Beruflich Dokumente

Kultur Dokumente

IBT199 IBTC Q1 2014 Holdings Press Release PRINT

Hochgeladen von

Oladipupo Mayowa Paul0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

34 Ansichten1 SeiteREPORT

Originaltitel

1403000455 IBT199 IBTC Q1 2014 Holdings Press Release PRINT

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenREPORT

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

34 Ansichten1 SeiteIBT199 IBTC Q1 2014 Holdings Press Release PRINT

Hochgeladen von

Oladipupo Mayowa PaulREPORT

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

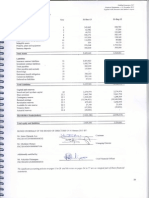

Consolidated and separate income statement

Group Group Company Company

31 Mar 14 31 Mar 13 31 Mar 14 31 Mar 13

Nmillion Nmillion Nmillion Nmillion

Gross earnings 30,221 26,586 189 163

Net interest income 11,726 8,255 - -

Interest income 17,019 14,666 - -

Interest expense (5,293) (6,411) - -

Non-interest revenue 13,085 11,872 189 163

Net fee and commission revenue 8,936 6,968 185 163

Fee and commission revenue 9,053 7,016 185 163

Fee and commission expense (117) (48) - -

Trading revenue 4,101 4,887 - -

Other revenue 48 17 4 -

Total income 24,811 20,127 189 163

Credit impairment charges (1,195) (1,885) - -

Income after credit impairment charges 23,616 18,242 189 163

Operating expenses (14,647) (13,503) (345) (178)

Staff costs (6,418) (5,910) (104) (85)

Other operating expenses (8,229) (7,593) (241) (93)

Profit before tax 8,969 4,739 (156) (15)

Income tax (2,072) (1,166) 40 4

Profit for the period 6,897 3,573 (116) (11)

Profit attributable to:

Non-controlling interests 651 391 - -

Equity holders of the parent 6,246 3,182 (116) (11)

Profit for the period 6,897 3,573 (116) (11)

Consolidated and separate statement of other comprehensive income

Group Group Company Company

31 Mar 14 31 Mar 13 31 Mar 14 31 Mar 13

Nmillion Nmillion Nmillion Nmillion

Profit for the period 6,897 3,573 (116) (11)

Other comprehensive income

Items that will never be reclassified to

profit or loss - - - -

Items that are or may be reclassified

subsequently to profit or loss:

Net change in fair value of available-for-sale

financial assets (245) 1,073 - -

Realised fair value adjustments on available-for-sale

financial assets reclassified to income statement - (467) - -

Income tax on other comprehensive income - - - -

Other comprehensive income for the period, net of tax (245) 606 - -

Total comprehensive income for the period 6,652 4,179 (116) (11)

Total comprehensive income attributable to:

Non-controlling interests 653 366 - -

Equity holders of the parent 5,999 3,813 (116) (11)

6,652 4,179 (116) (11)

