Beruflich Dokumente

Kultur Dokumente

TBCH 11

Hochgeladen von

Tornike JashiOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

TBCH 11

Hochgeladen von

Tornike JashiCopyright:

Verfügbare Formate

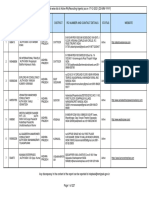

CHAPTER 11

Equity Financing

MULTIPLE CHOICE QUESTIONS

Theory/Definitional Quetion

1 Preferred stock and basic shareholder rights

2 Features of preferred stock as perceived by common shareholders

3 Basic shareholder rights

4 etermining compensation e!pense under the intrinsic value method

" #ccounting for stock options under the fair value method

$ #ccounting for stock options under the intrinsic value method

% isclosures&&fair value method vs' intrinsic value method

( #d)ustment to retained earnings on stock conversions

* Equity transactions effecting retained earnings

1+ ,tate la-s and their effect on dividend payments

11 .omponents of comprehensive income

12 /se of equity reserves under international accounting standards

13 efinition of par value of common stock

14 Entry to record fully paid stock subscription

1" 0reatment of dividends not declared or paid on cumulative preferred stock

1$ Presentation of treasury stock

1% 0reatment of gains1losses on treasury stock sale1purchase

1( etermine credit amount per share to common stock 2stock rights3

1* 4ournali5e e!ercise of stock rights

2+ Effect of preferred stock issuance on preferred stock outstanding

21 Effect of stock split on assets6 equity6 and paid&in capital

22 Effect of subscription sale on additional paid&in capital

23 .lassification of stock -arrants outstanding

24 7hen common stock shares issued are greater than shares outstanding

2" .ost1par value method of accounting for treasury stock

2$ .ost1par value method of accounting for treasury stock

2% Effect of cost method of accounting on retained earnings

2( Effect of par value method on additional paid&in capital and retained

earnings

2* efinition of stock rights

3+ Entry for lapse in stock rights

31 #ppropriations of retained earnings

14*

1!" .hapter 11 Equity

Financing

32 8aluation of property dividend

33 istribution of a property dividend

34 efinition of liquidating a dividend

3" 0reatment of e!cess on property dividend

3$ Effect of dividend on retained earnings and stockholders9 equity

3% Effect of a stock dividend

3( 0ransactions causing an increase in retained earnings

3* :eporting undistributed stock dividends

4+ #ppropriation of retained earnings1treasury stock purchases

41 ;mplementation of a quasi&reorgani5ation

42 Effect of quasi&reorgani5ation on capital and retained earnings

43 Effect of dividend distribution on additional paid&in capital and retained

earnings

44 :easons for )ournali5ing stock dividend

4" Effect of cash dividend declaration on retained earnings

4$ eclaration of liquidating dividend

4% 8aluation of property dividend

4( Effect of stock split or dividend on retained earnings

4* Effect of stock dividend on retained earnings and total stockholders9 equity

Co#$utational Quetion

"+ .omputation of total contributed capital

"1 .omputation of increase in additional paid&in capital

"2 4ournali5e acquisition of treasury stock

"3 .alculate stockholders9 equity using cost method

"4 4ournali5e sale of treasury stock

"" ,tock -arrants<determine amount credited to paid&in capital

"$ .omputation of compensation e!pense

"% .omputation of par value of stock after split

"( .omputation of outstanding shares after split

"* .omputation of proceeds allocated to common stock

$+ .omputation of balance of paid&in capital from treasury stock account

$1 .omputation of balances of paid&in capital and retained earnings

$2 .omputation of credit amount to stock account

$3 .omputation of stockholders9 equity using cost method

$4 .omputation of gain from sale of stock -arrants

$" .omputation of paid&in capital balance after reverse stock split

$$ 4ournali5e declaration of property dividend

$% .omputation of ividends Payable balance

$( 4ournali5e declaration of property dividend

$* .omputation of common stock amount after quasi&reorgani5ation

%+ 4ournal entry for a large stock dividend

%1 .omputation of a small stock dividend

%2 .omputation of dividends payable on common and preferred stock

%3 .omputation of increase1decrease in total stockholders9 equity from stock

dividend

%4 .omputation of amount of liquidating dividend

%" etermination of paid&in capital from quasi&reorgani5ation

%$ Effect of revaluation on retained earnings

%% .omputation of retained earnings balance&&stock dividend

%( .omputation of effect of stock dividend on common stock6 retained

earnings

%* Effect of a stock dividend

(+ 4ournali5e distribution of stock dividend

(1 .omputation of net income given stock and cash dividend amounts

(2 .omputation of income on receipt of stock dividend

(3 .omputation of balance of retained earnings

(4 .omputation of reduction in common stock for quasi&reorgani5ation

(" #ccounting for stock appreciation rights

PRO%LEMS

1 .omputation of balances for all equity accounts

2 4ournali5e equity transactions

3 4ournali5e reacquisition6 sale of stock under cost and par value

4 4ournali5e treasury stock transactions under cost method

" 4ournali5e stock -arrant transactions

$ .omputation of cash dividends to be received by common stockholders

% 4ournali5e declaration and payment of stock dividends

( 4ournali5e declaration and payment of stock dividends

* 4ournali5e capital stock transactions

1+ .omputation of equity balances and shares outstanding

11 Prepare statement of retained earnings

12 4ournali5e recapitali5ation of assets and elimination of deficit

13 4ournali5e events of reorgani5ation plan

14 4ournali5e declaration and payment of cash dividend

1" escribe effects of various equity transactions on statement of cash flo-s

1$ #ccounting for a stock option plan

1% Prepare statement of changes in stockholders= equity

1( #ccounting for performance&based stock option plans using fair value and

intrinsic value methods

1* Evaluation of use of Black&,choles model for stock compensation plans

1"1

MULTIPLE CHOICE QUESTIONS

c 1' 7hich of the follo-ing shareholder rights is most commonly enhanced in an

>?1 issue of preferred stock@

a' 0he right to vote for the board of directors'

b' 0he right to maintain one=s proportional interest in the corporation'

c' 0he right to receive a full cash dividend before dividends are paid to

other classes of stock'

d' 0he right to vote on ma)or corporate issues'

d 2' 7hich of the follo-ing features of preferred stock -ould most likely be

>?1 opposed by common shareholders@

a' Par or stated value'

b' .allable'

c' :edeemable'

d' Participating'

d 3' 7hich of the follo-ing is not one of the basic shareholders rights@

>?1 a' 0he right to participate in earnings'

b' 0he right to maintain one=s proportional interest in the corporation'

c' 0he right to participate in the proceeds of the sale of corporate assets

upon liquidation of the corporation'

d' 0he right to inspect the accounting records of the corporation'

b 4' 0he full amount of compensation e!pense incurred in a compensatory stock

>?" option plan under the intrinsic value method is kno-n at

a' the grant date'

b' the measurement date'

c' the plan adoption date'

d' the date the options e!pire'

a "' 0he e!ercise price and market price of stock under a fi!ed compensatory

stock

>?" option plan are equal on the grant date' 0he fair value of the options is

greater

than the option price' /nder the fair value method

a' .ompensation e!pense -ill be recogni5ed in connection -ith the option

plan'

b' Ao compensation e!pense -ill be recogni5ed in connection -ith the

option plan'

c' eferred compensation -ill be recogni5ed'

d' Ao paid&in capital from stock options -ill be recogni5ed'

b $' 0he e!ercise price and market price of stock under a fi!ed compensatory

stock

>?" option plan are equal on the grant date' 0he fair value of the options is

greater

than the option price' /nder the intrinsic value method

a' .ompensation e!pense -ill be recogni5ed in connection -ith the option

plan'

b' Ao compensation e!pense -ill be recogni5ed in connection -ith the

option plan'

c' eferred compensation -ill be recogni5ed'

d' Paid&in capital from stock options -ill be recogni5ed'

c %' .urrent financial accounting standards require

>?" a' the use of the fair value method6 but not the intrinsic value method'

b' the use of the fair value method and the intrinsic value method to

account for each plan'

c' disclosure in the notes to the financial statements of compensation

e!pense under the fair value method if the intrinsic value method is

used'

d' disclosure in the notes to the financial statements of compensation

e!pense under the intrinsic value method if the fair value method is

used'

c (' #n ad)ustment to retained earnings as a result of a conversion of preferred

>?$ stock to common stock most likely -ould occur -hen

a' par value of the preferred stock is high relative to fair value of the

common

stock'

b' par value of the common stock is less than the book value of the

preferred stock'

c' par value of the common stock e!ceeds the book value of the preferred

stock'

d' par value of the preferred stock is lo- relative to fair value of the

common'

b *' 7hich of the follo-ing is least likely to affect the retained earnings

balance@

>?% a' .onversion of preferred stock into common stock'

b' ,tock splits'

c' 0reasury stock transactions'

d' ,tock dividends'

b 1+' 7hich of the follo-ing is most likely to be found in state la-s regarding

>?% payment of dividends@

a' ividends may be paid from legal capital'

b' :etained earnings are available for dividends unless restricted by

contract or by statute'

c' /nreali5ed capital is available for any type of dividend'

d' .apital from donated assets is available for dividends'

a 11' 7hich of the follo-ing is not a component of comprehensive income@

>?* a' #sset revaluation reserve'

b' Aet income'

c' Foreign currency translation ad)ustment'

d' Binimum pension liability ad)ustment'

b 12' 0he use of equity reserves under international accounting standards

>?* a' is strictly voluntary on the part of the management of a company'

