Beruflich Dokumente

Kultur Dokumente

Labor 1 - Q&A

Hochgeladen von

krys_elleOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Labor 1 - Q&A

Hochgeladen von

krys_elleCopyright:

Verfügbare Formate

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 1 of 30

The Labor Code of the Philippines

Presidential Decree No. 442

Preliminary Title

Chapter 1

GENERAL PROVISIONS

Supposed a doctor (Caloy) who is single has a secretary (Karen). He pays the secretary

monthly compensation for doing the work of a receptionist but the relationship developed

and eventually they got married. But even after marriage, the wife continued to be a

secretary of the doctor and continued receiving monthly salary which is deducted from the

gross earnings of the doctor and to what extent is taxable income. However, the doctorhusband decides and wants his wife to stop working because they now have a child.

Consequently, her employment has been severed.

Q: What is the employment status of Karen before and after marriage? Is there employeremployee relationship between Caloy and Karen? Can Karen file an action for illegal

dismissal because she claims security of tenure after having been employed for more than

one (1) year, and for money claims (labor standard benefits)?

A: Before marriage there is an employer-employee relationship and Karen is deemed a

regular employee; after marriage, such relationship no longer subsisted. Hence, she has no

cause of action against her husband doctor.

The principle of law is that if there is a more fundamental relationship between the parties,

that is the relationship that prevails (Family and Property Relations between Husband and

Wife; Rights and Obligations of Husband and Wife, Family Code of the Philippines). This is the

reason why in labor standards (Book III, Title I) it is provided that members of the family

dependent on the employer for support are excluded from the provision of the labor

standards law. This is because there may be accountabilities/convictions for the labor law

violations.

It is very difficult to demarcate the relationship of the employee-wife Ruby with the

employer-husband Caloy and second, it becomes a problem of jurisdiction.

Unlike the regular courts, the labor tribunals are quasi-judicial bodies with special/limited

jurisdiction. They do not have general jurisdiction.

Under the factual milieu, there is no doubt that no employer-employee relationship exists

between Caloy and Ruby after marriage. By law and jurisprudence, there being a finding that

there exists no employer-employee relationship between the parties, the issues of whether

or not Ruby is entitled to backwages, separation pay and other money claims, do not deserve

to be passed upon. For the jurisdiction of the labor tribunal is primarily predicated upon the

existence of an employer-employee relationship between the parties. Hence, the absence of

such element removes the controversy from its scope of limited jurisdiction. 1

George Grotjahn GMBH & Co. vs. Judge Isnani, 235 SCRA 216, August 10, 1994; SARA v. Agarrado, 186 SCRA

627

1

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 2 of 30

Q2: What is the importance of the existence of employer-employee relationship?

A: Because the application of labor laws is predicated upon the existence of such employeremployee relationship.

No wonder many employers/businessmen deny the existence of employer-employee

relationship because they try to avoid the legal obligations related to labor standards,

security of tenure, social security, workmens compensation and unionization.

WHAT IS LABOR?

(a) Labor may refer to the activity, in which case, it is service or work; the exertion of

physical or mental effort, or both to the production of goods and services.

(b) Labor may also refer to the working class sector which derives its livelihood chiefly

from rendition of work or services in exchange for compensation.

(c) Labor may also refer to the labor force. The group or portion of the population which

is employed or capable of being employed in productive work. This therefore

includes not only those who are already employed but also the unemployed/underemployed.

(d) Labor also means that sector or group in a society, which derives its livelihood

chiefly from performance/rendition of work or services in exchange for

compensation under managerial direction.

HOW MAY LABOR BE CLASSIFIED?

Labor may be classified as:

According to the existence of a union:

(a) Organized: Those who are members of a trade union; with CBA.

(b) Unorganized: Those who are not members of any trade union; no CBA.

According to existence of employer-employee relationship:

(a) Formal: Those with a definite employer, there being an employer-employee

relationship.

(b) Informal: Those persons engaging in work producing goods or services without any

definite employer. There is no employer-employee relationship. Falling here would

be the sidewalk vendors, pedicab tricycle drivers, even scavengers (bote-dyaryo).

DIFFERENTIATE BETWEEN LABOR, SKILL AND WORK.

Labor is understood as physical toil although it does not necessarily exclude the

application of skill, thus, there is skilled and unskilled labor. Skill is the familiar knowledge of

any art or science, united with readiness and dexterity in execution or performance or in the

application of the art or science to practical purposes.

Work is broader than labor and covers all forms of physical or mental exertion, or both

combined, for the attainment of some object other than recreation or amusement per se.

WHAT IS LABOR LAW?

