Beruflich Dokumente

Kultur Dokumente

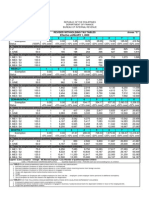

Receipts and Expenditures Rules

Hochgeladen von

nikiboigeniusOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Receipts and Expenditures Rules

Hochgeladen von

nikiboigeniusCopyright:

Verfügbare Formate

RECEIPTS AND INCOME

Sec. 3. Fees, Charges and Assessments. All fees, charges, assessments, and other

receipts or revenues collected by departments, bureaus and offices in the exerc

ise of their functions, at such rates as are now or may be approved by the appro

priate approving authority shall be deposited with the National Treasury as inco

me of the General Fund

RECEIPTS AND INCOME

Sec. 4. Reversion and Closure of Special Account in General Fund and Fiduciary o

r Trust Funds. All departments, bureaus and offices are mandated to revert all b

alances of Special Account in the General Fund and Fiduciary or Trust Funds to t

he General Fund in any of the following instances: (i) when their terms have exp

ired; or (ii) when they are no longer necessary for the attainment of the purpos

es for which said funds were established.

RECEIPTS AND INCOME

Sec. 5. Revolving Fund. Revolving funds shall be established and maintained only

for receipts derived from business-type activities of government agencies and w

hich are expressly created and authorized by law

RECEIPTS AND INCOME

Sec. 6. Trust Receipts. Receipts from nontax sources, including insurance procee

ds and donations for a term not exceeding one (1) year, authorized by law or con

tract for specific purposes

RECEIPTS AND INCOME

Sec. 7. Donations for a Term Exceeding One (1) Year. Department, bureaus and off

ices, including SUCs may accept donations, contributions, grants or gifts, in ca

sh or in kind, from various sources, domestic or foreign, for the purposes relev

ant to their functions

RECEIPTS AND INCOME

Sec. 9. Receipts Arising from Build-Operate-Transfer Transactions and Its Varian

t Schemes. Notwithstanding the provision of Section 6, receipts, such as toll fe

es, charges and other revenues arising from public sector projects implemented t

hrough build-operate-and-transfer arrangement and other variants pursuant to R.A

. No. 6957, as amended by R.A. No. 7718, collected by an office or agency of the

National Government but which shall accrue to the proponent private company or

individual in accordance with the contract entered into by said government offic

e or agency and the project proponent, shall be deposited in an authorized gover

nment depository bank and booked as trust liability account of the agency concer

ned to be utilized exclusively for the fulfilment of obligations as prescribed u

nder the contract

RECEIPTS AND INCOME

Sec. 10. Seminar, Conference and Training Fees. Departments, bureaus and offices

, including SUCs which conduct training programs in relation to their mandated f

unctions are authorized to collect seminar, conference and training fees from go

vernment and private agency participants, at such standard rates as the DBM and

CSC deem appropriate.

RECEIPTS AND INCOME

Sec. 11. Sale of Official Publications. Departments, bureaus and offices, includ

ing SUCs are authorized to sell their official publications whether electronical

ly or through other means. The proceeds derived from such sale shall be deposite

d with the National Treasury as income of the General Fund.

RECEIPTS AND INCOME

Sec. 12. Sale of Non-Serviceable, Obsolete or Unnecessary Equipment. Departments

, bureaus and offices, including SUCs are hereby authorized to sell non-servicea

ble, obsolete, or unnecessary equipment, including motor vehicles

RECEIPTS AND INCOME

Sec. 13. National Internal Revenue Taxes and Import Duties. The following are de

emed automatically appropriated: (a) National internal revenue taxes and import

duties payable or assumed by departments, bureaus and offices, including SUCs to

the National Government arising from foreign donations, grants and loans;

RECEIPTS AND INCOME

(b) Non-cash tax transactions of the following national government agencies:

(c) Tax expenditure subsidies granted by the Fiscal Incentives Review Board to G

OCCs, the AFP Commissary and Exchange Service, the PNP Service Store System, and

the Procurement Service Exchange Marts or PX Marts

RECEIPTS AND INCOME

Sec. 14. Loan Agreements. Departments, bureaus and offices, including SUCs and G

OCCs engaged in banking, shall in no case enter into foreign or domestic loan ag

reements, whether in cash or in kind

EXPENDITURES

Sec. 15. Use of the Current Year's Appropriations. All departments, bureaus and of

fices, including SUCs, shall ensure that the appropriations in this Act shall be

disbursed only for the purposes authorized herein and incurred during the curre

nt year.

EXPENDITURES

Sec. 16. Use of Government Funds. Government funds shall be utilized in accordan

ce with the appropriations authorized for the purpose.

EXPENDITURES

Sec. 17. Lease-Purchase Agreements. Departments, bureaus and offices, including

SUCs are authorized to use its annual rental appropriations for office space or

building for the acquisition of its office building under a lease- purchase agre

ement until full payment thereof

EXPENDITURES

Sec. 18. Purchase of Supplies, Materials and Equipment Spare Parts for Stock. Th

e inventory of supplies, materials and equipment spare parts to be procured out

of available funds shall at no time exceed the normal three-month requirement, s

ubject to pertinent rules and regulations issued by competent authority

EXPENDITURES

Sec. 19. Emergency Purchases. Agencies of the government are authorized to make

emergency purchases of supplies, materials and spare parts of motor transport eq

uipment when there is an unforeseen contingency requiring immediate purchase, su

bject to the conditions prescribed under R.A. No. 9184 and its Revised Implement

ing Rules and Regulations.

EXPENDITURES

Sec. 20. Procurement of Domestic and Foreign Goods. All appropriations for the p

rocurement of equipment, supplies and materials, and other products and services

authorized in this Act shall be used in accordance with the provisions of C.A.

No. 138, Section 43 of R.A. No. 9184 and its Revised IRR.

EXPENDITURES

Sec. 21. Contracting Multi-Year Projects. In the implementation of multi-year pr

ojects where the total cost is not provided in this Act, departments, bureaus an

d offices shall request the DBM for the issuance of a Multi-Year Obligational Au

thority following the guidelines under DBM Circular Letter No. 2004-12 dated Oct

ober 27, 2004.

EXPENDITURES

Sec. 22. Printing and Publication Expenditures. Departments, bureaus and offices

, including SUCs and GOCCs, are hereby given the option to engage the services o

f private printers in their printing and publication activities, subject to publ

ic bidding in accordance with R.A. No. 9184, its Revised IRR, and to pertinent a

ccounting and auditing rules and regulations

EXPENDITURES

Sec. 23. Extraordinary and Miscellaneous Expenses. Appropriations authorized her

ein may be used for extraordinary expenses of the following officials and those

of equivalent rank as may be determined by the DBM not exceeding:

EXPENDITURES

Sec. 23. Extraordinary and Miscellaneous Expenses cont'n

(a) P220,000 for each Department Secretary; (b) P90,000 for each Department Unde

rsecretary; (c) P50,000 for each Department Assistant Secretary; (d) P38,000 for

each head of bureau or organization of equivalent rank, and for each head of a

Department Regional Office; (e) P22,000 for each head of a Bureau Regional Offic

e or organization of equivalent rank; and (f) P16,000 for each Municipal Trial C

ourt Judge, Municipal Circuit Trial Court Judge, and Shari'a Circuit Court Judge.

In addition, miscellaneous expenses not exceeding SeventyTwo Thousand Pesos (P72

,000) for each of the offices under the above named officials are herein authori

zed.