b' is based on -hether a reserve is part of distributable or nondistributable

equity'

c' is primarily for the benefit of shareholders rather than creditors'

d' results in the elimination of the retained earnings category from the

total equity of a company'

c 13' 0he par value of common stock represents

>?2 a' the liquidation value of the stock'

b' the book value of the stock'

c' the legal nominal value assigned to the stock'

d' the amount received by the corporation -hen the stock -as originally

issued'

d 14' 0he entry to record the issuance of common stock for fully paid stock

>?2 subscriptions is

a' a memorandum entry'

b' .ommon ,tock ,ubscribed

.ommon ,tock

#dditional Paid&;n .apital

c' .ommon ,tock ,ubscribed

,ubscriptions :eceivable

d' .ommon ,tock ,ubscribed

.ommon ,tock

a 1"' Farnon .ompany has not declared or paid dividends on its cumulative

>?( preferred stock in the last three years' 0hese dividends should be reported

a' in a note to the financial statements'

b' as a reduction in stockholders= equity'

c' as a current liability'

d' as a noncurrent liability'

b 1$' 7hich of the follo-ing is an appropriate presentation of treasury stock@

>?3 a' #s a marketable security

b' #s a deduction at cost from total stockholders= equity

c' #s a deduction at cost from total contingent liabilities

d' #s a deduction at par from total stockholders= equity

b 1%' Cains and losses on the purchase and resale of treasury stock may be

>?3 reflected only in

a' paid&in capital accounts'

b' paid&in capital and retained earnings accounts'

c' income6 paid&in capital6 and retaining earnings accounts'

d' income and paid&in capital accounts'

c 1(' # company issued rights to its e!isting shareholders to acquire6 at D1" per

>?4 share6 "6+++ unissued shares of common stock -ith a par value of D1+ per

share' .ommon ,tock -ill be credited at

a' D1" per share -hen the rights are e!ercised'

b' D1" per share -hen the rights are issued'

c' D1+ per share -hen the rights are e!ercised'

d' D1+ per share -hen the rights are issued'

d 1*' # company issued rights to its e!isting shareholders to purchase for par

>?4 unissued shares of common stock -ith a par value of D1+ per share' 7hen

the market value of the common stock -as D12 per share6 the rights -ere

e!ercised' .ommon ,tock should be credited at D1+ per share and

a' Paid&;n .apital from ,tock :ights credited at D2 per share'

b' #dditional Paid&;n .apital credited at D2 per share'

c' :etained Earnings credited at D2 per share'

d' no credit made to #dditional Paid&;n .apital or :etained Earnings'

a 2+' 0he issuance of shares of preferred stock to shareholders

>?2 a' increases preferred stock outstanding'

b' has no effect on preferred stock outstanding'

c' increases preferred stock authori5ed'

d' decreases preferred stock authori5ed'

b 21' Eo- -ould a stock split affect each of the follo-ing@

>?(

0otal

,tockholders9 #dditional

#ssets Equity Paid&;n .apital

a' ;ncrease ;ncrease Ao effect

b' Ao effect Ao effect Ao effect

c' Ao effect Ao effect ;ncrease

d' ecrease ecrease ecrease

c 22' ?n February 16 authori5ed common stock -as sold on a subscription basis

at

>?2 a price in e!cess of par value6 and 2+ percent of the subscription price -as

collected' ?n Bay 16 the remaining (+ percent of the subscription price

-as collected' #dditional Paid&;n .apital -ould increase on

February 1 Bay 1

a' Ao Fes

b' Ao Ao

c' Fes Ao

d' Fes Fes

d 23' ,tock -arrants outstanding should be classified as

>?4 a' liabilities'

b' reductions of capital contributed in e!cess of par value'

c' capital stock'

d' additions to contributed capital'

c 24' #t the date of the financial statements6 common stock shares issued -ould

>?2 e!ceed common stock shares outstanding as a result of the

a' declaration of a stock split'

b' declaration of a stock dividend'

c' purchase of treasury stock'

d' payment in full of subscribed stock'

c 2"' 7hen treasury stock is purchased for more than its par value6 0reasury

,tock

>?3 is debited for the purchase price under -hich of the follo-ing methods@

.ost Bethod Par 8alue Bethod

a' Ao Ao

b' Ao Fes

c' Fes Ao

d' Fes Fes

d 2$' 7hen treasury stock is purchased for cash at more than its par value6 -hat

is

>?3 the effect on total stockholders= equity under each of the follo-ing

methods@

.ost Bethod Par 8alue Bethod

a' Ao effect ecrease

b' ecrease Ao effect

c' ;ncrease ;ncrease

d' ecrease ecrease

c 2%' 0reasury stock -as acquired for cash at a price in e!cess of its par value'

0he

>?3 treasury stock -as subsequently reissued for cash at a price in e!cess of

its acquisition price' #ssuming that the cost method of accounting for

treasury stock transactions is used6 -hat is the effect on retained earnings@

#cquisition of :eissuance of

0reasury ,tock 0reasury ,tock

a' Ao effect ;ncrease

b' ;ncrease Ao effect

c' Ao effect Ao effect

d' ;ncrease ecrease

d 2(' Five thousand shares of common stock -ith a par value of D1+ per share

-ere

>?3 issued initially at D12 per share' ,ubsequently6 16+++ of these shares -ere

acquired as treasury stock at D1" per share' #ssuming that the par value

method of accounting for treasury stock transactions is used6 -hat is the

effect of the acquisition of the treasury stock on each of the follo-ing@

#dditional :etained

Paid&;n .apital Earnings

a' ;ncrease Ao effect

b' ;ncrease ecrease

c' ecrease ;ncrease

d' ecrease ecrease

b 2*' 7hich of the follo-ing is issued to shareholders by a corporation as

evidence

>?4 of the o-nership of rights to acquire its unissued or treasury stock@

a' ,tock options

b' ,tock rights

c' ,tock dividends

d' ,tock subscriptions

d 3+' # company issued rights to its e!isting shareholders to purchase6 for D3+

per

>?4 share6 unissued shares of D1" par value common stock' 7hen the rights

lapse6

a' #dditional Paid&;n .apital -ill be credited'

b' ,tock :ights ?utstanding -ill be debited'

c' Cain on >apse of ,tock :ights -ill be credited'

d' no entry -ill be made'

b 31' ,elect the statement that is incorrect concerning the appropriations of

retained

>?% earnings'

a' #ppropriations of retained earnings do not change the total amount of

stockholders= equity'

b' #ppropriations of retained earnings reflect funds set aside for a

designated purpose6 such as plant e!pansion'

c' #ppropriations of retained earnings can be made as a result of

contractual requirements'

d' #ppropriations of retained earnings can be made at the discretion of the

board of directors'

d 32' 7hen a property dividend is declared and the book value of the property

>?( e!ceeds its market value6 the dividend is recorded at the

a' market value of the property at the date of distribution'

b' book value of the property at the date of declaration'

c' book value of the property at the date of distribution if it still e!ceeds the

market value of the property at the date of declaration'

d' market value of the property at the date of declaration'

c 33' ?n 4uly 316 2++16 >akers .orporation purchased "++6+++ shares of .eltic

>?( .orporation' ?n ecember 316 2++26 >akers distributed 2"+6+++ shares of

.eltic stock as a dividend to >akers9 stockholders' 0his is an e!ample of a

a' liquidating dividend'

b' investment dividend'

c' property dividend'

d' stock dividend'

b 34' 7hen a portion of stockholders= original investment is returned in the form

of

>?( a dividend6 it is called a

a' compensating dividend'

b' liquidating dividend'

c' property dividend'

d' equity dividend'

a 3"' 7hen a property dividend is declared and the market value of the property

>?( e!ceeds its book value6 the e!cess is credited to

a' Cain on istribution of Property ividends'

b' :etained Earnings'

c' #dditional Paid&;n .apital'

d' the related asset account'

b 3$' Eo- -ould the declaration of a 2+ percent stock dividend by 4ets

.orporation

>?( affect each of the follo-ing accounts on 4ets9 balance sheet@

:etained 0otal ,tock&

Earnings holders= Equity

a' ecrease ecrease

b' ecrease Ao effect

c' Ao effect ecrease

d' Ao effect Ao effect

a 3%' 7hen a dividend is declared and paid in stock6

>?( a' stockholders9 equity does not change'

b' total stockholders9 equity decreases'

c' the current ratio increases'

d' the amount of -orking capital decreases'

d 3(' 7hich of the follo-ing actions or events does not result in an addition to

>?% retained earnings@

a' # quasi&reorgani5ation

b' Earning of net income for the period

c' .orrection of an error in -hich ending inventory -as understated in a

previous year

d' ;ssuance of a 3&for&1 stock split

b 3*' /ndistributed stock dividends should be reported as

>?( a' a current liability'

b' an addition to capital stock outstanding'

c' a reduction in total stockholders= equity'

d' a note to the financial statements'

c 4+' # restriction of retained earnings is most likely to be required by

>?% a' incurring a net loss in the current year'

b' incurring a net loss in the prior year'

c' purchasing treasury stock'

d' reissuing treasury stock'

a 41' # quasi&reorgani5ation usually results in a net

>?11 a' -rite&do-n of assets and the elimination of a deficit'

b' -rite&do-n of assets and the continuation of a deficit'

c' -rite&up of assets and a net -rite&do-n of retained earnings'

d' -rite&do-n of assets and a net -rite&do-n of retained earnings'

d 42' # company -ith a substantial deficit undertakes a quasi&reorgani5ation'

