Beruflich Dokumente

Kultur Dokumente

LS Construction Cost Handbook 2012

Hochgeladen von

zzackingzzCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

LS Construction Cost Handbook 2012

Hochgeladen von

zzackingzzCopyright:

Verfügbare Formate

Legal: Langdon & Seah

All rights reserved. No part of the publication may be reproduced or copied in any form without prior written

permission from Langdon & Seah.

The information contained in the handbook should be regarded as indicative and for general guidance only.

Whilst every effort has been made to ensure accuracy, no responsibility can be accepted for errors and

omissions, however caused.

Unless otherwise stated, costs reflected in the handbook are costs as at 4th Quarter 2011.

CONSTRUCTION COSTS FOR SELECTED

ASIAN CITIES

BUILDING TYPE

US$/m

2

HONG KONG

+

SHANGHAI

+

BEIJING

+

GUANGZHOU/

SHENZHEN

+

CHONGQING

+

CHENGDU

+

DOMESTIC

Detached houses and bungalows 3,838 1,096 776 622 760 780

Terraced houses 2,863 822 528 439 480 500

Average standard apartments, high rise 2,217 658 560 525 440 470

Luxury apartments, high rise 2,453 987 993 605 800 1,000

OFFICE/COMMERCIAL

2,251 987 947 760 860 940

2,733 1,316 1,269 1,044 1,100 1,250

Shopping centres 2,545 1,206 1,090 983 900 950

HOTELS

Resort hotels N/A 1,370 N/A N/A N/A N/A

3-star budget hotels, inclusive of F.F. & E. 2,713 1,096 1,116 N/A 1,050 1,100

5-star luxury hotels, inclusive of F.F. & E. 3,436 2,193 1,919 1,517 1,880 2,150

INDUSTRIAL

1,184 N/A N/A N/A N/A N/A

warehouses 1,334 N/A N/A N/A N/A N/A

Single storey conventional factory of

structural steelwork N/A 548 586 520 550 550

Owner operated factories, low rise 1,805 735 765 648 N/A N/A

OTHERS

Basement carparks (< 3 levels) 1,900 830 780 759 700 700

Elevated carparks (< 4 levels) 1,028 398 456 353 390 390

Primary and secondary schools 1,497 598 632 415 480 500

Student hostels 1,663 343 335 266 330 330

Sports clubs inclusive of F.F. & E. 2,852 1,051 970 798 900 990

Exchange Rate Used : US$1 = HK$7.8 RMB6.35 RMB6.35 RMB6.35 RMB6.35 RMB6.35

The above costs are at 4th Quarter 2011 levels, inclusive of preliminaries and contingencies unless otherwise stated.

For latest cost information, please refer to our Quarterly Construction Cost Review.

+ Rates are exclusive of contingencies.

Prestige offices, high rise

Average standard offices, high rise

Light duty flatted factories

Heavy duty flatted factories and

CONSTRUCTION COSTS FOR SELECTED

ASIAN CITIES

BUILDING TYPE

US$/m

2

MACAU

SINGAPORE

KUALA

LUMPUR

BRUNEI INDIA

MANILA

DOMESTIC

Detached houses and bungalows 3,455 2,400 962 751 409 1,210

Terraced houses 3,015 2,040 317 525 300 620

Average standard apartments, high rise 1,545 1,680 463 871 347 845

Luxury apartments, high rise 2,230 2,760 1,070 1,071 439 1,070

OFFICE/COMMERCIAL

2,200 2,080 752 871 406 820

2,520 2,320 1,105 1,192 514 1,080

Shopping centres 2,710 2,240 917 1,097 470 960

HOTELS

Resort hotels N/A 2,480 1,333 1,438 723 1,290

3-star budget hotels, inclusive of F.F. & E. 2,560 2,560 1,537 1,559 817 1,230

5-star luxury hotels, inclusive of F.F. & E. 3,480 3,440 2,241 2,163 1,588 1,600

INDUSTRIAL

1,245 1,120 438 483 263 430

warehouses N/A 1,360 521 N/A 313 475

Single storey conventional factory of

structural steelwork N/A 960 435 441 252 410

Owner operated factories, low rise N/A N/A 530 N/A 317 440

OTHERS

Basement carparks (< 3 levels) 1,230 1,310 505 N/A 254 480

Elevated carparks (< 4 levels) 910 760 286 494 222 465

Primary and secondary schools N/A 1,055 327 693 178 590

Student hostels N/A 1,160 413 793 228 695

Sports clubs inclusive of F.F. & E. N/A 1,770 854 N/A 605 1,260

Exchange Rate Used : US$1 = MOP7.97 S$1.25 RM3.15 B$1.26 INR50 PHP43

Rates based on projects in Bangalore and are nett of VAT and

Service Tax. Mumbai costs are generally 8% higher.

Rates are exclusive of contingencies and include 12% VAT.

The above costs are at 4th Quarter 2011 levels, inclusive of preliminaries and contingencies unless otherwise stated.

For latest cost information, please refer to our Quarterly Construction Cost Review.

Rates are exclusive of contingencies and any management

contract fee.

Rates are nett of GST and exclusive of contingencies.

Prestige offices, high rise

Average standard offices, high rise

Light duty flatted factories

Heavy duty flatted factories and

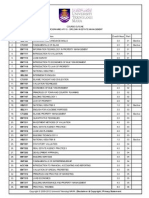

PROGRESS PAYMENTS

CONTRACT

PERIOD

CUMULATIVE

PROGRESS

CLAIMES

CONTRACT

PERIOD

CUMULATIVE

PROGRESS

CLAIMES

5% 1% 55% 59%

10% 3% 60% 68%

15% 5% 65% 77%

20% 7% 70% 83%

25% 10% 75% 88%

30% 14% 80% 92%

35% 21% 85% 94%

40% 29% 90% 96%

45% 38% 95% 98%

50%

48% 100% 100%

The following graph and table are an indication of the rate of expen-

diture for construction projects.

The rate of expenditure is an average rate and will vary from proj-

ect to project when specific project circumstances are taken into

account.

No account has been made for retention.

CONSTRUCTION COSTS FOR SELECTED

ASIAN CITIES

BUILDING TYPE

US$/m

2

KARACHI BANGKOK

#

JAKARTA ^ HO CHI MINH

#

SEOUL

$

TOKYO

DOMESTIC

Detached houses and bungalows 985 - 1,150 967 475 500 - 600 1,930 2,760

Terraced houses 250 - 350 583 N/A 425 - 485 1,605 N/A

Average standard apartments, high rise 580 - 775 828 595 635 - 760 1,310 2,230

Luxury apartments, high rise 870 - 1,150 1,162 800 815 - 945 1,630 3,100

OFFICE/COMMERCIAL

575 - 725 750 575 760 - 880 1,170 2,680

950 - 1,150 983 860 890 - 1,130 1,330 3,200

Shopping centres 695 - 900 800 495 695 - 815 1,480 2,190

HOTELS

Resort hotels 1,965 - 2,305 2,267 1,200 1,195 - 1,500 1,535 3,510

3-star budget hotels, inclusive of F.F. & E. 1,125 - 1,450 1,367 980 1,495 - 1,750 1,730 3,480

5-star luxury hotels, inclusive of F.F. & E. 1,800 - 2,100 1,933 1,395 1,825 - 2,060 2,300 5,100

INDUSTRIAL

300 - 375 600 N/A 238 - 390 N/A 1,540

warehouses 350 - 450 N/A N/A 395 - 510 N/A 2,040

Single storey conventional factory of

structural steelwork 435 - 450 600 260 385 - 510 690 1,760

Owner operated factories, low rise 325 - 425 N/A N/A 395 - 495 N/A N/A

OTHERS

Basement carparks (< 3 levels) 275 - 325 683 390 640 - 730 965 N/A

Elevated carparks (< 4 levels) 200 - 250 350 260 340 - 455 565 1,690

Primary and secondary schools 550 - 675 N/A N/A 475 - 500 1,820 2,070

Student hostels 410 - 540 N/A N/A 500 - 630 1,080 1,890

Sports clubs inclusive of F.F. & E. 810 - 900 N/A N/A 755 - 840 1,460 2,280

Exchange Rate Used : US$1 = PKR89.42 BAHT30 IDR8,910 VND21,011 KRW1,144 JPY78.14

$ Rates are nett of VAT and exclusive of contingencies.

Rates exclude contingencies, consultant fees and consumption tax.

The above costs are at 4th Quarter 2011 levels, inclusive of preliminaries and contingencies unless otherwise stated.

For latest cost information, please refer to our Quarterly Construction Cost Review.

#

Rates are nett of VAT and contingencies.

^

Rates are nett of VAT.

Prestige offices, high rise

Average standard offices, high rise

Light duty flatted factories

Heavy duty flatted factories and

M&E COSTS FOR SELECTED ASIAN CITIES

BUILDING TYPE

HONG KONG SHANGHAI BEIJING

GUANGZHOU/

SHENZHEN

CHONGQING CHENGDU

HK$/m

2

RMB/m

2

RMB/m

2

RMB/m

2

RMB/m

2

RMB/m

2

MECHANIAL SERVICES

1,600 - 2,350 761 - 966 750 - 990 650 - 880 700 - 900 700 - 1,000

Industrial * 380 - 500 173 - 289 160 - 270 135 - 240 150 - 250 150 - 250

Hotels 1,750 - 2,150 971 - 1,265 910 - 1,110 890 - 1,115 750 - 1,000 750 - 1,200

Shopping Centres 1,950 - 2,400 1,050 - 1,103 790 - 950 660 - 890 600 - 850 600 - 1,000