EXPENDITURES

Sec. 23. Extraordinary and Miscellaneous Expenses cont'n

For the purpose of this section, extraordinary and miscellaneous expenses shall

include, but shall not be limited to expenses incurred for: (a) Meetings, semina

rs and conferences; (b) Official entertainment; (c) Public relations; (d) Educat

ional, athletic and cultural activities; (e) Contributions to civic or charitabl

e institutions; (f) Membership in government associations; (g) Membership in nat

ional professional organizations duly accredited by the Professional Regulations

Commission; (h) Membership in the Integrated Bar of the Philippines; (i) Subscr

iption to professional technical journals and informative magazines, library boo

ks and materials; (j) Office equipment and supplies; and (k) Other similar expen

ses not supported by the regular budget allocation.

EXPENDITURES

Sec. 24. Travelling Expenses. Officials and employees of the government may be a

llowed payment of claims for reimbursement of travelling and related expenses in

curred in the course of official travel which are in excess of the authorized ra

tes, certified by the head of the agency concerned as absolutely necessary in th

e performance of an assignment, and supported by receipts, chargeable to availab

le allotment for travelling expenses, subject to the provisions of E.O. Nos. 248

and 248-A, s. 1995, as amended by E.O. No. 298.

EXPENDITURES

Sec. 25. Cultural and Athletic Activities. Of the appropriations authorized in t

his Act for the MOOE of each department, bureau, office or agency, an annual amo

unt not exceeding One Thousand Five Hundred Pesos (P1,500) per employee-particip

ant may be used for the purchase of costume or uniform, and other related expens

es in the conduct of cultural and athletic activities.

EXPENDITURES

Sec. 26. Science and Technology Research. The appropriations of departments, bur

eaus and offices, including SUCs for research and development (R&D) in agricultu

ral and fisheries, and in natural resources, environment, technological and engi

neering sciences shall be released upon recommendation of the DA and DOST, respe

ctively.

EXPENDITURES

Sec. 27. Human Resources Development and Training Programs. All agencies of the

government shall review and formulate their human resource development and train

ing programs to make the same responsive to the organizational needs and manpowe

r requirements of agencies and the need to train personnel in appropriate skills

and attitudes. They shall likewise include in their human resource development

and training programs measures to promote morale, efficiency, integrity, respons

iveness, progressiveness, courtesy as well as nationalism and patriotism in the

civil service. Such training programs shall be consistent with the rules and reg

ulations issued by the CSC for the purpose.

EXPENDITURES

Sec. 28. Programs and Projects Related to Gender and Development. All agencies o

f the government shall formulate a Gender and Development (GAD) Plan designed to

address gender issues within their concerned sectors or mandate and implement a

pplicable provisions under R.A. No. 9710 or the Magna Carta of Women, Convention

on the Elimination of All Forms of Discrimination Against Women, the Beijing Pl

atform for Action, the Millennium Development Goals (2000-2015), the Philippine

Plan for Gender- Responsive Development (1995-2025), and the Philippine Developm

ent Plan (2011-2016).

EXPENDITURES

Sec. 29. Programs and Projects Related to Senior Citizens and Differently-Abled.

All agencies of the government shall formulate plans, programs and projects int

ended to address the concerns of senior citizens and differently-abled person, i

nsofar as it relates to their mandated functions and integrate the same in their

regular activities.

EXPENDITURES

Sec. 30. Projects Related to Youth. All agencies of the government are encourage

d to provide allocation for youth development projects and activities within the

framework of the Philippine Medium-Term Youth Development Plan. The National Yo

uth Commission, in coordination with the DBM and NEDA, shall formulate a set of

guidelines for the implementation of projects related to youth.

EXPENDITURES

Sec. 31. Productivity Development and Food Security. All agencies of the governm

ent shall plant rice and other crops whenever feasible on government lands in it

s possession to develop productivity and promote food security. Implementation o

f this section is subject to guidelines issued by the DA and other agencies conc

erned.

EXPENDITURES

Sec. 32. National Greening Program. All agencies of the government shall plant t

rees in lands of the public domain in support of the National Greening Program u

nder E.O. No. 26, s. 2011. Implementation of this section is subject to guidelin

es issued by the DENR.

EXPENDITURES

Sec. 33. Disaster Prevention, Mitigation and Preparedness Projects. All agencies

of the government are encouraged to implement projects designed to address disa

ster risk reduction and management activities under R.A. No. 10121. Implementati

on of this section is subject to guidelines issued by the National Disaster Risk

Reduction and Management Council.

EXPENDITURES

Sec. 34. Climate Change Mitigation. All agencies of the government shall integra

te energy-savings solutions in the planning and implementation of all infrastruc

ture projects to mitigate the effects of climate change pursuant to the provisio

ns of R.A. No. 9729.

PERSONNEL AMELIORATION

Sec. 35. Funding of Personnel Benefits. Notwithstanding any provision of law to

the country, all personnel benefits costs of government officials and employees

shall be charged against the funds from which their salaries are paid. According

ly, in no case shall personnel benefits costs drawn from special accounts, fiduc

iary or trust, or other sources of funds be charged against the General Fund of

the National Government.

PERSONNEL AMELIORATION

Sec. 36. Remittance of Compulsory Contributions. Notwithstanding the provisions

of LOI No. 1102 dated January 13, 1981, the government and employee share in the

compulsory contributions to the Employees Compensation Commission, PHILHEALTH,

GSIS and HDMF pursuant to P.D. No. 626, as amended, R.A. No. 6111, R.A. No. 7875

, R.A. No. 8291, and R.A. No. 9679, respectively, shall be remitted directly by

departments, bureaus and offices to the respective recipient agencies unless a d

ifferent arrangement is agreed upon in writing among the DBM, the remitting agen

cy, and the recipient agency

PERSONNEL AMELIORATION

Sec. 37. Authorized Deductions. (a) The BIR, PHILHEALTH, GSIS, and HDMF; (b) Mut

ual benefits associations, thrift banks and nonstock savings and loan associatio

ns duly operating under existing laws which are managed by and/or for the benefi

t of government employees; (c) Associations/cooperatives/provident funds organiz

ed and managed by government employees for their benefit and welfare; (d) Duly l

icensed insurance companies accredited by appropriate government agency; and (e)

Rural banks accredited by the Bangko Sentral ng Pilipinas.

PERSONNEL AMELIORATION

Sec. 38. Service Fees. Departments, bureaus, offices and agencies, which collect

service fees for the payment of any obligation through authorized deductions un

der the preceding section, shall deposit said service fees with the National Tre

asury, to be recorded in its books of accounts as trust receipts. Said service f

ees shall be used exclusively for the operation of a Provident Fund in favor of

all its employees in accordance with A.O. No. 279, s. 1992 and pertinent rules a

nd regulations. The Provident Fund shall be used for loaning operations and othe

r purposes beneficial to all members as may be approved by its governing board.

PERSONNEL AMELIORATION

Sec. 39. Personnel Economic Relief Allowance. The personnel economic relief allo

wance (PERA) is granted to government personnel stationed in the Philippines in

order to supplement their salaries due to the rising cost of living. The PERA, i

n the amount of Two Thousand Pesos (P2,000) per month, shall be granted to civil

ian government personnel whether occupying regular, contractual, or casual posit

ions, appointive or elective whose positions are covered by R.A. No. 6758, as am

ended, as well as to the military and uniformed personnel

PERSONNEL AMELIORATION

Sec. 40. Uniform or Clothing Allowance. The appropriations provided for each dep

artment, bureau, office or agency may be used for uniform or clothing allowance

of employees at not more than Five Thousand Pesos (P5,000) each per annum, subje

ct to the rules and regulations issued by the DBM. In case of deficiency, or in

the absence of appropriation for the purpose, the requirements shall be charged

against available savings of the agency.

PERSONNEL AMELIORATION

Sec. 41. Magna Carta Benefits. The payment of magna carta benefits of public hea

lth workers and scientists, engineers, researchers, and other science and techno

logy personnel in the government shall be limited to the appropriations authoriz

ed in this Act for the purpose. Augmentation thereof from any available savings

of the agency concerned shall be subject to the approval by the DBM.