>?11 .ertain assets -ill be -ritten do-n to their present fair market values'

>iabilities -ill remain the same' Eo- -ould the entries to record the quasi&

reorgani5ation affect each of the follo-ing@

.ontributed .apital :etained Earnings

a' ecrease Ao effect

b' ;ncrease Ao effect

c' Ao effect ;ncrease

d' ecrease ;ncrease

d 43' ;f 4+ percent of the recent dividend paid by Packers .orporation -as

correctly

>?( considered to be a liquidating dividend6 ho- -ould this distribution affect

each of the follo-ing accounts@

#dditional :etained

Paid&;n .apital Earnings

a' Ao effect ecrease

b' Ao effect Ao effect

c' ecrease Ao effect

d' ecrease ecrease

d 44' /nlike a stock split6 a stock dividend requires a formal )ournal entry in the

>?( financial accounting records because

a' stock dividends increase the relative book value of an individual=s stock

holdings'

b' stock dividends increase the stockholders= equity in the issuing firm'

c' stock dividends are payable on the date they are declared'

d' stock dividends represent a transfer from :etained Earnings to .apital

,tock'

c 4"' # company declared a cash dividend on its common stock in ecember

1***6

>?( payable in 4anuary 2+++' :etained Earnings -ould

a' increase on the date of declaration'

b' not be affected on the date of declaration'

c' not be affected on the date of payment'

d' decrease on the date of payment'

d 4$' Eo- -ould the declaration of a liquidating dividend by a corporation affect

>?( each of the follo-ing@

.ontributed 0otal ,tock&

.apital holders9 Equity

a' Ao effect ecrease

b' ecrease Ao effect

c' Ao effect Ao effect

d' ecrease ecrease

a 4%' #n investment in marketable securities -as accounted for by the cost

method'

>?( 0hese securities -ere distributed to stockholders as a property dividend in

a nonreciprocal transfer' 0he dividend should be reported at the

a' fair value of the asset transferred'

b' fair value of the asset transferred or the recorded amount of the asset

transferred6 -hichever is higher'

c' fair value of the asset transferred or the recorded amount of the asset

transferred6 -hichever is lo-er'

d' recorded amount of the asset transferred'

d 4(' Eo- -ould retained earnings be affected by the declaration of each of the

>?( follo-ing@

,tock ividend ,tock ,plit

a' ecrease ecrease

b' Ao effect ecrease

c' Ao effect Ao effect

d' ecrease Ao effect

a 4*' Eo- -ould the declaration of a 1+ percent stock dividend by a corporation

>?( affect each of the follo-ing on its books@

:etained 0otal ,tock&

Earnings holders= Equity

a' ecrease Ao effect

b' ecrease ecrease

c' Ao effect ecrease

d' Ao effect Ao effect

d "+' 0he #melia .orporation -as incorporated on 4anuary 16 2++26 -ith the

>?2 follo-ing authori5ed capitali5ationG

4+6+++ shares of common stock6 no par value6 stated value D4+ per

share

1+6+++ shares of " percent cumulative preferred stock6 par value D1+

per share

uring 2++26 #melia issued 246+++ shares of common stock for a total of

D162++6+++ and $6+++ shares of preferred stock at D1$ per share' ;n

addition6 on ecember 2+6 2++26 subscriptions for 26+++ shares of

preferred stock -ere taken at a purchase price of D1%' 0hese subscribed

shares -ere paid for on 4anuary 26 2++3' 7hat should #melia report as

total contributed capital on its ecember 316 2++26 balance sheet@

a' D16+4+6+++

b' D162$26+++

c' D162*$6+++

d' D1633+6+++

b "1' ?n 4une 16 Bason .ompany issued (6+++ shares of its D1+ par common

stock

>?2 to i!on for a tract of land' 0he stock had a fair market value of D1( per

share on this date' ?n i!on=s last property ta! bill6 the land -as assessed

at D*$6+++' Bason should record an increase in #dditional Paid&;n .apital

of

a' D*$6+++'

b' D$46+++'

c' D4+6+++'

d' D1$6+++'

d "2' ?n #ugust 16 2++26 B' oran .ompany reacquired 46+++ shares of its D1"

par

>?3 value common stock for D1( per share' oran uses the cost method to

account for treasury stock' 7hat )ournal entry should oran make to

record the acquisition of treasury stock@

a' 0reasury ,tock'''''''''''''''''''''''''''''''''''''''''''''''''''''' $+6+++

#dditional Paid&;n .apital''''''''''''''''''''''''''''''''''''' 126+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' %26+++

b' 0reasury ,tock'''''''''''''''''''''''''''''''''''''''''''''''''''''' $+6+++

:etained Earnings'''''''''''''''''''''''''''''''''''''''''''''''' 126+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' %26+++

c' :etained Earnings'''''''''''''''''''''''''''''''''''''''''''''''' %26+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' %26+++

d' 0reasury ,tock'''''''''''''''''''''''''''''''''''''''''''''''''''''' %26+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' %26+++

b "3' Earbottle .orporation -as organi5ed on 4anuary 36 2++26 -ith authori5ed

>?3 capital of 1++6+++ shares of D1+ par common stock' uring 2++26

Earbottle had the follo-ing transactions affecting stockholders= equityG

4anuary %&&;ssued 4+6+++ shares at D12 per share

ecember 2&&Purchased $6+++ shares of treasury stock at D13 per

share

0he cost method -as used to record the treasury stock transaction'

Earbottle=s net income for 2++2 is D3++6+++' 7hat is the amount of

stockholders= equity at ecember 316 2++2@

a' D$4+6+++

b' D%+26+++

c' D%+(6+++

d' D%2+6+++

a "4' 0horpe .orporation holds 1+6+++ shares of its D1+ par common stock as

>?3 treasury stock6 -hich -as purchased in 1*** at a cost of D12+6+++' ?n

ecember 1+6 2+++6 0horpe sold all 1+6+++ shares for D21+6+++' #ssuming

that 0horpe used the cost method of accounting for treasury stock6 this sale

-ould result in a credit to

a' Paid&;n .apital from 0reasury ,tock of D*+6+++'

b' Paid&;n .apital from 0reasury ,tock of D11+6+++'

c' Cain on ,ale of 0reasury ,tock of D*+6+++'

d' :etained Earnings of D*+6+++'

c ""' ?n Barch 26 2++26 :oss .orporation issued 46+++ shares of $ percent

>?4 cumulative D1++ par value preferred stock for D4346+++' Each preferred

share carried one nondetachable stock -arrant -hich entitled the holder to

acquire6 at D1%6 one share of :oss D1+ par common stock' ?n Barch 26

2++26 the market price of the preferred stock 2-ithout -arrants3 -as D*+

per share and the market price of the stock -arrants -as D1" per -arrant'

0he amount credited to Paid&;n .apital in E!cess of Par&Preferred by :oss

on the issuance of the stock -as

a' D+'

b' D(6+++'

c' D346+++'

d' D$26+++'

b "$' ?n 4anuary 26 2++26 ,toner .orporation granted stock options to key

>?" employees for the purchase of $+6+++ shares of the company=s common

stock at D2" per share' 0he options are intended to compensate

employees for the ne!t t-o years' 0he options are e!ercisable -ithin a

four&year period beginning 4anuary 16 2++46 by grantees still in the employ

of the company' 0he market price of ,toner=s common stock -as D32 per

share at the date of grant' ,toner plans to distribute up to $+6+++ shares of

treasury stock -hen options are e!ercised' 0he treasury stock -as

acquired by ,toner at a cost of D2( per share and -as recorded under the

cost method' #ssume that no stock options -ere terminated during the

year' Eo- much should ,toner charge to .ompensation E!pense for the

year ended ecember 316 2++2@

a' D42+6+++

b' D21+6+++

c' D1(+6+++

d' D*+6+++

b "%' ?n ecember 1+6 aniel .o' split its stock "&for&2 -hen the market value

-as

>?( D$" per share' Prior to the split6 aniel had 2++6+++ shares of D1" par

value stock' #fter the split6 the par value of the stock -as

a' D3'++'

b' D$'++'

c' D1"'++'

d' D2$'++'

d "(' ?n ecember 1+6 aniel .o' split its stock "&for&2 -hen the market value

-as

>?( D$" per share' Prior to the split6 aniel had 2++6+++ shares of D1" par

value stock' #fter the split6 aniel=s outstanding shares -ould be

a' 16+++6+++'

b' 2++6+++'

c' 3++6+++'

d' "++6+++'

b "*' ?n 4uly 16 :ainbo- .orporation issued 26+++ shares of its D1+ par

common

>?2 and 46+++ shares of its D1+ par preferred stock for a lump sum of D(+6+++'

#t this date6 :ainbo-=s common stock -as selling for D1( per share and the

preferred stock for D13'"+ per share' 0he amount of proceeds allocated to

:ainbo-=s preferred stock should be

a' D4+6+++'

b' D4(6+++'

c' D"46+++'

d' D$+6+++'

c $+' 8ictor .orporation -as organi5ed on 4anuary 2 -ith 1++6+++ authori5ed

>?3 shares of D1+ par value common stock' uring the year6 8ictor had the

follo-ing capital transactionsG

4anuary " && issued %"6+++ shares at D14 per share

ecember 2% && purchased "6+++ shares at D11 per share

8ictor used the par value method to record the purchase of the treasury

shares'

