Beruflich Dokumente

Kultur Dokumente

Business Model of TATA Consultancy Services

Hochgeladen von

Mathan Anto Marshine0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

470 Ansichten41 SeitenBusiness model of TATA Consultancy Services

Originaltitel

Business model of TATA Consultancy Services

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenBusiness model of TATA Consultancy Services

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

470 Ansichten41 SeitenBusiness Model of TATA Consultancy Services

Hochgeladen von

Mathan Anto MarshineBusiness model of TATA Consultancy Services

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 41

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

1

Reinventing the Business Model

TATA Consultancy Services

Atul Katiyar

B Siva Sankaran

K Aravind Reddy

P Mathan Anto Marshine

S Srikanth

Group 04

IIM Indore

Correspondence:

Guided by Professor Prasanth Salwan

Tel: +91 22 41021513

E-mail: pm13atulk@iimidr.ac.in

pm13bsiva@iimidr.ac.in

pm13karavind@iimidr.ac.in

pm13pmathan@iimidr.ac.in

pm13srikanths@iimidr.ac.in

"Experience

Certainty"

"We will definitely maintain a certain amount of

war chest for acquisitions." - TCS CEO Mr.

N.ChandrasekaranET :18-Sep-2014

"One secret to maintaining a thriving business is

recognizing when it needs a fundamental

change." - "Reinventing your business model" by Clayton

M. Christensen BOD, TCS, Mark W. Johnson and Henning

Kagermann

Acknowledgement

The students thank Prof. Prasanth Salwan for his

valuable insights on business models.

Abstract

In a competitive business environment, it is

imperative for any organization to develop and

sustain an advantage. Over time, several successful

organizations have innovated on certain key phases

of their business and were able to effectively turn it

into a mechanism which positively isolated the

way they reduced their business costs or

consistently made customers pay more for their

offerings.

In a dynamic service business driven by quality

and innovation, the solution to retaining and

expanding customer base is not a straightforward

task. As an example of a domain witnessing

dramatic shifts in rather short spans of time, the

industry of Information Technology Enabled

Services (ITES) has undergone vast

transformations in the last decade itself. Even as

the industry is flattening out with weakening entry

barriers, players are identifying newer means to

innovate in the salient features of their business: be

it their underlying technology base, the quality of

solution, the delivery, the resource management

technique or even the talent acquisition policies.

However, in the Indian context - and to a fair

extent on a global setting - Tata Consultancy

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

2

Journal of International Business Studies

Services (TCS), an Indian Business Consultancy firm, has thrived in the global competition, producing

consistently outperforming results year on year with respect to market share and quality of services.

Unlike most of its competitors, TCS has not only been able to impregnate their entire business model

with multiple advantages complementing each other, but have also managed to retain the benefits of this

constructive interference.

Through this paper, we try to investigate the most significant features of TCS unique business model, its

complex network of interrelationships and intra-relationships, and how this mechanism has resulted in

creating unique advantages for the company. The investigation begins with a brief overview of the

relevant economic policies of India, and the dynamics that have helped shaped the industry. We also

deemed it a relevant and necessary exercise to compare the environment that TCS found itself in at the

head of the global economic meltdown (2007-8) and compare it with the present day scenario (2013-14),

since it was during this critical period that the company made a number of business choices, exposing

itself to a variety of risks, which eventually helped shape the distinct advantage it today enjoys. Finally,

we also theorize our observations on TCSs sources of competitive advantage and how the business

choices they made translated into consequences which were instrumental in mitigating the dangers posed

by competition and creating holds-up within its own ecosystem partners.

Journal of International Business Studies (Sep 2014)

Keywords: customer value proposition; key success factors, EFE matrix, PESTEL, Tetra-Threat; sustainable strategy; GNDM; COIN

Introduction

TCS, as an IT consulting company, stands out for its pioneering work in setting an industry standard

through its innovative model of solution delivery, which was its biggest advantage in the latter half of the

2000s. However, as a corporate, it has been focusing a lot of its efforts in sustaining a much less-obvious

advantage: cost efficiency.

A key proxy to identifying TCS sustained advantages is the feedback of its worldwide network of

customers, who generally have two things to say about them: state-of-the-art solutions, and cost-

effectiveness. Quite understandably, these have come from the kind of assets and the kind of people that

this 46-year old company has been accumulating strategically, brick by brick. Its remarkably high score

in industrial metrics like employee-attrition and asset utilization are testimonies to the above statement.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

3

Journal of International Business Studies

By bravely infusing certain key business choices in its corporate model over time, TCS has now nurtured

a complex network of interrelated positive business consequences, creating inimitable and path-

dependent advantages over other players. A framework is attached with this write-up, which attempts to

map the relationships of the companys broadest and most significant choices and consequences.

Looking at the evolution of this framework, there is evidence that TCS has been attempting to mitigate

competition by actually creating an inimitable business model. All the activities and advances that it has

built up over the last decade has been simply to reinforce the two pillars in its model: cost-efficiency and

service-efficiency.

Literature Review

In their review of "Reinventing your Business Model" by Mark W. Johnson, Clayton M. Christensen

and Henning Kagermann clustered the three steps for reinventing the business model.1) Find out

opportunity, key success factors and external environment to add customer value proposition by

aligning profit formula key resources & processes.2) Blue print to construct profit formula through

revenue model, cost structure ,margin model and resource velocity. 3) Compare model thus obtained with

existing model, that provides clarity on how align my business model with changing environment and key

success factors. We find this article very interesting and relevant considering one of the authors i.e.

Clayton M. Christensen role as board of director in TATA Consultancy services.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

4

Journal of International Business Studies

Strategic Dynamics

PESTEL Analysis: 2007 -2008 & 2013 - 2014

Factors 2007-08 2013-14

Political India spent 3.7% of GDP on IT (World

Bank World Development Indicators on

CDROM, 2005).This points out to the

concerted policies and vision by the

government and industry to promote

software exports and transfer of

technology and telecommunication.

Country getting the most stable government in

recent days emanating positive signals for the

for the business community for in and around

the country.

The Indian federal and state governments

are committed to developing and

broadening e-governance. Fourteen state

governments have IT-specific priority

policies and many have implementing IT

related projects.

Government is planning to set-up 15 new

laboratories which will facilitate registration

and testing of IT products before they are

launched in the market.

Postgraduate education and research in

IT is pursued for promoting R&D in the

emerging areas of Bluetooth technology

e-commerce, and nano-technology and

bioinformatics solutions. Foreign

investment in the sector is encouraged by

simplifying policies and strengthening

and upgrading telecommunication and IT

infrastructure.

In the 12th Five Year Plan (2012-17), the

Department of Information Technology

proposes to strengthen and extend the existing

core infrastructure projects to provide more

horizontal connectivity, build redundancy

connectivity, undertake energy audits of State

Data Centres (SDCs) etc.

Stable and collaborative political

structure along with federal form of

government, provide conducive

environment to the IT business to

flourish and grow.

The Government of India has fast tracked the

process of setting up of centers of National

Institute of Electronics and Information

Technology (NIELIT) in Northeast India

The Government of Brazil has liberalized the

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

5

Journal of International Business Studies

issue of short term work visas, a move which

will make it easier for Indian IT professionals

to take up assignments in Brazil.

Economic In 2006, real GDP growth was 9.4%, the

fourth consecutive year of growth above

8%, giving positive signal and

confidence to Indian IT companies, at

the same time receiving criticisms of

overheating of the economy.

