Beruflich Dokumente

Kultur Dokumente

Nero's Pasta Case Study Analysis - Group 9

Hochgeladen von

ajaxor0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

393 Ansichten9 Seitencase study analysis

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldencase study analysis

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

393 Ansichten9 SeitenNero's Pasta Case Study Analysis - Group 9

Hochgeladen von

ajaxorcase study analysis

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 9

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Neros Pasta Inc. Case Study Analysis

SECTION 1

GROUP 9

Name FT No.

Aman Abbi FT-14105

Bansi Simaria FT-14115

Mrinal Jha FT-14137

Sathis Raj FT-14163

Arindam Roy FT-14184

Neha Singhal FT-141108

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 1:

The economically justifiable rationales for mergers are synergy and tax

consequences. Synergy occurs when the value of the combined firm exceeds the

sum of the values of the firms taken separately.(if synergy exists, then the whole

is greater than the sum of the parts, and hence synergy is also called the 2 + 2 =

5 effect.)

A synergistic merger creates value that must be apportioned between the

stockholders of the companies involved.Synergy can arise from four sources:

(1) Operating economies of scale in management, production, marketing, or

distribution;

(2) Financial economies, which could include higher debt capacity, lower

transactions costs, or better coverage by securities analysts that can lead

to higher demand and, hence, higher prices;

(3) Differential management efficiency, which implies that new management

can increase the value of a firms assets; and

(4) Increased market power due to reduced competition.

Operating and financial economies are socially desirable, as are mergers that

increase managerial efficiency. However, mergers that reduce competition are

both undesirable and at times, illegal.

Another valid rationale behind mergers is tax considerations.For example, a firm

that is highly profitable and consequently in the highest corporate tax bracket

could acquire a company with large accumulated tax losses, and immediately use

those losses to shelter its current and future income.

The motives that are generally less supportable on economic grounds are risk

reduction, purchase of assets at below replacement cost, control, and

globalization.Managers often state that diversification helps to stabilize a firms

earnings stream and thus reduces total risk, and hence benefits

shareholders.Stabilization of earnings is certainly beneficial to a firms

employees, suppliers, customers, and managers.However, if a stock investor is

concerned about earnings variability, he or she can diversify more easily than

can the firm. Why should Firm A and Firm B merge to stabilize earnings when

stockholders can merely purchase both stocks and accomplish the same thing?

Further, we know that well-diversified shareholders are more concerned with a

stocks market risk than its stand-alone risk, and higher earnings instability does

not necessarily translate into higher market risk.

Sometimes a firm will be touted as a possible acquisition candidate because the

replacement value of its assets is considerably higher than its market value.For

example, in the early 1980s, oil companies could acquire reserves more cheaply

by buying out other oil companies than by exploratory drilling.However, the

value of an asset stems from its expected cash flows, not from its cost.Thus,

paying $1 million for a slide rule plant that would cost $2 million to build from

scratch is not a good deal if no one uses slide rules.

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 2:

In a friendly merger, there is an agreement between the management of the

acquiring firm and the management of the target firm. In most cases, the acquiring

firm initiates the action, and the rest of the time, the target initiatesit.The

managements of both firms get together and work out terms that they believe to be

beneficial to both sets of shareholders.At times, the management may also

encourage shareholders to tender their shares at the agreed price. Then they issue

statements to their stockholders recommending that they agree to the merger.Of

course, the shareholders of the target firm normally must vote on the merger, but

managements support generally assures that the votes will be favorable.

If a target firms management resists the merger, or there is disagreement between

the acquiring firm and the target firm, then the acquiring firms advances are said to

be hostile rather than friendly.In this case, the acquirer, if it chooses to, must make a

direct appeal to the target firms shareholders.This takes the form of a tender offer,

whereby the target firms shareholders are asked to tender their shares to the

acquiring firm in exchange for cash, stock, bonds, or some combination of the

three.If 51 percent or more of the target firms shareholders tender their shares,

then the merger will be completed over managements objection. A key point to

note is that the management of the target company discourages the tendering of

stockholders shares.