PERSONNEL AMELIORATION

Sec. 42. Special Counsel Allowance. Lawyer-personnel, including those designated

to assume the duties of a legal officer and those in the legal staff of departm

ents, bureaus, offices or agencies of the National Government deputized by the O

ffice of the Solicitor General to appear in court as special counsel in collabor

ation with the Solicitor General or prosecutors concerned, are hereby authorized

an allowance of One Thousand Two Hundred Fifty Pesos (P1,250) for each appearan

ce or attendance of hearing except pursuant to a motion for extension, chargeabl

e to savings in the appropriations of their respective offices, but not exceedin

g Five Thousand Pesos (P5,000) per month

PERSONNEL AMELIORATION

Sec. 43. Hazard Duty Pay. Hazard pay shall be granted to officials and employees

who are actually assigned to, and performing their duties in, strifetorn or emb

attled areas as may be determined and certified by the Secretary of National Def

ense and for the duration of such assignment. The grant of hazard duty pay shall

be subject to the rules and regulations prescribed under Budget Circular No. 20

05-4 and other rules and regulations issued by the DBM.

PERSONNEL AMELIORATION

Sec. 43. Honoraria. The respective agency appropriations for honoraria shall onl

y be paid to the following: (a) Teaching personnel of the DepEd, TESDA, SUCs and

other educational institutions, engaged in actual classroom teaching, whose tea

ching load is outside of the regular office hours or in excess of the regular lo

ad; (b) Those who act as lecturers, resource persons, coordinators and facilitat

ors in seminars, training programs, and other similar activities in training ins

titutions, including those conducted by entities for their officials and employe

es wherein no seminar fees are collected from participants;

PERSONNEL AMELIORATION

Sec. 43. Honoraria. . . continuation (c) Chairs and members of commissions, boar

ds, councils, and other similar entities, including personnel thereof who are no

t paid salaries nor per diems but compensated in the form of honoraria as provid

ed by law, rules and regulations; (d) Those who are involved in science and tech

nological activities who render services beyond their regular workload;

PERSONNEL AMELIORATION

Sec. 43. Honoraria. . . continuation (e) Officials and employees assigned to spe

cial projects, subject to the following conditions: (i) Said special projects ar

e reform-oriented or developmental, contribute to the improvement of service del

ivery and enhancement of the performance of the core functions of the agency, an

d have specific timeframes and deliveries for accomplishing objectives and miles

tones set by the agency for the year; and (ii) Such assignment entails rendition

of work in addition to, or over and above, their regular workload.

PERSONNEL AMELIORATION

Sec. 43. Honoraria. . . Continuation (f) Officials and employees authorized to r

eceive honoraria under R.A. No. 9184 and its Revised IRR. The grant of honoraria

to the foregoing shall be subject to the guidelines prescribed under Budget Cir

cular No. 2003-5, as amended by Budget Circular No. 2007-1 and National Budget C

ircular No. 2007510, Budget Circular No. 2007-2, and other guidelines issued by

the DBM.

PERSONNEL AMELIORATION

Sec. 44. Representation and Transportation Allowances. The following officials o

f national government agencies, while in the actual performance of their respect

ive functions, are hereby authorized monthly commutable representation and trans

portation allowances charged against appropriations authorized for the purpose a

t the rates indicated below: (a) P14,000 for Department Secretaries; (b) P11,000

for Department Undersecretaries; (c) P10,000 for Department Assistant Secretari

es;

PERSONNEL AMELIORATION

Sec. 44. Representation and Transportation Allowances continuation (d) P9,000 for

Bureau Directors and Department Regional Directors; (e) P8,500 for Assistant Bu

reau Directors, Department Assistant Regional Directors, Bureau Regional Directo

rs, and Department Service Chiefs; (f) P7,500 for Assistant Bureau Regional Dire

ctors; and (g) P5,000 for Chief of Divisions, identified as such in the Personal

Services Itemization and Plantilla of Personnel.

PERSONNEL AMELIORATION

Sec. 45. Official Vehicles and Transport. Government motor transportation may be

used by the following officials with costs chargeable to the appropriations aut

horized for their respective offices: (a) The President of the Philippines; (b)

The Vice-President; (c) The President of the Senate; (d) The Speaker of the Hous

e of Representatives;

PERSONNEL AMELIORATION

Sec. 45. Official Vehicles and Transport. . . Continuation (e) The Chief Justice

and Associate Justices of the Supreme Court; (f) The Presiding Justices of the

Court of Appeals, Court of Tax Appeals, and the Sandiganbayan; (g) The Departmen

t Secretaries, Undersecretaries, Assistant Secretaries and officials of equivale

nt rank; (h) Ambassadors, Ministers Plenipotentiary and Consuls in charge of con

sulates, in their respective stations abroad;

PERSONNEL AMELIORATION

Sec. 45. Official Vehicles and Transport. . . Continuation (i) The Chief of Staf

f, the Vice-Chief of Staff, and the Commanding Generals of the Major Services of

the Armed Forces of the Philippines; (j) Heads of Constitutional Commissions an

d the Ombudsman;

PERSONNEL AMELIORATION

Sec. 45. Official Vehicles and Transport. . . Continuation (k) Bureau Directors,

Department Regional Directors and Bureau Regional Directors; and (l) Those who

may be specifically authorized by the President of the Philippines, the Senate P

resident, with respect to the Senate, the Speaker, with respect to the House of

Representatives, and the Chief Justice, in the case of the Judiciary.

PERSONNEL AMELIORATION

Sec. 47. Quarters Privileges. Officials who are transferred form one station to

another by virtue of agency policies on shuffling or rotation of personnel and d

o not own houses or rooms therein, shall be provided free quarters within their

office premises.

PERSONNEL AMELIORATION

Sec. 48. Employment of Contractual Personnel. Heads of departments, bureaus, off

ices or agencies, when authorized in, and within the limits of their respective

appropriations, under this Act, may hire contractual personnel as part of the or

ganization to perform regular agency functions or specific vital activities or s

ervices which cannot be provided by the regular or permanent staff of the hiring

agency.

PERSONNEL AMELIORATION

Sec. 49. Year-End Bonus and Cash Gift. The yearend bonus equivalent to one (1) m

onth basic salary and additional cash gift of Five Thousand Pesos(P5,000) provid

ed under R.A. No. 6686, as amended by R.A. No. 8441, shall be granted to all Nat

ional Government officials and employees, whether under regular, temporary, casu

al or contractual status, on full-time or part-time basis, who have rendered at

least a total of four (4) months of service including leaves of absence with pay

from January 1 to October 31 of each year, and who are still in the service as

of October 31 of the same year.

PERSONNEL AMELIORATION

Sec. 50. Compensation and Position Classification System of Government-Owned or

Controlled Corporations. Pursuant to the provisions of R.A. No. 10149, the Gover

nance Commission for GOCCs shall develop a Compensation and Position Classificat

ion System which shall apply to all officers and employees of the GOCCs whether

covered by R.A. No. 6758, as amended or exempt therefrom, subject to approval by

the President of the Philippines.

PERSONNEL AMELIORATION

Sec. 51. Use of Appropriations for Retirement Gratuity and Terminal Leave. Appro

priations authorized in this Act to cover retirement benefit claims shall be rel

eased directly to the departments, bureaus and offices concerned computed based

on the provisions of applicable retirement laws, rules and regulations.

PERSONNEL AMELIORATION

Sec. 51. Personal Liability of Officials or Employees for Payment of Unauthorize

d Personal Services Cost. No official or employee in any of the departments, bur

eaus and offices shall be paid any personnel benefits charged against public fun

ds unless authorized by law. Grant of personnel benefits authorized by law but n

ot supported by specific appropriations shall also be deemed unauthorized.