Apartment 650 - 1,300 310 - 410 130 - 370 105 - 325 100 - 300 100 - 300

ELECTRICAL SERVICES

1,300 - 1,950 593 - 651 460 - 670 450 - 650 450 - 650 450 - 700

Industrial ** 450 - 850 305 - 431 320 - 450 260 - 400 300 - 400 300 - 400

Hotels 1,500 - 2,150 651 - 830 705 - 898 565 - 765 550 - 700 550 - 800

Shopping Centres 1,400 - 1,950 520 - 651 481 - 663 450 - 610 450 - 600 450 - 700

Apartment 850 - 1,300 252 - 368 253 - 386 240 - 380 250 - 350 250 - 350

HYDRAULIC SERVICES

270 - 380 110 - 163 95 - 140 105 - 140 70 - 130 70 - 130

Industrial 220 - 330 89 - 131 95 - 140 75 - 102 70 - 120 70 - 120

Hotels

800 - 1,050

368 - 488

360 - 470

325 - 410

300 - 400

300 - 400

Shopping Centres 270 - 380 137 - 184 140 - 200 105 - 140 70 - 130 70 - 130

Apartment 550 - 850 168 - 226 165 - 225 125 - 220 120 - 200 120 - 200

FIRE SERVICES

430 - 550 226 - 320 180 - 265 190 - 295 180 - 250 180 - 250

Industrial 250 - 300 168 - 278 140 - 215 125 - 240 150 - 250 150 - 250

Hotels 430 - 550 289 - 399 215 - 370 230 - 345 200 - 330 200 - 330

Shopping Centres 430 - 550 268 - 383 215 - 370 230 - 345 220 - 330 220 - 330

Apartment 75 - 120 47 - 116 60 - 125 55 - 105 50 - 100 50 - 100

LIFTS / ESCALATORS

550 - 900 275 - 540 294 - 577 250 - 410 350 - 550 350 - 600

Industrial 450 - 600 130 - 380 145 - 400 135 - 390 150 - 350 150 - 350

Hotels 450 - 650 215 - 485 232 - 520 200 - 390 300 - 450 300 - 500

Shopping Centres 650 - 850 320 - 485 327 - 520 305 - 430 300 - 400 300 - 450

Apartment 330 - 650 160 - 320 175 - 289 105 - 230 140 - 250 140 - 250

The above costs are at 4th Quarter 2011 levels, exclusive of contingencies unless otherwise stated.

*

Generally without A/C.

**

Excludes special power supply.

Offices

Offices

Offices

Offices

Offices

M&E COSTS FOR SELECTED ASIAN CITIES

BUILDING TYPE

MACAU SINGAPORE

KUALA

LUMPUR

BRUNEI INDIA

MANILA

MOP/m

2

S$/m

2

RM/m

2

B$/m

2

INR/m

2

PHP/m

2

MECHANIAL SERVICES

N/A 153 - 228 350 - 455 133 - 166 3,600 - 4,700 3,000 - 4,300

Industrial * N/A 29 - 136 60 - 90 17 - 29 1,600 - 2,800 650 - 1,300

Hotels 1,850 - 2,150 150 - 289 280 - 450 214 - 247 4,500 - 4,850 3,000 - 6,000

Shopping Centres 1,600 - 2,150 158 - 214 280 - 410 152 - 181 3,500 - 4,500 2,500 - 3,700

Apartment 550 - 650 95 - 192 200 - 283 157 - 181 2,000 - 2,500 1,900 - 3,000

ELECTRICAL SERVICES

N/A 203 - 306 220 - 465 171 - 214 2,800 - 4,000 3,300 - 6,000

Industrial ** N/A 58 - 148 140 - 157 143 - 171 1,800 - 3,100 2,000 - 3,500

Hotels 1,900 - 2,300 202 - 340 240 - 590 214 - 280 3,200 - 4,900 4,400 - 8,400

Shopping Centres 1,900 - 2,100 170 - 275 200 - 260 162 - 233 3,000 - 4,000 3,600 - 5,400

Apartment 650 - 850 109 - 252 85 - 210 185 - 233 1,200 - 1,600 3,200 - 4,800

HYDRAULIC SERVICES

N/A 31 - 71 23 - 52 12 - 29 575 - 850 900 - 2,000

Industrial N/A 19 - 39 36 - 45 8 - 14 375 - 650 700 - 1,200

Hotels

850 - 1,050

97 - 136

173 - 235

45 - 62

3,000 - 4,500

1,750 - 3,800

Shopping Centres 300 - 400 49 - 75 23 - 30 9 - 30 825 - 1,500 650 - 1,100

Apartment 550 - 750 75 - 159 18 - 45 28 - 44 1,300 - 1,800 1,300 - 2,600

FIRE SERVICES

N/A 32 - 64

57 - 80

24 - 29 900 - 1,200 600 - 1,200

Industrial N/A 24 - 54 45 - 60 9 - 14 400 - 550 600 - 900

Hotels 500 - 600 49 - 78 65 - 90 19 - 36 1,000 - 1,300 600 - 1,100

Shopping Centres 400 - 500 38 - 63 60 - 80 24 - 48 850 - 950 600 - 900

Apartment 100 - 150 19 - 53 20 - 25 19 - 38 450 - 550 600 - 1,300

LIFTS / ESCALATORS

N/A 62 - 177 88 - 400 7 - 24 650 - 900 1,600 - 2,900

Industrial N/A 46 - 114 54 - 190 3 - 14 400 - 550 N/A

Hotels 500 - 700 76 - 138 85 - 370 9 - 33 800 - 1,000 1,500 - 3,000

Shopping Centres 400 - 600 83 - 200 85 - 110 9 - 27 800 - 1,100 700 - 1,700

Apartment 400 - 500 27 - 123 63 - 105 8 - 19 500 - 700 800 - 1,500

Rates are based on projects in Bangalore and are nett of VAT and Service

Tax. Mumbai costs are generally 8% higher.

Transformer, included in Electrical Services.

*

Generally without A/C.

**

Excludes special power supply.

Rates are nett of GST.

The above costs are at 4th Quarter 2011 levels, exclusive of contingencies unless otherwise stated.

Offices

Offices

Offices

Offices

Offices

M&E COSTS FOR SELECTED ASIAN CITIES

BUILDING TYPE

KARACHI BANGKOK

JAKARTA

#

HO CHI MINH SEOUL

$

TOKYO

PKR/m

2

BHT/m

2

IDR'000/m

2

VND'000/m

2

KRW'000/m

2

JPY/m

2

MECHANIAL SERVICES

3,750 - 8,500 3,900 - 4,800 625 - 735 1,590 - 2,267 200 - 280 21,000

Industrial * 1,085 - 1,890 1,250 - 1,400 195 - 455 N/A 87 - 150 11,200

Hotels 7,600 - 9,950 4,500 - 5,100 625 - 840 N/A 205 - 330 14,800

Shopping Centres 7,600 - 9,950 4,400 - 4,800 570 - 680 N/A 144 - 240 7,100

Apartment 2,600 - 3,500 4,400 - 4,500 570 - 730 1,198 - 1,729 92 - 169 3,000

ELECTRICAL SERVICES

4,425 - 5,413 2,250 - 2,500 510 - 680 1,962 - 2,337 250 - 365 19,600

Industrial ** 2,431 - 3,392 1,650 - 1,700 280 - 450 N/A 115 - 150 10,400

Hotels 5,850 - 9,925 2,750 - 3,200 510 - 730 N/A 350 - 460 18,800

Shopping Centres 4,715 - 7,825 2,150 - 2,400 450 - 570 N/A 200 - 230 7,600

Apartment 2,000 - 3,270 2,390 - 2,950 510 - 680 1,740 - 2,197 130 - 165 12,200

HYDRAULIC SERVICES

765 - 1,205 750 - 890 120 - 190 263 - 502 32 - 55 12,600

Industrial 630 - 835 700 - 780 71 - 130 N/A 20 - 30 5,700

Hotels

3,200 - 4,845

1,350 - 1,490

510 - 740

N/A

57 - 89

16,600

Shopping Centres 465 - 1,240 780 - 950 120 - 190 N/A 27 - 56 5,400

Apartment 1,360 - 1,970 1,150 - 1,350 510 - 730 514 - 1,171 49 - 65 18,300

FIRE SERVICES

Included

in above

1,285 - 1,675 760 - 850 160 - 250 614 - 1,019 40 - 65

Industrial 1,125 - 2,025 720 - 750 70 - 130 N/A 27 - 30

Hotels 1,285 - 2,650 750 - 850 150 - 250 N/A 56 - 87

Shopping Centres 1,125 - 2,025 760 - 790 160 - 210 N/A 42 - 69

Apartment 850 - 1,350 760 - 850 160 - 210 420 - 528 32 - 65

LIFTS / ESCALATORS

1,745 - 3,100 1,000 - 1,050 270 - 740 563 - 1,079 45 - 60 5,600

Industrial 1,745 - 3,100 N/A N/A N/A 16 - 25 2,500

Hotels 3,500 - 8,100 1,000 - 1,100 270 - 680 N/A 110 - 155 5,100

Shopping Centres 1,745 - 3,100 210 - 490 205 - 540 1,161 - 1,642 55 - 78 3,600

Apartment 1,745 - 3,100 450 - 500 260 - 540 633 - 920 27 - 38 2,700

# All rates are nett of VAT. Rates for Electrical Services are excluding genset. Rates

for Hydraulic Services are excluding STP. Rates for Mechanical Services refer to

ACMV Rates only.

Services. Smoke spill exhaust system is included in Mechanical Services. Fire

alarm system, emergency PA system are included in Electrical Services.

*

Generally without A/C.

**

Excludes special power supply.

Based upon nett enclosed area and nett of VAT.

$ Rates are nett of VAT.

The above costs are at 4th Quarter 2011 levels,

exclusive of contingencies unless otherwise stated.

Offices

Offices

Offices

Offices

Offices

All costs are average. Sprinkler system, fire hose reel are included in Hydraulic

MAJOR RATES FOR SELECTED ASIAN CITIES

DESCRIPTION UNIT

HONG KONG SHANGHAI BEIJING

/ U O H Z G N A U G

SHENZHEN

CHONGQING CHENGDU

HK$ RMB RMB RMB RMB RMB

1. Excavating basements 2.00m deep m

3

115 30 15 25 16 20

2. Excavating for footings 1.50m deep m

3

110 25 18 30 18 25

3. Remove excavated materials off site m

3

190 * 105 25 68 43 35

4. m

3

650 168 120 155 120 130

5. Mass concrete grade 15 m

3

900 400 500 380 380 380

6. Reinforced concrete grade 30 m

3

1,130 470 560 465 420 420

7. Mild steel rod reinforcement kg 9.8 6 6.3 6.2 6.3 6.3

8. High tensile rod reinforcement kg 9.8 6 6.3 6.2 6.3 6.3

9.

slabs m

2

180

55

65

45

55

55

10. Sawn formwork to columns and walls m

2

180 55 55 45 55 55

11. 112.5mm thick brick walls m

2

190 60

@

90 58 47 50

12.

steel sheeting m

2

600

N/A

N/A

N/A

N/A

N/A

13. Aluminium casement windows, single

glazed m

2

1,700

600

780

**

550

750

**

750

**

14. Structural steelwork - beams, stanchions

and the like kg

25

12

11

14

12

12

15.

the like kg

27

10

11

11

10

10

16. 25mm cement and sand (1:3) paving m

2

80 35 20 21 22 25

17. 20mm cement and sand (1:4) plaster

to walls m

2

95

28

22

18

17

20

18.

