yes, the fees are cheap.

But still, they do add up.

And thats subtracted from your profts.

2. Traders Need More Expertise.

Some of my friends are fulltime traders.

The stock market is their fulltime job.

They dont do anything else.

Guess what: A lot of them still lose money!

Despite ALL their training.

3. Traders Need More Time.

How much time a day will you spend in actively

trading?

One hour? Two hours? Three hours?

Question: Why not just invest that one, or two, or

three hours ON your business? Even if you trade

only one hour a day, thats already fve hours a

week.

If youre a salesman, use that one hour to call up former customers just to s ay

Hi and build relationships.

If youre an entrepreneur, use that one hour to study how to market your products through the internet.

Believe me, youll earn more money!

And whatever added proft you earn from your business, you can plow back to the stock market as an

investor!

Stocks Update Stocks Update

Guidance for Stock Market Investing Exclusively for TrulyRichClub Members

Note: To understand the Stocks Update, frst read Bos Ebook, My Maid Invests in the Stock Market.

Click here www.TrulyRichClub.com to download now.

August 2013

Stocks Update PAGE 1 OF 8

Stocks Update Stocks Update

Volume 4, No. 15

Stocks Update PAGE 2 OF 8

Stocks Update Stocks Update

What You Should Never Do

After giving a talk on stock market investing, a participant (who probably came in late and didnt hear my

entire talk) came up to me and asked, Bo, my bank is offering me a personal loan of 0.9 percent monthly interest.

Can I borrow and put it in the stocks? If I can earn at least 20 percent a yearIll be on top

Questions like this make my toes curl.

I told him, I care for you. Dont do that. If I had an enemy I wanted to torture, Id tell him to trade the stock

market on borrowed money.

Work on Your Business, Not the Stock Market

Heres the harsh reality.

You cant invest in the stock market if you dont

have cashfow.

What is cashfow?

Cash that fows to you. (Gosh, Im so brilliant.)

Every month, you have a steady income stream that

pours money into your lap. That income stream could

be your job or business.

If you dont have cashfow, you cant invest in the

stock market. Period.

So what should you do?

Spend 99 percent of your time (creativity, energy,

attention) on your business.

Create your cashfow.

Increase your cashfow.

Multiply your cashfow.

And then spend 1 percent of your time on investing that cashfow on the stock market.

Happy investing!

May your dreams come true,

Bo Sanchez

PS. Mike will talk about the key highlights of the Citiseconlines midyear market briefng.

PS2. If you have questions, please visit our online forum where you can ask our panel of experts. To visit, click

here now.

Stocks Update Volume 4, No. 14 August 2013 PAGE 3 OF 8

Stocks Update Stocks Update

LONG-TERM GROWTH INTACT:

Key Highlights from COLs 2013 Midyear

Market Briefng

By Mike Vias

Last August 12, 2013 at Meralco Theatre, COL Financial held their 2013 Midyear Market Briefng entitled,

THE TIDES OF OPPORTUNITY. Here are some key highlights from that evening:

Long-term growth intact for the Philippine Stock Market

The Philippine Market will continue its long-term ascent, driven by the following strong fundamentals:

1. Favorable Economic Growth Outlook

2. Less Vulnerable to Risks Facing Emerging Markets in Asia

3. BSP to Limit Access to SDA Investments

Favorable Economic Growth Outlook

nSince 2008 (except for 2009) the Philippines has been outperforming the world in terms of its GDP. In

2012, we had a GDP of 6.6 percent as compared to the 2.3 percent of the world. Also, in the 1

st

quarter of

this year, we grew by 7.8 percent as against the 2.7 percent of the rest of the world. Such growth was better

than expected. It was the fattest in Asia and it is seen to have a more sustainable increase.

nConsumer spending driven by:

Strong consumer confdence hits an all-time high caused by: better job

opportunities, increase investment infows, and salary increases

Resiliency in OFW remittances and growth in BPO sector

Weaker peso and benign infation that will boost spending power

The Philippines is about to enter its demographic window. This is a

period of high economic growth caused by a growing number of people

entering the productive ages of 15 to 64. It has been seen that economies

of countries that had entered such a window grew by an average of 7.3

percent in the 1

st

decade alone. For us, it is expected to open in 2015

and last until 2050. During this time, we will see the working population

reach 63 percent in 2015 and peak at 69 percent by 2040-2055.

nInvestment spending driven by:

Credit ratings upgrade given by Fitch and S&P. An upgrade by Moodys

is expected to follow. Such an upgrade will mean that the Philippines will now be part of the radar screen

of more foreign investors, which will help ensure low funding cost, and lead to more investments, GDP

growth, and a higher stock market.

