Beruflich Dokumente

Kultur Dokumente

Master of Banking and Finance

Hochgeladen von

vagabondage0511Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Master of Banking and Finance

Hochgeladen von

vagabondage0511Copyright:

Verfügbare Formate

Faculty of Economics and Business Administration

Master of Banking and Finance

Master of Banking and Finance

Table of Contents

Master of Banking and Finance

Joining Forces to Understand the Complex Financial Dynamics

Why This Program?

Target Group

A Unique Combination of Advantages

Program Overview

Some Practical Information

Evaluation: a dynamic approach

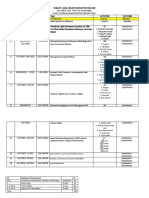

Course schedule

Degree

Tuition fee

Admission Procedures

Teaching Staff

Further Information

10

Joining Forces to Understand

the Complex Financial Dynamics

During the last few decades the financial world has gone through a complete transformation.

Deregulation of financial markets, spurred by dramatic technological evolutions, tore down the walls

that had existed between domestic and international money and capital markets as well as between

banks, insurance companies and stock brokers. Competition became the buzzword. World-wide financial service companies began restructuring their business lines and started developing new products

and markets. In Europe, the introduction of a single currency further encouraged these developments.

Finally, the recent financial crisis showed the importance of understanding financial markets in detail

and highlighted the necessity of a solid risk management.

Undoubtedly, the entire economy benefits from these evolutions. Unfortunately, for the financial intermediaries life becomes ever more complex. It is therefore no wonder that they are constantly in need

of specialised people: economists who understand the mechanics of financial markets will always be

scarce.

To accommodate this shortage the Department of Financial Economics of Ghent University introduced

advanced studies in Banking and Finance. The aim of this Master program is to provide the students

with in-depth knowledge of the latest developments in finance and banking and a thorough understanding of the relevant academic literature. The target group consists of economists with previous

education or working experience in the fields of finance or banking and sufficient proficiency in statistics and econometrics.

The program Master of Banking and Finance shows that the Department

of Financial Economics at Ghent University is continuously focusing on

evolutions of financial markets. By bringing together a group of motivated students and teachers, and by applying dynamic and multimedia

teaching methods, the Department of Financial Economics is striving to

increase understanding about and enthusiasm for financial developments.

Master of Banking and Finance

Why This Program?

The goal of this specialised program in Banking and

Finance is to form experts who are able to perform their

analysis of financial problems and developments within

a sound theoretical and quantitative framework. Their

analysis should also enable them to work out or to adapt

existing (company) strategies.

Indeed, working in the financial sector is becoming much

more demanding, but also very exiting. The deregulation

of financial markets has opened many opportunities for

financial service companies, investors, borrowers as well

Herman Verwilst

as for the government. Technological improvements in

Former Chairman of the management committee

communication and information processing have decre-

of Fortis Bank.

ased transaction costs dramatically, which altered the

core business of banks completely. At the same time,

The financial sector needs economists with a

these evolutions explain the huge growth rates in the

thorough micro- and macro-financial training

number of transactions on financial markets. Investors

and who have mastered quantitative manage-

have never before been confronted with such a broad

ment techniques for modern financial service

range of investment opportunities, whereas corporate

companies. They should also be able to develop

and government borrowers have flexible access to money,

a critical vision towards the important tenden-

being able to choose the maturity, the currency and even

cies and strategic choices in the financial indus-

the risk-profile of their financing. At the same time,

try. Young people with such a profile will be the

government agencies in general and central banks more

leading executives of the future.

specifically can not only actively use financial markets to

In my opinion, the Master of Banking and

steer the economy, but also learn about the expectations

Finance at Ghent University is the ideal program

of economic agents, to the extent that these expectati-

to acquire this knowledge and these skills.

ons are reflected in the prices of financial assets.

Master of Banking and Finance

Why This Program?

Of course, no benefits without any dangers financial markets never present free lunches. Although financial intermediaries are undoubtedly offered many opportunities, choosing among them becomes difficult. As financial markets are

in constant move, a choice that seems to add value to the company in one scenario may well turn out to be fatal in other

circumstances. Moreover, financial organisations often have many business lines and therefore many counterparties. It

follows that a clear understanding of all the interrelationships is crucial to ascertain the risk position of the entire organisation. Likewise, a major concern of prudential authorities is that the failure of one participant will lead, through its

multiple transactions, to the failure of several otherwise sound institutions, ultimately causing a total breakdown of the

financial system. All these examples point out that risk management should be well developed on financial markets.

Thorough understanding of the complex relationships and dynamics of financial markets and institutions requires

insight in many disciplines. Knowledge about the organisation of financial markets and the mechanics of the assets

traded is not sufficient, if it is not supplemented by awareness of macroeconomic and monetary concepts. Moreover, the

quantitative nature of finance also requires a sound command of econometrics and data processing skills. It is precisely

the need of the financial community for people who are able to combine these economic, financial and quantitative

skills that led the Faculty of Economics and Business Administration at Ghent University to organise advanced studies in

Banking and Finance. This Master program draws heavily upon the expertise of the young team of teachers and researchers from the Department of Financial Economics. This department groups sub-fields such as monetary economics,

banking, microeconomics of financial markets, investment analysis, financial econometrics, and risk management.

