Beruflich Dokumente

Kultur Dokumente

The Birth of Dunia (B) - Time To Actively Start Lending

Hochgeladen von

ajaxor0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

310 Ansichten17 SeitenStrategy

Originaltitel

The Birth of Dunia (B)- Time to Actively Start Lending

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenStrategy

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

310 Ansichten17 SeitenThe Birth of Dunia (B) - Time To Actively Start Lending

Hochgeladen von

ajaxorStrategy

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 17

Singapore Management University

Institutional Knowledge at Singapore Management University

Case Collection Case Writing Initiative

6-2013

Te Birth of Dunia (B): Time To Actively Start

Lending?

Swee Liang Tan

Singapore Management University, sltan@smu.edu.sg

Kevin Sproule

sproule@gmail.com

Venkataraman S N

Singapore Management University, snvenkat@smu.edu.sg

Follow this and additional works at: htp://ink.library.smu.edu.sg/cases_coll_all

Part of the Business Administration, Management, and Operations Commons, Corporate

Finance Commons, and the Finance and Financial Management Commons

Tis Case is brought to you for free and open access by the Case Writing Initiative at Institutional Knowledge at Singapore Management University. It

has been accepted for inclusion in Case Collection by an authorized administrator of Institutional Knowledge at Singapore Management University. For

more information, please email libIR@smu.edu.sg.

Citation

Tan, Swee Liang; Sproule, Kevin; and S N, Venkataraman. Te Birth of Dunia (B): Time To Actively Start Lending?. (2013). Case

Collection.

Available at: htp://ink.library.smu.edu.sg/cases_coll_all/47

SMU-12-0005B

This case was written by Professor Tan Swee Liang, Kevin Sproule and S. Venkataramanan at the Singapore

Management University. The case

intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised

certain names and other identifying information to pro

Copyright 2013, Tan Swee Liang, Kevin Sproule and S. Venkataramanan

THE BIRTH OF DUNIA (B

LENDING?

It was not without long nights and

business on September 29,

beginning to chief risk officer (CRO) Raman Krishnan. After all, opening the doo

on the lights seemed straightforward when compared to underwriting millions of dollars in

loans during a time of unprecedented

On April 16, 2009, Krishnan

2009. Given the macro-economic indicators,

they did. Dunia had just finished its second full quarter of operation

cautiously optimistic about the early returns. He thought about the collapse of Lehman Brothers

on September 15, 2008, and the financial crisis that had persisted worldwide. Despite this crisis

Dunia was lending and people were paying.

some signs that troubled Krishnan. The number of people that had left the U

Emirates altogether and defaulted on their loans

prices had plummeted. The

fallen 31% since the Lehman Brothers

The challenge that confronted Krishnan

companys money. Dunia

need to accelerate. At the end of 2008

it had over ten dollars sitting in the bank

growth targets set out in its

more and expand its portfolio quickly.

Krishnan was preparing hi

scrutinised in great detail.

review to be conducted with all of

Kakar, felt a critical component of operating the young business in

review of even the most fundamental components of the business. To facilitate this

management team was to

real loan applications, and

on their feedback, lessons learned

loan approving officers. Krishnan

thinking about what underwriting decision he would make on each one.

As he went through the list

macro strategy for risk would also have implications on the loan approvals he had in front of

him. Similarly he knew that

company strategy. While the

1

As measured by the S&P500 Index

Google Finance, http://www.google.com/finance?cid=626307

This case was written by Professor Tan Swee Liang, Kevin Sproule and S. Venkataramanan at the Singapore

The case was prepared solely to provide material for class discussion. The authors do not

intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised

identifying information to protect confidentiality.

Copyright 2013, Tan Swee Liang, Kevin Sproule and S. Venkataramanan

HE BIRTH OF DUNIA (B): TIME TO ACTIVELY START

It was not without long nights and some hard decisions, but Dunia opened

29, 2008. As big as the decision to launch was, it seemed like just the

fficer (CRO) Raman Krishnan. After all, opening the doo

on the lights seemed straightforward when compared to underwriting millions of dollars in

unprecedented uncertainty in the midst of a worldwide financial crisis

Krishnan received the preliminary financial report for the first quarter of

economic indicators, he did not expect the numbers to look as good as

they did. Dunia had just finished its second full quarter of operation,

cautiously optimistic about the early returns. He thought about the collapse of Lehman Brothers

and the financial crisis that had persisted worldwide. Despite this crisis

Dunia was lending and people were paying. But not everything was positive

some signs that troubled Krishnan. The number of people that had left the U

altogether and defaulted on their loans with the banking system

prices had plummeted. The global economy was getting worse, and the U

% since the Lehman Brothers collapse.

1

confronted Krishnan was how to begin loaning the vast majority of the

companys money. Dunia had been extremely cautious with its first loans, but the pace would

need to accelerate. At the end of 2008, for every dollar the company had underwritten in a loa

ten dollars sitting in the bank available for lending. To make money

its investment plan to shareholders, Dunia would need to lend much

portfolio quickly.

Krishnan was preparing his risk report for the boards approval, and he knew it would be

He also had a more immediate priority, which was

with all of the top Dunia management. The CEO of Dunia, Rajeev

Kakar, felt a critical component of operating the young business in such uncertain times

review of even the most fundamental components of the business. To facilitate this

to kick off the meeting by offering their own independent

and stating whether they would approve them and for how much.

lessons learned would be collated and communicated to the sales team and

Krishnan began analysing the 30 loan entries in full detail

thinking about what underwriting decision he would make on each one.

As he went through the list, he knew that the two ideas were linked. His decision about the

macro strategy for risk would also have implications on the loan approvals he had in front of

him. Similarly he knew that the approval of a loan would have to match

While the financial plans approved by the board of directors envisaged an

As measured by the S&P500 Index Value on September 5, 2008 (1,242.31) compared to the value on April 9, 2009 (856.56)

http://www.google.com/finance?cid=626307, accessed December 2012.

