Beruflich Dokumente

Kultur Dokumente

Ravi Tryng Out To Finalise

Hochgeladen von

Virendra JhaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Ravi Tryng Out To Finalise

Hochgeladen von

Virendra JhaCopyright:

Verfügbare Formate

AprojectReporton

VERIFICATIONOFASSETS&

LIABILITIES

SubmittedTo

MissBHAVANA

A.VCOLLEGEVASAI(W)

SemesterV

T.Y.BBI(20010-11)

GROUPMEMBERS

IVANMENEZES27

SRIRAJNAIR35

SHRADHAGODSE 10

MANALIGHARAT 08

HEMABRAHME 01

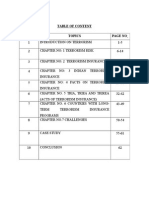

CONTENTS:

INTRODUCTIONTOAUDIT

AUDITSINACCOUNTING

TYPESOFAUDITOR

MEANINGOFVERIFICATION

SCOPE&OBJECTIVEOFVERIFICATION

SIXTEENPRINCIPLESOFVERIFICATION

VERIFICATIONOFTRANSACTIONS

VERIFICATIONOFSPECIFICASSETS

VERIFICATIONOFSPECIFICLIABILITIES

INTRODUCTIONTOAUDIT:

ThegeneraldefinitionofanAUDITisanevaluationofa

person,organization,system,process,enterprise,projector

product.Thetermmostcommonlyreferstoauditsinaccounting,

butsimilarconceptsalsoexistinprojectmanagement,quality

management,andforenergyconservation.

Anexaminationandverificationofacompany'sfinancial

andaccountingrecordsandsupportingdocumentsbya

professional,suchasaCertifiedPublicAccountant.

AnauditisanIRSexaminationofanindividualor

corporationstaxreturn,toverifyitsaccuracy.Thereare

threetypesofaudits:correspondenceaudits(theIRSmailsa

requestforadditionalinformation),officeaudits(aninterviewis

conductedatalocalIRSoffice),andfieldaudits(aninterviewis

conductedatataxpayer'splaceofbusiness,foracorporate

taxreturn).Sincethereisalwaysthechanceofan

audit,expertsrecommendkeepinggoodrecordstosupportallthe

informationinareturn.Thereasondetailed

andaccuratebookkeepingissoimportantisthattheburdenof

proofisonthefiler,nottheIRS.

AUDITSINACCOUNTING:

Auditsareperformedtoascertainthevalidityandreliabilityof

information; also to provide an assessment of asystem'sinternal

control. The goal of an audit is to express an opinion on the

person/organization/system(etc)inquestion,underevaluation

basedonworkdoneonatestbasis.Duetopracticalconstraints,

an audit seeks to provide onlyreasonable assurancethat the

statements are free from material error. Hence, statistical

samplingisoftenadoptedinaudits.Inthecaseoffinancialaudits,

asetoffinancialstatementsaresaidtobetrueandfairwhenthey

arefreeofmaterialmisstatements-aconceptinfluencedbyboth

quantitativeandqualitativefactors.

Audit is a vital part ofaccounting. Traditionally, audits were

mainly associated with gaining information about financial

systems and the financial records of a company or a business

(seefinancial audit). However, recent auditing has begun to

include other information about the system, such as information

about security risks, information systems performance (beyond

financial systems), and environmental performance. As a result,

there are now professions conducting security audits, IS audits,

andenvironmental.

Infinancial accounting, an audit is an independent

assessment of the fairness by which a company's financial

statements are presented by its management. It is performed by

competent, independent and objective person(s) known as

auditorsoraccountants,whothenissueanauditor'sreportbased

ontheresultsoftheaudit.

Incost accounting, it is a process for verifying the cost of

manufactureorproductionofanyarticle,onthebasisofaccounts

asregardsutilizationofmaterialorlabourorotheritemsofcosts,

maintained by the company. In simple words the term cost audit

meansasystematicandaccurateverificationofthecostaccounts

and records and checking of adherence to the objectives of the

costaccounting.

The Definition forAuditing and Assurance Standard (AAS)

1byICAI- "Auditing is the independent examination of financial

information of any entity, whether profit oriented or not, and

irrespectiveofitssizeorlegalform,whensuchanexaminationis

conductedwithaviewtoexpressinganopinionthereon."

TYPESOFAUDITORS:

Auditorsoffinancialstatementscanbeclassifiedintotwo

categories:

Externalauditor/StatutoryauditorisanindependentPublic

accountingfirmengagedbytheclientsubjecttotheaudit,to

expressanopiniononwhetherthecompany'sfinancial

statementsarefreeofmaterialmisstatements,whetherdueto

fraudorerror.Forpublicly-tradedcompanies,externalauditors

mayalsoberequiredtoexpressanopinionoverthe

effectivenessofinternalcontrolsoverfinancialreporting.

Externalauditorsmayalsobeengagedtoperformother

agreed-uponprocedures,relatedorunrelatedtofinancial

statements.Mostimportantly,externalauditors,though

engagedandpaidbythecompanybeingaudited,areregarded

asindependentauditors.

ThemostusedexternalauditstandardsaretheUSGAASof

theAmericanInstituteofCertifiedPublicAccountants;andthe

ISAInternationalStandardsonAuditingdevelopedby

theInternationalAuditingandAssuranceStandardsBoardof

theInternationalFederationofAccountants.

Internalauditorsareemployedbytheorganizationtheyaudit.

Theyperformvariousauditprocedures,primarilyrelatedto

proceduresovertheeffectivenessofthecompany'sinternal

controlsoverfinancialreporting.Duetotherequirement

ofSection404oftheSarbanesOxleyActof2002for

managementtoalsoassesstheeffectivenessoftheirinternal

controlsoverfinancialreporting(asalsorequiredofthe

externalauditor),internalauditorsareutilizedtomakethis

assessment.Thoughinternalauditorsarenotconsidered

independentofthecompanytheyperformauditproceduresfor,

internalauditorsofpublicly-tradedcompaniesarerequiredto

reportdirectlytotheboardofdirectors,orasub-committeeof

theboardofdirectors,andnottomanagement,sotoreduce

theriskthatinternalauditorswillbepressuredtoproduce

favorableassessments.

ThemostusedInternalAuditstandardsarethoseoftheInstitute

ofInternalAuditors.

Consultantauditorsareexternalpersonnelcontractedbythe

firmtoperformanauditfollowingthefirm'sauditingstandards.