(m/s) m

2

270

160

120

115

120

120

19. m

2

430 170 140 157 130 130

20. Two coats of emulsion paint to plastered

surfaces m

2

44

32

30

26

30

30

Average expected preliminaries % 10 - 15 3 - 8 5 - 10 5 - 10 5 - 10 5 - 10

The above costs are at 4th Quarter 2011 levels and are based on lump sum fixed price contract rates exclusive of preliminaries and

contingencies unless otherwise stated.

**

Rates for double glazed window.

*

Rate including waste charges implemented on 1 Dec. 2005.

@

Rates for 120mm thick concrete block walls.

Hardcore bed blinded with dine materials

Sawn formwork to soffits of suspended

Kliplok Colorbond 0.64mm profiled

Steelwork - angles, channels, flats and

Ceramic tiles bedded to floor screed

12mm fibrous plasterboard ceiling lining

MAJOR RATES FOR SELECTED ASIAN CITIES

DESCRIPTION UNIT

MACAU SINGAPORE

KUALA

LUMPUR

BRUNEI INDIA

MANILA

MOP S$ RM B$ INR PHP

1. Excavating basements 2.00m deep m

3

110 16.5 15 - 20 3.5 130 350

2. Excavating for footings 1.50m deep m

3

105 16.5 15 - 20 3 145 250

3. Remove excavated materials off site m

3

60 15 20 - 25 3 100 200

4. m

3

580 50 60 - 70 37 3,060 2,500

5. Mass concrete grade 15 m

3

680 202

230 - 250 117 4,200 3,500

6. Reinforced concrete grade 30 m

3

730 155 - 170 250 - 280 132 5,125 4,800

7. Mild steel rod reinforcement kg 9.5 1.6 - 1.75 3.5 - 3.8 0.98 40 47

8. High tensile rod reinforcement kg 9.5 1.6 - 1.75 3.5 - 3.8 0.98 42 48

9.

slabs m

2

160

30 - 33 30 - 38

14.5

425

850

10. Sawn formwork to columns and walls m

2

160 30 - 33 30 - 38 14 450 800

11. 112.5mm thick brick walls m

2

250 30 - 35 32 - 45 18.5 700 N/A

12.

steel sheeting m

2

N/A

43 55 - 60

56

960

900

13. Aluminium casement windows, single

glazed m

2

2,000

290 350 - 500

166 - 216

3,700

9,000

14. Structural steelwork - beams, stanchions

and the like kg

35

4.8- 5.8 6 - 7.5

3

75

100

15.

the like kg

32

4.8 - 5.8 6 - 7.5

2.7

75

95

16. 25mm cement and sand (1:3) paving m

2

80 11 15 - 22 7.5 300 350

17. 20mm cement and sand (1:4) plaster

to walls m

2

95

15.5 15 - 22

8

230

350

18.

(m/s) m

2

400

65.5 50 - 70

23

1,

100

1,200

19. m

2

460 30 30 - 45 28 850 1,300

20. Two coats of emulsion paint to plastered

surfaces m

2

80

3.5 - 4 3.5 - 4

5

130

350

Average expected preliminaries % 8 - 15 12 - 15 6 - 12 5 - 8 5 - 10 8 - 15

The above costs are at 4th Quarter 2011 levels and are based on lump sum fixed price contract rates exclusive of preliminaries and

contingencies unless otherwise stated.

Rates are based on projects in Bangalore and are nett of

VAT and Service tax. Mumbai costs are generally 8% higher.

Rates are nett of GST.

Rate for lean concrete blinding.

Hardcore bed blinded with fine materials

Sawn formwork to soffits of suspended

Kliplok Colorbong 0.64mm profiled

Steelwork - angles, channels, flats and

Ceramic tiles bedded to floor screed

12mm fibrous plasterboard ceiling lining

Rate for aluminium with anodized finish; 6mm thick.

MAJOR RATES FOR SELECTED ASIAN CITIES

DESCRIPTION UNIT

KARACHI BANGKOK

#

JAKARTA

#

HO CHI

MINH

#

SEOUL

$

TOKYO

PKR BHT IDR'000 VND'000 KRW JPY

1. Excavating basements 2.00m deep m

3

385 - 635 100 23 69 2,100 890

2. Excavating for footings 1.50m deep m

3

320 - 495 100 30 64 2,100 940

3. Remove excavated materials off site m

3

180 - 280 100 25 66 12,000 3,140

4. m

3

1,170 - 1,413 600 270 306 26,500 8,100

5. Mass concrete grade 15 m

3

5,000 - 5,500 2,000 710 1,352 57,000 11,200

6. Reinforced concrete grade 30 m

3

7,500 - 8,500 2,400 850 1,730 72,000 13,200

7. Mild steel rod reinforcement kg 80 - 110 31 10 23.3 1,070 68

8. High tensile rod reinforcement kg 77 - 115 30 10 22.2 1,080 83

9.

slabs m

2

485 - 625

350

120

181

23,000

3,400

10. Sawn formwork to columns and walls m

2

550 - 790 350 120 223 23,000 3,400

11. 112.5mm thick brick walls m

2

990 - 1,060 700 120 165 40,000 13,100

12.

steel sheeting m

2

3,765 - 4,845

1,200

175

516

35,000

2,200

13. Aluminium casement windows, single

glazed m

2

5,000 - 7,500

6,000

880

2,545

249,900

23,000

14. Structural steelwork - beams, stanchions

and the like kg

135 - 160

55

18

33.5

2,400

210

15.

the like kg

135 - 160

55

18

38.5

1,900

320

16. 25mm cement and sand (1:3) paving m

2

425 - 590 200 44 46 2,500 2,600

17. 20mm cement and sand (1:4) plaster

to walls m

2

375 - 580

200

50

66.35

8,300

3,000

18.

(m/s) m

2

1,300 - 1,500

1,200

110

245

55,000

6,100

19. m

2

850 - 1,250 800 100

300 24,000 N/A

20. Two coats of emulsion paint to plastered

surfaces m

2

270 - 375

100

18

62.3

7,100

900

Average expected preliminaries % 8 - 10 10 - 15 5 - 10 8 - 12 6 - 11 10 - 15

The above costs are at 4th Quarter 2011 and are based on lump sum fixed price contract rates exclusive of preliminaries and

contingencies unless otherwise stated.

$ Rates include labour costs and are nett of VAT.

& Including undercoat and primer.

# Rates are nett of VAT.

Rate for 9mm gypsum board.

Hardcore bed blinded with fine materials

sawn formwork to soffits of suspended

Kliplok Colorbong 0.64mm profiled

Steelwork - angles, channels, flats and

Ceramic tiles bedded to floor screed

12mm fibrous plasterboard ceiling lining

CONSTRUCTION COSTS FOR SELECTED

INTERNATIONAL CITIES

BUILDING TYPE

US$/m

2

SYDNEY AUCKLAND JO'BURG

LOS

ANGELES

SAN

FRANCISCO

NEW

YORK

LONDON

RESIDENTIAL

Average multi unit, high rise 2,845 1,770 940 3,500 3,600 3,700 2,420 - 3,060

Luxury unit, high rise 3,265 2,670 1,640 4,200 4,300 4,500 3,220 - 4,420

Individual prestige houses 3,440 2,815 1,650 3,400 3,500 3,800 3,600 - 5,430

COMMERCIAL/RETAIL

3,160 1,605 1,250 3,700 3,900 4,000 2,800 - 3,520

3,585 1,850 1,600 4,200 4,400 4,500 4,000 - 5,120

Major shopping centre (CBD) 2,530 1,110 1,180 2,800 3,100 3,200 1,830 - 2,390

HOTEL

3 star budget 3,265 2,220 1,900 2,100 2,200 2,250 1,940 - 2,340

5 star luxury 4,530 2,880 2,500 4,500 4,600 4,700 3,570 - 4,370

Resort style 4,110 2,220 3,000 4,500 4,600 N/A N/A

INDUSTRIAL

Light duty factory 685 450 430 1,200 1,400 1,200 850 - 1,070

Heavy duty factory 865 575 600 1,600 1,800 1,900 1,410 - 1,760

OTHERS

Multi storey carpark 895 535 460 850 880 900 510 - 860

District hospital 4,055 3,130 1,250 7,300 7,500 6,300 2,950 - 3,680

Primary and secondary schools 1,720 1,760 850 3,00 3,200 3,600 2,230 - 3,300

Exchange Rate Used

(as at July 2011) US$1 =

A$0.93 NZ$1.25 ZAR7.00 US$1.00 US$1.00 US$1.00 GBP0.63

The above costs are at 2nd Quarter 2011 levels. Prices excludes land, site works, professional fees, tenant fitout, equipment and

GST/VAT. Hotel rate includes FF&E.

Large fluctuation in exchange rates can create short tem anomalies.

Prestige offices, high rise

Average standard offices, high rise

CONSTRUCTION FLOOR AREA (CFA)

DEFINITION

The construction floor area measured from drawings is defined as

covered floor areas fulfilling the functional requirements of the

building measured to the outside face of the external walls or exter-

nal perimeter.

It includes floor ares occupied by:

partitions

columns

stairwells

lift shafts

plant rooms

water tanks

balconies

utilities platforms

vertical ducts

service floors higher than 2.2m and the like

But excludes floor areas occupied by:

bay windows

planters projecting from the building, and

the areas covered by canopies, roof eaves and awnings

Sloping surfaces such as staircases, escalators and carpark

ramps are to be measured flat on plan.