This case was written by Professor Tan Swee Liang, Kevin Sproule and S. Venkataramanan at the Singapore

was prepared solely to provide material for class discussion. The authors do not

intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised

Version: 2013-05-10

START

opened its first branch for

2008. As big as the decision to launch was, it seemed like just the

fficer (CRO) Raman Krishnan. After all, opening the doors and turning

on the lights seemed straightforward when compared to underwriting millions of dollars in

in the midst of a worldwide financial crisis.

the preliminary financial report for the first quarter of

he did not expect the numbers to look as good as

, and Krishnan was

cautiously optimistic about the early returns. He thought about the collapse of Lehman Brothers

and the financial crisis that had persisted worldwide. Despite this crisis,

ot everything was positive, and there were

some signs that troubled Krishnan. The number of people that had left the United Arab

with the banking system had increased. Oil

economy was getting worse, and the U.S. stock market had

was how to begin loaning the vast majority of the

first loans, but the pace would

had underwritten in a loan,

. To make money and meet the

would need to lend much

and he knew it would be

which was a sample portfolio

top Dunia management. The CEO of Dunia, Rajeev

such uncertain times was a

review of even the most fundamental components of the business. To facilitate this, the senior

own independent assessment of

whether they would approve them and for how much. Based

would be collated and communicated to the sales team and

full detail, and started

he knew that the two ideas were linked. His decision about the

macro strategy for risk would also have implications on the loan approvals he had in front of

f a loan would have to match Dunias overall

irectors envisaged an

Value on September 5, 2008 (1,242.31) compared to the value on April 9, 2009 (856.56)

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

2/16

aggressive ramp-up of lending, Krishnan would have to tell the companys management what

risk they could take on in a predictable fashion, and how to appropriately price that risk and

all this would be at a time when risk had become completely unpredictable.

The economy in the UAE after Lehman Brothers

After the collapse of Lehman Brothers in September 2008, the confidence in capital markets

around the world was shaken. The UAE economy was largely based on tourism and oil, both of

which were slowing. The price of a barrel of oil had already fallen from over US$100 in

September 2008 to US$52 in April 2009.

2

However, despite the external pressures, the overall outlook on the UAE was more positive

than many other countries. Growth rates were forecast in the mid-3% range, which was down

about 2% from 2008, but still above the negative growth rates forecasted in many developed

economies.

3

The central bank had infused significant capital into the financial markets and had

taken steps to mitigate the financial crisis from coming to the UAE. Headlines from the local

finance periodical Moneyworks, read UAE Property Market Starting to Stabilise: Landmark

Advisory and Markets Show Signs of Recovery. However, the internal view was that while

the worst might be over, the UAE was not yet in recovery mode.

Dunia gets started

The first branch opened as scheduled on September 29, 2008, in Abu Dhabi. The Hamdan

branch was located in central Abu Dhabi near a crowded Emirates grocery store. The branch

reflected the distribution strategy of Dunia. First, every customer would be met at the door by a

dedicated greeter. Once the greeter assessed the nature of the visit, he or she would get the

appropriate customer relation manager, or set the customer up with the general services counter

for matters like cash withdrawals or bill payments. Each centre was equipped to handle a

variety of questions, and it was opened during convenient hours to allow for customers to get

there when it fit their schedule.

The central Dunia contact centre had also come together nicely. The centre was staffed to

handle any customer call or email 24 hours a day. Dunia wanted to ensure that a customer

could always get an answer to his or her question. Potential customers were also reached in a

variety of ways. Ad campaigns and solicitations were taken out in newspapers, TV, internet,

and mobile phones. The customer had multiple channels to reach Dunia and that was driven

from day one. There were also plans to expand beyond the first branch within the next 12-18

months.

Dunias reaction to the Lehman collapse

The Lehman collapse made headlines worldwide in September 2008. The fall of a 158-year-old

finance company sent shockwaves around the world and made the idea of worldwide recession

even more plausible. Dunia was launched 14 days later and had to change course. Its unique

value proposition and go-to-market strategy were challenged. After presenting its ideas to the

board, it did launch, but not without taking some steps to mitigate potential risk, and setting an

adequate price for the risk they were assuming.

2

The Intercontinental Exchanges Brent Crude Oil stood at US$101.30 on September 10 2008 and US51.72 on April 16 2009. The

Intercontinental Exchange, ICE Brent Index, https://www.theice.com/marketdata/reports/ReportCenter.shtml, accessed

December 2012.

3

IMF Statistics, UAE, April 2012, http://www.imf.org/external/pubs/ft/scr/2012/cr12136.pdf, accessed December 2012.

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

3/16

Specifically Dunia changed its strategy in regard to loaning to the lowest income segment,

Dunia Money, by raising the minimum monthly qualifying income over two times. It also

raised the interest rates it charged on its loans (refer to Exhibit 1 for market segment interest

rates). The company then lowered the overall value of each loan to reduce the exposure to a

single customer (refer to Exhibit 2 for average loan size). Additional documentation was

requested prior to the loans being approved. Dunia also restricted lending to certain industries

which it viewed as high risk (refer to Exhibit 3 for risk response by Dunia).

However, as a consequence to the increased stringency in guidelines, by the end of the first few

months, Dunia had only underwritten loans to the tune of about 10% of its total equity, which

meant it had a lot more lending to do. Each instance of credit tightening was reducing the size

of the target market - resulting in lower sales than planned. Apart from the balance sheet impact

of the reduced volumes versus original plan, this was causing real frustration amongst the sales

teams.

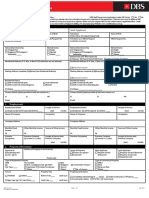

Approving the first loan

Dunia wrote its first check shortly after the Hamdan branch opened. First a customer would fill

in the comprehensive application. This required significant background on the potential

applicant. The application collected the customers name and resident status, current employer

and existing liability information. It also collected information about home country resident

status for those who were expatriates (refer to Exhibit 4 for a copy of the application form).

