Beruflich Dokumente

Kultur Dokumente

Students and Young People

Hochgeladen von

Moneylife FoundationCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Students and Young People

Hochgeladen von

Moneylife FoundationCopyright:

Verfügbare Formate

Students and

Young People

Useful contacts

Disha Financial Counselling

www.dishafc.org

Ahmedabad:

Phone: (079) 65126711 / 12 / 13

1.30 pm to 7.30 pm (Tuesday to Saturday)

Chennai:

Phone: (044) 42116459, 42115465/7

1.00 pm to 7.00 pm (Monday to Friday)

Other leaflets

This leaflet comes from a series of advice guides to help you

understand how credit reports are produced and used and

when they affect your life. Other guides available in this

series are listed below.

Hyderabad:

Phone: (040) 40038837 / 38 / 39

12.30 pm to 6.30 pm (Tuesday to Saturday)

Bereavement or serious illness

Denial of credit - Credit Crossroads

Divorce and separation - Credit Crossroads

Getting married - Credit Crossroads

Moving home - Credit Crossroads

Redundancy and reduction in income - Credit Crossroads

Jaipur:

Phone: (0141) 5101756 / 8

11.30 am to 5.30 pm (Tuesday to Saturday)

To get free copies of all these guides,

visit www.experian.in

Information we hold about you may not be the same as any

other credit information company

Delhi:

Phone: (0120) 2425972 / 73

11.30 am to 5.30 pm (Tuesday to Saturday)

Kanpur:

Phone: (0512) 3914556 / 7

11.00 am to 5.00 pm (Tuesday to Saturday)

Kolkata:

Phone: (033) 64602300 / 2299

1.00 am to 7.00 pm (Tuesday to Saturday)

Ludhiana:

Phone: (0161) 5084067

11.30 am to 5.30 pm (Tuesday to Saturday)

Mumbai:

Phone: (022) 65971815 / 16 / 17

1.30 am to 7.30 pm (Tuesday to Saturday)

Moneylife Foundation

www.mlfoundation.in

Telephone: +91-22-24441059-60

Email ID: mail@mlfoundation.in

Experian Credit Information Company of India

Consumer Support

http://www.experian.in

Email: consumer.support@in.experian.com

Phone: 022 - 66419000

Monday to Friday between 9:30am and 6:30pm

Address

P.O. Box.9096, Goregaon (East),

Mumbai - 400063.

*Financial Counselling provided by DISHA & Money life Foundation is a free and

confidential service. The service is to provide assistance to consumers by analyzing

their current financial situation and to counsel, advise and provide options to the

Consumer to take appropriate financial / investment decisions. The consumers are

requested to read all offer documents / literature and investment brouchers carefully

before Investing and rely on any such advise / counselling at their own accord. ECICI

under no circumstance shall be held responsible for any financial decisions and /or

investments made by the consumer and disclaims any and all liability financial or

otherwise suffered by the Consumer.

Credit Crossroads

When you apply for credit, for example a credit card or a

loan, you will probably give the lender permission to do a

check with Experian or another credit information company.

This check helps the lender know that you can afford to

repay the money you want to borrow.

Experian does not decide who should get credit, but the

information we provide may help the lender to decide.

We hope this guide will help you if you are about to begin

further studies or your first job.

How it all works

When you apply for credit, lenders have to make sure that you

are who you say you are and live where you say you live. They

also want to make sure that you are likely to be able to keep up

the repayments.

They will look at the information you give them when you apply

(such as your job and income). They will also look at the

information we hold about you, which we call your Credit

Information Report. It is important you understand the

information on your credit information report. Your credit

information report must also be up to date because it helps

lenders check:

Your name and address;

How you have managed credit in the recent past; and

How you are managing credit at the moment.

If your credit information report shows that you repay credit on

time, this will usually help you get credit. It may also help you get

the best credit deals. Once you close a credit account (such as a

credit card, a personal loan or a home loan), details of how you

handled your payments stay on your report. Negative

information such as a 'default' a credit account you have

broken the terms of also stays on your report.