7hat -ould be the balance in the paid&in capital from treasury stock

account at ecember 31@

a' D+

b' D"6+++

c' D1"6+++

d' D2+6+++

d $1' 0he stockholders= equity section of Eall .orporation=s balance sheet at

>?3 ecember 316 2++26 -as as follo-sG

.ommon stock 2D1+ par value6 authori5ed

16+++6+++ shares6 issued and outstanding

*++6+++ shares3''''''''''''''''''''''''''''''''''''''''''''''' D *6+++6+++

Paid&;n capital in e!cess of par''''''''''''''''''''''''''''' 26%++6+++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''' 163++6+++

0otal stockholders= equity'''''''''''''''''''''''''''''''''''''' D136+++6+++

?n 4anuary 26 2++36 Eall purchased and retired 1++6+++ shares of its stock

for D16(++6+++' Eall records treasury stock using the par value method'

;mmediately after retirement of these 1++6+++ shares6 the balances in the

additional paid&in capital and retained earnings accounts should be

Paid&;n .apital :etained

in E!cess of Par Earnings

a' D*++6+++ D163++6+++

b' D164++6+++ D(++6+++

c' D16*++6+++ D163++6+++

d' D264++6+++ D(++6+++

a $2' ;n 2++26 7yatt .orporation issued for D11+ per share6 1"6+++ shares of

D1++

>?$ par value convertible preferred stock' ?ne share of preferred stock may be

converted into three shares of 7yatt=s D2" par value common stock at the

option of the preferred shareholder' ?n ecember 316 2++36 all of the

preferred stock -as converted into common stock' 0he market value of the

common stock at the conversion date -as D4+ per share' 7hat amount

should be credited to the common stock account on ecember 316 2++3@

a' D1612"6+++

b' D16"++6+++

c' D16$"+6+++

d' D16(++6+++

d $3' .o! .orporation -as organi5ed on 4anuary 16 2++16 at -hich date it issued

>?3 1++6+++ shares of D1+ par common stock at D1" per share' uring the

period 4anuary 16 2++16 through ecember 316 2++36 .o! reported net

income of D4"+6+++ and paid cash dividends of D23+6+++' ?n 4anuary 1+6

2++36 .o! purchased $6+++ shares of its common stock at D12 per share'

?n ecember 316 2++36 .o! sold 46+++ treasury shares at D( per share'

.o! uses the cost method of accounting for treasury shares' 7hat is .o!=s

total stockholders= equity on ecember 316 2++3@

a' D16%2+6+++

b' D16%+46+++

c' D16$((6+++

d' D16$(+6+++

d $4' ?n February 246 BB. .ompany purchased 46+++ shares of 7inn .orp'=s

>?4 ne-ly issued $ percent cumulative D%" par preferred stock for D3+46+++'

Each share carried one detachable stock -arrant entitling the holder to

acquire at D1+ one share of 7inn no&par common stock' ?n February 2"6

the market price of the preferred stock e!&-arrants -as D%2 per share6 and

the market price of the stock -arrants -as D( per -arrant' ?n ecember

2*6 BB. sold all the stock -arrants for D416+++' 0he gain on the sale of

the stock -arrants -as

a' D+'

b' D16+++'

c' D*6+++'

d' D1+6$++'

b $"' ?n 4uly 16 Black .orporation had 2++6+++ shares of D1+ par common stock

>?( outstanding' 0he market price of the stock -as D12 per share' ?n the

same date6 Black declared a 1&for&2 reverse stock split' 0he par value of

the stock -as increased from D1+ to D2+6 and one ne- D2+ par share -as

issued for each t-o D1+ par shares outstanding' ;mmediately before the 1&

for&2 reverse stock split6 Black=s additional paid&in capital -as D$"+6+++'

7hat should be the balance in Black=s additional paid&in capital account

immediately after the reverse stock split@

a' D4"+6+++

b' D$"+6+++

c' D("+6+++

d' D16+"+6+++

b $$' .layton .o' o-ned 3+6+++ common shares of ayton .orporation

purchased

>?( in 1*** for D"4+6+++' ?n ,eptember 2+6 2++26 .layton declared a

property dividend of 1 share of ayton for every " shares of .layton stock

held by a stockholder' ?n that date6 there -ere "+6+++ common shares of

.layton outstanding6 and the market value of ayton shares -as D3+ per

share' 0he entry to record the declaration of the property dividend -ould

include a debit to :etained Earnings of

a' D+'

b' D3++6+++'

c' D3$+6+++'

d' D"4+6+++'

d $%' Beldon .o' -as organi5ed on 4anuary 26 2++26 -ith the follo-ing capital

>?( structureG

1+ percent cumulative preferred stock6 par value

D1++6 and liquidation value D1+"H issued and

outstanding 26+++ shares'''''''''''''''''''''''''''''''''''''''''''''''' D2++6+++

.ommon stock6 par value D2"H authori5ed 1++6+++

sharesH issued and outstanding 2+6+++ shares''''''''''''''' "++6+++

Beldon=s net income for the year ended ecember 316 2++26 -as D*++6+++6

but no dividends -ere declared' Beldon=s balance sheet -ould report

ividends Payable at ecember 316 2++26 of

a' D*+6+++'

b' D2+6+++'

c' D26+++'

d' D+'

b $(' ?n ,eptember 2+6 2++26 Ao55le .orporation declared the distribution of the

>?( follo-ing dividend to its stockholders of record as of ,eptember 3+6 2++2G

;nvestment in 1++6+++ shares of #stro .orporation stock6 carrying

value D$++6+++H fair market value on ,eptember 2+6 D164"+6+++H fair

market value on ,eptember 3+6 D16"%"6+++'

0he entry to record the declaration of the property dividend -ould include a

debit to :etained Earnings of

a' D16"%"6+++'

b' D164"+6+++'

c' D("+6+++'

d' D$++6+++'

b $*' 0he board of directors of ?vereager .o' decided that the company should

>?11 undergo a quasi&reorgani5ation effective on ecember 316 2++2' ?n that

date6 the company determined the follo-ing asset values'

Book 8alue Barket 8alue

;nventory''''''''''''''''''''''''''''''''''''''''''''''' D 1++6+++ D 11+6+++

Building''''''''''''''''''''''''''''''''''''''''''''''''' (++6+++ 4++6+++

Equipment''''''''''''''''''''''''''''''''''''''''''''' 1(+6+++ 14+6+++

D 16+(+6+++ D $"+6+++

0he stockholders= equity section at ecember 316 2++26 is presented belo-'

.ommon stock6 D2+ par6 (+6+++ shares issued and

outstanding''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D16$++6+++

#dditional paid&in capital''''''''''''''''''''''''''''''''''''''''''''''''' (++6+++

:etained earnings 2deficit3''''''''''''''''''''''''''''''''''''''''''''''' 2%++6+++3

0otal'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D 16%++6+++

0he quasi&reorgani5ation is to be accomplished by reducing the par value

of the stock to D1" per share' ;mmediately after the quasi&reorgani5ation6

the common stock amount -ould be

a' D16$++6+++'

b' D162++6+++'

c' D(++6+++'

d' D4++6+++'

c %+' ?n 4une 16 2++16 Patriot .orporation declared a stock dividend entitling its

>?( stockholders to one additional share for each share held' #t the time the

dividend -as declared6 the market value of the stock -as D1+ per share

and the par value -as D" per share' ?n this date Patriot had 16+++6+++

shares of common stock authori5ed of -hich $++6+++ shares -ere

outstanding' #ssuming the par value of the stock -as not changed6 -hat

entry should Patriot make to record this transaction@

a' :etained Earnings'''''''''''''''''''''''''''''''''''''''''''''' $6+++6+++

.ommon ,tock ividend istributable''''''''' 36+++6+++

.apital in E!cess of Par'''''''''''''''''''''''''''''''' 36+++6+++

b' ,tock ividend Payable''''''''''''''''''''''''''''''''''''' $6+++6+++

.ommon ,tock ividend istributable''''''''' 36+++6+++

.apital in E!cess of Par'''''''''''''''''''''''''''''''' 36+++6+++

c' :etained Earnings'''''''''''''''''''''''''''''''''''''''''''''' 36+++6+++

.ommon ,tock ividend istributable''''''''' 36+++6+++

d' Ao entry

a %1' 0he stockholders9 equity section of olphin .orporation as of ecember

316

>?( 2++26 contained the follo-ing accountsG

.ommon stock6 2"6+++ shares authori5edH 1+6+++ shares

issued and outstanding ''''''''''''''''''''''''''''''''''''''''''''''''''' D 3+6+++

.apital contributed in e!cess of par'''''''''''''''''''''''''''''''''''''' 4+6+++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' (+6+++

