Beruflich Dokumente

Kultur Dokumente

International Monetary System

Hochgeladen von

Jimit Salot0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

70 Ansichten20 SeitenInternational Finance

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenInternational Finance

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

70 Ansichten20 SeitenInternational Monetary System

Hochgeladen von

Jimit SalotInternational Finance

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 20

INTERNATIONAL FINANCE

Module 2: International Monetary System

By Sanjay K Sinha

PPT slides by Sanjay K Sinha for course on International Finance

International monetary system

A set of law, rules, standards, instruments and institutions that governs

international exchange of money

Role of the international monetary system

Ensure exchange rate stability

Facilitate corrections / adjustments in balance-of-payments disequilibria

Ensure access to international liquidity

Historical overview of exchange rate regimes:

Classical Gold Standard System(1821 1914)

The Gold Standard System (1925 1931)

Bretton Woods System (1944 1973)

Floating Exchange Rates (Since1973)

PPT slides by Sanjay K Sinha for course on International Finance

2

Since 1973 Flexible exchange rates

In 1973, floating rate system became widespread; countries moved to

flexible exchange rate system

Gold was abandoned as an international reserve asset

Flexible exchange rates were accepted by the IMF members

Central banks were allowed to intervene in the exchange rate markets to

iron out unwarranted volatilities

Non-oil-exporting countries and less-developed countries were given

greater access to IMF funds

PPT slides by Sanjay K Sinha for course on International Finance

3

Current currency systems

Monetary standard or Currency

A monetary standard is a standard monetary unit that acts as a medium of exchange and a

measure of value of goods and services in a country

3 types of currencies in international monetary system today

National currencies

Artificial currencies

Composite currency

Different countries follow different currency exchange rate regimes

ranging from rigidly fixed to independently floating

PPT slides by Sanjay K Sinha for course on International Finance

4

Exchange rate regimes

There are two exchange rate systems which have generally been in use:

Fixed Rates

An exchange rate regime in which the government of a country is committed to maintaining a fixed

exchange rate for its domestic currency

Under a fixed exchange rate regime, any increase in the exchange rate of the domestic currency

relative to a foreign currency is known as devaluation, and any decrease is called revaluation

Floating Rates

A flexible exchange rate system involves the exchange rate between two currencies that is determined

by market forces

Under a floating exchange rate regime, any increase in the exchange rate of the domestic currency

relative to a foreign currency is known as depreciation and any decrease is called appreciation

Till the collapse of BW system in 1973, fixed rate system was in use across

all the previous international monetary systems

Since 1973, floating exchange rate system came in use in varied levels of free

float

PPT slides by Sanjay K Sinha for course on International Finance

5

Floating exchange rate systems

Freely floating system

Managed float

Pegged exchange rates

Hard pegging

Soft pegging

Adjustable pegging

Crawling peg

Target zone arrangement

PPT slides by Sanjay K Sinha for course on International Finance

6

Foreign exchange markets

7

PPT slides by Sanjay K Sinha for course on International Finance

Forex (FX) market

A market where currencies are exchanged to facilitate its participants in:

Transferring of purchasing power between countries

Acquiring or providing credit for international trade transactions

Minimizing exposure to the risks of exchange rate changes

FX market is unique in:

Largest trading volumes amongst all financial markets (Avgdaily turnover upwards of

US$ 4 trillion)

Most liquid of all the financial markets

Largest number and variety of traders in the market

Geographically, the widest market

Longest trading hours 24 hours a day, every banking weekday

Big domination by one currency US$ accounts for 85% of trade

PPT slides by Sanjay K Sinha for course on International Finance

8

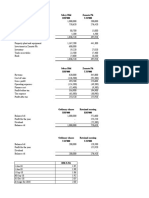

BIS

@

April 2010 report

9

PPT slides by Sanjay K Sinha for course on International Finance

@ : Bank for International Settlements

FX market participants

Two-tiered market

Wholesale market

Dealers (or market makers)

Include banks and non-bank dealers

Buy and sell at quoted bid and offer prices

Brokers

Serve as matchmakers but do not carry inventory/ put their own money

Retail market

Governments

Corporations

Smaller financial institutions

Individuals

PPT slides by Sanjay K Sinha for course on International Finance

10

Forex transactions (1/2)

Spot transaction

It is the purchase of foreign exchange with delivery and payment on the second following

business day

Date of settlement is referred to as the value date

The price that is quoted for this immediate settlement on a currency is called the Spot Rate

