Beruflich Dokumente

Kultur Dokumente

1701 Aif

Hochgeladen von

JOHAYNIE0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

61 Ansichten7 Seiten1701-AIF(99)

Originaltitel

1701-AIF(99)

Copyright

© © All Rights Reserved

Verfügbare Formate

XLS, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1701-AIF(99)

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

61 Ansichten7 Seiten1701 Aif

Hochgeladen von

JOHAYNIE1701-AIF(99)

Copyright:

© All Rights Reserved

Verfügbare Formate

Als XLS, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 7

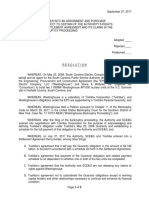

(To be filled up by the BIR )

DLN: PSIC: PSOC:

1 For the Year 2 Category: Taxpayer/Filer Self-Employed Professional Estate

(YYYY) (Mark one) Spouse

Part I B a c k g r o u n d I n f o r m a t i o n

3 Taxpayer 3

Identification No.

4 Taxpayer's Name (Name of Decedent / Trust Account) (Last Name, First Name, Middle Initial for Individuals)

4

5 Name of Administrator / Trustee (If Individual, Last Name first, followed by First Name and Middle Initial)

5

6A Method of Inventory Valuation 6B Method of Bookkeeping 6C Kind of Books Registered

(Specify)

Manual Computerized Loose-leaf Bound

Part II I n c o m e S t a t e m e n t

Comparative

Previous Year Current Year

7 Gross Sales/Revenues/Receipts/Fees

7A 7B

8 Share from General Professional Partnership Income 8A 8B

9 Less: Sales Returns and Allowances 9A 9B

Sales Discounts 9C 9D

10 Net Sales/Revenues/Receipts/Fees (Item 7 and 8 less Item 9)

10A 10B

11 Less: Cost of Sales/Services (Schedule 1)

11A 11B

12 Gross Profit from Operations (Item 10 less Item 11) 12A 12B

Add: Non-operating Income

13 Gain from Sales / Exchanges of Real Properties (Sch.4) 13A 13B

14 Gain from Sales / Exchanges of Other Fixed Assets,Scrap, etc. 14A 14B

15 Gain from Sales / Exchanges of Stocks 15A 15B

16 Other Income (Schedule 5) 16A 16B

17 Total Gross Income (Sum of Items 12 to 16)

17A 17B

Less: Expenses

18 Salaries and Allowances 18A 18B

19 Fringe Benefit 19A 19B

20 SSS, GSIS, Medicare, HDMF and Other Contributions 20A 20B

21 Commission 21A 21B

22 Outside Services

22A 22B

23 Advertising

23A 23B

24 Rental 24A 24B

25 Insurance 25A

25B

26 Royalties 26A 26B

27 Repairs and Maintenance

27A 27B

28 Representation and Entertainment

28A 28B

29 Transportation and Travel 29A 29B

30 Fuel and Oil 30A 30B

31 Communication, Light and Water

31A 31B

32 Supplies

32A 32B

33 Interest 33A 33B

34 Taxes and Licenses (Schedule 2) 34A 34B

35 Losses

35A 35B

36 Bad Debts 36A 36B

37 Depreciation 37A 37B

38 Amortization of Intangibles 38A 38B

39 Depletion 39A 39B

40 Charitable Contribution 40A 40B

41 Research and Development 41A 41B

42 Amortization of Pension Trust Contribution 42A 42B

43 Miscellaneous 43A 43B

44 Total Expenses (Sum of Items 18 to 43) 44A 44B

45 Net Income/ (Loss) (Item 17 Less Item 44) 45A 45B

Account

1701AIF

Information Form

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Self-Employed and Professional Individuals/

Estate and Trusts (Engaged in Trade or Business)

(To be accomplished & filed with BIR Form No. 1701

unless taxpayer opted for Optional Standard Deduction)

July 1999 (ENCS)