RELEASE AND USE OF FUNDS

Sec. 52. Use of Savings. The President of the Philippines, the Senate President,

the Speaker of the House of Representatives, the Chief Justice of the Supreme C

ourt, the Heads of Constitutional Commissions enjoying fiscal autonomy, and the

Ombudsman are hereby authorized to use savings in their respective appropriation

s to augment any deficiencies incurred for the current year in any item of their

respective appropriations.

RELEASE AND USE OF FUNDS

Sec. 53. Meaning of Savings and Augmentation. Savings refer to portions or balan

ces of any programmed appropriationin this Act free from any obligation or encum

brance which are: (i) still available after the completion or final discontinuan

ce or abandonment of the work, activity or purpose for which the appropriation i

s authorized; (ii) from appropriations balances arising from unpaid compensation

and related costs pertaining to vacant positions and leaves of absence without

pay; and (iii) from appropriations balances realized from the implementation of

measures resulting in improved systems and efficiencies and thus, enabled agenci

es to meet and deliver the required or planned targets, programs, and services a

pproved in this Act at a lesser cost.

RELEASE AND USE OF FUNDS

Sec. 53. Meaning of Savings and Augmentation. . . continuation Augmentation impl

ies the existence in this Act of a program, activity, or project with an appropr

iation, which upon implementation or subsequent evaluation of needed resources,

is determined to be deficient. In no case shall a non-existent program, activity

, or project, be funded by augmentation from savings or by the use of appropriat

ions otherwise authorized in this Act.

RELEASE AND USE OF FUNDS

Sec. 54. Rules in the Realignment of Savings. Realignment of Savings from one al

lotment class to another shall require prior approval of the DBM. Departments, b

ureaus and offices, including SUCs, are authorized to augment any item of expend

iture within Personal Services and MOOE, except intelligence funds which require

prior approval of the President of the Philippines. However, realignment of fun

ds among objects of expenditures within Capital Outlays shall require prior appr

oval of the DBM.

RELEASE AND USE OF FUNDS

Sec. 55. Rules in the Realignment of Savings for the Payment of Collective Negot

iation Agreement Incentives. Savings from allowable MOOE allotments generated ou

t of cost-cutting measures identified in the Collective Negotiation Agreements (

CNAs) and supplements thereto may be used for the grant of CNA incentive by agen

cies with duly executive CNAs: PROVIDED, that one-time annual payment of CNA inc

entives must be made through written resolution signed by representatives of bot

h labor and management, and approved by the agency head: PROVIDED, FURTHER, That

the funding resources and amount of CNA incentives shall, in all cases, be limi

ted to allowable MOOE allotments and rates determined by the DBM, respectively.

RELEASE AND USE OF FUNDS

Sec. 56. Priority in the Use of Savings. In the use of savings, priority shall b

e given to the augmentation of the amounts set aside for compensation, year-endb

onus and cash gift, retirement gratuity, terminal leave benefits, oldage pension

of veterans and other personnel benefits authorized by law, and those expenditu

re items authorized in agency special provisions and in other sections of the Ge

neral Provisions in this Act.

RELEASE AND USE OF FUNDS

Sec. 57. Mandatory Expenditures. The amounts programme for petroleum, oil and lu

bricants as well as for water, illumination and power services, telephone and ot

her communication services, and rent requirements shall be disbursed solely for

such items of expenditures

RELEASE AND USE OF FUNDS

Sec. 58. Expenditures for Business-Type Activities. Appropriations for the procu

rement of supplies and materials intended to be utilized in the conduct of busin

ess-type activities shall be disbursed solely for such business-type activity an

d shall not be realigned to any other expenditure item.

RELEASE AND USE OF FUNDS

Sec. 59. Intelligence Funds. No amount in this Act shall be released or disburse

d for confidential and intelligence activities unless approved by the President

of the Philippines, or specifically identified and authorized as such confidenti

al or intelligence fund

RELEASE AND USE OF FUNDS

Sec. 60. Confidential Funds. Confidential funds authorized in this Act shall onl

y be released or disbursed upon approval of the Department Secretary concerned.

Confidential expenses refer to those related to surveillance activities in civil

ian government agencies that are intended to support the mandate or operations o

f the agency. Implementation of this section shall be subject to guidelines to b

e issued by the DBM.

RELEASE AND USE OF FUNDS

Sec. 61. Use and Release of Confidential and Intelligence Funds for Government O

wned and/or Controlled Corporations and Local Government Units. No amount shall

be released or disbursed by GOCCs for confidential or intelligence activities un

less approved by the President of the Philippines specifically identified and au

thorized as such confidential or intelligence fund in their corporate operating

budgets

RELEASE AND USE OF FUNDS

Sec. 62. Realignment of Funds for ForeignAssisted Projects. The amount appropria

ted in this Act for the implementation of foreignassisted projects, including lo

an proceeds and peso counterpart, shall not be realigned except to other foreign

-assisted projects

RELEASE AND USE OF FUNDS

Sec. 63. Availability of Appropriations. All appropriations authorized in this A

ct shall be available for release and obligation for the purposes specified, and

under the same special provisions applicable thereto, until the end of FY 2013:

PROVIDED, That a report on these releases and obligations shall be submitted to

the Senate Committee on Finance and House Committee on Appropriations, either i

n printed form or by way of electronic document.

RELEASE AND USE OF FUNDS

Sec. 64. Prohibition Against Impoundment of Appropriations. No appropriations au

thorized under this Act shall be impounded through retention or deduction, unles

s in accordance with the rules and regulations to be issued by the DBM: PROVIDED

, That all the funds appropriated for the purposes, programs, projects, and acti

vities authorized under this Act, except those covered under the Unprogrammed Fu

nd, shall be released pursuant to Section 33 (3), Chapter 5, Book VI of E.O. No.

292.

RELEASE AND USE OF FUNDS

Sec. 65. Unmanageable National Government Budget Deficit. Retention or deduction

of appropriations authorized in this Act shall be effected only in cases where

there is an unmanageable National Government budget deficit. Unmanageable Nation

al Government budget deficit as used in this section shall be construed to mean

that: (i) the actual National Government budget deficit has exceeded the quarter

ly budget deficit targets consistent with the full-year target deficit as indica

ted in the BESF submitted by the President and approved by Congress pursuant to

Section 22, Article VII of the Constitution, or (ii) there are clear economic in

dications of an impending occurrence of such condition, as determined by the Dev

elopment Budget Coordinating Committee and approved by the President.

RELEASE AND USE OF FUNDS

Sec. 66. Prohibition Against Retention or Deduction of Allotment. Fund releases

from appropriations provided in this Act shall be transmitted intact or in full

to the office or agency concerned. No retention or deduction as reserves or over

head shall be made, except as authorized by law, or upon direction of the Presid

ent of the Philippines.

RELEASE AND USE OF FUNDS

Sec. 67. Direct Release of Funds to Regional Offices and Other Implementing Unit

s. Funds allotted for regional offices and other implementing units but included

in the budgets of their Central Offices or which are specifically allocated for

the different regions/implementing units shall be released directly to said reg

ional offices/implementing units.

RELEASE AND USE OF FUNDS

Sec. 68. Lump-Sum Appropriations. Release of lump-sum appropriations shall only

be made upon submission by the government agency concerned to DBM of the complet

e details or list of subprograms/activities or sub-projects with the correspondi

ng cost up to the lowest level i.e., provincial, city or municipal level, as the

case may be.

RELEASE AND USE OF FUNDS

Sec. 69. Certification of Availability of Funds. No expenditures of obligations

chargeable against any authorized allotment shall be incurred by departments, bu

reaus and offices, including SUCs without first securing a certification of avai

lability of funds for the purposed from the agency chief accountant, subject to

Section 40, Chapter 5 and Section 58, Chapter 7, Book VI of E.O. No. 292

RELEASE AND USE OF FUNDS

Sec. 70. Disbursement of Funds. Disbursement of public funds for obligations inc

urred with proper authority for its incurrence shall be disbursed only through t

he BTr and/or authorized servicing banks under the Modified Disbursement Scheme.