Hostile takeovers generally end up in the acquiring company offering (and

sometimes winning) a premium price for the price of a share. This is to win over the

stockholders of the target firms who may be skeptical regarding the fair value of

the price and / or to tempt them with monetary incentive. Additionally, a premium

generally detracts other prospective, competing, acquiring firms.

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 3:

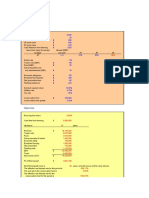

1996 1997 1998 1999

Net Sales $20,000,000 $25,000,000 $31,250,0

00

$39,062,500

Variable Operating

Costs

1,70,00,000 2,12,50,000 2,65,62,50

0

3,30,62,500

Depreciation 2,50,000 3,00,000 3,60,000 4,32,000

Fixed Operating

Costs

7,50,000 9,00,000 10,80,000 12,96,000

Interest Expense 2,50,000 3,00,000 3,60,000 4,32,000

Earnings Before

taxes

17,50,000 22,50,000 28,87,500 36,69,375

Taxes 7,00,000 9,00,000 11,55,000 14,79,750

Net Income 10,50,000 13,50,000 17,32,500 22,19,625

Plus Depreciation 2,50,000 3,00,000 3,60,000 4,32,000

Cash Flow 13,00,000 16,50,000 20,92,500 26,51,625

Required Addition

to Equity

5,00,000 6,00,000 7,20,000 2,16,000

Available Cash

Flow

8,00,000 10,50,000 13,72,500 24,35,625

Expected Terminal

Value

2,59,51,539

Free Cash Flow 8,00,000 10,50,000 13,72,500 2,83,87,164

Interest Expenses are usually deducted in the merger cash flow statements to

deduce the actual free cash flow available to the company. However, for capital

budgeting cash flow analysis, the return required by the investors furnishing the

capital is accounted cost of capital discount rate, and hence including again

interest expenses in financing flows for capital budgeting would lead to "double

counting."

Retained earnings are also deduced to as that money is accounted for reinvesting

in the company business & it should not be included in the free cash flow of the

company.

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 4:

Beta Unlevering: Values

Beta of Nero 1.2

Debt 40%

Equity 60%

D/E 0.667

Tax 30%

Unlevered Beta 0.82

Beta Relevering Values

Unlevered Beta 0.82

Debt 50%

Equity 50%

Tax 40%

D/E 1

Relevered Beta 1.31

Column1 Values

Cost of Capital (WACC)

Constant Growth rate 5%

Rf 7%

Market Risk Premium 6%

Cost of Debt 10%

Cost of Equity Re= (Rf+(Rm-Rf)) 14.85%

Equity 50%

Debt 50%

WACC 10.43%

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 5:

Terminal Value = Final year CF * (1 + Long term growth rate)/(Discount rate -

Long term growth rate)

= $2,35,32,574

If there is another firm that is evaluating Nero, they would get a different WACC

unless otherwise they keep the same capital structure and they have the same

operating risk

Question 6:

(a) Nero's management should employ as many defensive moves as it can to

dissuade a buyout pre-offer. The moves are: employing a staggered board

to maintain board continuity, using golden or preferably tin parachutes to

increase the cost of the buyout, usage of supermajority voting as

prerequisite for the merger.

Post the offer, a share repurchase can be used to decrease the number of

outstanding shares, or the management may replace equity with debt by

engaging in a Leveraged capitalization, or counter the hostile bid by

attempting to acquire the other company.

(b) Engaging a White Knight defense employs the firm to sell out to a party

that agrees to some concessions viz. payment of a higher price, not laying

off employees etc. Besides this additional buyers can be invited to bid for

the company so that competition leads to better compensation for the

shareholders.

(c) A White Squire tactic means that a party be invited so that it invests

significantly in the firm but votes with the management but does not buy

additional shares. This eliminates the problem of the firm losing its

independence as in the case of a White Knight defense. Also it protects the

shareholders from losing value by holding out against a takeover. A white

squire usually sells off its shares once the hostile bidder has withdrawn

his offer.

(d) Golden Parachute is a clause that provides the management (usually in a

high position) to be paid a sum if his/her contract is terminated, but this

is often employed as a deterrent to a bid. Instead a tin parachute should

be employed where all employees get benefits if contracts are terminated.