FDI up to 100 per cent under the automatic

route is allowed in Data processing, software

development and computer consultancy

services; software supply services; business

and management consultancy services, market

research services, technical testing & analysis

services.

For Indian IT Services companies, with

revenues largely earned in U.S. dollars

and costs primarily in Indian Rupees, the

INR/USD exchange rate was of special

importance. From October 1, 2006 to

October 1, 2007, the Rupee had

appreciated from Rs. 45.9 to Rs. 39.8 per

dollar. Companies making special

arrangements to hedge this fluctuation.

Between April 2000 and June 2013, the

computer software and hardware sector

attracted cumulative foreign direct investment

(FDI) of Rs 53,757.60 crore (US$ 7.97

billion), according to data released by the

Department of Industrial Policy and

Promotion (DIPP).

IT spending in emerging markets was

growing very rapidly with 20% and 19%

growth rates in India and China

respectively in 2006

World economy is coming out of the global

recession posing well for the business

especially export oriented businesses as IT.

Potential of technology to transform sectors

such as healthcare, public services, utilities

and education is well recognized, hence a

spurt in IT investments expected as the year

progresses.

Social Enrolment in Indian technology schools

is expecting to reach 600,000 by 2008,

thus providing a huge and culturally

diverse talent base for the IT companies.

Education system in India is producing labor

force for the industry which is cheap and

talented. Also they are able to communicate

easily with people of other countries as the

mode of education is English.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

6

Journal of International Business Studies

India is having 10% of world total

software developers which is growing at

the rate of 32%, which means in the next

three years India will have the highest

no. of software developers in the world.

Availability of large no. of people in the

working age group does not pose minimizes

the risk of labor shortage.

The Indian education system places

strong emphasis on mathematics and

science, resulting in a large number of

science and engineering graduates.

Mastery over quantitative concepts

coupled with English proficiency has

resulted in a skill set that has enabled the

country to taake advantage of the current

international demand for IT.

Cultural diversity is equipping people here to

become adaptive to other cultures and

countries, helping them work effectively with

foreign cultures.

Availability of large no. of people in the

working age group does not pose

minimizes the risk of labor shortage.

In India there has been a rising trend of

couples working and staying in cities that

facilitate employment for both. The husband

and wife both find it easier to work and stay

together given the new corporate culture in

cities like Bangalore, Gurgaon, Pune, Bombay

etc.

Diverse cultural environment of the

country, give the perfect adaptability to

the people of country to work in different

cultural atmosphere.

Companies are adopting the policy of giving

back to the society through, thus benefitting

society not directly connected to the business.

Technology Increase in the cost optimization

measures by implementing packaged

software solutions like ERP,CRM and

Core banking products.

Disruptive technologies present an entire new

gamut of opportunities for IT firms in India.

Over 400 Indian IT companies had

acquired quality certifications with 82

companies certified at SEI CMM Level 5

higher than any other country in the

India has got low price mobile tariffs which

add to the advantage of industry. Advent of

Smartphone, tablets, iPads, has added to the

advantage and has increased the opportunity.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

7

Journal of International Business Studies

world, giving India an image of credible

outsourcing destination to the world.

The no. of PC sold per year increasing as

well as the no. of internet users rising in

domestic market, promising good for the

IT&ES industry in the country.

Cloud represents the largest opportunity under

Social, Mobility, Analytics and Cloud

(SMAC), increasing at a CAGR of

approximately 30 per cent to around US$

650700 billion by 2020. Social media is the

second most lucrative segment for IT firms,

offering a US$ 250 billion market opportunity

by 2020.

Environment Companies are focusing on reducing

carbon footprints, energy utilization,

water consumption etc.

Companies are focusing on reducing carbon

footprints, energy utilization, water

consumption etc.

Environmental conservation and

protection is an issue which has gained

prominence because of deteriorating

environmental balance which is

threatening the sustainability of life and

nature

They run and grow their business on an

environmentally sustainable basis, cultivating

eco-efficient practices like helping and

partnering in effective disposal of e-waste etc.

Legal Indian labor laws are flexible and mostly

non-union workers are found in the IT

sector due to the better working

conditions, salaries and other job-related

opportunities compared to employees in

other sectors.

Govt. of India implemented amended form of

Information Technology Act 2000 on 27th

Oct. 2009. It provides additional focus to

informational security. It has added several

new sections on offences including Cyber

Terrorism and Data Protection. Copyright

protection and cyber laws were included in it.

The tax benefits firms enjoyed under the

Software Technology Parks of India

(STPI) were set to expire in 2009. These

benefits included a 10-year exemption

period from income taxes on export

profits as well as exemptions from many

indirect taxes, such as on procurement of

Indian labor laws are flexible and mostly non-

union workers are found in the IT sector due

to the better working conditions, salaries and

other job-related opportunities compared to

employees in other sectors.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

8

Journal of International Business Studies

capital goods.

In broad terms, the IT sector had been

promised continued benefits under the

governments new Special Economic

Zones (SEZ) program.

Companies Act, 2013, has made CSR

compulsory for companies

Question remained as to the treatment of

firms located in STPIs under the new

program as Nasscom advocated for

maximum benefits for IT Services

companies under the SEZ program.

External Factor Evaluation(EFE) Matrix : 2007 -2008

KEY EXTERNAL FACTORS(1-4, 4 being superior) WEIGHT RATING WEIGHTED

SCORE

Opportunities

Worldwide growth in technology spend rising by 7.3%, was

1.3 trillion more than the 2006.

0.07 3 0.21

With BPO and Packaged Software showing the highest of

9.7% and 8.3% respectively.

0.06 4 0.24

IT Service industry growing at the 6.3%. 0.07 3 0.21

USA, Western Europe and Japan being the biggest market,

looking for outsourcing majority of their work.

0.07 3 0.21

The increasing demand for higher value-added services and

innovation as part of the outsourcing contracts.

0.05 3 0.15

Customers off shoring the services in order to save on cost,

hence giving opportunity to cheap hub as India.

0.07 4 0.28

Rising demand for services among businesses in order to

improve on cost.

0.06 3 0.18

Rising demand due to increasing zest for innovation and

time to market.

0.05 3 0.15

Threats

Strengthening of INR causing reduction in margins from 0.07 3 0.21

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

9

Journal of International Business Studies

export dependent industry

Tough competition causing commoditization of low end

products

0.07 3 0.21

Competition among domestic companies driving employee

cost high

0.07 3 0.21

Tough competition from new emerging IT hub such as

China, Malaysia, Singapore, Mexico etc.

0.07 4 0.28

Rising issues of visa availability for countries like UK &

USA.

0.06 3 0.18

HR issues such as high attrition rate and penury of talented

and skilled employees being faced by the industry.

0.07 3 0.21

Risk in treasury with the institutions being used as financial

partners for hedging business due financial volatility.

0.05 3 0.15

Client and customer non-compliance to financial

obligations.

0.04 2 0.08

Total 1 3.16

External Factor Evaluation(EFE) Graphical: 2007 -2008

Weighted scores were plotted graphically separately for both opportunities and threats for better

representation.

Global Technology

Spending

15%

Rising BPO and

Packaged softwares

17%

Increase in

outsourcing

15%

Demand for

Innovation

10%

Cheap Resource

20%

Rise in services

business

13%

Increase zest

for Innovation

10%

Opportunities (2007-08)

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

10

Journal of International Business Studies

External Factor Evaluation(EFE) Matrix: 2013 -2014

KEY EXTERNAL FACTORS(1-4, 4 being superior) WEIGHT RATING WEIGHTED

SCORE

Opportunities

World economies improving, showing better future prospect

to IT business as a whole

0.09 3 0.27

Global Technology spending grew by 5.4% in 2014, better

than the year 2013.