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 3 of 30

Labor law is the law governing the rights and duties of employers and employees; first,

with respect to the terms and conditions of employment, and second, with respect to the labor

disputes arising from collective bargaining respecting such terms and conditions.

Labor legislation consists of statutes, regulations and jurisprudence governing the

relations between capital and labor, by providing for certain employment standards and a legal

framework for negotiating, adjusting and administering those standards and other incidents of

employment.

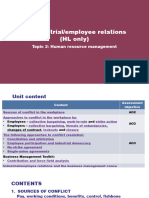

HOW MAY LABOR LAWS BE DIVIDED?

Labor laws may be divided into labor standards law and labor relations law.

DEFINE LABOR STANDARDS.

Labor standards law sets out the least or basic terms, conditions and benefits of

employment that employers must provide or comply with and to which employees are entitled

as a matter of legal right.

Labor standards are the minimum requirements prescribed by existing laws, rules and

regulations relating to wages, hours of work, cost-of-living allowance, and other monetary and

welfare benefits, including occupational, safety and health standards.

DEFINE LABOR RELATIONS.

Labor relations law defines the status, rights and duties and the institutional mechanisms

that govern the individual and collective interactions of employers, employees or their

representatives. It is also a means by which terms and conditions above the minimum are fixed

(e.g. CBA, Arbitration).

DISTINGUISH BETWEEN LABOR STANDARDS AND LABOR RELATIONS.

The distinction between labor standards and labor relations is useful for academic

purposes but in reality, the two overlap. For instance, the grievance machinery is a labor relations

mechanism, but very often the subject of the complaint is labor standards such as unpaid

overtime work or disciplinary actions.

Figuratively, one may think of labor standards as the material or the substance to be

processed while labor relations is the mechanism that processes the substance.

IS LABOR DIFFERENT FROM INDUSTRIAL RELATIONS?

The question is largely theoretical as the two are practically interchangeable. Academics

however use labor relations to refer to situations involving unionized companies and

industrial relations for non-unionized ones, or labor relations refer to matters internal to the

labor sector and industrial relations to management-labor interaction.

DEFINE AND DISTINGUISH BETWEEN

LEGISLATION.

SOCIAL LEGISLATION AND SOCIAL WELFARE

Social legislation comprises of those laws that provide particular kinds of protection or

benefits to society (all members of society) or segments thereof in furtherance of social justice;

those that require payment of benefits by government agencies to the worker or his family when

and while he cannot work by reason of sickness, old age, death and similar hazards.

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 4 of 30

Social welfare legislation covers benefits for contingencies over and above what the law

requires of employers, which the State provides to the worker and his family. It is distinguished

from social legislation in that welfare statutes are predicated upon employer-employee relationship,

whereas the other is not.

IS THERE A DISTINCTION BETWEEN LABOR LAW AND SOCIAL LEGISLATION?

Yes, but the two are not easy to delineate.

Social legislation is defined as those laws that provide particular kinds of protection or

benefits to society or segments thereof in furtherance of social justice. In that sense, labor laws are

necessarily social legislation.

Labor laws or labor legislation directly affects employment; designed to meet the daily

needs of workers; covers employment for profit or gain; affecs the work of employee; benefits are

paid by the workers employer. In short, it refers only to employees.

Social legislation governs the effects of employment (e.g. ECC, sickness benefits);

involves long range benefits (e.g. retirement benefits, disability or death benefits); covers

employment for profit and non-profit; affects life of employee; benefits are paid by concerned

government agencies. (e.g. GSIS, SSS, ECC, Medicare)

If distinction must be stressed at all, it is simply in the sense that labor laws are social

legislation but not all social legislations are labor laws. In other words, in relation to each other,

social legislation as a concept is broader, labor laws is narrower.

WHAT IS SOCIAL JUSTICE?

In Calalang v. Williams, social justice is defined as neither communism, nor despotism,

nor atomism, nor anarchy, but the humanization of laws and the equalization of social and

economic forces by the State so that justice in its rational and objectively secular conception may

at least be approximated.

Social justice means the promotion of the welfare of ALL the people, the adoption of the

Government of measures calculated to ensure economic stability of all the component elements of

society through the maintenance of proper economic and social equilibrium in the interrelations

of the members of the community, constitutionally, through the adoption of measures legally

justifiable, or extra-constitutionally, through the exercise of power underlying the existence of all

governments, on the time-honored principle of salus populi est suprema lex.