Thisdiffersfromtheexternalauditor,whofollowstheirown

auditingstandards.Thelevelofindependenceistherefore

somewherebetweentheinternalauditorandtheexternal

auditor.Theconsultantauditormayworkindependently,oras

partoftheauditteamthatincludesinternalauditors.Consultant

auditorsareusedwhenthefirmlackssufficientexpertiseto

auditcertainareas,orsimplyforstaffaugmentationwhenstaff

arenotavailable.

Qualityauditorsmaybeconsultantsoremployedbythe

organization.

MEANINGOFVERIFICATION:

Verificationisaprocessbywhichanauditorsatisfieshimself

abouttheaccuracyoftheassetsandliabilitiesappearinginthe

balancesheetbyinspectionofthedocumentaryevidence

available.

confirmationoftheassetsandliabilitiesappearinginthebalance

sheet.

Thus,verificationincludesverifying

(i) theexistenceoftheassets;

(ii) legalownershipandpossessionoftheassets;

(iii) ascertainingthattheassetisfreefromanycharge;and

(iv) correctvaluation

Ofcourse,itisnotpossiblefortheauditortoverifyeachand

everyasset.ItwasheldinKingstonCottonMillscasethat"itisno

partofanauditor'sdutytotakestock.Noonecontendsthatitis.

Hemustrelyonotherpeopleforthedetailsofstockintradein

hand".

However,asperthedecisiongiveninMeKessonand

Robinscase(1939)theauditormustphysicallyinspectsomeof

theassets.Nowtheauditorhastoreportwhetherthebalance

sheetshowstrueandfairviewofthestateofaffairsofthe

company.Hence,heisrequiredtoverifyalltheassetsand

liabilitiesappearinginthebalancesheet.Incaseoffailure,the

auditorcanbeheldliablefordamages.

Accordingtothe'StatementofAuditingPractices'issuedbyICAI,

Theauditor'sobjectinregardtoassetsgenerallyistosatisfy

that

Theyexist;

Theybelongtotheclient;

They are in the possession of the client or persons

authorisedbyhim;

They are not subjected to undisclosed encum-

branchesorlien.

They are stated in the balance sheet at proper

amounts in accordance with sound accounting

principlesand

Theyarerecordedintheaccount."

Verificationincludesconfirmationofthe

following:

Thattheassetswereinexistenceonthedateofthebalance

sheet;

That the assets had been acquired for the purpose of

businessonly;

Thattheassetshadbeenacquiredunderaproperauthority;

Thattherightofownershipoftheassetsvestedinthe

organization;

SCOPEOFVERIFICATION

Verificationincludesconfirmationofthefollowing:

1.Thatthe assetswere inexistenceon the date ofthe balance

sheet;

That the assetshad beenacquiredforthe purposeofbusiness

only;

Thattheassetshadbeenacquiredunderaproperauthority;

That the right of ownership of the assets vested in the

organization;

That the assets were free from any charge; and that the assets

wereproperly

valuedanddisclosedinthebalancesheet.

OBJECTOFVERIFICATION:

Followingaretheobjectsofverificationofassetsandliabilities:

Toshowcorrectvaluationofassetsandliabilities.

Toknowwhetherthebalancesheetexhibitsatrueandfairview

ofthestateofaffairsofthebusiness.

Tofindoutwhethertheassetswereinexistence.

Tofindouttheownershipandtitleoftheasset.Todetectfrauds

anderrors.

Toverifythearithmeticalaccuracyofthebooksofaccounts.

To find out whether there is an adequate internal control

regardingacquisition,utilizationanddisposalofassets.

Toensurethattheassetshavebeenrecordedproperly.

While conducting verification following points should be

consideredbytheauditor:

Existence:

The auditor should confirm that all the

assets of the company are physically existing on the date

ofBalanceSheet.

Possession:

The auditor has to verify that the assets are in the

possessionofthecompanyonthedate ofBalanceSheet.

Ownership:

The auditor shouldconfirmthat theassetislegally

ownedbythecompany.

Chargeorlien:

Theauditorshouldverifywhethertheassetissubjecttoany

chargeorlien

Record:

Theauditorshouldconfirmthattheassetsandliabilities

arerecordedinthebooksandthereisnocomissionofany

assetorliability.

Auditreport:

UnderMAOCARO'88,theauditorhastoreportwhether

themanagementhasconductedphysicalverificationoffixed

assetsandstockandthedifferences,ifany,betweenthe

physicalinventory,andtheinventoryasperthebooks.

EventsafterBalanceSheetdate:

Theauditorshouldfindoutwhetheranyeventafterthe

dateofBalanceSheethasaffectedanyitemsofassetsand

liabilities.

SixteenPrinciplesofVerification:

Adequateandeffectiveverificationisanessentialelement

ofallarmslimitationanddisarmamentagreements.

Verificationisnotanaiminitself,butanessentialelementin

theprocessofachievingarmslimitationanddisarmament

agreements.

Verificationshouldpromotetheimplementationofarms

limitationanddisarmamentmeasures,buildconfidence

amongStatesandensurethatagreementsarebeing

observedbyallparties.

Adequateandeffectiveverificationrequiresemploymentof

differenttechniques,suchasnationaltechnicalmeans,

internationaltechnicalmeansandinternationalprocedures,

includingon-siteinspections.

Verificationinthearmslimitationanddisarmamentprocess

willbenefitfromgreateropenness.

Armslimitationanddisarmamentagreementsshouldinclude

explicitprovisionswherebyeachpartyundertakesnotto

interferewiththeagreedmethods,proceduresand

techniquesofverification,whentheseareoperatingina

mannerconsistentwiththeprovisionsoftheagreementand

generallyrecognizedprinciplesofinternationallaw.

Armslimitationanddisarmamentagreementsshouldinclude

explicitprovisionswherebyeachpartyundertakesnottouse

deliberateconcealmentmeasureswhichimpedeverification

ofcompliancewiththeagreement.

Toassessthecontinuingadequacyandeffectivenessofthe

verificationsystem,anarmslimitationanddisarmament

agreementshouldprovideforproceduresandmechanisms

forreviewandevaluation.Wherepossible,time-framesfor

suchreviewsshouldbeagreedinordertofacilitatethis

assessment.

Verificationarrangementsshouldbeaddressedattheoutset

andateverystageofnegotiationsonspecificarmslimitation

anddisarmamentagreements.