0.07 3 0.21

Domestic IT-BPM revenue is expected to grow at 9.7 per

cent to gross ` 1,910 billion in FY2014

0.07 4 0.28

India offers continue cost advantage, being 7-8X cheaper

than source countries and 30% cheaper than next low cost

service provider country.

0.07 3 0.21

Largest pool of trained human resource available in India,

with 5.3 MN graduates.

0.07 4 0.28

Health Care Sector emerging as one of the most promising

sector domestically as well as globally.

0.06 2 0.12

Strengthening

of INR

13%

Commodisation of

Low end services

14%

Rising Salaries

14%

Competition from

emerging IT hubs

18%

Rising Visa

related issues

12%

Rising Attrition rate

14%

Financial and

Currency Volatility

10%

Compliance

related issues

5%

Threats (2007-08)

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

11

Journal of International Business Studies

Global delivery model of companies giving an access to the

coveted sectors of Health, Defense etc.

0.07 3 0.21

Threats

Some economies still showing the sign of slow or very slow

growth, which may impact IT industry as it is closely linked

with world economy.

0.07 4 0.28

Non-tariff trade barriers may lead to some challenges of

compressed margins and increased cost.

0.08 4 0.32

New disruptive technology posing challenges to traditional

customers.

0.1 4 0.4

Post-merger threat to industries as no. of M&A increasing. 0.05 3 0.15

Maintaining the right pool of talent becoming important as

it could impact delivery and quality of service.

0.06 3 0.18

Currency volatility 0.06 3 0.18

Increasing pressure on margins due to rising pay and rising

expanse.

0.05 3 0.15

Anti-Bribery law getting more stringent. 0.03 4 0.09

Total 1 3.33

External Factor Evaluation(EFE) Graphical: 2013 -2014

Weighted scores were plotted graphically separately for both opportunities and threats for better

representation.

Improving Global

Economy

17%

Global Technology

Spending

13%

Domestic IT

Spending

18%

Cheap Resource

13%

Rise in trained

human resource

18%

Emerging

Sectors

8%

Efficient

Delivery model

13%

Opportunities(2013-14)

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

12

Journal of International Business Studies

Porter five force analysis: 2007-08 & 2013 -2014

Factors Affecting Rivalry Among Existing Competitors

To what extent does pricing rivalry or non-price competition (e.g., advertising) erode the profitability of

a typical firm in this industry?

2013-14 2007-08

1. Degree of seller

concentration?

High High

2. Rate of industry growth? Growth rate 7.4% over 2012-13 5.4 %

3. Significant cost differences

among firms?

Yes Yes

4. Excess capacity? No Yes

5. Cost structure of firms:

sensitivity of costs to capacity

utilization?

No No

6. Degree of product

differentiation among sellers?

Brand loyalty to existing sellers?

Cross-price elasticities of

demand among competitors in

industry?

1) High

2) Less

3) Less

1) High

2) Yes

3) Less

Slow growth

of economies

16%

Trade barriers

18%

Disruptive

Technologies

23%

Post merger

integration

9%

Attrition rate

10%

Currency Volatility

10%

Rising Salaries

9%

Anti-bribery laws

5%

Threats (2013-14)

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

13

Journal of International Business Studies

7. Buyers costs of switching

from one competitor to another?

Yes Yes

8. Are prices and terms of sales

transactions observable?

Yes Yes

9. Can firms adjust prices

quickly?

No No

10. Large and/or infrequent sales

orders?

No, as IT spending is always

huge and strategic oriented.

Yes

11. Use of facilitating

practices (price leadership,

advance announcement of price

changes)?

Yes, Industry has first mover

advantage.

Yes

12. History of cooperative

pricing?

No, it is less as market forces are

highly competitive.

No.

13. Strength of exit barriers? No, entry and exit is easy. No.

Factors Affecting the Threat of Entry

To what extend does the threat or incidence of entry work to erode the profitability of a typical firm in

this industry?

2013-14 2007-08

14. Significant economies of

scale?

Yes Yes

15. Importance of reputation or

established brand loyalties in

purchase decision?

Yes Yes

16. Entrants access to

distribution channels?

Yes, there are strong players in

each segment Tier-I,II and III

companies and focused startups.

Yes

17. Entrants access to raw

materials?

Yes, resources are easily

available.

Yes

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

14

Journal of International Business Studies

18. Entrants access to

technology/know-how?

Yes Yes

19. Entrants access to favorable

locations?

Yes, IT penetrated into tier II &

III cities.

Yes

20. Experience-based

advantages of incumbents?

Yes, Large corporate don't risk

outsourcing to firms of relative

smaller size.

Yes

21. Network externalities:

demand-side advantages to

incumbents from large installed

base?

Yes Yes

22. Government protection of

incumbents?

No No

23. Perceptions of entrants about

expected retaliation of

incumbents/reputations of

incumbents for toughness?

Minimum, industry is diversified

in terms of verticals and

geography and people

dependent.

Minimum, industry is diversified

in terms of verticals and

geography and people

dependent.

Factors Affecting or Reflecting Pressure from Substitute Products and Support from

Complements

To what extend does competition from substitute products outside the industry erode the profitability of

a typical firm in the industry?

2013-14 2007-08

24. Availability of close

substitutes?

Not for all IT solution. Not for all IT solution.

25. Price-value characteristics of

substitutes?

Price of substitutes is generally

high.

Price of substitutes will be high.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

15

Journal of International Business Studies

26. Price elasticity of industry

demand?

High High

27. Availability of close

complements

Yes, hardware Yes

28. Price-value characteristics of

complements?

Price of hardware is

comparatively higher and most

cases it is bundled with software.

Price of hardware is

comparatively higher

Factors Affecting or Reflecting Power of Input Suppliers

To what extend do individual suppliers have the ability to negotiate high input prices with typical firms

in this industry? To what extend do input prices deviate from those that would prevail in a perfectly

competitive input market in which input suppliers act as price takers?

2013-14 2007-08

29. Is supplier industry more

concentrated than industry it

sells to?

Human Resources: High

Hardware: Less

Office space: High

Human Resources: High

Hardware: Less

Office space: High

30. Do firms in industry

purchase relatively small

volumes relative to other

customers of supplier? Is typical

firms purchase volume small

relative to sales of typical

supplier?

Human Resources: No, Yes

Hardware: Yes, Yes

Office space: No, No

Human Resources: No, Yes

Hardware: Yes, Yes

Office space: No, No

31. Few substitutes for

suppliers input?

Human Resources: High

Hardware: Less

Office space: High

Human Resources: High

Hardware: Less

Office space: High

32. Do firms in industry make

relationship-specific investments

to support transactions with

specific suppliers?

Human Resources: Yes

Hardware: Yes

Office space: Relatively no,

being SEZ mostly with

government.

Human Resources: Yes

Hardware: Yes

Office space: No, boom of SEZ.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

16

Journal of International Business Studies

33. Do suppliers pose credible

threat of forward integration into

the product market?

Yes, increasing cases of

supplier/sub contractors

establishing relationship directly

with customers.

Yes

34. Are suppliers able to price

discriminate among prospective

customers according to

ability/willingness to pay for

input?