The measurement of construction floor area is as defined by

Langdon & Seah.

FINANCIAL DEFINITIONS & FORMULAE

Discount Rate

The rate of return a developer expects when investing in a proj-

ect.

i.e. opportunity cost

Internal Rate of Return (IRR)

The IRR may be defined as the interest rate that equates the pres-

ent value of expected future cash flows to the cost of the invest-

ment.

The IRR can be compared to the Discount Rate.

Net Present Value (NPV)

The NPV is the present value of all future cash flows, discounted

back to todays values at the Discount Rate.

The NPV indicates in todays dollars the profit or loss a developer

makes above or below his required profit (based on a nominated

Discount Rate).

72 Rule

The approximate number of years required to double your capital

can be calculated by dividing the interest rate into 72.

e.g. If interest rate = 10% p.a.

Then 72 10 = 7.2 years

It will take approximately 7.2 years to double your

capital if it is invested at 10% p.a.

PV = present value

FV = future value

PMT = payment amount

n = period (e.g. 10 years with monthly payments,

n = 10 x 12 = 120)

i = interest rate per period

(e.g. 12% p.a. compounded monthly;

i = 12% 12 months = 1% per period)

Future value of $1

Future value of $1 per period

Sinking fund (the amount

required to be put away periodi-

cally to realise

some future sum)

Present value of $1

Present value of $1 per period

Annuity with a PV of $1

FV = PV (1+i)

n

FV = PMT [((1+i)

n

1) i]

PMT = FV [i ((1+i)

n

1)]

PV = FV [1 (1+i)

n

]

PV = PMT [((1+i)

n

1) (i(1+i)

n

)]

PMT = PV[(i(1+i)

n

) ((1+i)

n

- 1)]

MORTGAGE REPAYMENT TABLE

REPAYMENT (years) Interest

p.a. 5 10 15 20

5% 18.87 10.61 7.91 6.60

6% 19.33 11.10 8.44 7.16

7% 19.80 11.61 8.99 7.75

8% 20.28 12.13 9.56 8.36

9% 20.76 12.67 10.14 9.00

10% 21.25 13.22 10.75 9.65

11% 21.74 13.78 11.37 10.32

12% 22.24 14.35 12.00 11.01

13% 22.75 14.93 12.65 11.72

14% 23.27 15.53 13.32 12.44

15% 23.79 16.13 14.00 13.17

16% 24.32 16.75 14.69 13.91

17% 24.85 17.38 15.39 14.67

18% 25.39 18.02 16.10 15.43

19% 25.94 18.67 16.83 16.21

20% 26.49 19.33 17.56 16.99

21% 27.05 19.99 18.31 17.78

22% 27.62 20.67 19.06 18.57

23% 28.19 21.35 19.82 19.37

24% 28.77 22.05 20.58 20.17

25% 29.35 22.75 21.36 20.98

Based on:

* 1,000 units of currency

* Interest compounded monthly

* Equal monthly repayments

Example

Borrow $1,000,000 to be repaid monthly at 10% p.a.

over 10 years.

Repayments = 1,000,000 / 1,000 x $13.22

= $13,220 per month

PRIME RATES & BASE LENDING RATES

as at 4th Quarter 2011

Country Rate (%)

Australia* 4.50

Brunei 5.50

China

**

6.90

Egypt*** 10.25

Hong Kong 5.00

India 14.75

Indonesia 6.00

Japan

^

1.60

Macau 5.25

Malaysia 6.60

New Zealand

^^

10.01

Pakistan

^^^

13.97

Philippines 5.74

Singapore 5.38

South Africa 9.00

South Korea

+

3.25

Thailand

++

7.71

United Kingdom 0.50

United States of America 3.25

Vietnam

+++

9.00

Source:

DLS branches

Central Bank of Egypt (www.cbe.org.eg)

Reserve Bank of New Zealand (www.rbnz.govt.nz)

Bank of England (www.bankofengland.co.uk)

www.economagic.com

www.investec.com

www.money-rates.com

* Over Night Cash Rate

** 3-Year Benchmark Lending Rate

*** Overnight Lending Rate

^ Long Term Prime Rate % pa (Implementation 10-Dec-2010)

^^ SME Overdraft Rate (Previously Businesss Base Lending Rate)

^^^ Weighted Average Lending Rate

+ Base Rate of The Bank of Korea

++ Minimum Loan Rate % pa (Average Based on Local Bank)

+++ Minimum and in VND per year

UTILITY COSTS FOR SELECTED

ASIAN CITIES

CITY

EXCHANGE

RATE

ELECTRICITY

DOMESTIC

COMMERCIAL/

INDUSTRIAL

US$1= US$/kWh US$/kWh

Hong Kong HK$7.80 0.10 0.11

Shanghai RMB6.35

0.097(peak) /

0.048(normal)

0.16(peak) /

0.077(normal)

Beijing RMB6.35 0.07 0.13

Guangzhou RMB6.35 0.09 0.17 / 0.14

Shenzhen RMB6.35 0.1066 0.048 - 0.183

Macau MOP7.97 0.11 0.12

Kuala Lumpur RM3.15 0.069 - 0.144 0.110 - 0.137

Singapore S$1.25 0.22 0.22

Jakarta IDR8,910 0.089 0.102

WATER FUEL

DOMESTIC

COMMERCIAL/

INDUSTRIAL

DIESEL LEADED UNLEADED

US$/m

3

US$/m

3

US$/litre US$/litre US$/litre

0.83 0.59 1.52 N/A 2.05

0.46 0.60 1.17 N/A 1.19 - 1.26

0.63 0.98 1.08 N/A 1.13

0.20 0.43 / 0.29 0.84 N/A 1.04

0.361 - 0.721 0.525 1.177 N/A 1.089 - 1.271

0.54 0.66 1.48 N/A 1.99

0.181 - 0.635 0.657 - 0.724 0.57 N/A 0.60

1.44 1.67 1.27 N/A 1.75

0.250 0.475 0.475 N/A 0.505

Bangkok BHT30.00 0.044 - 0.096 0.054 - 0.056

Manila PHP43.00 0.20 - 0.27 0.21

Brunei B$1.26 0.008 - 0.12 0.057 - 0.159

Ho Chi Minh VND21,000 0.091

0.082 - 0.141 /

0.051 - 0.092

Bangalore INR50.00 0.078 - 0.196 0.112 - 0.352

New Delhi INR50.00 0.098 - 0.167 0.123 - 0.229

Karachi PKR89.42 0.078 - 0.16 0.16 - 0.23

Seoul KRW1,146 0.155 0.0879

Tokyo JPY78.14 0.277 0.277

0.274 - 0.466 0.306- 0.510 0.951 N/A 1.074

0.56 - 0.65 1.32 1.095 N/A 1.243

0.087 - 0.349 0.484 - 0.524 0.302 0.404 0.421

0.21 - 0.50 0.65 / 0.35 0.995 N/A 0.99 - 1.014

3.083 - 5.507 4.142 - 6.829 0.921 N/A 1.457

3.304 - 5.288 4.865 - 7.932 0.82 N/A 1.328

0.175 - 0.319 0.292 - 0.529 1.105 N/A 0.983

0.311 1.475 1.61 N/A 1.73

2.726 5.170 1.459 N/A 1.639

Basis of Charges in Shenzhen, China

Water

Domestic : Within 22m

3

= US$ 0.361/m

3

; 23 - 30m

3

= US$ 0.541/m

3

;

31m

3

and above = US$ 0.721/m

3

Commercial : US$ 0.525/m

3

Industrial : US$ 0.525/m

3

Electricity

Commercial : US$ 0.158/kWh

Industrial : Peak = US$ 0.183/kWh; Normal = US$ 0.138/kWh;

Off-peak = US$ 0.048/kWh

Unleaded Fuel

90# = US$1.089/litre; 93# = US$1.174/litre; 97# = US$1.271/litre

The above costs are at 4th Quarter 2011 levels

Basis of Charges in Hong Kong, China

Water

Domestic :

0 - 12m

3

= Free of charge; 12 - 43m

3

= US$ 0.53/m

3

;

43 - 62m

3

= US$ 0.83/m

3

; Above 62m

3

= US$ 1.16/m

3

Electricity (Based on tariff scheme of CLP Holding Limited)

Domestic (bi-monthly consumption)

0 - 400kWh = US$ 0.10/kWh; 400 - 1,000kWh = US$ 0.11/kWh;

1,000 - 1,800kWh = US$ 0.12/kWh; Above 1,800kWh = US$ 0.13/kWh

Basis of Charges in Macau, China

Water

Domestic :

3

Other charges (Depending on meter size 15mm - 200mm) :

Meter rental = US$0.33 - 58.07/month;

Minimum consumption fee = US$2.22 - 383/month

Commercial/ Industrial :

Charges for ordinary users (e.g. Business, government buildings,

schools, associations, hospitals and others) only. Special users (e.g.

gaming industries, hotels, saunas, golf cources, construction, public

infrastructures and other temporary consumption) are excluded.

Electricity

n o i t p m u s n o c , s e g r a h c d n a m e d f o n o i t i s o p m o c e r a f f i r a t y t i c i r t c e l E

charges, fuel clause adjustment and government tax.

Basis of Charges in Beijing and Guangzhou, China

Unleaded fuel rate is for Unleaded gasoline 97.

Basis of Charges in Shanghai, China

Unleaded Fuel

93# = US$1.19/litre; 97# = US$1.26/litre

Basis of Charges in Kuala Lumpur, Malaysia

Unleaded fuel rate is for Unleaded petrol Ron 95.

Basis of Charges in Singapore (All rates are nett of GST)

Domestic water rate includes conservation tax and water-borne fee and is an

average for the 1st 40m

3

, exclude sanitary appliance fee.

Non-domestic water rate includes conservation tax and water-borne fee,

exclude sanitary appliance fee.

Electricity tariff is based on low tension power supply.

Unleaded fuel rate is for 98 Unleaded petrol as at 15 November 2011.

Diesel fuel rate as at 15 November 2011.

Basis of Charges in Manila, Philippines

Water

Domestic : 32m

3

- 52m

3

/month

Commercial/Industrial : 3,204m

3

/month

Electricity

Domestic : 100kWh - 533kWh

Commercial/Industrial : 222,600kWh

Water and Electricity actual billing includes miscellaneous charges such

as Environmental Charge, Currency Exchange Rate Adjustment (CERA),

VAT, etc.

