Beruflich Dokumente

Kultur Dokumente

Tut Q Extra Trust

Hochgeladen von

chunlun87Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Tut Q Extra Trust

Hochgeladen von

chunlun87Copyright:

Verfügbare Formate

BAC 4644

TRUST

NOV 2012

Question 1

Ahmad was a businessman carrying on a cement business. He passed away suddenly in

2009, leaving behind his wife and four children. Before his death, he had prepared a will

in which his wife was named as the trustee and their four children as the beneficiaries.

He willed one half of the trust income to the first child at the discretion of the trustee. The

balance will be distributed equally between the second and third child. A sum of RM

10,000 is to be accumulated each year for the fourth child, now aged five years until the

child reaches the age of 18 years.

Under the terms of the will, the widow is entitled to an annuity of RM 60,000 per year.

Ahmad had investments from which are derived interest, dividend and rent. The details of

the business and the investment income for the year ended 31 Mar 2011 are as follows:

Business : 1 April 2010 - 31 Mar 2011

Gross income

Allowable expenses

Capital allowances due

Balancing charges

Balancing allowances

RM

800,000

620,000

60,000

3,000

26,000

Other income

Rental

Dividends (Malaysia)

Bank interest

Note (i)

Note (ii)

Dividends (China)(remitted)

Notes:

15,000

10,000

5,000

8,000

i)The dividend is paid from a single tier account and no taxes were deducted at source.

ii)The interest income is derived from a fixed deposit with a Malaysian bank.

During the year, the trust paid a cash donation of RM 4,000 to an approved charitable

institution and RM 2,000 to a poor relative of Ahmad.

Based on the trust distributable income of RM 50,000 before accumulation, the trustee

made the following payments to the beneficiaries for the year ended 31 March 2011: a

sum of RM 6,000 to the first child and RM 10,000 each to the second and third child.

The trustee also incurred management fee of RM 1,000 during the year for executing and

administering the trust.

Required

___________________________________________________________________________________________________________

250138769.doc

1/1

BAC 4644

TRUST

NOV 2012

Compute the chargeable income of the trust for the year of assessment 2011 assuming

that section 61(2) of the Income Tax Act 1967 (as amended) was applied. S 61(2) - DG

allow the beneficiarys share of income as a deduction from the trust total income to

arrive at the chargeable income.

Question 2(Trusts with Accumulation)

Mr. Z died on 30th October 2011. A trust was created in his will. The income of the trust

for the year ended 31st December 2011 is as follows:

Business I (Malaysian)

Business II (Foreign)

Rent (Malaysian) net

RM

60,000 (Adjusted income RM 40,000)

30,000 (All remitted to Malaysia)

4,000

Additional information:

(a)

(b)

(c)

(d)

(e)

(f)

(g)

Cost of administering the trust is RM 2,000.

Approved donation amounts to RM 5,000.

Annuity of RM 15,000 is payable to Madam Y, the widow.

of the distributable trust income (if any) after distributing the annuity and

donation, is accumulated for the deceaseds son, Mr. X.

Mr. V and Mr. W are to have equal share in of the distributable income.

Mr. U is to be paid such sums as the trustee deems fit.

There are 3 trustees. One of them is resident in Malaysia.

In 2011, the beneficiaries received the following sums from the trust:

Beneficiary

Mr. V

Mr. W

Mr. U

-------------Amount Received in Malaysia----------Within Malaysia

Outside Malaysia

14,000

14,000

4,000

1,000

1,000

1,000

All the amounts received outside Malaysia in 2011 were remitted to the beneficiaries.

Required:

(a)

(b)

Calculate the income tax payable by the trust for year of assessment 2011.

Calculate the statutory income of each beneficiary for year of assessment 2011

assuming that all the beneficiaries are tax resident in Malaysia.

___________________________________________________________________________________________________________

250138769.doc

2/2

BAC 4644

TRUST

NOV 2012

Question 3 (Settlement)

Mr. A owns several properties from which he received rentals. He decided to settle his

properties and the income therefrom among his children in the following manner:

1st Son Mr. B

Mr. B is married and is 42 years old. Under the terms of the settlement, Mr. B is to

receive the income from the properties so long as he lives. On his death, the properties

and the right to income would revert to Mr. A.

