Beruflich Dokumente

Kultur Dokumente

Document de Travail: "Keeping-Up With The Joneses, A New Source of Endogenous Fluctuations"

Hochgeladen von

torosterudOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Document de Travail: "Keeping-Up With The Joneses, A New Source of Endogenous Fluctuations"

Hochgeladen von

torosterudCopyright:

Verfügbare Formate

Hgh

Document de travail

Lille 1 Lille 2 Lille 3

[201439]

Keeping-up with the Joneses, a new source of

endogenous fluctuations

Jean-Philippe Garnier

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

Keeping-up with the Joneses, a

new source of endogenous

fluctuations

Jean-Philippe Garnier

Jean-Philippe Garnier

PRES Universit Lille Nord de France, Universit Lille 3, Laboratoire EQUIPPE, EA

4018, Villeneuve dAscq, France

jean-philippe.garnier@univ-lille3.fr

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

Keeping-up with the Joneses, a new source of

endogenous uctuations

Jean-Philippe GARNIER

Universit de Lille 3 - Charles de Gaule, EQUIPPE, Lille, France

First version : March 2013

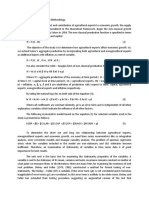

Abstract : Our main objective is to study the impact of consumption externality

like keeping of with the Joneses on the properties of long-run equilibrium in the two-sector

optimal growth model. Does this consumption externality lead to a new mechanism of

local indeterminacy and endogenous uctuations ? We will see that, in two-sector growth

models with exogenous labor and without technological externalities, if the representative

agent is able to give more value to his social status than his own consumption, this is the

keys of a new mechanism for endogenous uctuations. Moreover, by opposition with the

other endogenous uctuation mechanisms, we will see that this one doesnt need to have

restriction on the factor intensity conguration of the consumption sector.

Keywords : Two-sector models, continous-time models, consumption externality,

keeping up with the Joneses, local indeterminacy, endogenous uctuations.

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

1 Introduction

We propose an extension of the papers of Garnier, Venditti and Nishi-

mura [8, 9] where endogenous uctuations can be obtain without both tech-

nological externalities and restrictions on the capital intensity conguration

of the consumption sector. Local indeterminancy is obtained only by adding

a consumption externality in preferences (i.e. keeping up with the Joneses).

This one adds an exogenous variable that represents the consumption stan-

dard of the economy. To obtain this new endogenous uctuations mechanim,

we assume that the marginal utility of consumption is increasing with res-

pect to the externalities. Recall that the intertemporal substitution elasticity

of the consumption (IESC) measures the responsiveness of the consumption

growth to the interest growth rate but this consumption externality implies

the existence of two values of the IESC :

The rst, called IESC at the private level, doent integrate the exter-

nality and is positive. I note this elasticity by

cc

in the paper. It measures

responsiveness of the consumption growth to the interest growth rate of the

representative agent.

The second, called IESC at the social level (i.e. evaluted at the syme-

tric equilibrium), integrates externality and can be negative here since we

assume that agents can give more weight to their social status rather than

to their own present consumption. IESC at the social level measures the

responsiveness of the consumption growth to the interest growth rate of all

society. I note this elasticity by in the paper. Consequently, this consump-

tion externalty breaks the symetry of the responsiveness of the consumption

growth to the interest growth rate between the private and social levels.

This idea is of the same kind of the one used in the models where tech-

nological externalities break the duality between price and quantity eects

2 The Model

We consider an innite horizon, continous-time, two-sector model with

Cobb-Douglas technologies, inelastic labor supply and consumption exter-

1

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

nalities through "keeping up with the Joneses" preferences. The economy

consists of competitive rms and a representative household.

2.1 Firms

The consumption good y

0

and capital good y

1

are produced by capital

x

1j

and labor x

0j

, j = 0, 1, through a Cobb-Douglas technology but without

sector-specic externalities and with constant returns to scale : see the paper

Garnier et al [9] p. 328 equation (2) with

ij

=

ij

, so all the technological

structure of the paper holds.