Basis of Charges in Seoul, Korea

Water

Domestic = US$0.939/month (basic rate) + US$0.311/m

3

(Within 30m

3

usage)

Commercial = US$77.39/month (basic rate) + US$1.475/m

3

(Within 100m

3

usage)

Electricity

Domestic = US$4.757/month (basic rate) + US$0.155/kWh

(500kWh below in use)

Commercial = US$5.243/month (basic rate) + US$0.0879/kWh

(within 1,000kWh, 3,300V - 66,000V)

Basis of Charges in Tokyo, Japan (All rates are VAT inclusive)

Water

Domestic : Rates for 30mm diameter of water piping

+ Basic rate of US$41.64.

Commercial / Industrial : Rates for 100mm diameter of water piping

+ Basic rate of US$1,146.28.

Electricity

0kWh - 120kWh = US$0.217/kWh; 120kWh - 300kWh = US$0.277/kWh;

Over 300kWh = US$0.292/kWh

Basic rate = US$3.309 - 10A (ampere); US$9.927 - 30A (ampere);

US$19.855 - 60A (ampere) is added.

Basis of Charges in Ho Chi Minh, Vietnam (All rates are VAT inclusive)

Water

Domestic : Used in norm = US$ 0.21; Used over norm = US$ 0.50

Industrial = US$0.35

Commercial = US$0.65

Electricity

Domestic electricity rates are applied to the 301 KW above wards

Fuel : Diesel fuel D.O - 0.05%

: 92 and 95 Unleaded petrol as at October 2011.

Basis of Charges in Bangkok, Thailand

Unleaded fuel rate is for Gasohol 95.

Basis of Charges in Karachi, Pakistan

Fuel : The diesel fuel rate is for High Speed Diesel.

: The unleaded fuel rate is for Premier Petrol.

Basis of Charges in Brunei

Electricity (Domestic) : Tariff effective from 1st Jan 2012. 1-10 kWh 10c,

11-60 kWh 8c, 61-100kWh 12c, above 100kWh 15c

IDD CODES

Source : www.worldtimeserver.com ; www.worldtimezone.com

www.timeanddate.com

LOCATION

IDD

COUNTRY

CODE

AREA

CODE

Australia:

Melbourne 61 3

Perth 61 8

Sydney 61 2

Bahrain 973 -

Bangladesh (Dhaka) 880 2

Bhutan (Thimphu) 975 2

Brunei:

Bandar Seri Begawan 673 2

Kuala Belait 673 3

Cambodia (Phnom Penh) 855 23

Canada:

Toronto (Metropolitan) 1 416

Vancouver 1 604/250/ 778

China:

Beijing 86 10

Guangzhou 86 20

Hong Kong 852 -

Macau 853 -

Shanghai 86 21

Shenzhen 86 755

France (Paris) 33 1

India:

Bangalore 91 80

Chennai 91 44

New Delhi 91 11

Mumbai 91 22

Indonesia:

Bali 62 361

Jakarta 62 21

Ireland:

Cork 353 21

Dublin 353 1

Japan:

Tokyo 81 3

Osaka 81 6

Kazakhstan (Almaty) 7 727

Korea (Seoul) 82 2

Korea (Pyongyang) 850 2

Laos (Vientiane) 856 21

LOCATION

IDD

COUNTRY

CODE

AREA

CODE

Malaysia:

Johor Bahru 60 7

Kota Kinabalu 60 88

Kuala Lumpur 60 3

Kuching 60 82

Penang 60 4

Mongolia (Ulaanbaatar) 976 11

Myanmar (Rangoon) 95 1

Nepal (Kathmandu) 977 1

New Zealand:

Auckland 64 9

Wellington 64 4

Pakistan (Karachi) 92 21

Philippines (Manila) 63 2

Qatar 974 -

Singapore 65 -

Spain:

Barcelona 34 93

Girona 34 972

South Africa:

Johannesburg 27 11

Cape Town 27 21

Sri Lanka (Colombo) 94 1

Russia (Moscow) 7 495

Taiwan (Taipei) 886 2

Thailand:

Bangkok 66 2

Phuket 66 76

United Arab Emirates:

Abu Dhabi 971 2

Dubai 971 4

United Kingdom:

London 44 20

Edinburgh 44 131

USA:

Los Angeles 1 213

New York 1 212

Vietnam:

Ho Chi Minh City 84 8

Hanoi 84 4

WEIGHT AND MEASURES

Metric Measures and Equivalents

LENGTH

1 millimetre (mm) = 0.0394 in

1 centimetre (cm) = 10 mm = 0.3937 in

1 metre (m) = 100 cm = 1.0936 yd

1 kilometre (km) = 1,000 m = 0.6214 mile

AREA

1 sq cm (cm

2

) = 100 mm

2

= 0.1550 in

2

1 sq metre (m

2

) = 10,000 cm

2

= 1.1960 yd

2

1 hectare (ha) = 10,000 m

2

= 2.4710 acres

1 sq km (km

2

) = 100 ha = 0.3861 mile

2

VOLUME / CAPACITY

1 cu cm (cm

3

) = 0.0610 in

3

1 cu decimetre (dm

3

) = 1,000 cm

3

= 0.0353 ft

3

1 cu metre (m

3

) = 1,000 dm

3

= 1.3080 yd

3

1 litre (l )

= 1 dm

3

= 1.76 pt

1 hectolitre (hl ) = 100 l = 21.997 gal

MASS (WEIGHT)

1 milligram (mg) = 0.0154 grain

1 gram (g) = 1,000 mg = 0.0353 oz

1 kilogram (kg) = 1,000 g = 2.2046 lb

1 tonne (t) = 1,000 kg = 0.9842 ton

USA MEASURES AND EQUIVALENTS

USA Dry Measure Equivalents

1 pint = 0.9689 UK pint = 0.5506 l

USA Liquid Measure Equivalents

1 fluid ounce = 1.0408 UK fl oz = 29.574 ml

1 pint (16 fl oz) = 0.8327 UK pt = 0.4723 l

1 gallon = 0.8327 UK gal = 3.7854 l

LENGTH

1 inch (in) = 2.54 cm

1 foot (ft) = 12 in = 0.3048 m

1 yard (yd) = 3 ft = 0.9144 m

1 mile = 1,760 yd = 1.6093 km

1 int. nautical mile = 2,025.4 yd = 1.853 km

AREA

1 sq inch (in

2

) = 6.4516 cm

2

1 sq foot (ft

2

) = 144 in

2

= 0.0929 m

2

1 sq yard (yd

2

) = 9 ft

2

= 0.8361 m

2

1 acre = 4,840 yd

2

= 4,046.9 m

2

1 sq mile (mile

2

) = 640 acres = 2.59 km

2

VOLUME / CAPACITY

1 cu inch (in

3

) = 16.387 cm

3

1 cu foot (ft

3

) = 1,728 in

3

= 0.0283 m

3

1 fluid ounce (fl oz) = 28.413 ml

1 pint (pt) = 20 fl oz = 0.5683 l

1 gallon (gal) = 8 pt = 4.5461 l

MASS (WEIGHT)

1 ounce (oz) = 437.5 grains = 28.35 g

1 pound (lb) = 16 oz = 0.4536 kg

1 stone = 14 lb = 6.3503 kg

1 hundredweight (cwt) = 112 lb = 50.802 kg

1 ton = 20 cwt = 1.016 t

Temperature Conversion

o

C = 5/9 (

o

F - 32)

o

F = (9/5

o

C) + 32

o

C

o

F

Imperial Measures and Equivalents

CONVERSION GUIDE

Conversion Formulae

To use the conversion formulae simply multiply the Imperial mea-

surement by the factor beside the conversion you wish to make.

For example 6 inches into milimetres. 6 inches multiplied by 25.4

equals 152.4 milimetres. Conversely if you wish to convert Metric

measure into Imperial measure simply divide by the same factor.

LENGTH

To Convert Multiply by

mili-inches into micrometres 25.4

inches into milimetres 25.4

inches into centimetres 2.54

inches into metres 0.0254

feet into centimetres

feet into milimetres 304.8

30.48

feet into metres 0.3048

yards into metres 0.9144

fathoms into metres 1.8288

chains into metres 20.1168

furlongs into metres 201.168

miles, statute into kilometres 1.609344

miles, nautical into kilometres 1.852

VOLUME & CAPACITY

To Convert Multiply by

cubic inches into cubic centimetres 16.387064

cubic inches into litres 0.016387

cubic feet into cubic metres 0.0283168

cubic feet into litres 28.316847

UK quarts into litres

UK pints into litres 0.5682613

1.1365225

cubic yards into cubic metres 0.7645549

UK gallons into litres 4.54609

UK gallons into cubic metres 0.0045461

UK fluid ounces into cubic centimetres 28.413063

POWER

To Convert Multiply by

foot pounds-force per second into watts 1.35582

horsepower into watts 745.7

foot pounds-force per second into kilowatts 0.001356

horsepower into kilowatts 0.7457

horsepower into metric horsepower 1.01387

AREA

To Convert Multiply by

square inches into square milimetres 645.16

square inches into square centimetres 6.4516

square feet into square centimetres 929.0304

square feet into square metres 0.092903

square yards into (0.01 hectare)

square yards into square metres 0.836127

0.0083613

acres into square metres 4046.8564

acres into hectares 0.4046856

square miles into square kilometres 2.589988

MASS

To Convert Multiply by

grains into miligrams 64.79891

grains into metric carats 0.323995

grains into grams 0.064799

pennyweights into grams 1.555174

ounces troy into grams

ounces into grams 28.349523

31.103477

ounces into kilograms 0.0283495

pounds into kilograms 0.4535924

stones into kilograms 6.35023932

hundredweights into kilograms 50.802345

tons into kilograms 1016.0469

tons into metric tonnes 1.01605

tahils into grams 37.799

kati into kilograms 0.60479

PUBLIC HOLIDAYS

2011 2012

MALAYSIA

New Years Day**

Chinese New Year

Prophet Muhammads Birthday

Labour Day

Wesak Day

King/Agongs Birthday

Hari Raya Aidilfitri*

National Day

Malaysia Day

Hari Raya Qurban*

Deepavali*

Awal Muharram

Christmas Day

* Subject to change

** Except Johor, Kelantan, Kedah, Perlis & Terengganu

# Except Kelantan & Terengganu

## The following day will be an additional Public Holiday

01

03 - 04

15

01

17

04

30 - 31

31

16

06

26

27

25

Jan

Feb

Feb

May

May

Jun

Aug

Aug

Sep

Nov

Oct

Nov

Dec

01

23 - 24

05

01

05

02

19 - 20

31

16

26

13

15

25

Jan

##

Jan

#

Feb

##

May

May

Jun

Aug

##

Aug

Sep

##

Oct

Nov

Nov

Dec

PAKISTAN

Kashmir Day

Eid-e-Milad-un-Nabi*

(Birth of Prophet)

