Beruflich Dokumente

Kultur Dokumente

Budget News 2014-15

Hochgeladen von

dchz_62Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Budget News 2014-15

Hochgeladen von

dchz_62Copyright:

Verfügbare Formate

New Delhi: Bringing cheer to individual taxpayers, Finance Minister Arun Jaitley in his

maiden Union Budget 2014-15 in Parliament on Thursday, raised personal tax

exemption limit to Rs 2.5 lakh from the current Rs 2 lakh.

Income tax exemption limit for senior citizens has been raised to Rs 3 lakh.

The Investment limit under Section 80C has also been hiked to Rs 1.5 lakh from the

current Rs 1 lakh, while the FM increased housing loan interest rate deduction limit to

Rs 2 Lakh.

In further relief to the depositors, the FM announced that the PPF (Public Provident

Fund) deposit ceiling will be raised to Rs 1.5 lakh per annum from the existing Rs 1

lakh.

The FM also announced to raise FDI in Defence and Insurance sectors to 49 percent and

said that the subsidy regime, particularly food and fuel, will be overhauled.

Assuring investors that retrospective amendments to tax laws will be undertaken with

extreme caution, Jaitley said all fresh cases arising out of the 2012 amendment of I-T Act

will be looked into by a high-level CBDT committee.

However, the existing tax disputes, arising out of Retrospective Amendment to the

Income tax Act, 1961, and are pending in courts, will be allowed to reach their logical

conclusions, he said.

Stating that his predecessors have left a very daunting target of meeting the fiscal

deficit, Jaitley said that the BJP government will take this as a challenge and meet the

fiscal deficit target of 4.1 percent of GDP.

Jaitley told Parliament that India`s 1.2 billion people were "exasperated" after two years

of economic growth of below 5 percent.

He vowed that Asia`s third largest economy would expand at a rate of 7-8 percent

within three to four years.

Here are the key highlights of Union Budget 2014-15:

DIRECT TAX

* No hike in direct tax rates

* Retained tax targets for FY15

* Gross tax revenue seen 10.9% of GDP in FY16; 11.2% in FY17

* Retained interim gross tax collection aim

* Propose relief to individual tax payers

* Up 80C tax break invest cap to Rs 150,000 from Rs 100,000

* Up tax exemption limit for senior citizens to Rs 300,000

* No change in rate of surcharge for corporates, individuals

* No change in surcharge rates for direct tax

* To up personal income tax exemption limit to Rs 250,000

* Personal income tax exemption hiked by Rs 50,000 per year

* Will consider views on new Direct Tax Code draft

* Education cess to continue at 3%

* Expect GST, direct tax rationalization to restore revenues

* FY15 total divestment mop-up aim 634 Rs billion

* FY15 receipts from disinvestment 434.25 Rs billion

* FY15 non-PSU divestment mop-up aim 150 Rs billion

* FY15 capital receipts seen Rs 739.5 billion

* FY15 dividend, surplus from RBI, PSU bks seen Rs 624 billion

* Govt FY15 dividend, profit from PSUs seen 278 Rs billion

* FY15 gross tax receipt Rs 13.64 trillion

* Net loss on direct tax proposals Rs 222 billion FY15

* FY15 non-tax revenue Rs 2.12 trillion

* FY15 total expenditure estimated Rs 17.95 trillion

* FY15 plan allocation Rs 5.7 trillion, up 26.9% on yr

* FY15 non-plan expenditure estimated Rs 12.19 trillion

INDIRECT TAX

* Special additional duty exemption on wind power components

* Excise on RO membrane used in household filters cut to 6%

* FPI income from securities trade to be treated capital gain

* Fliers can now get 100 duty-free cigarettes vs 200 earlier

* Fliers can now get 25 duty-free cigars vs 50 earlier

* Excise duty on winding copper wires raised to 12% from 10%

* Scraps customs duty on e-book readers

* Customs duty on battery waste, scrap cut to 5% vs 10%

* Excise on cigarettes of above 65 mm length hiked by 11-21%

* Excise on cigarettes of below 65 mm length hiked by 72%

* Excise duty on un-manufactured tobacco raised to 55% vs 50%

* Excise duty on chewing tobacco raised to 70% vs 60%

* Up excise duty on pan masala to 16% from 12%

* Up excise duty on gutka to 70% from 60%

* No countervailing duty exemption on portable X-Ray units

* Special additional duty exemption for smart card PVC sheet

* Excise duty on recorded smart card hiked to uniform 12%

* Customs duty on forged steel ring for wind power cut to 5%

* No import duty on aircraft engines, parts for maintenance

* No import duty on security fibre for Bank Note Paper Mill

* Uniform excise duty of 6% with CENVAT on paper for textbook

* No import duty on HIV diagnostic kit, drug for govt agency

* Nil excise on machinery used for compressed biogas units

* Nil excise on forged steel rings for wind power equipment

* Concessional 5% customs duty on bio-CNG plant components

* Metal core PCB, LED driver excise for LED light cut to 6%

* No svc tax on bio-medical waste disposal facility

* No tax on svcs by tour operators for foreign tourists

* No svc tax on loading, unloading, transportation of cotton

* To broaden tax base reviewed negative list for service tax

* Shipping industry to get svc tax benefits

* Print media to continue to be exempted from svc tax

* Certain service tax exemption are being withdrawn

* Mobile, internet advt revenue to come under svc tax net

* Service tax proposed on radio taxis

* Clean energy cess hiked to Rs 100/tn vs Rs 50

* 5% additional excise duty on aerated water with sugar

* Exempt excise duty on flat copper wires used in solar cells

* Exempts sheets used in solar panels from customs duty

* Cut excise duty on some footwear to 6% from 12%

* Scope of Settlement Commission being enlarged

* Indian Custom Single Window Project to be taken up

* Indian cos can get advance tax ruling on indirect taxes

* Indirect tax proposals to yield Rs 75.2 billion more revenue

* Levies 2.5% customs duty on metallurgical coal

* Levies 2.5% customs duty on cut, broken diamonds

* Customs duty on RBD, palm stearin for soap mfg scrapped

* Customs duty on reformate cut to 2.5% vs 10%

* Some oil cakes exempt from customs duty till Dec 31

* Nil customs duty on regasified LNG for supply to Pakistan

* Imposed educational cess on imported electronic pdts

* Scraps customs duty on sub-19 inch LCD, LED panels

* Scraps additional duty on imported computer components

* Import of smart card to attract higher CVD

* Colour picture tubes exempt from basic customs duty

* Basic customs duty on crude, naphthalene cut to 5% vs 10%

* Customs duty of 10% on telecom products outside tax Act