This acts both as a deterrent as well as gets rid of the agency problem.

Question 7:

NPV $1,87,11,198.24

Max offer per share $3.74

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Max value per share 2.621119824 $2.62

Offer rate $2.62

Question 8:

The sharing of value between the acquired firm and the buyout firm is divided on

the basis of the distribution of shares between the two. According to present

scenario the bidders have 30% of the equity share. As the market share of the

buying firm increases, the premium commanded by the overtaking firm also

increases. A perfect synergy exists, when the buying and bought firm have an

equal market share.

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 9:

The variable cost in the case is given as 85% of the sales. Now if it goes above

85% the net income will decrease and in turn the cash flow will be reduced. On

the other hand if the variable cost is below 85%, the cash flow for the years

increases.

The managers will be interested in the sensitivity analysis to determine the

effect that variable costs have on the price of the share. In this case, if the share

price has to be $3/share, the NPV of Nero should be

(3*5000000)=$15000000.The variable costs will be more than 85% of the sales.

Question 10:

Beta before merger = 1.2

According to Hamada's Equation-

Beta levered = beta unlevered * (1+(1-T)*D/S)

Beta before Merger- 1.2 = Beta* (1+(.7*2/3))

Beta After merger = 1.2* (1+ (.6*1))/1.47 = 1.3

Return on Equity = 7+ 1.3*6 = 14.8%

WACC= .5*14.8+.5*10*(1-.4)= 10.4%

Return on equity projected in the analysis is 42% for the year 1996.

Return on equity projected in the analysis is 45% for the year 1997.

Return on equity projected in the analysis is 48.13% for the year 1998.

Return on equity projected in the analysis is 51.38% for the year 1999.

The return on equity is increasing by 3% every year. More conservative

estimates on the various costs can lead to different values.

Question 11:

30% of the stocks is held by the management of Nero. But an acquisition

requires minimum of 51% of the stocks of the target company which implies that

the bidder should turn to the stockholders of the company.

ICI pays a premium as we have already discussed above.

Offering the ICIs stocks instead of Neros.

In both the options shareholders accept only if crosses or reaches their

perceived value. Otherwise, the stockholder could accept to a cash offer if there

is an open offer to offer a premium price over the current market price of the

stock. If the offer made is in stock, then the risk is transferred to Neros Pasta,

hence they will get a higher part of the synergy.

Financial Management 2

Neros Pasta Inc. Case Study Analysis

Question 12:

ICI should make an offer as below:

It should be a friendly deal with stock price at $2.00 if the Neros reject

the offer then increase the premium to 40% of $1.5 which is about $2.1

Neros present management should be included to mitigate the

operational risks. An advisory board can be set up from ICI to work hand

in hand with the present management of Neros Pasta; so that both the

parties can make the maximum benefit of the synergies.

However, if they try to reject the offers, ICI can have a hostile takeover.

Das könnte Ihnen auch gefallen

- Nero's Pasta Case Study AnalysisDokument8 SeitenNero's Pasta Case Study AnalysisAbhinav RajNoch keine Bewertungen

- Case 5: Merger Analysis Computer Concepts/computechDokument9 SeitenCase 5: Merger Analysis Computer Concepts/computechLouis De MoffartsNoch keine Bewertungen

- OPT SolutionDokument52 SeitenOPT SolutionbocfetNoch keine Bewertungen

- Stocks, Valuation and Market EquilibriumDokument35 SeitenStocks, Valuation and Market EquilibriumNesreen RaghebNoch keine Bewertungen

- Chapter 5Dokument31 SeitenChapter 5FăÍż SăįYąðNoch keine Bewertungen

- Week 7 Workshop Solutions - Long-Term Debt MarketsDokument3 SeitenWeek 7 Workshop Solutions - Long-Term Debt MarketsMengdi ZhangNoch keine Bewertungen