You can ask us to send you a copy of your credit information

report. We will also send you a leaflet to help you understand the

information and answer any questions you have. You can also

get help and advice from our website.

To order a copy of your credit information report:

visit www.experian.in

call 022 6641 9000

email us at consumer.support@in.experian.com; or

write to:

Consumer Support Team

Experian Credit Information Company of India Private Ltd

P. O. Box 9096

Goregaon (East)

Mumbai 400063.

You will need to send us the completed and signed

CreditInformation Report Request Form with a signed and dated

photocopy of one of the following:

PAN card, or

Passport, or

Voters ID.

AND

any one of the following (no more than 3 months old and for your

current address):

electricity bill, or

telephone bill, or

latest bank statement, or

lease/licence deed, or

sale/purchase deed, or

passport.

Your credit information report will cost Rs.138:

use internet banking to make a National Electronic Fund

Transfer (NEFT), or

pay at any of the 65,000 branches of more than 89 banks with

the NEFT facility, or

pay by demand draft payable in Mumbai to 'Experian Credit

Information Company of India Private Limited'. The demand

draft should be valid for 3 months.

check www.experian.in for any other different mode of

payment

Building up a picture

It can often be difficult for young people to get credit when they

are trying to borrow for the first time, because lenders like to

check that you have paid credit off on time in the past and so may

refuse your application if you haven't already established a credit

history. They check this with a credit information company, such

as Experian.

If you are successful in getting credit and you manage your loan

accounts responsibly paying them off on time then you will be

building up a picture of sensible financial behaviour on your

credit information report which will help you in the future. If you

fail to honour your credit commitments, this will show on your

credit information report and will affect your ability to get loans

and credit cards in the future.

When you apply for a loan or a credit card, lenders will need to

verify your identity and address. Ensure you have documents to

prove who you are and where you live before you apply,

whether you are using your family home address or a temporary

one. Lenders often use credit scoring to assess whether or not

you will be able to pay back a debt on time and in full. The exact

way lenders assess loan applications varies from company to

company, including how they work out any credit score. This is

why some lenders say yes when others say no. Before you apply,

make sure you are asking for credit suitable for a student or

young person.

affect your chance of getting credit in the future. Use credit wisely

and budget to make sure you don't spend too much. It's often a

good idea to set up direct debits to ensure regular repayments.

You should also check your bank and credit card statements very

carefully each month to make sure you know where you are

spending your money.

Be responsible when you borrow budget for it

When you are thinking of borrowing in any form, be careful to

work out the real cost of the credit you want, including how much

you will pay back in total. Draw up a budget to make sure you can

afford the repayments. Don't forget to include costs that only

happen once in a while, such as annual charges.

Typically, an education loan of up to Rs.4 lakh does not require

any collateral security or a parent's guarantee. For loans ranging

from Rs.4 lakh to Rs.7.5 lakh, banks may require you to provide a

parent's and a third party guarantee. Loans above Rs.7.5 lakh

require a parent's guarantee and collateral security has to be

provided before the loan can be approved and given to you.

You do not have to start repaying an education loan until 6 or 12

months after you have completed your studies or once you get a

job, whichever is the earlier. However, you will have to pay

interest on the loan in that time (the moratorium period) if your

annual income from all sources is more than Rs.4.5 lakh. If it is

less than that you can get a certificate from the Income

Certificate Issuing Authority in your state and all the interest

during the moratorium period will be subsidised by central

government.

Find your best option

You'll probably get a few banks offering you 'free' credit cards or

attractive deals on personal loans to cover your hostel and other

expenses. 'Free' credit cards mean you pay no joining or annual

fees. You still have to pay back what you buy on the card and you

will still pay interest on the amount you borrow on a card if you do

not pay off the full amount you owe each month.

Credit cards can be very expensive if you don't pay them off on

time, and in full, every month. Some cards charge interest on the

whole amount shown on your bill, even if you do pay some off. So

check the small print before you apply to see if the card is right for

you and look at different cards before you decide. Be aware that it

is very expensive to get cash on a credit card as you will start

paying interest from the day you take out the money.

