Beruflich Dokumente

Kultur Dokumente

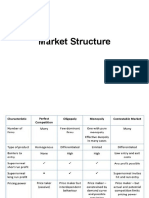

Oligopoly Market Characteristics

Hochgeladen von

gvibh0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

53 Ansichten2 SeitenThis document discusses oligopoly, which is a market structure with few sellers. It describes key characteristics of oligopoly including homogenous or unique products, barriers to entry and exit, imperfect information, and potential for above-normal profits. Examples provided include carbonated beverages and domestic aviation in India. Under oligopoly, each seller considers its rival's output or price in determining its own profit-maximizing strategy. Several non-collusive oligopoly models are outlined that differ based on assumptions about how sellers conjecture their rivals' behavior, including Cournot, Bertrand, and Stackelberg models. Limitations of non-collusive oligopoly include uncertainty due to reliance on conjectures. Sellers may therefore move towards collusive

Originalbeschreibung:

Oligopoly

Originaltitel

Oligopoly

Copyright

© © All Rights Reserved

Verfügbare Formate

DOC, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document discusses oligopoly, which is a market structure with few sellers. It describes key characteristics of oligopoly including homogenous or unique products, barriers to entry and exit, imperfect information, and potential for above-normal profits. Examples provided include carbonated beverages and domestic aviation in India. Under oligopoly, each seller considers its rival's output or price in determining its own profit-maximizing strategy. Several non-collusive oligopoly models are outlined that differ based on assumptions about how sellers conjecture their rivals' behavior, including Cournot, Bertrand, and Stackelberg models. Limitations of non-collusive oligopoly include uncertainty due to reliance on conjectures. Sellers may therefore move towards collusive

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

53 Ansichten2 SeitenOligopoly Market Characteristics

Hochgeladen von

gvibhThis document discusses oligopoly, which is a market structure with few sellers. It describes key characteristics of oligopoly including homogenous or unique products, barriers to entry and exit, imperfect information, and potential for above-normal profits. Examples provided include carbonated beverages and domestic aviation in India. Under oligopoly, each seller considers its rival's output or price in determining its own profit-maximizing strategy. Several non-collusive oligopoly models are outlined that differ based on assumptions about how sellers conjecture their rivals' behavior, including Cournot, Bertrand, and Stackelberg models. Limitations of non-collusive oligopoly include uncertainty due to reliance on conjectures. Sellers may therefore move towards collusive

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOC, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Oligopoly

Oligopoly Market Characteristics

Few sellers.

Homogenous or unique products.

Blockaded entry and exit.

Imperfect dissemination of information.

Opportunity for above-normal economic! pro"ts in long-run

equilibrium.

Examples of Oligopoly

#arbonated Beverage $arket %epsico & #oca #ola!' (omestic aviation

Industry in India Few %layers like Indian )irlines' *et airways'

+ing"s,er!.

In t,is form of market structure' t,e number of sellers is few suc, t,at a seller

can closely watc, w,at ,is co-selller is doing in terms of ,is price & output

and take t,at into consideration w,ile doing ,is own pro"t maximi-ation

exercise.

For instance. /et % 0 a 1 b2 be t,e market demand curve w,ere t,e

market is supplied by two sellers 3 & 4. 5,en market demand can

be expressed as

% 0 a 1 b 23624!. 7ow "rm8seller 3 will de"ne ,is pro"t function

as

9 0 5: 15# 0 %23 1 #3 0 ;a 1 b23624!<23 1 #3 .

5,us now wit, oligopoly' a seller=s pro"t function includes rival=s

output 24 as given' w,ic, was not t,e case in ot,er forms of

market. >imilarly it can also include %4 if sellers are competing

based on %rices and not on market s,are

5,is value of rival=s output 24! is arrived at by a seller by looking

at ,ow rival was selling in last period. He looks at t,e quantity or

price ,is rival was selling or c,arging in last period and assumes

guesses or con?ectures! t,at t,e rival will continue to do t,e same

in t,is period and based on t,is guess about 24 or %4' ,e

incorporates t,ese 24 or %4 in ,is pro"t function and maximi-es ,is

pro"t and determines ,is equilibrium quantity 23! to be sold and

price %3! to be c,arged.

5,e seller does not' ,owever' talk to ,is rival to understand exactly

w,at would be 24 or %4 . 5,is is t,e case of non-collusive oligopoly.