Yes Yes

Factors Affecting or Reflecting Power of Buyers

To what extend do individual buyers have the ability to negotiate low purchase prices with typical firms

in this industry? To what extent to purchase prices differ from those that would prevail in a market with

a large number of fragmented buyers in which buyers act as price takers?

2013-14 2007-08

35. Is buyers industry more

concentrated than industry it

purchases from?

No, as large number of verticals

and geographies.

No

36. Do buyers purchase in large

volumes? Does a buyers

purchase volume represent large

fraction of typical sellers sales

revenue?

1) Yes, IT deals are large

2) Yes.

1) Yes, usually IT deals are large

2) Yes.

37. Can buyers find substitutes

for industrys product?

Very less, as substitutes are

usually inefficient and difficult

to sustain.

Very less.

38. Do firms in industry make

relationship-specific investments

to support transactions with

specific buyers?

Yes, Customer relationship

management is core strength in

this industry.

Yes, Customer relationship

management is core strength in

this industry.

39. Is price elasticity of demand

of buyers product high or low?

Price elasticity is high Price elasticity is high

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

17

Journal of International Business Studies

40. Do buyers pose credible

threat of backward integration?

No, as outsourcing is cheaper

option.

No

41. Does product represent

significant fraction of cost in

buyers business?

Yes Yes

42. Are prices in the market

negotiated between buyers and

sellers on each individual

transaction or do sellers post a

take-it-or-leave it price that

applies to all transactions?

No, usually services are

negotiated.

No

Key and Critical Success factors: 2007-08 & 2013-14

Critical Success Factors of 2007-08 Critical Success Factors of 2013-14

Diligent senior leadership

Ability to preempt market trends

Price competitiveness

Customer intimacy

Financial position

Abundant and agile talent pool

Abundant and agile talent pool

Diligent senior leadership

Risk management capabilities

Innovation capabilities

Financial position

There has been a change in the major critical success factors of TCS between 2007-08 and 2013-14.

In 2007-08 critical success factors like financial position, abundant and agile talent pool and diligent

senior leadership have been the core success factors for TCS. Considering the effect that the 2008

recession had on the global IT spending, TCSs most vital critical success factors were price

competitiveness and customer intimacy.

The ability of the senior leadership to preempt the global economic scenario was the key for TCS to

implement strategies that focused on these critical success factors.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

18

Journal of International Business Studies

In the interval between 2007-08 and 2013-14, the focus of the IT industry worldwide had shifted

from enterprise software systems to individual centric emerging technologies like mobility and cloud

technology.

This transition occurred owing to the advancement in computing hardware technology giving way for

cheaper access for individuals to access and own devices with high and very high computational

power.

TCS is focused on developing its risk management capabilities and innovation capabilities which are

very important factors when it comes to individual centric emerging technologies.

Considering the demographics of emerging economies the emerging technologies are to grow faster

in these countries than in other major countries.

TCS has ventured into emerging economies and has already made its global presence felt in

important emerging economies where the adoption of emerging technologies is expected to grow at a

higher rate.

Competitive Profile Matrix (CPM)

TCS Infosys CTS IBM HP

Critical Success

Factors

Weight Rating Score Rating Score Rating Score Rating Score Rating Score

Technology/

Innovation

0.1 2 0.2 3 0.3 2 0.2 4 0.4 4 0.4

Price

Competitiveness

0.25 4 1 2 0.5 4 1 2 0.5 2 0.5

Process Quality 0.2 2 0.4 4 0.8 3 0.6 4 0.8 4 0.8

End - to - end

solutions

0.05 3 0.15 3 0.15 1 0.05 3 0.15 4 0.2

Employee

competitiveness

0.15 3 0.45 4 0.6 3 0.45 4 0.6 4 0.6

Financial position 0.1 4 0.4 4 0.4 4 0.4 4 0.4 4 0.4

Management 0.15 4 0.6 2 0.3 3 0.45 4 0.6 3 0.45

3.2 3.05 3.15 3.45 3.35

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

19

Journal of International Business Studies

Perceptual Map based on CPM

Perceptual drawn by grouping critical success factors into external and internal based on nature of the

factor.

Example: Price, Process quality and End-to-End solutions are grouped as external

Technology, Employee competitiveness and financial position management are grouped as internal

Developing the logic of firm

Customer value proposition

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

20

Journal of International Business Studies

Key Resources

Agile Talent Pool

Diligent Senior

Management

Partnerships with

academic institutions

Key Processes

International

Accounting standards

introduced

Compliance stds

introduced

Profit Formula

Fixed cost revenue

model

Cont Margin: 23.58%

Exp/Rev: 59.72%

Net Margin: 21.78%

Wages/Rev: 26.59%

2007 - 2008

2013 - 2014

Profit Formula

Transaction based

revenue model

Cont Margin: 29.09%

Exp/Rev: 52.73%

Net Margin: 22.96%

Wages/Rev: 26.24%

Key Processes

COSO based ERM

policies brought in.

Robust revision of

compliances and Risk

policies

New BR policies

Key Resources

Agile Talent Pool

Diligent Senior

Management

Partnerships with

academic and

scientific institutions

Customer Value Proposition

Operational Effectiveness

Product Leadership

Our products are uniquely better!

Customer Value Proposition

Customer Intimacy

We make things easier for you!

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

21

Journal of International Business Studies

Reasons for the differences in customer value proposition, profit formula, key

resources and processes: 2007-08 & 2013-14

2007-2008 Strategy

The strategies followed by TCS in the year 2007-2008 can be classified as Operational strategies and

Geographical focused strategies.

The operational strategies encompass the Global Network Delivery Model (GNDM), Inorganic Growth

Strategies and Integrated Full Services Play.

The GNDM model

The GNDM was brought with an intent to bring in homogeneous standards across all centers of TCS

i.e. one global service standard. It would also help TCS implement a follow the sun model where the

dependency on geographically distributed centers would decrease bringing in an opportunity to

function seamlessly.

Inorganic growth

TCS aimed at attaining inorganic growth by focusing on different geographies, diverse competencies

and also aimed at acquiring new capabilities that would lead to synergistic growth. Inorganic growth

was a cheaper option to consider because of the availability of cheaper targets during an

economically stressed period.

Integrated Full Services Play

Offering Integrated Full Services Play would enable TCS to capture the entire IT value chain

products, services, consulting, implementation and support.

Focus on Corporate Governance

TCS focused on implementing best practices in corporate governance across all levels in the

organization.

Evolution of this Companys brand identity

TCS considered that they had an implicit promise to provide a level of certainty and excellence to its

customers, that no other IT company can match.

TCSs geographically focused strategies considered opportunities in multiyear relationships with

multiple services in major markets and end to end services in emerging markets.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

22

Journal of International Business Studies

Market Expansion

TCS started a new phase of market expansion by entering new growth markets like Latin America,

China, Middle East and Africa as the Company perceived a significant gap in the market place for

high quality services. The Company started engaging with regional and national champions in these

markets, many of whom have since emerged as our key customers in these newer geographies as well

as globally as they have expanded into other major markets.

Leadership in all forms of people development

TCS started its own program of creating an eco-system for technology talent by working closely with

academic institutions and scientific bodies, initially in India and subsequently globally. TCS had

created a scalable and replicable training model that allowed them to use their training programs at

other centers in India as well as in US, China, Hungary and Uruguay.