Only apply for credit after you have decided on your best option.

The importance of responsible borrowing

When you apply for a loan, you will give the lender permission to

contact a credit information company and access your credit

information report. The lender will know your age and should

take that into account when seeing that you have little or no

history of credit. Remember, to build up a good credit history you

must make all your repayments on time. It really is important, as

all repayments and missed ones are recorded on your credit

information report. This report will be used every time you apply

for a loan. So how you manage any credit you have now will

Information about other people

When the lenders share information with us that you have a joint

loan, or you are a guarantor to a loan, the said account is flagged

accordingly in the credit information report as joint, guarantor,

individual etc.

Being a guarantor or a co-signee to a joint loan is a serious

commitment. Even if the other party has assured you that they

will take responsibility for repaying the debt, if they miss

payments or default on the commitment this will also be recorded

on your credit information report and will likely affect your ability

to get credit in the future.

If loans are just in your name, you are totally responsible for

paying them. If your friends leave and owe you money, the fact

that they should have paid part of the debt will not protect you.

Whether or not you manage to get them to pay their share, you

will be held responsible if the company decides to try to recover

the debt. If you can't pay you might end up with a court judgment

against you.

Help is at hand

If you are struggling with any repayments, let your lenders know

as soon as possible. If you keep in touch they will try to help. In

the case of education loans, if you are unable to find a job or the

salary is not sufficient for you to keep up the EMI (Equated

Monthly Instalment), you will find most banks willing to extend

the moratorium period for up to 2 years and restructure your loan

repayments.

If you need advice on credit management, contact any of the

agencies, set up by banks and the Reserve Bank of India, listed

at the end of this leaflet. Only go to free advice providers, do not

be tempted by commercial companies offering similar services

you do not have to pay for this sort of help.

Remember that your credit history starts to build up from the time

that you first get credit. Your good financial behaviour now can

make your access to credit faster and easier at later stages in life

when you may need it more, for example to buy a home or a car

or to set up a business. Your student loan is the foundation of

your future credit history, so be responsible.

Das könnte Ihnen auch gefallen

- Bombay High Court Issues Rules For Video Conferencing For CourtsDokument14 SeitenBombay High Court Issues Rules For Video Conferencing For CourtsMoneylife FoundationNoch keine Bewertungen

- Mohan Gopal Letter2PMDokument12 SeitenMohan Gopal Letter2PMMoneylife FoundationNoch keine Bewertungen

- Report of The Fact-Finding Mission On Media's Reportage of The Ethnic Violence in ManipurDokument24 SeitenReport of The Fact-Finding Mission On Media's Reportage of The Ethnic Violence in ManipurThe WireNoch keine Bewertungen

- Bombay High Court Issues Rules For Video Conferencing For CourtsDokument14 SeitenBombay High Court Issues Rules For Video Conferencing For CourtsMoneylife FoundationNoch keine Bewertungen

- Mohan Gopal Letter2PMDokument16 SeitenMohan Gopal Letter2PMMoneylife FoundationNoch keine Bewertungen

- RBI Wilful Defaulters PSBs Annex 1 RTIDokument51 SeitenRBI Wilful Defaulters PSBs Annex 1 RTIMoneylife Foundation83% (6)

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDokument276 SeitenSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDokument276 SeitenSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- Syndicate Bank Risk Assessment and Inspection Reports Shared by RBIDokument276 SeitenSyndicate Bank Risk Assessment and Inspection Reports Shared by RBIMoneylife Foundation100% (5)

- SIC Pandes OrderDokument5 SeitenSIC Pandes OrderMoneylife FoundationNoch keine Bewertungen

- City Union Bank Inspection ReportDokument114 SeitenCity Union Bank Inspection ReportMoneylife Foundation100% (1)

- SEBI Final Order Against Ms. Chitra Ramkrishna and OthersDokument190 SeitenSEBI Final Order Against Ms. Chitra Ramkrishna and OthersMoneylife FoundationNoch keine Bewertungen