* Cut customs duty on steel grade limestone, dolomite to 2.5%

* Customs duty on coal tar pitch cut to 5% from 10%

* Customs duty waived for crude glycerine used in soaps

* Cuts basic customs duty on methyl alcohol to 5%

* Cuts basic customs duty on ethane propane to 2%

* Scraps customs duty on spandex yarn

* Excise on capital good, consumer durable extended by 6 mos

* Excise on food processing, packaging equipment cut to 6%

* 2.5% uniform duty on semi-processed diamonds, gemstones

* Up export duty on bauxite to 20% from 10%

* Customs duty on ship imported for breaking cut to 2.5%

* Uniform 2.5% customs duty on all types of imported coal

* Customs duty on some wind power equipment cut to 5%

* Hikes customs duty on flat steel pdts to 7.5% vs 5%

* Up long-term capital gain tax on MFs to 20% vs 10%

TAX REFORMS

* Tax regime to be investor friendly

* Must improve tax-GDP ratio

* Extend 10-yr tax holiday for power projects to Mar 31, 2017

* 15% tax break to cos investing over Rs 250 million on plants

* FIIs' security portfolio income to be seen as capital gain

* 15% tax on dividends from foreign arms of Indian co to stay

* Plan to enlarge scope of income tax settlement commission

* To provide certainty in tax laws

* Propose changes in transfer pricing rules

* Propose to strengthen authority for advance ruling in tax

* High level panel to interact with industry on indirect tax

* Clarification on tax issues to be given

* Plan law, administrative changes to reduce tax disputes

* Resident tax payer to get facility of advance tax ruling

* Propose changes to resolve ongoing direct tax disputes

* Aim stable, predictable investor-friendly tax regime

* Tax demands worth Rs 4 trillion currently under litigation

* GST to result in higher tax mop-up for Centre, states

* Committed to stable, practical tax regime

* Won't ordinarily bring in tax changes retrospectively

* Govt's right for retrospective legislation unquestionable

* Retrospective taxes should be done with caution

* All cases of retrospective tax to be studied by CBDT panel

* Hope to bring final solution to GST issue in FY15

* GST debate must come to an end

* GST to streamline tax administration

* Assure states govt to be more than fair on GST

* To give tax pass through to real estate invest trust

* Up interest payment rebate on home loan to Rs 200,000

* No sunset clause for tax benefit on div from foreign arms

* Transfer price arithmetic mean concept to continue

FISCAL, CAD SITUATION

* Govt aims to cut fiscal deficit to 3.6% in FY16

* Govt aims to cut fiscal deficit to 3% in FY17

* Govt aims to cut revenue deficit to 2.2% in FY16

* Govt aims to cut revenue deficit to 1.6% in FY17

* FY16 tax-GDP ratio seen 10.9%, FY17 at 11.2%

* Accepted FY15 4.1% fiscal deficit target as a challenge

* Better CAD, fisc prudence most significant development FY15

* Aim of 4.1% of GDP fisc gap indeed daunting

* Narrowing fiscal gap to give RBI comfort to ease policy

* Reduction in fiscal deficit achieved by spending cuts

* Need fisc prudence that will lead to fisc consolidation

* To continue to remain watchful on CAD front

GOVT SPENDING

* Estimate expenditures to be cut to 13.1% FY16; 12.5% FY17

* Need to match expenses by greater resource mop-up

* Fisc consolidation roadmap shows limited space medium-term

* To constitute expenditure mgmt panel

* Time has come to revive efficiency of govt spend

* Must reduce wasteful expenditure

* Cannot spend beyond our needs

* Can't leave behind legacy of debt

* Non-tax revenue must be increased

GROWTH, INFLATION

* Inflation, especially of food, needs to reduced further

* See inflation easing as fiscal gap narrows

* See room for invest, capital inflows as fisc gap narrows

* Higher growth is a sine qua non

* Still not out of the woods on inflation

* Seen gradual moderation in WPI inflation recently

* Bound to usher in a regime to boost growth

* Two years of sub-5% growth created challenging situation

* Today's steps only start of a journey to sustained growth

* Slowdown in India reflects trend in many economies

* Seeing greenshoots of recovery globally

* Euro area expected to witness growth

* Look forward to lower inflation rate

* India unhesitatingly desires to grow

FINANCIAL SECTOR

* To take up insurance regulator bill for consideration

* To address low penetration of insurance

* Suitable incentives for increasing reach of insurance

* RBI will create framework for licenses of small banks

* Govt in principle agrees to consolidation of PSU banks