This form required supporting documentation and was designed to ensure the validity of the

information on the form.

Working without a credit bureau

On-us versus off-us behaviour

A central tenet of the Dunia strategy was the successful deployment of analytics, which was

used to provide excellent customer service. Krishnan realised that analytics tools were very

useful to his risk team, as they were critical to understanding the interplay between risk,

revenue and response. As he commented:

My unit is the biggest consumer of analytics. So what are the main uses? There is flexible

MIS [Management Information Systems] and reporting, they facilitate rapid cross selling,

effective portfolio management based on early indicators and then the three Rs: risk

revenue and response. It is not just about risk management, but about managing risk,

revenue and response. And obviously none of this is a substitute for sound judgment.

The analytics tools would facilitate a customer level risk profile, which was especially

important considering the lack of a comprehensive credit bureau in the UAE. Analytics proved

so central that Dunia structured its product offering to support gathering critical customer

information. Krishnan remarked on the effort to provide data to the analytics team:

While most financial institutions would launch a credit card many years after launch,

Dunia launched its credit card almost immediately after launch. Now what does this do?

It provides a very powerful tool to understand on us behaviour more than just loan

payment behaviour. For a loan, what is the behaviour? Did the customer pay or not? If

the customer paid, did he pay on time or did he pay late? Whereas on a credit card, the

behaviour of a customer can be a lot more than that. Its utilization, velocity of utilization,

how fast did customers ramp up their card, what kind of merchants did they spend with,

what are their repayment ratios, are they transactors or revolvers? If customers are

revolvers, are they paying exactly the minimum at 5% or are they paying 50% or 80%?

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

4/16

Are you a cash user or not, and if you are a cash user, are you a consistent cash user?

There is a whole lot of information sitting in there, which you can use for your

behavioural analysis.

When credit card and loan data were merged, Krishnan hoped to have a clear picture of a

customer and his or her credit worthiness.

He felt this was critical as the analytics would feed into other parts of the business. For example,

analytics also provided a way to reward the customer. With spending behaviour, Dunia would

analyse the credit history of customers and extend higher credit limits where appropriate. This

provided a strong incentive to many of the target Dunia customers as they got more access to

credit for sound payment history. Analytics also fed the call centre operations. With an

effective analytics-based view of the customer, the company would be able to offer

complementary products and cross-sell other Dunia services. With such a heavy focus on

analytics, the call centre soon transformed from a cost centre to a profit centre due to these

cross-selling activities.

Verification process

Another core component of Dunias risk mitigation efforts was the verification of the applicant.

In other words, this process involved not only looking at the information that was provided on

the loan application, but also independently verifying that it was in fact true. Krishnan said of

Dunias first efforts:

Field verification was required for 100% of the cases; once our sales force went to an

office to source a customer, we initiated an independent verification so someone from our

team would go out and meet the customer independently at the office.

With a member of the risk team also independently verifying the details of the loan application,

Krishnan felt that this helped avoid the incentive of a sales person pushing through loans

without a full verification. This was all part of Dunias overall strategy to get as much

information as they could, and with credit card transaction data and independently verified

application data, it hoped to mitigate the uncertainty inherent in not having a comprehensive

credit bureau.

The application had several pieces of information that would be verified and considered in the

credit decision. The data collected fell into some of the following categories:

1. Monthly income

2. Employer details (name of employer, type of employer, e.g., top tier multinational, self-

employed, etc.)

3. Contact information (e.g., phone number, email address, etc.)

4. Years with present and previous companies

5. Vehicle and home ownership

6. Details of existing loans

An effort was made, where possible, to verify the information given by the applicant through

independent verification. For example, monthly income could be verified with company pay

stubs, and contact and income information could be verified with the employer. Internal

consistency of the same piece of information gathered from various sources was also

considered. Every effort was made to collect and review relevant information to facilitate the

credit decision.

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

5/16

Some of the numbers are in

By March 2009, the final numbers for the 2008 annual report had been audited by Price

Waterhouse Coopers. Krishnan also had the numbers for the first quarter 2009. Dunia had been

operating for two full quarters, and he had data on six months of lending activity. Two things

gave him cause for concern. The first was the early delinquency trend. As measured by the

loans that were more than 30 days late in payment, the loans that Dunia had made in November

2008 had a delinquency rate four times greater than its benchmark. This was the benchmark

that Dunia had set based on past experience, and the delinquency that Krishnan observed was

worrisome. He felt that for such a young tenure of loans, not seeing a steady stream of

payments was a source of significant concern. Moreover, delinquencies in the first month had

fallen initially after November 2008, but had now been rising to levels that alarmed Krishnan.

In fact a measure of all loans made to date when Dunia hit the four-month market were more

than three times what the company had deemed an acceptable level (refer to Exhibit 5 for loan

delinquency trends).

The second was the larger macro-economic picture. The stresses that the UAE had witnessed in

November 2008 were still there, and showed signs of getting worse. Oil prices were down, and

the price of credit default swaps (which was one of the key triggers of the financial crisis) was

highly volatile and exposed a significant risk (refer to Exhibit 6 for global oil prices). Various

experts had varied views on what this meant. The credit rating agency, Moodys said:

The very high ratings of the Federal Government of the United Arab Emirates (UAE) are

resistant to the steep fall that has been recorded in international oil prices since July

2008. The core assumption that underpins Moody's Aa2 ratings is that the Federal

Government is fully supported by the government of Abu Dhabi, also rated Aa2. Even if

oil prices were to fall below $30 per barrel, the Abu Dhabi government has recourse to a

large stock of offshore financial assets.