BIR Form 1701AIF (ENCS) - Page 2

Part III B a l a n c e S h e e t

Assets Beginning Ending

Current Assets

46 Cash on Hand and in Banks 46A 46B

47 Marketable Securities 47A 47B

48 Accounts Receivable - Trade 48A 48B

49 Less: Allowance for Bad Debts 49A 49B

50 Net Accounts Receivable - Trade 50A 50B

51 Other Receivables 51A 51B

Inventory

52 Finished Goods / Merchandise 52A 52B

53 Goods in Process 53A 53B

54 Raw Materials 54A 54B

55 Supplies 55A 55B

56 Total Inventory (Sum of Items 52 to 55) 56A 56B

57 Prepayments 57A 57B

58 Total Current Assets (Sum of Items 46, 47, 50, 51, 56 & 57) 58A 58B

Long-Term Investments

59 Stocks and Bonds 59A 59B

60 Real Estate 60A 60B

61 Others 61A 61B

62 Total Long-Term Investments (Sum of Items 59 to 61) 62A 62B

Fixed Assets

63 Land 63A 63B

64 Building 64A 64B

65 Less: Accumulated Depreciation 65A 65B

66 Net Book Value - Building 66A 66B

67 Other Depreciable Assets 67A 67B

68 Less: Accumulated Depreciation 68A 68B

69 Net Book Value - Other Depreciable Assets (Item 67 less Item 68) 69A 69B

70 Fixed Asset - Appraisal Increase 70A 70B

71 Less:Accum. Dep'n-Appraisal Increase 71A 71B

72 Net Book Value (Item 70 less Item 71) 72A 72B

73 Total Fixed Assets (Sum of Items 63, 66, 69 & 72) 73A 73B

74 Other Assets 74A 74B

75 Total Assets (Sum of Items 58, 62, 73 & 74) 75A 75B

LIABILITIES AND OWNER'S EQUITY

Current Liabilities

76 Accounts Payable - Trade 76A 76B

77 Other Payables 77A 77B

78 Total Current Liabilities (Sum of Items 76 & 77) 78A 78B

Long-Term Liabilities

79 Long-Term Debts 79A 79B

Deferred Credits / Other Liabilities

80 Deferred Credits/Other Liabilities 80A 80B

81 Total Liabilities (Sum of Items 78 to 80) 81A 81B

Owner's Equity

82 Balance, January 1 82A 82B

83 Additional Investment/Donated Capital 83A 83B

84 Net Income/(Loss) 84A 84B

85 Appraisal Capital 85A 85B

86 Drawings 86A 86B

87 Balance, December 31 (Sum of Items 82 to 85 less Item 86) 87A 87B

88 Total Liabilities and Owners Equity ( Sum of Items 81 and 87) 88A 88B

Schedule 1 BREAKDOWN OF COST OF SALES/SERVICES

A. For Trading Entity:

89 Merchandise Inventory, Beginning 89A 89B

90 Add: Purchases 90A 90B

91A/B Add: Freight In 91A 91B

91C/D Less: Purchase Returns and Allowances

91C 91D

91E/F Purchase Discounts

91E 91F

91G/H Net Purchases

91G 91H

92 Goods Available for Sale (Sum of Items 89 & 91D) 92A 92B

93 Less: Merchandise Inventory, Ending 93A 93B

94 Total Cost of Sales (Item 92 less item 93) 94A 94B

BIR Form 1701AIF(ENCS) - Page 3

BREAKDOWN OF COST OF SALES/SERVICES (continuation)

B. For Manufacturing Entity:

95 Raw Materials Inventory, Beginning 95A 95B

96 Add: Purchases 96A 96B

97A/B Add: Freight In 97A 97B

97C/D Less: Purchase Returns and Allowances 97C 97D

97E/F Purchase Discounts 97E 97F

97G/H Net Purchases 97G 97H

98 Raw Materials Available For Use (Sum of Items 95 & 97 ) 98A 98B

99 Less: Raw Materials Inventory, Ending 99A 99B

100 Total Raw Materials Used ( Item 98 less Item 99) 100A 100B

101 Direct Labor 101A 101B

102 Manufacturing Overhead:

103 Supervision & Indirect Labor 103A 103B

104 Supplies 104A 104B

105 Rental 105A 105B

106

Outside Services

106A 106B

107 Communication, Light & Water 107A 107B

108 Taxes and Licenses (Schedule 2) 108A 108B

109 Depreciation 109A 109B

110 Others 110A 110B

111

Total Manufacturing Overhead (Sum of Items 103 to 110)