- Chapter 9Dokument7 SeitenChapter 9sylbluebubblesNoch keine Bewertungen

- BKM 10e Chap012Dokument9 SeitenBKM 10e Chap012kenNoch keine Bewertungen

- Hull-OfOD8e-Homework Answers Chapter 03Dokument3 SeitenHull-OfOD8e-Homework Answers Chapter 03Alo Sin100% (1)

- Buffett CaseDokument15 SeitenBuffett CaseElizabeth MillerNoch keine Bewertungen

- Behavioral Finance and Technical Analysis ProblemsDokument13 SeitenBehavioral Finance and Technical Analysis ProblemsBiloni Kadakia100% (1)

- Business Valuation: Economic ConditionsDokument10 SeitenBusiness Valuation: Economic ConditionscuteheenaNoch keine Bewertungen

- CF - Questions and Practice Problems - Chapter 15Dokument3 SeitenCF - Questions and Practice Problems - Chapter 15Lê Hoàng Long NguyễnNoch keine Bewertungen

- If The Coat FitsDokument4 SeitenIf The Coat FitsAngelica OlescoNoch keine Bewertungen

- 13 SolutionDokument55 Seiten13 Solutiontisha10rahman100% (1)

- Bond Portfolio ManagementDokument20 SeitenBond Portfolio ManagementJasiz Philipe OmbuguNoch keine Bewertungen

- EXAM 1 IPM Solutions Spring 2012 (B)Dokument12 SeitenEXAM 1 IPM Solutions Spring 2012 (B)kiffeur69100% (6)

- Ugcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCoDokument6 SeitenUgcs3/entry Attachment/ABE65837 A36D 4962 83A2 52ED02546362 FRL440TheWmWrigleyJrCotimbulmanaluNoch keine Bewertungen

- Bkm9e Answers Chap006Dokument13 SeitenBkm9e Answers Chap006AhmadYaseenNoch keine Bewertungen

- Can One Size Fit All?Dokument21 SeitenCan One Size Fit All?Abhimanyu ChoudharyNoch keine Bewertungen

- Fm14e SM Ch13Dokument7 SeitenFm14e SM Ch13Syed Atiq TurabiNoch keine Bewertungen

- MBA 670 Exam 1Dokument14 SeitenMBA 670 Exam 1Lauren LoshNoch keine Bewertungen

- Practical Financial Management Appendix BDokument16 SeitenPractical Financial Management Appendix Bitumeleng10% (1)

- Chapter 6: Risk Aversion and Capital Allocation To Risky AssetsDokument14 SeitenChapter 6: Risk Aversion and Capital Allocation To Risky AssetsBiloni KadakiaNoch keine Bewertungen

- A Case Study On Ferrari: 2015 Initial Public OfferingDokument12 SeitenA Case Study On Ferrari: 2015 Initial Public Offeringtazim100% (1)

- 2.4 Earnings Per ShareDokument40 Seiten2.4 Earnings Per ShareMinal Bihani100% (1)

- Money Demand and Equilibrium RatesDokument23 SeitenMoney Demand and Equilibrium RatesJudithNoch keine Bewertungen

- Deegan5e SM Ch28Dokument20 SeitenDeegan5e SM Ch28Rachel Tanner100% (2)

- MC Practice Ch 16 Capital StructureDokument3 SeitenMC Practice Ch 16 Capital Structurebusiness docNoch keine Bewertungen

- Case #84 Risk and Rates of Return - Filmore EnterprisesDokument9 SeitenCase #84 Risk and Rates of Return - Filmore Enterprises3happy3100% (5)

- Chapter 14 Agency Theory SolutionDokument7 SeitenChapter 14 Agency Theory SolutionariestbtNoch keine Bewertungen

- EAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFDokument2 SeitenEAST COAST YACHTS GOES PUBLIC-minicase - Module 2 PDFGhoul GamingNoch keine Bewertungen

- Questions Chapter 16 FinanceDokument23 SeitenQuestions Chapter 16 FinanceJJNoch keine Bewertungen

- Payout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Dokument4 SeitenPayout Policy: File, Then Send That File Back To Google Classwork - Assignment by Due Date & Due Time!Gian RandangNoch keine Bewertungen

- East Coast Yachts Goes InternationalDokument1 SeiteEast Coast Yachts Goes InternationalAries MayaNoch keine Bewertungen