Target Group

The Master program is intended for economists having some background in finance and who feel the need for a serious

in-depth training in finance and banking. Students graduating from this program will probably feel at ease in functions

or departments such as

investment analysis

risk management units of financial and corporate organisations

asset and liability management units of financial intermediaries

pension funds, hedge funds

study department of a central bank or government agency

financial consulting firms, rating agencies

supervisory bodies for financial markets and institutions

university or research departments

Master of Banking and Finance

A Unique Combination of Advantages

A specialised program

university offers a computer room reserved exclusively

All courses are specialised and advanced within the broad

for the Master students. Besides specialised statistical and

field of finance and banking.

econometric software, standard packages such as Microsoft Office, E-mail software, and Internet browsers are also

Financial insights are combined with macroeconomics and

installed on the computers. To download data, the faculty

monetary policy

subscribes to Datastream Data Channel, from which most

Finance is not an isolated world. The interrelationships

financial and macroeconomic data can be accessed.

between on the one hand finance and banking and macroeconomic policy on the other hand are studied extensi-

Opportunity to obtain in-the-field experience

vely. Advanced courses in macroeconomics, monetary

The assignments prepare the students for a final graduation

economics, corporate finance and organisation of financial

project. During the last two months of the program, teams

markets describe the larger setting in which finance should

of two students will be given the opportunity to work full-

be situated.

time on a project in a financial institution or government

agency under the supervision of both the academic staff

You will become familiar with the most recent techniques

and a company supervisor. Examples of such projects will be

used in finance

made available on the website of the Master program.

All courses are strongly founded in academic research.

Students will be guided through recent academic papers

Getting international exposure

and encouraged to use the tools and models proposed to

In finance and banking it is important to have an interna-

analyse and solve real-world problems.

tional dimension and obviously international problems will

Thorough quantitative basis

invite internationally renowned guest speakers and guest

Because of the availability of abundant data, solving finance

professors. For instance, we are glad that Frank Smets, who

and banking problems often involves extensive number

is head of the Monetary Policy Research unit of the Euro-

crunching. Although most courses will discuss appropriate

pean Central Bank, has agreed to teach Monetary Econo-

methods to perform such analyses, an advanced course in

mics in the Master program. Of course, also by choosing

financial econometrics will provide the students with the

English as the common language in this program, we expli-

necessary background.

citly want to attract an international student population.

Enjoy interactive education and train your presentation

skills

In the Master program a lot of time will be devoted to classroom discussion, presentations of case studies and papers,

and expositions of analyses of real-world problems. By

doing so, students will be able to train their oral and written presentations skills. They will learn how to state and

defend their arguments as well as to (critically) evaluate

the statements of students and teachers.

Working together in applying concepts

Many assignments and cases are to be solved by teams of

two to four students. These assignments serve to better

grasp theory and to be able to handle real-world finance

problems. Because of the importance of these assignments,

as a general rule, there will be no lectures after lunch. For

Extensive professional support

Many courses are taught by members of the Department

of Financial Economics. This department hosts a young

team of professors and researchers. Their research covers

most subfields in the domain of finance and banking. More

details can be found on the Departments website. All

teachers and researchers will be available to help students

finding their way in the world of finance. In addition, the

program co-ordinator assists students with more practical

problems.

Opportunity to spread courses over 2 years: the possibility

exists to spread the Master program over two years.

An attractive study environment

The city of Ghent hosts the largest student population of

the country; the University alone accounts for over 30,000

students, enrolled in 9 faculties. The Faculty of Economics

most courses, the grades on the assignments will weigh

and Business Administration is situated close to the Medie-

heavily on the final grades.

val city centre. Theatres, musea and sporting facilities are

Excellent computer facilities

4

be discussed in most courses. In addition we will frequently

In order to be able to work in the best circumstances, the

within walking distance. Student housing is comfortable

and affordable.

More information can be found on www.ugent.be

Master of Banking and Finance

Program Overview

Below we list a description of the courses offered in the Master program.

Advanced Investments

ships are established between various financial markets

(stocks, bonds, corporate bonds, exchange rates, commodities) and economic indicators (growth, inflation, inte-

Michael Frmmel

rest rates, balance of payments, central bank policies).

This course focuses on recent developments in portfolio

The objective is to investigate the consequences of these

theory and finance, such as behavioural finance, bubbles

interactions for investment decisions, both asset alloca-

and globalized markets. Both the empirical testing of

tion and market timing, as well as the risk of financial

theoretical models and the empirical analysis of financial

assets. Students also have to manage an asset portfolio to

markets are discussed. The goal is to make the students

translate theory into practice.

acquainted with the academic literature in these fields

International Banking

and Financial Markets

and to teach them how to apply the methods introduced

in these papers to real-world problems.

