Beruflich Dokumente

Kultur Dokumente

2011 Half Year Result Statement

Hochgeladen von

Oladipupo Mayowa PaulCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

2011 Half Year Result Statement

Hochgeladen von

Oladipupo Mayowa PaulCopyright:

Verfügbare Formate

Guaranty Trust Bank plc

Guaranty Trust Bank plc reports audited half year group results for the period ended June

30 2011 and declares a dividend of 25 kobo per share

Lagos Nigeria August 12, 2011 Guaranty Trust Bank plc (GTBank), (Bloomberg:

GUARANTY:NL/Reuters: GUARANT.LG) provider of diversified financial services, announces its

Audited Financial results under Nigerian GAAP for the 6 months ended 30 June 2011 and declares a

half year dividend of 25 kobo per share.

Commenting on the results, Segun Agbaje, Managing Director/ CEO of Guaranty Trust Bank plc

said:

Our successes during the half year are the result of our adherence to the principles upon

which this institution was founded: hard work, innovation, service excellence and

professionalism. Our goal in the oncoming months is to further position Guaranty Trust

Bank as the institution of choice by enhancing customer experiences at our touchpoints

and growing our market share through exceptional service delivery.

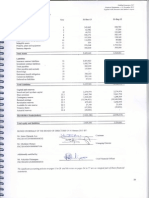

Financial Highlights

Strong Earnings

Profit after tax and extra ordinary item of N27.48bn (30 June 2010: N18.22bn) a

50.8% growth from Half Year 2010. PAT includes an extraordinary item of N2.23bn which

represents the net gain on disposal and diminution in value of SMEEIS investments.

Profit before tax of N31.9bn (30 June 2010: N25.72bn)

An increase of 24% in PBT compared to half-year 2010, driven by strong margins and

increased efficiency.

Earnings per share of 86 kobo per share (30 June 2010: 77 kobo per share)

Half Year dividend of 25 kobo per share

Subsidiaries While all subsidiaries account for less than 10% of the total profitability of

GTBank.

All GTBank subsidiaries (local and international) are P&L positive.

All foreign, bank subsidiaries continue to show strong profitability and performance in their

local markets.

All non-bank subsidiaries are in their final stages of divestment in line with CBNs repeal of

universal banking and GTBanks decision to focus on commercial banking. In particular, the

Bank has completed the sale of its 67.68% stake in Guaranty Trust Assurance Plc (GTAssur)

to Assur Africa Holding (AAH).

Revenue

Gross Earnings of N91.84bn (30 June 2010: N82.96bn)

Interest Income of N62.88bn (30 June 2010: N61.07bn). Relatively flat growth in overall

interest income (compared to June 2010) a result of lower industry-wide lending rates.

Non Interest Income including extra-ordinary item of N28.95bn (30 June 2010: N21.89bn)

A 32% increase compared to June 2010 as a result of increased volumes in customer

transactions.

Net interest Margin remains strong at 8.17%

Balance Sheet

Total Assets and contingents of N1.87trn (31 December 2010: N1.58trn)

Loans and Advances of N627.33bn (balance after sale of loans to AMCON) (31

December 2010: N593.46bn) A growth of 5.71% (Net of sales to AMCON) from December

2010 .

Deposits from Customers of N915.64bn, (31 December 2010: N761.19bn) 20% growth

of from December 2010, a sign of increased and continued customer confidence in GTBank.

Liquidity Ratio of 59.36% (31 December 2010: 49.11%)

GTBank is poised to take advantage of opportunities that may emerge in our market while

maintaining a prudent and conservative approach to lending.

Credit Quality

Non Performing Loans to total loans improved to 3.61% (31 December 2010: 6.76%)

Allowance for Credit Losses increased to 104% (31 December 2010: 101%)

Continued focus on efficiency

Cost to Income profile improved to 53.02% (31 December 2010: 56.82%).

Managements aim is to be back below 50% by December 2011.

12 August 2011

Enquiries:

GTBank +234-1-2714591

Lola Odedina, Head, Communications & External Affairs

Pascal Or

Muyiwa Teriba, Investor Relations +234-1-4484156

Notes to the Editors:

Guaranty Trust Bank is a diversified financial services company with over N1trillion in assets providing

banking, insurance, investment management, registrar services, mortgages and commercial finance

through 181 local branches, 541 local ATMs, our international and subsidiary offices and the Internet

(gtbank.com).