In essence, social justice is both a juridicial principle and a societal goal. As a juridical

principle, it prescribes equality of the people, rich or poor, before the law. As a goal, it means the

attainment of decent quality of life of the masses through humane productive efforts. The process

and the goal are inseparable because one is the synergistic cause and effect of the other legal

equality opens opportunities that strengthen equality that creates more opportunities. The

pursuit of social justice does not require making the rich poor but, by lawful process, making the

rich share with government the responsibility of realizing social justice as an end.

Social justice does not champion division of property or equality or economic status;

what it and the Constitution do guaranty are equality of opportunity, equality of political rights,

equality before the law, equality between values given and received, and equitable sharing of the

social and material goods on the basis of efforts exerted in their production. ( Guido v. Rural

Progress Administration, L-2089, October 31, 1949)

WHAT IS THE RELATION OF SOCIAL JUSTICE TO LABOR LAWS?

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 5 of 30

Social justice, being the goal, the State is commanded to create not just economic

opportunities but to diffuse economic wealth. The enactment of labor laws is one of the methods

done by the State to ensure this.

This is a recognition that, in a situation of extreme mass poverty, political rights, no

matter how strongly guaranteed by the constitution, become largely rights enjoyed by the upper

and middle classes and are a myth for the underprivileged. Without the improvement of

economic conditions, there can be no real enhancement of the political rights of the people.

WHAT IS A LABOR DISPUTE?

A labor dispute includes any controversy or matter concerning terms and conditions of

employment or the association or representation of persons in negotiating, fixing, maintaining,

changing or arranging the terms and conditions of employment, regardless of whether the

disputants sstand in the proximate relation of employer and employee. (Art. 212[1], Labor Code)

WHAT ARE THE KINDS OF LABOR DISPUTES?

Labor Standards disputes may pertain to:

(a) compensation (e.g. UPW, stringent output quota, illegal deductions);

(b) benefits (e.g. NP Holiday Pay, OT or other wage-related benefits); and

(c) working conditions (e.g. unrectified work hazards).

Labor Relations Disputes may pertain to:

(a) Organizational right dispute/ULP (e.g. coercion, restraint or interference in

unionization; reprisal or discrimination due to union activities; company

unionism; intra-union dispute.

(b) Representation dispute (e.g. certification election; determination of the SEBA,

contest for recognition by different sets of union officers of same union.

(c) Bargaining dispute (e.g. refusal to bargain [ULP]; bargaining in bad faith;

bargaining deadlock; economic strike or lockout.

(d) Contract administration/personnel policy disputes (e.g. non-compliance with

CBA provisions; disregard of grievance machinery, etc.

(e) Employment tenure dispute (e.g. non-regularization of employees; labor-only

contracting; illegal dismissal; non-issuance of employment contract)

Fundamental Principles

WHAT ARE THE SOURCES OF LABOR RIGHTS?

(1) Constitution

(2) Legislation (Labor Code of the Philippines; Civil Code; and other special

laws)

(3) Contract/CBA

(4) Company Policy

(5) Company past practices

WHAT ARE THE BASIC RIGHTS OF WORKERS AS GUARANTEED BY THE CONSTITUTION? (ART.

XIII, SEC. 3)

Under Labor Standards

(1) Right to Security of tenure;

(2) Right to Receive a living wage;

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 6 of 30

(3) Right to Share in the fruits of production; and

(4) Right to work under Humane conditions.

Under Labor Relations

(1) Right to Organize themselves;

(2) Right to Conduct collective bargaining or negotiation with management;

(3) Right to Engage in peaceful concerted activities including strike; and

(4) Right to Participate in policy and decision-making processes.

WHAT IS THE CONSTITUTIONAL BASIS FOR LABOR LAWS?

Labor laws are enacted under the police powers of the State, specifically, the power of the

State to pass laws to promote the general welfare. This may limit existing rights.

Likewise, under the social justice provisions, the State shall guarantee the rights of all

workers to self-organization, collective bargaining and negotiation, peaceful concerted activities,

and right to strike according to law. They shall be entitled to security of tenure, humane

conditions of work and living wage. They shall participate in policy and decision making

processes affecting their rights and benefits as may be provided by law. (Art. XIII, Sec. 3) It

contemplates equitable diffusion of wealth and political power (National Service Corp. v NLRC,

Nov. 29, 1988)

But this does not mean every labor dispute should be decided pro-labor. Management

also has its own rights.

WHAT ARE THE OTHER CONSTITUTIONAL BASIS FOR LABOR LAWS?