2nd Son Mr. C

Mr. C is 22 years old and is married. Under the terms of the settlement, Mr. A can revoke

the settlement anytime

Daughter Ms D

Ms D is 20 years old and unmarried. Under the terms of settlement she has absolute right

to her share of properties and the income

___________________________________________________________________________________________________________

250138769.doc

3/3

Das könnte Ihnen auch gefallen

- pcc-2011 TaxDokument19 Seitenpcc-2011 TaxHeena NigamNoch keine Bewertungen

- CA Foundation May22 AssessmentDokument4 SeitenCA Foundation May22 AssessmentSmita AdhikaryNoch keine Bewertungen

- Business Taxation MBA III 566324802Dokument5 SeitenBusiness Taxation MBA III 566324802mohanraokp2279Noch keine Bewertungen

- CA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Dokument36 SeitenCA. Pankaj Saraogi: by Visiting Faculty - ICAI FCA, B. Com. (H) - SRCC, B. Ed., Licentiate ICSI, M. Com., DISA (ICAI)Velayudham ThiyagarajanNoch keine Bewertungen

- BC 501 Income Tax Law 740766763 PDFDokument15 SeitenBC 501 Income Tax Law 740766763 PDFSakshi JainNoch keine Bewertungen

- COC Training ExcercisesDokument8 SeitenCOC Training ExcercisesGuddataa DheekkamaaNoch keine Bewertungen

- Uog Year 2 Taxation Paper Uog March 2013Dokument9 SeitenUog Year 2 Taxation Paper Uog March 2013helenxiaochingNoch keine Bewertungen

- CBSE Class 11 Accountancy Question Paper SA 2 2012 PDFDokument6 SeitenCBSE Class 11 Accountancy Question Paper SA 2 2012 PDFsivsyadavNoch keine Bewertungen

- Tax Assignment 1 March 2012Dokument11 SeitenTax Assignment 1 March 2012Bé HòaNoch keine Bewertungen

- F6 InterimDokument7 SeitenF6 InterimSad AnwarNoch keine Bewertungen

- Taxation Management (FIN623) : Assignment # 02Dokument2 SeitenTaxation Management (FIN623) : Assignment # 02Rajesh KumarNoch keine Bewertungen

- P5 Syl2012 InterDokument12 SeitenP5 Syl2012 InterVimal ShuklaNoch keine Bewertungen

- Income Tax Model PaperDokument5 SeitenIncome Tax Model PaperSrinivas YerrawarNoch keine Bewertungen

- Trust TutorialDokument3 SeitenTrust TutorialpremsuwaatiiNoch keine Bewertungen

- All Level 2 Coc Questions Simple To Approach 1 Docx 802a3df9f39Dokument14 SeitenAll Level 2 Coc Questions Simple To Approach 1 Docx 802a3df9f39ibsituabdelaNoch keine Bewertungen

- Py c7 Q MurabahaDokument6 SeitenPy c7 Q MurabahaWan KhaidirNoch keine Bewertungen

- All Level Two Coc QuestionsDokument15 SeitenAll Level Two Coc Questionsabelu habite neriNoch keine Bewertungen

- CA Exam Preparatory Question AnswersDokument4 SeitenCA Exam Preparatory Question AnswersBhavye GuptaNoch keine Bewertungen

- Tax Planning & Financial Reporting 2nd Mid TermDokument6 SeitenTax Planning & Financial Reporting 2nd Mid TermKrishan Kant PartiharNoch keine Bewertungen

- Test 4 Revision Class Question - 2023Dokument3 SeitenTest 4 Revision Class Question - 2023Given RefilweNoch keine Bewertungen

- Acc 723 Tutorial One QuestionsDokument4 SeitenAcc 723 Tutorial One QuestionsJohn TomNoch keine Bewertungen

- 9 Partnership Question 21Dokument11 Seiten9 Partnership Question 21kautiNoch keine Bewertungen

- Income Tax Question BankDokument8 SeitenIncome Tax Question Banksurya.notes19Noch keine Bewertungen

- Accounting For RevenuesDokument7 SeitenAccounting For Revenuesvijayranjan1983Noch keine Bewertungen

- PL Financial Accounting and Reporting Sample Paper 1Dokument11 SeitenPL Financial Accounting and Reporting Sample Paper 1karlr9Noch keine Bewertungen

- FA - Excercises & Answers PDFDokument17 SeitenFA - Excercises & Answers PDFRasanjaliGunasekeraNoch keine Bewertungen

- Assignment MBA III: Business Taxation: TH THDokument4 SeitenAssignment MBA III: Business Taxation: TH THShubham NamdevNoch keine Bewertungen