2.2 Household

We assume that the population is constant and normalized to one and

the labor suply is inelastic i.e. according to the case where the labor sup-

ply elasticity is innite in the paper of Garnier et al [9]. The representative

agent derives his utility from consumption c(t) and faces consumption ex-

ternality z(t), that is : U (c(t), z (t)). The consumption externality is given

by the consumption average of the economy which can be interpreted as

the consumption standard. The function U satises the standard hypothe-

sies but the introduction of consumption standard implies that consumption

spillovers aect the households utility. The "keeping up with the Joneses"

formulation of preference is such that the marginal utility of consumption

rises with the consumption standard. Hence the following assumption holds :

Assumption 1 : U(., z(t)) is increasing and concave z(t) R

+

, the rst

partial derivatives satisfy U

z

(c(t), z(t)) > 0 and U

c

(c(t), z(t)) > 0 and the

second partial derivatives satisfy U

cz

(c(t), z(t)) > 0 and U

cc

(c(t), z(t)) < 0

We introduce the following elasticities :

cc

=

U

c

(c(t), z (t))

c(t)U

cc

(c(t), z (t))

> 0 (1)

cz

=

U

c

(c(t), z (t))

c(t)U

cz

(c(t), z (t))

> 0 (2)

2

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

where

cc

is the private Intertemporal Elasticity of Susbstitution in

Consumption (IESC) and

cz

is the elasticity of substitution between

consumption and consumption standard.

The enhanced value of the consumption standard by the agent is positi-

vely correlate to

cz

. We introduce the ratio

c(t)

z(t)

as the social status of the

agent.

We can have

cc

<

cz

i.e. U

cc

+ U

cz

> 0 that is, we consider that the

agents may give more weight to their social status rather than to their own

present consumption.

The objective of the representative agent is to solve the following inter-

temporal optimization problem by taking z(t) as given :

max

y

1

(t),x

1

(t)

0

e

t

U (c(t), z(t)) dt

s.c. x(t) = y

1

(t) gx

1

(t)

x

1

(0) = x

1

given

(3)

2.3 The competitive equilibrium

Let us denote by the social IESC :

=

1

cc

cz

(4)

If

cc

< (>)

cz

then we have > (<)0. We note that plays the same

role that the parameter in the dynamical system (13) of the model of

Garnier et al [8] p.331, but here can also be negative (i.e. < 0) that

corresponds to the complementary part of the half-line 4

describes in the

paper p.244 section 3.3 (i.e inelastic labor supply) but without sector-specic

externalities. Therefore both dynamical system and steady-state (x

1

, p

1

) are

the same than the ones of Garnier et al [9] p.331 equation (13).

In order to study the indeterminacy properties of equilibrium, we linearize

the dynamical system around (x

1

, p

1

) which gives a Jacobian characterized

by a Trace and a Determinant.

In this type of models the steady state is locally indeterminate if and only

if the Jacobian matrix has two eigenvalues with negative real part what is

3

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

equivalent to verify that T < 0 et D > 0. Moreover, Trace and Determinant

are functions of , then when gets from to 0, T () and D() move

along the line called in what follows

(see Garnier et al [9] ).

3 Endogenous uctuations and social status

Here, the case > 0 doesnt interest us since it cannot provide local inde-

terminacy : in this case, Garnier, Venditti and Nishimura [7] have shown that

sector-specic externalities are needed to have local indetermincy. Conse-

quently, we only focus on the case where the level of consumption externality

is suciently large to have

cc

>

cz

and thus < 0 i.e. agent favours his

social status

c(t)

z(t)

more than his own consumption c(t) over time.

We study the variations of T () and D() in the (T, D) plane, when

varies continuously on ], 0[.

So, when gets from to 0, the pair (T () , D()) moves along the

half line

1

characterized by a starting point (T () , D()) :

T () =

dc

dx

1

dy

1

dp

1

dc

dp

1

+

dy

1

dx

1

g (5)

D() = 0 (6)

and a ending point (T (0) , D(0)) such that :

D(0) =

dy

1

dx

1

g

+ g

dw

1

dp

1

< 0 (7)

T (0) = (8)

Consequently, we know from benhabib and Nishimura [5] that, without

sector-specic externalities, indeterminacy is ruled out for = 0 (i.e. en-

ding point) whereas the starting point is located on the abscissa area since

D() = 0 . We have to locate both starting and ending points to draw the

line and to show that it gets in the local indeterminacy area.

1. When > 0, the pair (T () , D()) moves along the another part of the half line

: see Garnier, Venditti and Nishimura [8].

4

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

We can verify both T () < 0 and D is an increasing function of , then

the half line

gets by the indeterminacy area.

More precisely, there exists ], 0[ such that the steady state is

locally indeterminate ], [.

Hence, we give the following proposition :

Lemma 1 : Under assumptions 1 then :

1

p

1

c

dc

dp

1

], 0[ such that < the steady state (x

1

, p

1

) is locally

indeterminate and > the steady state (x

1

, p

1

) is saddle point.