AllStateshaveequalrightstoparticipateintheprocessof

internationalverificationofagreementstowhichtheyare

parties.

Adequateandeffectiveverificationarrangementsmustbe

capableofproviding,inatimelyfashion,clearand

convincingevidenceofcomplianceornon-compliance.

Continuedconfirmationofcomplianceisanessential

ingredienttobuildingandmaintainingconfidenceamongthe

parties.

Determinationsabouttheadequacy,effectivenessand

acceptabilityofspecificmethodsandarrangementsintended

toverifycompliancewiththeprovisionsofanarmslimitation

anddisarmamentagreementcanonlybemadewithinthe

contextofthatagreement.

Verificationofcompliancewiththeobligationsimposedbyan

armslimitationanddisarmamentagreementisanactivity

conductedbythepartiestoanarmslimitationand

disarmamentagreementorbyanorganizationattherequest

andwiththeexplicitconsentoftheparties,andisan

expressionofthesovereignrightofStatestoenterintosuch

arrangements.

Requestsforinspectionsorinformationinaccordancewith

theprovisionsofanarmslimitationanddisarmament

agreementshouldbeconsideredasanormalcomponentof

theverificationprocess.Suchrequestsshouldbeusedonly

forthepurposesofthedeterminationofcompliance,care

beingtakentoavoidabuses.

Verificationarrangementsshouldbeimplementedwithout

discrimination,and,inaccomplishingtheirpurpose,avoid

undulyinterferingwiththeinternalaffairsofStatepartiesor

otherStates,orjeopardizingtheireconomic,technological

andsocialdevelopment.

Tobeadequateandeffective,averificationregimeforan

agreementmustcoverallrelevantweapons,facilities,

locations,installationsandactivities.

WhatVerificationofAssetsandLiabilitiesincludes

SocialSecuritynumber:

DeterminewhetheranameandassociatedSocial

SecuritynumbermatchthedataintheSocialSecurity

Administrationsrecords

Taxreturns:

Ensurethatincometaxdatasubmittedbyapplicants

areaccurateandfreefromfraud

Undisclosedliabilities:

Refreshacreditreportpriortoclosingtoidentify

additionaldebtorcreditinquiries

Employment:

Confirmanapplicantsemploymentstatus,aswellas

lengthofemployment,salary,andposition

Deposit:

Reviewassetspriortoapprovingaloanbyfindingout

howlonganaccounthasbeenopen,itscurrentstandingand

balance,andifanyoverdraftshaveoccurred

Mortgage:

Receivemortgagepaymenthistory,balance,and

monthlypaymentamountforanexistingmortgage

Rent:

Assesstheabilityoftheapplicanttomakeamonthly

mortgagepaymentbasedonmonthlyrentpaymenthistory

Lease:

Determinetheoutstandingliabilityofarentertoa

landlord

Insurance:

Determinecoverageforanassetoract

VERIFICATIONOFTRANSACTION:

THEADUITORSHOULDBEEXAMINETHEFOLLOWING

ASPECTS:

LegalAspects:

o Seewhetherthelegalrequirementsgoverningthe

entity,relatingtoinvestments,havebeencompliedwith,

alongwithanyotherconditionsrelatingtoinvestments

whichrestrict,qualifyorabridgetherightofownership

and/ordisposalofinvestments.

Documents:

o Ensurethatthetransactionsforthepurchase/saleof

investmentsaresupportedbydueauthorityand

documentation

Adjustments:

o Whereinvestmentshavebeenpurchasedorsold

cum/exdividend/interest/rights/bonusseewhether

properadjustmentsinthisregardhavebeenmadein

thecost/salesvalueofsecuritiespurchasedorsold

Rights:

o Examinetheoffercontainedintheletterofrights,in

caseofarightsissue.Wheretherightshavebeen

renouncedorotherwisedisposedofornotexercised,

examinetherelveevantdecisionoftheappropriate

authorityinthisbehalf,asalsothatthesaleproceeds,if

anyhavebeenduelyaccountedfor.

Bonus:

o Verifytheintimationstotheentityregardingsuchissue,

withaviewtoascertainingtherecieptandrecordingof

thrrequisitenumberofsharedbytheentity.

MarketValue:

o Wheretheamountofpurchaseorsaleofinvestment

aresubstantialcheckthepricepaid/receivewith

referencetothestockexchangetationwhereavailable

onorabovethedateofpurchaseofsale.

VERIFICATIONOFSPECIFICASSETS

LandandBuildings:

Sometimesthetwoassetsareshowntogetherinthe

BalanceSheet.Nevertheless,theirledgeraccounts

shouldalwaysbeseparatedparticularlyinviewofthefact

thatbuildingsaresubjecttodepreciationwhilelandin

generalisnot.

Ifthebuildinghasbeenbuiltorisinthecourseof

construction,underacontracttheauditorshouldverifythe

debitbalanceoftheaccountbyreferencetothearchitect's

certificate,aswellasthecontractor'sreceiptsforamounts

paid.

Ifthebuildinghasbeenconstructedbytheclient'sown

organisation,itwillbenecessaryfortheauditortoverify

thatthebasisuponwhichcostofmaterials,wagesandthe

supervisionchargedhavebeenallocatedtotheaccount,

isreasonable.Theexpenseschargedshouldincludeall

theexpenditurenecessarytobringthebuildinginto

existenceandtomakeithabitable.Asasafeguardagainst

anymistakearisingintheexpenseschargeabletothe

asset,theauditorshouldobtainacertificatefroma

responsibleofficialinrespectoftotalexpenditureincurred

ontheconstructionofthebuildinguptothedateofthe

BalanceSheet.Theamountofexpenditure,where

possible,shouldalsobecomparedwiththeestimatedcost

ofconstructionwhichmayhavebeenpreparedbyan

architectorreceivedwiththetenders,ifany,invitedfor

construction.Ifthereisamaterialdiscrepancyinthe

amountofactualandestimatedexpenditure,causes

thereofshouldbereviewed.

PlantandMachinery

IntheabsenceofaPlantRegistercontainingdetailed

particularsofvariousarticlesofmachineryandequipment,

showingseparatelyoriginalcost,additiontoandsalesfromit

fromtimetotime.Itisnotnormallypracticablefortheauditor

toverifytheexistenceofsuchassets.Theauditorsshould

thereforeinsistonaPlantRegisterbeingmaintainedwhere

thevalueandvarietyofmachineryandplantaresubstantial

incomparisonwiththetotaiassetsofthebusiness.