Strong business confdence driven by expansion of businesses, the countrys strong macroeconomic

fundamentals, and the said credit rating upgrade.

Healthy and liquid banking system

Favorable regional developments

Growth in PPP Projects

nInvestment spending willing and ready as seen by the improvement of governments fnances in the recent

years. This will pave the way for higher spending, and we saw this even in the 2

nd

quarter of this year. Such

spending is expected to remain strong in 2014 with social and economic service to grow faster.

Less Vulnerable to Risks Facing Emerging Markets in Asia

Compared to Thailand and Indonesia who suffered from GDP downgrade, the Philippines was given an

upgrade.

The Philippine is becoming less dependent on exports and the sale of commodities, which makes the

Philippines more resilient to global economic weakness and the rebalancing of the Chinese economy.

The Philippines boasts of a very strong current account position, minimizing the threat of a sharp peso

depreciation.

The potential increase in interest rates is expected to be minimal.

BSP to Limit Access to SDA Investments

Trust entities offering SDA investments will no longer be able to offer such, as these will be phased out by

November 2013.

This will cause funds to go into riskier assets looking for higher yields, such as the stock market. This will

also help mitigate the unfavorable impact of foreign fund outfow.

Challenges and Risks

However, along with these drivers that will justify the continued long-term growth of the market, we also

face some challenges and risks ahead:

The Philippine market is comparatively expensive against Thailand and Indonesia. Although this is

justifable because of our better economic outlook.

Earnings growth is seen to slow down in 2014, with the consumer and property sectors leading the pack.

Investor sentiments remain poor and fearful.

Weaker currency

Rising interest rates

Volatile stock market

PSEi Projection

Thus, by the end of 2013, COL Research foresees the PSEi closing between 7250-7500 and 7450-7700 for

the end of 2014.

I hope this has given you a better idea where our market is headed. On our part we simply have to be

continuously faithful with our SAM investment as it goes through such tides of opportunities where we can get a

better average price for our stocks. Make sure your monthly or quarterly investment remains intact.

Happy long-term investing!

Stocks Update Volume 4, No. 14 August 2013 PAGE 4 OF 8

Stocks Update Stocks Update

Stocks Update Volume 4, No. 14 August 2013 PAGE 5 OF 8

Stocks Update Stocks Update

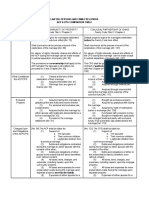

Here are our SAM Tables (as of market closing August 15, 2013).