5,ere are several models of non-collusive oligopoly depending on

di@erent types of con?ectures8guesses t,at a seller makes about ,is

rival

Non-Collusive Oligopoly Models

#ournot (uopoly $odel 1 w,en a seller makes a guess about ,is rivals

output be,avior Ax. #oke and %epsi

Bertrand=s (uopoly $odel - w,en a seller makes a guess about ,is rivals

price be,avior Ax. 5imes of India and Hindustan 5imes

>tackelberg=s (uopoly $odel 1 w,en a seller is a market leader in t,e

sense ,e knows t,e demand and cost conditions of t,e market and also

knows t,at ,is rival will watc, ,is be,avior and take it into ,is decision

making. 5,is normally ,appens w,en a seller is a "rst-mover in t,e

industry. Ax. >ony in gaming industry.

>wee-y=s +inked demand curve $odel- guess of a seller is if ,e raises

price no co-seller will follow ,im but if ,e lowers price all co-sellers will

follow

Limitation of Non-collusive Oligopoly

7on-collusive form of oligopoly gives rise to a lot of uncertainty. Because entire

pro"t maximi-ation exercise of a seller is based on guess about rival=s be,avior.

If rival=s be,avior does follow w,at ,e guessed t,en ,is pro"t max exercise fails

to give t,e maximum pro"t.

5o avoid suc, uncertainty sellers in oligopoly market often move towards

#ollusive oligopoly by secretly colluding wit, co-sellers

Collusive Oligopoly

#artels 1 market s,aring' ?oint pro"t maximi-ation may be t,e ob?ective of

t,e cartel

$ergers 1 become one seller

%rice /eaders,ip 1 eit,er t,e dominant "rm or t,e low cost "rm will set t,e

price' ot,ers will follow it.

BBBBBBB

Das könnte Ihnen auch gefallen

- Oligopoly Market CharacteristicsDokument3 SeitenOligopoly Market Characteristicskdatta86Noch keine Bewertungen

- Option Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3Von EverandOption Market Making : Part 1, An Introduction: Extrinsiq Advanced Options Trading Guides, #3Noch keine Bewertungen

- ECO-501 All Question Ans For Mid Term Exam: Q. Define The Direct Tax and Indirect Tax & Give The Proper ExampleDokument7 SeitenECO-501 All Question Ans For Mid Term Exam: Q. Define The Direct Tax and Indirect Tax & Give The Proper ExampleAsim HowladerNoch keine Bewertungen

- 1 Market Structure and CompetitionDokument4 Seiten1 Market Structure and CompetitionAnna MuravickayaNoch keine Bewertungen

- Ch. 7 Firm Competition andDokument25 SeitenCh. 7 Firm Competition ands130220073Noch keine Bewertungen

- Trading Riot Auction Market Theory - Understanding of Market andDokument13 SeitenTrading Riot Auction Market Theory - Understanding of Market andJ100% (2)

- Better Volume IndicatorDokument7 SeitenBetter Volume IndicatorKhandaker DidarNoch keine Bewertungen

- Value Trading Basics: What Is Value and How Do We Define It?Dokument5 SeitenValue Trading Basics: What Is Value and How Do We Define It?gneymanNoch keine Bewertungen

- Economics for Investment Decision Makers Workbook: Micro, Macro, and International EconomicsVon EverandEconomics for Investment Decision Makers Workbook: Micro, Macro, and International EconomicsNoch keine Bewertungen

- Oligopoly EconomicsDokument14 SeitenOligopoly Economicsuday99says50% (2)

- Trading Options: Using Technical Analysis to Design Winning TradesVon EverandTrading Options: Using Technical Analysis to Design Winning TradesNoch keine Bewertungen

- Acegazettepriceaction Supplyanddemand 140117194309 Phpapp01Dokument41 SeitenAcegazettepriceaction Supplyanddemand 140117194309 Phpapp01Panneer Selvam Easwaran100% (1)

- Oligopoly - Wikipedia PDFDokument57 SeitenOligopoly - Wikipedia PDFHarshita ChhabraNoch keine Bewertungen

- Economic6 OligopolyDokument42 SeitenEconomic6 Oligopolypeter banjaoNoch keine Bewertungen

- Perfect CompetitionDokument27 SeitenPerfect CompetitionShivangi mittalNoch keine Bewertungen

- 2022-2023 Price Action Trading Guide for Beginners in 45 MinutesVon Everand2022-2023 Price Action Trading Guide for Beginners in 45 MinutesBewertung: 4.5 von 5 Sternen4.5/5 (4)