(1) Principle of shared responsibility/Principle of co-determination (Sec. 3, Art. XIII)

(2) Preferential use of voluntary modes of settling disputes, including conciliation

(3) Right to just share in fruits of production (management/to reasonable return on

investments and to expansion and growth)

(4) Right to form unions (Sec. 8, Art. III)

(5) Right to self-organization for government workers (Art. 9-B, Sec. 2)

(6) Promotion of full employment (Sec. 9, Art. II)

(7) Affirmation of labor as a primary social economic force (Art. II, Sec. 18)

(8) No involuntary servitude (Art. III, Sec. 18[2])

(9) Full protection to labor/full employment (Art. XIII, Sec. 3)

(10) Protection of working women (Art. XIII, Sec. 14)

(11) Family living wage and income (Art. XV, Sec. 3[3])

ARE LABOR LAWS PRO-LABOR?

Not necessarily. Although the rights of workers and employees are heavily protected by

the Constitution and Philippine labor laws to the point that it would be easy to say that

Philippine labor laws are pro-labor,

CITE OTHER RELATED LAWS PERTAINING TO LABOR.

A. Under the Civil Code

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 7 of 30

1) Art. 1700 The relations between capital and labor are not merely

contractual. They are so impressed with public interest that labor contracts

must yield to the common good. Therefore, such contracts are subject to the

special laws on labor unions, collective bargaining, strikes and lockouts,

closed shop, wages, working conditions, hours of work and other similar

subjects.

2) Art. 1701 Neither capital nor labor shall act oppressive against the other, or

impair the interest or convenience of the public. (Principle of non-oppression)

3) Art. 1702 In case of doubt, all labor legislations and all labor contracts shall

be construed in favor of safety and decent living for the laborers. (Correlate

with Art. 4, LCP about construction in favor of labor)

4) Art. 1703 No contract which practically amounts to involuntary servitude

under the guise whatsoever shall be valid.

5) Art. 1708 The laborers wage shall not be subject to execution or

attachment, except for debts incurred for food, shelter, clothing and medical

attendance.

6) Art. 1709 The employer shall neither seize nor retain any tool or other

articles belonging to the laborer.

7) Art. 1710 Dismissal of laborers shall be subject to the supervision of the

government, under special laws.

B. Under the Revised Penal Code

1) Art. 289 Formation, maintenance and prohibition of combination of capital

or labor through violence or threats. The penalty of arresto mayor and a

fine not exceeding P300 shall be imposed upon any person who, for the

purpose of organizing, maintaining or preventing coalitions of capital or

labor, strike of laborers or lock-out of employees, shall employ violence or

threats in such a degree as to compel or force the laborers or employers in

the free and legal exercise of their industry of work, if the act shall not

constitute a more serious offense in accordance with the provisions of the

RPC.

2) Art. 315 (4)(a) Failure of the employer to pay his employees/laborer as

required by Section 1 of RA 602 (1st Minimum Wage Law, April 6, 1951 as

amended by RA 6727 which took effect on July 1, 1989, and further amended by RA

8188, Double Indemnity Act of 1998), at least once every two weeks, except due

to force majeure shall be prima facie considered a Fraud committed by such

employer against his employees/laborers by means of false pretenses similar

to those mentioned in the same manner as therein provided. (People v. Vera

Reyes, 67 Phil. 187)

Note: Every pay day gives an independent cause of action. (Abrasaldo v. CIA

Maritima, L-11917, July 21, 1959

C. Special laws

1) SSS Law (RA 1161, as amended by RA 8282, May 24, 1997)

2) GSIS Law (RA 1146, as amended by RA 8291, May 30, 1997)

3) Limited Portability Law of 1994 (RA 7699)

4) National Health Insurance Act of 1995 (RA 7875, as amended by RA 9241)

5) Paternity Leave Law (RA 8187)

6) Maternity Leave (RA 7322, March 1992)

7) Home Mutual Development Fund Law (PagIBIG) (RA 7742, as amended by

RA 9679 of 2009 Mandatory Coverage of OFW)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 8 of 30

8)

9)

10)

11)

12)

13)

14)

13th Month Pay Law (PD 851)

Retirement Pay Law (RA 7641 and RA 8788 [Underground Mine Workers])

Migrant Workers Act (RA 8042 as amended by RA 10022)

Anti-Sexual Harassment Law (RA 7877)

Magna Carta for Public Health Workers of 1995 (RA 7305)

Act allowing the employment of night workers (RA 10151, June 21, 2011)

Anti-Child Labor Act (RA 7610, Section 14, as amended by RA No. 9231,

December 19, 2003)

WHAT IS THE PROTECTION-TO-LABOR CLAUSE IN THE CONSTITUTION?