111A 111B

112 Total Manufacturing Costs (Sum of Items 100, 101 & 111) 112A 112B

113 Add: Work in Process, Beginning 113A 113B

114 Less: Work in Process, Ending 114A 114B

115 Total Cost of Goods Manufactured 115A 115B

116 Add: Finished Goods Inventory, Beginning 116A 116B

117 Less: Finished Goods Inventory, Ending 117A 117B

118

Total Cost of Goods Manufactured & Sold

118A 118B

C. For Service Entity:

119 Direct Charges - Salaries, Wages & Benefits 119A 119B

120 Direct Charges - Materials & Supplies 120A 120B

121 Direct Charges - Rental 121A 121B

122 Direct Charges - Depreciation (Schedule 4) 122A 122B

123 Direct Charges - Outside Services 123A 123B

124 Direct Charges - Others 124A 124B

125 Total Cost of Services (Sum of Items 119 to 124) 125A 125B

Schedule 2

Schedule of Taxes and Licenses

Kind of Tax Official Receipt No. Date Paid Amount

126A 126B 126C 126D

127A 127B 127C 127D

128A 128B 128C 128D

129A 129B 129C 129D

130A 130B 130C 130D

131A 131B 131C 131D

132A 132B 132C 132D

133A 133B 133C 133D

134A 134B 134C 134D

135 Total 135D

Schedule 3 Schedule of Income - producing Properties

Property Nature of Income Amount of Income

136A 136B 136C

137A 137B 137C

138A 138B 138C

139A 139B 139C

140A 140B 140C

141A 141B 141C

142A

142B

142C

143A

143B

143C

144A

144B

144C

145 Total 145

Trust

Comparative

Account

1701AIF

Information Form

Republika ng Pilipinas

Kagawaran ng Pananalapi

Kawanihan ng Rentas Internas

For Self-Employed and Professional Individuals/

Estate and Trusts (Engaged in Trade or Business)

(To be accomplished & filed with BIR Form No. 1701

unless taxpayer opted for Optional Standard Deduction)

July 1999 (ENCS)

BIR Form 1701AIF (ENCS) - Page 2

B a l a n c e S h e e t

Ending

BIR Form 1701AIF(ENCS) - Page 3

BREAKDOWN OF COST OF SALES/SERVICES (continuation)

Schedule of Taxes and Licenses

Amount

BIR Form No. 1701AIF (ENCS) - Page 4

Schedule 4 Sales / Exchanges of Real Properties - (Attach Additional Sheets, if Necessary)

Description of Property Selling Price/Fair Market Value Costs & Expenses/Book Value Gain / (Loss) Creditable Tax Withheld Capital Gains Tax Paid

146A 146B 146C 146D 146E 146F

147A 147B 147C 147D 147E 147F

148A 148B 148C 148D 148E 148F

149A 149B 149C 149D 149E 149F

150 Total 150A 150B 150C

Schedule 5 Schedule of Other Income (Note: If income is tax-exempt, place an "X" under the Exempt column)

Nature of Income Amount of Income Creditable Tax Withheld Final Tax Withheld /Paid Exempt

151 Interest 151A 151B 151C 151D

152 Rental 152A 152B 152C 152D

153 Fees/Commission 153A 153B 153C 153D

154 Dividend 154A 154B 154C 154D

Income from Other Sources:

155 155A 155B 155C 155D

156 156A 156B 156C 156D

157 157A 157B 157C 157D

158 Total 158A 158B 158C 158D

Schedule 6 ( For Estates and Trusts ) Payments to Heirs/Beneficiaries (Attach Additional Sheets if Necessary)

Name TIN Amount Tax Withheld

159A 159B 159C 159D

160A 160B 160C 160D

161A 161B 161C 161D

162A 162B 162C 162D

163 Total 163A 163B

I declare, under the penalties of perjury, that this return has been made in good faith, verified by me, and to the best of my knowledge and belief,

is true and correct, pursuant to the provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof.

164

Taxpayer's Signature Over Printed Name

Note: Attach additional sheets, if necessary

* If Taxpayer's income is from long-term contracts, the tax return shall, likewise, be accompanied by Certificates of Percentage

of Completion during the taxable year of the projects performed under existing contracts issued and signed by the Architect or Engineer.

* Husband and wife earning business and/or professional income shall accomplish separate Account Information Forms

(Form 1701AIF-1) for their respective businesses/professions.