4

However, the financial industry, with a less direct link to the government of Abu Dhabi had a

less sanguine view. Fitchs Dubai director Robert Thursfield observed:

Fitch's outlook for GCC [Gulf Cooperation Council] banks has become less favourable

as it has become evident that the region's banks and financial institutions will not be able

to fully insulate themselves from the global credit crisis. GCC banks are now feeling the

effects of the crisis, which is likely to cause deterioration in banking sector profitability

and capitalisation going forward.

5

Standard & Poors analyst Farouk Soussa said of his companys rating:

The outlook revision reflects the impact of the difficult global macroeconomic and

financing environment on the Emirate of Dubai (not rated) The medium-term risks to

Dubais economy have, in our view, increased as demand in the all-important real estate

sector shows clear signs of abating, raising the possibility of a sharp correction in the

real estate market, and an associated contraction in development and construction.

6

4

Moodys: UAE Sovereign Rating Not Threatened by Oil Price Fall, Global Credit Research Moodys Investor Services,

December 30, 2008, http://www.moodys.com/research/Moodys-UAE-sovereign-rating-not-threatened-by-oil-price-fall--

PR_170191, accessed January 2013.

5

K. S. Sreekumar, Creditworthiness Questioned, Gulf Weekly, January 14, 2009,

http://www.gulfweeklyworldwide.com/Articles.aspx?articleid=21191, accessed January 2013.

6

Outlook on Few Government-related Entities Negative on Deteriorating Economic Outlook, Dubai Chronicle, December 17,

2008. http://www.dubaichronicle.com/2008/12/17/outlook-on-some-government-related-entities-negative-on-deteriorating-

economic-outlook/, accessed January 2013.

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

6/16

These were troubling signs for Krishnan, and as he got ready for his meeting with the senior

management team, he had two things on his mind. The first was the 30 individual loan

applications he would have to provide his credit and risk assessment on (refer to Exhibit 7 for

details of the 30 loan applications). And second, his comments on those would also drive the

overall risk strategy of Dunia going forward.

He realized that his rationale for approving or rejecting the loans would articulate the broader

lending strategy. He would thus need to understand what risk would be appropriate for Dunia,

and then make his case in both the micro sense, with the individual accounts, and then more

broadly across the whole portfolio. If the credit criteria were tightened further given the macro

stress as well as the early delinquency indicators, there would be additional challenges in terms

of managing the sales force and their motivation levels, given the ensuing inevitable reduction

in volumes. Further, there would be a need to understand how and from where to source

sufficient number of potential borrowers, who would satisfy the revised criteria and also enable

Dunia to meet the planned growth numbers.

Krishnan had his work cut out for him and it was time to get started.

SMU-12-0005B

EXHIBIT 1: TRENDS OF

(RANGE

Source: Dunia Internal Information

Source: Dunia Internal Information

25.0%

27.0%

29.0%

31.0%

33.0%

35.0%

37.0%

39.0%

41.0%

Oct-08 Dec

BASE

0

20

40

60

80

100

120

Oct-08

L

o

a

n

s

i

z

e

i

n

d

e

x

-

O

c

t

2

0

0

8

=

1

0

0

Trends of average loan size index

Dunia (B): Time to

7/16

TRENDS OF INTEREST RATES ON LOAN SEGMENTS

(RANGE: BASE OF 8%, GOING UP TO + 8%)

Source: Dunia Internal Information

EXHIBIT 2: AVERAGE LOAN SIZE

Source: Dunia Internal Information

Dec-08 Jan-09 Mar-09 Apr-09

Interest Rates

08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09

Trends of average loan size index - Oct 2008 to Apr 2009

Time to Actively Start Lending?

AN SEGMENTS

MAF

SMM

SEMM

09 Apr-09

Oct 2008 to Apr 2009

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

8/16

EXHIBIT 3: RISK RESPONSE AT DUNIA

Source: Dunia Internal Information

External Outlook Internal Response

Pre Sep 2008:

Irrational exuberance

Aggressive growth in

asset prices

High inflation

Record growth in

consumer lending

High leverage

Low income eligibility requirements

Aggressive credit policies

Lower pricing

Sep08 to May09:

Lehman bankruptcy

Bailouts of Too Big to

Fail organizations by

taxpayer

Tighter credit

Liquidity dried up

Asset bubbles burst

Oil prices plummeted

Significant increase in income

eligibility requirements

Blacklisted construction sector

Significant increase in lending rate

Tighter credit

Higher

documentation

More evidence

required of

banking and other

credit behaviour

required

Field visits for

every case

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

9/16

EXHIBIT 4: APPLICATION FORM FOR OPENING AN ACCOUNT RELATIONSHIP

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

10/16

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

11/16

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

12/16

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

13/16

EXHIBIT 5: LOAN DELINQUENCY RATES (INDEXED, IDEAL = 100)

Note: This chart presents the delinquency indicator against an ideal of 100. The Y-axis denotes

when the loan was originated, and the X-axis denotes months from initial booking. For example

355 for Jan-09 at M3 would mean loans originated in January 2009 when looking at payments

made on those loans in April 2009 had a delinquency rate 3.55 times higher than ideal.

Source: Dunia Internal Information

Month M1 M2 M3 M4 M5

Nov-08 468 339 310 397 335

Dec-08 131 292 278 273

Jan-09 193 297 355

Feb-09 443 298

Mar-09 465

SMU-12-0005B

ICE Brent Crude Oil 1 Month Delivery

Source: Market Data, Financial Times

http://markets.ft.com/research/Markets/Tearsheets/Summary?s=IB.1:IEU

Dunia (B): Time to

14/16

EXHIBIT 6: GLOBAL OIL PRICES

ICE Brent Crude Oil 1 Month Delivery

Financial Times,

http://markets.ft.com/research/Markets/Tearsheets/Summary?s=IB.1:IEU, accessed January 2013.

Time to Actively Start Lending?

, accessed January 2013.