- Econ252 Midterm 1 Key Terms and ConceptsDokument7 SeitenEcon252 Midterm 1 Key Terms and Conceptstariq_nuriNoch keine Bewertungen

- The Dilemma at Day 21Dokument4 SeitenThe Dilemma at Day 21Christian AndreNoch keine Bewertungen

- Sally Jameson CaseDokument2 SeitenSally Jameson Casemaniaa545Noch keine Bewertungen

- Acquisition Valuation 2 PDFDokument19 SeitenAcquisition Valuation 2 PDFVibhor Agarwal0% (2)

- Hitungan Kuis 7 Bunyan - Lumber - CaseDokument15 SeitenHitungan Kuis 7 Bunyan - Lumber - Caserica100% (1)

- Chapter 10 Futures Arbitrate Strategies Test BankDokument6 SeitenChapter 10 Futures Arbitrate Strategies Test BankJocelyn TanNoch keine Bewertungen

- The History and Business of Wm. Wrigley Jr. CompanyDokument7 SeitenThe History and Business of Wm. Wrigley Jr. CompanySyed Ahmedullah Hashmi100% (1)

- Warant & ConvertibleDokument13 SeitenWarant & ConvertibleHayu AriantiNoch keine Bewertungen

- frm指定教材 risk management & derivativesDokument1.192 Seitenfrm指定教材 risk management & derivativeszeno490Noch keine Bewertungen

- Chap 023Dokument42 SeitenChap 023nobNoch keine Bewertungen

- Dokumen - Tips Bodie Kane Marcus 8th Editionsolution CH 1 4Dokument35 SeitenDokumen - Tips Bodie Kane Marcus 8th Editionsolution CH 1 4Shahab AftabNoch keine Bewertungen

- Exercise Problems - 485 Fixed Income 2021Dokument18 SeitenExercise Problems - 485 Fixed Income 2021Nguyen hong LinhNoch keine Bewertungen

- FG2233Dokument11 SeitenFG2233Hassan Sheikh0% (1)

- Soln CH 14 Bond PricesDokument12 SeitenSoln CH 14 Bond PricesSilviu TrebuianNoch keine Bewertungen

- How Much Should a Firm Borrow? Key Factors and TradeoffsDokument8 SeitenHow Much Should a Firm Borrow? Key Factors and TradeoffsCecilia MontessoroNoch keine Bewertungen

- FLINDER Valves and Controls IncDokument1 SeiteFLINDER Valves and Controls IncStephanie WidjayaNoch keine Bewertungen

- Chapter 13 The Stock MarketDokument7 SeitenChapter 13 The Stock Marketlasha KachkachishviliNoch keine Bewertungen

- Wrigley Case AnswerDokument4 SeitenWrigley Case AnswerYehan MatuilanaNoch keine Bewertungen

- FM2 Project1 Sec01 Grp7Dokument8 SeitenFM2 Project1 Sec01 Grp7Vineet KhandelwalNoch keine Bewertungen

- Summary Mergers & Acquisitions (25!11!2021)Dokument5 SeitenSummary Mergers & Acquisitions (25!11!2021)Shafa ENoch keine Bewertungen

- Profit and Shareholder MaximizationDokument23 SeitenProfit and Shareholder MaximizationDaodu Ladi BusuyiNoch keine Bewertungen

- 02 IFRS 3 Business CombinationDokument15 Seiten02 IFRS 3 Business CombinationtsionNoch keine Bewertungen

- RossFCF10ce SM ch23 FINALDokument11 SeitenRossFCF10ce SM ch23 FINALyash sindhiNoch keine Bewertungen

- Pledge (And Hedge) Allegiance To The CompanyDokument6 SeitenPledge (And Hedge) Allegiance To The CompanyBrian TayanNoch keine Bewertungen

- Reasons For Mergers and AcquisitionsDokument3 SeitenReasons For Mergers and AcquisitionsJuwon Jeremiah MakuNoch keine Bewertungen

- Discrete StructureDokument89 SeitenDiscrete Structure2010GaneshNoch keine Bewertungen