* Attach additional sheets to the Income Tax Returns and Account Information Forms, if necessary

Das könnte Ihnen auch gefallen

- Deed of Absolute Sale 2Dokument2 SeitenDeed of Absolute Sale 2michael lumboyNoch keine Bewertungen

- Pantawid Pasada Program Recipients - Partial List PDFDokument201 SeitenPantawid Pasada Program Recipients - Partial List PDFTaek WoonNoch keine Bewertungen

- Ayala Land, Inc. Documentary Requirements, Conditions and Policies Governing Property OffersDokument3 SeitenAyala Land, Inc. Documentary Requirements, Conditions and Policies Governing Property OffersJojo Aboyme CorcillesNoch keine Bewertungen

- Contract To Sell Helen CagayanDokument3 SeitenContract To Sell Helen CagayanMarton Emile DesalesNoch keine Bewertungen

- Form 38 ApplicationDokument2 SeitenForm 38 ApplicationEliseo C. Alibania, Jr.Noch keine Bewertungen

- Extrajudicial Settlement of Estate - SAKLAWDokument7 SeitenExtrajudicial Settlement of Estate - SAKLAWRC Farms TalakagNoch keine Bewertungen

- 1701A Annual Income Tax ReturnDokument1 Seite1701A Annual Income Tax ReturnmoemoechanNoch keine Bewertungen

- 1701A Annual Income Tax ReturnDokument2 Seiten1701A Annual Income Tax ReturnJaneth Tamayo NavalesNoch keine Bewertungen

- HLF065 ChecklistRequirementsWindow1Accounts V05Dokument2 SeitenHLF065 ChecklistRequirementsWindow1Accounts V05Jerson OboNoch keine Bewertungen

- Special Power of Attorney for Property PurchaseDokument2 SeitenSpecial Power of Attorney for Property PurchaseJohn Clefford LapezNoch keine Bewertungen

- Special Power of Attorney For Sellers (HQP-HLF-274, V01) - FilloutDokument2 SeitenSpecial Power of Attorney For Sellers (HQP-HLF-274, V01) - FilloutAnne Cauan100% (1)

- How To Enroll EfpsDokument18 SeitenHow To Enroll EfpsAdyNoch keine Bewertungen

- DIGITAL Customer Update FormDokument1 SeiteDIGITAL Customer Update FormConnie NudaloNoch keine Bewertungen

- Broker Accreditation ContractDokument2 SeitenBroker Accreditation ContractMiriam RamirezNoch keine Bewertungen

- PayslipDokument3 SeitenPayslipBoy Ice PickNoch keine Bewertungen

- Philippines Capital Gains Tax Return Form 1707Dokument2 SeitenPhilippines Capital Gains Tax Return Form 1707Anne VallaritNoch keine Bewertungen

- @properties Exclusive Marketing AgreementDokument2 Seiten@properties Exclusive Marketing AgreementPeter AngeloNoch keine Bewertungen

- Transfer of Land Ownership ApprovedDokument4 SeitenTransfer of Land Ownership ApprovedAngie DouglasNoch keine Bewertungen

- OmnibusSwornStatement-NEW Bidding Format PDFDokument2 SeitenOmnibusSwornStatement-NEW Bidding Format PDFMichelle S. AlejandrinoNoch keine Bewertungen

- Request Certified Tax Declaration CopyDokument1 SeiteRequest Certified Tax Declaration CopyAnthony RizaldNoch keine Bewertungen

- Advance Receipt BlankDokument1 SeiteAdvance Receipt BlankRajesh VermaNoch keine Bewertungen

- Daily Accomplishment Report SampleDokument1 SeiteDaily Accomplishment Report SampleNah ReeNoch keine Bewertungen

- Sample Draft For Mayor's PermitDokument1 SeiteSample Draft For Mayor's PermitJireh Mae CorderoNoch keine Bewertungen

- Contract To Sell: WitnessethDokument4 SeitenContract To Sell: WitnessethNicki BombezaNoch keine Bewertungen

- SSS R3 Contribution Collection List in Excel FormatDokument2 SeitenSSS R3 Contribution Collection List in Excel FormatChristopher Daniels0% (2)