(See the proof in the appendix).

This lemma gives a condition set leading endogenous uctuations without

restrictions on the factor intensity of the consumption good.

Does it possible to have a negative IESC at the social level and how can

we interpret it ? This possibility has been yet studied by Robert Hall [11].

He explains that a detailed study of data for the twentieth-century United

States Shows no strong evidence that the elasticity of intertemporal substi-

tution is positive and that earlier nding of substantially positive elasticities

are reversed when appropriate estimation methods are used. Even if a lot

of empirical estimations of IESC give a really small positive value there is

some extimations that give a negative value (Hansen and Singleton 1988)

3.1 Endogenous uctuations mechanism

Now, starting from an arbitrary equilibrium, consider that he expects

another one with a higher rate of investment and higher level of capital stock

coming from an instantaneous increase in relative price of investment good

p

1

. The only way that this other equilibrium path becomes a new equilibrium

is to nd a mechanism which reverses the price toward the equilibrium and

osets this initial increase. Suppose, for example, that the investment good is

capital intensive, then, from the Rycbzynsky theorem, a higher capital stock,

at constant prices, implies an increase (more than proportional) of output

5

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

of the investment sector and a decrease (more than proportional) of output

of the consumption sector : the consumption social standard decreases. Now

from Stolper-Samuelson theorem, the initial price rise leads to an increase in

the rate of return of capital, given by w

1

, and to maintain the equality of the

overall return to capital and discount rate :

p

1

p

1

+

w

1

(p

1

)

p

1

cp

p

1

p

1

+

cx

x

1

x

1

=

+ g

2

, the price of the investment good must decline. However, this is not

enough to check the rycbzynsky eect. But there is another eect coming

from IESC at the social level ( < 0) : there are two opposite eects playing

through the decreasing marginal utility in consumption (i.e. U

cc

< 0) and

through the positive eect of externality on this marginal utility (i.e. U

cz

> 0

) but the last is higher and the marginal utility decreases. Consequently, the

loss in the present consumption will be not oset in the future, that is, a

decrease in the social stantard implies a future decrease of the consumption

level.

The IESC measures the responsiveness of the consumption growth to

the interest rate : let s consider a present decreasing of the interest rate

such that the aggregate consumption decreases for one unity, thus the social

status decreases for one unity. Normally, this decreasing has to be oset

in the future. But here, the representative agents want to keep their social

status consequently if the present social status decreases for one unity agents

decrease their consumption in order to keep it constant over time. So, all

agents wants only to keep their social status and they dont have to postpone

the present decreases of consumption. That is measured by the IESC at the

aggregate level : a present decrease of the social status implies a future

decreases of the consumption.

2. With cp =

p

1

c

c

p

1

the price-elasticity of the consumption and cx =

x

1

c

c

x

1

the

capital-elasticity of the consumption and they are negatives.

6

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

4 Examples

Let us consider this utility function :

U(c(t), z(t)) =

1

1

"

c(t)

1+

c(t)

z(t)

#

1

where 1 > > 0 a measure of the weight of the social status c/z in prefe-

rences and > 0 the individual risk aversion or the intertemporal elasticity

of substitution in consumption at the private level. This function satises

assumption 1 and :

cc

=

1

cz

=

1

(1 )

Therefore :

= (1 )

Note that for any 1 > > 0, if = 0 (i.e. the utility is linear with respect

to the consumption) then = < 0 and if = 1 then = 1 Therefore

]0, 1[, [0, 1[ such that [0, [ we have < 0.

We want to illustrate the lemma 1 for both capital and labor intensive

consumption good.

We use a parametrization according empirical results on the labor share

in european countries :

01

= 0.62

g = 0.05

= 0.01

If we set

00

= 0.6 the consumption good is capital intensive, moreover,

we obtain the following critical value : = 0.05. we can set for example,

= 0.2 and = 0.3125. Otherwise, if we set

00

= 0.65 the consumption

good is now labor intensive, the new critical value is = 0.01, we can set,

for example, = 0.2 and = 0.2625.

7

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

5 Concluding comments

We have shown that keeping up with the Joneses externality in prefe-

rences are able to lead endogenous uctuations of the steady-state without

restriction on capital intensity conguration of sectors and without sector-

specic externalities.

6 Appendix

6.1 Computation of derivatives used in T() and D()

All derivatives corresponds to that given section A.3 p.347-351 in the

paper of Garnier et al [9] without sector-specic externalities (i.e. T =

T)

and with inelastic labor supply (i.e ).