Koen Schoors

Financial Econometrics

Gerdie Everaert

The aim of this course is to study a widely neglected

issue: How do commercial banking systems behave under

distress? We analyse the causes of banking crises around

The aim of this course is to provide students with the

the world and propose methods to prevent these crises

ability to recognise problems in financial economics and

or, if need be, to solve them. Various institutional arran-

to analyse these problems within the existing scientific

gements are compared, ranging from deposit insurance

literature. To this respect, students are acquainted with

schemes to exchange rate arrangements. Also the inter-

a number of modern econometric techniques commonly

national financial architecture comes under scrutiny.

employed in the financial literature.

Special attention goes to the analysis of a number of rela-

An important accent in this course is to provide students

tively recent cases.

with the ability to translate the acquired knowledge to

real problems, i.e. students are required to be able to

provide solutions to practical problems in a scientifically

well-founded and creative way.

Financial Risk Management

Frank De Jonghe (Deloitte)

Management of Financial Institutions

Rudi Vander Vennet

The course intends to provide a thorough understanding of the main issues and the complex interactions

in the management of modern financial services firms

(FSFs). The aim is to (1) identify important trends within

In this course, the pricing and the use of derivative

the changing environment of FSFs, including the finan-

products is discussed. Especially the quantitative techni-

cial crisis, (2) articulate and understand strategic issues

ques used for pricing and risk management will be exten-

in financial intermediation, (3) master up-to-date analy-

sively covered. Next to that, in three separate sessions,

tical and quantitative tools to tackle the key decisions in

the key ingredients for the measurement of market risk,

FSFs, (4) propose and justify scientifically accurate and

credit risk and operational risk are introduced.

workable solutions for real-world problems, (5) confront

evidence obtained in cases or research with the acquired

Economics of Financial Markets

William De Vijlder (BNP Paribas Investment Partners)

This course analyzes the interaction between financial

markets and the macroeconomic environment. Relation-

body of theoretical and empirical knowledge in the

field, and (6) critically assess competing paradigms of FSF

analysis.

Master of Banking and Finance

Program Overview

Governance in Financial Institutions

Herman Verwilst

This course starts from the basic knowledge about the

role of banks in the economy. The fundamentals of regulation and supervision are thoroughly presented, as well

as the revealed shortfalls and the proposed adjustments.

The internal and external governance of banks is analysed. The observed weakness and proposed improvements

will be discussed. Students write and defend a paper on

one of the topics.

The aim of the course is to understand the behaviour

Topics in Advanced Corporate Finance

Dries Heyman

This course wants to give the students a thorough understanding of various important corporate finance decisions; In order to achieve that, both theory and recent

empirical evidence will be reviewed. We focus on a

number of important topics: capital structure, payout

policy, corporate governance, mergers and acquisitions

and initial public offerings. Next to class work, students

will also make an empirical study on one of these topics.

of individual banks versus regulation, supervision and

governance, to understand the function and rationale of

public intervention in financial markets and enable the

Topics in Empirical Research in Finance

students to solve independently and on an academic level

problems that are related to bank behaviour and bank

Michael Frmmel/Dries Heyman/Rudi Vander Vennet

supervision

The goal of this course is to accustom students with

recent empirical research in finance and banking. To this

end, researchers from universities and financial institu-

Monetary Economics

tions will be invited to share their research results and

their practical experience with the students and other

Gert Peersman

This course wants to give the students a thorough understanding of the way monetary policy is conducted and the

interested participants. In addition, the students will be

required to use some of the results or techniques presented in their own empirical research.

transmission of monetary policy signals to the rest of the

economy.

Thesis (Graduation Project)

Strategy and Organisation of

Financial Institutions

Herman Verwilst

During the last two months of the academic year (May

and June) students will be given the opportunity to work

in small teams on their thesis in a financial institution. This

will allow them to demonstrate their capacity to analyse

The aim of the course is to make students understand

real-world situations in a scientifically accurate way using

the complex interactions in the organisation of financial

the modelling techniques covered in the Master courses.

services firms, their strategy formulation and the imple-

Often, they will be required to offer solutions to actual

mentation of strategic plans.

problems and to assess potential policy implications of

such solutions. The thesis subjects are usually suggested

by financial institutions or other companies. A team consisting of faculty members and employees of the company

will supervise the students while working on the thesis.

The findings will be presented by the end of June to the

supervising team.

Master of Banking and Finance

Some Practical Information

Evaluation: a dynamic approach

Admission procedures

The courses in this Master program frequently use interactive

Students with a Belgian university degree (2nd cycle) or a Belgian

learning methods, so students are expected to participate acti-

HOLT degree (higher education of minimum 4 years of study):

vely. Opportunities are offered to hold group discussions, to

People meeting this requirement are invited to take an admission test,

the purpose of which is to determine the prior knowledge of banking and finance research, of quantitative skills, and English. (Partial)

exemption of this admission test can be offered if, on the basis of the

curriculum, the individual seems to be familiar with these basics. More

information about these tests can be found on our website: http://

www.feb.ugent.be/fineco/mbf/

To apply for exemption, you should fill out the information form

(see website: http://www.feb.ugent.be/fineco/mbf/) and mail it to

mbf@ugent.be

solve case studies, to give presentations and to discuss actual

situations with lecturers and guest speakers. In other words, the

permanent evaluation of participants is indispensable and very

important.