Forward transaction

It is purchase of foreign exchange with delivery and payment at a future value date (usually

one, two, three, six and twelve months)

Exchange rate is established at the time of the agreement

The rate applicable for the forward transaction that is quoted is called the Forward Rate

PPT slides by Sanjay K Sinha for course on International Finance

11

Forex transactions (2/2)

Swap transaction

It is simultaneous purchase and sale of a given amount of foreign exchange for two different

value dates; Both purchase and sale are conducted with the same counterparty

Common types of swap - spot against forward, forward-forward, non-deliverable forwards

(NDF)

The rate at which the swap will occur for one of the parties entering into the agreement is

called the Swap Rate

PPT slides by Sanjay K Sinha for course on International Finance

12

Spot market quotes

Direct and indirect quotes

Direct quote is quote of domestic currency (DC) per unit foreign currency (FC) i.e. DC/FC

E.g. 45.25 45.75 Rs./US$

It is called direct quote because that is how people enquire/indicate the rate in any domestic market,

For e.g. how many Rupees for a kilo of wheat

Indirect quote is quote of foreign currency (FC) per unit domestic currency (DC) i.e. FC/DC

E.g. US$/Rs. 0.0219 0.0221

Therefore, indirect quote is reciprocal of direct quote

A direct quote for one party in the transaction will be the indirect quote for the other

Bid and ask prices

The bid price is the amount a dealer is willing to pay for buying a currency

The ask price is the amount the dealer wants for selling a currency

It is always that Ask Price >Bid Price; The bid-ask spread is the difference between the ask

and bid prices. Therefore, Bid-Ask spread = (Ask price Bid price) / Ask price

Some people instead take mid-point of bid and ask quotes in the denominator to find spread

Less traded and more volatile a currency, greater is the spread

PPT slides by Sanjay K Sinha for course on International Finance

13

Spot market: Cross rates

When certain currency pairs are inactively traded, their exchange rate is

determined through their relationship to a widely traded third currency

Eg. An Indian importer needs Finnish Markka(FIM) to pay for purchases

from Nokia. Indian Rupee (INR) is not widely quoted against the FIM,

but both currencies are quoted against the US Dollar (USD)

Assume their rates against USD at:

INR 45/ USD

FIM 4.2/ USD

Cross rate will be:

PPT slides by Sanjay K Sinha for course on International Finance

14

Interpreting bid-ask quotes (1/2)

Consider the quote of Rs.45.25 45.75 /US$

Remember this is quote offered by a dealer; so look at it from his perspective

The quote means that dealer would buy US$ from you at Rs.45.25 (he is

bidding Rs.45.25 for each dollar i.e. he will pay to buy dollar) and would

sell US$ to you at Rs.45.75 (he is asking for Rs.45.75 for each dollar i.e. he

will accept to sell dollar)

Both bid and ask quotes are always for buying or selling the denominator

currency (base currency) respectively

So, if we take a quote represented in the form of Numerator currency to Denominator

currency (like in the above example, for the bid quote of Rs.45/US$, Rs. will be the

Numerator currency and US$ the denominator currency):

Bid quotes are in the form Pay X to buy unit Denominator (i.e. Base) currency, and

Ask quotes are in the form Accept Y to sell unit Denominator (i.e. Base) currency

In other words, if I am the dealer, then the bid (ask) quotes from me would always mean how much I

will pay (accept) to buy (sell) the denominator currency

PPT slides by Sanjay K Sinha for course on International Finance

15

Interpreting bid-ask quotes (2/2)

Now, as the dealer buys Dollars from you, in effect, he is selling Rupees to

you

Therefore, his bid quote for Dollars of Rs.45.25/US$ could also be construed to mean that he

would sell Rs. to you at Rs.45.25 for each Dollar

That is, Bid quote for Dollars of Pay Rs. 45.25 to buy a US$ also means Sell Rs.45.25 for

a US$ i.e. Accept 1 US$ to sell Rs.45.25 or Accept 1/45.25 US$ to sell a Re. implying an Ask

quote for Rupees of Accept 1/45.25 US$ to sell a Re.