STOCK Current Price Buy Below Price Target Price Action to Take

AC 598.50 602.4 753.00 Continue Buying

BDO 82.00 89.60 112.00 Continue buying

DNL 6.87 8.40 10.50 Continue buying

JGS 40.00 34.4 43.00

HOLD: Stop buying

*as per Bos instructions

LRI 10.50 12.68 15.85 Continue buying

MBT 110.00 119.20 149.00 Continue buying

MEG 3.40 3.89 4.87 Continue buying

MER 291.20 278.00 347.50 Stop buying for now

SM 805.50 760.00 950.00 Stop buying for now

TEL 3,070.00 2848.00 3,560.00 Stop buying for now

STOCK

SYMBOL

DATE

BOUGHT

PRICE

BOUGHT

PRICE

TODAY

YOUR

RETURN

BUY BELOW

PRICE

TARGET

PRICE

EXPECTED

GROWTH

AC Jul-13 603.50 598.50 -0.83% 654.80 753.00 24.77%

Aug-13 598.50 598.50 0.00% 602.40 753.00 25.81%

TOTAL -0.41% 25.29%

BDO Apr-13 86.10 82.00 -4.76% 89.60 112.00 30.08%

Jun-13 84.50 82.00 -2.96% 97.40 112.00 32.54%

Jul-13 87.50 82.00 -6.29% 97.40 112.00 28.00%

Aug-13 82.00 82.00 0.00% 89.60 112.00 36.59%

TOTAL -3.50% 31.80%

DNL Feb-13 6.45 6.87 6.51% 8.48 9.75 51.16%

Mar-13 6.71 6.87 2.38% 8.48 9.75 45.31%

Apr-13 7.00 6.87 -1.86% 8.70 10.00 42.86%

May-13 8.36 6.87 -17.82% 8.70 10.00 19.62%

Jun-13 7.90 6.87 -13.04% 8.70 10.00 26.58%

Jul-13 6.58 6.87 4.41% 8.70 10.00 51.98%

Aug-13 6.87 6.87 0.00% 8.40 10.50 52.84%

TOTAL -2.77% 41.48%

JGS Feb-12 25.75 42.00 63.11% 28.83 35.00 35.92%

Mar-12 26.55 42.00 58.19% 30.43 35.00 31.83%

Apr-12 34.00 42.00 23.53% 34.78 40.00 17.65%

May-12 31.40 42.00 33.76% 34.78 40.00 27.39%

Jun-12 32.00 42.00 31.25% 34.78 40.00 25.00%

Aug-12 32.50 42.00 29.23% 34.78 40.00 23.08%

Sep-12 32.95 42.00 27.47% 34.78 40.00 21.40%

Oct-12 33.20 42.00 26.51% 34.78 40.00 20.48%

Nov-12 34.10 42.00 23.17% 37.39 43.00 26.10%

TOTAL 35.13% 25.43%

Stocks Update Volume 4, No. 14 August 2013 PAGE 6 OF 8

Stocks Update Stocks Update

STOCK

SYMBOL

DATE

BOUGHT

PRICE

BOUGHT

PRICE

TODAY

YOUR

RETURN

BUY BELOW

PRICE

TARGET

PRICE

EXPECTED

GROWTH

LRI Jun-13 11.50 10.50 -8.70% 12.68 15.85 37.83%

Jul-13 11.00 10.50 -4.55% 12.68 15.85 44.09%

Aug-13 10.50 10.50 0.00% 12.68 15.85 50.95%

TOTAL -6.62% 44.29%

MBT Jun-11 71.52 110.00 53.80% 78.88 93.60 30.87%

Jul-11 79.55 110.00 38.28% 78.88 93.60 17.66%

Aug-11 75.50 110.00 45.70% 78.88 93.60 23.97%

Sep-11 72.00 110.00 52.78% 78.88 93.60 30.00%

Oct-11 69.05 110.00 59.30% 78.88 93.60 35.55%

Nov-11 71.90 110.00 52.99% 78.88 93.60 30.18%

Dec-11 68.00 110.00 61.76% 78.88 93.60 37.65%

Jan-12 70.60 110.00 55.81% 83.07 108.00 52.97%

Feb-12 78.90 110.00 39.42% 83.07 108.00 36.88%

Mar-12 88.00 110.00 25.00% 93.91 108.00 22.73%

Apr-12 86.00 110.00 27.91% 93.91 108.00 25.58%

May-12 88.75 110.00 23.94% 93.91 108.00 21.69%

Jun-12 86.50 110.00 27.17% 93.91 108.00 24.86%

Sep-12 93.40 110.00 17.77% 93.91 108.00 15.63%

Oct-12 93.00 110.00 18.28% 104.35 120.00 29.03%

Nov-12 96.05 110.00 14.52% 104.35 120.00 24.93%

Jan-13 103.40 110.00 6.38% 113.04 130.00 25.73%

Feb-13 112.50 110.00 -2.22% 129.57 149.00 32.44%

Mar-13 117.00 110.00 -5.98% 129.57 149.00 27.35%

Apr-13 118.30 110.00 -7.02% 129.57 149.00 25.95%

Jun-13 121.00 110.00 -9.09% 129.57 149.00 23.14%

Jul-13 112.70 110.00 -2.40% 129.57 149.00 32.21%

Aug-13 110.00 110.00 0.00% 119.20 149.00 35.45%

TOTAL 25.83% 28.80%

MEG May-13 4.23 3.40 -19.62% 4.16 4.78 13.00%

Jun-13 3.67 3.40 -7.36% 4.16 4.78 30.25%

Jul-13 3.15 3.40 7.94% 4.16 4.78 51.75%

Aug-13 3.40 3.40 0.00% 3.89 4.87 43.24%

TOTAL -4.76% 34.56%

MER Jul-13 286.60 291.20 1.61% 278.00 347.50 21.25%

TOTAL 1.61% 21.25%

TEL Jun-13 2902.00 3020.00 4.07% 3043.50 3500.00 20.61%

Jul-13 2854.00 3020.00 5.82% 2800.00 3500.00 22.63%

TOTAL 4.94% 21.62%

Stocks Update Volume 4, No. 14 August 2013 PAGE 7 OF 8

Stocks Update Stocks Update

Mike Vias is a Corporate Accounts Offcer and Relationship Manager at CitisecOnline. He is a Certifed

Securities Representative and a Certifed Investment Solicitor.