Course schedule

When?

The sessions take place on a daily basis, generally from 9 am till

1 pm. The afternoon will be devoted to case study preparation,

group discussion, exercises, preparation of presentations, guest

lectures, etc.

Language?

The program will be taught in English. All presentations and

reports will be in English. Consequently, a sufficient proficiency

in English is a necessary entry requirement.

Students with a non-Belgian degree having a second cycle academic degree:

There are 2 compulsory procedures for admission, we advise you to start

both procedures at the same time. The first procedure allows us to ascertain whether the applicant has the necessary background to be able to

successfully participate to the Master program. The second procedure is

the general acceptance procedure set up by Ghent University.

Where?

Procedure 1: First of all we ask you to complete the information form

All courses will take place at our campus at Woodrow Wilson-

(see website: http://www.feb.ugent.be/fineco/mbf/) and mail it to

mbf@ugent.be

In order to speed up the process of application, you should also send:

1. a letter of motivation (why you would like to study advanced

courses in Banking and Finance at Ghent University)

2. your Curriculum Vitae (with copies of your diplomas and degrees)

3. two letters of reference 4. your GMAT score

plein 5D, Ghent the building where also the Department of

Financial Economics is located. The room is equipped with the

necessary IT-infrastructure and the computer class for the Master

students is also in the building.

Start of the program: end of September

End of the lectures: end of April

Thesis (Graduation project): the thesis starts beginning of May

and the results will be presented to the faculty and the bank/

company by the end of June.

Examination periods: Although in most cases students will be

evaluated during the lecture weeks, for some courses a formal

examination will be organised during two weeks after the Christmas holidays (first semester courses) and one week after the

Easter break (second semester courses). If necessary, a second

examination session is organised in September.

Degree

Participants who end the program successfully will obtain a

Master of Banking and Finance.

The university degree will only be granted to participants who

meet all admission requirements, attend sessions regularly,

complete the final project successfully and pass the test on the

different subjects.

Tuition fee

Currently, the tuition fee is set at 564,30. Participants

have to enrol at Ghent University. For students who wish

to follow the program on a part-time basis, tuition fee will

also be spread over two years. In addition to the tuition fee,

there are other specific costs like books, course material, use

of software, etc. We estimate this cost at approximately

400.

The address is:

Faculty of Economics and Business Administration

Master of Banking and Finance, Lena De Cock

Tweekerkenstraat 2, 9000 Gent, Belgium

Students with a non-Belgian degree are required to take the GMAT

organised by the Graduate Management Admission Council. This test

is organised at numerous locations all over the world (see http://www.

gmac.com for additional information). When taking the GMAT, please

mention that the results should be forwarded to the Faculty of Economics and Business Administration of Ghent University (GMAT code

number 7096). Based on their curriculum and this score, students may

qualify for admission. In addition, students may be required to take

an admission test. (Partial) exemption of this admission test can be

offered if, on the basis of a strong academic curriculum, the individual

seems to be familiar with the required basics.

The admission test consists of three parts: (1) Financial Economics

(2) Investment Analysis, and (3) Econometrics and Statistics. Our

website contains references to books suited to prepare for the admission test.

For any questions you may have with reference to procedure 1, please

contact mbf@ugent.be

Procedure 2: In order to be able to register for the Master of Banking

and Finance, you MUST register at Ghent University.

For more information: http://www.ugent.be/en/teaching/admission/

degreestudent/application

For any questions you may have with reference to procedure 2,

7

please contact internationalstudents@UGent.be

Master of Banking and Finance

Teaching Staff

Prof. dr. Michael Frmmel

Prof. dr. Gerdie Everaert

Michael Frmmel studied mathematics and business

Gerdie Everaert obtained his Ph.D. at Ghent University

administration in Aachen, Germany, and obtained his

in 2000 with a dissertation on public capital, economic

PhD at the Leibniz Universitt Hannover, Germany, in

growth and the labour market. He teaches econome-

2003 with a dissertation on exchange rate volatility. His

trics at Ghent University. His current research interests

research focuses mainly on international finance, the

are panel data econometrics, the macroeconomics and

foreign exchange market and transition economies.

econometrics of the labour market and the effects of

He worked as a visiting researcher at the Austrian, the

fiscal policy. He published in a variety of academic jour-

Bulgarian and the Hungarian National Bank and joined

nals including the Journal of Economic Dynamics and

the Department of Financial Economics at Ghent Univer-

Control, Journal of Time Series Econometrics, Macroeco-

sity in 2007 as professor of finance. Michael Frmmel

nomic Dynamics, Empirical Economics, Public Choice and

is author of two books and various articles inter alia in

Economic Modelling.