D1"+6+++

olphin=s board of directors declared a 1+ percent stock dividend on #pril 16

2++36 -hen the market value of the stock -as D% per share' #ccordingly6

16+++ ne- shares -ere issued' #ll of olphin9s stock has a par value of

D3 per share' #ssuming olphin sustained a net loss of D126+++ for the

quarter ended Barch 316 2++36 -hat amount should olphin report as

retained earnings as of #pril 16 2++3@

a' D$16+++

b' D$46+++

c' D$(6+++

d' D%36+++

b %2' 0he Cradison .orporation had the follo-ing classes of stock outstanding

as

>?( of ecember 316 2++2G

.ommon stock6 D2+ par value6 2+6+++ shares outstanding

Preferred stock6 $ percent6 D1++ par value6 cumulative6 26+++ shares

outstanding

Ao dividends -ere paid on preferred stock for 2+++ and 2++1' ?n

ecember 316 2++26 a total cash dividend of D2++6+++ -as declared' 7hat

are the amounts of dividends payable on both the common and preferred

stock6 respectively@

a' D+ and D2++6+++

b' D1$46+++ and D3$6+++

c' D1%$6+++ and D246+++

d' D1((6+++ and D126+++

a %3' ?n 4une 3+6 2++26 ?=Eara .o' declared and issued a 1+ percent stock

>?( dividend' Prior to this dividend6 ?=Eara had $+6+++ shares of D1+ par value

common stock issued and outstanding' 0he market value of ?=Eara .o'=s

common stock on 4une 3+6 2++26 -as D24 per share' #s a result of this

stock dividend6 by -hat amount -ould ?=Eara=s total stockholders= equity

increase 2decrease3@

a' D+

b' D$+6+++

c' D(46+++

d' D2(46+++3

b %4' ?n 4anuary 26 2+++6 the board of directors of Cimli Bining .orporation

>?( declared a cash dividend of D162++6+++ to stockholders of record on

4anuary 1(6 2+++6 and payable on February 1+6 2+++' 0he dividend is

permissible by la- in Cimli=s state of incorporation' ,elected data from

Cimli=s ecember 316 1***6 balance sheet follo-G

#ccumulated depletion'''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D 2++6+++

.apital stock'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 161++6+++

#dditional paid&in capital''''''''''''''''''''''''''''''''''''''''''''''''''''''' (++6+++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' "++6+++

0he D162++6+++ dividend includes a liquidating dividend of

a' D(++6+++'

b' D%++6+++'

c' D$++6+++'

d' D2++6+++'

b %"' .ardinal .ompany9s balance sheet at ecember 316 2++16 contained the

>?11 follo-ing accountsG

.ommon stock6 D2+ par6 1++6+++ authori5ed6

$+6+++ outstanding'''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D162++6+++

Paid&;n capital in e!cess of par''''''''''''''''''''''''''''''''''''''''''''' 1"+6+++

:etained earnings 2deficit3''''''''''''''''''''''''''''''''''''''''''''''''''''

2"4+6+++3

.ardinal9s ne- management suggested6 and received approval for a quasi&

reorgani5ation' 0he ne- par value is to be D1+ a share6 Equipment is to be

-ritten do-n D1"26+++6 and ;nventory is to be increased D(6+++' Eo-

much #dditional Paid&;n .apital from :eorgani5ation -ill initially be

recorded -ith the entry to reduce the par value of the common stock@

a' D"4+6+++

b' D$++6+++

c' D$*+61++

d' D16+++6+++

b %$' .ardinal .ompany9s balance sheet at ecember 316 2++16 contained the

>?11 follo-ing accountsG

.ommon stock6 D2+ par6 1++6+++ authori5ed6 $+6+++

outstanding''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D162++6+++

Paid&;n capital in e!cess of par''''''''''''''''''''''''''''''''''''''''''''' 1"+6+++

:etained earnings 2deficit3''''''''''''''''''''''''''''''''''''''''''''''''''''

2"4+6+++3

.ardinal9s ne- management suggested6 and received approval for a quasi&

reorgani5ation' 0he ne- par value is to be D1+ a share6 Equipment is to be

-ritten do-n D1"26+++6 and ;nventory is to be increased D(6+++' 7hat is

the net increase in the deficit from revaluation of assets@

a' D+

b' D1446+++

c' D1"26+++

d' D"4+6+++

a %%' ?n ecember 316 2++26 the stockholders= equity section of #ddyson .o'

-as

>?( as follo-sG

.ommon stock6 par value D1+H authori5ed6 $+6+++

sharesH issued and outstanding6 1(6+++ shares'''''''''''''' D1(+6+++

#dditional paid&in capital''''''''''''''''''''''''''''''''''''''''''''''''''''''' 2326+++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1*26+++

0otal stockholders= equity'''''''''''''''''''''''''''''''''''''''''''''''''''''' D$+46+++

?n Barch 316 2++36 #ddyson declared a 1+ percent stock dividend6 and

accordingly 16(++ additional shares -ere issued6 -hen the fair market

value of the stock -as D1$ per share' For the three months ended Barch

316 2++36 #ddyson sustained a net loss of D$46+++' 0he balance of

#ddyson=s :etained Earnings as of Barch 316 2++36 should be

a' D**62++'

b' D11+6+++'

c' D1126+++'

d' D12(6+++'

b %(' .ash dividends on the D1+ par value common stock of ,ackville .ompany

>?( -ere as follo-sG

1st quarter of 2++2'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D4++6+++

2nd quarter of 2++2''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 4"+6+++

3rd quarter of 2++2'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' "++6+++

4th quarter of 2++2'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' ""+6+++

0he 4th quarter cash dividend -as declared on ecember 2+6 2++26

to stockholders of record on ecember 316 2++2' Payment of the

4th quarter dividend -as made on 4anuary *6 2++3'

;n addition6 ,ackville declared a " percent stock dividend on its D1+

par value common stock on ecember 16 2++26 -hen there -ere

1"+6+++ shares issued and outstanding and the market value of the

common stock -as D2+ per share' 0he shares -ere issued on

ecember 16 2++2'

7hat -as the effect on ,ackville=s stockholders= equity accounts as a result

of the 2++2 dividend transactions@

#dditional

.ommon ,tock Paid&;n .apital :etained Earnings

a' D%"6+++ credit D+ D16*%"6+++ debit

b' D%"6+++ credit D%"6+++ credit D26+"+6+++ debit

c' D1"+6+++ credit D1"+6+++ credit D16*++6+++ debit

d' D1"+6+++ credit D%"6+++ credit D26+"+6+++ debit

d %*' ?n ,eptember 16 2++26 ,teelers .orporation declared and issued a 2+

percent

>?( common stock dividend' Prior to this date6 ,teelers had 2+6+++ shares of

D2 par value common stock that -ere both issued and outstanding' 0he

market value of ,teelers9 stock -as D2+ per share at the time the dividend

-as issued' #s a result of this stock dividend6 ,teelers9 total stockholders9

equity

a' decreased by D4+6+++'

b' decreased by D4++6+++'

c' increased by D4++6+++'

d' did not change'

b (+' Ellis .ompany has 16+++6+++ shares of common stock authori5ed -ith a

par

>?( value of D3 per share of -hich $++6+++ shares are outstanding' Ellis

authori5ed a stock dividend -hen the market value -as D( per share6

entitling its stockholders to one additional share for each share held' 0he

par value of the stock -as not changed' #ssuming the declaration is not

recorded separately6 -hat entry6 if any6 should Ellis make to record

distribution of the stock dividend@

a' :etained Earnings''''''''''''''''''''''''''''''''''''''''''' 46(++6+++

.ommon ,tock''''''''''''''''''''''''''''''''''''''''''' 16(++6+++

Cain on ,tock ividends'''''''''''''''''''''''''''' 36+++6+++

b' :etained Earnings''''''''''''''''''''''''''''''''''''''''''' 16(++6+++

.ommon ,tock''''''''''''''''''''''''''''''''''''''''''' 16(++6+++

c' :etained Earnings''''''''''''''''''''''''''''''''''''''''''' 46(++6+++

.ommon ,tock''''''''''''''''''''''''''''''''''''''''''' 16(++6+++

Paid&;n .apital from ,tock ividends'''''''' 36+++6+++

d' Bemorandum entry noting the number of additional shares issued as a

dividend

d (1' 0he follo-ing data are e!tracted from the stockholders= equity section of the

>?( balance sheet of Cuthrie .orporationG

121311+1 121311+2

.ommon stock 2D1 par value3''''''''''''''''''''''''''''''' D"+6+++ D"16+++

Paid&;n capital in e!cess of par''''''''''''''''''''''''''''' 2"6+++ 2*6+++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''' "+6+++ "263++

uring 2++26 the corporation declared and paid cash dividends of D%6"++

and also declared and issued a stock dividend' 0here -ere no other

changes in stock issued and outstanding during 2++2' Aet income for 2++2

-as

a' D263++'

b' D*6(++'

c' D1+6(++'

d' D146(++'

a (2' .ohen .orporation o-ns 16+++ shares of common stock of Berg6 ;nc'6 a

large

>?( publicly traded company listed on a ma)or stock e!change' ;f Berg issues a

2+ percent stock dividend -hen the par value is D1+ per share and the

market value is D%+ per share6 ho- much and -hat type of income should

.ohen report@

a' D+

b' D26+++ ordinary income

c' D146+++ ordinary income

d' D26+++ ordinary income and D126+++ e!traordinary income

a (3' 0he follo-ing -as abstracted from the accounts of the ?ak .orp' at year&

endG

>?$ 0otal income since incorporation''''''''''''''''''''''''''''''''''''''''''' D42+6+++

0otal cash dividends paid'''''''''''''''''''''''''''''''''''''''''''''''''''''' 13+6+++

Proceeds from sale of donated stock'''''''''''''''''''''''''''''''''''' 4"6+++

0otal value of stock dividends distributed''''''''''''''''''''''''''''' 3+6+++

E!cess of proceeds over cost of treasury stock sold'''''''''''' %+6+++

7hat should be the current balance of :etained Earnings@

a' D2$+6+++

b' D2*+6+++

c' D3+"6+++

d' D33"6+++

d (4' ,tanley .orp' has incurred losses from operations for several years' #t the