2012 Top 10 Winners of TrulyRichClubs Stocks

If you followed our Stock Recommendations in the past, youd have enjoyed these earnings. Were reposting this

again to encourage you to be faithful to your monthly investments today for the stocks we recommend above.

Never give up. And youll have great winners 10 to 20 years from now!

Note: The percentage returns cannot be compared between the two tables below. The All Time Winners table does

not take into consideration a cost-averaging method. The percentage return is only from a buy-and-hold strategy.

The 2012 Table however integrates a cost-averaging method throughout the months it was under the Buy-Below.

STOCKS

STOCK

SYMBOL

TIME

RECOMMENDED

ESTIMATED

TIME

HELD

PRICE

RANGE

ESTIMATED

RETURN

Ayala Land ALI

June 2011 to February 2012

(3

rd

week)

9 Months P15.09 to P21.65 35%

Nickel Asia NIKL

February 2012 to March

2012

(3

rd

week)

2 Months P23.75 to P26.20 10.32%

Bank of The

Philippine

Islands

BPI

February 2012 to November

2012 (4

th

week)

10 Months P68.45 to P91.00 34.29%

Ayala

Corporation

AC

October 2012 to December

2012 (2

nd

week)

2 Months P440.00 to P520.00 17.65%

SM Prime

Holdings

SMPH

February 2012 to December

2012 (1

st

week)

10 Months P12.48 to P17.00 27.75%

Top 10 Past Winners of TrulyRichClubsStocks

STOCKS

STOCK

SYMBOL

TIME

RECOMMENDED

TIME

HELD

PRICE

RANGE

YOUR

RETURN

Lepanto LC Dec 2010 to May 2011 5 Months P0.34 to P0.85 150%

Jollibee JFC Mar 2010 to May 2011 14 Months P47.50 to P94.45 98%

Security Bank SECB Mar 2010 to May 2011 14 Months P53.00 to P96.20 81%

DMCI DMC Sep 2010 to May 2011 8 Months P27.25 to P44.80 64%

Intl Container ICT Sep 2010 to May 2011 8 Months P32.40 to P48.70 50%

First Gen Co. FGEN Mar 2010 to May 2011 14 Months P9.80 to P14.78 50%

Megaworld MEG Jul 2010 to May 2011 10 Months P1.54 to P2.30 49%

Nickel Asia NKL Oct 2010 to May 2011 8 Months P15.00 to P22.40 49%

Ayala Land ALI Mar 2010 to May 2011 14 Months P11.25 to P16.64 47%

Energy Devt Co. EDC Mar 2010 to May 2011 14 Months P4.85 to P6.49 33%

(Disclaimer: Past performance doesnt guarantee that youll have the exact same results in the future. After all,

your earnings all depend on the markets performance.)

Das könnte Ihnen auch gefallen

- Invests P10 A Day - Su - 20141020Dokument8 SeitenInvests P10 A Day - Su - 20141020Victoriano AbanaNoch keine Bewertungen

- Duplicate Yourself To Duplicate Your Income Ws - 20110812Dokument6 SeitenDuplicate Yourself To Duplicate Your Income Ws - 20110812Victoriano Abana100% (1)

- Avoid Free Lunch AttitudeDokument2 SeitenAvoid Free Lunch AttitudeVictoriano AbanaNoch keine Bewertungen

- What Can Hurt Your BusinessDokument5 SeitenWhat Can Hurt Your BusinessVictoriano AbanaNoch keine Bewertungen

- My Maid Invests in The Stock Market and Why You Should TooDokument84 SeitenMy Maid Invests in The Stock Market and Why You Should TooAbby Balendo100% (7)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Conceptual Framework WITH ANSWERSDokument25 SeitenConceptual Framework WITH ANSWERSDymphna Ann CalumpianoNoch keine Bewertungen

- Advanced Accounting ProblemsDokument4 SeitenAdvanced Accounting ProblemsAjay Sharma0% (1)