Wheresucharegisteriskept,itiscustomarytoprepareat

theendofeachyearastatementfromthePlantRegister

showingopeningbalance,saleandadditiontheretoduring

theyearinrespectofvariousitemsofmachineryandplant.

ItstotalisthenreconciledwiththebalanceintheGeneral

Ledger.

Thecostofaddition,ifany,isverifiedwiththeinvoiceof

machinerysuppliedtogetherwithevidenceinrespectof

otherincidentalexpenseschargeabletotheaccount,

includinginstallationexpenses.Ifanyoftheaddition

representsthecostofmachinerymanufacturedbythe

concernwithitsownmaterialandbyitsownlabour,the

basisonwhichtheexpenditurehasbeenallocatedshouldbe

verified.Inaddition,acertificateisobtainedfromthe

engineerresponsibleforthemanufactureoftheplant

confirmingthetotalcostofmanufacture.

Incaseanyitemormachineryhasbeenscrapped,destroyed

orsoldtheauditorshouldascertainthattheprofitorloss

arisingthereonhasbeencorrectlydeterminedwhichhas

eitherbeendisclosedintheProfitandLossAccountor

creditedtotheCapitalReserve.Inappropriate

circumstances,acertificateshouldbeobtainedfromasenior

officialthatthishasbeendone.

Thoughitisthedutyofthemanagementtoensurethatfixed

assetsareinexistence,theauditoralsoshould,periodicaily,

physicallyexaminevariousitemsofplantandmachineryand

otherfixedassets,say,onceineverythreeorfiveyears,

dependinguponthesizeoftheconcern.

Certaincompanies,forconvenienceofinspectionattachto

eachunitofplantandmachineryametallicdiscbearingthe

numberatwhichitisshowninthePlantRegister.

Whenanassethasbeenrevalued,depreciationshouldbe

providedontherevisedvalueandnotonthehistoricalvalue.

LeaseholdProperty

Variousstepsinvolvedintheverificationofleaseholdrightsare

statedbelow:

Inspecttheleaseorassignmentthereoftoascertainthe

amountofpremium,ifany,forsecuringthelease,andits

termsandconditions;andthattheleasehasbeenduly

registered.Aleaseexceedingoneyearisnotvalidunless

ithasbeengrantedbyaregisteredinstrument(section

107oftheTransferofPropertyAct,1882).

Ascertainthatalltheconditions,thefailuretocomplywith

whichmightresultintheforfeitureorcancellationofthe

lease,e.g.,paymentofgroundrentontheduedates,

insuranceofproperty,itsmaintenanceinasatisfactory

stateofrepairs,etc.prescribedbythelease,arebeing

dulycompliedwith.

Examinethecounterpartofthetenants'agreements,if

partoftheleaseholdpropertyhasbeensublet.

Makecertainthatdueprovisionsforanyclaimthatmight

ariseunderthedilapidationclauseontheexpiryofthe

leasehasbeenmade,and,ifnosuchprovisionhasbeen

made,drawtheclient'sattentiontothematter.

Ensurethattheoutlayaswellasanylegalexpenses

incurredtoacquiretheleasewhichareshownasanasset

intheBalanceSheetare'tieingwrittenoffataratewhich

couldcompletelywipeofftheassetovertheunexpired

termofthelease.

Aleaseholdproperty,evenwherenopremiumhasbeen

paidforitsacquisition,maysometimecometohavea

considerablevalue.Insuchacase,itmaynotbe

advisabletocontinuetoshowtheassetasifithasno

valueNevertheless,wheretheleaseholdrightshavebeen

revaluedthatfactshouldbeclearlyshownonthebalance

sheettilltheaccounthasbeencompletelywrittenoff.

IntangibleAssets:

AnIntangibleAssetisanidentifiablenon-monetaryasset,

withoutphysicalsubstance,heldforuseintheproduction

orsupplyofgoodsorservices,forrentaltoothers,orfor

administrativepurposes.Enterprisesfrequentlyexpend

resources,orincurliabilities,ontheacquisition,

development,maintenanceorenhancementofintangible

resourcessuchasscientificortechnicalknowledge,

designandimplementationofnewprocessesorsystems,

licenses,intellectualproperty,marketknowledgeand

trademarks(includingbrandnamesandpublishingtitles).

Commonexamplesofitemsencompassedbythesebroad

headingsarecomputersoftware,patents,copyrights,

motionpicturefilms,customerlists,mortgageservicing

rights,fishinglicences,importquotas,franchises,

customerorsupplierrelationships,customerloyalty,

marketshareandmarketingrights.Goodwillisanother

exampleofanitemofintangiblenaturewhicheitherarises

onacquisitionorisinternallygenerated.Ifanitemcovered

doesnotmeetthedefinitionofanintangibleasset,

expendituretoacquireitorgenerateitinternallyis

recognisedasanexpensewhenitisincurred.However,if

theitemisacquiredinanamalgamationinthenatureof

purchase,itformspartofthegoodwillrecognisedatthe

dateoftheamalgamation(seeparagraph55).

Someintangibleassetsmaybecontainedinorona

physicalsubstancesuchasacompactdisk(inthecaseof

computersoftware),legaldocumentation(inthecaseofa

licenceorpatent)orfilm(inthecaseofmotionpictures).

Thecostofthephysicalsubstancecontainingthe

intangibleassetsisusuallynotsignificant.Accordingly,

thephysicalsubstancecontaininganintangibleasset,

thoughtangibleinnature,iscommonlytreatedasapartof

theintangibleassetcontainedinoronit.

Insomecases,anassetmayincorporatebothintangible

andtangibleelementsthatare,inpractice,inseparable.In

determiningwhethersuchanassetshouldbetreated

underAS10,AccountingforFixedAssets,orasan

intangibleassetunderthisStatement,judgementis

requiredtoassessastowhichelementispredominant.

Forexample,computersoftwareforacomputercontrolled

machinetoolthatcannotoperatewithoutthatspecific

softwareisanintegralpartoftherelatedhardwareandit

istreatedasafixedasset.Thesameappliestothe

operatingsystemofacomputer.Wherethesoftwareisnot

anintegralpartoftherelatedhardware,computer

softwareistreatedasanintangibleasset.

Patterns,Dies,LooseTools,etc.

Severalentitieshavelargeinvestmentsinsuchassets

whichhavearelativelyshortusefullifeandlowunitcost.