- FE QuestionsDokument2 SeitenFE Questionsviedereen12Noch keine Bewertungen

- Acca Questions CertifrDokument1 SeiteAcca Questions CertifrblessonNoch keine Bewertungen

- TAX Papers - Paper 1Dokument2 SeitenTAX Papers - Paper 1syedshahNoch keine Bewertungen

- P6mys 2011 Dec QDokument10 SeitenP6mys 2011 Dec QJayden Ooi Yit ChunNoch keine Bewertungen

- Ftxmys Pilot PaperDokument19 SeitenFtxmys Pilot Paperaqmal16Noch keine Bewertungen

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDokument12 SeitenCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavNoch keine Bewertungen

- No.............................. MAY'2011: Ipco Group-I Paper-1 AccountingDokument12 SeitenNo.............................. MAY'2011: Ipco Group-I Paper-1 AccountingSamson KoshyNoch keine Bewertungen

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDokument12 SeitenCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- Finance Accounting 3 May 2012Dokument15 SeitenFinance Accounting 3 May 2012Prasad C MNoch keine Bewertungen

- Single SystemDokument7 SeitenSingle SystemRobert HensonNoch keine Bewertungen

- TH TH STDokument3 SeitenTH TH STsharathk916Noch keine Bewertungen

- Acca Tx-Mys 2019 JuneDokument14 SeitenAcca Tx-Mys 2019 JuneChoo LeeNoch keine Bewertungen

- Tutorial 3 WHT DiscussDokument6 SeitenTutorial 3 WHT DiscussAqila Syakirah IVNoch keine Bewertungen

- Tutorial MurbahahDokument2 SeitenTutorial MurbahahSULEIMANNoch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument56 Seiten© The Institute of Chartered Accountants of IndiaTejaNoch keine Bewertungen

- Case StudiesDokument3 SeitenCase StudiesjmfaleelNoch keine Bewertungen

- Specific Financial Reporting Ac413 May19aDokument4 SeitenSpecific Financial Reporting Ac413 May19aAnishahNoch keine Bewertungen

- Quiz On Account ReceivableDokument4 SeitenQuiz On Account ReceivableJomel BaptistaNoch keine Bewertungen

- Assignment TaxationDokument2 SeitenAssignment TaxationDilruba HassanNoch keine Bewertungen

- Question Analysis: Taxation IDokument9 SeitenQuestion Analysis: Taxation IIQBALNoch keine Bewertungen

- FOA II 2nd AssignmentDokument5 SeitenFOA II 2nd Assignmentshekaibsa38Noch keine Bewertungen

- NIB d2011 PDFDokument190 SeitenNIB d2011 PDFMahmood KhanNoch keine Bewertungen

- Test Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100Dokument8 SeitenTest Series: October, 2014 Mock Test Paper - 2 Intermediate (Ipc) : Group - I Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100TejTejuNoch keine Bewertungen

- Ftxmys 2012 Jun QDokument13 SeitenFtxmys 2012 Jun Qaqmal16Noch keine Bewertungen

- Uj 35520+SOURCE1+SOURCE1.1Dokument14 SeitenUj 35520+SOURCE1+SOURCE1.1sacey20.hbNoch keine Bewertungen

- Institutional AssessementDokument4 SeitenInstitutional Assessementmagarsa hirphaNoch keine Bewertungen

- Ftxmys 2011 Dec QDokument12 SeitenFtxmys 2011 Dec Qaqmal16Noch keine Bewertungen

- Case Study - CLC - Chapter 4Dokument5 SeitenCase Study - CLC - Chapter 4Thái Nữ Hoàng AnhNoch keine Bewertungen

- A211 MC 7 - StudentDokument4 SeitenA211 MC 7 - StudentWon HaNoch keine Bewertungen

- C7 TaxDokument4 SeitenC7 TaxaskermanNoch keine Bewertungen

- Assignment Accounting FundamentalsDokument2 SeitenAssignment Accounting FundamentalsRajshree DewooNoch keine Bewertungen

- Chapter 7 AssignmentDokument27 SeitenChapter 7 Assignmentsanskritishukla2020Noch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Topic 1: Decision Analysis 1. Six Steps in Decision TheoryDokument8 SeitenTopic 1: Decision Analysis 1. Six Steps in Decision Theorychunlun87Noch keine Bewertungen