The Group operates as one of the leading Nigerian banks offering a wide range of financial services

and products throughout Nigeria and in the West African sub-region. The Bank is rated B+ by Fitch

and S&P, a reflection of the Bank's stability and reputation of being a well established franchise with

strong asset quality and consistent excellent financial performance.

The Bank has five banking subsidiaries established outside of Nigeria Guaranty Trust Bank

(Gambia) Ltd (GTB Gambia), Guaranty Trust Bank (Sierra Leone) Ltd (GTB Sierra Leone),

Guaranty Trust Bank (Ghana) Ltd (GTB Ghana), Guaranty Trust Bank (Liberia) Ltd (GTB Liberia)

and Guaranty Trust Bank (United Kingdom) Ltd (GTB UK).

The Bank also has five non-banking subsidiaries: Guaranty Trust Assurance Plc (GTB Assurance),

which provides insurance services in Nigeria, GTB Registrars Limited (GTB Registrars), a securities

registrar, GTHomes Limited (GTHomes), which provides mortgage services, GTB Asset Management

Limited (GTB Asset), which provides asset management and other investment services and GTB

Finance B.V. (GTB Finance), a finance subsidiary located in The Netherlands. In each of the past

three years, profit from the GTBank (Nigeria) accounted for over 90.0% of the Groups total income.

Das könnte Ihnen auch gefallen

- 2012 Year End Results Press ReleaseDokument3 Seiten2012 Year End Results Press ReleaseOladipupo Mayowa PaulNoch keine Bewertungen

- 2013 Year End Results Press Release - Final WebDokument3 Seiten2013 Year End Results Press Release - Final WebOladipupo Mayowa PaulNoch keine Bewertungen

- Full Year 2011 Results Presentation 2Dokument16 SeitenFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNoch keine Bewertungen

- June 2011 Results PresentationDokument17 SeitenJune 2011 Results PresentationOladipupo Mayowa PaulNoch keine Bewertungen

- June 2012 Investor PresentationDokument17 SeitenJune 2012 Investor PresentationOladipupo Mayowa PaulNoch keine Bewertungen

- PR Q2 Fy11Dokument7 SeitenPR Q2 Fy11smilealwayssgNoch keine Bewertungen

- Booklet - Final 16 Aug 2011Dokument24 SeitenBooklet - Final 16 Aug 2011wgjlubbeNoch keine Bewertungen

- Annual Report 2009-10 of Federal BankDokument88 SeitenAnnual Report 2009-10 of Federal BankLinda Jacqueline0% (1)

- Press Release - 20 January, 2012: ST STDokument7 SeitenPress Release - 20 January, 2012: ST STNimesh MomayaNoch keine Bewertungen

- Annual Report 2011 Eng BNP Paribas IndonesiaDokument47 SeitenAnnual Report 2011 Eng BNP Paribas IndonesiaAvenzardNoch keine Bewertungen

- FY 2012-13 First Quarter Results: Investor PresentationDokument31 SeitenFY 2012-13 First Quarter Results: Investor PresentationSai KalyanNoch keine Bewertungen

- Brainworks Capital Management Interim Financial Results 30 June 2013Dokument42 SeitenBrainworks Capital Management Interim Financial Results 30 June 2013Kristi DuranNoch keine Bewertungen

- Bank of BarodaDokument28 SeitenBank of BarodaVincent KaburuNoch keine Bewertungen

- FS NBP December2010Dokument185 SeitenFS NBP December2010Abdul Wahab ShaikhNoch keine Bewertungen

- Results Press Release For December 31, 2015 (Result)Dokument4 SeitenResults Press Release For December 31, 2015 (Result)Shyam SunderNoch keine Bewertungen

- An UpDokument25 SeitenAn UpAyush AgarwalNoch keine Bewertungen

- Interim Management StatementDokument30 SeitenInterim Management StatementPriyanka RaipancholiaNoch keine Bewertungen

- Financial Strength of Shahjalal Islami BankDokument14 SeitenFinancial Strength of Shahjalal Islami BankEasin Mohammad RomanNoch keine Bewertungen

- Executive SummaryDokument31 SeitenExecutive SummaryFasi2013Noch keine Bewertungen

- Financial Performance of State Bank of PakistanDokument2 SeitenFinancial Performance of State Bank of PakistanMuzna KhalidNoch keine Bewertungen

- 2011 Citibank Berhad Annual ReportDokument136 Seiten2011 Citibank Berhad Annual Reportwhwei91Noch keine Bewertungen

- Press Release Q3-FY23 - IDFC FIRST BankDokument3 SeitenPress Release Q3-FY23 - IDFC FIRST BankcowboymanNoch keine Bewertungen