Consolidated and separate statement of financial position

Group Group Company Company

31 Mar 14 31 Dec 13 31 Mar 14 31 Dec 13

Nmillion Nmillion Nmillion Nmillion

Assets

Cash and cash equivalents 160,946 120,312 2,104 2,722

Trading assets 60,418 40,711 - -

Pledged assets 24,484 24,733 - -

Derivative assets 2,831 1,526 - -

Financial investments 131,455 139,304 - -

Loans and advances 374,813 383,927 - -

Loans and advances to banks 68,158 94,180 - -

Loans and advances to customers 306,655 289,747 - -

Equity Investment in group companies - - 68,951 68,951

Other assets 23,350 19,829 1,856 1,038

Current and deferred tax assets 7,420 7,716 158 118

Property and equipment 24,154 24,988 2,554 2,572

Total assets 809,871 763,046 75,623 75,401

Equity and liabilities

Equity 104,298 97,634 71,731 71,846

Equity attributable to ordinary shareholders 100,324 94,313 71,731 71,846

Ordinary share capital 5,000 5,000 5,000 5,000

Ordinary share premium 65,450 65,450 65,450 65,450

Reserves 29,874 23,863 1,281 1,396

Non-controlling interest 3,974 3,321 - -

Liabilities 705,573 665,412 3,892 3,555

Trading liabilities 62,880 66,960 - -

Derivative liabilities 1,011 1,085 - -

Deposit and current accounts 510,906 468,038 - -

Deposits from banks 58,544 51,686 - -

Deposits from customers 452,362 416,352 - -

Other borrowings 65,027 48,764 - -

Current and deferred tax liabilities 8,968 7,788 2 2

Subordinated debt 6,624 6,399 - -

Other liabilities 50,157 66,378 3,890 3,553

Total equity and liabilities 809,871 763,046 75,623 75,401

Board of directors

Atedo N.A. Peterside CON (Chairman), Sola David-Borha (Chief Executive), Dominic Bruynseels*, Moses Adedoyin, Sam Cookey,

Ifeoma Esiri, Arnold Gain**, Ratan Mahtani****, Chris Newson**, Sim Tshabalala***, Maryam Uwais MFR

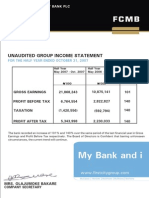

Unaudited financial results for the

three months ended 31 March 2014

*British ** South African/British

***South African ****Singaporean

Sola David-Borha

Chief Executive Officer

FRC/2013/CIBN/00000001070

Stanbic IBTC Holdings PLC RC1018051

Arthur Oginga

Chief Financial Officer

FRC/2013/IODN/00000003181

Atedo N.A. Peterside C O N

Chairman

FRC/2013/CIBN/00000001069

The full financial statements were approved by the Board of Directors on 16 April 2014 and signed on its behalf by:

Overview of financial results

The quarter was marked by sustained high interest rate regime, relative volatility

in the foreign exchange market, competition for quality credit and a bearish trend

in the capital market. The groups financial results for the quarter reflect sound

growth momentum in its underlying businesses. Significant growth in profitability

and business operations were recorded in the quarter, which were driven by

increased client transaction volumes and activities, improved cost of funding and

operational efficiency, a well-positioned trading book and steady growth in loan

and deposit books.

Net interest income increased by 42%, benefiting from growth in loans to

customers and banks, increasing yields on investment securities and improved

funding cost. Interest income grew by 16%, while interest expense declined by

17%. The reduction in interest expense is supported by the improvement in our

deposit mix, as the ratio of low cost deposits to total deposits improved to 55%

from 46% achieved in 1Q 2013 and 52% recorded at the end of 2013.

Key performance indicator

Non-interest revenue grew by 10% to N13.1 billion (1Q 2013: N11.9 billion)

driven by increased transactional volumes and activities aided by growth in

number of customers, increased card related fees, a function of the high ATM

uptime, steady growth within our wealth business and good advisory mandates

in investment banking.

Operating expenses grew by 9% to N14.6 billion keeping with inflation.

Consequently, the cost-to-income ratio improved to 59.0% from 67.1% recorded

in 1Q 2013. We are committed to ensuring that revenues continue to grow

at a faster rate than cost growth.

Overall, the group recorded an 89% growth in profit before tax to N9.0 billion,

while profit after tax increased by 93% to N6.9 billion.

1Q 2014

Gross income growth 13.7%

Total income growth 23.3%

Profit before tax growth 89.3%

Profit after tax growth 93.0%

Gross loans and advances growth (3 month period) 6.0%

Deposit growth (3 month period) 8.6%

Net interest margin 5.8%

Return on average equity 26.0%

Cost-to-income ratio 59.0%

Capital adequacy

- Group 22.4%

- Bank 16.6%

Fitch rating AAA (nga)

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Dokument3 Seiten9854 Goldlink Insurance Audited 2013 Financial Statements May 2015Oladipupo Mayowa PaulNoch keine Bewertungen

- Filling Station GuidelinesDokument8 SeitenFilling Station GuidelinesOladipupo Mayowa PaulNoch keine Bewertungen

- Amcon Bonds FaqDokument4 SeitenAmcon Bonds FaqOladipupo Mayowa PaulNoch keine Bewertungen