6.2 Proof of the proposition 1

See Garnier, Venditti and Nishimura [9] for the proof of the computation

of 4

.

The computation of

dT

d

and

dD

d

give :

dT

d

=

p

1

c

E

2

c

x

1

y

1

p

1

+

c

p

1

+ g

w

1

p

1

(9)

dD

d

=

p

1

c

E

2

c

p

1

y

1

x

1

g

+ g

w

1

p

1

(10)

Since

dc

dp

1

=

1

b

2

[(1

0

) a

11

+

0

a

01

x

1

] < 0 then

dD

d

=

p

1

c

E

2

dc

dp

1

D(0) >

0 and T () < 0.

7 Bibliography

Rfrences

[1] Alonso-Carrera J., Caball J., Raurich X., 2007 :"Can consommation

spillovers be a source of equilibrium indeterminacy ?" CAMA Working

Paper, 13"

8

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

[2] Benhabib, J., and Farmer R.(1994) : Indeterminacy and Increasing Re-

turns," Journal of Economic Theory, 63, 19-41.

[3] Benhabib, J., and Farmer R. (1996) : Indeterminacy and Sector Specic

Externalities," Journal of Monetary Economics, 37, 397-419.

[4] Benhabib, J. and Farmer R. (1999) : Indeterminacy and Sunspots in

Macroeconomics," in Handbook of Macroeconomics, J.B. Taylor and M.

Woodford (eds.), North-Holland, Amsterdam, 387-448.

[5] Benhabib, J., and Nishimura K. (1998) : Indeterminacy and Sunspots

with Constant Returns," Journal of Economic Theory, 81, 58-96.

[6] Dupor B., and W.F. Liu (2003) : "Jealousy and Equilibrium Overcon-

sumption", American Economic Review, 93, 423-428

[7] Garnier, J.P., Nishimura K. and Venditti A. (2007) : Capital-Labor

Substitution and Indeterminacy in Continuous-Time Two-Sector Mo-

dels," Advances in Mathematical. Economics, 10, 31-49.

[8] Garnier, J.P., Nishimura K. and Venditti A. (2007) : Intertempo-

ral Substitution in Consumption, Labor Supply Elasticity and Suns-

pot Fluctuations in Continuous-Time Models," International Journal

of Economic Theory, 3, 235-239

[9] Garnier, J.P., Nishimura K. and Venditti A. (2013) : Local Indetermi-

nacy in Continous-Time Models : The Role of Returns to Scale" Ma-

croeconomi Dynamic, 17, 326-357

[10] Grandmont, J.-M., Pintus P. and De Vilder R. (1998) : Capital-Labor

Substitution and Competitive Nonlinear Endogenous Business Cycles,"

Journal of Economic Theory, 80, 14-59.

[11] Hall R. (1988) : Intertemporal substitution in consumption, Journal

of Political Economic vol 96 n 2.

[12] Liu, W.F. and S. Turnovsky (2005) : "Consumption Externalities, Pro-

duction Externalities and Long-Run Macroeconomic Eciency," Jour-

nal of Economics, 89, 1097-1129.

9

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

Documents de travail rcents

Hubert Jayet, Glenn Rayp, Ilse Ruyssen and Nadiya Ukrayinchuk :

Immigrants' location choice in Belgium [2014-38]

Fabrice Gilles: Evaluating the impact of a working time regulation on capital

operating time. The French 35-hour work week experience [2014-37]

Marc Germain : "NIMBY, taxe foncire et vote par les pieds" [2013-36]

Aurlie Mahieux and Lucia Mejia-Dorantes: The Impacts of public transport

policies on a non mobility area: French study case in the north of France

[2013-35]

Richard Duhautois and Fabrice Gilles: Payroll tax reductions and job flows in

France [2013-34]

Cristina Badarau, Florence Huart and Ibrahima Sangar : Indebtedness and

macroeconomic imbalances in a monetary-union DSGE [2013-33]

Marion Drut: Vers un systme de transport oprant selon les principes de

lconomie de la fonctionnalit? [2013-32]

Jrme Hricourt and Sandra Poncet : Exchange Rate Volatility, Financial

Constraints and Trade: Empirical Evidence from Chines [2013-31]

Jean-Baptiste Desquilbet et Fdi Kalai : La banque conventionnelle et la

banque islamique avec fonds propres : contrat de dpt et partage du risque

de liquidit [2013-30]

Ccily Defoort and Carine Drapier: Immigration and its dependence on the

welfare system: the case of France [2012-29]