- FSED 2F Application Form FSIC For Occupancy Permit Rev02Dokument1 SeiteFSED 2F Application Form FSIC For Occupancy Permit Rev02JuenNoch keine Bewertungen

- Bulacan InvestigationDokument12 SeitenBulacan InvestigationAnonymous tyY1qUNoch keine Bewertungen

- Landlord Rental Increase LetterDokument2 SeitenLandlord Rental Increase LetterNellie LennieNoch keine Bewertungen

- DATA On LGU Plantilla PositionsDokument1 SeiteDATA On LGU Plantilla PositionsArvin EsoenNoch keine Bewertungen

- Film Investor Funding ContractDokument8 SeitenFilm Investor Funding Contractconstantineganosis772Noch keine Bewertungen

- Tax Refund LetterDokument1 SeiteTax Refund LetterClaire MeredithNoch keine Bewertungen

- RSS Form 2-BDokument2 SeitenRSS Form 2-BCee Silo AbanNoch keine Bewertungen

- The Brinton Firm RetainerDokument9 SeitenThe Brinton Firm RetainerJason VertezNoch keine Bewertungen

- Development Permit ApplicationDokument1 SeiteDevelopment Permit ApplicationCityofLulingTXNoch keine Bewertungen

- Apply Certificate Non-CoverageDokument1 SeiteApply Certificate Non-CoveragehellojdeyNoch keine Bewertungen

- 2307Dokument16 Seiten2307Marjorie JotojotNoch keine Bewertungen

- The Columns Legazpi Village MakatiDokument32 SeitenThe Columns Legazpi Village MakatiSari EspinaNoch keine Bewertungen

- Checklist of Documentary Requirements On Sale of Real Property Rmo15 - 03anxa2 PDFDokument1 SeiteChecklist of Documentary Requirements On Sale of Real Property Rmo15 - 03anxa2 PDFCavinti LagunaNoch keine Bewertungen

- Special Power of AttorneyDokument1 SeiteSpecial Power of AttorneyFrancis DayoNoch keine Bewertungen

- Education Service Contracting: Application Form ESC Form 1Dokument3 SeitenEducation Service Contracting: Application Form ESC Form 1alexzandra marie posadasNoch keine Bewertungen

- Order of Survey of Mineral Rights (Mineral Agreement/Financial and Technical Assistance Agreement)Dokument3 SeitenOrder of Survey of Mineral Rights (Mineral Agreement/Financial and Technical Assistance Agreement)regina maximoNoch keine Bewertungen

- Agreement For The Installation of Closed Circuit Television System (CCTV) For Mateussen Software, IncDokument2 SeitenAgreement For The Installation of Closed Circuit Television System (CCTV) For Mateussen Software, IncVilly CenitaNoch keine Bewertungen

- Memorandum of Payment - RobosaDokument5 SeitenMemorandum of Payment - RobosaFaye RegachoNoch keine Bewertungen

- Mortgage Contract: JOSEPH DUMULONG, Filipino, of Legal Age, Residing at 16 Property ST., GSIS VillageDokument2 SeitenMortgage Contract: JOSEPH DUMULONG, Filipino, of Legal Age, Residing at 16 Property ST., GSIS VillageRalph Carlo SumaculubNoch keine Bewertungen

- Renewal of Contractor's License Application Form...Dokument23 SeitenRenewal of Contractor's License Application Form...DANILO M. TOLEDANESNoch keine Bewertungen

- Submittal Transmittal - 001Dokument1 SeiteSubmittal Transmittal - 001Engr SwapanNoch keine Bewertungen

- OmbDokument11 SeitenOmbromeo n bartolomeNoch keine Bewertungen

- FAASFORMSDokument2 SeitenFAASFORMSGennelyn Lozano IsraelNoch keine Bewertungen

- Alpha Global Marketing's ForEx guideDokument12 SeitenAlpha Global Marketing's ForEx guideRich Alex ApuntarNoch keine Bewertungen

- Procedure For Land AcquisitionDokument25 SeitenProcedure For Land AcquisitionRob ClosasNoch keine Bewertungen

- Courtesy Wedding Block Contract - TemplateDokument2 SeitenCourtesy Wedding Block Contract - TemplatejockmystyleNoch keine Bewertungen

- Affidavit - Ante (No Loans)Dokument1 SeiteAffidavit - Ante (No Loans)Danielle Edenor Roque PaduraNoch keine Bewertungen