- Summary of Anna Coulling's A Complete Guide To Volume Price AnalysisVon EverandSummary of Anna Coulling's A Complete Guide To Volume Price AnalysisBewertung: 5 von 5 Sternen5/5 (1)

- A Learning Market-Maker in The Glosten-Milgrom Model PDFDokument19 SeitenA Learning Market-Maker in The Glosten-Milgrom Model PDFJose Antonio Dos RamosNoch keine Bewertungen

- Trading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Von EverandTrading Implied Volatility: Extrinsiq Advanced Options Trading Guides, #4Bewertung: 4 von 5 Sternen4/5 (1)

- Commitments of Traders: Strategies for Tracking the Market and Trading ProfitablyVon EverandCommitments of Traders: Strategies for Tracking the Market and Trading ProfitablyBewertung: 5 von 5 Sternen5/5 (1)

- An easy approach to options trading: The introductory guide to options trading and the main option trading strategiesVon EverandAn easy approach to options trading: The introductory guide to options trading and the main option trading strategiesBewertung: 5 von 5 Sternen5/5 (1)

- And Deals With Their Business Transaction. Mysore Market EtcDokument7 SeitenAnd Deals With Their Business Transaction. Mysore Market Etcarchana_anuragiNoch keine Bewertungen

- Arbitrage Trade Analysis of Stock Trading in NSE and BSE MBA ProjectDokument86 SeitenArbitrage Trade Analysis of Stock Trading in NSE and BSE MBA ProjectNipul Bafna100% (3)

- Unit 8Dokument15 SeitenUnit 8Ajeet KumarNoch keine Bewertungen

- MARKET STRUCTURE - 4th UnitDokument22 SeitenMARKET STRUCTURE - 4th UnitDr VIRUPAKSHA GOUD GNoch keine Bewertungen

- Technical Analysis for Direct Access Trading: A Guide to Charts, Indicators, and Other Indispensable Market Analysis ToolsVon EverandTechnical Analysis for Direct Access Trading: A Guide to Charts, Indicators, and Other Indispensable Market Analysis ToolsBewertung: 2 von 5 Sternen2/5 (1)

- Futures Cheat SheetDokument7 SeitenFutures Cheat SheetDanaeus Avaris Cadmus100% (1)

- ECON 696: Managerial Economics and Strategy Lecture Notes 6: Competitors and CompetitionDokument9 SeitenECON 696: Managerial Economics and Strategy Lecture Notes 6: Competitors and CompetitionappleanuNoch keine Bewertungen

- Chapter-10 (Microeconomics) Forms of MarketDokument8 SeitenChapter-10 (Microeconomics) Forms of MarketSourav KumarNoch keine Bewertungen

- The Art and Science of Technical Analysis: Market Structure, Price Action, and Trading StrategiesVon EverandThe Art and Science of Technical Analysis: Market Structure, Price Action, and Trading StrategiesBewertung: 3.5 von 5 Sternen3.5/5 (4)

- 46699bosfnd p4 cp3 U2Dokument43 Seiten46699bosfnd p4 cp3 U2Arun KCNoch keine Bewertungen

- Topic 14Dokument45 SeitenTopic 14Nicole MuroiwaNoch keine Bewertungen

- Question1:-In Your Daily Life From Where You Get Goods?Dokument33 SeitenQuestion1:-In Your Daily Life From Where You Get Goods?Lokesh MaharNoch keine Bewertungen

- Market StructureDokument20 SeitenMarket StructureSunny RajpalNoch keine Bewertungen

- Unit 4 Economics Market Structure.Dokument68 SeitenUnit 4 Economics Market Structure.Devyani ChettriNoch keine Bewertungen

- Economics of Futures Trading: For Commercial and Personal ProfitVon EverandEconomics of Futures Trading: For Commercial and Personal ProfitNoch keine Bewertungen

- Baird - Option Market Making, 1993Dokument205 SeitenBaird - Option Market Making, 1993ethexman80% (5)

- Compare and Contrast These Explanations of Horizontal FDI The Market Imperfections Approach, Vernon's Product Life Cycle Theory, and Knickerbocker Theory of FDI.Dokument3 SeitenCompare and Contrast These Explanations of Horizontal FDI The Market Imperfections Approach, Vernon's Product Life Cycle Theory, and Knickerbocker Theory of FDI.Zainorin Ali50% (2)

- Micro Economics:market Structures.Dokument33 SeitenMicro Economics:market Structures.Manal AftabNoch keine Bewertungen