Section 3, Article XIII on Social Justice and Human Rights of the 1987 Constitution

provides:

The State shall afford full protection to labor, local and overseas, organized and

unorganized, and promote full employment and equality of employment opportunities for all. It

shall guarantee the rights of all workers to self-organization, collective bargaining and

negotiations, and peaceful concerted activities, including the right to strike in accordance with

law. They shall be entitled to security of tenure, humane conditions of work, and a living wage.

They shall also participate in policy and decision-making processes affecting their rights and

benefits as may be provided by law.

The State shall promote the principle of share responsibility between workers and

employers and the preferential use of voluntary modes in settling disputes, including

conciliation, and shall enforce their mutual compliance therewith to foster industrial peace.

The State shall regulate the relations between workers and employers, recognizing the

right of labor to its share in the fruits of production and the right of enterprises to reasonable

returns on investments, and to expansion and growth.

WHAT ARE THE BASIC PRINCIPLES ENUNCIATED IN THE LABOR CODE ON PROTECTION TO

LABOR?

a.

b.

c.

The State shall afford protection to labor, promote full employment, ensure equal

work opportunities regardless of sex, race or creed and regulate the relations

between workers and employers. The State shall assure the rights of workers to selforganization, collective bargaining, security of tenure and just and humane

conditions of work. (Art. 3, LCP) (Rance et al. v. NLRC, GR No.L- 68147, June 30, 1988)

Labor contracts are not ordinary contracts as the relation between capital and labor is

impressed with public interest. (Art. 1700, NCC)

In case of doubt, labor laws and rules shall be interpreted in favor of labor. (Art. 4,

LCP)

Cases:

The settled rule is that in case of conflict between the evidence presented by the

employer and the worker, the scales of justice must be tilted in favor of worker

consonant with the Social Justice adage that those who have less in life should have

more in laws.

It is a time-honored rule that in controversies between a worker and his

employer, doubts reasonably arising from the evidence, or in the interpretation of

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 9 of 30

agreements and writing should be resolved in the workers favor. (Prangan v. NLRC,

GR No. 126529, April 15, 1998, 289 SCRA 142, 148-149 cited in Acuna et al. v. CA, GR

No. 159832, May 5, 2006)

Likewise, labor laws, particularly those granting rights and benefits are of a

mandatory character and cannot be waived by contract.

In one case, the union and management agreed in the CBA to condone

implementation of a wage order granting 12 pesos wage increases. The SC said that

this was void. Firstly, it is only the wage board which could approve an exemption.

Secondly, the parties in a CBA may establish clauses they deem convenient provided

they are not contrary to law, morals, good customs, public order or public policy.

One cannot apply the rule on compromise agreements to such a provision in the

CBA. Compromises are means to end labor disputes and not against public policy.

(Manila Fashion v. NLRC, GR 117878, November 13, 1996)

Construed in favor of labor if there is doubt as to the meaning of the legal and

contractual provision. If the provision is clear and unambiguous, it must be applied

in accordance with its express terms. (Meralco v. NLRC, GR No. 78763, July 12, 1989)

Not all labor disputes should be resolved in favor of labor. The law also

recognizes that management has rights which are also entitled to respect and

enforcement of fair play. (St. Lukes medical Center Employees Association v. NLRC, GR

No. 162053, March 7, 2007)

WHAT ARE THE LIMITS TO THE PROTECTION AFFORDED BY THE CONSTITUTION AND LABOR

LAWS?

1) The protection of the rights of workers cannot justify disregard of relevant facts in

the construction of the text and applicable rules in order to arrive at a disposition in

favor of an employee. (PAL v. NLRC, 201 SCRA 687)

2) Courts cannot render decision on the basis of sympathy for the workingman at the

expense of the employer. (Caltex v. PLO, 92 Phil. 1014; Manning International Corp. v.

NLRC, 195 SCRA 155 [1991])

3) Where both parties have violated the law, neither party is entitled to protection.

(PMBUSCO Employees Union v. CIR, 68 Phil. 591)

4) Protection to labor is NOT a license to condone wrong. (Pacific Mills, Inc. v. Alonzo,

199 SCRA 617)

WHAT ARE THE RIGHTS OF MANAGEMENT?

The employer has the right to:

(1) Conduct business;

(2) Prescribe rules;

(3) Select and hire employees;

(4) Transfer or discharge employees; and

(5) Return of investment and expansion of business.

WHAT IS THE DOCTRINE OF MANAGEMENT PREROGATIVE?