- Final Board ResolutionDokument3 SeitenFinal Board ResolutionWACHNoch keine Bewertungen

- Exercise 5 Project: Mortgage Payment Calculator With Data Table and Amortization ScheduleDokument9 SeitenExercise 5 Project: Mortgage Payment Calculator With Data Table and Amortization ScheduleGlyza Celeste RonquilloNoch keine Bewertungen

- Credit Card Application: Please State Your Relative's Name and Relation If YESDokument2 SeitenCredit Card Application: Please State Your Relative's Name and Relation If YESMha AnnNoch keine Bewertungen

- Car Sticker Application Form 2021Dokument1 SeiteCar Sticker Application Form 2021Karl LabagalaNoch keine Bewertungen

- HLURB Ruling Orders Delivery of Property DocumentsDokument10 SeitenHLURB Ruling Orders Delivery of Property DocumentsChloe Sy GalitaNoch keine Bewertungen

- Sample FS PDFDokument20 SeitenSample FS PDFCjls KthyNoch keine Bewertungen

- New Income Tax Return BIR Form 1701 - November 2011 RevisedDokument6 SeitenNew Income Tax Return BIR Form 1701 - November 2011 RevisedBusinessTips.Ph100% (4)

- Monthly Value-Added Tax DeclarationDokument17 SeitenMonthly Value-Added Tax DeclarationMIRAHNELNoch keine Bewertungen

- Biomes 3) - TaigaDokument2 SeitenBiomes 3) - TaigaJOHAYNIENoch keine Bewertungen

- Civil Procedure 7 - Bagunu v. Aggabao GR No. 186487 15 Aug 2011 SC Full TextDokument12 SeitenCivil Procedure 7 - Bagunu v. Aggabao GR No. 186487 15 Aug 2011 SC Full TextJOHAYNIENoch keine Bewertungen

- Tax 2 Case 1 BDO Vs Republic GR No. 198756 January 13 2015Dokument28 SeitenTax 2 Case 1 BDO Vs Republic GR No. 198756 January 13 2015JOHAYNIENoch keine Bewertungen

- English Reviewers: Expository WritingDokument13 SeitenEnglish Reviewers: Expository WritingJOHAYNIENoch keine Bewertungen

- Civil Procedure 6 - Republic v. Roman Catholic Archbishop of Manila GR No. 192975 12 Nov 2012 SC Full TextDokument6 SeitenCivil Procedure 6 - Republic v. Roman Catholic Archbishop of Manila GR No. 192975 12 Nov 2012 SC Full TextJOHAYNIENoch keine Bewertungen

- Credit Trans - Magbanua Vs Tabusares (1970)Dokument6 SeitenCredit Trans - Magbanua Vs Tabusares (1970)JOHAYNIENoch keine Bewertungen

- UST Performance MeasuresDokument2 SeitenUST Performance MeasuresJOHAYNIENoch keine Bewertungen

- Biomes 3) - TaigaDokument2 SeitenBiomes 3) - TaigaJOHAYNIENoch keine Bewertungen

- Stress ManagementDokument1 SeiteStress ManagementJOHAYNIENoch keine Bewertungen

- COL FormDokument7 SeitenCOL FormelminvaldezNoch keine Bewertungen

- Court upholds PFF as juridical entity in travel agency disputeDokument6 SeitenCourt upholds PFF as juridical entity in travel agency disputeJoicey CatamioNoch keine Bewertungen

- Civil Procedure 21 - Mediserv Inc. v. CA GR No. 161368 05 Apr 2010 SC Full TextDokument9 SeitenCivil Procedure 21 - Mediserv Inc. v. CA GR No. 161368 05 Apr 2010 SC Full TextJOHAYNIENoch keine Bewertungen

- People Vs Eroles y VerangaDokument6 SeitenPeople Vs Eroles y VerangaJOHAYNIENoch keine Bewertungen

- G.R. No. L-17295Dokument3 SeitenG.R. No. L-17295Henson MontalvoNoch keine Bewertungen

- San Beda College of Law: Emory Id in Ommercial AWDokument24 SeitenSan Beda College of Law: Emory Id in Ommercial AWJOHAYNIENoch keine Bewertungen