Carine Drapier and Nadiya Ukrayinchuk : Les conditions de travail et la sant

des immigrs : Seraient- ils plus rsistants la pnibilit au travail que les

natifs ? [2012-28]

Etienne Farvaque, Muhammad Azmat Hayat and Alexander Mihailov: Who

Supports the ECB?Evidence from Eurobarometer Survey Data [2012-27]

Nathalie Chusseau, Jol Hellier and Bassem Ben-Halima : Education,

Intergenerational Mobility and Inequality [2012-26]

Nathalie Chusseau and Jol Hellier : Inequality in Emerging Countries [2012-

25]

Nathalie Chusseau and Michel Dumont: Growing Income Inequalities in

Advanced [2012-24]

h

a

l

-

0

1

0

0

6

9

1

2

,

v

e

r

s

i

o

n

1

-

1

6

J

u

n

2

0

1

4

Das könnte Ihnen auch gefallen

- Comparing Behavioural and Rational Expectations For The US Post-War EconomyDokument19 SeitenComparing Behavioural and Rational Expectations For The US Post-War Economymirando93Noch keine Bewertungen

- Estimating Long Run Effects in Models With Cross-Sectional Dependence Using Xtdcce2Dokument37 SeitenEstimating Long Run Effects in Models With Cross-Sectional Dependence Using Xtdcce2fbn2377Noch keine Bewertungen

- Diebold 2015 Paper PDFDokument24 SeitenDiebold 2015 Paper PDFswopguruNoch keine Bewertungen

- UC Berkeley Econ 140 Section 10Dokument8 SeitenUC Berkeley Econ 140 Section 10AkhilNoch keine Bewertungen

- Ecotrics (PR) Panel Data 2Dokument16 SeitenEcotrics (PR) Panel Data 2Arka DasNoch keine Bewertungen

- Seitani (2013) Toolkit For DSGEDokument27 SeitenSeitani (2013) Toolkit For DSGEJake BundokNoch keine Bewertungen

- Econometrics Hw-1Dokument31 SeitenEconometrics Hw-1saimaNoch keine Bewertungen

- Spurious Reg and Co IntegrationDokument22 SeitenSpurious Reg and Co IntegrationKaran MalhotraNoch keine Bewertungen

- 616.301 FC Advanced Microeconomics: John HillasDokument78 Seiten616.301 FC Advanced Microeconomics: John HillasPulkit GoelNoch keine Bewertungen

- Problem Set 1 "Working With The Solow Model"Dokument26 SeitenProblem Set 1 "Working With The Solow Model"keyyongparkNoch keine Bewertungen

- The Dynamic Behaviour of An Endogenous Growth Model With Public Capital and PollutionDokument16 SeitenThe Dynamic Behaviour of An Endogenous Growth Model With Public Capital and PollutionsdsdfsdsNoch keine Bewertungen

- BasicsDokument8 SeitenBasicsgrahn.elinNoch keine Bewertungen

- Ecu - 07103 Lecture Notes PDFDokument63 SeitenEcu - 07103 Lecture Notes PDFKhalid Mahadhy0% (1)

- Olg GrowthDokument57 SeitenOlg GrowthamzelsoskNoch keine Bewertungen

- Econometrics and Softwar Applications (Econ 7031) AssignmentDokument8 SeitenEconometrics and Softwar Applications (Econ 7031) AssignmentbantalemeNoch keine Bewertungen

- Modeling Long-Run Relationship in FinanceDokument43 SeitenModeling Long-Run Relationship in FinanceInge AngeliaNoch keine Bewertungen

- Blanchar y Quah (1993)Dokument7 SeitenBlanchar y Quah (1993)kimura_kimuraNoch keine Bewertungen

- Institute of Applied Economic Research, Directorate of Urban and Regional Studies, E-Mail: Waldery - Rodrigues@Dokument24 SeitenInstitute of Applied Economic Research, Directorate of Urban and Regional Studies, E-Mail: Waldery - Rodrigues@camilo_lauretoNoch keine Bewertungen

- Q. 1 Discuss in Detail The Rules of Differentiation. Also Discuss The Importance of Differentiation in Economics. AnsDokument8 SeitenQ. 1 Discuss in Detail The Rules of Differentiation. Also Discuss The Importance of Differentiation in Economics. AnsMuhammad NomanNoch keine Bewertungen

- Basic Econometrics 1 (Password - BE)Dokument30 SeitenBasic Econometrics 1 (Password - BE)SULEMAN HUSSEININoch keine Bewertungen

- Panel Data For LearingDokument34 SeitenPanel Data For Learingarmailgm100% (1)