- Tutorial-12 Q - Chapter-17-RaibornDokument4 SeitenTutorial-12 Q - Chapter-17-Raibornchunlun87Noch keine Bewertungen

- Tutorial 12 Q & A-StudentsDokument2 SeitenTutorial 12 Q & A-Studentschunlun87Noch keine Bewertungen

- Tutorial 14 Q & ADokument4 SeitenTutorial 14 Q & Achunlun87Noch keine Bewertungen

- Tutorial 13 Q & A - StudentsDokument2 SeitenTutorial 13 Q & A - Studentschunlun87Noch keine Bewertungen

- Tutorial 12 Q A Chapter 17 RaibornDokument7 SeitenTutorial 12 Q A Chapter 17 Raibornchunlun87Noch keine Bewertungen

- Minimization Problem: Minimum Number Cover All ZerosDokument5 SeitenMinimization Problem: Minimum Number Cover All Zeroschunlun87Noch keine Bewertungen

- Tutorial 11 Q & A StudentsDokument4 SeitenTutorial 11 Q & A Studentschunlun87Noch keine Bewertungen

- Tutorial 8 Q & ADokument3 SeitenTutorial 8 Q & Achunlun87Noch keine Bewertungen

- Tutorial 6 Q & ADokument4 SeitenTutorial 6 Q & Achunlun87Noch keine Bewertungen

- Tutorial 10 Q & ADokument4 SeitenTutorial 10 Q & Achunlun87Noch keine Bewertungen

- Tutorial 7 Q & ADokument5 SeitenTutorial 7 Q & Achunlun87Noch keine Bewertungen

- Tutorial 9 Q & ADokument2 SeitenTutorial 9 Q & Achunlun87Noch keine Bewertungen

- Tutorial 5 Q & ADokument6 SeitenTutorial 5 Q & Achunlun87Noch keine Bewertungen

- Assignment Question 3Dokument2 SeitenAssignment Question 3chunlun87Noch keine Bewertungen

- Tutorial 7 Q & ADokument5 SeitenTutorial 7 Q & Achunlun87Noch keine Bewertungen

- Tutorial 3 Q & ADokument3 SeitenTutorial 3 Q & Achunlun87Noch keine Bewertungen

- Tutorial 2 Q & ADokument6 SeitenTutorial 2 Q & Achunlun87Noch keine Bewertungen

- Case Preparation ChartDokument6 SeitenCase Preparation Chartchunlun87Noch keine Bewertungen

- Tutorial 4 Q & ADokument5 SeitenTutorial 4 Q & Achunlun87100% (1)

- Tutorial 1 Q & ADokument2 SeitenTutorial 1 Q & Achunlun87Noch keine Bewertungen

- Answer Topic 1 Part 2 Exc2 (C)Dokument1 SeiteAnswer Topic 1 Part 2 Exc2 (C)chunlun87Noch keine Bewertungen

- Assignment Topic Subject Code: Bac 4685 Goods and Service Tax (GST)Dokument2 SeitenAssignment Topic Subject Code: Bac 4685 Goods and Service Tax (GST)chunlun87Noch keine Bewertungen

- Case Preparation ChartDokument6 SeitenCase Preparation Chartchunlun87Noch keine Bewertungen

- Adv Tax Assignment (With Cover)Dokument14 SeitenAdv Tax Assignment (With Cover)chunlun87Noch keine Bewertungen

- AA Money Changing 151014 Legal Review (For Finance)Dokument31 SeitenAA Money Changing 151014 Legal Review (For Finance)chunlun87Noch keine Bewertungen

- Adv Tax Tut1Dokument1 SeiteAdv Tax Tut1chunlun87Noch keine Bewertungen

- Part 2 - Discussion On The Case About Our Opinion: Respondent (R)Dokument2 SeitenPart 2 - Discussion On The Case About Our Opinion: Respondent (R)chunlun87Noch keine Bewertungen

- Adv Tax AssignmentDokument14 SeitenAdv Tax Assignmentchunlun87Noch keine Bewertungen

- MAF680 Case: Chicken Run: Group MembersDokument12 SeitenMAF680 Case: Chicken Run: Group MemberscasmaliaNoch keine Bewertungen

- Participant Get Form DocumentDokument14 SeitenParticipant Get Form DocumentRonald SandersNoch keine Bewertungen

- Compensation ExamplesDokument26 SeitenCompensation ExamplesNAFEES NASRUDDIN PATELNoch keine Bewertungen