- WalmartDokument10 SeitenWalmartLương Thế CườngNoch keine Bewertungen

- Social Cognitive Theory and Adoption of Ebook DevicesDokument15 SeitenSocial Cognitive Theory and Adoption of Ebook DevicesajaxorNoch keine Bewertungen

- Milton CycleDokument2 SeitenMilton CycleajaxorNoch keine Bewertungen

- Beyond The Convergence: Outsourcing + SaasDokument3 SeitenBeyond The Convergence: Outsourcing + SaasajaxorNoch keine Bewertungen

- Deployment ModelDokument2 SeitenDeployment ModelajaxorNoch keine Bewertungen

- Feedback Industry Report BicycleDokument24 SeitenFeedback Industry Report BicycleajaxorNoch keine Bewertungen

- Markopolis 2014 - Case StudyDokument5 SeitenMarkopolis 2014 - Case StudyajaxorNoch keine Bewertungen

- 5 Samurai Case PDFDokument6 Seiten5 Samurai Case PDFajaxorNoch keine Bewertungen

- Atlas CyclesDokument3 SeitenAtlas CyclesajaxorNoch keine Bewertungen

- The Birth of Dunia (B) - Time To Actively Start LendingDokument17 SeitenThe Birth of Dunia (B) - Time To Actively Start LendingajaxorNoch keine Bewertungen

- Back Office StrategyDokument2 SeitenBack Office StrategyajaxorNoch keine Bewertungen

- 85097821Dokument2 Seiten85097821ajaxorNoch keine Bewertungen

- Google Apps Stirs Governm: Hews AnDokument2 SeitenGoogle Apps Stirs Governm: Hews AnajaxorNoch keine Bewertungen

- Trucking Through The CloudDokument6 SeitenTrucking Through The CloudajaxorNoch keine Bewertungen

- Total SAP TablesDokument12 SeitenTotal SAP Tablesssurisetty99% (102)

- Software Delivery ModelsDokument22 SeitenSoftware Delivery ModelsajaxorNoch keine Bewertungen

- Look To The Clouds and Ask, "Why?": TrendsDokument2 SeitenLook To The Clouds and Ask, "Why?": TrendsajaxorNoch keine Bewertungen

- SAP BusinessObjects BI4.0 Installation Manual (Inclusive Mobile Configuration For Ipad)Dokument19 SeitenSAP BusinessObjects BI4.0 Installation Manual (Inclusive Mobile Configuration For Ipad)asimalampNoch keine Bewertungen

- Saas - The Emerging Model For Packaged Software: Architecture ConsiderationsDokument3 SeitenSaas - The Emerging Model For Packaged Software: Architecture ConsiderationsajaxorNoch keine Bewertungen

- Kiva Productions - SAP and Data WarehousingDokument21 SeitenKiva Productions - SAP and Data WarehousingcusvaiNoch keine Bewertungen

- PEL Annual Report FY2013Dokument152 SeitenPEL Annual Report FY2013Neel ModyNoch keine Bewertungen

- Kiva Productions - SAP and Data WarehousingDokument21 SeitenKiva Productions - SAP and Data WarehousingcusvaiNoch keine Bewertungen

- Lecture 5 - Cost of CapitalDokument17 SeitenLecture 5 - Cost of Capitalannalenas2000Noch keine Bewertungen

- Risk and Return Fundamentals for Financial ManagementDokument77 SeitenRisk and Return Fundamentals for Financial ManagementAayat R. AL KhlafNoch keine Bewertungen

- Case Analysis: American Home Products CorporationDokument3 SeitenCase Analysis: American Home Products CorporationYanbin CaoNoch keine Bewertungen

- Chapter 11 - Cost of CapitalDokument20 SeitenChapter 11 - Cost of Capitalreza786Noch keine Bewertungen

- Latih Soal Untuk Mhs Fin MGTDokument13 SeitenLatih Soal Untuk Mhs Fin MGTnajNoch keine Bewertungen

- ACCA Paper F9 Full Study Textbook (Sample Download v2)Dokument30 SeitenACCA Paper F9 Full Study Textbook (Sample Download v2)accountancylad100% (1)