Quantitative Finance, the Journal of Comparative Economics and the Journal of International Money and Finance.

Prof. dr. William De Vijlder

Prof. dr. Rudi Vander Vennet

William De Vijlder has been working in asset manage-

Rudi Vander Vennet is full professor of financial econo-

Chief Investment Officer and Managing Director of

mics, program director of the Master of Banking and

Fortis Investment Management, the asset management

Finance and chairman of the Department of Financial

company of Fortis. Since 2009 he is CIO of Strategy and

Economics at Ghent University. After obtaining a degree

Partners and member of the Management Committee of

in economics and a master in finance, he was enrolled

BNP Paribas Investment Partners. He obtained his PhD at

in a Ph.D. program at the University of Rochester, New

Ghent University in 1990 and has been part-time profes-

York. His Ph.D. dissertation analyzed the performance

sor at the same university since 1991.

ment since 1989. From 2000 till 2009 he was Global

effects of European bank mergers and acquisitions. He

is (co-) author of various articles on banking and monetary topics in, e.g., Journal of Money, Credit and Banking

Prof. dr. Koen Schoors

or Journal of Banking and Finance and he has written

Koen Schoors obtained his Ph.D. at Ghent University in

several contributions in books dealing with European

1998 with a dissertation on the emergence of a commer-

bank markets and the EMU. In 1999 he received two

cial banking system in Russia. Later he worked as a

important scientific awards. Next to his academic duties,

consultant and banking expert in Moscow and spent one

he has acquired valuable experience as a member of the

year at Oxford University as a postdoctoral researcher

board of directors of a number of holding companies

before returning to Ghent University. His main research

and financial institutions and as a consultant for various

focus is banking and finance, corporate finance, law and

financial companies.

finance, law and economics and institutional economics.

Het has published widely on these topics in journals like

Journal of Comparative Economics, International Review

of Law and Economics, Economics of Transition, Journal

of Corporate Finance, and Oxford Economic Papers. He

is an affiliate researcher at LICOS (Centre for Institutions

and Economic Performance in Leuven), BOFIT (Bank of

Finland Institute for Economies in Transition) and WDI

(World Development Institute, University of Michigan).

He widely contributes to the public debate in several

economic fields.

Master of Banking and Finance

Teaching Staff

Prof. dr. Herman Verwilst

Prof. dr. Gert Peersman

Herman Verwilst obtained his Ph.D. in economics at the

Gert Peersman is full professor of Monetary Economics

Johns Hopkins University (USA) in 1974 and worked until

at the Department of Financial Economics. He obtained

1979 at the International Monetary Fund. In 1980 he

his PhD in 2001 at Ghent University with a dissertation

joined the Department of Financial Economics at Ghent

titled The transmission of monetary policy in the Euro

University as full-time professor. He is now part-time

area: Implications for the European Central Bank. His

professor. After a political career as head of the cabinet

main research fields are monetary economics, monetary

at the Belgian Ministery of Economic Affairs and as a

policy and macroeconometrics. He published in various

member of the Belgian Senate, he moved to the financial

international peer reviewed journals, such as Economic

sector where he had several executive functions first at

Journal, International Economic Review, Economic Policy,

the ASLK-Bank and later in the Fortis Group. Further-

the Journal of Applied Econometrics, the Journal of

more, he is chairman or member of several advisory coun-

Money, Credit and Banking, He has been a consultant

cils. He has written several academic articles on of bank-

for The European Central Bank (Frankfurt) and the Bank

ing and monetary economics, which were published in

of England (London). He is also a member of the Belgian

both international and Belgian journals. In 1994 he held

High Council for Finance.

the distinguished Francqui chair in Economics.

Prof. dr. Frank De Jonghe

Dr. Dries Heyman

Frank De Jonghe is a partner at Deloitte, responsible for

Dries Heyman is a postdoctoral FWO-fellow at the Depart-

the Actuarial and Financial Risk Advisory team. The team

ment of Financial Economics. He obtained his PhD in 2008

offers both added value support services to the exter-

at Ghent University with a dissertation titled Topics on

nal auditors, and independent consulting, in a variety

the Portfolio Management of Financial Investments. His

of areas, such as valuation of financial instruments, risk

main research areas are mutual fund behavior en behavi-

measurement and management, Basel II(I) and Solvency

oral finance. He published in international peer reviewed

II, commodities trading, asset management, securitisa-

journals such as Small Business Economics and Insurance:

tion,

Mathematics and Economics.

Frank holds a PhD in Theoretical Physics from the University of Leuven. Before joining Deloitte, he worked for

Euroclear as internal auditor, and at ING IM as mutual

fund portfolio manager.