Customer Value Proposition

The 2007-08 period was an economically, financially and operationally stressed period for all

companies that rely on IT services to run their businesses. TCS chose to offer a We make things

easier for you (Customer Intimacy) proposition, while its competitors were offering an Our

product is uniquely better (Product Leadership) proposition, which was possible because of three

primary reasons:

Diligent leadership

An abundant and agile talent pool

Sparkling financial health

By offering Customer Intimacy as its primary value proposition during difficult times helped TCS

create a holdup during the brighter days of the economy.

Critical Success Factors

Diligent senior leadership

-5

0

5

10

15

20

25

0

50

100

150

200

250

300

350

2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015

Global IT Spending

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

23

Journal of International Business Studies

Ability to preempt market needs

Price competitiveness

Customer Intimacy

Financial position

An abundant and agile talent pool

2013-2014 Strategy

The Key elements of the companys growth strategy during this period were: Customer centricity, full

services portfolio, global network deliver model, non linear business models, and experience certainty.

Focus on Digital Five Forces - Mobility, Big Data, Social Media, Cloud Computing and Robotics

TCS identified that the impact of the Digital Five Forces on the society would be of a higher

magnitude than the technology cycles, enterprise systems that have driven business in previous

decades. They also were able identify that what the digital five forces were doing, was to complete the

entire transaction loop, by bringing in the most important element of business, the individual

consumer.

0

2

4

6

8

10

12

0

100

200

300

400

2009 2010 2011 2012 2013 2014 2015

Global Enterprise Software Spending

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

24

Journal of International Business Studies

Innovation

The company continues to invest in research and innovation that will meet customer requirements

today, in the near term and in the long term. The three segments of innovation that TCS is focusing on

are: Derivative, Platform, Disruptive innovations. The Company actively pursues collaboration with

academic research and innovative start-up companies to help customers solve problems.

Human resources strategy

The drive to create a homogeneous work culture across the organization helped TCS integrate its

diverse global talent base into a high performing cohesive unit. The company has started to re-imagine

its HR processes, use digital technologies namely, mobile, social, cloud and analytics in an integrated

manner.

Talent management, leadership development and talent retention

The Inspire program continues to identify and develop high-potential employees for leadership roles.

Potential leaders are nurtured through training and coaching and given challenging roles to build

leadership capability.

Risk Management

The increasing global trends in digitization driven by the forces of social, mobility, analytics and

cloud coupled with the large size of the addressable global market and the relatively low current levels

of penetration of the target markets suggest significant headroom for future growth. The Company has

positioned itself well for the growth in business with an aligned strategy, structure and capabilities.

Strategic focus on geographical diversity

0

500

1000

1500

2000

2009 2010 2011 2012 2013 2014 2015* 2016* 2017* 2018*

Global Smartphone Shipments

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

25

Journal of International Business Studies

TCS continues its strategy to focus on APAC, Latin America and Middle East & Africa in order to de-

risk geographical concentration and create a significant presence. Contribution of these new growth

markets to the total revenue almost doubled in the last decade.

Customer Value Proposition

Unlike in 2007-2008, in 2013-2014 TCS offered a Product leadership and operational excellence oriented

customer value proposition. That is TCS focused more on offering an Our products are uniquely better

proposition than on a We make things easier for you proposition.

Critical Success Factors

Abundant and agile talent pool

Diligent senior leadership

Risk management capabilities

Innovation capabilities

0.00%

10.00%

20.00%

30.00%

40.00%

2011 2012 2013 2014 2015* 2016* 2017*

Global Smartphone Penetration

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

26

Journal of International Business Studies

Creating and Sustaining Competitive advantage and Business Model

Analysis of Competitive advantages of TCS

VRIO Framework Analysis

Summary of VRIO, Competitive Implications, and Economic Implications

Parameter Valuable? Rare? Costly

to

Imitate?

Organized

Properly?

Competitive

Implications

Economic

Implications

Geographic

expansion/penetration

and Strategic

alliances

Yes Yes Yes Yes Sustained

Advantage

Above

Normal

Non linear business

models

Yes No No No Competitive

Parity

Low

Normal

Full services portfolio Yes Yes Yes Yes Sustained

Advantage

Above

Normal

Global network

delivery model

Yes No Yes Yes Competitive

Parity

Normal

TCS Co-Innovation

Network

Yes Yes Yes Yes Sustained

Advantage

Above

Normal

Digital 5 forces Yes Yes Yes Yes Sustained

Advantage

Above

Normal

Robust HR systems Yes No Yes Yes Temporary

Advantage

Above

Normal

Near shore model Yes No No Yes Competitive

Parity

Normal

Customer centricity Yes Yes Yes Yes Sustained

Advantage

Above

Normal

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

27

Journal of International Business Studies

Detailed Analysis

Competitive

Advantages

Sustainable Advantage?

Geographic

expansion/penetration

and Strategic

alliances

Yes. TCS penetrated strongly in global geographies both

organically and inorganically through strategic acquisitions like

SITAR Sweden, Alti SA France, Comicrom Chile, TKS Teknosoft

Switzerland, Pearl group UK, FNS Australia etc.

In each of the acquisitions geographic penetration was not the

only objective. TCS ensured that its scope of offering

increases. Example: After completion of TKS and FNS, TCS was

able to offer full fledged software products for banking industry.

TCS ensured it integrates/consolidates/transforms it acquired

entity within a span of 2-3 years to TCS subsidiary in that

corresponding region.

Apart from mergers and Acquisitions(M&A), TCS also formed

strategic alliances(JV) through its subsidiaries in countries like

China and Japan.

TCS formed tripartite Joint Venture between National Software

Export Base, TCS, and Microsoft.

TCS formed (60-40)% JV with Mitsubishi corporation, Japan,

First of its kind by any Indian IT services company.

Non linear business

models

No. We performed a comprehensive analysis of TCS using

operational figures and data sheet of TCS annual report. We found

key performance analysis parameter of IT industry i.e. Revenue

per employee is increasing for the past 5 years. (Please refer to

ratio analysis part of appendix), also number of employees

increased over the same period. however non-linear business of IT

services like product licenses, product implementation fees,

product AMC etc were not increasing over the same period with

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

28

Journal of International Business Studies

the increase in number of resources. (Please refer to TCS Data

sheet, tab "IFRS-PnL,BS-USD" section column: Sale of

Equipment and Software Licenses part of appendix section:

Consolidated Historical Financials)

Hence we could conclude that TCS could not sustain the

competitive advantage by having a portfolio of software products.

Full services portfolio Yes.TCS ensured it provided extensive portfolio of services in IT

Industry. TCS used to execute some Government projects even

though they dont make much margin out of it.

TCS as a policy used to execute some niche services projects at

loss/less profit margin initially to acquire skills in that scope of

services. Example: TCS was just a technology partner for

Motorola Solutions from 2005, however from 2010 onwards TCS

started working on services related to business consulting aspects

of ERP implementation services.

As discussed in section "Geographic expansion/penetration and

Strategic alliances" through each of its acquisition TCS added

additional scope of services/products in its portfolio apart from

geographic penetration.

Project/Services portfolio of TCS would be unique and different

from its competitors. TCS completed projects to clients with 1 mn

to 100 mn revenue and even beyond like fortune 500 companies.

(Please refer to TCS Data sheet, tab " Operating Metrics"

section column: TCS CLIENT METRICS part of appendix:

Consolidated Historical Financials) TCS conducts CAT, India's

renowned B-School aptitude test. TCS in collaboration with MP

Govt. in MPONLINE. TCS has India's largest BPO services. TCS

has renowned banking product suite BANCS. TCS has its own

ERP solution i-ON for SMB business.