- Civil Procedure 10 - DBP v. Castillo GR No. 163827 17 Aug 2011 SC Full TextDokument9 SeitenCivil Procedure 10 - DBP v. Castillo GR No. 163827 17 Aug 2011 SC Full TextJOHAYNIENoch keine Bewertungen

- Civil Procedure 7 - Bagunu v. Aggabao GR No. 186487 15 Aug 2011 SC Full TextDokument12 SeitenCivil Procedure 7 - Bagunu v. Aggabao GR No. 186487 15 Aug 2011 SC Full TextJOHAYNIENoch keine Bewertungen

- Civil Procedure 3 - Atty. Cabili v. Judge Balindong AM No. RTJ-10-2225 06 Sept 2011 SC Full TextDokument13 SeitenCivil Procedure 3 - Atty. Cabili v. Judge Balindong AM No. RTJ-10-2225 06 Sept 2011 SC Full TextJOHAYNIENoch keine Bewertungen

- Civil Procedure 54 - Galang Jr. v. Geronimo GR No. 192792 22 Feb 2011 SC Full TextDokument4 SeitenCivil Procedure 54 - Galang Jr. v. Geronimo GR No. 192792 22 Feb 2011 SC Full TextJOHAYNIENoch keine Bewertungen

- Civil Procedure 40 - Atty. Ferrer v. Spouses Diaz GR No. 165300 23 Apr 2010 SC Full TextDokument15 SeitenCivil Procedure 40 - Atty. Ferrer v. Spouses Diaz GR No. 165300 23 Apr 2010 SC Full TextJOHAYNIENoch keine Bewertungen

- Civil Procedure 26 - Optima Realty Corp. v. Hertz Phil. Exclusive Cars Inc. GR No. 183035 09 Jan 2013 SC Full TextDokument9 SeitenCivil Procedure 26 - Optima Realty Corp. v. Hertz Phil. Exclusive Cars Inc. GR No. 183035 09 Jan 2013 SC Full TextJOHAYNIE0% (1)

- Court of Appeals Decision on Service of SummonsDokument9 SeitenCourt of Appeals Decision on Service of SummonsJOHAYNIENoch keine Bewertungen

- Civil Procedure 27 - HDMF v. See GR No. 170292 22 Jun 2011 SC Full TextDokument10 SeitenCivil Procedure 27 - HDMF v. See GR No. 170292 22 Jun 2011 SC Full TextJOHAYNIENoch keine Bewertungen

- Philippine National Bank vs. Aznar GR 171805Dokument9 SeitenPhilippine National Bank vs. Aznar GR 171805Keith BalbinNoch keine Bewertungen

- LET Coverage March 2016Dokument6 SeitenLET Coverage March 2016Jen SabangNoch keine Bewertungen

- Civil Procedure 44 - Dare Adventure Farm Corp. v. CA GR No. 161122 24 Sept 2012 SC Full TextDokument7 SeitenCivil Procedure 44 - Dare Adventure Farm Corp. v. CA GR No. 161122 24 Sept 2012 SC Full TextJOHAYNIENoch keine Bewertungen

- Philippine National Bank vs. Aznar GR 171805Dokument9 SeitenPhilippine National Bank vs. Aznar GR 171805Keith BalbinNoch keine Bewertungen

- Civil Procedure 57 - Esperida v. Jurado GR No. 172538 25 Apr 2012 SC Full TextDokument7 SeitenCivil Procedure 57 - Esperida v. Jurado GR No. 172538 25 Apr 2012 SC Full TextJOHAYNIENoch keine Bewertungen

- Denial of Motion for Reconsideration of Order Granting Dismissal is AppealableDokument12 SeitenDenial of Motion for Reconsideration of Order Granting Dismissal is AppealableJOHAYNIENoch keine Bewertungen

- Civil Procedure 53 - Ibrahim v. COMELEC GR No. 192289 08 Jan 2013 SC Full TextDokument12 SeitenCivil Procedure 53 - Ibrahim v. COMELEC GR No. 192289 08 Jan 2013 SC Full TextJOHAYNIENoch keine Bewertungen

- Fuchs Petrolube Annual Report 2014Dokument223 SeitenFuchs Petrolube Annual Report 2014surajit7guptaNoch keine Bewertungen

- 2003 December (Question)Dokument6 Seiten2003 December (Question)Luke WanNoch keine Bewertungen