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

15/16

EXHIBIT 7: SAMPLE OF 30 LOAN APPLICATIONS

Applicant Number 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Result Good Good Rejected Good Bad Rejected Rejected Good Bad Bad Rejected Good Good Rejected Rejected

Gender M F M F M F F M M M M M M M M

Nationality Foreigner Foreigner Foreigner Foreigner Local Foreigner Foreigner Foreigner Foreigner Foreigner Foreigner Foreigner Foreigner Foreigner Foreigner

Fixed income amt US$ 625 900 1,400 1,500 1,700 1,700 1,800 1,908 2,000 2,000 2,000 2,000 2,400 2,500 2,500

Variable income amt 400 400 0 600 0 110 0 0 0 0 1400 1600 0 0

Type of co employed Top tier Top tier

Small

business

Large local

corporate

Top tier Mid-range Top tier Mid-range Top tier Mid-range Top tier

Large local

corporate

Top tier Top tier Mid-range

Availability of home

telephone number - Y/N

Y Y Y Y Y Y Y Y Y Y Y Y N Y Y

Availability of office

telephone number - Y/N

Y N Y Y Y Y Y N Y Y Y N Y Y Y

Availability of mobile

telephone number - Y/N

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Availability of personal

email address - Y/N

Y Y Y Y N Y Y Y Y Y N Y Y N N

Availability of office email

address - Y/N

N N Y N N N N N Y N N N N N N

Marital status Married Married Married Married Single Single Single Single Single Single Single Married Married Married Married

Age 42 37 54 36 28 37 24 27 40 35 30 54 57 50 30

Family in UAE - Y/N Y Y N Y N N N N N N N Y Y N Y

Spouse working - Y/N N Y N Y N N N N N N N N N N N

If spouse working, monthly

income

0 1000 0 1500 0 0 0 0 0 0 0 0 0 0

Type of accommodation Rented

Company

Provided

Rented

Shared

Accomm

Company

Provided

Rented

Company

Provided

Company

Provided

Rented

Company

Provided

Rented Rented

Company

Provided

Company

Provided

Rented

Rental paid US$ 285 575 500 920 0 1,000 0 570 300 0 200 980 1,085 0 400

Vehicle ownership - Y/N Y Y N N N Y N Y N N N Y N N N

Make and model of vehicle

Toyota

Corolla

Hyundai

Getz

Premier

Vehicle financed - Y/N Y N N N N

Home ownership in UAE -

Y/N

N N N N N N N N N N N N

Total work experience 13 2 29 8 4 4 2 5 10 11 7 26 34 13 2

Details of existing loans

US$

PIL EMI

155

PIL EMI

215

PIL EMI

315

PIL 600 0

PIL EMI

600

PIL EMI

500

PIL EMI

700

PIL EMI

750

Auto EMI

510

Details of existing credit

cards US$ limit

3025 818 4000 1250

2 cards

15,000 limit

1 card, 400

limit

4000 6648 20000

SMU-12-0005B Dunia (B): Time to Actively Start Lending?

16/16

Applicant Number 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30

Result Rejected Good Good Good Bad Rejected Rejected Good Good Good Bad Rejected Bad Bad Good

Gender M F F M M M M M M F M M M M M

Nationality Foreigner Local Local Foreigner Local Foreigner Local Local Foreigner Local Foreigner Local Foreigner Foreigner Foreigner

Fixed income amount

US$

2,500 2,618 2,800 2,906 3,000 3,000 3,000 3,329 3,400 3,800 12,000 14,000 30,000 40000 Variable

Variable income amount 0 1200 0 0 0 0 1800 1600 0 0 0 0

Type of co employed Top tier Top tier Top tier Top tier

Large local

corporate

Small

business

Large local

corporate

Large local

corporate

Top tier

Mid-

range

Self

employed

Self

employed

Self

employed

Self

employed

Self

employed

Availability of home

telephone number - Y/N

Y N Y Y Y Y Y N N Y Y Y Y Y Y

Availability of office

telephone number - Y/N

Y N N N Y Y Y N N N Y Y Y Y Y

Availability of mobile

telephone number - Y/N

Y Y Y Y Y Y Y Y Y Y Y Y Y Y Y

Availability of personal

email address - Y/N

Y Y Y Y Y Y Y Y Y Y N N Y Y Y

Availability of office

email address - Y/N

N N N N N Y N N N N N Y N N N

Marital status Married Single Married Single Single Single Married Married Married Married Married Single Single Married Married

Age 34 29 49 29 40 40 32 34 33 53 40 32 38 35 49

Family in UAE - Y/N N N Y N N N Y Y Y N N N N Y N

Spouse working - Y/N N N Y N N N Y Y Y N N N N N N

If spouse working,

monthly income

0 0 2000 0 0 0 1500 1800 2600 0 0 0 0 0 0

Type of accommodation Rented Rented Rented

Shared

Accomm

Company

Provided

Rented Rented

Company

Provided

Rented

Company

Provided

Rented Rented Rented Rented Rented

Rental paid US$ 300 780 1,225 875 0 300 860 2,215 1,125 600 1,250 1,500

Vehicle ownership - Y/N N N Y Y Y N Y Y Y Y Y Y Y Y Y

Make and model of

vehicle

Economy Mid-range

Toyota

Fortuner

Hyundai

Santa Fe

Economy Mid-range Luxury Economy

Vehicle financed - Y/N N Y Y Y N Y N Y

Home ownership in UAE

- Y/N

N N N N N N N N N N N N Y

Total work experience 1 7 20 1 4 17 2 12 10 25 7 1 14 7

Details of existing loans

US$

PIL EMI

1300

PIL EMI

200

PIL EMI

480

PIL plus

auto EMI

1500

PIL EMI

250, Auto

EMI 350

PIL EMI

125

PIL EMI

410,

Auto

EMI 500

PIL 2500

PIL + auto

2300

Details of existing credit

cards US$ limit

4088 4000 4000 6707 9401 2725

1 card 400

limit

4000

2 cards,

20,000

limit

5832

Source: Dunia Internal Information

Das könnte Ihnen auch gefallen

- Modelin NG Banks' ' Probabil Lity of de EfaultDokument23 SeitenModelin NG Banks' ' Probabil Lity of de Efaulthoangminhson0602Noch keine Bewertungen