- The Strategic Options day Trader: How to win Trade Plans, Master the Financial Markets and Maximize 200% Profit Daily to Become a day Trader MillionaireVon EverandThe Strategic Options day Trader: How to win Trade Plans, Master the Financial Markets and Maximize 200% Profit Daily to Become a day Trader MillionaireNoch keine Bewertungen

- Market StructureDokument19 SeitenMarket StructureSri HarshaNoch keine Bewertungen

- A Case Study in Perfect CompetitionDokument7 SeitenA Case Study in Perfect CompetitionAddy Elia83% (6)

- Assignment Unit VI:: Columbia Southern University Huynh Dong HaDokument8 SeitenAssignment Unit VI:: Columbia Southern University Huynh Dong HaHạnh NguyễnNoch keine Bewertungen

- Chapter 8 Microeconomics For Managers Winter 2013 PDFDokument24 SeitenChapter 8 Microeconomics For Managers Winter 2013 PDFJessica Danforth GalvezNoch keine Bewertungen

- Collusive Oligopoly and OPEC. What Are The Possible Cartel Formation in Petroleum Companies in India?Dokument24 SeitenCollusive Oligopoly and OPEC. What Are The Possible Cartel Formation in Petroleum Companies in India?Suruchi GoyalNoch keine Bewertungen

- Managerial Economics: Unit - 2Dokument54 SeitenManagerial Economics: Unit - 2HIFZUR RAHMANNoch keine Bewertungen

- Question Bank: Forms of Market and Price Determination Very Short Answer Questions (1 Mark)Dokument7 SeitenQuestion Bank: Forms of Market and Price Determination Very Short Answer Questions (1 Mark)api-232747878Noch keine Bewertungen

- 19641chapter-4 PRICE DETERMINATION PDFDokument58 Seiten19641chapter-4 PRICE DETERMINATION PDFJustin Gomez100% (5)

- Chapter 6 & 7 Homework PacketDokument6 SeitenChapter 6 & 7 Homework PacketJohn JohnsonNoch keine Bewertungen

- Sales DistributionDokument24 SeitenSales DistributionSakhamuri Ram'sNoch keine Bewertungen

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthVon EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthNoch keine Bewertungen

- Chapter - 4: Unit 1 Meaning and Types of MarketsDokument58 SeitenChapter - 4: Unit 1 Meaning and Types of Marketsharsha143saiNoch keine Bewertungen

- Primer On Market ProfileDokument4 SeitenPrimer On Market Profilechalasanica100% (2)

- Applied Economics: Module No. 4: Week 4: First QuarterDokument10 SeitenApplied Economics: Module No. 4: Week 4: First QuarterhiNoch keine Bewertungen

- Power Trading: Winning Guerrilla, Micro, and Core TacticsVon EverandPower Trading: Winning Guerrilla, Micro, and Core TacticsBewertung: 3 von 5 Sternen3/5 (1)

- Tips and Samples CH 11, MICRODokument12 SeitenTips and Samples CH 11, MICROtariku1234Noch keine Bewertungen

- The Nature of Trends: Strategies and Concepts for Successful Investing and TradingVon EverandThe Nature of Trends: Strategies and Concepts for Successful Investing and TradingNoch keine Bewertungen

- Vsa Basics From MTMDokument32 SeitenVsa Basics From MTMabanso100% (1)

- MTV Brand Resonance ModelDokument1 SeiteMTV Brand Resonance ModelgvibhNoch keine Bewertungen

- Fevikwik 1Dokument2 SeitenFevikwik 1gvibh100% (1)

- India Grows at NightDokument6 SeitenIndia Grows at Nightgvibh0% (1)

- Date: - To, The Director Goa Institute of Management Ribandar, Goa - 403 006Dokument3 SeitenDate: - To, The Director Goa Institute of Management Ribandar, Goa - 403 006gvibhNoch keine Bewertungen

- Ecotimes ESCO Article1Dokument9 SeitenEcotimes ESCO Article1gvibhNoch keine Bewertungen

- 2 PDFDokument11 Seiten2 PDFAkshay PawarNoch keine Bewertungen

- 1 - Alburo vs. VillanuevaDokument2 Seiten1 - Alburo vs. VillanuevaXavier BataanNoch keine Bewertungen

- FW TNORM Disposal in KYDokument9 SeitenFW TNORM Disposal in KYAppCitizensLawNoch keine Bewertungen

- LHC U10-FrameworkDokument2 SeitenLHC U10-FrameworkArges KLNoch keine Bewertungen