- Nations Trust Bank Annual Report 2008Dokument134 SeitenNations Trust Bank Annual Report 2008Maithri Vidana Kariyakaranage100% (1)

- Q1 Results FY2010 11Dokument3 SeitenQ1 Results FY2010 11HinaJhambNoch keine Bewertungen

- ICICI Bank Sees 18% Credit Growth in 2010-11Dokument5 SeitenICICI Bank Sees 18% Credit Growth in 2010-11arshsing143Noch keine Bewertungen

- Draft Press Release Half Year 2012Dokument1 SeiteDraft Press Release Half Year 2012Khursheed AhmadNoch keine Bewertungen

- Our Network: Our Presence, in All Corners of Pakistan, Is More Than Just Being ThereDokument4 SeitenOur Network: Our Presence, in All Corners of Pakistan, Is More Than Just Being ThereRulz MakerNoch keine Bewertungen

- Karnataka Bank Net Profit: ' 280.69 Crore Up by 72.3%Dokument3 SeitenKarnataka Bank Net Profit: ' 280.69 Crore Up by 72.3%Naveen SkNoch keine Bewertungen

- IngvysyaDokument12 SeitenIngvysyashashi1124Noch keine Bewertungen

- United Bank Limited: Unconsolidated Condensed Interim Financial StatementsDokument20 SeitenUnited Bank Limited: Unconsolidated Condensed Interim Financial StatementsYasir SheikhNoch keine Bewertungen

- TTB Annual Report 2008Dokument80 SeitenTTB Annual Report 2008Francis DansoNoch keine Bewertungen

- Q2FY24 Press ReleaseDokument5 SeitenQ2FY24 Press ReleaseSivasankaran KannanNoch keine Bewertungen

- Prime Banks Credit CardDokument9 SeitenPrime Banks Credit CardIsmat Jerin ChetonaNoch keine Bewertungen

- FN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsDokument5 SeitenFN 601 Financial Management Lecture 4 - Working Capital Management Review and Assignment QuestionsBaraka100% (1)

- ZBFH Audited Results For FY Ended 31 Dec 13Dokument7 SeitenZBFH Audited Results For FY Ended 31 Dec 13Business Daily ZimbabweNoch keine Bewertungen

- Disclaimer: The Cytonn Weekly Is A Market Commentary Published by Cytonn Asset Managers Limited, AnDokument31 SeitenDisclaimer: The Cytonn Weekly Is A Market Commentary Published by Cytonn Asset Managers Limited, AnEdward NjorogeNoch keine Bewertungen

- Assignment # 3 Banking & InsuranceDokument20 SeitenAssignment # 3 Banking & InsurancerenikaNoch keine Bewertungen

- Unilever Q3 Sep 2011Dokument2 SeitenUnilever Q3 Sep 2011seyivctorNoch keine Bewertungen

- Press Release Unity Bank Q3FY2024 Financial PerformanceDokument2 SeitenPress Release Unity Bank Q3FY2024 Financial Performancepunitrai28111Noch keine Bewertungen

- Q2 2011 - FinancialResultsDokument7 SeitenQ2 2011 - FinancialResultspatburchall6278Noch keine Bewertungen

- (Kotak) ICICI Bank, January 31, 2013Dokument14 Seiten(Kotak) ICICI Bank, January 31, 2013Chaitanya JagarlapudiNoch keine Bewertungen

- National Bank Limited: Some Latest Information of NBL in Capital Market at A GlanceDokument2 SeitenNational Bank Limited: Some Latest Information of NBL in Capital Market at A GlanceJulia RobertNoch keine Bewertungen

- During The 1960s The BankDokument3 SeitenDuring The 1960s The BankSami UllahNoch keine Bewertungen

- Sassaf Citi PresDokument29 SeitenSassaf Citi PresakiskefalasNoch keine Bewertungen

- Bank of Kigali 2010 9M 2010 Results UpdateDokument59 SeitenBank of Kigali 2010 9M 2010 Results UpdateBank of KigaliNoch keine Bewertungen

- NBP FSJune30 2011 Half YearDokument35 SeitenNBP FSJune30 2011 Half YearAwara ChaudharyNoch keine Bewertungen

- Financials: Highlights of The Financial Results For The Year Ended 31 MARCH, 2011Dokument6 SeitenFinancials: Highlights of The Financial Results For The Year Ended 31 MARCH, 2011Sujith KarunagaranNoch keine Bewertungen

- Financial StatementsDokument114 SeitenFinancial StatementsKumanan MunusamyNoch keine Bewertungen