- AOL.com (Review and Analysis of Swisher's Book)Von EverandAOL.com (Review and Analysis of Swisher's Book)Noch keine Bewertungen

- Il&Fs: Corporate Governance Nmims BangaloreDokument58 SeitenIl&Fs: Corporate Governance Nmims BangaloreAnkur KhareNoch keine Bewertungen

- Case 1 - Term Sheet Negotiations For Trendsetter Inc. Group 3Dokument10 SeitenCase 1 - Term Sheet Negotiations For Trendsetter Inc. Group 3Avanish Nagar 23Noch keine Bewertungen

- AssignmentDokument10 SeitenAssignmentaruakshNoch keine Bewertungen

- Deutsche Bank CIO Report Central Bank Digital CurrenciesDokument15 SeitenDeutsche Bank CIO Report Central Bank Digital CurrenciesForkLogNoch keine Bewertungen

- Securitization Case StudyDokument5 SeitenSecuritization Case Studymldc2011Noch keine Bewertungen

- Alternatives in Todays Capital MarketsDokument16 SeitenAlternatives in Todays Capital MarketsjoanNoch keine Bewertungen

- Organizational Behaviour Analysis - Group 4Dokument25 SeitenOrganizational Behaviour Analysis - Group 4Aqeela NajeebNoch keine Bewertungen

- Comparison of Banks in Pakistan As Per Their Market ShareDokument5 SeitenComparison of Banks in Pakistan As Per Their Market ShareBahria noty100% (1)

- Ai PDFDokument65 SeitenAi PDFKhadri MohammedNoch keine Bewertungen

- Determinnt of Banking Profitability - 2Dokument5 SeitenDeterminnt of Banking Profitability - 2thaonguyenpeoctieuNoch keine Bewertungen

- Case Study: Selecting A Trade BankerDokument5 SeitenCase Study: Selecting A Trade BankerMohit SahajpalNoch keine Bewertungen

- Tutorial 9 Q & ADokument2 SeitenTutorial 9 Q & Achunlun87Noch keine Bewertungen

- Roland Berger Study Banking Myanmar Sept PDFDokument28 SeitenRoland Berger Study Banking Myanmar Sept PDFYosia SuhermanNoch keine Bewertungen

- NBFC CrisisDokument12 SeitenNBFC CrisisvikuNoch keine Bewertungen

- Fintech and The Future of Finance GlossaryDokument14 SeitenFintech and The Future of Finance GlossaryAKINBONI MICHEALNoch keine Bewertungen

- Course - 307, LINDEBD VALUATION REPORT PDFDokument26 SeitenCourse - 307, LINDEBD VALUATION REPORT PDFFarzana Fariha LimaNoch keine Bewertungen

- Demica Report - SCFinternational - LinksDokument8 SeitenDemica Report - SCFinternational - LinksHitesh KamraNoch keine Bewertungen

- Teaching Note: Case AbstractDokument6 SeitenTeaching Note: Case AbstractOwel TalatalaNoch keine Bewertungen

- Pre-Delinquency Management (PDM) Solution: - Aniket Rane Neha SinghDokument16 SeitenPre-Delinquency Management (PDM) Solution: - Aniket Rane Neha SinghAniket RaneNoch keine Bewertungen

- Attrition ManagementDokument20 SeitenAttrition Managementvenkataswamynath channa100% (1)

- Zeroing in Anti Dumping PDFDokument27 SeitenZeroing in Anti Dumping PDFkartikeya gulatiNoch keine Bewertungen

- HRM-470-S1-Group-K (Union)Dokument29 SeitenHRM-470-S1-Group-K (Union)I.M.H. Hemal Chowdhury 1611692630100% (1)

- DBS Mortgage All-In-One Application Form 2016Dokument3 SeitenDBS Mortgage All-In-One Application Form 2016Viola HippieNoch keine Bewertungen

- Retail Banking and Wholesale BankingDokument6 SeitenRetail Banking and Wholesale BankingNiharika Satyadev Jaiswal100% (2)

- Ethics in Financial Analysis: Battlefield of Principles: "Transilvania" University of BrasovDokument7 SeitenEthics in Financial Analysis: Battlefield of Principles: "Transilvania" University of BrasovNATALIA CAMARGONoch keine Bewertungen

- SMRT - Internal Crisis LeadershipDokument27 SeitenSMRT - Internal Crisis Leadershipnidhi guptaNoch keine Bewertungen

- 'BOOTS Pension Fund Management TO CHECKDokument2 Seiten'BOOTS Pension Fund Management TO CHECKMatsatka VitaNoch keine Bewertungen

- Management of Management Department - Book Review by Prof MV MonicaDokument2 SeitenManagement of Management Department - Book Review by Prof MV MonicaMTC Global TrustNoch keine Bewertungen

- Fin 464Dokument4 SeitenFin 464Zihad Al AminNoch keine Bewertungen

- Ibps Capsule Part - 1: by Spread The KnowledgeDokument10 SeitenIbps Capsule Part - 1: by Spread The KnowledgePratiksha KapoorNoch keine Bewertungen

- Red Hat GlobalDokument14 SeitenRed Hat GlobalChester Connolly100% (1)

- AssignmentDokument1 SeiteAssignmentSheryar NaeemNoch keine Bewertungen

- Bfc5130 Case Studies in Banking and Finance Homework Dianrong Marketplace: Marketplace Lending, Blockchain, and The New Finance' in ChinaDokument1 SeiteBfc5130 Case Studies in Banking and Finance Homework Dianrong Marketplace: Marketplace Lending, Blockchain, and The New Finance' in ChinaAlex YisnNoch keine Bewertungen