Pakistan Day

Labour Day

Independence Day

Eid al-Fitr (End of Ramadan)*

Allama Muhammad Iqbal Day

Eid-ul-Azha*

(Feast of the Sacrifice)

Ashoura*

Quaid-e-Azams Birthday

*Subject to change

05

16

23

01

14

30 Aug-

09

07 - 09

06 - 07

25

Feb

Feb

Mar

May

Aug

01 Sep

Nov

Nov

Dec

Dec

05

05

23

01

14

19 - 21

09

26 - 27

24 - 25

25

Feb

Feb

Mar

May

Aug

Aug

Nov

Oct

Nov

Dec

2011 2012

CHINA

New Years Day

@

Chinese New Years Eve

Chinese New Year*

Tomb-Sweeping Day**

Labour Day

+

Dragon-Boat Festival

#

Mid Autumn Festival

National Day^

@ 2nd and 3rd Jan are holidays, 31 Dec is working day.

* 25th to 28th Jan are holidays.

** 2nd and 3rd Apr are holidays, 31st Mar and 1st Apr are

working days.

+ 29th and 30th Apr are holidays, 28th Apr is working day.

# 22nd and 24th Jun are holidays.

^ 4th to 7th Oct are holidays.

01

02

03 - 04

05

01

06

12

01 - 03

Jan

Feb

Feb

Apr

May

Jun

Sep

Oct

01

22

23 - 24

04

01

23

30

01 - 03

Jan

Jan

Jan

Apr

May

Jun

Sep

Oct

BRUNEI

New Years Day**

Chinese New Year

Prophet Muhammads Birthday**

National Day

Royal Brunei Armed Forced Ann.

Israk Miraj**

His Majestys Birthday**

First Day of Ramadhan*

Ann. Revelation of the Holy Koran*

Hari Raya Aidilfitri*

Hari Raya Aidilfitri* (2nd day)

Hari Raya Aidil Adha*

&

**

First Day of Hijrah*

&

**

Christmas Day*

Fridays and Saturdays are government off days

* Subject to change

** Replacement for Fridays / Sundays

01

03

15

23

31

29

16

01

17

30

31

07

28

25

Jan

Feb

Feb

Feb

May

Jul

Jul

Aug

Aug

Aug

Aug

Nov

Nov

Dec

02

23

06

23

31

18

16

21

06

20

21

26

15

25

Jan

Jan

Feb

Feb

May

Jun

Jul

Jul

Aug

Aug

Aug

Oct

Nov

Dec

PUBLIC HOLIDAYS

2011 2012

MACAU

New Years Day*

The first working day after

New Years Day

#

Lunar New Year Eve (Afternoon)

Lunar New Year

Ching Ming Festival

Good Friday

The day following Good Friday*

Easter Monday#

Labour Day

The Buddhas Birthday*

The first working day after

the Buddhas Birthday

#

Tung Ng Festival

The first working day after

the Tung Ng Festival

#

Banks Holiday

The day following Chinese

Mid-Autumn Festival

National Day

Chong Yeung Festival

All Souls Day

Feast of the Immaculate

Conception*

The first working day after the

Feast of the Immaculate

Conception#

Macao SAR Establishment Day

Winter Solstice*

Christmas Eve

Christmas Day

Banks Holiday

New Years Eve (Afternoon)

#

* Not applicable to Bank

# Special Holiday Granted by Chief Executive.

^ As the day following Chinese Mid-Autumn Festival and

National Day fall on the same day, one additional holiday will

be granted following the National Day.

01

-

02

03 - 05

05

22

23

25

01 - 02

10

-

06

-

01

13

01 - 03

05

02

08

-

20

22

24

25 - 26

27

-

Jan

-

Feb

Feb

Apr

Apr

Apr

Apr

May

May

-

Jun

-

Jul

Sep

Oct

Oct

Nov

Dec

-

Dec

Dec

Dec

Dec

Dec

-

01

02

-

23 - 25

04

06

07

09

01

28

30

23

25

02

01

01

23

02

08

10

20

21

24

25

26

31

Jan

Jan

-

Jan

Apr

Apr

Apr

Apr

May

Apr

Apr

Jun

Jun

Jul

Oct

Oct^

Oct

Nov

Dec

Dec

Dec

Dec

Dec

Dec

Dec

Dec

2011 2012

INDONESIA

New Years Day 01

Jan

01

Jan

Chinese New Year (Imlek) 03 Feb 23 Jan

Prophet Muhammads Birthday 15 Feb 05 Feb

Hindu Day of Quiet (Nyepi) 05 Mar 23 Mar

Good Friday 22 Apr 06 Apr

Waicak Day (Buddha Birthday) 17 May 06 May

Ascension Day of Jesus Christ 02 May 17 May

Ascension Day of Prophet

Muhammad* 29 Jul 17 Jun

National Independence Day 17 Aug 17 Aug

Idul Fitri* 30 Sep 19 Aug

31 Sep 20 Aug

Idul Adha Day 06 Nov 26 Oct

Hijriyah New Year 27 Dec 15 Nov

* Subject to change

Christmas Day 25 Dec 25 Dec

HONG KONG

The First day Of January

Lunar New Years Day

Ching Ming Festival

Good Friday

Easter Monday

Buddhas Birthday

Labour Day

Tuen Ng Festival

HKSAR Establishment Day

The day following Chinese

Mid-Autumn Festival

National Day

Chung Yeung Festival

Christmas Day

# When public holiday falls on Sunday, the following Monday is

an alternative holiday.

* As the day following Chinese Mid-Autumn Festival and

National Day fall on the same day, one additional holiday will

be granted following the National Day.

01

03 - 05

05

22 - 23

25

10

01 - 02

06

01

13

01

05

25 - 27

Jan

Feb

Apr

Apr

Apr

May

May

Jun

Jul

Sep

Oct

Oct

Dec

01

23 - 25

04

06 - 07

09

28

01

23

01

01

01

23

25 - 26

Jan

#

Jan

Apr

Apr

Apr

Apr

May

Jun

Jul

#

Oct*

Oct*

Oct

Dec

PUBLIC HOLIDAYS

2011 2012

JAPAN

New Years Day*

Coming of Age Day

National Foundation Day*

Spring Equinox Day*

Day of Showa*

Constitution Memorial Day*

Greenery Day*

Childrens Day*

Marine Day

Respect-for-Senior-Citizens Day

Autumnal Equinox Day*

Physical Fitness Day

Cultural Day*

Labor Thanksgiving Day*

The Emperors Day*

*When Public Holiday falls on Sunday, the following Monday is

an alternative holiday.

01

10

11

21

29

03

04

05

18

19

23

10

03

23

23

Jan

Jan

Feb

Mar

Apr

May

May

May

Jul

Sep

Sep

Oct

Nov

Nov

Dec

02

09

11

20

30

03

04

05

16

17

22

08

03

23

23

Jan

Jan

Feb

Mar

Apr

May

May

May

Jul

Sep

Sep

Oct

Nov

Nov

Dec

INDIA

New Years Day

Sankranthi

Republic Day

Good Friday

May Day

Independence Day

Gandhi Jayanthi

Karnataka Formation Day

Deepavali

Christmas Day

01

14

26

22

01

15

02

01

26

25

Jan

Jan

Jan

Apr

May

Aug

Oct

Nov

Oct

Dec

01

14

26

06

01

15

02

01

13

25

Jan

Jan

Jan

Apr

May

Aug

Oct

Nov

Nov

Dec

2011 2012

KOREA

New Years Day

Lunar New Year (Seol)

Independent Movement Day

Buddhas Birthday

Childrens Day

Memorial Day

Liberation Day

Full Moon Day (Chuseok)

National Foundation Day

Christmas Day

01

02 - 04

01

10

05

06

15

11 - 13

03

25

Jan

Feb

Mar

May

May

Jun

Aug

Sep

Oct

Dec

01

23 - 24

01

28

05

06

15

29 - 01

03

25

Jan

Jan

Mar

May

May

Jun

Aug

Oct

Oct

Dec

PHILIPPINES (Regular Holidays)

Regular Holidays

New Years Day

Maundy Thursday

Good Friday

Araw ng Kagitingan

Labour Day

Independence Day

End of Eid-ul-Fitre

National Heroes Day

Eid-ul Adha

Bonifacio Day

Christmas Day

Rizal Day

Special Holidays

(Non Working Holidays)

Ninoy Aquino Day

All Saints Day

Last Day of the Year

01

21

22

09

01

12

31

30

07

30

25

30

21

01

31

Jan

Apr

Apr

Apr

May

Jun

Aug

Aug

Nov

Nov

Dec

Dec

Aug

Nov

Dec

01

05

06

09

01

12

19

30

26

30

25

30

21

01

31

Jan

Apr

Apr

Apr

May

Jun

Aug

Aug

Oct

Nov

Dec

Dec

Aug

Nov

Dec

PUBLIC HOLIDAYS

2011 2012

SINGAPORE

New Years Day

Chinese New Year

Good Friday

Labour Day

Vesak Day

National Day

Hari Raya Puasa

Hari Raya Haji

Deepavali*

Christmas Day

*Subject to changes

^ The following Monday will be a public holiday

01

03 - 04

22

01

17

09

30

06

26

25

Jan

Feb

Apr

May

May

Aug

Aug

Nov

Oct

Dec

01

23 - 24

06

01

05

09

19

26

13

25

Jan^

Jan

Apr

May

May

Aug

Aug^

Oct

Nov

Dec

TAIWAN

Founding Day

Lunar New Years Eve

Lunar New Year

Replacement Holiday

Peace Memorial Day

Woman Day and Childrens Day

Ching Ming Festival

Labour Day

Dragon Boat Festival

Mid-Autumn Festival

Double Ten Day

Replacement Holiday

* As 4-Feb is adjusted to work, this day is adjusted to holiday.