>?11 recommendation of the ne- president6 the board of directors voted to

implement a quasi&reorgani5ation6 sub)ect to stockholder approval'

;mmediately prior to the restatement6 on 4une 3+6 ,tanley=s balance sheet

-as as follo-sG

.urrent assets''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D ""+6+++

Property6 plant and equipment 2net3'''''''''''''''''''''''''''''''''''''' 163"+6+++

?ther assets'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 2++6+++

D261++6+++

0otal liabilities'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D $++6+++

.ommon stock''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 16$++6+++

#dditional paid&in capital''''''''''''''''''''''''''''''''''''''''''''''''''''''' 3++6+++

:etained earnings 2deficit3''''''''''''''''''''''''''''''''''''''''''''''''''''

24++6+++3

D261++6+++

0he stockholders approved the quasi&reorgani5ation effective 4uly 16 to be

accomplished by a reduction in other assets of D1"+6+++6 a reduction in

property6 plant and equipment 2net3 of D3"+6+++6 and appropriate

ad)ustment to the capital structure' 0o implement the quasi&reorgani5ation6

,tanley should reduce the common stock account in the amount of

a' D+'

b' D1++6+++'

c' D4++6+++'

d' D$++6+++'

a ("' ?n 4anuary 16 2++26 #dams .ompany offered its top management stock

>?12 appreciation rights -ith the follo-ing termsG

?ption price 2predetermined3'''''''''''''''''''''''''''''''''''''''''''''''D2+ per share

Aumber of shares'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''1+6+++

Eolding period''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''2 years

E!piration period'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''ec' 316

2++2

0he stock appreciation is to be paid in cash upon e!ercise' 0he market

value

of #dam=s common -as as follo-sG

4an'16 2++2''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''D2+ per

share ec' 316 2++2'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''D24 per

share

ec' 316 2++3 '''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''D2( per

share

Eo- much should #dams disclose on the ecember 316 2++36 balance

sheet as the liability for stock appreciation rights@

a' D(+6+++

b' D$+6+++

c' D4+6+++

d' D2"6+++

PRO%LEMS

Problem 1

Barker .orp' received a charter authori5ing 12+6+++ shares of common stock at

D1" par value per share' uring the first year of operations6 4+6+++ shares -ere

sold at D2( per share' $++ shares -ere issued in payment of a current operating

debt of D1(6$++' ;n the first year6 the net income -as D1426+++'

uring the year6 dividends of D3$6+++ -ere paid to stockholders' #t the end of the

year6 total liabilities -ere D(26+++' /se the given data to compute the follo-ing

items at the end of the first year 2sho- all computations3G

213 0otal liabilities and stockholders= equity

223 ,tockholders= equity

233 .ontributed capital

243 ;ssued capital stock 2par3

2"3 ?utstanding capital stock 2par3

2$3 /nissued capital stock 2number of shares3

2%3 Paid&;n capital in e!cess of par value

Solution 1

>?2

213 ,hares sold 24+6+++ ! D2(3''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D1612+6+++

,hares issued in payment of debt 2$++ ! D313'''''''''''''''''''''''''''' 1(6$++

Aet income''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1426+++

0otal liabilities''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' (26+++

D163$26$++

>ess dividends''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 3$6+++

0otal liabilities I stockholders= equity'''''''''''''''''''''''''''''''''''''' D1632$6$++

223 D1632$6$++ & D(26+++ J D162446$++

233 D1612+6+++ K D1(6$++ J D1613(6$++

243 4+6$++ shares ! D1" J D$+*6+++

2"3 4+6$++ shares ! D1" J D$+*6+++

2$3 12+6+++ & 4+6$++ J %*64++ shares

2%3 D1613(6$++ & D$+*6+++ J D"2*6$++

Problem 2

L Aote to the instructorG Problem 2 can be shortened by eliminating the subscription

of preferred shares 2entries e & f3'

0he follo-ing transactions relate to the stockholders= equity transactions of >indsay

.orporation for its initial year of e!istence'

2a3 4an' % #rticles of incorporation are filed -ith the state' 0he state authori5ed

the issuance of 1+6+++ shares of D"+ par value preferred stock and

2++6+++ shares of D1+ par value common stock'

2b3 4an' 2( 4+6+++ shares of common stock are issued for D14 per share'

2c3 Feb' 3 (+6+++ shares of common stock are issued in e!change for land and

buildings that have an appraised value of D2"+6+++ and D16+++6+++6

respectively' 0he stock traded at D1" per share on that date on the

over&the&counter market'

2d3 Feb' 24 26+++ shares of common stock are issued to ,hane and 7inston6

#ttorneys&at&>a-6 in payment for legal services rendered in

connection -ith incorporation' 0he company charged the amount to

organi5ation costs' 0he market value of the stock -as D1$ per

share'

2e3 ,ep' 12 :eceived subscriptions for 1+6+++ shares of preferred stock at D"3

per share' # 4+ percent do-n payment accompanied the

subscriptions' 0he balance is due on ?ctober 1'

2f3 ?ct' 1 :eceived the final payment for 1+6+++ shares'

Prepare )ournal entries to record the foregoing transactions' ;dentify the entries by

letter 2a & f3'

Solution 2

>?2

2a3 Ao entry is required for the authori5ation of shares'

2b3 .ash 24+6+++ ! D143'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' "$+6+++

.ommon ,tock 24+6+++ ! D1+3''''''''''''''''''''''''''''''''''''' 4++6+++

Paid&;n .apital in E!cess of Par&&.ommon''''''''''''' 1$+6+++

2c3 >and''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 24+6+++

Buildings''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' *$+6+++

.ommon ,tock 2(+6+++ ! D1+3''''''''''''''''''''''''''''''''''''' (++6+++

Paid&;n .apital in E!cess of Par&&.ommon''''''''''''' 4++6+++

AoteG 0he fair market value of the stock is more readily determinable than the

value of the real property because it -as traded on the over&the&counter

market on the transaction date' 0he value of the stock should be assigned

to the land and buildings in proportion to their appraised values'

.ost of >and J D2"+6+++12D2"+6+++ K D16+++6+++3 ! D162++6+++ J D24+6+++

.ost of Building J D16+++6+++12D2"+6+++ K D16+++6+++3 ! D162++6+++ J

D*$+6+++

2d3 ?rgani5ation .osts 226+++ ! D1$3'''''''''''''''''''''''''''''''''''''''' 326+++

.ommon ,tock 226+++ ! D1+3''''''''''''''''''''''''''''''''''''''''''' 2+6+++

Paid&;n .apital in E!cess of Par&&.ommon''''''''''''''''' 126+++

2e3 .ash 21+6+++ ! D"3 ! 4+M3''''''''''''''''''''''''''''''''''''''''''''''''''''' 2126+++

,ubscriptions :eceivable'''''''''''''''''''''''''''''''''''''''''''''''' 31(6+++

Preferred ,tock ,ubscribed 21+6+++ ! D"+3''''''''''''''''''''' "++6+++

Paid&;n .apital in E!cess of Par&&Preferred'''''''''''''''' 3+6+++

2f3 .ash 21+6+++ ! D"3 ! $+M3''''''''''''''''''''''''''''''''''''''''''''''''''''' 31(6+++

,ubscriptions :eceivable'''''''''''''''''''''''''''''''''''''''''''' 31(6+++

Preferred ,tock ,ubscribed''''''''''''''''''''''''''''''''''''''''''''' "++6+++

Preferred ,tock'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' "++6+++

Problem 3

?n #ugust 1+6 4ameson .orporation reacquired (6+++ shares of its D1++ par value

common stock at D134' 0he stock -as originally issued at D11+' 0he shares -ere

resold on Aovember 21 at D14"'

Provide the entries required to record the reacquisition and the subsequent resale

of the stock using theG

213 Par value method of accounting for treasury stock'

223 .ost method of accounting for treasury stock'

Solution 3

>?3

213 #ug' 1+ 0reasury ,tock 2(6+++ ! D1++3''''''''''''''''''''''''''''' (++6+++

Paid&;n .apital in E!cess of Par 2(6+++ ! D1+3''' (+6+++

:etained Earnings 2(6+++ ! D243''''''''''''''''''''''''' 1*26+++

.ash 2(6+++ ! D1343'''''''''''''''''''''''''''''''''''''''' 16+%26+++

Aov' 21 .ash 2(6+++ ! D14"3''''''''''''''''''''''''''''''''''''''''''''' 161$+6+++

0reasury ,tock''''''''''''''''''''''''''''''''''''''''''' (++6+++

Paid&;n .apital in E!cess of Par'''''''''''''''' 3$+6+++

223 #ug' 1+ 0reasury ,tock''''''''''''''''''''''''''''''''''''''''''''''''' 16+%26+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 16+%26+++

Aov' 21 .ash 2(6+++ ! D14"3''''''''''''''''''''''''''''''''''''''''''''' 161$+6+++

0reasury ,tock''''''''''''''''''''''''''''''''''''''''''' 16+%26+++

Paid&;n .apital from ,ale of 0reasury

,tock 2(6+++ ! D113'''''''''''''''''''''''''''''''''''' ((6+++

Problem 4

0he data belo- are from the ecember 316 2++26 balance sheet of the Eandi

.orner .orporationG

.ommon stock6 D"+ par6 36+++ shares issued and

outstanding'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D1"+6+++

Paid&in capital in e!cess of par'''''''''''''''''''''''''''''''''''''''' 4"6+++

:etained earnings'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' %"6+++

uring 2++36 the follo-ing transactions affecting corporate capital -ere recordedG