- Ascari Euler EquationDokument25 SeitenAscari Euler EquationCristian PiñerosNoch keine Bewertungen

- MicEconAids VignetteDokument36 SeitenMicEconAids Vignettegrodrigueziglesias9303Noch keine Bewertungen

- Consumption and Income: Paneleconometric Evidence For West GermanyDokument17 SeitenConsumption and Income: Paneleconometric Evidence For West GermanyMiGz ShiinaNoch keine Bewertungen

- Discussion Paper Series: Combining Microsimulation and Optimization To Identify Optimal Flexible Tax-Transfer RulesDokument39 SeitenDiscussion Paper Series: Combining Microsimulation and Optimization To Identify Optimal Flexible Tax-Transfer RulesgotoxicNoch keine Bewertungen

- Cointegration M CovrigDokument5 SeitenCointegration M CovrigIoana ConstantinescuNoch keine Bewertungen

- Ph.D. Core Exam - Macroeconomics 13 January 2017 - 8:00 Am To 3:00 PMDokument4 SeitenPh.D. Core Exam - Macroeconomics 13 January 2017 - 8:00 Am To 3:00 PMTarun SharmaNoch keine Bewertungen

- Robust Pareto Tail Modeling For The Estimation of Indicators On Social Exclusion Using The R Package LaekenDokument14 SeitenRobust Pareto Tail Modeling For The Estimation of Indicators On Social Exclusion Using The R Package LaekenServando Valdes CruzNoch keine Bewertungen

- Ec 384 Applied Econometrics Topic 1 - 2023Dokument99 SeitenEc 384 Applied Econometrics Topic 1 - 2023Claire ManyangaNoch keine Bewertungen

- Tax Reform and Welfare Measurement: Do We Need Demand System Estimation?Dokument15 SeitenTax Reform and Welfare Measurement: Do We Need Demand System Estimation?Chu Ngọc MaiNoch keine Bewertungen

- Entropy 21 00530 v2Dokument10 SeitenEntropy 21 00530 v2Guilherme ChagasNoch keine Bewertungen

- Empirical Estimation of Elasticities and Their Use: Murat Gen CDokument9 SeitenEmpirical Estimation of Elasticities and Their Use: Murat Gen CZundaNoch keine Bewertungen

- Mixed Model Analysis For OverdispersionDokument9 SeitenMixed Model Analysis For OverdispersiontheijesNoch keine Bewertungen

- The Nonparametric Approach To Applied Welfare Analysis: Donald J. Brown Caterina Calsamiglia February 2006Dokument8 SeitenThe Nonparametric Approach To Applied Welfare Analysis: Donald J. Brown Caterina Calsamiglia February 2006elrodrigazoNoch keine Bewertungen

- MAT2001-SE Course Materials - Module 3 PDFDokument32 SeitenMAT2001-SE Course Materials - Module 3 PDFKiruthiga DeepikaNoch keine Bewertungen

- The Impact of Jump Risk On Nomial Interst Rates and Foreign Exchange RateDokument15 SeitenThe Impact of Jump Risk On Nomial Interst Rates and Foreign Exchange RateMinh KhoaNoch keine Bewertungen

- Notes For Econ 8453Dokument51 SeitenNotes For Econ 8453zaheer khanNoch keine Bewertungen

- 4.applied - Cointegration Approach A Solvency-Adewojo AdekunbiDokument8 Seiten4.applied - Cointegration Approach A Solvency-Adewojo AdekunbiImpact JournalsNoch keine Bewertungen

- 1 205Dokument205 Seiten1 205bicameloNoch keine Bewertungen

- 2011 L1 FinalDokument89 Seiten2011 L1 FinalAnca AfloroaeiNoch keine Bewertungen

- Econometrics - SlidesDokument264 SeitenEconometrics - SlidesSamuel ObengNoch keine Bewertungen

- Macro Questionss12Dokument8 SeitenMacro Questionss12paripi99Noch keine Bewertungen

- Chapter IDokument41 SeitenChapter Ihien05Noch keine Bewertungen

- Lecture Note 11 Panel AnalysisDokument11 SeitenLecture Note 11 Panel AnalysisKasun PereraNoch keine Bewertungen

- 581 ProjDokument11 Seiten581 ProjKeenaLiNoch keine Bewertungen

- Economics 202 Pset 1Dokument4 SeitenEconomics 202 Pset 1Richard PillNoch keine Bewertungen

- Econometric Model With Cross-Sectional, Time Series, and Panel DataDokument4 SeitenEconometric Model With Cross-Sectional, Time Series, and Panel DataDian KusumaNoch keine Bewertungen