Evidently,itisadifficultmatter,underthecircumstances,

toprepareaseparateaccountforeachsuchassets

althoughacarefuicontroloversuchpropertyisnecessary.

Ontheseconsiderations,someentitieschargeoffsmall

toolsandothersimilaritemstoProductionAccountasand

whentheyarepurchasedanddonotplaceanyvalueon

theunusedstockontheBalanceSheet.Nevertheless,a

recordofissuesandreceiptsoftoolstoworkmeniskept,

asacheckonthesamebeingpilferedanda

memorandumstockaccountofdiesandpatternsisalso

maintained.Inotherconcerns,thecostoftools,dies,etc.

purchasedisdebitedtoappropriateassetsaccount,and

aninventoryoftheunuseditemsattheendoftheyearis

preparedandvalued;thesumtotalofopeningbalance

andpurchasereducedbythevalueofclosingstock,as

disclosedbytheinventory,ischargedofftoProduction

Accountinrespectofsuchassets.Ontheotherhand,

someconcernscarrysuchassetsattheirbookvaluesat

theendofthefirstyearandchargeoffthecostofallthe

purchasesinthesubsequentyeartotheProduction

Accountonthepleathattheyrepresentcostof

replacement.

Themostsatisfactorymethod,however,isthatof

preparinganinventoryofserviceablearticles,attheclose

ofeachyear,andrevaluingtheassetsonthisbasis,the

variousarticlesincludedintheinventorybeingvaluedat

cost.Care,however,shouldbetakentoseethatthe

inventorydoesnotincludeanywornoutordefective

articlesthelifeofwhichhasalreadyrunout.

Furniture,FittingsandFixtures:

Thecostoftheseassetsshouldbeverifiedbyreferenceto

theinvoicesofsuppliers.Alltheexpenditureincidentalto

theirpurchasealsoshouldbedebitedtotheappropriate

assetaccount.

Further,theauditorshouldcarefullyscrutinisethedetails

ofthecostofadditionsdebitedtotheseaccountssoasto

ascertainthatonlythecostofgenuineadditionshasbeen

debitedtosuchaccounts.

Inthecaseofassetsinregardtowhichthereisadanger

ofiossthroughpilferage,thereshouldbeasatisfactory

systemofstockcontroloverthem.

Itrequiresthateacharticleoffurnitureisenteredina

StockRegisterbeforeitspriceispaidandthestock

numberunderwhichitisenteredispaintedoveritalso

thatattheendofeachperiod,aninventoryisprepared

andreconciledwiththeStockRegisterandcostofallthe

articleswhichbecomesunserviceableorhavebeenlostis

writtenoffunderproperauthority.

BillsReceivable:

Ifpossible,theauditorshouldattendonthelastdayofthe

accountingperiodtoinspectthebillsinhandandagree

theirtotalwiththebalanceintheBillsReceivableAccount.

Ifverificationispostponedtillsometimeafterthe

existenceofthebillswhichhadmaturedinbetweenthe

twodatesshouldbeverifiedwiththeentriesinrespectof

cashcollectedforthem.Ifsomebillswerediscounted

afterthedateoftheBalanceSheet,thecollectionoftheir

proceedsshouldbeverified.Ifanybillsweredishonored

afterthedateoftheBalanceSheet,theauditorshould

ascertainwhatportion,ifany,oftheamountwillnotbe

recoveredandensurethatprovisionforthesamehas

beenmade.Whereanewbillisreportedtohavebeen

takeninlieuofabillwhichhasmatured,theauditor

shouldinspectthebill.Whereanumberofbillsarefound

tohavebeendiscountedbeforethecloseoftheyearthe

auditorshouldseethattheamountofthebillsso

discountedisshownasacontingentliabilityonthe

BalanceSheet.Ifsomeofthebillsarewithbankersfor

collection,theauditorshouldobtainacertificatefrom

them.

Generally,itwillbethedutyoftheauditortoensurethat

thebillswereproperlydrawnandstampedandthatthey

werenotdishonoured.Wheresomeofthebillswere

dishonoured,theauditorshouldensurethattheyhave

beennotedandprotested.

VerificationofSpecificLiabilities:

Verification of Liabilities

The term liability in its usual and ordinarysense refers

to a state of being under legal obligation. Like verificationand valuation of assets,

verification of liabilities is an equally importantaspect of auditing. If liabilities are

not properly verified and valued, thebalance sheet of a business enterprise will not

exhibit a true and fairview of its state of affairs. Therefore, the auditor should see

thatliabilities are genuine and duly authorized. He must obtain a certificatefrom a

responsible official of the client, stating that to the best of hisknowledge and belief:

1.All liabilities, whether for purchase or expense or on any other

account existing at the date of the balance sheet, have been

included in the books of accounts.

2.All the contingent liabilities have either been disclosed in a foot

note to the balance sheet or have been provided for. Re

Westminster Road Construction and engineering Co. Ltd. (1932),

it was held that all the expense and liabilities which thecompany could be expected

to have incurred had been dulyrecorded in the books of accounts. While delivering

thejudgment in the case, Justice Bennett Observed:

It was settled law that an auditor did not discharge his duty if he merely saw

that the balance sheet accurately represented what was shown by the books on the

material date. If the auditor found that a company in the course of its business

wasincurring liabilities of a particular kind, and that the creditors sent in their

invoices after an interval, and that liabilities of the kind in question must have been

incurred during the accountancy period under audit, and that when he was making

his audit a sufficient time had not elapsed for the invoices relating to such

liabilities to have been received and recorded in the companys books, it became

his duty to make specific inquiries as to the existence of such liabilities and also

before he signed a certificate as to the accuracy of the balance sheet, to go through

the invoice files of the company, in order to see that no invoices relating to

liabilities had been omitted.

In the light of the above decision, it can be

inferred that it is quite essential for an auditor to see that:

All liabilities have been clearly stated in the balance sheet;

All he liabilities stated in the balance sheet relate to the

business itself;

They represent genuine and duly authorized transactions; and

No item of liabilities has been omitted, under or over-stated, i.e.,

all liabilities appear at their actual figures in the balance sheet.

It should also be noted that liabilities are not valued like assets. Therefore, it would

be sufficient on the part of auditor to satisfy himself about the correct disclosure of

information in respect of every item appearing in the liabilities side of the balance

sheet of a business concern.