So, if Rs. is domestic currency (DC) and US$ is foreign currency (FC), then

Bid quote for Dollar (FC) i.e. (DC/FC)

bid

=45.25

And, Ask quote for Rupees (DC) i.e. (FC/DC)

ask

=1/45.25

Multiplying the two, (DC/FC)

bid

* (FC/DC)

ask

=45.25 * (1/45.25) =1

=> (DC/FC)

bid

= 1 / (FC/DC)

ask

And similarly, (DC/FC)

ask

= 1 / (FC/DC)

bid

PPT slides by Sanjay K Sinha for course on International Finance

16

Cross rate bid-ask quotes (1/2)

What is INR/Turkish Lira (TRY) rate if: USD 0.022225 /INR; USD 0.633236 /TRY?

Step 1 Establish the equation for transaction

Step 2 Break down the transaction

INR/TRY

bid

(i.e. pay INR to buy TRY) could be seen as a set of 2 transactions

Transaction 1: Pay INR to Buy USD (i.e. use INR/USD

bid

rate)

Transaction 2: Pay USD to Buy TRY (i.e. use USD/TRY

bid

rate)

Similarly, INR/TRY

ask

(i.e. accept INR to sell TRY) could be seen as:

Transaction 1: Accept INR to Sell USD (i.e. use INR/USD

ask

rate)

Transaction 2: Accept USD to Sell TRY (i.e. use USD/TRY

ask

rate)

These could be converted into easy-to-remember formulae as:

If FC

a

and FC

b

are the two foreign currencies INR and TRY respectively and DC is the

domestic currency USD, then

(FC

a

/ FC

b

)

bid

= (FC

a

/ DC)

bid

(DC/FC

b

)

bid

(FC

a

/ FC

b

)

ask

= (FC

a

/ DC)

ask

(DC/FC

b

)

ask

PPT slides by Sanjay K Sinha for course on International Finance

17

Cross rate bid-ask quotes (2/2)

Step 3 Compute substituting the values

Let, FC

a

= INR; FC

b

= TRY; and DC = USD

(FC

a

/ FC

b

)

bid

= (FC

a

/ DC)

bid

(DC/FC

b

)

bid

(FC

a

/ FC

b

)

ask

= (FC

a

/ DC)

ask

(DC/FC

b

)

ask

=> (INR/TRY)

bid

= (INR/USD)

bid

x (USD/TRY)

bid

= {1/(USD/INR)

ask

} x (USD/TRY)

bid

= (1/0.0225) x (0.6332) = 28.1422

=> (INR/TRY)

ask

= (INR/USD)

ask

x (USD/TRY)

ask

= {1/(USD/INR)

bid

} x (USD/TRY)

ask

= (1/0.0222) * (0.6336) = 28.5405

INR/TRY quote would be: 28.1422 5405

PPT slides by Sanjay K Sinha for course on International Finance

18

Spot market: Triangular arbitrage

A process of making money by sequentially buying and selling various

currencies, ending with the original currency

Sometimes for a very short while, inter-market prices be such that cross

rates and direct rates differ slightly; this offers an arbitrage opportunity

Not generally available to general players and only dealers are able to avail

of such arbitrage

PPT slides by Sanjay K Sinha for course on International Finance

19

Forward market quotations

Quoted in either of the two forms

Outright quote

Similar to spot quotes

Generally quoted to commercial customers

Forward premium or discount / Points

These are the difference between the forward rate and the spot rate

Do not reflect the exchange rate by themselves

Forward premium for J apanese Yen for an Indian importer will be:

f

Rs./

= Forward

Rs./

Spot

Rs./

* 360 *100

Spot

Rs./

n

Where, n =no. of days in the forward contract

When Forward

Rs./

is more than Spot

Rs./

, forward is said to be at a premium i.e. is at a

premium or Rs. would depreciate

When Forward

Rs./

is less than Spot

Rs./

, forward is said to be at a discount i.e. is at a discount

or Rs. would appreciate

PPT slides by Sanjay K Sinha for course on International Finance

20

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- PROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheDokument4 SeitenPROBLEM 1: P Company Had 90% Ownership Interest Acquired Several Years Ago in S Company. TheMargaveth P. Balbin75% (4)

- UK Deloitte PlatformsDokument212 SeitenUK Deloitte PlatformsNaisscentNoch keine Bewertungen

- Asian PaintsDokument24 SeitenAsian Paintscsowbhagya81% (16)

- Pressures For Global IntegrationDokument16 SeitenPressures For Global IntegrationMahpuja JulangNoch keine Bewertungen