- Differential Calculus Is A Subfield of CalculusDokument10 SeitenDifferential Calculus Is A Subfield of CalculusIzyan Mohd SubriNoch keine Bewertungen

- Notes On EconometricsDokument295 SeitenNotes On EconometricsTabarnoucheNoch keine Bewertungen

- Theoretical FrameworkDokument2 SeitenTheoretical FrameworkMark Dennis AsuncionNoch keine Bewertungen

- Error Correction ModelDokument37 SeitenError Correction ModelRollins JohnNoch keine Bewertungen

- Simplifying Numerical Analyses of Hamilton-Jacobi-Bellman EquationsDokument28 SeitenSimplifying Numerical Analyses of Hamilton-Jacobi-Bellman EquationsSteve DemirelNoch keine Bewertungen

- SampleDokument11 SeitenSampleGodson OnophurhiNoch keine Bewertungen

- Distribución Pareto Lognormal y OtrasDokument27 SeitenDistribución Pareto Lognormal y OtrasjerweberNoch keine Bewertungen

- Barro ConvergenceDokument30 SeitenBarro ConvergenceIrán ApolinarNoch keine Bewertungen

- Department of Economics Working Paper SeriesDokument26 SeitenDepartment of Economics Working Paper SeriesMeenalshubhamNoch keine Bewertungen

- Introduction To Mathematical EconomicsDokument164 SeitenIntroduction To Mathematical Economics.cadeau01Noch keine Bewertungen

- Bhide CVDokument3 SeitenBhide CVtorosterudNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Abraham CV Nov10Dokument3 SeitenAbraham CV Nov10torosterudNoch keine Bewertungen

- 6th Central Pay Commission Salary CalculatorDokument15 Seiten6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Pimsleur Swedish - BookletDokument16 SeitenPimsleur Swedish - Bookletjgrav667100% (1)

- ConfidenceDokument1 SeiteConfidenceMy Scribd IINoch keine Bewertungen

- HakanssonLindqvistVlachos2015 SortingDokument82 SeitenHakanssonLindqvistVlachos2015 SortingtorosterudNoch keine Bewertungen

- SupplementDokument16 SeitenSupplementtorosterudNoch keine Bewertungen

- ABayesianDSGEModelOfStockMarketBu Preview PDFDokument51 SeitenABayesianDSGEModelOfStockMarketBu Preview PDFtorosterudNoch keine Bewertungen

- Deferra CV PDFDokument4 SeitenDeferra CV PDFtorosterudNoch keine Bewertungen

- Jep 30 4 3 PDFDokument28 SeitenJep 30 4 3 PDFtorosterudNoch keine Bewertungen

- 2015 QualityChess CatalogDokument2 Seiten2015 QualityChess CatalogtorosterudNoch keine Bewertungen

- Fama On Bubbles: Tom Engsted January 2015Dokument11 SeitenFama On Bubbles: Tom Engsted January 2015torosterudNoch keine Bewertungen

- Time For Men To Catch Up On Women?: A Study of The Swedish Gender Wage Gap 1973-2012Dokument35 SeitenTime For Men To Catch Up On Women?: A Study of The Swedish Gender Wage Gap 1973-2012torosterudNoch keine Bewertungen

- Centre D'economie de La Sorbonne: Documents de Travail DuDokument21 SeitenCentre D'economie de La Sorbonne: Documents de Travail DutorosterudNoch keine Bewertungen

- Finance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.CDokument53 SeitenFinance and Economics Discussion Series Divisions of Research & Statistics and Monetary Affairs Federal Reserve Board, Washington, D.CtorosterudNoch keine Bewertungen

- Intellectual Property Rights, Technology Diffusion, and Agricultural DevelopmentDokument44 SeitenIntellectual Property Rights, Technology Diffusion, and Agricultural DevelopmenttorosterudNoch keine Bewertungen

- Document de Travail: "Keeping-Up With The Joneses, A New Source of Endogenous Fluctuations"Dokument13 SeitenDocument de Travail: "Keeping-Up With The Joneses, A New Source of Endogenous Fluctuations"torosterudNoch keine Bewertungen

- Very Important Journal ArticleDokument62 SeitenVery Important Journal ArticletorosterudNoch keine Bewertungen

- PI 041 1 Draft 3 Guidance On Data Integrity 1Dokument52 SeitenPI 041 1 Draft 3 Guidance On Data Integrity 1Yolanda PerezNoch keine Bewertungen