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 10 of 30

Under the doctrine of management prerogative, every employer has the inherent right to

regulate, according to his own discretion and judgment, all aspects of employment, including

hiring, work assignments, working methods, the time, place and manner of work, work

supervision, transfer of workers, and discipline, dismissal and recall of employees. (Rural Bank of

Cantillan v. Julve, GR No. 169750, February 27, 2007)

WHAT ARE THE LIMITATIONS TO MANAGEMENT PREROGATIVES?

Management prerogatives are subject to limitations by (1) law; (2) contract or CBA; and

(3) general principles of fair play and justice. (Mendoza v. Rural Bank of Lucban, GR No. 155421, July

7, 2004)

WHO ARE COVERED BY THE LABOR CODE?

All rights and benefits granted to workers under this Code shall, except as may otherwise

be provided herein, apply to all workers, whether agricultural or non-agricultural. (Art. 6, LCP)

Thus, the Labor Code applies to all workers, whether agricultural or non-agricultural,

including employees in a government-owned or controlled corporation incorporated under the

Corporation Code.

WHO ARE EXEMPTED FROM THE COVERAGE OF THE LABOR CODE?

The following are exempted from the coverage of the Labor Code:

(1) Government employees are governed by Civil Service laws, rules and regulations;

(2) Employees of GOCC created by special law or original charter (as provided by the

1987 Constitution, The Civil Service Commission, Sec. 2[1]);

(3) Foreign government instrumentalities (JUSMAG-PHILIPPINES v. NLRC, GR No.

108813, December 15, 1994)

(4) International agencies (Lasco v. UNRFNRE, GR Nos. 109095-109107, February 23, 1995)

(5) Employees of intergovernmental or international organizations (SEFDEC-AQD v.

NLRC, GR No. 86773, February 14, 1992)

(6) Corporate officers/intra-corporate disputes which fall under PD 902-A and now

under the jurisdiction of the regular courts pursuant to Securities Regulations Code

[RA 8799]. (Nacpil v. IBC, GR No. 144767, March 21, 2002)

(7) Local water districts (Tanjay Water District v. Gabaton, GR Nos. 63742 and 84300, April

17, 1989) EXCEPT where NLRC jurisdiction is invoked. (ZCWD v. Buat, GR No. 104389,

May 27, 1994); and

(8) Members of the BOD, officers or employees of electric cooperatives. (Francisco Silva as

NEA Administrator v. Leovigildo T. Mationg, GR No. 153837, July 21, 2010; SAMELCO II,

et. al Seludo, GR No. 173840, April 25, 2012)

Note: Private school teachers entitlement to security of tenure are governed by the

Manual of Regulations for Private Schools and NOT the Labor Code. However, the Labor Code

applies suppletorily. (Aklan College, Inc. v. Guarino, GR No. 152949, 2007; St. Paul College v. Ancheta,

GR. No. 169905, Sep. 7, 2011)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 11 of 30

Book One

PRE EMPLOYMENT

The law on pre-employment is Book I (Art. 12-42) of the Labor Code and RA 8042, the

Migrant Workers and Overseas Filipino Workers Act of 1995, as amended by RA 10022.

Recruitment and Placement of Workers

WHAT IS RECRUITMENT AND PLACEMENT?

Recruitment and placement is any act of canvassing, enlisting, contracting, transporting,

utilizing, hiring, or procuring workers and includes contract services, referrals, or advertising,

promising for employment locally or abroad, whether for profit or not, whether undertaken by a

non-licensee or non-holder of authority: Provided, that any such non-license or non-holder who, in

any manner, offers or promises for a fee employment abroad to two or more persons shall be

deemed as engaged in such act.

Recruitment includes the act of referral or the act of passing along or forwarding an

applicant for employment after an initial interview/s for employment to a selected employer,

placement officer or bureau. (People v. Saley, 291 SCRA 715, 1998; People v. Goce, August 29, 1995)

It must be shown that the defendant gave the distinct impression that she has the power

to deploy and find employment for complainant abroad. (People v. Goce, ibid)

The number of persons dealt with is not an essential ingredient/element of the act of

recruitment and placement. The proviso merely creates a presumption. (People v. Panis, GR No. L58674-77, July 11, 1986)

WHAT IS A PRIVATE RECRUITMENT AGENCY?

Any person or association engaged in the recruitment and placement of workers, locally

or overseas, without charging, directly or indirectly, any fee from the workers or employers.

WHAT IS A LICENSE? WHAT IS AUTHORITY?

A license is a document issued by DOLE authorizing a person or entity to operate a

private employment agency.

An authority is a document issued by DOLE authorizing a person or association to

engage in recruitment and placement activity as a private recruitment agency.

WHAT IS THE RELEVANT LAW ON RECRUITMETN FOR OVERSEAS EMPLOYMENT?