- City Union Bank Inspection ReportDokument114 SeitenCity Union Bank Inspection ReportMoneylife Foundation100% (1)

- City Union Bank Inspection ReportDokument114 SeitenCity Union Bank Inspection ReportMoneylife Foundation100% (1)

- 30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalDokument17 Seiten30-Dec-2020-Memorandum To Sebi and Justice BN AgrawalMoneylife FoundationNoch keine Bewertungen

- MLF Presentation To SEBI Mahalingam Committee 13 May 2022Dokument13 SeitenMLF Presentation To SEBI Mahalingam Committee 13 May 2022Moneylife FoundationNoch keine Bewertungen

- ANMI Sub112 Dated 29 Dec To MOF On Limitation ClauseDokument2 SeitenANMI Sub112 Dated 29 Dec To MOF On Limitation ClauseMoneylife FoundationNoch keine Bewertungen

- MLF Presentation To SEBI Mahalingam Committee 13 May 2022Dokument13 SeitenMLF Presentation To SEBI Mahalingam Committee 13 May 2022Moneylife FoundationNoch keine Bewertungen

- Joint-Representation Extension Filing TAR ITReturnsDokument7 SeitenJoint-Representation Extension Filing TAR ITReturnsMoneylife FoundationNoch keine Bewertungen

- Order For Home TestingDokument3 SeitenOrder For Home TestingMoneylife FoundationNoch keine Bewertungen

- SEBI Final Order Against Ms. Chitra Ramkrishna and OthersDokument190 SeitenSEBI Final Order Against Ms. Chitra Ramkrishna and OthersMoneylife FoundationNoch keine Bewertungen

- SEBI Final Order Against Ms. Chitra Ramkrishna and OthersDokument190 SeitenSEBI Final Order Against Ms. Chitra Ramkrishna and OthersMoneylife FoundationNoch keine Bewertungen

- Monthly Data YCEW Dec 2021Dokument4 SeitenMonthly Data YCEW Dec 2021Moneylife FoundationNoch keine Bewertungen

- Erratic and Irresponsible Approach of Finance Ministry Towards IT InfrastructureDokument10 SeitenErratic and Irresponsible Approach of Finance Ministry Towards IT InfrastructureMoneylife FoundationNoch keine Bewertungen

- NSE List of Expelled Brokers 19 Oct 2021Dokument7 SeitenNSE List of Expelled Brokers 19 Oct 2021Moneylife FoundationNoch keine Bewertungen

- Reliance Capital Limited: Vu VM of ' ('Dokument4 SeitenReliance Capital Limited: Vu VM of ' ('Moneylife Foundation100% (1)

- NSE List of Expelled Brokers 19 Oct 2021Dokument7 SeitenNSE List of Expelled Brokers 19 Oct 2021Moneylife FoundationNoch keine Bewertungen

- Letter To CJI On WritDokument2 SeitenLetter To CJI On WritMoneylife FoundationNoch keine Bewertungen

- PR DICGC AmendmentAct2021 Section18A PaymentToDepositorsOfInsuredBanksUnder AIDDokument3 SeitenPR DICGC AmendmentAct2021 Section18A PaymentToDepositorsOfInsuredBanksUnder AIDMoneylife FoundationNoch keine Bewertungen

- SC Order Northern Railways Vs Sanjay Shukla 06 Sep 2021Dokument7 SeitenSC Order Northern Railways Vs Sanjay Shukla 06 Sep 2021Moneylife FoundationNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- ACCA104 - Notes ReceivableDokument7 SeitenACCA104 - Notes ReceivableAnaluz Cristine B. CeaNoch keine Bewertungen

- This Study Resource Was: Case: San Miguel in The New MillenniumDokument2 SeitenThis Study Resource Was: Case: San Miguel in The New MillenniumBaby BabeNoch keine Bewertungen

- RBC US Dream HomeDokument36 SeitenRBC US Dream HomeJuliano PereiraNoch keine Bewertungen