Verificationofliabilitiesmaybecarriedoutbyemployingthe

followingprocedures:

ExaminationofRecords

DirectConfirmationProcedure

ExaminationofDisclosure

AnalyticalReviewProcedures

ObtainingManagementRepresentations

LOANS&BORROWINGS:

Theauditorshouldsatisfyhimselfthattheloansobtainedare

withintheborrowingpowersoftheentity.

Theauditorshouldcarryoutanexaminationoftherelevant

recordstojudgethevalidityandaccuracyoftheloans.

Inrespectofloansandadvancesfrombanks,financial

institutionsandothers,theauditorshouldexaminethatthe

bookbalancesagreewiththestatementsofthelenders.He

shouldalsoexaminethereconciliationstatements,ifany,

preparedbytheentityinthisregard.

Theauditorshouldexaminetheimportanttermsintheloan

agreementsandthedocuments,ifany,avidencingchargein

respectofsuchloansandadvances.Heshouldparticularly

examinewhethertherequirementsoftheapplicablestatue

regardingcreationandregistrationofchargeshavebeen

compliedwith.

Incasethevalueofthesecurityfallsbelowtheamountofthe

loanoutstanding,theauditorshouldexaminewhetherthe

loanisclassifiedassecuredonlytotheextentofthemarket

valueofthesecurity.

Whereshort-termsecuredloanshavebeendisclosed

separatelyfromothersecuredloans,theauditorshould

verifythecorrectnessoftheamountofsuchshort-term

loans.

Whereinstallmentoflong-termloansfallingduewithinthe

nexttwelvemonthshavebeendisclosedinthefinancial

statementstheauditorshouldverifythecorrectnessofthe

amountofsuchinstallments.

Theauditorshouldexaminethehirepurchaseagreements

forthepurchaseofassetsbytheentityandensurethe

correctnessoftheamountsshownasoutstandinginthe

accountsandalsoexaminethesecurityaspect.Future

installmentsunderhirepurchaseagreementsforthe

purchaseofassetsmaybeshowedassecuredloans.

Thedifferedpaymentcreditsshouldbeverifiedwith

referencetotheimportanttermsintheagreement,including

duedatesofpaymentsandguaranteesfurnishedbythe

banks.Theauditorshouldalsoverifythehundies/bills

acceptedseparately.

Creditors&OtherCurrentLiability:

Theauditorshouldchecktheadequacyofcut-offprocedures

adoptedbytheentityinrelationtotransactionsaffectingthe

creditoraccounts.Forexample,theauditormayexaminethe

documentsrelatingtoreceiptofgoodsfromsuppliersduring

afewdaysimmediatelybeforetheyear-endedandverifythat

therelatedinvoiceshavebeenrecordedaspurchasesofthe

currentyear.

Theauditorshouldcheckthetotalofthecreditorsbalances

agreeswiththerelatedcontrolaccount,ifany;thedifference,

ifany,shouldbeexamined.

Theauditorshouldexaminethecorrespondenceandother

relevantdocumentaryevidencetosatisfyhimselfaboutthe

validity,accuracyandcompletenessofcreditors/acceptance.

Theauditorshouldverifythatinthecaseswhereincomeis

collectedinadvanceforservicestoberenderedinfuture,the

unearnedportion,notapplicabletotheperiodunderaudit,is

notrecognizedasincomeoftheperiodunderauditbutis

showninthebalancesheetasapartofcurrentliabilities.

Whileexaminingscheduleofcreditorsandotherschedules

suchasthoserelatingtoadvancepayments,unclaimed

dividendsandotherliabilities,theauditorshouldpayspecial

attentiontothefollowingaspects:

LongOutstandingItems

Unadjustedclaimsforshortsupplies,poorquality,discount,

commission,etc.

Liabilitiesnotcorrelated/adjustedagainstrelatedadvances

Authorizationandcorrectnessoftransfersfromoneaccount

toanother.

Basedonthisexaminationaforesaid,theauditorshould

examinewhetheranyadjustmentsinaccountsarerequired.

Incasethereareanyunusualpaymentsaroundtheyear-

end,theauditorshouldexaminethemthoroughly.In

particular,theauditorshouldexamineiftheentriesrelating

toanysuchpaymentshavebeenreservedinthesubsequent

period.

Theauditorshouldreviewsubsequenttransactionsto

identify/confirmmaterialliabilitiesoutstandingatthebalance

sheetdate.

Provisions:

Thetermprovisionmeansamountsretainedbywayofproviding

fordepreciationinvalueofassetsorretainedbywayofproviding

foranyknownliabilitytheamountofwhichcannotbedetermined

withsubstantialaccuracy.Provisionsincludethoseinrespectof

depreciationordiminutioninthevalueofassets,products

warranties,servicecontractsandguarantees,taxesandlevies,

gratuity,proposeddividend,etc.Theguidancenote,however,

doesnotdealwithprovisionsfordepreciationordiminutioninthe

valueofassets.

Theauditofprovisionsprimarilyinvolvesexaminingthe

reasonablenessandadequacyoftheamountsprovidedfor.The

auditorshouldalsoexaminethattheprovisionsmadearenotin

excessofwhatisreasonablyrequired.

ProvisionforTaxesandDuties:

Theadequacyoftheprovisionfortaxationfortheyear

shouldbeexamined.Thepositionregardingtheoverall

outstandingliabilityoftheentityasthedateofbalancesheet

shouldbereviewed.Inrespectofassessmentscompleted,

revisedorrectifiedduringtheyear,theauditorshouldexamine

whethersuitableadjustmentshavebeenmadeinrespectof

additionaldemandsorrefunds,asthecasemaybe.Similarly,he

shouldexaminewhetherexcessprovisionsorrefundshavebeen

propelyadjusted.Therelevantordersreceiveduptothetimeof

auditshouldbeconsideredand,onthisbasis,itshouldbe

examinedwhetheranyshortprovisionshavebeenmadegood.If

thereisamaterialtaxliabilityforwhichnoprovisionismadein

theaccounts,theauditorshouldqualifyhisreportinthisrespect

evenifthereservesareadequatetocovertheliability.

ProvisionforGratuity:

Theauditorshouldexaminewhethertheentityisrequiredto

paygratuitytoitsemployeesbyvirtueoftheprovisionsofthe

PaymentofGratuityAct,1972intermsofagreementwith

employeesand,ifso,whetherprovisionforaccuringgratuity

liabilityhasbeenmadebytheentity.Theauditorshouldexamine

theadequacyofthegratuityprovisionwithreferencetothe

actuarialcertificateobtainedbytheentity.Incasetheentityhas

notobtainedsuchanactuarialcertificate,theauditorshould

examinewhetherthemethodfollowedbyitforcalculatingthe

accuringliabilityforgratuityisrational.