* Propose to revamp small savings scheme

* Framework for differential bks for small businesses, poor

* Govt to infuse Rs 112 billion in PSU banks FY15

* To provide all households with banking facilities

* There should be at least 2 bank accounts in each household

* To work on revival of banks' stressed assets

* To set up 6 new debt recovery tribunals

* Rising NPAs of banks a matter of concern

* To introduce uniform KYC norms

* PSU banks allowed to sell shares to meet Basel-III norms

* PSU bks need Rs 2.4 trillion to meet Basel-III norm 2018

* Bks' capital to be raised by retail shareholding directly

* Govt will continue major holding in PSU banks

* Will examine proposal to give additional autonomy to banks

* To infuse money in PSU banks via sale of shares to public

* Propose to allow banks to issue long-term infra bonds

* Propose number of measures to energise Indian capital mkt

* Time-bound fincl inclusion plan on Aug 15

* Adoption of new Indian accounting standard mandatory FY17

* To strengthen regulatory framework of commodity mkt

* To introduce single Demat acct for all fincl transactions

* To implement warehousing receipt plan with vigour

* To revamp IDRs and introduce Bharat Depository Receipts

* Extend 5% withholding tax on all India co bonds to Jun 2017

* To allow international settlement of India debt securities

* To liberalise ADR, GDR regime

* Advised regulators to deepen FX mkts

* Extend eligibility date for FX borrow to Jun 30, 2017

* To complete consultation on Indian Fincl Code expeditiously

* Aim to encourage fund managers to shift to India

* MF investments need to be of at least 36 mos to be defined long-term

* To set up panel to look at unclaimed PPF accounts

* Panel to moot ways to use unclaimed PPF, pension fund money

* EPFO to launch unified account scheme

* Annual PPF deposit ceiling to be raised to Rs 150,000

* Will bridge regulatory gap for chit funds

* Fincl stability foundation of rapid recovery

* Urgent task of policy is to kick-start invest cycle

* To help PSUs invest retained earnings in capital projects

FARM SECTOR

* Committed to give wheat, rice at reasonable price to poor

* See 4% growth in agriculture FY15

* Have enough central pool grain stock to handle weak monsoon

* Will conduct open mkt sale to control grain stocks

* States to be encouraged to develop farming markets

* To create national common farm market

* Plan Rs 1 billion for Kisan TV on farming issues in FY15

* Plan to finance 500,000 landless farmers through NABARD

* Allot Rs 50 billion for NABARD long-term rural credit fund

* Allot Rs 2 billion for forming 2000 producers' organisations

* Extended 3% interest subvention for farmers in FY15

* Aim Rs 8 trillion for farm credit FY15

* Rural infra corpus allocation raised to Rs 300 billion FY15

* To expedite FCI recast

* Allocate Rs 50 billion farm warehousing plan

* Allot Rs 500 million for indigenous cattle, inland fishery

* Up rural infra fund corpus by Rs 50 billion vs interim

* Allots Rs 5 billion for farm price stabilisation fund

* Plan Rs 560 million for soil testing labs across India

* Allots Rs 1 billion for climate change adaptation fund

* Allots Rs 1 billion for farmers' soil health card plan

INFRASTRUCTURE/INDUSTRY

* To revive old, closed oil, gas wells

* Rs 1 billion for pilot work on ultramodern coal power plants

* To ensure just allocation to states from mineral royalty

* National Gas Grid needs 15,000-km more gas pipeline

* To use PPP mode to add 15,000-km gas pipeline

* Revision of royalty rate on minerals due soon

* To expedite resolution of iron ore mining impasse

* Existing impasse of coal sector will be resolved

* To accelerate exploration of coal bed methane reserves

* Adequate coal to be given to existing power plants

* To set up new airports in Tier-I, II cities via PPP, AAI

* To introduce e-visa facility at 9 Indian airports

* Allot Rs 378 billion to NHAI

* NHAI to target 8,000 km of road development in FY15

* Allot Rs 30 billion for North East highways

* Allots Rs 5 billion for new solar power projects

* Allots Rs 1 billion for clean tech in thermal power plants

* 1 Rs billion for metro rail projects for Lucknow, Ahmedabad

* Must plan metros in cities with population over 2 million

* To spend Rs 42 billion for Ganga river transport plan

* To announce comprehensive policy for shipbuilding FY15

* 16 new port projects to be awarded in FY15

* Allot Rs 116 billion to develop outer harbour port projects

* Plan textile clusters in Rae Bareli, Lucknow, Surat