Global network

delivery model

No. TCS pioneered the Global Network Delivery Model(GNDM)

in outsourcing industry. In fact TCS obtained the trademark for

GNDM. However over a period almost every outsourced projects

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

29

Journal of International Business Studies

were executed through a modified version of global delivery

model.

Hence there is no significant competitive advantage exist with this

resource.

TCS Co-Innovation

Network

Yes. TCS Co-Innovation Network(COIN) is a rich and diverse

network ecosystem that comprises emergent technology

companies, research labs of academic institutions, leading

technology vendors, venture funds to offer collaborative IT and IT

services innovation for customers. TCS inbuilt innovation labs

coordinates and collaborates with COIN. TCS ensures it offer

value proposition to each partner in this ecosystem. COIN helps

TCS to sense the technology landscape, VC funding pattern in

different emerging technologies and also customer needs through

innovations. Thus COIN helps TCS to find out the market

maturity graph for their service capabilities and thereby predict

future trend of the industry. COIN being a diverse geographical

network, it helps to find out emergence of innovation and VC

funding in a particular geography.

Example: COIN identifies major investment in China is happening

in internet space & Integrated electronics, In Israel funding is

raised for life sciences and clean technology. (Derived from the

White paper on TCS COIN - Emerging Technology trends)

No doubt, COIN helps TCS stay relevant in changing patterns in Industry

also adds to TCS learning curve.

Digital 5 forces Yes. TCS full services portfolio offering and diversified

geographical presence has placed itself ahead in experience curve.

TCS's timely strategic investment in digital 5 forces(cloud, social

media, big data analytics, mobile computing and artificial

intelligence) has helped to develop platform based innovations for

various industries specific problems comprising SMAC

technologies.

Ex: Telecom vertical - TCS Hosted OSS/BSS(HOBS)

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

30

Journal of International Business Studies

Digital forces were disrupting the way in which traditional

business has been operated and managed. Example: Health

checkup has become a ongoing activity. Wearable devices collect

data and feed into cloud(from android devices) which maintains

the history of many individuals. Big data analytics helps to track

and find out any deviation in health factors. If something went

wrong, easily doctor will be intimated using mobile apps.

Robust HR systems Neutral. TCS HR system is robust considering the below facts

TCS is progressive, young and second largest organization

behind IBM in terms of employee strength, At the same

time ensuring having average age of employee as 29 years

and women workforce consisting of 32.7% of total work

force.

High employee retention rate in industry at 88.7%.

Employees represented from 118 nationalities (i.e. all

continents) and deployed in 55 countries.

TCS follows Indian way of campus recruitment(Now online

campus commune channel) even in countries like USA,

Canada, Uruguay, China and Hungary. After recruitment

they were inducted for training in India/Abroad. Thereby

they follow "oneTCS" culture for easy and effective

integration both in paper and practice.

TCS went on to one level ahead in conducting TCS IT Wiz

- India's largest Inter-school competition to serve dual

purpose both social intent and attract them young.

Through Academic Interface program, continually engages

with leading institutions like IIT & IIM's for MDP

programs, Guest Lectures, Internships and PPO's through

case study competitions.

TCS HR strategically recruits fresher's in large number compared

to experienced individuals. Reasons are 1) Good pool of fresh

candidates available in India at low cost 2) Having fresher in

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

31

Journal of International Business Studies

large proportion among its 3,00,000 + workforce helps to even

out the cost incurred in employee salary and perks.

HR system is highly depend on the external environment which is

supportive now in providing talented pool of graduates at low cost.

We are not sure if low cost resources will be available in next 5

years considering the economic growth and inflationary trends in

India.

Near shore model No.TCS enjoyed advantage initially by having its near shore to

North America in Uruguay.TCS expanded the subsequent centers

organically and inorganically in UK, Europe, Japan etc. However

competitors realized the potential of this model and imitated by

opening the centers in same regions.

Customer centricity Yes. We analyzed using real time facts from one of our group

member, who worked with TCS during Global slowdown.

His SBU faced a situation on Nov,2009 where in a leading

financial institution could not release the payment for past two

milestones. Client openly acknowledged their financial situation

and requested TCS management to provide a moratorium period

of 5 months for each of the milestone citing the last 10 year

relationship. TCS management accepted the client request and

allowed its consultants to work on onshore and offshore as usual,

however other technology and business consulting partners

removed their consultants immediately next day and were not

ready to negotiate on any terms towards pending payments.

After he left TCS to pursue MBA, he happened to meet ex-

colleagues in Jan 2014. He came to know that once financial

situation got improved, bank outsourced 5000 people effort to

TCS and TCS was made as the only technology partner. Most of

Vendors(including Wipro and Deloitte) who existed prior to 2009

were removed.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

32

Journal of International Business Studies

TCS roots in TATA values of handling relationship with

customers achieves significant edge over its competitors in

sustaining customer centricity.

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

33

Journal of International Business Studies

Tetra-Threat framework analysis

DIFFICULT TO IMITATE OVERCOMES SUBSTITUTION

NO SLACK HIGH HOLDUP

Hold up of customers

is very high with TCS.

From 2005, revenue from

repeat business is more

than 96% (Please refer to

TCS Data sheet, tab "

Operating Metrics"

section column: Revenue

from Repeat Business

part of Appendix)

TCS has lowest

attrition in the

Industry.Also,great

leadership from thought

leaders Mr. F.C. Kohli

and Mr. Ramadorai.

Mr. N Chandra, current

CEO, though inherited

stable company. He

managed the organization

well post global slow

down.

TCS faces genuine threat

of subsituting its IT

solutions by products and

viceversa. however TCS

mitigates this risk by

diversifying its services

and packaged solution

offering.

TCS mitigates the risk of

imitation in three horizon

of innovations derivative,

disruptive and platform

based innovation guided

by specialist HBS

Prof.Christensen. Hence

resources and processes

are continuosly

innovated.

TATA group business

values, code of

conduct & support

to TCS is not

imitable.

ADDED VALUE

VALUE APPROPRIATED

Journal of International Business Studies

(2004) 35, 318

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

34

Journal of International Business Studies

Business model of TCS (2013-14)

Value loop

Flexible Consequences leading to competitive advantage

TCS business acumen is two-pronged: one one hand, the company has been able to successfully

preempt competitors games and core-competencies, and on the other hand, align its

resources efficiently to equip itself with assets and qualities in order to counterbalance competitors

advantages. The organization clearly knew about the perishability of technological advantages and the

commoditization of a human-resource advantage in the IT industry; and began using their first-moves to

build into greater levels of customer satisfaction and cost-leadership, instead of focusing on leveraging

its opportunities to eat into market share. Given the financial and marketing backing

of a huge brand name which spelled trust in India, TCS realized rightly that they were the best-suited

company to undertake a cost-leadership strategy, yet they acknowledged that they could not sustain its

leadership without earning loyal customers across the world, who were looking for top quality services.

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

35

Journal of International Business Studies

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

36

Journal of International Business Studies

Model (2013-14)

Learning

How TCS experienced "Certainty"?: Transition from one of the top Indian IT Player to

India's largest company.

Before 2007-2008, TCS was neither India's no.1 in market capitalization nor a big difference

existed between TCS and Infosys. TCS sensed the externalities and predicted key success factor to

thrive and succeed in the industry very well. TCS anticipated correctly that outcome of the

recession will be enforcement of Stringent International compliances, protectionist measures, need

of innovative cost efficient technologies and availability of cheap resources. TCS build strategies

to convert each of the outcomes of recession to its competitive advantage. TCS focused on

geographical penetration in depth and width; today TCS has agile HR system which could place

resource from any corner of the world to service its global clients. Also, TCS has very strong local

presence in all developed economies hence unaffected by protectionist measures. TCS adopted

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

37

Journal of International Business Studies

international standards and policies on compliance and regulation; thus helped its brand getting

unaffected in controversial business clauses unlike its competitors.