RELEASE AND USE OF FUNDS

Sec. 71. Limitations on Cash Advance and Reportorial Requirements. Notwithstandi

ng any provision of law to the contrary, cash advances shall not be granted unti

l such time that the earlier cash advances availed of by the officials or employ

ees concerned shall have been liquidated pursuant to pertinent accounting and au

diting rules and regulations.

RELEASE AND USE OF FUNDS

Sec. 72. Requirements on Fund Transfers to Civil Society Organizations.Fund tran

sfers to Civil Society Organizations (CSOs) shall be made only when earlier fund

releases, if any, have been fully liquidated and at least seventy percent (70%)

of the latest fund transfer availed of by the CSOs shall have been liquidated p

ursuant to pertinent accounting and auditing rules and regulations.

RELEASE AND USE OF FUNDS

Sec. 73. Personal Liability of Officials and Employees for the Incurrence of Pay

ment of Unauthorized or Unlawful Obligation or Expenditure. Any and all official

s or employees who will authorize, allow or permit, as well as those who are neg

ligent in the performance of their duties and functions which resulted in, the i

ncurrence or payment of unauthorized and unlawful obligation or expenditure shal

l be personally liable to the government for the full amount committed or expend

ed, and shall be subject to disciplinary actions in accordance with Section 43,

Chapter 5 and Seciton 80, Chapter 7, Book VI of E.O. No. 292.

ADMINISTRATIVE PROCEDURES

Sec. 74. Organizational and Staffing Pattern Changes. Unless otherwise provided

by law or directed by the President of the Philippines, no organizational units

or changes in key positions in any department or agency shall be authorized in t

heir respective organizational structures and staffing patterns and funded from

appropriations provided under this Act.

ADMINISTRATIVE PROCEDURES

Sec. 75. Institutional Strengthening and Productivity Improvement in Agency Orga

nization and Operations and Implementation of Reorganization Mandated by Law. Th

e government shall adopt institutional strengthening measures to improve service

delivery and enhance productivity.

ADMINISTRATIVE PROCEDURES

Sec. 75. Institutional Strengthening and Productivity Improvement in Agency Orga

nization and Operations and Implementation of Reorganization Mandated by Law. .

. Continuation Heads of departments, bureaus, offices, agencies, and other entit

ies of the Executive Branch shall: (i) conduct a comprehensive review of their r

espective mandates, missions, objectives, functions, programs, projects, activit

ies, systems and procedures; (ii) identify areas where improvements are necessar

y; and (iii) implement corresponding structural, functional and operational adju

stments that will result in streamlined organization and operations and improved

performance and productivity.

ADMINISTRATIVE PROCEDURES

Sec. 76. Performance-Based Budgeting. The Organizational Performance Indicator F

ramework (OPIF) shall be the conceptual and operational framework to institution

alize performance or results-based budgeting in the departments, bureaus and off

ices, including SUCs and GOCCs. The annual budgetary levels of national governme

nt agencies shall consider agency physical accomplishments vis--vis targets formu

lated in terms of Major Final Outputs (MFOs) and their corresponding Performance

Indicators (PIs).

ADMINISTRATIVE PROCEDURES

Sec. 77. Service Contracts. Departments, bureaus and offices including SUCs and

GOCCs, are hereby authorized to enter into service contracts with other governme

nt agencies, private firms, individuals, or NGOs for services related or inciden

tal to their respective functions and operations, whether on a part-time or full

time basis.

ADMINISTRATIVE PROCEDURES

Sec. 78. Electronic Interconnection through the Internet and E-Commerce Applicat

ion. Departments, bureaus and offices, including SUCs and GOCCs, may use existin

g appropriations to install an electronic on-line network to facilitate the open

, speedy and efficient electronic on-line transmission conveyance and use of ele

ctronic data messages or documents consistent with R.A. No. 8792

ADMINISTRATIVE PROCEDURES

Sec. 79. Implementation of Executive Order No. 429, Series of 2005. The appropri

ations provided in this Act for the regional/field offices in Region IV-B may be

realigned to Region VI to implement E.O. No. 429, s. 2005 upon approval by the

President of the Philippines of the implementation plan to be submitted by the D

ILG under A.O. No. 129, s. 2005.

ADMINISTRATIVE PROCEDURES

Sec. 80. Transfer of National Government Agencies and Funds to the Autonomous Re

gion in Muslim Mindanao. National government offices and agencies in the ARMM wh

ich are not excluded under paragraph 9, Section 2, Article V of R.A. No. 6734, a

s amended by Section 3, Article IV of R.A. No. 9054, together with their personn

el, equipment, properties and budgets shall be placed under the control and supe

rvision of the ARMM Regional Government, pursuant to a schedule prescribed by th

e Oversight Committee in accordance with its mandate under the provisions of R.A

. No. 6734, as amended by R.A. No. 9054. Prior to said transfer, said agencies o

f the National Government shall continue their operations and the discharge of t

heir respective functions.

ADMINISTRATIVE PROCEDURES

Sec. 81. Allocation for Autonomous Region in Muslim Mindanao in Nationwide Proje

cts. In the implementation of nationwide programs, projects, and activities, whe

ther funded under this Act or other laws, the implementing agency shall ensure t

hat the requirements of ARMM are provided. The funds for the purpose shall be re

leased based on, and made only upon submission by the implementing agencies conc

erned of the allocation for ARMM per province. The respective heads of the imple

menting agencies shall be responsible for ensuring that the amounts allocated fo

r ARMM per province are posted on the respective official websites of the implem

enting agencies.

ADMINISTRATIVE PROCEDURES

Sec. 82. Allocation of National Government Agencies for the Autonomous Region in

Muslim Mindanao. National projects allocated for the ARMM by the NG agencies at

the instance/request of the Representative of the Congressional District may be

implemented by the ARMM Regional Government: PROVIDED, That the Representative

of the District concerned shall be informed of the release of the amounts and st

atus of implementation of the programs and projects funded from the said allocat

ion.

ADMINISTRATIVE PROCEDURES

Sec. 83. Internal Revenue Allotment of LGUS. The IRA which is automatically appo

priated shall be apportioned among LGUs, including provinces, cities, and munici

palities created, approved, and ratified in 2011, in accordance with the allocat

ion formula prescribed under Section 285 of R.A. No. 7160

ADMINISTRATIVE PROCEDURES

Sec. 84. Use and Disbursement of Internal Revenue Allotment of LGUs. The amount

appropriated for the LGU's share in the Internal Revenue Allotment shall be used i

n accordance with Sections 17 (g) and 287 of R.A. No. 7160. The annual budgets o

f LGUs shall be prepared in accordance with the forms, procedures and schedules

prescribed by the DBM and those jointly issued with the Commission on Audit.

ADMINISTRATIVE PROCEDURES

Sec. 85. Strict Adherence to Procurement Procedures, Laws, Rules and Regulations

. In the procurement of infrastructure projects, goods and consulting services,

including works undertaken by administration, all government agencies shall stri

ctly adhere to the provisions of R.A. No. 9184, its Revised Implementing Rules a

nd Regulations (IRR) and other guidelines that may be issued by the GPPB

ADMINISTRATIVE PROCEDURES

Sec. 86. Purchase of Common-Use Supplies. All national government agencies inclu

ding SUCs and GOCCs shall purchase from the Procurement Service (PS) all commonu

se supplies listed in the PS catalogue as mandated under LOI No. 755 dated Octob

er 18, 1978. The PS shall regularly update its catalogue to include all commonly

used items procured by departments, bureaus and offices such as, but not limite

d to, information and communications technology requirements, software licenses,

and telecommunications services, to ensure costefficiency.