@

As 3-Mar is adjusted to work, this day is adjusted to holiday.

#

As 22-Dec is adjusted to work, this day is adjusted to holiday.

01

02

03 - 07

-

28

04

05

01

06

12

10

-

Jan

Feb

Feb

-

Feb

Apr

Apr

May

Jun

Sep

Oct

-

01

22

23 - 27*

27

28

04

04

01

23

30

10

31

Jan

Jan

Jan

Feb

@

Feb

Apr

Apr

May

Jun

Sep

Oct

Dec

#

2011 2012

THAILAND

New Years Day

Chinese New Year*

Makha Bucha Day

Chakri Memorial day

Songkran Festival

National Labour Day

Coronation Day

Royal Ploughing Ceremony Day

+

Visakha Bucha Day

Mid Year Bank Holiday

#

Asarnha Bucha Day

Khao Phansa Day (Buddhist Lent)

+

H.M. The Queens Birthday

Chulalongkorn day

H.M. The Kings Birthday

Constitution Day

New Years Eve

*Unofficial Chinese Community Only

#

Banks only

+

Government only

1

Substitute for 31 Dec 2011 (Sat)

2

Substitute for 14 Apr (Sat)

3

Substitute for 05 May (Sat)

4

Substitute for 12 Aug (Sun)

03

03

18

06

13 - 15

02

05

13

17

01

15

18

12

24

05

12

31

Jan

Feb

Mar

Apr

Apr

May

May

May

May

Jul

Jul

Jul

Aug

Oct

Dec

Dec

Dec

02

23

07

06

13 - 16

01

07

09

04

01

02

03

13

23

05

10

31

Jan

1

Jan

Mar

Apr

Apr

2

May

May

3

May

Jun

Jul

Aug

Aug

Aug

4

Oct

Dec

Dec

Dec

VIETNAM (Normal Scheduled Holidays)

Solar New Year

Lunar New Year

Hung Vuong King Celebration

Liberation Day of Saigon

International Labour Day

National Day

Christmas Day

* Substitute for 1 Jan (Sun)

** Substitute for 22 Jan (Sun)

# Substitute for 31 Mar (Sat)

^ Substitute for 2 Sep (Sun)

03

03 - 07

12

02

03

02

25

Jan

Feb

Apr

May

May

Sep

Dec

02

23 - 26**

02

30

01

03

25

Jan*

Jan

Apr

#

Apr

May

Sep^

Dec

ABOUT US

First established in 1934 in Singapore under the name "Waters

and Watson" we survived the Second World War to become

the pre-eminent Quantity Surveying and Construction cost

Management firm in Asia - operating for many years as Lang-

don Every and Seah. One of our early partners, Mr. Seah

Mong Hee, was the first Chartered Surveyor (RICS) in the

world.

Our Hong Kong office opened in 1949 and we quickly estab-

lished ourselves as the leading firm in the profession.

Following a series of global mergers, Davis Langdon & Seah

International was founded in 1990. As we begin 2012, Davis

Langdon & Seah has grown to almost 3,000 staff in 40 offices

across Asia, and continues to cooperate with Davis Langdon in

Europe & Middle East, USA, Australia & New Zealand and

Africa - forming a network of over 100 offices across more than

30 contries.

We entered the China market in 1984, introducing modern cost

management techniques to its newly evolving construction

market. Our initial commissions were from Hong Kong and

foreign developers investing in China, although we have since

then further developed our client base to include state owned

enterprises and local privatedevelopers. We now have 16

offices across China located in Hong Kong, Shanghai, Beijing,

Guangzhou, Shenzhen, Macau, Chongqing, Wuhan, Tianjin,

Shenyang, Chengdu, Foshan, Hangzhou, Dalian, Sanya and

Suzhou with a total staff count of around 1,400.

For over 60 years, DLS Hong Kong/China has been proac-

tively providing world-class construction consulting services for

all types of building and infrastructure projects. We are com-

mitted to further extending our professional expertise to related

fields and further expanding our activities in China to support

the needs of our clients as they explore one of the world's larg-

est and fastest growing markets.

QUALITY MANAGEMENT SYSTEM

Nowadays an effective Quality Management System is one of the

core elements in any kind of business. Davis Langdon and Seah

Hong Kong Limited aims to provide not merely quantity surveying

services but also the highest quality services to meet clients'

requirements.

We launched our Quality Management System in 1993 and have

continually upgraded our quality standards since then.

Davis Langdon & Seah Hong Kong Limited achieved certification

to ISO 9001: 1987 by the Hong Kong Quality Assurance Agency

in October 1994 to cover quantity surveying services. We were

certifies to ISO 9001: 1994 in October 1995.

The following further displays our commitment to the continual

improvement of our Quality Management System:

(i) June 2009 saw Davis Langdon & Seah Hong Kong Limited

being certified to the ISO 9001: 2008 standard.

(ii) In December 2009, the Hong Kong office of Davis Langdon &

Seah China Limited was certified to the ISO 9001:2008 standard.

(iii) In September 2010, Davis Langdon & Seah Macau Limited

was certified to the ISO 9001:2008 standard.

Plans are currently well advanced to further extend our HKQAA

ISO certification to all our offices in China.

CONSTRUCTION COSTS FOR HONG KONG

The above costs are at 4th Quarter 2011 levels.

BUILDING TYPE

HK$/m

2

BUILDING SERVICES TOTAL

DOMESTIC

Public rental housing, high rise 6,055 - 6,810 1,045 - 1,350 7,100 - 8,160

Private housing estates, high rise 14,035 - 14,780 2,455 - 3,320 16,490 - 18,100

Private luxury apartments, high rise 15,805 - up 3,325 - 4,220 19,130 up

Terraced houses 19,065 - 20,490 2,255 - 2,860 21,320 - 23,350

Individual prestige houses 27,485 up 2,455 - 3,610 29,940 up

OFFICE/COMMERCIAL

12,340 - 13,350 4,150 - 5,280 16,490 - 18,630

16,470 up 4,850 - 6,130 21,320 up

Average standard shopping centres 11,840 - 14,770 4,700 - 5,430 16,540 - 20,200

Prestige shopping centres 16,420 up 4,900 - 6,130 21,320 up

HOTELS

3-star budget hotels, inclusive of F.F. & E. 15,070 - 16,630 4,930 - 5,700 20,000 - 22,330

5-start luxury hotels, inclusive of F.F. & E. 21,470 up 5,330 - 6,550 26,800 up

INDUSTRIAL

6,980 - 7,410 1,750 - 2,330 8,730 - 9,740

15 kpa (300 lb.) loading 7,640 - 8,590 2,000 - 2,580 9,640 - 11,170

OTHERS

Carparks, above ground 6,210 - 6,480 1,300 - 2,050 7,510 - 8,530

Primary and secondary schools 9,120 - 9,330 2,050 - 2,850 11,170 - 12,180

International schools 10,960 - 11,680 3,000 - 3,950 13,960 - 15,630

Student hostels 8,790 - 10,060 3,150 - 3,950 11,940 - 14,010

Sports clubs inclusive of F.F. & E. 15,270 - 16,970 5,350 - 6,900 20,620 - 23,870

Average standard office, high rise

Prestige offices, high rise

Light duty flatted factories, 7.5 kpa (150lb.) loading

Heavy duty flatted factories and warehouses,

M&E COSTS FOR HONG KONG

BUILDING TYPE

HK$/m

2

MECHANICAL

SERVICES

ELECTRICAL

SERVICES

FIRE

SERVICES

LIFTS/

ESCALATORS

HYDRAULIC

SERVICES

TOTAL

SERVICES

DOMESTIC

Public rental housing, high rise - - 450 - 550 75 - 120 200 - 250 320 - 430 1,045 - 1,350

Private housing estates, high rise 650 - 850 850 - 1,050 75 - 120 330 - 550 550 - 750 2,455 - 3,320

Private luxury apartments, high rise 1,100 - 1,300 1,050 - 1,300 75 - 120 450 - 650 650 - 850 3,325 - 4,220

Terraced houses 850 - 1,100 850 - 1,050 55 - 110 - - 500 - 600 2,255 - 2,860

Individual prestige houses 850 - 1,400 1,050 - 1,500 55 - 110 - - 500 - 600 2,455 - 3,610

OFFICE/COMMERCIAL

1,600 - 1,950 1,300 - 1,650 430 - 550 550 - 750 270 - 380 4,150 - 5,280

1,900 - 2,350 1,600 - 1,950 430 - 550 650 - 900 270 - 380 4,850 - 6,130

Average standard shopping centres 1,950 - 2,150 1,400 - 1,600 430 - 550 650 - 750 270 - 380 4,700 - 5,430

Prestige shopping centres 1,950 - 2,400 1,600 - 1,950 430 - 550 650 - 850 270 - 380 4,900 - 6,130

HOTELS

3-star budget hotels, inclusive of F.F. & E. 1,750 - 1,950 1,500 - 1,750 430 - 550 450 - 550 800 - 900 4,930 - 5,700

5-start luxury hotels, inclusive of F.F. & E. 1,850 - 2,150 1,750 - 2,150 430 - 550 450 - 650 850 - 1,050 5,330 - 6,550

INDUSTRIAL

(150 lb.) loading 380 - 500 450 - 650 250 - 300 450 - 550 220 - 330 1,750 - 2,330

warehouses, 15 kpa (300 lb.) loading 380 - 500 650 - 850 250 - 300 500 - 600 220 - 330 2,000 - 2,580

OTHERS

Carparks, above ground 200 - 550 450 - 650 250 - 300 250 - 350 150 - 200 1,300 - 2,050

Primary and secondary schools 550 - 850 850 - 1,050 250 - 350 150 - 250 250 - 350 2,050 - 2,850

International schools 1,300 - 1,600 1,050 - 1,400 250 - 350 150 - 250 250 - 350 3,000 - 3,950

Student hostels 650 - 850 1,400 - 1,600 350 - 450 150 - 250 600 - 800 3,150 - 3,950

Sports clubs inclusive of F.F. & E. 2,500 - 3,000 1,800 - 2,500 450 - 600 250 - 350 350 - 450 5,350 - 6,900

The above costs are at 4th Quarter 2011 levels.