ProvisionforBonus:

Inthecaseofprovisionforbonus,theauditorshould

examinewhethertheliabilityisprovidedforinaccordancewith

thepaymentofBonusAct,1965and/oragreementwiththe

employeesorwardofcompetentauthority.Wherethebonus

actuallypaididinexcessoftheamountrequiredtobepaidasper

theprovisionsoftheapplicablelaw/agreement/award,theauditor

shouldspecificallyexaminetheauthorityforthesame.

Provisionsfordividends:

Theauditorshouldexaminethatdividendsareprovidedfor

asperapplicableprovisionsoftherelevantlawsandrulesframed

thereunder,relevantagreementsandresolutions.

OtherProvisions:

Whereprovisionsaremadeforliabilitiesthatmayariseon

accountofproductwarranties,servicecontracts,performance

warranties,etc.theauditorshouldexaminetheprovisionsmade

areinaccordancewithaccountingstandard(AS)4,contingencies

andeventsoccurringafterBalanceSheetdateissuedbythe

instituteofchartedaccountantsofIndia.Theauditorshouldalso

examinethereasonablenessofthebasisadoptedforquantifying

theprovisionwithreferencetotherelevantagreements.

Share Capital

Capital is not the liability of the company sofar as the going concern

principle is concerned. Still, the auditor isrequired to verify its correctness so that

he can report on thecorrectness of the balance sheet.

The steps to be taken for verifying the sharecapital of the company covering

several phases has been enumeratedas below:

Check the authorized share capital with the relevant clause of

the Memorandum of Association.

Obtain a list of shareholders, check with the register of members,

and verify the capital account.

Obtain a schedule showing the movement during the year in the

above account. Verify entries in respect of the additions on the

account of issue of new shares.

The following work in this respect should be carried out:

See that the allotment of the shares has been made

complying with the legal provisions.

See that the issuing capital does not exceed the authorized

capital.

Examine resolution of the Board in respect of allotment of

the shares.

Vouch the money received on applications and allotmentand on calls, if any,

with the counterfoil of the receipt book,bank statement and advices and

other relevant availableevidence.

If in accordance with the provisions of the Memorandumand Articles of

Association and prospectus, the directorsare required to take up their

qualification shares, see thatcompany has received the required amount.

In case where the shares were allotted for considerationother than cash,

examine the contract constituting theallottees title to the shares and the

directors minutes

If the shares were issued at a premium, see that premiumhad been shown

separately and not under the share capital.

If the shares were issued at the discount the auditor shouldsee that it was duly

authorized and in accordance with theprovisions of the Act. In this regard,

the auditor shouldsatisfy himself in respect of the following matters:

It was a subsequent issue of the shares since the

first issue cannot be at discount.

The issue of share at discount was authorized by an

ordinary resolution passed in a general meeting of

the company.

The resolution stated the maximum rate of the

discount at which shares were issued.

Not less than one year must, at the date of issue

have elapsed since the date of the company was

entitled to commence business.

The shares to be issued at discount must be issued

within the six months after the date on which the

issue is sanctioned by the Board.

Every prospectus shall contain particulars of the

discount allowed on the issue of shares or so muchof that discount as has not

been written off on thedate of issue of the prospectus.

In the case of forfeiture of shares, the auditor should satisfy

himself on the following points:

(a)The procedure as laid down in the Articles relating to

forfeiture of shares were followed i.e., the forfeiture waspermitted by the Articles

of the company and the DirectorsResolution forfeiting the shares was passed.

(b)Examine the entries in the books of accounts for the

forfeiture of shares, and ensure that the necessary

adjustments were made in the register of members.

(c)Where the forfeited shares were sold or re-issued, see that

the issue of such shares was authorized by the directors andthe amount of discount

did not exceed the amount alreadyreceived thereon from the defaulting

shareholders.

(d)Any capital profit or re-issue of forfeited shares should be

transferred to the capital reserve.

5.If shares were allotted to the foreign nationals, examine the

permission given by the related legal authorities.

6.Where the company has issued redeemable preference shares,

verify the terms on which they were issued with prospectus.

7.Examine the rights attaching to the various types of shares in the

Articles of Association of the company.

Debentures:

Examine the Memorandum and Articles ofAssociation of the company to

ascertain its borrowings powers and theextent and mode of borrowings. If the

directors are empowered toborrow on behalf of the company, examine the

directors minutesregarding the issue of debentures and the mortgage of the

companysproperty. A copy of debentures creating and evidencing the

chargeshould be inspected and the receipts of money should be dulyvouched. Any

redemption should be vouched with the minutesauthorizing the redemption.

Bills Payable:

The method of verification of bills payable

should include the following steps:

1. Obtain a schedule of bills payable. Check it with bills payable

book.

2.Check casts of the schedule.

3.Examine the unpaid bills. Trace their subsequent payments into

the cashbook of succeeding period.

4.Verify to see that as far as possible there are no bills payable left

out and not entered in the books of accounts.

5.Obtain confirmation from the parties to whom bills of large

amount, if any, have been issued.

6.Verify the calculation of the interest on bills payable.

7.if bills payable were issued out of a regular counterfoil book, go

through the running number of bills issued and examine the

counterfoils with the bills payable register.