- Sunlife Proposal Bianca OseraDokument2 SeitenSunlife Proposal Bianca OseraBianca Joy OseraNoch keine Bewertungen

- ReconciliationDokument15 SeitenReconciliationManisha AmudaNoch keine Bewertungen

- Towers Watson 500 Largest Asset ManagersDokument20 SeitenTowers Watson 500 Largest Asset ManagersAdam TanNoch keine Bewertungen

- Exam KeyDokument8 SeitenExam KeyrudypatilNoch keine Bewertungen

- Risk Tolerance and Strategic Asset ManagementDokument26 SeitenRisk Tolerance and Strategic Asset ManagementMaestroanon100% (1)

- Neptune Orient Lines: Valuation and Capital StructureDokument14 SeitenNeptune Orient Lines: Valuation and Capital Structure梨子莹Noch keine Bewertungen

- Folleto de Admisión de MetrovacesaDokument572 SeitenFolleto de Admisión de Metrovacesaamedina7800Noch keine Bewertungen

- Aggregate Expenditure ModelDokument18 SeitenAggregate Expenditure ModelGourab RayNoch keine Bewertungen

- Youth Entrepreneurship Development IssuesDokument8 SeitenYouth Entrepreneurship Development IssuessabetaliNoch keine Bewertungen

- Tutorial 1 A172 Interco TransactionDokument5 SeitenTutorial 1 A172 Interco TransactionNisrina NSNoch keine Bewertungen

- FINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELDokument95 SeitenFINANCIAL PERFORMANCE ANALYSIS OF MACHCHAPUCHHRE BANK AND KUMARI BANK BASED ON CAMELRajNoch keine Bewertungen

- Xavier University engineering exam practiceDokument2 SeitenXavier University engineering exam practiceAnonymous EvbW4o1U7Noch keine Bewertungen

- Chapter 02Dokument22 SeitenChapter 02Kaveh ArabpourNoch keine Bewertungen

- DBD Accounting ManualDokument47 SeitenDBD Accounting ManualFarrukh TouheedNoch keine Bewertungen

- 3 Major Financial Statements: Three Sections of The Statement of Cash FlowsDokument3 Seiten3 Major Financial Statements: Three Sections of The Statement of Cash FlowsPrecious Ivy FernandezNoch keine Bewertungen

- MoneyGram - Providing Global Money Transfers and Financial ServicesDokument3 SeitenMoneyGram - Providing Global Money Transfers and Financial ServicesRamon ArevaloNoch keine Bewertungen

- TATADokument26 SeitenTATAvinit_shah90Noch keine Bewertungen

- Boing AirbusDokument16 SeitenBoing AirbusJUAN PIMINCHUMONoch keine Bewertungen

- Understanding Bank Credit AnalysisDokument116 SeitenUnderstanding Bank Credit AnalysisSekar Murugan100% (2)

- KTRL Comm ReviewerDokument19 SeitenKTRL Comm ReviewerKevin G. PerezNoch keine Bewertungen

- Women EntrepreneursDokument34 SeitenWomen EntrepreneursANUP RNoch keine Bewertungen

- To Invest in The Multibagger Parag Milk PDFDokument3 SeitenTo Invest in The Multibagger Parag Milk PDFChetan PanchamiaNoch keine Bewertungen

- A Comparitive Study of "Product Penetration and Digitalization" by HDFC Bank in ChandigarhDokument87 SeitenA Comparitive Study of "Product Penetration and Digitalization" by HDFC Bank in ChandigarhRattan GulatiNoch keine Bewertungen

- Khula Sizwe Property Prospectus SummaryDokument156 SeitenKhula Sizwe Property Prospectus SummaryLacrimioara LilyNoch keine Bewertungen

- LOI - Shipper & ConsigneeDokument2 SeitenLOI - Shipper & ConsigneeFelipe Arango100% (1)

- Satish Project 1Dokument3 SeitenSatish Project 1satishNoch keine Bewertungen

- TopSteelmakers2013 PDFDokument32 SeitenTopSteelmakers2013 PDFgobe86Noch keine Bewertungen

- Workshop Solutions T1 2014Dokument78 SeitenWorkshop Solutions T1 2014sarah1379Noch keine Bewertungen