- Case Analysis Questions PDFDokument2 SeitenCase Analysis Questions PDFcs55csNoch keine Bewertungen

- SME Rating AgencyDokument18 SeitenSME Rating Agencyashish_kanojia123341150% (2)

- Birlasoft CaseA PDFDokument30 SeitenBirlasoft CaseA PDFRitika SharmaNoch keine Bewertungen

- Posidex ExposureDokument1 SeitePosidex ExposureAkshay MahajanNoch keine Bewertungen

- A Review On Credit Card Default Modelling Using Data ScienceDokument7 SeitenA Review On Credit Card Default Modelling Using Data ScienceEditor IJTSRDNoch keine Bewertungen

- An Analysis of The Problems Facing The Banking Sector in ZimbabweDokument3 SeitenAn Analysis of The Problems Facing The Banking Sector in ZimbabweMarvelous Ngundu80% (10)

- Pssbooklet PDFDokument142 SeitenPssbooklet PDFForkLogNoch keine Bewertungen

- JAL Case Analyst ReportDokument24 SeitenJAL Case Analyst Reportuygh gNoch keine Bewertungen

- Faculty of Business Administration American International University - Bangladesh (AIUB) Report OnDokument22 SeitenFaculty of Business Administration American International University - Bangladesh (AIUB) Report OnAhamed ZubairNoch keine Bewertungen

- Grameen BankDokument5 SeitenGrameen BankNitin ChidrawarNoch keine Bewertungen

- CITT Decision: Frito-Lay v. CBSADokument25 SeitenCITT Decision: Frito-Lay v. CBSACUSLI NexusNoch keine Bewertungen

- CH 5 Bonds Book QuestionsDokument6 SeitenCH 5 Bonds Book QuestionsSavy DhillonNoch keine Bewertungen

- BN4206 Riks and ValueDokument10 SeitenBN4206 Riks and ValueKarma SherpaNoch keine Bewertungen

- Treasury Project Asset Liability ManagementDokument18 SeitenTreasury Project Asset Liability ManagementAISHWARYA CHAUHANNoch keine Bewertungen

- Case Study: Scenario 3 - University of Cambridge Moves To Online TeachingDokument28 SeitenCase Study: Scenario 3 - University of Cambridge Moves To Online TeachingElparth OfficialNoch keine Bewertungen

- GCC Wealth Insight ReportDokument23 SeitenGCC Wealth Insight ReporthoussamzreikNoch keine Bewertungen

- 5.0 RiskFoundation Install GuideDokument132 Seiten5.0 RiskFoundation Install GuideARIZKINoch keine Bewertungen

- Tamara Pitch Deck - BNPLDokument34 SeitenTamara Pitch Deck - BNPLimzobaer100% (2)

- Ziqitza Healthcare Limited Challenge of Scaling Up Emergency MedicalDokument18 SeitenZiqitza Healthcare Limited Challenge of Scaling Up Emergency MedicalYadav KrishnaNoch keine Bewertungen

- MFIN 6205 Final ReportDokument26 SeitenMFIN 6205 Final ReportAhmedMalikNoch keine Bewertungen

- HSBC Bank Bangladesh Powervantage Account (Pva)Dokument7 SeitenHSBC Bank Bangladesh Powervantage Account (Pva)carinagtNoch keine Bewertungen

- IB Presentation1Dokument17 SeitenIB Presentation1Bharti Virmani0% (1)

- Credit Derivatives: Techniques to Manage Credit Risk for Financial ProfessionalsVon EverandCredit Derivatives: Techniques to Manage Credit Risk for Financial ProfessionalsNoch keine Bewertungen

- Credit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsVon EverandCredit Risk Assessment: The New Lending System for Borrowers, Lenders, and InvestorsNoch keine Bewertungen

- Fixed Income Markets Assignment: TanushiDokument5 SeitenFixed Income Markets Assignment: TanushiTanushiNoch keine Bewertungen

- Nero's Pasta Case Study Analysis - Group 9Dokument9 SeitenNero's Pasta Case Study Analysis - Group 9ajaxorNoch keine Bewertungen

- Discrete StructureDokument89 SeitenDiscrete Structure2010GaneshNoch keine Bewertungen

- Social Cognitive Theory and Adoption of Ebook DevicesDokument15 SeitenSocial Cognitive Theory and Adoption of Ebook DevicesajaxorNoch keine Bewertungen

- WalmartDokument10 SeitenWalmartLương Thế CườngNoch keine Bewertungen

- Feedback Industry Report BicycleDokument24 SeitenFeedback Industry Report BicycleajaxorNoch keine Bewertungen

- Deployment ModelDokument2 SeitenDeployment ModelajaxorNoch keine Bewertungen

- Back Office StrategyDokument2 SeitenBack Office StrategyajaxorNoch keine Bewertungen

- Milton CycleDokument2 SeitenMilton CycleajaxorNoch keine Bewertungen

- 5 Samurai Case PDFDokument6 Seiten5 Samurai Case PDFajaxorNoch keine Bewertungen

- Markopolis 2014 - Case StudyDokument5 SeitenMarkopolis 2014 - Case StudyajaxorNoch keine Bewertungen

- Atlas CyclesDokument3 SeitenAtlas CyclesajaxorNoch keine Bewertungen

- Total SAP TablesDokument12 SeitenTotal SAP Tablesssurisetty99% (102)

- Trucking Through The CloudDokument6 SeitenTrucking Through The CloudajaxorNoch keine Bewertungen

- Beyond The Convergence: Outsourcing + SaasDokument3 SeitenBeyond The Convergence: Outsourcing + SaasajaxorNoch keine Bewertungen

- PEL Annual Report FY2013Dokument152 SeitenPEL Annual Report FY2013Neel ModyNoch keine Bewertungen