- Transaction History Reportwellnxtcorporwellnxt Corporation14062019210657Dokument2 SeitenTransaction History Reportwellnxtcorporwellnxt Corporation14062019210657roda mansuetoNoch keine Bewertungen

- International Marketing Chapter 1Dokument8 SeitenInternational Marketing Chapter 1wube100% (2)

- Economic GeographyDokument20 SeitenEconomic GeographyИто ХиробумиNoch keine Bewertungen

- Lyka Kendall B. Adres: Personal Na ImpormasyonDokument2 SeitenLyka Kendall B. Adres: Personal Na ImpormasyonKendall BarbietoNoch keine Bewertungen

- Acfrogam9vr5 9htlenhsziunerqgkungvwcsh0b2jyccm3abq6hxcy50g89zyz3xz 1grxx8713dp3cyspmmsk25vjx6budfsrv4 Wyd1oqvu5z1e4mp Zr0colh91xxzxha0gdtsiyifi5quyDokument1 SeiteAcfrogam9vr5 9htlenhsziunerqgkungvwcsh0b2jyccm3abq6hxcy50g89zyz3xz 1grxx8713dp3cyspmmsk25vjx6budfsrv4 Wyd1oqvu5z1e4mp Zr0colh91xxzxha0gdtsiyifi5quyAbrar AhmedNoch keine Bewertungen

- Ec1723 Syllabus Sept4 2018-1Dokument11 SeitenEc1723 Syllabus Sept4 2018-1auctmetuNoch keine Bewertungen

- Distribution NetworkDokument3 SeitenDistribution NetworkMaryam KhalidNoch keine Bewertungen

- Chap 013Dokument102 SeitenChap 013limed1Noch keine Bewertungen

- Project: Principles of MarketingDokument11 SeitenProject: Principles of MarketingtiloooNoch keine Bewertungen

- Marketing Plan: Marketiing Management Term ReportDokument13 SeitenMarketing Plan: Marketiing Management Term ReportHayat Omer MalikNoch keine Bewertungen

- Imc PlanDokument5 SeitenImc Planliza alegre100% (1)

- Zara-Benneton Case Study PDFDokument136 SeitenZara-Benneton Case Study PDFrizka100% (1)

- Handbook How To Do Business in GC enDokument8 SeitenHandbook How To Do Business in GC enСергей МартынецNoch keine Bewertungen

- Fundamental Analysis by COL FInancialDokument43 SeitenFundamental Analysis by COL FInancialroksimalsNoch keine Bewertungen

- Asian PaintDokument12 SeitenAsian PaintAnkit DubeyNoch keine Bewertungen

- Aerari ProfileDokument7 SeitenAerari ProfilemobinjabbarNoch keine Bewertungen

- Akram-Lodhi & Cristobal Kay. Surveying The Agrarian Question, Part 2. Current Debates and BeyondDokument31 SeitenAkram-Lodhi & Cristobal Kay. Surveying The Agrarian Question, Part 2. Current Debates and BeyondCarlos Eduardo Olaya DiazNoch keine Bewertungen

- Sample Marketing Plan: AppendixDokument11 SeitenSample Marketing Plan: Appendixokoro matthewNoch keine Bewertungen

- The Case of ButterflyDokument2 SeitenThe Case of ButterflyNiranjan ParkhiNoch keine Bewertungen

- PGDM Syllabus NewDokument66 SeitenPGDM Syllabus Newbkpanda20065753Noch keine Bewertungen

- Group Project 2 Sabry Zamato SolutionDokument5 SeitenGroup Project 2 Sabry Zamato SolutionSyafahani SafieNoch keine Bewertungen

- The Influence of Advertising On Consumer Brand PreferenceDokument8 SeitenThe Influence of Advertising On Consumer Brand PreferenceUmair MajeedNoch keine Bewertungen

- FacilitiesDokument4 SeitenFacilitiesBhaskar SahaNoch keine Bewertungen

- Big BazarDokument88 SeitenBig Bazarmrmanju79% (14)

- Final Paper - Application Analysis of Escrow System On Payment Transaction in An Online ShopDokument18 SeitenFinal Paper - Application Analysis of Escrow System On Payment Transaction in An Online ShopSaid Muhamad FarosNoch keine Bewertungen

- Marketing Analysis of Vegetables in Khorda District Under OctmpDokument47 SeitenMarketing Analysis of Vegetables in Khorda District Under OctmpAbhilashRayaguruNoch keine Bewertungen