* To allocate Rs 2 billion to set up 6 more textile clusters

* Rs 500 million set aside for Pashmina production in J&K

* To revive MSMEs via committee; panel report in 3 months

* New friendly bankruptcy framework for MSMEs

* MSME definition to be revised to allow higher capital cap

* To create Rs 100 billion fund to attract invest in start-ups

* To set up Industrial Smart Cities in 7 cities

* Rs 1 billion for natl industrial corridor based in Pune

* To complete Amritsar-Kolkata industrial corridor soon

* To take effective steps to revive SEZs

* SEZs to be developed in Kandla, JNPT

* Govt dept, ministries to be linked via e-platform by Dec 31

* To set up export promotion mission

* To build at least 500 model cities via PPP route

* To allocate Rs 5 billion for new rural power plan

* Committed to supply 24X7 power supply to all households

* Swachch Bharat scheme to cover each household by 2019

* Country in no mood to suffer lack of infra, basic amenities

* Need to revive growth in mfg, infra sectors

* To give Rs 70.6 billion to develop smart cities in FY15

* Rs 22.50 billion to strengthen border infrastructure

* Allots Rs 22.5 billion for border force strengthening

* Rs 10 billion for accelerating rail systems in border areas

* Allot Rs 1 billion for agri infra fund

* Plan Rs 500 billion for municipal debt mgmt for infra

* Digital connect, solid waste mgmt part of urban renewal plan

* Safe drinking water, sewage mgmt part of urban renewal plan

SOCIAL SECTOR

* Rs 9.9 billion for socio econ development of border villages

* Allocate Rs 1 billion for good governance plan

* Plan to include slum redevelopment in CSR

* Committed to provide housing to all by 2022

* Proposes changes in norms for affordable housing

* To allocate Rs 120 billion to NHB

* To set aside Rs 80 billion for rural housing scheme in FY15

* Allots Rs 40 billion for low-cost housing for urban poor

* Allots Rs 1 billion for community radio plan

* To allocate Rs 10 billion for new PM irrigation plan

* Announces Backward Regional Grant Fund

* Allocate Rs 36 billion for national rural drinking programme

* Rs 21.42-billion- added impetus to watershed programme

* Allots Rs 1 billion for rural entrepreneurship plan

* To spend Rs 143.89 billion for PM rural road plan

* To revive senior citizen pension scheme

* To give Rs 2 billion for SC entrepreneurship scheme FY15

* Extends senior citizens' pension plan till Aug 2015

* Allocate Rs 1 billion for tribal welfare plan

* Allocates Rs 505 billion for scheduled caste, tribe schemes

* Plan Kisan Vikas Patra for banked, unbanked population

* Propose to launch Skill India programme

* Propose panel to mull use of inactive fund in postal scheme

* Plan Braille currency notes for visually challenged persons

* Plan crisis mgmt centre in Delhi hospital via Nirbhaya Fund

* To spend Rs 1 billion for beti bachao, beto padhao scheme

* Rs 500 million to road min for pilot project on women safety

* Allots Rs 5 billion for setting up 4 more AIIMS

* Free drug, diagnostic svc to be taken up on priority

* Announces schemes for disabled persons

* To set up 15 model rural health research centres

* Govt to give assistance to 4 state drug central authority

* Can't be oblivious that large population below poverty line

* Those below poverty line want to be the new middle class

* Next generation has hunger to use societal opportunities

* Country in no mood to suffer unemployment

IMPROVING FDI

* To hike FDI in insurance to 49%

* FDI in several sectors provides additional resources

* To hike FDI in defence to 49%

* Domestic defence mfg sector at nascent stage

* NDA policy to encourage FDI in selective sectors

* FDI in selected sectors to help larger interest of country

SUBSIDY BURDEN

* To review food, fuel subsidy

* Food, oil subsidy to be more targeted

* New urea policy will be formulated

* Essential to follow policy of reducing subsidy spends

* Aim to make food subsidy better directed

EDUCATION PUSH

* To set up five more IITs, 5 more IIMs

* Allots Rs 5 billion to set up more IITs, IIMs

* Plan IIMs in Punjab, Odisha, Bihar, Maharashtra, Himachal

* Plan 5 more IITs in Chattisgarh, Goa, J&K, Andhra, Kerala

* To start Pandit Madan Mohan Malaviya Teaching Programme

* Allots Rs 2 billion for new agri, horticulture universities

* Plan to have Horticulture University in Haryana, Telangana

* Plan to set up agricultural university in Andhra, Rajasthan

* Allocate Rs 1 billion for modernisation of Madrasas

* Allots Rs 1 billion to set up 2 farm research institutes