ADMINISTRATIVE PROCEDURES

Sec. 87. Construction Standards and Guidelines. Appropriations authorized under

this Act for the construction of buildings for SUCs, schools, hospitals, sanitar

ia, health centers and health stations, roads and bridges, and irrigation system

s, among others, shall be implemented only in accordance with the appropriate st

andards and specifications for the planning, survey, design and construction of

the project as prescribed by the DepEd, DPWH, DOTC, DA-NIA, as the case may be.

In addition, land use and zoning guidelines as prescribed by existing laws, rule

s and regulations shall be strictly observed.

ADMINISTRATIVE PROCEDURES

Sec. 88. Implementing Agency for Nationally Funded Projects. Pursuant to Section

17 (c) of R.A. No. 7160, projects, facilities, programs and services funded und

er this Act shall be implemented by the appropriate government agency irrespecti

ve of the nature and location of such projects, facilities, programs and service

s: PROVIDED, That the National Government may delegate the implementation thereo

f to the LGUs with the capability to and who will actually implement the project

by themselves through the execution of a MOA

ADMINISTRATIVE PROCEDURES

Sec. 89. Submission of Annual Operating Budgets for Retained Income and Audited

Financial Statements. All departments, bureaus, and offices, including SUCs auth

orized by law to retain and/or use income shall prepare and submit to the DBM th

eir respective annual operating budgets covering said income and the correspondi

ng expenditures not later than November 15, 2012, and their FY 2012 audited fina

ncial statements not later than March 1, 2013. Failure to submit said annual ope

rating budget and the audited financial statements shall render any disbursement

from said retained income void, and shall subject the erring officials and empl

oyees to disciplinary actions in accordance with Section 43, Chapter 5, and Sect

ion 80, Chapter 7, Book VI of E.O. No. 292, and to appropriate criminal action u

nder existing penal laws.

ADMINISTRATIVE PROCEDURES

Sec. 90. Report on Compliance with COA Audit Findings and Recommendations. All d

epartments, bureaus and offices, including SUCs, GOCCs and LGUs, shall within si

xty (60) days from their receipt of the COA annual audit report submit, either i

n printed form or by way of electronic document, to the COA a status report on t

he actions taken on said audit findings and recommendations, copy furnished the

DBM, House Committee on Appropriations and Senate Committee on Finance.

ADMINISTRATIVE PROCEDURES

Sec. 91. Submission of Quarterly Financial and Narrative Accomplishment Reports.

Within thirty (30) days after the end of each quarter, each department, bureau

and office, including SUCs, shall submit a quarterly financial and narrative acc

omplishment reports to the House Committee on Appropriations and Senate Committe

e on Finance, copy furnished the DBM, COA, and the appropriate Committee Chairma

n of the House of Representatives. The financial report shall show the cumulativ

e allotments, obligations incurred/liquidated, total disbursements, unliquidated

obligations, unobligated and unexpended balances, and the results of expended a

ppropriations.

ADMINISTRATIVE PROCEDURES

Sec. 92. Transparency in Infrastructure Projects. All agencies of the government

implementing infrastructure projects shall post on their respective websites wi

thin thirty (30) calendar days from entering into contract with the winning cont

ractor the following information per project: (i) project title and detailed des

cription which shall include the nature and location thereof; (ii) the detailed

estimates in arriving the Approved Budget for the Contract; and (iii) the winnin

g contractor and the detailed estimates of the bid as awarded.

The government agencies concerned shall likewise post on their respective websit

es within thirty (30) calendar days from the issuance of a certificate of comple

tion the following: (i) detailed actual cost of the project; and (ii) variation

orders issued, if any.

ADMINISTRATIVE PROCEDURES

Sec. 93. Transparency Seal. To enhance transparency and enforce accountability,

all national government agencies shall maintain a transparency seal to be posted

on their official websites. The transparency seal shall contain the following i

nformation: (i) the agency's mandates and functions, names of its officials with t

heir position and designation, and contact information; (ii) annual reports, as

required under National Budget Circular Nos. 507 and 507-A dated January 31, 200

7 and June 12, 2007, respectively, for the last three (3) fiscal years; (iii) th

eir respective approved budgets and corresponding targets immediately upon appro

val of this Act; (iv) major programs and projects categorized in accordance with

the five key results areas under E.O. No. 43, s. 2011; (v) the program/projects

beneficiaries as identified in the applicable special provisions; (vi) status o

f implementation and program/project evaluation and/or assessment reports; and (

vii) annual procurement plan, contracts awarded and the name of contractors/supp

liers/consultants.

ADMINISTRATIVE PROCEDURES

Sec. 94. Exemption from Garnishment. All amounts appropriated and released under

this Act shall be exempt from garnishment.

END OF PRESENTATION THANK YOU VERY MUCH FOR LISTENING

Presenter: Dimsy V. Lucas

A Certified Public Servant

Das könnte Ihnen auch gefallen

- RELEVANT EVIDENCE RULESDokument51 SeitenRELEVANT EVIDENCE RULESvanessa pagharion100% (9)

- Accounting for Government DisbursementsDokument64 SeitenAccounting for Government Disbursementssayafront100% (1)

- Lessons Learned - Risk Management Issues in Genetic Counseling (2007)Dokument151 SeitenLessons Learned - Risk Management Issues in Genetic Counseling (2007)AditiNoch keine Bewertungen

- Requirements (Cash Advance)Dokument60 SeitenRequirements (Cash Advance)Rosemarie Guinayen Perez-MalagueñaNoch keine Bewertungen

- GAA 2012 General ProvisionsDokument19 SeitenGAA 2012 General ProvisionsdantemayorNoch keine Bewertungen

- A Strategic Management PaperDokument7 SeitenA Strategic Management PaperKarll Brendon SalubreNoch keine Bewertungen

- MechanismDokument17 SeitenMechanismm_er100Noch keine Bewertungen

- DOF Local Finance Circular 03-93Dokument4 SeitenDOF Local Finance Circular 03-93Peggy SalazarNoch keine Bewertungen

- Ateneo 2007 Criminal ProcedureDokument69 SeitenAteneo 2007 Criminal ProcedureJingJing Romero98% (55)

- Accounting For Disbursement and Related TransactionsDokument12 SeitenAccounting For Disbursement and Related TransactionsHinataNoch keine Bewertungen

- Bar Review Companion: Taxation: Anvil Law Books Series, #4Von EverandBar Review Companion: Taxation: Anvil Law Books Series, #4Noch keine Bewertungen

- Law On Natural Resources Reviewer PDFDokument108 SeitenLaw On Natural Resources Reviewer PDFKrisLarrNoch keine Bewertungen

- Political LawDokument15 SeitenPolitical LawRaymund Flores100% (1)

- Ordinance No 1 TaxationDokument5 SeitenOrdinance No 1 TaxationMiguel BravoNoch keine Bewertungen

- RR 10-76Dokument4 SeitenRR 10-76matinikkiNoch keine Bewertungen

- Z - General Provisions FY 2023 GAADokument24 SeitenZ - General Provisions FY 2023 GAAJVB 1029Noch keine Bewertungen

- Accounting For Local Government Unit I. Basic Fatures and PoliciesDokument10 SeitenAccounting For Local Government Unit I. Basic Fatures and PoliciesChin-Chin Alvarez SabinianoNoch keine Bewertungen

- Recoletos Law Center Notes On LaborDokument33 SeitenRecoletos Law Center Notes On LabornikiboigeniusNoch keine Bewertungen

- Labor LawDokument17 SeitenLabor LawRaymund Flores100% (2)

- Philippine Ports AuthorityDokument9 SeitenPhilippine Ports AuthorityFarina R. SalvadorNoch keine Bewertungen