Das könnte Ihnen auch gefallen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- A Project Report ON "Disaster-Management": P.L.Shroff College of Arts & Commerce, ChinchaniDokument4 SeitenA Project Report ON "Disaster-Management": P.L.Shroff College of Arts & Commerce, ChinchaniVirendra JhaNoch keine Bewertungen

- Financial Analysis of Reliance Industries Limited: A Project Report OnDokument108 SeitenFinancial Analysis of Reliance Industries Limited: A Project Report OnVirendra Jha0% (1)

- A Project Report On Budgetary Control SystemDokument81 SeitenA Project Report On Budgetary Control SystemVirendra JhaNoch keine Bewertungen

- Purpose of The StudyDokument39 SeitenPurpose of The StudyVirendra JhaNoch keine Bewertungen

- StrategicmanagementDokument41 SeitenStrategicmanagementVirendra JhaNoch keine Bewertungen

- AccountDokument108 SeitenAccountVirendra JhaNoch keine Bewertungen

- AuditingDokument26 SeitenAuditingVirendra Jha100% (1)

- Cost AccountingDokument28 SeitenCost AccountingVirendra JhaNoch keine Bewertungen

- Gold MarketDokument25 SeitenGold MarketVirendra Jha100% (1)

- Case StudyDokument3 SeitenCase StudyVirendra JhaNoch keine Bewertungen

- Problem of Credit To Small FarmersDokument2 SeitenProblem of Credit To Small FarmersVirendra JhaNoch keine Bewertungen

- ConclusionDokument1 SeiteConclusionVirendra JhaNoch keine Bewertungen

- Terrorism Risk A New Face in The Insurance Sector: Project Report byDokument4 SeitenTerrorism Risk A New Face in The Insurance Sector: Project Report byVirendra JhaNoch keine Bewertungen

- Gold Market Sonu EDITEDDokument24 SeitenGold Market Sonu EDITEDVirendra JhaNoch keine Bewertungen

- Table of Content SR - NO. Topics Page No NODokument1 SeiteTable of Content SR - NO. Topics Page No NOVirendra JhaNoch keine Bewertungen

- How Does Insurance WorkDokument6 SeitenHow Does Insurance WorkVirendra JhaNoch keine Bewertungen

- Content: Definition: Global Depository Receipt (GDR) Procedure For Issue of GDR in A CompanyDokument29 SeitenContent: Definition: Global Depository Receipt (GDR) Procedure For Issue of GDR in A CompanyVirendra JhaNoch keine Bewertungen

- Ravi ProjectDokument22 SeitenRavi ProjectVirendra JhaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Paper 3 FrinqDokument4 SeitenPaper 3 Frinqapi-301975170Noch keine Bewertungen

- National Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyDokument8 SeitenNational Article Writing Competition 2020: Centre For Competition and Investment Laws and PolicyNisha PasariNoch keine Bewertungen

- Holy Spirit Mass SongsDokument57 SeitenHoly Spirit Mass SongsRo AnnNoch keine Bewertungen

- A. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFDokument4 SeitenA. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFbiarrodNoch keine Bewertungen

- PostmanPat Activity PackDokument5 SeitenPostmanPat Activity PackCorto Maltese100% (1)

- Sponsor and Principal Investigator: Responsibilities of The SponsorDokument10 SeitenSponsor and Principal Investigator: Responsibilities of The SponsorNoriNoch keine Bewertungen

- List of Marketing Metrics and KpisDokument5 SeitenList of Marketing Metrics and KpisThe KPI Examples ReviewNoch keine Bewertungen

- Tadano450xl PDFDokument12 SeitenTadano450xl PDFmunawar0% (1)

- 61-Article Text-180-1-10-20170303 PDFDokument25 Seiten61-Article Text-180-1-10-20170303 PDFSOUMYA GOPAVARAPUNoch keine Bewertungen

- Emergency Floatation Helicoptero PDFDokument14 SeitenEmergency Floatation Helicoptero PDFterrywhizardhotmail.com The Best Of The Best.Noch keine Bewertungen

- Soal Try Out Ujian NasionalDokument9 SeitenSoal Try Out Ujian NasionalAgung MartaNoch keine Bewertungen

- Clay & Shale Industries in OntarioDokument193 SeitenClay & Shale Industries in OntarioJohn JohnsonNoch keine Bewertungen

- North Rig 4Dokument1 SeiteNorth Rig 4avefenix666Noch keine Bewertungen

- Allowable Nozzle LoadsDokument6 SeitenAllowable Nozzle Loads김동하Noch keine Bewertungen

- Edagogy of Anguages: VerviewDokument54 SeitenEdagogy of Anguages: VerviewMukesh MalviyaNoch keine Bewertungen

- Calculations: M 0 M 1 c1 c1 0 c2 c2 1 2Dokument6 SeitenCalculations: M 0 M 1 c1 c1 0 c2 c2 1 2shadab521100% (1)

- Common Rail Injector Tester CR-C +S60H Multifunction Test MachineDokument3 SeitenCommon Rail Injector Tester CR-C +S60H Multifunction Test MachineAlen HuangNoch keine Bewertungen

- GE Elec 7 UNIT-3 NoDokument22 SeitenGE Elec 7 UNIT-3 NoLyleNoch keine Bewertungen

- ADP ObservationDokument15 SeitenADP ObservationSanjay SNoch keine Bewertungen

- SB Roadmap B1 1Dokument161 SeitenSB Roadmap B1 1Carmen Flores AloyNoch keine Bewertungen

- A A ADokument5 SeitenA A ASalvador__DaliNoch keine Bewertungen

- Characteristics of Victorian BritainDokument3 SeitenCharacteristics of Victorian BritainmwaqasenggNoch keine Bewertungen

- Cues Nursing Diagnosis Background Knowledge Goal and Objectives Nursing Interventions and Rationale Evaluation Subjective: Noc: NIC: Fluid ManagementDokument10 SeitenCues Nursing Diagnosis Background Knowledge Goal and Objectives Nursing Interventions and Rationale Evaluation Subjective: Noc: NIC: Fluid ManagementSkyla FiestaNoch keine Bewertungen

- RKS IFC 2015 Solar CellDokument23 SeitenRKS IFC 2015 Solar CellAnugrah PangeranNoch keine Bewertungen

- C779-C779M - 12 Standard Test Method For Abrasion of Horizontal Concrete SurfacesDokument7 SeitenC779-C779M - 12 Standard Test Method For Abrasion of Horizontal Concrete SurfacesFahad RedaNoch keine Bewertungen

- Industrial Marketing Module 2Dokument32 SeitenIndustrial Marketing Module 2Raj Prixit RathoreNoch keine Bewertungen

- Solution Manual For Understanding Business 12th Edition William Nickels James Mchugh Susan MchughDokument36 SeitenSolution Manual For Understanding Business 12th Edition William Nickels James Mchugh Susan Mchughquoterfurnace.1ots6r100% (51)

- Copper For BusbarDokument60 SeitenCopper For BusbarSunil Gadekar100% (3)

- Restoring PH Balance in The BodyDokument6 SeitenRestoring PH Balance in The Bodycinefil70Noch keine Bewertungen

- The Internet of ThingsDokument33 SeitenThe Internet of ThingsKaedara KazuhaNoch keine Bewertungen