The Migrant Workers and Overseas Filipinos Act of 1995 (RA No. 8042) as amended by

RA 10022, May 8, 2010 and its Omnibus and Implementing Rules.

WHAT IS OVERSEAS EMPLOYMENT?

Overseas employment pertains to the employment of a worker outside the Philippines

which is covered by a valid contract. (POEA Rules and Regulations governing the Recruitment and

Employment of Land-Based Overseas Workers, February 4, 2002)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 12 of 30

DEFINE OVERSEAS FILIPINO WORKER.

An Overseas Filipino Worker refers to a person (Filipino) who is to be engaged, is

engaged, or has been engaged in a remunerated activity in a State of which he or she is not a

citizen or on board a vessel navigating the foreign seas other than a government ship used for

military or non-commercial purposes or on an installation located offshore or on the high seas; to

be used interchangeably with migrant worker. (Sec. 2, RA 10022)

HOW ARE OFWS CLASSIFIED?

OFWs are classified as either sea-based or land-based. Sea-based OFWs/Seamen are

those employed in a vessel engaged in maritime navigation. While land-based OFWs pertain to

contract workers other than a seaman, including workers engaged in offshore activities whose

occupation requires that majority of his working or gainful hours are spent on land.

WHAT AGENCIES ARE GIVEN THE DUTY TO PROMOTE THE WELFARE AND RIGHTS OF OFWS?

1. Department of Foreign Affairs

2. Department of Labor and Employment

3. Philippine Overseas Employment Agency

4. Overseas Workers Welfare Administration provides social and welfare services

including insurance coverage, legal assistance, placement assistance and remittances

services to OFW; under RA 8042, it shall provide the Filipino migrant worker and his

family assistance in the enforcement of contractual obligations by agencies, entities

and/or their principals.

5. Re-Placement and Monitoring Center (RPM) develops livelihood programs for

returning migrant workers to integrate the returning migrant workers to the

Philippine society; and

6. National Labor Relations Commission tasked with the settlement or adjudication of

labor disputes.

Note: POEA has taken over the function of the Overseas Employment Development

Board (OEDB) and National Seamen Board (NSB).

WHAT ARE THE PRINCIPAL FUNCTIONS OF THE POEA?

The POEA has the following principal functions:

(a) Formulation, implementation, and monitoring of overseas employment of Filipino

workers;

(b) Protection of their right to fair and equitable employment practices; and

(c) Deployment of Filipino workers through government hiring.

WHAT ARE THE FUNCTIONS OF THE POEA?

The functions of the POEA may be divided into (a) regulatory and (b) adjudicatory.

The regulatory functions of the POEA, as provided in RA 9422, are:

(1) Regulate private sector participation in the recruitment and overseas placement of

workers through its licensing and registration system;

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 13 of 30

(2) Formulate and Implement in coordination with appropriate entities concerned, when

necessary, a system for promoting and monitoring the overseas employment of

Filipino workers taking into consideration their welfare and the domestic manpower

requirements;

(3) Inform migrant workers their rights as workers and as human beings;

(4) Instruct and guide the workers how to assert their rights and provide the available

mechanism to redress violation of their rights;

(5) Deploy trained and competent Filipino workers to foreign government and

instrumentalities and such other employers as public interest may require, only to

countries:

a. Where the Philippines has conducted bilateral labor agreements or

arrangements;

b. Observing and/or complying with the international laws and standards for

migrant workers;

c. Guaranteeing to protect the rights of Filipino migrant workers.

The adjudicatory functions of the POEA include:

(1) Administrative cases involving violations of licensing rules and regulations and

registration of recruitment and employment agencies;

(2) Disciplinary action cases and other special cases which are administrative in

character, involving employers, principals, contracting partners and Filipino migrant

workers.

WHAT ARE THE GROUNDS FOR DISCIPLINARY ACTION UNDER RA 8042?

Under RA 8042, the grounds for disciplinary action are:

(1)

(2)

(3)

(4)

(5)

Prostitution;

Unjust refusal to depart for the worksite;

Gun-running or possession of deadly weapons;

Vandalism or destroying company property;

Violation of the laws and sacred practices of the hose country and unjustified breach

of employment contract;

(6) Embezzlement of funds of the company or fellow worker entrusted for delivery to

relatives in the Philippines;

(7) Creating trouble at the worksite or in the vessel;

(8) Gambling;

(9) Initiating or joining a strike or work stoppage where the laws of the host country

prohibit strikes or similar actions;

(10) Commission of felony punishable by Philippine laws or by the host country;

(11) Theft or robbery;

(12) Drunkenness

(13) Drug addiction or possession or trafficking of prohibited drugs; and

(14) Desertion or abandonment.