- Mafia Bride by CD Reiss (Reiss, CD)Dokument200 SeitenMafia Bride by CD Reiss (Reiss, CD)Aurniaa InaraaNoch keine Bewertungen

- Maceda v. Macaraig (1993) Case DigestDokument6 SeitenMaceda v. Macaraig (1993) Case DigestShandrei GuevarraNoch keine Bewertungen

- IRR RA 5980 Financing Company ActDokument9 SeitenIRR RA 5980 Financing Company Actskylark74Noch keine Bewertungen

- David vs. ArroyoDokument5 SeitenDavid vs. ArroyoDeus Dulay93% (14)

- 05 Askeland ChapDokument10 Seiten05 Askeland ChapWeihanZhang100% (1)

- Openstack Deployment Ops Guide PDFDokument197 SeitenOpenstack Deployment Ops Guide PDFBinank PatelNoch keine Bewertungen

- Working Capital Management at Padmavathi Co-operative BankDokument53 SeitenWorking Capital Management at Padmavathi Co-operative BankMamidishetty Manasa67% (3)

- General ProvisionDokument22 SeitenGeneral ProvisionAnna LynNoch keine Bewertungen

- Philippines 2011 national budget law summaryDokument34 SeitenPhilippines 2011 national budget law summaryHobert LluzNoch keine Bewertungen

- Fy 2010 General ProvisionsDokument6 SeitenFy 2010 General ProvisionsAllenNoch keine Bewertungen

- Text of RA9162Dokument18 SeitenText of RA9162Juan Luis LusongNoch keine Bewertungen

- General Fund receipts and savings provisionsDokument6 SeitenGeneral Fund receipts and savings provisionsVIRGILIO OCOY IIINoch keine Bewertungen

- Adjusted ProfitDokument12 SeitenAdjusted ProfitDivine ugboduNoch keine Bewertungen

- Bir-Rulings Income and DeductionsDokument4 SeitenBir-Rulings Income and DeductionsRB BalanayNoch keine Bewertungen

- taxation 2 notesDokument27 Seitentaxation 2 notesBlessing Timothy 180174Noch keine Bewertungen

- Research Note: Explanation. - For The Purpose of This Clause, The Term "Schedule Bank" Means A Bank IncludedDokument3 SeitenResearch Note: Explanation. - For The Purpose of This Clause, The Term "Schedule Bank" Means A Bank IncludedSHREYANSH BARVENoch keine Bewertungen

- General System of Financial ManagementDokument21 SeitenGeneral System of Financial ManagementDorthyNoch keine Bewertungen

- Implementing Rules and Regulations of EO NO. 70Dokument91 SeitenImplementing Rules and Regulations of EO NO. 70MadoTanNoch keine Bewertungen

- Value Added Tax 3Dokument8 SeitenValue Added Tax 3Nerish PlazaNoch keine Bewertungen

- CHAPTER 5-RubyDokument3 SeitenCHAPTER 5-RubyVenchNoch keine Bewertungen

- Gov. Acc. Chapter 5Dokument38 SeitenGov. Acc. Chapter 5Thea Marie GuiljonNoch keine Bewertungen

- Agree-Bop 2019 Final DraftDokument12 SeitenAgree-Bop 2019 Final DraftKwasi AdarkwaNoch keine Bewertungen

- Revenues and Other ReceiptsDokument45 SeitenRevenues and Other ReceiptsFrank James100% (1)

- GAA 2020 VOL 1 B - General ProvisionsDokument25 SeitenGAA 2020 VOL 1 B - General ProvisionsRonald VillaNoch keine Bewertungen

- 319655-2021-An Act Appropriating Funds For The Operation20220209-12-1luqtbkDokument43 Seiten319655-2021-An Act Appropriating Funds For The Operation20220209-12-1luqtbkAicing Namingit-VelascoNoch keine Bewertungen

- RA 11639 An - Act - Appropriating - Funds 2021Dokument43 SeitenRA 11639 An - Act - Appropriating - Funds 2021SkskskskNoch keine Bewertungen

- Today Is Friday, October 03, 2014Dokument9 SeitenToday Is Friday, October 03, 2014Bryan MagnayeNoch keine Bewertungen

- Agree-Property Rate 2019 Final DraftDokument12 SeitenAgree-Property Rate 2019 Final DraftKwasi AdarkwaNoch keine Bewertungen

- RR 10-76Dokument4 SeitenRR 10-76cheska_abigail950Noch keine Bewertungen

- Accounting For Government and Not-For-Profit OrganizationsDokument7 SeitenAccounting For Government and Not-For-Profit OrganizationsAngela QuililanNoch keine Bewertungen

- ACC 312 Semestral OutputDokument11 SeitenACC 312 Semestral Outputgelyncastromero25Noch keine Bewertungen

- Accounting and Budgeting Policies for Local Government UnitsDokument34 SeitenAccounting and Budgeting Policies for Local Government UnitsRachel Sanculi LustinaNoch keine Bewertungen

- PD 1234Dokument3 SeitenPD 1234gerald scottNoch keine Bewertungen

- Export Processing Zone AuthorityDokument18 SeitenExport Processing Zone AuthoritypvcarreonNoch keine Bewertungen

- Presentation Covering FEMA - Act, Regulations Framed There Under, Master CircularDokument11 SeitenPresentation Covering FEMA - Act, Regulations Framed There Under, Master CircularAvinash RajakNoch keine Bewertungen

- Law No. 116 of 2013 For Promoting Foreign Direct Investment in KuwaitDokument18 SeitenLaw No. 116 of 2013 For Promoting Foreign Direct Investment in KuwaitMohammad RNoch keine Bewertungen

- Dof Local Finance Circular No 01-93Dokument4 SeitenDof Local Finance Circular No 01-93RaymondNoch keine Bewertungen

- Presidential Decree No. 66Dokument17 SeitenPresidential Decree No. 66Bonjen KalbitNoch keine Bewertungen

- PWA Important DefinitionsDokument18 SeitenPWA Important DefinitionsmuhammadimranavanNoch keine Bewertungen

- Revenue Audit Memorandum Order No. 01-95: I. RationaleDokument3 SeitenRevenue Audit Memorandum Order No. 01-95: I. RationalesaintkarriNoch keine Bewertungen

- Excise Law PDFDokument54 SeitenExcise Law PDFJay BudhdhabhattiNoch keine Bewertungen

- VAT Zero Rated Transactions PhilippinesDokument8 SeitenVAT Zero Rated Transactions PhilippineskmoNoch keine Bewertungen

- Government Withholding Tax GuideDokument9 SeitenGovernment Withholding Tax GuideChristian AnresNoch keine Bewertungen

- Digest RR 13-2018Dokument9 SeitenDigest RR 13-2018Maria Rose Ann BacilloteNoch keine Bewertungen

- RMC 1-80Dokument1.167 SeitenRMC 1-80Ramon Augusto Melad LacambraNoch keine Bewertungen

- Amendment To Sikkim Financial Rules, 1979.Dokument30 SeitenAmendment To Sikkim Financial Rules, 1979.PembaLama100% (1)

- ReportingDokument15 SeitenReportingDaniella SorianoNoch keine Bewertungen

- Accounting For LgusDokument47 SeitenAccounting For LgusPatricia Reyes100% (1)

- 10-Casiguran Aurora09 Part2-Findings and RecommendationsDokument7 Seiten10-Casiguran Aurora09 Part2-Findings and RecommendationsKasiguruhan AuroraNoch keine Bewertungen

- Local Business Taxes ExplainedDokument73 SeitenLocal Business Taxes Explainedflordeliza de jesusNoch keine Bewertungen

- Fiscal Incentives To TEZ Operators and Registered Tourism Enterprises Within The TEZDokument2 SeitenFiscal Incentives To TEZ Operators and Registered Tourism Enterprises Within The TEZjerson_xx6816Noch keine Bewertungen