- Performance Measurement, Compensation, and Multinational ConsiderationsDokument32 SeitenPerformance Measurement, Compensation, and Multinational ConsiderationsSugim Winata EinsteinNoch keine Bewertungen

- Credit Management Policy of NCC Bank LimitedDokument42 SeitenCredit Management Policy of NCC Bank LimitedAshaduzzamanNoch keine Bewertungen

- Naveed Khan (Finance Report)Dokument167 SeitenNaveed Khan (Finance Report)Sadiq SagheerNoch keine Bewertungen

- ACP Vs CPGDokument3 SeitenACP Vs CPGSGT100% (4)

- Chapter-1 Rationale For The Study: Customer Satisfaction With Product & Service of Reliance Mutual FundDokument58 SeitenChapter-1 Rationale For The Study: Customer Satisfaction With Product & Service of Reliance Mutual Fundmanan_gondaliya100% (2)

- Financing Decisions - Practice QuestionsDokument3 SeitenFinancing Decisions - Practice QuestionsAbrarNoch keine Bewertungen

- BAI2 SpecsDokument41 SeitenBAI2 SpecsSrinath BabuNoch keine Bewertungen

- Working Capital MGTDokument61 SeitenWorking Capital MGTDinesh Kumar100% (1)

- Internal Rate of Return - Wikipedia, The Free EncyclopediaDokument8 SeitenInternal Rate of Return - Wikipedia, The Free EncyclopediaOluwafemi Samuel AdesanmiNoch keine Bewertungen

- A Summer Training Project Report On Tata Aig 2010-11 MuzaffarnagarDokument105 SeitenA Summer Training Project Report On Tata Aig 2010-11 Muzaffarnagarghanshyam1988Noch keine Bewertungen

- Sharekhan Top Picks: CMP As On September 01, 2014 Under ReviewDokument7 SeitenSharekhan Top Picks: CMP As On September 01, 2014 Under Reviewrohitkhanna1180Noch keine Bewertungen

- Chapter 2 WACC Q BankDokument22 SeitenChapter 2 WACC Q Bankuzair ahmed siddiqi100% (1)

- Raghee Horner Daily Trading EdgeDokument53 SeitenRaghee Horner Daily Trading Edgepsoonek100% (8)

- David Sm15 Case Im 25 L'OrealDokument22 SeitenDavid Sm15 Case Im 25 L'OrealJa JUOINoch keine Bewertungen

- Valuation and Depreciation Public Sector PDFDokument186 SeitenValuation and Depreciation Public Sector PDFcorneliu100% (1)

- FMSDokument12 SeitenFMSMahesh SatapathyNoch keine Bewertungen

- Test Bank Accounting 25th Editon Warren Chapter 14 Long Term Liabi PDFDokument86 SeitenTest Bank Accounting 25th Editon Warren Chapter 14 Long Term Liabi PDFMichael Linard SamileyNoch keine Bewertungen

- SWOT of India and ChinaDokument2 SeitenSWOT of India and ChinaSatish KorabuNoch keine Bewertungen

- Basel II Framework PDFDokument1 SeiteBasel II Framework PDFanupam20099Noch keine Bewertungen

- Property MapDokument26 SeitenProperty Mapanar beheheheNoch keine Bewertungen

- Chemalite IncDokument2 SeitenChemalite IncRaju Milan100% (2)

- Dolphin Fund PresentationDokument40 SeitenDolphin Fund Presentationgpanagi1Noch keine Bewertungen

- TB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesDokument24 SeitenTB - Chapter20 Hybrid Financing - Preferred Stock, Leasing, Warrants, and ConvertiblesMarie Bernadette AranasNoch keine Bewertungen

- Course Syllabus & Schedule: ACC 202 - I ADokument8 SeitenCourse Syllabus & Schedule: ACC 202 - I Aapi-291790077Noch keine Bewertungen

- What Is Financial Statement AnalysisDokument4 SeitenWhat Is Financial Statement AnalysisDivvy JhaNoch keine Bewertungen

- Financial Modeling ValuationDokument82 SeitenFinancial Modeling ValuationHarsh Ashish100% (2)

- Cost of Poor QualityDokument4 SeitenCost of Poor QualitylugarxNoch keine Bewertungen

- FinalDokument52 SeitenFinalhitesh_shihoraNoch keine Bewertungen