- Kingdom Annual Audited Results Dec 2009Dokument11 SeitenKingdom Annual Audited Results Dec 2009Kristi DuranNoch keine Bewertungen

- Manmohan Parnami: NSE Symbol: AUBANK Scrip Code: 540611, 958400, 974093, 974094 & 974095Dokument60 SeitenManmohan Parnami: NSE Symbol: AUBANK Scrip Code: 540611, 958400, 974093, 974094 & 974095krishna PatelNoch keine Bewertungen

- UCBL Intern ReportDokument89 SeitenUCBL Intern Reportziko777100% (1)

- BasicDokument2 SeitenBasicOmar Faruk SujonNoch keine Bewertungen

- Highlights For The Six Months Ended June 30, 2015 (Company Update)Dokument137 SeitenHighlights For The Six Months Ended June 30, 2015 (Company Update)Shyam SunderNoch keine Bewertungen

- Peoples Merchant Annual Report 2010-11Dokument98 SeitenPeoples Merchant Annual Report 2010-11jkdjfaljdkjfkdsjfdNoch keine Bewertungen

- Sterling Bank PLC Half Year 2010 Release - July 27, 2010Dokument5 SeitenSterling Bank PLC Half Year 2010 Release - July 27, 2010Sterling Bank PLCNoch keine Bewertungen

- Fastest Theory of JungleDokument3 SeitenFastest Theory of JungleSami UllahNoch keine Bewertungen

- State Bank of India Press Release FY 2010-11 Sbi Stand Alone ResultsDokument5 SeitenState Bank of India Press Release FY 2010-11 Sbi Stand Alone ResultsSanjay BhardwajNoch keine Bewertungen

- Q2 2016 Earnings ReleaseDokument5 SeitenQ2 2016 Earnings ReleaseAnonymous Feglbx5Noch keine Bewertungen

- Amcon Bonds FaqDokument4 SeitenAmcon Bonds FaqOladipupo Mayowa PaulNoch keine Bewertungen

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Dokument3 Seiten9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNoch keine Bewertungen

- Filling Station GuidelinesDokument8 SeitenFilling Station GuidelinesOladipupo Mayowa PaulNoch keine Bewertungen

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDokument32 SeitenFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNoch keine Bewertungen

- 9M 2013 Unaudited ResultsDokument2 Seiten9M 2013 Unaudited ResultsOladipupo Mayowa PaulNoch keine Bewertungen

- 2007 Q1resultsDokument1 Seite2007 Q1resultsOladipupo Mayowa PaulNoch keine Bewertungen

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDokument31 SeitenFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNoch keine Bewertungen

- Dec09 Inv Presentation GAAPDokument23 SeitenDec09 Inv Presentation GAAPOladipupo Mayowa PaulNoch keine Bewertungen

- 2007 Q2resultsDokument1 Seite2007 Q2resultsOladipupo Mayowa PaulNoch keine Bewertungen

- Unaudited Half Year Result As at June 30 2011Dokument5 SeitenUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNoch keine Bewertungen

- International Hotel Appraisers4Dokument5 SeitenInternational Hotel Appraisers4Oladipupo Mayowa PaulNoch keine Bewertungen

- Margin Requirement Examples For Sample Options-Based PositionsDokument2 SeitenMargin Requirement Examples For Sample Options-Based PositionsOladipupo Mayowa PaulNoch keine Bewertungen

- Fs 2011 GtbankDokument17 SeitenFs 2011 GtbankOladipupo Mayowa PaulNoch keine Bewertungen

- Ratio Back SpreadsDokument20 SeitenRatio Back SpreadsOladipupo Mayowa PaulNoch keine Bewertungen

- Val Project 6Dokument17 SeitenVal Project 6Oladipupo Mayowa PaulNoch keine Bewertungen

- Marriott ValuationDokument16 SeitenMarriott ValuationOladipupo Mayowa PaulNoch keine Bewertungen

- Hotels and Motels - Industry Data and AnalysisDokument8 SeitenHotels and Motels - Industry Data and AnalysisOladipupo Mayowa PaulNoch keine Bewertungen

- Banking Finance Sectorial OverviewDokument15 SeitenBanking Finance Sectorial OverviewOladipupo Mayowa PaulNoch keine Bewertungen

- Go Ask Alice EssayDokument6 SeitenGo Ask Alice Essayafhbexrci100% (2)

- (ACYFAR2) Toribio Critique Paper K36.editedDokument12 Seiten(ACYFAR2) Toribio Critique Paper K36.editedHannah Jane ToribioNoch keine Bewertungen