Further Information

Other Master program

If you would like to obtain further information

Master of Marketing Analysis

about the Master program in Banking and Finance,

Programme Director: Prof. dr. Dirk VAN DEN POEL

please do not hesitate to contact us:

Tel.: +32 (0)9 264 89 90

E-mail: mma@UGent.be

Michael Frmmel/Rudi Vander Vennet

Program Directors

Phone: +32 (0)9 264 89 79 (Michael Frmmel)

Phone: +32 (0)9 264 35 13 (Rudi Vander Vennet)

Fax: +32 (0)9 264 89 95

E-mail: Michael.Froemmel@UGent.be

E-mail: Rudi.VanderVennet@UGent.be

How to reach us

Lena De Cock/Nathalie Verhaeghe

Program Co-ordinators

Phone: +32 (0)9 264 34 68 (Lena De Cock)

Phone: +32 (0)9 264 89 84 (Nathalie Verhaeghe)

Department of

Financial Economics

Email: mbf@UGent.be

Ghent University

Faculty of Economics and Business Administration

Tweekerkenstraat 2

9000 Ghent

Belgium

Faculty of Economics and

Business Administration

Faculty of Economics and Business Administration

Department of Financial Economics

Woodrow Wilsonplein 5D

9000 Ghent, Belgium

Phone +32 (0)9 264 35 12

Fax +32 (0)9 264 89 95

http://www.feb.ugent.be/fineco/

More detailed information on the Master of

Banking and Finance can be found at our website

http://www.feb.ugent.be/fineco/mbf/

10

Das könnte Ihnen auch gefallen

- European Investment Bank Annual Report 2019 on the European Investment Advisory HubVon EverandEuropean Investment Bank Annual Report 2019 on the European Investment Advisory HubNoch keine Bewertungen

- Chapter 1-IBF IntroductionDokument61 SeitenChapter 1-IBF IntroductionHay JirenyaaNoch keine Bewertungen

- Artificial Intelligence Applied To Stock Market Trading A ReviewDokument20 SeitenArtificial Intelligence Applied To Stock Market Trading A ReviewAbdellatif Soklabi100% (1)

- Effect of Accounting Conservatism Level, Debt Contracts and Profitability On The Earnings Management of Companies: Evidence From Tehran Stock ExchangeDokument6 SeitenEffect of Accounting Conservatism Level, Debt Contracts and Profitability On The Earnings Management of Companies: Evidence From Tehran Stock ExchangeTI Journals PublishingNoch keine Bewertungen

- Introduction To Investment Banking PDFDokument74 SeitenIntroduction To Investment Banking PDFNitesh MishraNoch keine Bewertungen

- Exemples Projets de Recherche PHD PDFDokument78 SeitenExemples Projets de Recherche PHD PDFDieudonné ManirakizaNoch keine Bewertungen

- Unit 2. Investment Companies and Unit TrustDokument10 SeitenUnit 2. Investment Companies and Unit TrustCLIVENoch keine Bewertungen

- Bankscope Database GuideDokument2 SeitenBankscope Database GuideKUBuslib0% (1)

- Financial Modeling & Analysis Course, Ottawa - The Vair CompaniesDokument4 SeitenFinancial Modeling & Analysis Course, Ottawa - The Vair CompaniesThe Vair CompaniesNoch keine Bewertungen

- Foreign Exchange Activities of Southeast Bank LimitedDokument48 SeitenForeign Exchange Activities of Southeast Bank LimitedRayhan AhmedNoch keine Bewertungen

- Efficience of Financial InstitutionsDokument62 SeitenEfficience of Financial InstitutionsFlaviub23Noch keine Bewertungen

- MPhil Handbook 2019-20 v1Dokument121 SeitenMPhil Handbook 2019-20 v1Osten MahNoch keine Bewertungen

- Implementing Phase One of IFRS 9 Financial Instruments GL IFRSDokument24 SeitenImplementing Phase One of IFRS 9 Financial Instruments GL IFRSAli Kreidieh100% (1)

- FinTech-transforming-finance ACCA November 2016Dokument16 SeitenFinTech-transforming-finance ACCA November 2016CrowdfundInsider100% (2)

- European Financial Markets and Institutions PDFDokument2 SeitenEuropean Financial Markets and Institutions PDFVenkatNoch keine Bewertungen

- Cost and Management Accounting - Course OutlineDokument9 SeitenCost and Management Accounting - Course OutlineJajJay100% (1)

- Making IFRS9 and Basel Requirements CompatibleDokument25 SeitenMaking IFRS9 and Basel Requirements CompatibleCarlos Antonio NogueiraNoch keine Bewertungen

- Motivation Letter WUDokument2 SeitenMotivation Letter WUdash maxNoch keine Bewertungen

- Tech. Innovation in Banking in IndiaDokument12 SeitenTech. Innovation in Banking in IndiaDebasish RoutNoch keine Bewertungen

- Determinants of Commercial Banks' Performance A Case of NepalDokument13 SeitenDeterminants of Commercial Banks' Performance A Case of NepalAyush Nikhil75% (4)

- 28 Illustrative Ifrs Corporate Consolidated Financial Statements 2009Dokument164 Seiten28 Illustrative Ifrs Corporate Consolidated Financial Statements 2009grover_deepak18100% (1)