Prestige offices, high rise

Average standard offices, high rise

Light duty flatted factories, 7.5 kpa

Heavy duty flatted factories and

BUILDING COST TRENDS IN HONG KONG

Historical TPI values from 1970 onwards available at www.dlsqs.com.

* Provisional

Source : Architectural Services Department, Hong Kong, SAR

Refer to www.archsd.gov.hk for further information.

* Up to Q2 only

YEAR

INDEX

(Base = 100, at Year 1970)

Q1 Q2 Q3 Q4

2000 1,079 1,057 1,040 1,020

2001 990 960 945 935

2002 915 890 875 840

2003 855 878 895 895

2004 940 952 933 930

2005 945 955 963 970

2006 970 980 985 990

2007 1,020 1,074 1,175 1,150

2008 1,239 1,360 1,355 1,281

2009 1,245 1,242 1,253 1,273

2010 1,297 1,315 1,342 1,367

2011 1,385 1,425 1,452 1,476*

YEAR

INDEX

(Base = 100, at Year 1970)

Q1 Q2 Q3 Q4

2000 959 873 858 844

2001 862 842 807 721

2002 687 742 692 733

2003 720 723 722 681

2004 685 712 704 701

2005 711 716 718 697

2006 714 730 751 789

2007 821 859 906 998

2008 1,118 1,305 1,401 1,262

2009 1,074 983 1,111 1,107

2010 1,134 1,161 1,249 1,266

2011* 1,273 1,320

* 1/11 to 8/11 only

Source : Civil Engineering and Development Department, Hong Kong, SAR

Refer to www.cedd.gov.hk/eng/index.htm for further information.

YEAR

HYD CONST. COST

INDEX

(Nov. 1975 Value = 100)

CEDD CIVIL

ENGINEERING

WORKS INDEX

(1980 Value = 100)

2000 844 419

2001 838 416

2002 839 416

2003 848 419

2004 871 428

2005 869 429

2006 886 436

2007 917 450

2008 1,031 500

2009 950 461

2010 989 481

2011* 1,061 518

LABOUR INDEX IN HONG KONG

Figures above are the quarterly average of the monthly indices

Source: Census and Statistics Department, Hong Kong, SAR

Refer to www.censtatd.gov.hk for further information.

*

Up to Q2 only

YEAR

INDEX

(Base = 100, at June 1995)

Q1 Q2 Q3 Q4

2000 152 153 154 154

2001 152 152 152 151

2002 150 150 149 148

2003 147 146 146 143

2004 143 140 140 138

2005 137 136 133 132

2006 131 133 134 136

2007 137 135 131 130

2008 129 128 128 129

2009 129 128 129 130

2010 131 131 131 132

2011*

133 134

MATERIAL PRICES IN HONG KONG

GALVANIZED MILD STEEL ANGLE

Source: Census and Statistics Department, Hong Kong, SAR

Refer to www.censtatd.gov.hk for further information.

Source: Census and Statistics Department, Hong Kong, SAR

Refer to www.censtatd.gov.hk for further information.

REBAR

SAND

ORDINARY PORTLAND CEMENT

Source: Census and Statistics Department, Hong Kong, SAR

Refer to www.censtatd.gov.hk for further information.

Source: Census and Statistics Department, Hong Kong, SAR

Refer to www.censtatd.gov.hk for further information.

Source: Organization of the Petroleum Exporting Countries (OPEC)

Refer to www.opec.org for further information.

Source: International Monetary Fund

Refer to www.imf.org for further information.

CRUDE OIL

COPPER GRADE A

ESTIMATING RULES OF THUMB AND DESIGN

NORMS FOR HONG KONG

CFA TO GFA RATIO

Building Type CFA : GFA

Residential 1.15 to 1.25 : 1

1.15 to 1.25 : 1

Hotel 1.30 to 1.45 : 1

FUNCTIONAL AREA DISTRIBUTION IN 5-STAR HOTELS

Functional Area % of Total Hotel CFA

Front of House 15 - 20%

Guestroom Floors 50 - 60%

Back of House 25 - 30%

DIMENSIONS OF TYPICAL GRADE A OFFICE SPACE

Component Dimension

Distance from curtain wall to

core wall 9 - 13 m

Population 9 m

2

usable floor

area/person

Average waiting interval for lifts 30 - 40 seconds

DENSITY OF BASIC MATERIALS FOR STRUCTURE

Material Density

Concrete 2,400 kg/m

3

Cement 1,450 kg/m

3

Sand 1,600 kg/m

3

Aggregate 1,600 kg/m

3

Steel 7,843 kg/m

3

AVERAGE LOADS VOLUME

Lorry (24 ton) 10.0 m

3

Concrete truck (24 ton) 5.5 m

3

Barge 200 - 1,450 m

3

AVERAGE PILING RATIO - BORED PILES

Building Type m

2

CFA / m

2

cross

section area of piles

Residential 200 - 300

200 - 250

Hotel 200 - 300

AVERAGE PILING RATIO - DRIVEN H-PILES

Building Type m

2

CFA / No. of piles

Residential 50 - 90

50 - 80

Hotel 50 - 90

AVERAGE PILING RATIO - PRE-BORED H-PILES

Building Type m

2

CFA / No. of piles

Residential 70 - 120

70 - 110

Hotel 70 - 120

All pile ratios are for high-rise buildings with normal soil

conditions.

BUILDING STRUCTURE - CONCRETE RATIO

0.4 m

3

/m

2

to 0.5 m

3

/m

2

Reinforcement

AVERAGE EXTERNAL WALL/FLOOR RATIO

Residential Apartments 1.0 m

2

/m

2

0.4 m

2

/m

2

Industrial 0.4 m

2

/m

2

Office / Commercial

Office / Commercial

Office / Commercial

Office / Commercial

Concrete/floor area

Formwork/floor area 2.2 m

2

/m

2

to 3.0 m

2

/m

2

160 kg/m

3

to 250 kg/m

3

Office, Hotel

AVERAGE INTERNAL WALL/FLOOR RATIO

Residential Apartments 1.0 m

2

/m

2

0.5 m

2

/m

2

Hotel 1.5 m

2

/m

2

The above ratios are indicative and for reference purposes

only. They do not account for buildings with special

shapes, configurations or particularly small foot prints.

AVERAGE LIGHTING LEVEL

Building Type Lux

Residential 300

500

Retail 400

Hotel 300

School 300 - 500

AVERAGE POWER DENSITY

Building Type VA/m

2

CFA

Residential 80 - 100

70

Retail 300 - 400

Hotel - Accommodation 30

Hotel - F&B Area 550

School 50

AVERAGE COOLING LOAD

Building Type m

2

Cooling Area/RT

Residential 18 - 23

14 - 18

Retail 12-14

Hotel 23

School 23

DIMENSIONS OF PARKING SPACES

Minimum

Type of Vehicle Length Width Headroom

Private Cars and

Taxis 5 m 2.5 m 2.4 m

Light Goods Vehicles 7 m 3.5 m 3.6 m

Medium/Heavy

Goods Vehicle 11 m 3.5 m 4.7 m

Container Vehicles 16 m 3.5 m 4.7 m

Coaches and Buses 12 m 3.5 m 3.8 m

Light buses 8 m 3 m 3.3 m

Minimum headroom means the clearance between

the floor and the lower most projection from the ceiling

including any lighting units, ventilation ducts, conduits

or similar

INDICATIVE DIMENSIONS FOR SPORTS GROUNDS

Length Width

Tennis Court 40 m 20 m

Squash Court 10 m 6.4 m

Basketball Court 34 m 20 m

Volleyball Court 36 m 20 m

Badminton Court 20 m 10 m

Ice Rink 61 m 26 m

Soccer Pitch 120 m 90 m

The above dimensions are for a single court with

appropriate clearance. No spectator seating or support

area has been allowed.

Office

Office

Office

Office

CONSTRUCTION ACTIVITY IN HONG KONG

* 1/11 to 9/11 onl y

#

As from January 2003 onwards, statistics by Buildings Department

on "Consent to Commence" are published with 2 sub-divisions, viz.

"First Submission" and "Major Revision". Details can be found in

the Buildings Department's "Monthly Digest".

YEAR

COMPLETED

m

2

CONSENT TO

COMMENCE

m

2

2000 1,515,000 1,850,000

2001 1,354,000 1,388,000

2002 1,908,000 1,372,000

2003

#

1,587,000 1,683,000

2004

#

1,720,000 1,115,000

2005

#

1,227,000 1,476,000

2006

#

1,389,000 1,398,000

2007

#

1,030,000 1,539,000

2008

#

1,097,000 997,000

2009

#

815,000 1,075,000

2010

#

1,139,000 1,210,000

2011

#

* 750,000 791,000

Source: Census and Statistics Department, Hong Kong, SAR

Buildings Department, Hong Kong , SAR

Refer to www.censtatd.gov.hk and www.bd.gov.hk for further information.

CONSTRUCTION VALUE IN HONG KONG

* 1/11 to 9/11 only

Source: Census and Statistics Department, Hong Kong, SAR

Refer to www.censtatd.gov.hk for further information.

YEAR

VALUE IN NOMINAL

TERMS

HK$ MILLIONS

VALUE IN CONSTANT

(2000) MARKET PRICE

HK$ MILLIONS

2000 122,071 114,691

2001 113,986 111,385

2002 106,000 108,677

2003 99,032 106,274

2004 93,171 100,615

2005 90,851 98,275

2006 90,230 96,269

2007 92,866 96,844

2008 99,599 97,024

2009 100,944 93,683

2010 111,274 100,278

2011*

91,332 78,106

FIREE RECORDALS TRACKER: NOVEMBER

2011 UPDATE

Since May 2007, any injection of foreign capital in foreign-

invested real estate enterprises (FIREEs) must be recorded with

the PRC Ministry of Commerce (MOFCOM). These FIREE