- Rmo 1985Dokument58 SeitenRmo 1985Mary graceNoch keine Bewertungen

- Notes - Tax I - Create Law - Nov 24Dokument9 SeitenNotes - Tax I - Create Law - Nov 240506sheltonNoch keine Bewertungen

- BSP Papal CoinDokument1 SeiteBSP Papal CoinisluvhimNoch keine Bewertungen

- RMC No. 23-2007-Government Payments WithholdingDokument7 SeitenRMC No. 23-2007-Government Payments WithholdingWizardche_13Noch keine Bewertungen

- Revised Rules of ProcedureDokument24 SeitenRevised Rules of ProcedurenikiboigeniusNoch keine Bewertungen

- Letter Head Commission On AuditDokument1 SeiteLetter Head Commission On AuditnikiboigeniusNoch keine Bewertungen

- Fina L CCP AOM 2013 01 SubsidyDokument6 SeitenFina L CCP AOM 2013 01 SubsidynikiboigeniusNoch keine Bewertungen

- Fraud Audit and Investigation Office0001Dokument1 SeiteFraud Audit and Investigation Office0001nikiboigeniusNoch keine Bewertungen

- Stonehill Vs DioknoDokument2 SeitenStonehill Vs DioknojelyneptNoch keine Bewertungen

- Transmital Letter For CCP On Cash AdvanceDokument1 SeiteTransmital Letter For CCP On Cash AdvancenikiboigeniusNoch keine Bewertungen

- Full Texts of Cases Under Administrative LawDokument116 SeitenFull Texts of Cases Under Administrative LawnikiboigeniusNoch keine Bewertungen

- Coa C2014-003Dokument53 SeitenCoa C2014-003Mark Lester Lee AureNoch keine Bewertungen

- Monetization of Leave Credits PDFDokument1 SeiteMonetization of Leave Credits PDFnikiboigeniusNoch keine Bewertungen

- Republic of The Philippines Commonwealth Ave., Quezon City: Commission On AuditDokument4 SeitenRepublic of The Philippines Commonwealth Ave., Quezon City: Commission On AuditnikiboigeniusNoch keine Bewertungen

- Live-View Remote: Rm-Lvr1Dokument16 SeitenLive-View Remote: Rm-Lvr1nikiboigeniusNoch keine Bewertungen

- Memo To All SAs & ATLs On The Audit Observations oDokument14 SeitenMemo To All SAs & ATLs On The Audit Observations onikiboigeniusNoch keine Bewertungen

- CCP Inspection Report on Delivered GI PipesDokument1 SeiteCCP Inspection Report on Delivered GI PipesnikiboigeniusNoch keine Bewertungen

- EXPANDED WITHHOLDING TAX Tax Base in The Computation of 1% EWT and 6% Creditable VAT - The 1% Expanded Creditable Withholding Tax Imposed UnderDokument1 SeiteEXPANDED WITHHOLDING TAX Tax Base in The Computation of 1% EWT and 6% Creditable VAT - The 1% Expanded Creditable Withholding Tax Imposed UndernikiboigeniusNoch keine Bewertungen

- Consti1 Course OutlineDokument22 SeitenConsti1 Course OutlinenikiboigeniusNoch keine Bewertungen

- AutobahnDokument2 SeitenAutobahnnikiboigeniusNoch keine Bewertungen

- DAP Separate Opinion SAJ Antonio T. CarpioDokument27 SeitenDAP Separate Opinion SAJ Antonio T. CarpioHornbook RuleNoch keine Bewertungen

- Revised Withholding Tax TablesDokument1 SeiteRevised Withholding Tax TablesJonasAblangNoch keine Bewertungen

- Environmental RationaleDokument97 SeitenEnvironmental Rationalegoannamarie7814Noch keine Bewertungen

- Judicial Affidavit RuleDokument10 SeitenJudicial Affidavit RulenikiboigeniusNoch keine Bewertungen

- APA - 7thed - UCW Student Paper TemplateDokument4 SeitenAPA - 7thed - UCW Student Paper Templatesimerpreet3Noch keine Bewertungen

- Flow Through Pipes: Departmentofcivilengineering Presidency University, Bangalore-64 BY Santhosh M B Asstistant ProfessorDokument15 SeitenFlow Through Pipes: Departmentofcivilengineering Presidency University, Bangalore-64 BY Santhosh M B Asstistant ProfessorSanthoshMBSanthuNoch keine Bewertungen

- Split Plot Design GuideDokument25 SeitenSplit Plot Design GuidefrawatNoch keine Bewertungen

- The Four Principles of SustainabilityDokument4 SeitenThe Four Principles of SustainabilityNeals QuennevilleNoch keine Bewertungen

- Provisional List of Institutes1652433727Dokument27 SeitenProvisional List of Institutes1652433727qwerty qwertyNoch keine Bewertungen

- 1.9 Bernoulli's Equation: GZ V P GZ V PDokument1 Seite1.9 Bernoulli's Equation: GZ V P GZ V PTruong NguyenNoch keine Bewertungen

- The Issue of Body ShamingDokument4 SeitenThe Issue of Body ShamingErleenNoch keine Bewertungen

- Inbound 8511313797200267098Dokument10 SeitenInbound 8511313797200267098phan42Noch keine Bewertungen

- Rostam's Seven LaboursDokument3 SeitenRostam's Seven LaboursArifin SohagNoch keine Bewertungen

- Internal Disease AnsDokument52 SeitenInternal Disease AnsKumar AdityaNoch keine Bewertungen

- Learner's Activity Sheet: English (Quarter 4 - Week 5)Dokument5 SeitenLearner's Activity Sheet: English (Quarter 4 - Week 5)Rufaidah AboNoch keine Bewertungen

- Catalogue PDFDokument4 SeitenCatalogue PDFShivam GuptaNoch keine Bewertungen

- Bioav 3Dokument264 SeitenBioav 3Sabiruddin Mirza DipuNoch keine Bewertungen

- Lewis Carrol: Birth: DeathDokument21 SeitenLewis Carrol: Birth: DeathmarialuvsjeffNoch keine Bewertungen

- Final Exam IN Sample QuestionsDokument27 SeitenFinal Exam IN Sample QuestionsJI TEN100% (1)

- Sankalp Sanjeevani NEET: PhysicsDokument11 SeitenSankalp Sanjeevani NEET: PhysicsKey RavenNoch keine Bewertungen

- Hireena Essay AnsDokument2 SeitenHireena Essay AnsTasniiem ChandraaNoch keine Bewertungen

- Oposa vs. Factoran 224 Scra 792Dokument28 SeitenOposa vs. Factoran 224 Scra 792albemartNoch keine Bewertungen

- NVH PDFDokument3 SeitenNVH PDFSubhendu BarisalNoch keine Bewertungen

- A. Rationale: Paulin Tomasuow, Cross Cultural Understanding, (Jakarta: Karunika, 1986), First Edition, p.1Dokument12 SeitenA. Rationale: Paulin Tomasuow, Cross Cultural Understanding, (Jakarta: Karunika, 1986), First Edition, p.1Nur HaeniNoch keine Bewertungen

- Slope Stability Analysis MethodsDokument5 SeitenSlope Stability Analysis MethodsI am AngelllNoch keine Bewertungen

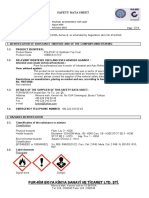

- Polifur 1K Synthetic Top Coat MSDS Rev 2 ENDokument14 SeitenPolifur 1K Synthetic Top Coat MSDS Rev 2 ENvictorzy06Noch keine Bewertungen

- Volume 4-6Dokument757 SeitenVolume 4-6AKNoch keine Bewertungen