- Cds13041 Yamaha PWC Plug-In EcuDokument1 SeiteCds13041 Yamaha PWC Plug-In EcuGérôme ZélateurNoch keine Bewertungen

- Soneri Bank Compensation PolicyDokument20 SeitenSoneri Bank Compensation PolicySapii MandhanNoch keine Bewertungen

- EC2 406006 001 EFE 0121 - Controgen Generator Excitation System Description - Rev - ADokument29 SeitenEC2 406006 001 EFE 0121 - Controgen Generator Excitation System Description - Rev - AAnonymous bSpP1m8j0n50% (2)

- Purchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsDokument4 SeitenPurchases + Carriage Inwards + Other Expenses Incurred On Purchase of Materials - Closing Inventory of MaterialsSiva SankariNoch keine Bewertungen

- Practitioners Guide For Business Development Planning in FPOsDokument70 SeitenPractitioners Guide For Business Development Planning in FPOsMythreyi ChichulaNoch keine Bewertungen

- Automatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Dokument7 SeitenAutomatic Stair Climbing Wheelchair: Professional Trends in Industrial and Systems Engineering (PTISE)Abdelrahman MahmoudNoch keine Bewertungen

- VISCOROL Series - Magnetic Level Indicators: DescriptionDokument4 SeitenVISCOROL Series - Magnetic Level Indicators: DescriptionRaduNoch keine Bewertungen

- Revit 2019 Collaboration ToolsDokument80 SeitenRevit 2019 Collaboration ToolsNoureddineNoch keine Bewertungen

- Hosts 1568558667823Dokument5 SeitenHosts 1568558667823Vũ Minh TiếnNoch keine Bewertungen

- Ms Microsoft Office - WordDokument3 SeitenMs Microsoft Office - WordFarisha NasirNoch keine Bewertungen

- CH 2 Nature of ConflictDokument45 SeitenCH 2 Nature of ConflictAbdullahAlNoman100% (2)

- AutoCAD Dinamicki Blokovi Tutorijal PDFDokument18 SeitenAutoCAD Dinamicki Blokovi Tutorijal PDFMilan JovicicNoch keine Bewertungen

- YeetDokument8 SeitenYeetBeLoopersNoch keine Bewertungen

- A Religious LeadershipDokument232 SeitenA Religious LeadershipBonganiNoch keine Bewertungen

- 87 - Case Study On Multicomponent Distillation and Distillation Column SequencingDokument15 Seiten87 - Case Study On Multicomponent Distillation and Distillation Column SequencingFranklin Santiago Suclla Podesta50% (2)

- Product Guide TrioDokument32 SeitenProduct Guide Triomarcosandia1974Noch keine Bewertungen

- Dr. Li Li Prof. Feng Wu Beijing Institute of TechnologyDokument20 SeitenDr. Li Li Prof. Feng Wu Beijing Institute of TechnologyNarasimman NarayananNoch keine Bewertungen

- Payment of GratuityDokument5 SeitenPayment of Gratuitypawan2225Noch keine Bewertungen

- Chat Application (Collg Report)Dokument31 SeitenChat Application (Collg Report)Kartik WadehraNoch keine Bewertungen

- Danube Coin LaundryDokument29 SeitenDanube Coin LaundrymjgosslerNoch keine Bewertungen

- Possession: I. A. Definition and Concept Civil Code Art. 523-530 CasesDokument7 SeitenPossession: I. A. Definition and Concept Civil Code Art. 523-530 CasesPierrePrincipeNoch keine Bewertungen

- Awais Inspector-PaintingDokument6 SeitenAwais Inspector-PaintingMohammed GaniNoch keine Bewertungen

- CNG Fabrication Certificate16217Dokument1 SeiteCNG Fabrication Certificate16217pune2019officeNoch keine Bewertungen

- STM Series Solar ControllerDokument2 SeitenSTM Series Solar ControllerFaris KedirNoch keine Bewertungen

- Algorithm - WikipediaDokument34 SeitenAlgorithm - WikipediaGilbertNoch keine Bewertungen

- Pthread TutorialDokument26 SeitenPthread Tutorialapi-3754827Noch keine Bewertungen

- Descriptive Statistics - SPSS Annotated OutputDokument13 SeitenDescriptive Statistics - SPSS Annotated OutputLAM NGUYEN VO PHINoch keine Bewertungen

- Sign Language To Speech ConversionDokument6 SeitenSign Language To Speech ConversionGokul RajaNoch keine Bewertungen