* Allocate Rs 49.66 billion for national secondary edu plan

* Allocate Rs 286.35 billion for national education plan

* Plan 12 more govt medical colleges with dental facilities

* Allots Rs 286.35 billion for Sarva Shiksha Abhiyan

* 12 more govt medical institute to be added

* Plan AIIMS institutes in Andhra, Bengal, and Vidarbha

* School curriculum to have chapter on gender sensitivity

* To set aside Rs 1 billion girl child education scheme

TECHNOLOGY BOOST

* Allot Rs 1 billion for Technology Development Fund

* To allow mfg cos to sell pdts on e-commerce platform freely

* Special focus on software exporting start-ups

* Allots Rs 5 billion for rural broadband programme

* Set aside Rs 1 billion for virtual classroom projects FY15

* Plan to launch pan-India Digital India programme

* Need to boost pvt, public investment in agro tech sector

SUPPORT TO STATES

* Govt committed to address issues in Andhra, Telangana

* Rs 2 billion to improve power availability in Delhi

* Allots Rs 5 billion for Delhi water reforms

* Plan 24X7 TV channel for North Eastern states

* Rs 1 billion for centre for Himalayan studies in Uttarakhand

* Rs 10 billion to up rail connectivity in Northeast

* Allots Rs 1 billion for organic farming in northeast

* Allocate Rs 5 billion for displaced Kashmiri migrants

* Biotech clusters to be set up in Bengaluru, Faridabad

* May mull viability gap funding for Goa convention centre

* To set up world class convention centre in Goa via PPP

SPORTS

* Allots Rs 1 billion for Asian, Commonwealth Games training

* To set up sports institute in Manipur

* To give Rs 2 billion to develop sports infra in J&K

* Allots Rs 1 billion for Sports University in Manipur

* Rs 2 billion for indoor, outdoor stadiums in J&K

* To set up natl sports academies for major sports

FY15 ESTIMATES

* Expect FY15 GDP growth to be 5.4-5.9%

* FY15 nominal GDP growth assumed at 13.4%

* FY15 fiscal deficit projected at Rs 5.31 trillion

* FY15 fiscal deficit pegged 4.1% of GDP

* FY15 revenue gap Rs 3.78 trillion

* FY15 revenue deficit pegged 2.9% of GDP

* Govt's FY15 effective revenue deficit seen 1.6% of GDP

* Govt's FY15 service tax mop-up seen Rs 2.16 trillion

* Govt's FY15 excise duty mop-up seen Rs 2.07 trillion

* Govt's FY15 customs duty mop-up seen Rs 2.02 trillion

* Govt's FY15 income tax mop-up seen Rs 2.84 trillion

* Govt's FY15 corporation tax mop-up seen Rs 4.51 trillion

* FY15 tax-GDP ratio seen 10.6%

* FY15 tax revenue targeted to grow 19.8% on year

* Govt's FY15 gross borrowing estimated Rs 6.00 trillion

* Govt's FY15 net borrowing estimated Rs 4.612 trillion

* Govt's FY15 short-term borrowing Rs 345.53 billion

* Govt's FY15 short-term borrow pegged Rs 346 billion

* Govt's FY15 net 364-day T-Bill mop-up seen Rs 201 billion

* Govt's FY15 net 91-day T-Bill mop-up seen Rs 145 billion

* FY15 net receipt from small savings seen Rs 82 billion

* FY15 interest receipts pegged at Rs 197.51 billion

* FY15 interest payments seen at Rs 4.27 trillion

* Govt's FY15 gilts buyback, switch Rs 500 billion

* Govt's FY15 MSS bond issue pegged Rs 200 billion

* FY15 dividend, profit pegged at Rs 902.29 billion

* FY15 receipts from other communication svcs Rs 454.7 billion

* Govt's FY15 spectrum, other svs mop-up pegged Rs 455 billion

* Govt's FY15 cash drawdown pegged Rs 172 billion

* FY15 securities against small savings Rs 82.29 billion

* FY15 total subsidy Rs 2.6 trillion

* FY15 food subsidy Rs 1.15 trillion

* FY15 fuel subsidy Rs 634.3 billion

* FY15 fertiliser subsidy Rs 729.7 billion

MISCELLANEOUS

* Several space missions planned in FY15

* Allots Rs 2.29 trillion for defence

* Up FY15 defence buy allotment by Rs 50 billion vs interim

* To up capital outlay by Rs 50 billion for defence

* Allots Rs billion for war memorial, museum

* State police force allocation raised to Rs 30 billion

* Allocate Rs 2 billion for Sardar Patel statue in Gujarat

* Young Leaders Programme to be set up with Rs 1 billion

* Allots Rs 5 billion for five tourist circuits

* To allot Rs 1 billion for spiritual tourism

* Allots Rs 2 billion for national heritage development

* Allots Rs 500 million for national police memorial

* Allots Rs 1 billion for river-interlink study

* NRI fund for Ganga to be set up

* Allots Rs 20.37 billion for Ganga conservation project

* Aim to lay down broad policy indicator

* Must address problem of black money

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Engg STD Heat ExchangersDokument23 SeitenEngg STD Heat Exchangersdchz_62Noch keine Bewertungen