- BIR Form No. 0901-O (Other Income) Bureau of Internal RevenueDokument2 SeitenBIR Form No. 0901-O (Other Income) Bureau of Internal RevenueChristianNicolasBetantosNoch keine Bewertungen

- 2nd Place Graduate Team-Light Business Jet FamilyDokument98 Seiten2nd Place Graduate Team-Light Business Jet FamilyTiborGašparacNoch keine Bewertungen

- Locker PolicyDokument7 SeitenLocker Policyअमरेश झाNoch keine Bewertungen

- CCTV Implementing By-Law and DecisionsDokument12 SeitenCCTV Implementing By-Law and DecisionssultanprinceNoch keine Bewertungen

- Audit Compliance Review: The Institute of Chartered Accountants of PakistanDokument8 SeitenAudit Compliance Review: The Institute of Chartered Accountants of Pakistanabid murtazaiNoch keine Bewertungen

- Eexi - MEPC 335 76 Add2 - Annex9Dokument12 SeitenEexi - MEPC 335 76 Add2 - Annex9Matija VasilevNoch keine Bewertungen

- NPA (EASA) 20 - 2011 - Basics - Cerinte Pentru AerodromuriDokument41 SeitenNPA (EASA) 20 - 2011 - Basics - Cerinte Pentru AerodromuriVlad CapritaNoch keine Bewertungen

- Basic Agreement For Huawei Supplier Qualification V1.0Dokument19 SeitenBasic Agreement For Huawei Supplier Qualification V1.0Okoss BraderNoch keine Bewertungen

- Indoor Play Facilties - Safety Requirements For Play Facilities - Their RequirementsDokument23 SeitenIndoor Play Facilties - Safety Requirements For Play Facilities - Their RequirementsAnonymous RmzEd3jANoch keine Bewertungen

- Kranav Kapur Investment Project 019Dokument18 SeitenKranav Kapur Investment Project 019Angna DewanNoch keine Bewertungen

- Uganda Legal Framework AnalysisDokument15 SeitenUganda Legal Framework AnalysisGODFREY JATHONoch keine Bewertungen

- Sa Residence Fee ProposalDokument6 SeitenSa Residence Fee Proposalapi-245735583Noch keine Bewertungen

- Mukesh Kumar Narayan 1Dokument5 SeitenMukesh Kumar Narayan 1Mukesh LalNoch keine Bewertungen

- Sts OperationDokument39 SeitenSts Operationtxjiang100% (3)

- BNP Paribas Due Diligence Job DescriptionDokument2 SeitenBNP Paribas Due Diligence Job DescriptionEline ChavanuNoch keine Bewertungen

- Moore v. TMH Complaint and AnswerDokument206 SeitenMoore v. TMH Complaint and AnswerbmortonNoch keine Bewertungen

- As ISO 10014-2007 Quality Management Systems - Guidelines For Realizing Financial and Economic BenefitsDokument10 SeitenAs ISO 10014-2007 Quality Management Systems - Guidelines For Realizing Financial and Economic BenefitsSAI Global - APACNoch keine Bewertungen

- Gammon Philippines, Inc. v. Metro Rail Transit Development Corporation, G.R. No. 144792, January 31, 2006Dokument3 SeitenGammon Philippines, Inc. v. Metro Rail Transit Development Corporation, G.R. No. 144792, January 31, 2006Kris Razo100% (1)

- CSSP RubayaDokument148 SeitenCSSP RubayaChaudhary Wasim MurtazaNoch keine Bewertungen

- Bajnath V Resume 2 W Cover Letter2Dokument2 SeitenBajnath V Resume 2 W Cover Letter2vbajnath1Noch keine Bewertungen

- MICROECONOMICSDokument11 SeitenMICROECONOMICSMichael GuanzingNoch keine Bewertungen

- The Public Procurement Act PDFDokument53 SeitenThe Public Procurement Act PDFJonas Kañombi MukwatuNoch keine Bewertungen

- Cukr Skateboard Waiver 082307Dokument2 SeitenCukr Skateboard Waiver 082307michaelcukr100% (9)

- Iil T11Dokument9 SeitenIil T11limkq-wb20Noch keine Bewertungen

- Labour Act 2003Dokument14 SeitenLabour Act 2003Arunjeet Singh RainuNoch keine Bewertungen

- Detailed Evisa Process of KurdistanDokument27 SeitenDetailed Evisa Process of KurdistanMd Shahroz Alam100% (1)