#ug' 1$ Purchased 4++ shares of treasury stock at D%( per share'

?ct' 23 Purchased 22" shares of stock at D%1 per share and immediately

retired the stock'

Aov' 3 ,old 1"+ shares of the treasury stock purchased on #ug' 1$ at D(1

per share'

#ssuming the cost method is used for treasury stock and that retained earnings are

to be reduced minimally in stock reacquisition transactions6 provide the entries

required to record the above transactions'

Solution 4

>?3

#ug' 1$ 0reasury ,tock''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 3162++

.ash 24++ ! D%(3''''''''''''''''''''''''''''''''''''''''''''''''' 3162++

?ct' 23 .ommon ,tock 222" ! D"+3''''''''''''''''''''''''''''''''''''''''' 1162"+

Paid&;n .apital in E!cess of Par 222" ! D1"3'''''''''''''' 363%"

:etained Earnings 222" ! D$3''''''''''''''''''''''''''''''''''''' 163"+

.ash 222" ! D%13''''''''''''''''''''''''''''''''''''''''''''''''' 1"6*%"

Aov' 3 .ash 21"+ ! D(13''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1261"+

0reasury ,tock 21"+ ! D%(3''''''''''''''''''''''''''''''''' 116%++

Paid&;n .apital from ,ale of 0reasury

,tock 21"+ ! D33'''''''''''''''''''''''''''''''''''''''''''''''''' 4"+

Problem 5

0he Perry .ompany -ants to raise additional equity capital' 0he company decides

to issue "6+++ shares of D2" par preferred stock -ith detachable -arrants' 0he

package of the stock and -arrants sells for D1+"' Each -arrant enables the holder

to purchase t-o shares of D1+ par common stock at D3+ per share' ;mmediately

follo-ing the issuance of the stock6 the stock -arrants are selling at D14 each' 0he

market value of the preferred stock -ithout the -arrants is D*$'

213 Prepare a )ournal entry for Perry .ompany to record the issuance of the

preferred stock and the detachable -arrants'

223 #ssuming that all the -arrants are e!ercised6 prepare a )ournal entry for Perry

to record the e!ercise of the -arrants'

233 #ssuming that only %+ percent of the -arrants are e!ercised6 prepare a )ournal

entry for Perry to record the e!ercise and e!piration of the -arrants'

Solution 5

>?4

213 .ash 2"6+++ ! D1+"3'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' "2"6+++

.ommon ,tock 7arrants''''''''''''''''''''''''''''''''''''''''' $$6(1(

Preferred ,tock 2"6+++ ! D2"3'''''''''''''''''''''''''''''''''''''' 12"6+++

Paid&;n .apital in E!cess of Par<Preferred ,tock' 33361(2

8alue assigned to -arrantsG

14111+ ! D1+" ! "6+++ J D $$6(1(

8alue assigned to preferred stockG

*$111+ ! D1+" ! "6+++ J D4"(61(2

223 .ommon ,tock 7arrants''''''''''''''''''''''''''''''''''''''''''''''''' $$6(1(

.ash 21+6+++ ! D3+3'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 3++6+++

.ommon ,tock 21+6+++ ! D1+3''''''''''''''''''''''''''''''''''''' 1++6+++

Paid&;n .apital in E!cess of Par<.ommon ,tock'' 2$$6(1(

233 .ommon ,tock 7arrants 2%+M ! D$$6(1(3''''''''''''''''''''''''''' 4$6%%3

.ash 2%6+++ ! D3+3 '''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 21+6+++

.ommon ,tock 2%6+++ ! D1+3''''''''''''''''''''''''''''''''''''''' %+6+++

Paid&;n .apital in E!cess of Par<.ommon ,tock'' 1($6%%3

.ommon ,tock 7arrants 23+M ! D$$6(1(3''''''''''''''''''''''''''' 2+6+4"

Paid&;n .apital from E!pired ,tock 7arrants'''''''''' 2+6+4"

Problem 6

Bennett .ompany paid cash dividends totaling D1"+6+++ in 2+++ and D%"6+++ in

2++1' ;n 2++26 Bennett intends to pay cash dividends of D(++6+++' .ompute the

amount of cash dividends per share to be received by common stockholders in

2++2 under each of the follo-ing assumptions' 0reat each case independently'

0here -ere no dividends in arrears as of 4anuary 16 2+++'

213 2"6+++ shares of commonH 1++6+++ shares of $ percent6 D"+ par cumulative

preferred'

223 2"6+++ shares of commonH "+6+++ shares of $ percent6 D"+ par noncumulative

preferred'

233 2"6+++ shares of commonH %+6+++ shares of $ percent6 D1++ par cumulative

preferred'

Solution 6

>?(

213 .umulative preferred

Preferred dividends per yearG 1++6+++ shares ! D3 J D3++6+++

Paid ;n #rrears

Preferred dividends in 2+++ 'D1"+6+++ D1"+6+++

Preferred dividends in 2++1G

#rrearage from 2+++ D %"6+++ 2 %"6+++3

#rrearage from 2++1 D3++6+++

0otal in arrears at 1213112++1 D3%"6+++

ividends for 2++2G

#rrearage from years 2+++ and 2++1 D3%"6+++

.urrent year preferred dividend 3++6+++

0otal preferred dividends paid in 2++2 D$%"6+++

:emainder to commonG D(++6+++ & D$%"6+++ J D12"6+++

.ommon dividends per shareG D12"6+++12"6+++ shares J D"'++ per share

223 Aoncumulative preferred

Preferred dividends per yearG "+6+++ shares ! D3 J D1"+6+++

ividends in arrears for 2+++G D +

ividends in arrears for 2++1G +

ividends for 2++2G 1"+6+++

0otal preferred dividends D1"+6+++

:emainder to commonG D(++6+++ & D1"+6+++ J D$"+6+++

.ommon dividends per shareG D$"+6+++12"6+++ shares J D2$'++ per share

233 .umulative preferred

Preferred dividends per yearG %+6+++ shares ! D$ J D42+6+++

Paid ;n #rrears

Preferred dividends in 2+++ 'D1"+6+++ D2%+6+++

Preferred dividends in 2++1G

#rrearage from 2+++ D %"6+++ 2%"6+++3

#rrearage from 2++1 42+6+++

0otal in arrears at 1213112++1 D$1"6+++

ividends for 2++2G

0otal dividends paid in 2++2'''''''''''''''''''''''''''''''''''''''''''' D(++6+++

#rrearage from years 2+++ and 2++1'''''''''''''''''''''''''''''' $1"6+++

#mount available for preferred dividend in 2++2'''''''''''' D1("6+++

0otal preferred dividends D(++6+++

:emainder to commonG D+

.ommon dividends per shareG D+

Problem 7

?n 4anuary 16 2++26 the records of the Cerrard .orporation sho-ed these

balancesG

.ommon stock&&authori5ed %(6+++ shares at D1++ parH

issued 3+6(++ shares'''''''''''''''''''''''''''''''''''''''''''''''''''' D36+(+6+++

Paid&;n capital in e!cess of par''''''''''''''''''''''''''''''''''''''''''''' 2$46(++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 26*$+6+++

uring 2++2 and 2++36 these transactions occurredG

4uly 16 2++2 eclared stock dividend 2from unissued stock3 of 1 share for

each 2 shares outstanding6 issued ,eptember 1' 2Prior to the

declaration6 the market value of the unissued stock -as D11"

per share'3

4une 16 2++3 eclared stock dividend 2from unissued stock3 of 1 share for

each 1+ shares outstanding6 issued #ugust 1' 2Prior to the

declaration6 the market value of the unissued stock -as D12+

per share'3

Provide the entries to record the declaration and payment of the stock dividends

during 2++2 and 2++3'

Solution 7

>?(

2++2

4uly 1 :etained Earnings'''''''''''''''''''''''''''''''''''''''''''''' 16"4+6+++

,tock ividends istributable''''''''''''''''''''''' 16"4+6+++

N23+6(++123 ! D1++O

,ep' 1 ,tock ividends istributable'''''''''''''''''''''''''''' 16"4+6+++

.ommon ,tock 2D1++ par3'''''''''''''''''''''''''''''''' 16"4+6+++

2++3

4une 1 :etained Earnings'''''''''''''''''''''''''''''''''''''''''''''' ""464++

,tock ividends istributable''''''''''''''''''''''' 4$26+++

Paid&;n .apital from ,tock ividends''''''''''' *264++

3+6(++ K 1"64++ J 4$62++ outstanding shares

4$62++ ! 1+M J 46$2+ shares

46$2+ shares ! D12+ J D""464++

#ug' 1 ,tock ividends istributed''''''''''''''''''''''''''''''' 4$26+++

.ommon ,tock 2D1++ par3'''''''''''''''''''''''''''' 4$26+++

Problem 8

/pon organi5ation on 4anuary 16 2++26 ?kra ;nc' -as authori5ed to issue 2++6+++

shares of D1+ par common stock in multiples of 1++ shares' uring 2++26 11+6+++

shares -ere sold at D$" per shareH $6+++ shares -ere later reacquired as treasury

stock at D%2 per share' # stock split of 2&for&1 on all issued shares -as approved

on ecember 316 2++2'

uring 2++36 these dividend and treasury stock transactions occurredG

#pril 12 eclared and paid a 1+ percent stock dividend on all outstanding

shares'