- In Come Tax Withholding Assistant For Employers 2022 BDokument2 SeitenIn Come Tax Withholding Assistant For Employers 2022 Badam smithNoch keine Bewertungen

- #35500038 - Megha Engg - MLIP Project Cluster-V - Tax InvoiceDokument4 Seiten#35500038 - Megha Engg - MLIP Project Cluster-V - Tax InvoicerameshNoch keine Bewertungen

- Boat Airdopes 431 Bluetooth Headset: Grand Total 1499.00Dokument2 SeitenBoat Airdopes 431 Bluetooth Headset: Grand Total 1499.00Sneh PanchalNoch keine Bewertungen

- Refunds: S. No. Particulars (')Dokument9 SeitenRefunds: S. No. Particulars (')Rohit KasbeNoch keine Bewertungen

- W9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFDokument1 SeiteW9-990 Tax Form 2016 MEDLIFE (2016-2017) PDFAnonymous 6ZE5pGNoch keine Bewertungen

- Part B PDFDokument3 SeitenPart B PDFDebesh KuanrNoch keine Bewertungen

- Stamp Duty Reforms On Residential PropertyDokument2 SeitenStamp Duty Reforms On Residential Propertyvidhyaa1011Noch keine Bewertungen

- Revenue Regulations No. 01-79: Regulations Governing The Taxation of Non-Resident CitizensDokument3 SeitenRevenue Regulations No. 01-79: Regulations Governing The Taxation of Non-Resident Citizenssaintkarri100% (1)

- Certificate NACIN Jan-2024 72ndbatch (Revised)Dokument2 SeitenCertificate NACIN Jan-2024 72ndbatch (Revised)IAS MeenaNoch keine Bewertungen

- Part 1-Donor'S TaxDokument2 SeitenPart 1-Donor'S TaxAllen KateNoch keine Bewertungen

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Dokument1 SeiteItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaNoch keine Bewertungen

- Federal Income Taxation: TECEP® Test Description For ACC-421-TEDokument5 SeitenFederal Income Taxation: TECEP® Test Description For ACC-421-TETamirat HailuNoch keine Bewertungen

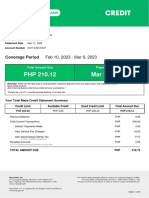

- MayaCredit SoA 2023MARDokument2 SeitenMayaCredit SoA 2023MARJan SaysonNoch keine Bewertungen

- Premium ReceiptsDokument1 SeitePremium ReceiptsRajNoch keine Bewertungen

- Marubeni Corporation VS Commissioner ofDokument3 SeitenMarubeni Corporation VS Commissioner ofMarjorie C. Sabijon-VillarinoNoch keine Bewertungen

- Income Taxation SchemesDokument12 SeitenIncome Taxation SchemesargelenNoch keine Bewertungen

- Tax File Memorandum and Research EssayDokument7 SeitenTax File Memorandum and Research EssayAssignmentLab.com0% (1)

- Invoice: Depo Pasir SedoganDokument1 SeiteInvoice: Depo Pasir SedoganChandra PriatamaNoch keine Bewertungen

- Wickliffe Schools Levy HistoryDokument4 SeitenWickliffe Schools Levy HistoryThe News-HeraldNoch keine Bewertungen

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDokument4 SeitenMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANoch keine Bewertungen

- First Statement:: Answer: ADokument6 SeitenFirst Statement:: Answer: AJames DiazNoch keine Bewertungen

- Payslip Sep 2023Dokument1 SeitePayslip Sep 2023paras rawatNoch keine Bewertungen

- Bipard Prashichhan (Gaya) 87 2023Dokument2 SeitenBipard Prashichhan (Gaya) 87 2023tinkulal91Noch keine Bewertungen

- Charles SchwabDokument45 SeitenCharles SchwabThe Washington PostNoch keine Bewertungen

- Form 52Dokument1 SeiteForm 52fcanitinjainNoch keine Bewertungen

- Preferential Taxation - Senior Citizens LawDokument2 SeitenPreferential Taxation - Senior Citizens LawKezNoch keine Bewertungen

- Israel Phil TreatyDokument4 SeitenIsrael Phil TreatyGrace TrinidadNoch keine Bewertungen

- Income From House Property Practical 1Dokument1 SeiteIncome From House Property Practical 1Jitendra SharmaNoch keine Bewertungen