- Management, Identified Competencies and CoursesDokument10 SeitenManagement, Identified Competencies and CoursesAshe BalchaNoch keine Bewertungen

- Asset Management PresentationDokument27 SeitenAsset Management PresentationSamer KahilNoch keine Bewertungen

- Some Applications of Mathematics in Finance (7 November 2008)Dokument52 SeitenSome Applications of Mathematics in Finance (7 November 2008)Join RiotNoch keine Bewertungen

- Financial Markets ModuleDokument248 SeitenFinancial Markets ModuleTrường Nguyễn100% (2)

- GCMA BookDokument524 SeitenGCMA BookZiaul Huq100% (5)

- IfrsDokument23 SeitenIfrsdefactosnipeNoch keine Bewertungen

- 2017 - Application of Machine Learning Techniques For Stock Market PredictionDokument110 Seiten2017 - Application of Machine Learning Techniques For Stock Market PredictiontippitoppiNoch keine Bewertungen

- Internship Report MCB Bank 1Dokument67 SeitenInternship Report MCB Bank 1abdul rehmanNoch keine Bewertungen

- MSC Finance and Economics Brochure 2019Dokument15 SeitenMSC Finance and Economics Brochure 2019Yass CosmeticsNoch keine Bewertungen

- Ed - 16wchap07sln For 30 Jan 2018Dokument7 SeitenEd - 16wchap07sln For 30 Jan 2018MarinaNoch keine Bewertungen

- In Tech We Trust: A Report From The Economist Intelligence UnitDokument34 SeitenIn Tech We Trust: A Report From The Economist Intelligence UnitAbhishekNoch keine Bewertungen

- Master Thesis - Su PDFDokument103 SeitenMaster Thesis - Su PDFAnonymous qAegy6GNoch keine Bewertungen

- STATADokument58 SeitenSTATARiska GrabeelNoch keine Bewertungen

- Strategic Management/ Business Policy: Slides 2 Industry AnalysisDokument41 SeitenStrategic Management/ Business Policy: Slides 2 Industry AnalysisballadnaNoch keine Bewertungen

- Derivatives - The Tools That Changed FinanceDokument205 SeitenDerivatives - The Tools That Changed FinanceAlvin AuNoch keine Bewertungen

- Assignment 3 - Financial Case StudyDokument1 SeiteAssignment 3 - Financial Case StudySenura SeneviratneNoch keine Bewertungen

- Chapter I - Merchant BankingDokument4 SeitenChapter I - Merchant BankingSam ChinthaNoch keine Bewertungen

- Management AccountingDokument269 SeitenManagement Accountingmanisha.sachdevaNoch keine Bewertungen

- Get The CISI Certificate With IntelivistoDokument1 SeiteGet The CISI Certificate With IntelivistoIntelivisto Consulting India Private LimitedNoch keine Bewertungen

- Brighton Business School Referencing HandbookDokument26 SeitenBrighton Business School Referencing Handbookheavyh4lifeNoch keine Bewertungen

- PWC Ifrs and Luxembourg GaapDokument148 SeitenPWC Ifrs and Luxembourg Gaapronitraje100% (2)

- Fundamentals Course Outline OfferDokument21 SeitenFundamentals Course Outline Offerlizzie111Noch keine Bewertungen

- PWC Ifrs Ifrs9 New Way Hedging StrategiesDokument2 SeitenPWC Ifrs Ifrs9 New Way Hedging StrategiesfabiopnoronhaNoch keine Bewertungen

- Capital Structure and Financial Performance.-Financial Seminar Group-RuthDokument25 SeitenCapital Structure and Financial Performance.-Financial Seminar Group-RuthBenardMbithiNoch keine Bewertungen

- The Effect of Mobile Banking On Financial PerformanceDokument69 SeitenThe Effect of Mobile Banking On Financial PerformanceHanane Kadi100% (1)

- Ias 16Dokument48 SeitenIas 16Khalid AzizNoch keine Bewertungen

- FM Ebook - Part 2-Financial ModellingDokument36 SeitenFM Ebook - Part 2-Financial ModellingtejaasNoch keine Bewertungen

- Capital Structure TheoriesDokument25 SeitenCapital Structure TheoriesLalit ShahNoch keine Bewertungen

- DNB Supervision Manual ILAAP 2.1 - tcm51-222258Dokument86 SeitenDNB Supervision Manual ILAAP 2.1 - tcm51-222258viorelu99100% (1)

- Solution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting FrameworkDokument893 SeitenSolution 1.1: Solutions To Gripping IFRS: Graded Questions Financial Reporting Frameworksarvesh guness100% (1)

- CFA Level 1 Corporate Finance E Book - Part 4Dokument5 SeitenCFA Level 1 Corporate Finance E Book - Part 4Zacharia VincentNoch keine Bewertungen

- KPMG Impact of IFRS - BankingDokument36 SeitenKPMG Impact of IFRS - Bankinghui7411Noch keine Bewertungen