TCS adopted customer intimacy and cost efficiency as key strategies, both turn to be successful

in helping TCS deliver large projects at less cost. Also, TCS purchased/leased key assets in India

i.e. 15-20 kms away from all leading tier I and II cities.

Suggestion

How TCS could continue "Experience Certainty" for next 5-10 years?

TCS achievement in terms of revenue were achieved by global competitors like IBM, Accenture and HP

at much less number of resources; less cost due to their concrete strategy in execution of non linear

business model. i.e. IBM bundles product and service at higher fees; Accenture offers more high end

consulting services. TCS competitors in India, namely Cognizant (CTS) offers high end consulting

services and has strong penetration in North America, whereas Infosys focuses on adding innovative

products and packaged solution to its portfolio. With the change of industry environment in terms of

rising in salaries, trend towards commodity of existing service offering, protectionist measures and

success factor of Industry evolved with disruption of existing customer business model by digital 5

forces; there is a greater need to have additional resources with greater scope of skills to increase non-

linear revenue model. Resource intensive i.e. linear model to thrive in IT industry might not be

successful. Hence there is a greater need for TCS to improve upon its portfolio scope to offer non-linear

revenues. As concluded in the article by Ramon Casadeus-Masanell and Jorge Tarzijan article on 'When

one business model isn't enough" we draw the similar analogy to stress upon the need for

complementary business model to add on to the non-linear revenues in future to thwart the competitive

forces. TCS has decades of strong experience on IT services and it has presence in major Forbes 500

companies, Hence there exist a greater scope to extend its current Global consulting practice to offer

high end business consulting. Also, TCS could look for strategic acquisition of firms offering high end

strategic consulting services.

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

38

Journal of International Business Studies

Appendix

1. RATIO ANALYSIS

Ratio

Analysis Unit

FY FY FY FY FY FY FY FY FY FY

2013-14 2012-13 2011-12 2010-11 2009-10 2008-09 2007-08 2006-07 2005-06

2004-

05

Critical Ratios - IT/Knowledge industry

Total revenue C

81809.3

6

62989.4

8

48893.8

3

37324.5

1

30028.9

2

27812.8

8

22619.5

2

18685.2

1

13263.9

9

9748.4

7

Total

Headcount as

at March 31 Num 300464 276196 238583 198614 160429 143761 111407 89419 66480 45714

Revenue Per

Employee C 0.2723 0.2281 0.2049 0.1879 0.1872 0.1935 0.2030 0.2090 0.1995 0.2132

Ratios - Financial performance

Employee

cost/total

revenue % 49.49 50.68 50.48 50.38 50.17 52.07 50.45 48.17 46.08 44.98

Other

operating

cost/total

revenue % 19.77 20.68 19.99 19.67 20.88 22.15 24.3 24.32 26.15 26.16

Total

cost/total

revenue % 69.25 71.36 70.48 70.05 71.05 74.22 74.75 72.5 72.22 71.14

EBIDTA

(before other

income)/

% 30.75 28.64 29.52 29.95 28.95 25.78 25.25 27.5 27.78 28.86 total revenue

Prot before

tax/total

revenue % 31.05 28.72 28.48 29.53 27.61 22.11 25.84 26.32 26.44 27.02

Tax/total

revenue % 7.42 6.37 6.95 4.91 3.99 3.02 3.48 3.55 3.84 4.07

Effective tax

rate -

tax/PBT % 23.9 22.19 24.42 16.61 14.44 13.64 13.45 13.5 14.53 15.07

Profit after

tax/total

revenue % 23.43 22.09 21.3 24.3 23.31 18.9 22.22 22.55 22.37 20.28

Ratios - Growth

Revenue % 29.88 28.83 31 24.3 7.97 22.96 21.06 40.87 36.06 . !

EBIDTA

(before other

income) % 39.43 24.97 29.14 28.57 21.27 25.54 11.14 39.48 30.94 . !

Prot after

tax % 37.7 33.65 14.84 29.53 33.18 4.58 19.31 42 50.07 . !

Ratios - Balance Sheet

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

39

Journal of International Business Studies

Debt-equity

ratio times 0.01 0.01 0 0 0.01 0.04 0.04 0.06 0.02 0.06

Current ratio times 2.74 2.69 2.22 2.35 1.88 2.26 2.24 2.24 2.25 2.24

Days sales

outstanding

(DSO)

days 81 82 86 80 71 79 87 84 90 77 in ` terms

Days sales

outstanding

(DSO)

days 82 82 81 82 74 74 87 88 90 78 in $ terms

Invested

funds / total

assets % 43.01 36.38 34.81 36.81 45.68 26.29 28.97 27.03 17.67 17.92

Capital

expenditure /

total revenue % 3.8 4.18 4.06 4.85 3.43 3.95 5.58 6.64 4.69 3.72

Operating

cash ows /

total revenue % 18.03 18.44 14.27 17.72 24.66 19.45 17.22 18.58 18.76 21.46

Free cash

ow/operatin

g cash ow % 78.9 77.33 71.52 72.66 86.07 79.7 67.6 64.25 74.97 82.64

Depreciation

/ average

gross block % 10.57 10.25 10.65 10.35 10.78 11.13 15.05 17.1 18.09 13.57

Ratios - per share

EPS -

adjusted for

bonus ` 97.67 70.99 53.07 46.27 35.67 26.81 25.68 21.53 15.16 11.84

Price earning

ratio, end of

year times 21.79 22.14 22.01 25.56 21.89 10.07 15.79 28.97 31.57 30.23

Dividend per

share ` 32 22 25 14 20 14 14 13 13.5 11.5

Dividend per

share -

adjusted for

bonus ` ` 32 22 25 14 20 7 7 5.75 3.38 2.88

Market

capitalisation

/ total

revenue times 5.1 4.88 4.67 6.2 5.09 1.9 3.51 6.53 7.06 7.05

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

40

Journal of International Business Studies

2. Consolidated Historical Financials

TCS_Data_Sheet.xls

x

https://drive.google.com/file/d/0B_ZF3pDhMAHpdVlZbnUyNUhsb2s/edit?usp=sharing

3. Facts about TCS Co-Innovation Network(COIN)

1. Overview of startups in TCS COIN

Company Area

Aito Technologies Customer Experience Analytics

Activeo Real-time Contact Center Performance Monitoring

Attensity Sentiment Analysis, Social Media Monitoring

Avhan Unified Customer Interaction Process

Cicero Desktop Activity Intelligence and Improvement

Software, Enterprise Mobility

Clarabridge Sentiment Analysis, Social Media Monitoring

ESQ Business Transaction Management

iKen Solutions AI-based Consumer Analytics Platform

Inbenta Semantic Virtual Assistant

Jacada Customer Experience Management

Kaltura Video Content Management

Kana CRM Solutions for Customer Experience

Management

Knoahsoft Workforce Optimization

Neospeech Text to Speech Engine

OpenSpan User Process Improvement / User Experience

Perpetuuiti Disaster Recovery Management

Seclore Information Rights Management

SmartConnect Customer Interaction Management

Reinventing the Business Model - TCS Atul, Aravind, Siva, Mathan & Srikanth

41

Journal of International Business Studies

Testplant Automation and Software Application Testing

VeryDay Service Design, Product Design and Interaction

Design

2. TCS Brochure on TCS Co-Innovation Network

https://drive.google.com/file/d/0B_ZF3pDhMAHpRUZvNGczejRlMkk/edit?usp=sharing

3. White paper on TCS COIN - Emerging Technology trends

https://drive.google.com/file/d/0B_ZF3pDhMAHpNnFYa29Dd0JDUzA/edit?usp=sharing

References

TCS COIN communications(coin.queries@tcs.com) (2011) white paper on 'The TCS COIN Emerging Technology