- Indian Boilers Regulations - 1950Dokument21 SeitenIndian Boilers Regulations - 1950dchz_62Noch keine Bewertungen

- List of Approved Shop For Manufacturer of Pressure Vessels & Safety Fittings PDFDokument18 SeitenList of Approved Shop For Manufacturer of Pressure Vessels & Safety Fittings PDFGaurav MehrotraNoch keine Bewertungen

- Monel Data SheetDokument16 SeitenMonel Data SheetElias KapaNoch keine Bewertungen

- Steel StructuralsDokument10 SeitenSteel Structuralsdchz_62Noch keine Bewertungen

- Guide To Design of Anchors Bolts and Other Steel EmbedmentsDokument14 SeitenGuide To Design of Anchors Bolts and Other Steel Embedmentsvinku90% (1)

- EIL Material Selection ChartDokument1 SeiteEIL Material Selection ChartshamashergyNoch keine Bewertungen

- Astm - Igc - eDokument8 SeitenAstm - Igc - edchz_62Noch keine Bewertungen

- Branch Connection Fittings (MSS SP-97) - Weldolet®, Sockolet®, Thredolet®, Latrolet®, Elbolet®, Nipolet®, Sweepolet®Dokument3 SeitenBranch Connection Fittings (MSS SP-97) - Weldolet®, Sockolet®, Thredolet®, Latrolet®, Elbolet®, Nipolet®, Sweepolet®dchz_62Noch keine Bewertungen

- Annexure BDokument2 SeitenAnnexure Bdchz_62Noch keine Bewertungen

- 17moorflex Brochure CompleteDokument40 Seiten17moorflex Brochure CompleteViola HippieNoch keine Bewertungen

- SS Butterfly Valves..Dokument2 SeitenSS Butterfly Valves..dchz_62Noch keine Bewertungen

- Auto Cad ErrorDokument1 SeiteAuto Cad Errordchz_62Noch keine Bewertungen

- Hvac ToolsDokument3 SeitenHvac Toolsdchz_62Noch keine Bewertungen

- Steel Piping Estimate Sheet Date Project System Page #Dokument1 SeiteSteel Piping Estimate Sheet Date Project System Page #dchz_62Noch keine Bewertungen

- Ib 10Dokument2 SeitenIb 10dchz_62Noch keine Bewertungen

- Ib 10Dokument2 SeitenIb 10dchz_62Noch keine Bewertungen

- Ib 10Dokument2 SeitenIb 10dchz_62Noch keine Bewertungen

- Pipe Flow ExpertDokument4 SeitenPipe Flow Expertdchz_62Noch keine Bewertungen

- Calculation PaperDokument1 SeiteCalculation Paperdchz_62Noch keine Bewertungen

- Tema Plugging ParagraphDokument1 SeiteTema Plugging Paragraphdchz_62Noch keine Bewertungen

- TCS - 13Dokument1 SeiteTCS - 13dchz_62Noch keine Bewertungen

- APNLogDokument1 SeiteAPNLogdchz_62Noch keine Bewertungen

- Shiksha Patri - GujaratiDokument27 SeitenShiksha Patri - Gujaratikbv2842100% (3)

- UntitledDokument1 SeiteUntitleddchz_62Noch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Village Survey Form For Project Gaon-Setu (Village Questionnaire)Dokument4 SeitenVillage Survey Form For Project Gaon-Setu (Village Questionnaire)Yash Kotadiya100% (2)

- Characteristics of Testable HypothesesDokument30 SeitenCharacteristics of Testable HypothesesMarivic Diano67% (3)

- Chemical Engineering Projects List For Final YearDokument2 SeitenChemical Engineering Projects List For Final YearRajnikant Tiwari67% (6)