- Barangay Budget FormsDokument31 SeitenBarangay Budget FormsNonielyn Sabornido100% (1)

- SEC Vs BalwaniDokument23 SeitenSEC Vs BalwaniCNBC.comNoch keine Bewertungen

- Forex Trading by Money Market, BNGDokument69 SeitenForex Trading by Money Market, BNGsachinmehta1978Noch keine Bewertungen

- 2 Re Calculation of SSD For HDB Sale Under 2 Years of OwnershipDokument17 Seiten2 Re Calculation of SSD For HDB Sale Under 2 Years of Ownershipapi-308324145Noch keine Bewertungen

- Assessment of OMT TollCollection-RoadsDokument158 SeitenAssessment of OMT TollCollection-Roadsmitu100% (1)

- SCMDokument22 SeitenSCMPradeep Dubey100% (2)

- The California Fire Chronicles First EditionDokument109 SeitenThe California Fire Chronicles First EditioneskawitzNoch keine Bewertungen

- Where To Invest in Africa 2020Dokument365 SeitenWhere To Invest in Africa 2020lindiNoch keine Bewertungen

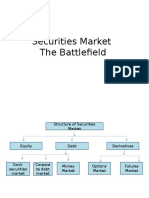

- Securities Market The BattlefieldDokument14 SeitenSecurities Market The BattlefieldJagrityTalwarNoch keine Bewertungen

- Earning Response Coefficients and The Financial Risks of China Commercial BanksDokument11 SeitenEarning Response Coefficients and The Financial Risks of China Commercial BanksShelly ImoNoch keine Bewertungen

- Percent Practice SheetDokument55 SeitenPercent Practice SheetkamalNoch keine Bewertungen

- LGU-NGAS TableofContentsVol1Dokument6 SeitenLGU-NGAS TableofContentsVol1Pee-Jay Inigo UlitaNoch keine Bewertungen

- Total and Cumulative Budgeted CostDokument15 SeitenTotal and Cumulative Budgeted CostZahraJanelleNoch keine Bewertungen

- Private Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Dokument6 SeitenPrivate Program Opportunity - Procedure - From 25K An Up + Small Cap Flash - Jan 16, 2024Esteban Enrique Posan BalcazarNoch keine Bewertungen

- Income Tax Test BankDokument65 SeitenIncome Tax Test Bankwalsonsanaani3rdNoch keine Bewertungen

- 12Dokument8 Seiten12ifowwNoch keine Bewertungen

- Olino vs Medina land dispute caseDokument2 SeitenOlino vs Medina land dispute caseOyi Lorenzo-Liban0% (1)

- IITK Parental Income CertificateDokument3 SeitenIITK Parental Income CertificateSaket DiwakarNoch keine Bewertungen

- Reconstitution: Russell 3000 Index - AdditionsDokument10 SeitenReconstitution: Russell 3000 Index - AdditionsepbeaverNoch keine Bewertungen

- Pepsi PaperDokument6 SeitenPepsi Paperapi-241248438Noch keine Bewertungen

- Man Company investment income from Kind CorpDokument12 SeitenMan Company investment income from Kind Corpbobo kaNoch keine Bewertungen

- Preventing MSME Fraud with Due DiligenceDokument16 SeitenPreventing MSME Fraud with Due Diligencesidh0987Noch keine Bewertungen

- The Little Black Book of Copywriting SecretsDokument30 SeitenThe Little Black Book of Copywriting SecretsJeeva2612100% (27)

- Form 7Dokument5 SeitenForm 7NagamaheshNoch keine Bewertungen

- Dennis w2Dokument5 SeitenDennis w2Dennis GieselmanNoch keine Bewertungen

- The Constitutional Corporation - Rethinking Corporate GovernanceDokument200 SeitenThe Constitutional Corporation - Rethinking Corporate Governancedanyboy80100% (2)

- Nigerian Stock Exchange Performance On Economic GrowthDokument18 SeitenNigerian Stock Exchange Performance On Economic GrowthsonyNoch keine Bewertungen