Trends Report 2011' pages:

TCS COIN communications(coin.queries@tcs.com) (2014) brochure on 'Co-Innovation Network (COIN) Synergies in the

Innovation Space' pages:

Mr. Kedar Shirali (Head, Investor Relations - TCS) (2014) data sheet on 'Consolidated historical financials' tab: IFRS-

PnL,BS-USD, Operating Metrics

Ramon Casadeus-Masanell and Jorge Tarzijan article on 'When one business model isn't enough'

Mark W.Johnson,Clayton Christensen and Henning Kagermann article on "Reinventing your business model"

Thomas Eiesmann article on "Business model analysis for Entrepreneurs"

Mr. Kedar Shirali (Head, Investor Relations - TCS) (2014) 'Annual Reports' year: 2007-08 & 2013-14

Mr. Nandhi Keswaran, Consultant, Delivery manager - TCS

Das könnte Ihnen auch gefallen

- Role CFODokument32 SeitenRole CFOChristian Joneliukstis100% (1)

- How To Create Custom Concurrent RequestsDokument12 SeitenHow To Create Custom Concurrent Requestskilarihari100% (1)

- Business Model For NetflixDokument8 SeitenBusiness Model For NetflixJacques OwokelNoch keine Bewertungen

- Q1. What Are The Organizational and Operational Issues That Underlie The Problems Facing BPS?Dokument5 SeitenQ1. What Are The Organizational and Operational Issues That Underlie The Problems Facing BPS?Munsif JavedNoch keine Bewertungen

- India StartupsDokument24 SeitenIndia StartupsjyotiNoch keine Bewertungen

- Accenture Project Report E1Dokument13 SeitenAccenture Project Report E1AgA0% (1)

- Post Jio Impact - Research Project PDFDokument12 SeitenPost Jio Impact - Research Project PDFVeera JainNoch keine Bewertungen

- BSNLDokument8 SeitenBSNLnarendramohan27289100% (1)

- Project On SpicesDokument96 SeitenProject On Spicesamitmanisha50% (6)

- Submitted To: Submitted By: Prof - Shalini Khandelwal Anchal Sethi Vineet Garg Bhaaveya Jain PrakharDokument26 SeitenSubmitted To: Submitted By: Prof - Shalini Khandelwal Anchal Sethi Vineet Garg Bhaaveya Jain PrakharVineet GargNoch keine Bewertungen

- Jio Case StudyDokument15 SeitenJio Case StudyAmal Raj SinghNoch keine Bewertungen

- Tata Motors Siebel Case StudyDokument4 SeitenTata Motors Siebel Case Studysridhar_eeNoch keine Bewertungen

- Co Branding Strategy For Tcs Value, Image and Other IssuesDokument97 SeitenCo Branding Strategy For Tcs Value, Image and Other Issuesak302Noch keine Bewertungen

- Cloudstrat Case StudyDokument10 SeitenCloudstrat Case StudyAbhirami PromodNoch keine Bewertungen

- Marketing Mix of TATA MOTORS: 1. ProductDokument5 SeitenMarketing Mix of TATA MOTORS: 1. ProductArpit JaiswalNoch keine Bewertungen

- Case Study HenkelDokument21 SeitenCase Study HenkelMai Khánh100% (1)

- Research Report On Bharti Airtel Limited.Dokument15 SeitenResearch Report On Bharti Airtel Limited.bhalussNoch keine Bewertungen

- Case 1 - ERP StoryDokument2 SeitenCase 1 - ERP StoryRam Kumar Servai0% (1)

- Fractal AnalyticsDokument22 SeitenFractal Analyticsrohitpatil22267% (3)

- Digital Innovation at Toyota Motor North AmericaDokument19 SeitenDigital Innovation at Toyota Motor North Americaarun singhNoch keine Bewertungen

- Big SpaceshipDokument2 SeitenBig Spaceshipcpaking23Noch keine Bewertungen

- ERP Story: Key Elements of ABS Project SuccessDokument4 SeitenERP Story: Key Elements of ABS Project SuccessAnkit Sachdeva100% (1)

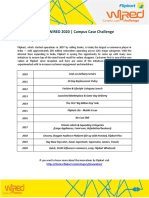

- WiRED 4.0 Business Case Study PDFDokument4 SeitenWiRED 4.0 Business Case Study PDFrohitNoch keine Bewertungen

- MOGLIX ProfileDokument2 SeitenMOGLIX ProfilePranjal KanwarNoch keine Bewertungen

- Infosys StrategiesDokument4 SeitenInfosys StrategiesSohini Das100% (1)

- GATIDokument25 SeitenGATIAryan SarohaNoch keine Bewertungen

- Analysis of Key Financial Ratios for Sun PharmaDokument12 SeitenAnalysis of Key Financial Ratios for Sun PharmaPuneet Singh DhaniNoch keine Bewertungen

- TBR Wipro LeanDokument8 SeitenTBR Wipro LeanAnonymous fVnV07HNoch keine Bewertungen

- Digital Transformation in TQMDokument26 SeitenDigital Transformation in TQMHarsh Vardhan AgrawalNoch keine Bewertungen

- Strategic Analysis of InfosysDokument40 SeitenStrategic Analysis of InfosysMaruti VagmareNoch keine Bewertungen

- Ashok's TCS Project Report NewDokument150 SeitenAshok's TCS Project Report NewRaja Sekhar100% (2)

- Tata Motors Siebel CasestudyDokument4 SeitenTata Motors Siebel Casestudyvikramgupta1950100% (7)

- KM at TCS A Case StudyDokument6 SeitenKM at TCS A Case StudyVandana SinghNoch keine Bewertungen

- TATA DoCoMo ETOP, PESTEL, SAP, SWOTDokument10 SeitenTATA DoCoMo ETOP, PESTEL, SAP, SWOTSrikanth Kumar Konduri60% (5)

- Business Intelligence Tools ComparisonDokument10 SeitenBusiness Intelligence Tools ComparisonAbner AugustoNoch keine Bewertungen

- TATA Motors ValuechainDokument24 SeitenTATA Motors ValuechainBhawana SinhaNoch keine Bewertungen

- GD-WAT Bible 2019 01 21 PDFDokument109 SeitenGD-WAT Bible 2019 01 21 PDFTushar Mani AgarwalNoch keine Bewertungen

- Quest MBA EnI Pragya Budhathoki Assignment IIDokument8 SeitenQuest MBA EnI Pragya Budhathoki Assignment IIpragya budhathokiNoch keine Bewertungen

- GSTDokument13 SeitenGSTPrakarsh Aren0% (2)

- EDW at HDFCDokument26 SeitenEDW at HDFCYogesh YadavNoch keine Bewertungen

- Natarajan ChandrasekaranDokument2 SeitenNatarajan ChandrasekaranNaganathan RajendranNoch keine Bewertungen