?ct' 1% #ll treasury stock -as sold at D(1 per share'

ec' 4 eclared and paid these dividendsG

D1 cash dividend per share for common stock outstanding

Property dividend of 1 share of Eall .o' common stock for each

1+ shares of ?kra stock held' 0he cost to the company for 1

share of Eall .o' common stock -as D2" -ith a current market

value of D3+'

Provide the entries to record the declaration and payment of the dividends on

ecember 46 2++3'

Solution 8

>?(

.ommon ,tock escription ,hares

;ssued during 2++2''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 11+6+++

:eacquired during 2++2''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 2$6+++3

?utstanding on ecember 316 2++2''''''''''''''''''''''''''''''''''''''''''' 1+46+++

?utstanding after 2&for&1 stock split6 ecember 316 2++2

21+46+++ ! 23''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 2+(6+++

1+M stock dividend6 #pril 12 21+M ! 2+(6+++3''''''''''''''''''''''''''''''''' 2+6(++

:esale of treasury stock6 ?ct' 1% 2$6+++ ! 23''''''''''''''''''''''''''''''''' 126+++

?utstanding ecember 46 2++3'''''''''''''''''''''''''''''''''''''''''''''''''' 24+6(++

2++3

ec' 4 :etained Earnings''''''''''''''''''''''''''''''''''''''''''''''''''' 24+6(++

.ash ividends Payable 224+6(++ ! D13''''''''''''''''' 24+6(++

.ash ividends Payable''''''''''''''''''''''''''''''''''''''''' 24+6(++

.ash ''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 24+6(++

ec' 4 :etained Earnings 2246+(+ ! D3+3'''''''''''''''''''''''''''''''' %2264++

Property ividends Payable 2246+(+ ! D2"3''''''''''' $+26+++

Cain on istribution of Property ividends 2246+(+ ! D"3 12+64++

Property ividends Payable'''''''''''''''''''''''''''''''''''' $+26+++

;nvestment in Eall .o' ,tock'''''''''''''''''''''''''''''' $+26+++

Problem 9

uring 2++26 the follo-ing transactions related to the capital stock of the Buffet&>ine

.orp' occurredG

4an' % eclared a D'%" cash dividend on 1"+6+++ shares of preferred stock'

Feb' % Paid dividends on preferred stock'

Barch 4 eclared a D'"+ cash dividend on 2++6+++ shares of common stock -ith a

D2+ par value'

Barch 1( Paid dividends on common stock'

4une 3+ ,plit common stock 4&for&1'

4uly * Purchased 126+++ shares of Buffet&>ine=s o-n common stock at D32 per

shareH acquisition recorded at cost'

,ept' 1+ eclared a cash dividend of D'4+ per share on common stock

outstanding'

,ept' 1( Paid dividends on common stock'

Provide the entries to record the above transactions'

Solution 9

>?(

4an' % :etained Earnings 21"+6+++ ! D'%"3''''''''''''''''''''''''''' 1126"++

.ash ividends Payable&&Preferred ,tock''''' 1126"++

Feb' % .ash ividends Payable&&Preferred ,tock''''''''''' 1126"++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1126"++

Bar' 4 :etained Earnings 22++6+++ ! D'"+3''''''''''''''''''''''''''' 1++6+++

.ash ividends Payable&&.ommon ,tock'''''' 1++6+++

Bar' 1( .ash ividends Payable&&.ommon ,tock'''''''''''' 1++6+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1++6+++

4une 3+ Bemorandum entry

4uly * 0reasury ,tock&&.ommon''''''''''''''''''''''''''''''''''''' 3(46+++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 3(46+++

,ept' 1+ :etained Earnings'''''''''''''''''''''''''''''''''''''''''''''''' 31"62++

.ash ividends Payable&&.ommon ,tock

N2(++6+++ & 126+++3 ! D'4+O''''''''''''''''''''''''''''''''''''''' 31"62++

,ept' 1( .ash ividends Payable&&.ommon ,tock'''''''''''' 31"62++

.ash''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 31"62++

Problem 10

0he stockholders= equity section of 4essie .orp' is presented belo-'

.ommon stock6 D2+ par value6 authori5ed 16+++6+++ shares6

issued and outstanding 4++6+++ shares''''''''''''''''''''''''''''''' D (6+++6+++

#dditional paid&in capital'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 264++6+++

:etained earnings''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1+6(++6+++

0otal stockholders= equity'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D 2162++6+++

.omplete the follo-ing table to depict the number of shares of stock and balances in

the stockholders= equity accounts after each of the follo-ing transactions' Each

situation is to be considered independently of the others'

2a3 1" percent stock dividend6 market value D2" per share

2b3 2&for&1 stock split

2c3 1++ percent stock dividend6 market value D2" per share

#dditional 0otal

?utstanding .ommon Paid&;n :etained ,tockholders=

,hares ,tock .apital Earnings Equity

2a3

2b3

2c3

Solution 10

>?(

#dditional 0otal

?utstanding .ommon Paid&;n :etained ,tockholders=

,hares ,tock .apital Earnings Equity

2a3 4$+6+++ D*62++6+++ D26%++6+++ D*63++6+++ D2162++6+++

2b3 (++6+++ D(6+++6+++ D264++6+++ D1+6(++6+++ D2162++6+++

2c3 (++6+++ D1$6+++6+++ D264++6+++ D26(++6+++ D2162++6+++

Problem 11

0he follo-ing information pertains to :ondo .orp' for the year ended ,eptember 3+6

2++2'

Aet income'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D %"6+++

:etained earnings6 ?ct' 16 2++1''''''''''''''''''''''''''''''''''''''''''''''''''''''''' ($+6+++

.ash dividends declared'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1$64++

,tock dividends declared'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 416+++

?verstatement of depreciation e!pense of 1**( and 1***<preta!'' $26+++

0a! rate'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 3+M

Prepare a statement of retained earnings for :ondo .orp' for the year ended

,eptember 3+6 2++2'

Solution 11

>?$

:ondo .orp'

,tatement of :etained Earnings

For Fear Ended ,eptember 3+6 2++2

:etained earnings6 ?ctober 16 2++16 as originally reported' D ($+6+++

Prior period ad)ustment&&overstatement of depreciation6 net

of income ta!es of D1(6$++'''''''''''''''''''''''''''''''''''''''''''' 4364++

:etained earnings6 ?ctober 16 2++16 as restated''''''''''''''''' D *+364++

#ddG Aet income'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' %"6+++

>essG .ash dividends declared'''''''''''''''''''''''''''''''''' D 1$64++

,tock dividends declared'''''''''''''''''''''''''''''''''' 416+++ "%64++3

:etained earnings6 ,eptember 3+6 2++2'''''''''''''''''''''''''''''' D *216+++

Problem 12

0he board of directors of >ogan Piano .o' decided that the company should undergo

a quasi&reorgani5ation effective on ecember 316 2++2' ?n that date6 the company

determined the follo-ing asset values'

Book 8alue Barket 8alue

Bachinery''''''''''''''''''''''''''''''''''''''''''''' D 4+6+++ D 4+6+++

Building''''''''''''''''''''''''''''''''''''''''''''''''' 3++6+++ 1%"6+++

Equipment''''''''''''''''''''''''''''''''''''''''''''' *"6+++ (+6+++

D43"6+++ D2*"6+++

0he stockholders= equity section at ecember 316 2++26 is presented belo-'

.ommon stock6 D2" par6 2"6+++ shares issued and outstanding'''' D$2"6+++

#dditional paid&in capital'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 2"+6+++

:etained earnings 2deficit3''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 222"6+++3

0otalPPPPPPPPPPPPPPPPPPPPPPPP D$"+6+++

0he quasi&reorgani5ation is to be accomplished by reducing the par value of the

stock to D2+ per share'

213 Prepare the )ournal entry required to ad)ust the assets'

223 Prepare the )ournal entry to record the recapitali5ation'

233 Prepare the )ournal entry to record the elimination of the deficit'

Solution 12

>?11

213 #d)ustment of asset values to proper carrying amountsG

:etained Earnings'''''''''''''''''''''''''''''''''''''''''''''''' 14+6+++

Building'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 12"6+++

Equipment'''''''''''''''''''''''''''''''''''''''''''''''''''''''' 1"6+++

223 :ecapitali5ationG

.ommon ,tock 22"6+++ ! D" par reduction3''''''''''''''''''' 12"6+++

#dditional Paid&;n .apital'''''''''''''''''''''''''''''''' 12"6+++

233 Elimination of deficitG

#dditional Paid&;n .apital''''''''''''''''''''''''''''''''''''' 3$"6+++

:etained Earnings''''''''''''''''''''''''''''''''''''''''''' 3$"6+++

2D22"6+++ K D14+6+++3

Problem 13

0he balance sheet belo- -as prepared for the .ardenas .orporation )ust prior to a

quasi&reorgani5ationG

.ardenas .orporation

Balance ,heet

4uly 316 2++2

Assets

.urrent assets''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D 4++6+++

>and' 'P'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 2++6+++

Buildings and equipment'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 16%++6+++

>ess accumulated depreciation&&buildings and equipment'''''''''''' 2$++6+++3

0otal assets'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D 16%++6+++

Liabilities and Stockholders !"uit#

.urrent liabilities''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' D 2++6+++

.apital stock 2par D"+3'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 16$++6+++

Paid&;n capital in e!cess of par''''''''''''''''''''''''''''''''''''''''''''''''''''''' 32+6+++

:etained earnings 2deficit3'''''''''''''''''''''''''''''''''''''''''''''''''''''''''''''' 242+6+++3