- Essay Writing FCE Part 1 - Sample Task # 5 - Technological DevelopmentsDokument3 SeitenEssay Writing FCE Part 1 - Sample Task # 5 - Technological DevelopmentsMaria Victoria Ferrer Quiroga100% (1)

- Macbeth - Themes and MotifsDokument5 SeitenMacbeth - Themes and MotifsCat Caruso100% (3)

- The Problem of EvilDokument13 SeitenThe Problem of Evilroyski100% (2)

- Conflict Resolution in Community Setting (Part-II)Dokument20 SeitenConflict Resolution in Community Setting (Part-II)S.Rengasamy100% (3)

- Case Study Evaluation RubricDokument1 SeiteCase Study Evaluation RubricalamtareqNoch keine Bewertungen

- Fahmy 2015Dokument7 SeitenFahmy 2015Yasser Alghrafy100% (1)

- Future Namibia - 2nd Edition 2013 PDFDokument243 SeitenFuture Namibia - 2nd Edition 2013 PDFMilton LouwNoch keine Bewertungen

- Bible Parser 2015: Commentaires: Commentaires 49 Corpus Intégrés Dynamiquement 60 237 NotesDokument3 SeitenBible Parser 2015: Commentaires: Commentaires 49 Corpus Intégrés Dynamiquement 60 237 NotesCotedivoireFreedomNoch keine Bewertungen

- Guidelines Public SpeakingDokument4 SeitenGuidelines Public SpeakingRaja Letchemy Bisbanathan MalarNoch keine Bewertungen

- Map of The Agora of AthensDokument1 SeiteMap of The Agora of Athensrosana janNoch keine Bewertungen

- Under Down UnderDokument698 SeitenUnder Down Underttreks100% (3)

- Timothy Leary - Space Migration SMIILE PDFDokument53 SeitenTimothy Leary - Space Migration SMIILE PDFRichard Woolite100% (1)

- Bayan, Karapatan Et Al Vs ErmitaDokument2 SeitenBayan, Karapatan Et Al Vs ErmitaManuel Joseph FrancoNoch keine Bewertungen

- George Barna and Frank Viola Interviewed On Pagan ChristianityDokument9 SeitenGeorge Barna and Frank Viola Interviewed On Pagan ChristianityFrank ViolaNoch keine Bewertungen

- About QliphothDokument6 SeitenAbout Qliphothsergeik.scribd100% (1)

- Hart Fuller DebateDokument10 SeitenHart Fuller DebatePulkit GeraNoch keine Bewertungen

- Level 3 Health and Social Care PackDokument735 SeitenLevel 3 Health and Social Care PackGeorgiana Deaconu100% (4)

- Philippine Christian University Samploc I, City of Dasmarinas Cavite Master of Arts in EducationDokument12 SeitenPhilippine Christian University Samploc I, City of Dasmarinas Cavite Master of Arts in EducationOxymoronic BlasphemyNoch keine Bewertungen

- Patient Autonomy and RightDokument24 SeitenPatient Autonomy and RightGusti Ngurah Andhika P67% (3)

- Victim Compensation: Adv. Mandar LotlikarDokument4 SeitenVictim Compensation: Adv. Mandar LotlikarDeepsy FaldessaiNoch keine Bewertungen

- 9 Vidhyas From ShashtraDokument4 Seiten9 Vidhyas From ShashtrabantysethNoch keine Bewertungen

- Albert Einstein: Einstein's Early YearsDokument21 SeitenAlbert Einstein: Einstein's Early YearsAimee HernandezNoch keine Bewertungen

- Connotative Vs Denotative Lesson Plan PDFDokument5 SeitenConnotative Vs Denotative Lesson Plan PDFangiela goc-ongNoch keine Bewertungen

- Heart of ThelemaDokument15 SeitenHeart of ThelemaSihaya Núna100% (1)

- Boscombe Valley MisteryDokument20 SeitenBoscombe Valley Misteryronie1988Noch keine Bewertungen

- Unesco - SASDokument4 SeitenUnesco - SASmureste4878Noch keine Bewertungen

- 235414672004Dokument72 Seiten235414672004Vijay ReddyNoch keine Bewertungen

- My Husband Wants To Spend My Inheritance MoneyDokument2 SeitenMy Husband Wants To Spend My Inheritance MoneyDANIELANoch keine Bewertungen

- Art Subject, Source of Subject, Type of Subject, Content of ArtDokument56 SeitenArt Subject, Source of Subject, Type of Subject, Content of ArtJanela Aviles100% (5)