- METHOD STATEMENT FOR INSTALLATION OF Light FixturesDokument5 SeitenMETHOD STATEMENT FOR INSTALLATION OF Light FixturesNaveenNoch keine Bewertungen

- Join Our Telegram Channel: @AJITLULLA: To Get Daily Question Papers & SolutionsDokument24 SeitenJoin Our Telegram Channel: @AJITLULLA: To Get Daily Question Papers & SolutionsNaveen KumarNoch keine Bewertungen

- ReliabilityDokument5 SeitenReliabilityArmajaya Fajar SuhardimanNoch keine Bewertungen

- The Vapour Compression Cycle (Sample Problems)Dokument3 SeitenThe Vapour Compression Cycle (Sample Problems)allovid33% (3)

- OPSS1213 Mar98Dokument3 SeitenOPSS1213 Mar98Tony ParkNoch keine Bewertungen

- READING 4 UNIT 8 Crime-Nurse Jorge MonarDokument3 SeitenREADING 4 UNIT 8 Crime-Nurse Jorge MonarJORGE ALEXANDER MONAR BARRAGANNoch keine Bewertungen

- Feeder BrochureDokument12 SeitenFeeder BrochureThupten Gedun Kelvin OngNoch keine Bewertungen

- India Wine ReportDokument19 SeitenIndia Wine ReportRajat KatiyarNoch keine Bewertungen

- G1 Series User Manual Ver. 1.2Dokument101 SeitenG1 Series User Manual Ver. 1.2unedo parhusip100% (1)

- Blueprint Huynh My Ky Duyen 2022 McDonald'sDokument2 SeitenBlueprint Huynh My Ky Duyen 2022 McDonald'sHuỳnh Mỹ Kỳ DuyênNoch keine Bewertungen

- Border Collie Training GuidelinesDokument12 SeitenBorder Collie Training GuidelinespsmanasseNoch keine Bewertungen

- Women and ViolenceDokument8 SeitenWomen and ViolenceStyrich Nyl AbayonNoch keine Bewertungen

- Classification of Speech ActDokument1 SeiteClassification of Speech ActDarwin SawalNoch keine Bewertungen

- Funding HR2 Coalition LetterDokument3 SeitenFunding HR2 Coalition LetterFox NewsNoch keine Bewertungen

- Pe 3 Syllabus - GymnasticsDokument7 SeitenPe 3 Syllabus - GymnasticsLOUISE DOROTHY PARAISO100% (1)

- Scope: Procter and GambleDokument30 SeitenScope: Procter and GambleIrshad AhamedNoch keine Bewertungen

- Education in America: The Dumbing Down of The U.S. Education SystemDokument4 SeitenEducation in America: The Dumbing Down of The U.S. Education SystemmiichaanNoch keine Bewertungen

- TC 10 emDokument7 SeitenTC 10 emDina LydaNoch keine Bewertungen

- 2 Dawn150Dokument109 Seiten2 Dawn150kirubelNoch keine Bewertungen

- High Speed DoorsDokument64 SeitenHigh Speed DoorsVadimMedooffNoch keine Bewertungen

- Null 6 PDFDokument1 SeiteNull 6 PDFSimbarashe ChikariNoch keine Bewertungen

- M.Info M.Info: Minfo@intra - Co.mzDokument8 SeitenM.Info M.Info: Minfo@intra - Co.mzAntonio ValeNoch keine Bewertungen

- Cover Letter UchDokument1 SeiteCover Letter UchNakia nakia100% (1)

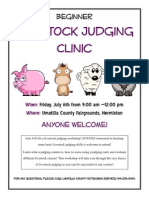

- Jun Judging ClinicDokument1 SeiteJun Judging Cliniccsponseller27Noch keine Bewertungen

- Introduction and Vapour Compression CycleDokument29 SeitenIntroduction and Vapour Compression Cycleمحسن الراشدNoch keine Bewertungen

- Soil Biotechnology (SBT) - Brochure of Life LinkDokument2 SeitenSoil Biotechnology (SBT) - Brochure of Life Linkiyer_lakshmananNoch keine Bewertungen

- 208-Audit Checklist-Autoclave Operation - FinalDokument6 Seiten208-Audit Checklist-Autoclave Operation - FinalCherry Hope MistioNoch keine Bewertungen