- Google Apps Stirs Governm: Hews AnDokument2 SeitenGoogle Apps Stirs Governm: Hews AnajaxorNoch keine Bewertungen

- Software Delivery ModelsDokument22 SeitenSoftware Delivery ModelsajaxorNoch keine Bewertungen

- 85097821Dokument2 Seiten85097821ajaxorNoch keine Bewertungen

- Saas - The Emerging Model For Packaged Software: Architecture ConsiderationsDokument3 SeitenSaas - The Emerging Model For Packaged Software: Architecture ConsiderationsajaxorNoch keine Bewertungen

- Look To The Clouds and Ask, "Why?": TrendsDokument2 SeitenLook To The Clouds and Ask, "Why?": TrendsajaxorNoch keine Bewertungen

- SAP BusinessObjects BI4.0 Installation Manual (Inclusive Mobile Configuration For Ipad)Dokument19 SeitenSAP BusinessObjects BI4.0 Installation Manual (Inclusive Mobile Configuration For Ipad)asimalampNoch keine Bewertungen

- Kiva Productions - SAP and Data WarehousingDokument21 SeitenKiva Productions - SAP and Data WarehousingcusvaiNoch keine Bewertungen

- Kiva Productions - SAP and Data WarehousingDokument21 SeitenKiva Productions - SAP and Data WarehousingcusvaiNoch keine Bewertungen

- Che 342 Practice Set I IDokument4 SeitenChe 342 Practice Set I IDan McNoch keine Bewertungen

- Tankguard AR: Technical Data SheetDokument5 SeitenTankguard AR: Technical Data SheetAzar SKNoch keine Bewertungen

- Inductive Grammar Chart (Unit 2, Page 16)Dokument2 SeitenInductive Grammar Chart (Unit 2, Page 16)Michael ZavalaNoch keine Bewertungen

- Visa Requirements Austrian EmbassyDokument2 SeitenVisa Requirements Austrian Embassyadalcayde2514Noch keine Bewertungen

- Reading Task CardsDokument2 SeitenReading Task CardscatnappleNoch keine Bewertungen

- Induction-Llgd 2022Dokument11 SeitenInduction-Llgd 2022Phạm Trúc QuỳnhNoch keine Bewertungen

- Data MiningDokument721 SeitenData MiningAuly Natijatul AinNoch keine Bewertungen

- Step Recovery DiodesDokument3 SeitenStep Recovery DiodesfahkingmoronNoch keine Bewertungen

- Unit 1: Exercise 1: Match The Words With The Pictures. Use The Words in The BoxDokument9 SeitenUnit 1: Exercise 1: Match The Words With The Pictures. Use The Words in The BoxĐoàn Văn TiếnNoch keine Bewertungen

- Web Server ProjectDokument16 SeitenWeb Server Projectمعتز العجيليNoch keine Bewertungen

- Transportation Problem VAMDokument16 SeitenTransportation Problem VAMLia AmmuNoch keine Bewertungen

- Keywords: Communication, Technology, Collaborative, Evaluative Learning, InnovativeDokument11 SeitenKeywords: Communication, Technology, Collaborative, Evaluative Learning, InnovativeNnamani EmmanuelNoch keine Bewertungen

- TreeSize Professional - Folder Contents of - CDokument1 SeiteTreeSize Professional - Folder Contents of - CHenrique GilNoch keine Bewertungen

- Lecture 3 - Marriage and Marriage PaymentsDokument11 SeitenLecture 3 - Marriage and Marriage PaymentsGrace MguniNoch keine Bewertungen

- q2 Long Quiz 002 EntreDokument8 Seitenq2 Long Quiz 002 EntreMonn Justine Sabido0% (1)

- Q3 Week 1 Homeroom Guidance JGRDokument9 SeitenQ3 Week 1 Homeroom Guidance JGRJasmin Goot Rayos50% (4)

- 15.910 Draft SyllabusDokument10 Seiten15.910 Draft SyllabusSaharNoch keine Bewertungen

- Chinaware - Zen PDFDokument111 SeitenChinaware - Zen PDFMixo LogiNoch keine Bewertungen

- Digest of Ganila Vs CADokument1 SeiteDigest of Ganila Vs CAJohn Lester LantinNoch keine Bewertungen

- QT1-EVNPMB2-0-NCR-Z-013 Water Treament System of AccommondationDokument3 SeitenQT1-EVNPMB2-0-NCR-Z-013 Water Treament System of AccommondationDoan Ngoc DucNoch keine Bewertungen

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDokument8 SeitenSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityCamille CastilloNoch keine Bewertungen

- Freelance Contract TemplateDokument7 SeitenFreelance Contract TemplateAkhil PCNoch keine Bewertungen

- Nepal CountryReport PDFDokument64 SeitenNepal CountryReport PDFnickdash09Noch keine Bewertungen

- CRM Module 1Dokument58 SeitenCRM Module 1Dhrupal TripathiNoch keine Bewertungen

- Siemens C321 Smart LockDokument2 SeitenSiemens C321 Smart LockBapharosNoch keine Bewertungen

- IMS DB Interview Questions: Beginner LevelDokument19 SeitenIMS DB Interview Questions: Beginner LevelsudhakarcheedaraNoch keine Bewertungen

- Kilifi HRH Strategic Plan 2018-2021Dokument106 SeitenKilifi HRH Strategic Plan 2018-2021Philip OlesitauNoch keine Bewertungen

- Integrated Recycling Systems: Harris Complete PackageDokument4 SeitenIntegrated Recycling Systems: Harris Complete PackageNicolás Toro ValenzuelaNoch keine Bewertungen

- Zapanta v. COMELECDokument3 SeitenZapanta v. COMELECnrpostreNoch keine Bewertungen

- OMS - Kangaroo Mother CareDokument54 SeitenOMS - Kangaroo Mother CareocrissNoch keine Bewertungen