- Accounting For ManagersDokument286 SeitenAccounting For ManagersSatyam Rastogi100% (1)

- Financial Risk Management: A Practitioner's Guide to Managing Market and Credit RiskVon EverandFinancial Risk Management: A Practitioner's Guide to Managing Market and Credit RiskBewertung: 2.5 von 5 Sternen2.5/5 (2)

- The Advanced Fixed Income and Derivatives Management GuideVon EverandThe Advanced Fixed Income and Derivatives Management GuideNoch keine Bewertungen

- Presentation On in - Basket ExerciseDokument11 SeitenPresentation On in - Basket Exerciseneha_singh_1050% (2)

- JSPS Application GuidelinesDokument9 SeitenJSPS Application GuidelinesNihad AdnanNoch keine Bewertungen

- Legal Issues Log SessionDokument4 SeitenLegal Issues Log SessionMohd AizatNoch keine Bewertungen

- Application Form: Professional Regulation CommissionDokument1 SeiteApplication Form: Professional Regulation CommissioncielNoch keine Bewertungen

- SSC CPO Results 2017 Tier I - FemalesDokument57 SeitenSSC CPO Results 2017 Tier I - FemalesTushitaNoch keine Bewertungen

- Exercises Adjectives Ending in Ing and EdDokument5 SeitenExercises Adjectives Ending in Ing and EdQuintero D'Souza SebastianNoch keine Bewertungen

- Field Study 2: Episode 1 The Teacher We RememberDokument22 SeitenField Study 2: Episode 1 The Teacher We RememberRose GilaNoch keine Bewertungen

- Homework Lesson 20Dokument4 SeitenHomework Lesson 20Quân LêNoch keine Bewertungen

- Chemistry Unit 3b June 2011 AS EDEXCEL MARK SCHEMEDokument18 SeitenChemistry Unit 3b June 2011 AS EDEXCEL MARK SCHEMEGhaleb W. MihyarNoch keine Bewertungen

- Sample CV Curriculum Vitae: EducationDokument32 SeitenSample CV Curriculum Vitae: EducationyemresimsekNoch keine Bewertungen

- 10 Strategies For Media Manipulation - Noam Chomsky PDFDokument2 Seiten10 Strategies For Media Manipulation - Noam Chomsky PDFsususuNoch keine Bewertungen

- Detailed-Lesson-Plan (Finals)Dokument13 SeitenDetailed-Lesson-Plan (Finals)Missy Mae MaturanNoch keine Bewertungen

- Top 12 Brain-Based Reasons Why Music As Therapy Works: Karen MerzenichDokument5 SeitenTop 12 Brain-Based Reasons Why Music As Therapy Works: Karen MerzenichpitamberrohtanNoch keine Bewertungen

- Exercise 1: Analysis of Continuous Beam: StaadproDokument20 SeitenExercise 1: Analysis of Continuous Beam: Staadpromskumar1909Noch keine Bewertungen

- DLP Drugs Substance of AbuseDokument2 SeitenDLP Drugs Substance of AbuseRosel LibradoNoch keine Bewertungen

- Profile of Department of EconomicsDokument33 SeitenProfile of Department of EconomicsSripara KrishnaNoch keine Bewertungen

- Kas1 ReviewerDokument1 SeiteKas1 ReviewerMarco ConopioNoch keine Bewertungen

- 2122 M02 Banathy ISD ModelDokument16 Seiten2122 M02 Banathy ISD ModelImeldaFaniNoch keine Bewertungen

- Verb TenseDokument3 SeitenVerb TenseadauNoch keine Bewertungen

- Examen Basico 6-21Dokument5 SeitenExamen Basico 6-21Frank's Larry Antezana CalatayudNoch keine Bewertungen

- General Director AdDokument1 SeiteGeneral Director Adapi-690640369Noch keine Bewertungen

- Resume Noor AinDokument4 SeitenResume Noor AinAre YenNoch keine Bewertungen

- Courtship and Academic BenefitsDokument17 SeitenCourtship and Academic BenefitsLance Hofer-draperNoch keine Bewertungen

- PE and Health 3 Week 2 FINALDokument8 SeitenPE and Health 3 Week 2 FINALFritzie SulitanaNoch keine Bewertungen

- K To 12 Food (Fish) ProcessingDokument20 SeitenK To 12 Food (Fish) Processingjagelido83% (23)

- Admission TicketDokument2 SeitenAdmission TicketTudor RadacineanuNoch keine Bewertungen

- Music History 02Dokument2 SeitenMusic History 02Matheus Felipe Lessa OliveiraNoch keine Bewertungen

- Singapore Math Algebra in Elementary - Beckmann - 2004Dokument5 SeitenSingapore Math Algebra in Elementary - Beckmann - 2004Dennis Ashendorf100% (2)

- Culture Change ModelsDokument16 SeitenCulture Change ModelsRatna Dwi WulandariNoch keine Bewertungen

- GecDokument3 SeitenGecdiktatorimhotep8800Noch keine Bewertungen