- Abridged Financial Statement September 2012Dokument2 SeitenAbridged Financial Statement September 2012Oladipupo Mayowa PaulNoch keine Bewertungen

- IBT199 IBTC Q1 2014 Holdings Press Release PRINTDokument1 SeiteIBT199 IBTC Q1 2014 Holdings Press Release PRINTOladipupo Mayowa PaulNoch keine Bewertungen

- Best Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFADokument16 SeitenBest Practice Guidelines Governing Analyst-Corporate Issuer Relations - CFAOladipupo Mayowa PaulNoch keine Bewertungen

- 9M 2013 Unaudited ResultsDokument2 Seiten9M 2013 Unaudited ResultsOladipupo Mayowa PaulNoch keine Bewertungen

- 2007 Q1resultsDokument1 Seite2007 Q1resultsOladipupo Mayowa PaulNoch keine Bewertungen

- June 2009 Half Year Financial Statement GaapDokument78 SeitenJune 2009 Half Year Financial Statement GaapOladipupo Mayowa PaulNoch keine Bewertungen

- First City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsDokument31 SeitenFirst City Monument Bank PLC.: Investor/Analyst Presentation Review of H1 2008/9 ResultsOladipupo Mayowa PaulNoch keine Bewertungen

- q1 2008 09 ResultsDokument1 Seiteq1 2008 09 ResultsOladipupo Mayowa PaulNoch keine Bewertungen

- q1 2008 09 ResultsDokument1 Seiteq1 2008 09 ResultsOladipupo Mayowa PaulNoch keine Bewertungen

- FCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedDokument4 SeitenFCMB Group PLC Announces HY13 (Unaudited) IFRS-Compliant Group Results - AmendedOladipupo Mayowa PaulNoch keine Bewertungen

- FCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationDokument32 SeitenFCMB Group PLC 3Q13 (IFRS) Group Results Investors & Analysts PresentationOladipupo Mayowa PaulNoch keine Bewertungen

- 2007 Q2resultsDokument1 Seite2007 Q2resultsOladipupo Mayowa PaulNoch keine Bewertungen

- Unaudited Half Year Result As at June 30 2011Dokument5 SeitenUnaudited Half Year Result As at June 30 2011Oladipupo Mayowa PaulNoch keine Bewertungen

- 2006 Q1resultsDokument1 Seite2006 Q1resultsOladipupo Mayowa PaulNoch keine Bewertungen

- 9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Dokument5 Seiten9-Months 2012 IFRS Unaudited Financial Statements FINAL - With Unaudited December 2011Oladipupo Mayowa PaulNoch keine Bewertungen

- June 2011 Results PresentationDokument17 SeitenJune 2011 Results PresentationOladipupo Mayowa PaulNoch keine Bewertungen

- 5 Year Financial Report 2010Dokument3 Seiten5 Year Financial Report 2010Oladipupo Mayowa PaulNoch keine Bewertungen

- 5 Year Financial Report 2010Dokument3 Seiten5 Year Financial Report 2010Oladipupo Mayowa PaulNoch keine Bewertungen

- Dec09 Inv Presentation GAAPDokument23 SeitenDec09 Inv Presentation GAAPOladipupo Mayowa PaulNoch keine Bewertungen

- June 2012 Investor PresentationDokument17 SeitenJune 2012 Investor PresentationOladipupo Mayowa PaulNoch keine Bewertungen

- Final Fs 2012 Gtbank BV 2012Dokument16 SeitenFinal Fs 2012 Gtbank BV 2012Oladipupo Mayowa PaulNoch keine Bewertungen

- Full Year 2011 Results Presentation 2Dokument16 SeitenFull Year 2011 Results Presentation 2Oladipupo Mayowa PaulNoch keine Bewertungen

- 2011 Year End Results Press Release - FinalDokument2 Seiten2011 Year End Results Press Release - FinalOladipupo Mayowa PaulNoch keine Bewertungen

- 2011 Half Year Result StatementDokument3 Seiten2011 Half Year Result StatementOladipupo Mayowa PaulNoch keine Bewertungen

- Fs 2011 GtbankDokument17 SeitenFs 2011 GtbankOladipupo Mayowa PaulNoch keine Bewertungen