- Topic 6 Supplement (Cost of Capital, Capital Structure and Risk)Dokument36 SeitenTopic 6 Supplement (Cost of Capital, Capital Structure and Risk)Jessica Adharana KurniaNoch keine Bewertungen

- Analyzing Capital Structure of Tesco and SainsburyDokument3 SeitenAnalyzing Capital Structure of Tesco and SainsburySarath P Babu100% (1)

- FINC2011 Tutorial 5Dokument10 SeitenFINC2011 Tutorial 5suitup100100% (4)

- CA IPCC FM Charts For All Chapters by CA Mayank KothariDokument4 SeitenCA IPCC FM Charts For All Chapters by CA Mayank Kotharishanky63167% (3)

- Introduction To Global Investment Banking - Merrill LynchDokument28 SeitenIntroduction To Global Investment Banking - Merrill LynchAlexander Junior Huayana Espinoza100% (2)

- Equity Valuation: Capital and Money Markets AssignmentDokument5 SeitenEquity Valuation: Capital and Money Markets AssignmentSudip BainNoch keine Bewertungen

- Financial Management Syllabus SYBcom Sem 3Dokument1 SeiteFinancial Management Syllabus SYBcom Sem 3AmenaNoch keine Bewertungen

- Ms Comprehesive Exam Cart - October, 2015Dokument4 SeitenMs Comprehesive Exam Cart - October, 2015Vel JuneNoch keine Bewertungen

- Landmark Facility Solution Excel WorkingsDokument22 SeitenLandmark Facility Solution Excel Workingsalka murarka27% (33)

- Week 14 Risk and The Cost of Capital II: Financial Management Spring 2012Dokument28 SeitenWeek 14 Risk and The Cost of Capital II: Financial Management Spring 2012ssunday giftNoch keine Bewertungen

- Shareholder Value ReviewsDokument3 SeitenShareholder Value ReviewsMukesh ChauhanNoch keine Bewertungen

- Company Financial Analysis and Ratio Comparison Over 5 YearsDokument6 SeitenCompany Financial Analysis and Ratio Comparison Over 5 YearsAanchal MahajanNoch keine Bewertungen

- The Cost of Capital Components and WACCDokument1 SeiteThe Cost of Capital Components and WACCMariam TariqNoch keine Bewertungen

- Weighted Average Cost of Capital (WACC) ExplainedDokument27 SeitenWeighted Average Cost of Capital (WACC) ExplainedGeorge Renard SpinellyNoch keine Bewertungen

- Capital Structure Theory - Net Operating Income ApproachDokument3 SeitenCapital Structure Theory - Net Operating Income Approachoutlanderlord100% (1)

- Sapm Notes (Problems)Dokument11 SeitenSapm Notes (Problems)anilkc9Noch keine Bewertungen

- Using the CAPM for capital budgetingDokument5 SeitenUsing the CAPM for capital budgetingangel guarinNoch keine Bewertungen

- Warner Body WorksDokument35 SeitenWarner Body WorksPadam Shrestha50% (4)

- Financial Management MCQsDokument18 SeitenFinancial Management MCQsAnkit BaranwalNoch keine Bewertungen

- SGV Cup - RevisedDokument9 SeitenSGV Cup - RevisedVincent Larrie MoldezNoch keine Bewertungen

- Company-Specific Risk Premiums (American Bankruptcy Insitute, 2010) PDFDokument100 SeitenCompany-Specific Risk Premiums (American Bankruptcy Insitute, 2010) PDFMichael SmithNoch keine Bewertungen

- Ramco Cement AR 2020 21Dokument283 SeitenRamco Cement AR 2020 2135Komala venkata ramya seelaNoch keine Bewertungen

- Department of Commerce: Sri Dev Suman Uttarakhand University Tehri GarhwalDokument29 SeitenDepartment of Commerce: Sri Dev Suman Uttarakhand University Tehri Garhwalpsychopath peopleNoch keine Bewertungen

- EVA & MVA Calculation of BSRM SteelsDokument9 SeitenEVA & MVA Calculation of BSRM SteelsMahmudul QuaderNoch keine Bewertungen