WHICH HAS JURISDICTION OVER DISCIPLINARY ACTION CASES OF

THE POEA?

OFWS, THE NLRC OR

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 14 of 30

The POEA retains jurisdiction over disciplinary action cases. (Eastern Mediterranean

Maritime Ltd. & AGEMAR Manning Agency Inc. v. Estanislao Surio, et al., GR No. 154213, August 23,

2012)

Although RA 8042, through its Sec. 10, transferred the original and

exclusive jurisdiction to hear and decide money claims involving overseas

Filipino workers from the POEA to the labor arbiters, the law did not remove

from the POEA the original and exclusive jurisdiction to hear and decide all

disciplinary action cases and other special cases administrative I character

involving such workers. The obvious intent of RA 8042 was to have the POEA

focus its efforts in resolving all administrative decision matters affecting and

involving such workers. This intent was even expressly recognized in the

Omnibus Rules and Regulations Implementing the Migrant Workers and

Overseas Filipinos Act of 1995 promulgated on February 29, 1996, viz:

Section 28. Jurisdiction of the POEA. The POEA shall exercise

original and exclusive jurisdiction to hear and decide:

(a) all cases, which are administrative in character,

involving or arising out of violations or rules and

regulations relating to licensing and registration of

recruitment and employment agencies or entities;

and

(b) disciplinary action cases and other special cases,

which are administrative in character, involving

employers, principals, contracting partners and

Filipino migrant workers.

Section 29. Venue. The cases mentioned in Section 28(a) of this

Rule, may be filed with the POEA adjudication Office or the

DOLE/POEA regional office of the place where the complainant

applied or was recruited, at the option of the complainant. The

office with which the complaint was first filed shall take

cognizance of the case.

Disciplinary action cases and other special cases, as

mentioned in the preceding Section, shall be filed with the POEA

Adjudication Office.

It is clear, therefore, that the NLRC had no appellate jurisdiction to

review the decision of the POEA in disciplinary cases involving overseas contract

workers.

WHAT ARE THE ENTITIES AUTHORIZED TO ENGAGE IN RECRUITMENT AND PLACEMENT?

Only the following entities are authorized to engage in recruitment and placement:

(a)

(b)

(c)

(d)

(e)

Public Employment Offices (PESO ACT OF 1999 RA 8759)

POEA;

Private recruitment entities;

Private employment agencies;

Shipping or manning agents or representatives;

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 15 of 30

(f) Such other persons or entities as may be authorized by the Secretary of Labor and

Employment;

(g) Construction contractors, if authorized by DOLE

(h) Members of the diplomatic corps (but hiring must also go through the POEA);

(i) Name hirees

WHO ARE DISQUALIFIED FROM RECRUITMENT AND PLACEMENT OF WORKERS FOR OVERSEAS

EMPLOYMENT?

(1) Travel agencies and sales agencies of airline companies (Art. 26, LCP);

(2) Officers and members of the Board of any corporation or members in a partnership

engaged in the business of a travel agency;

(3) Corporations and partnerships when any of its officers, members of the board or

partners, is also an officer, member or partner of a corporation or partnership

engaged in the business of a travel agency (interlocking officers);

(4) Persons, partnerships or corporations which have derogatory records, such as but

not limited to:

a. Those certified to have derogatory record or information by the NBI or by

the Anti-Illegal Recruitment branch of the POEA;

b. Those against whom probable cause or prima facie finding of guilt for illegal

recruitment or other related cases exists;

c. Those convicted for illegal recruitment or other related cases and/or crimes

involving moral turpitude;

d. Those agencies whose license have been previously cancelled or revoked by

POEA for violations of RA 8042, PD 442 as amended and their implementing

rules and regulations as well as the Labor Codes implementing rules and

regulations;

e. Officials and employees of the DOLE or other government agenices directly

involved in overseas employment program and their relatives within the 4th

civil degree by consanguinity or affinity; and

f. Those whose license have been previously cancelled or revoked (Sec. 2, Rule

I, 2002 Rules and Regulations on the Recruitment and Employment of Land-Based

Workers)

IS DIRECT-HIRING OF OFWS ALLOWED?

NO. Employers cannot directly hire workers for overseas employment except through

authorized entities. (Art. 18, LCP)

Except:

(1)

(2)

(3)

(4)

Members of the diplomatic corps;

International organizations;

Other employers as may be allowed by Sec. of Labor; and

Name Hirees.

Note: Name hirees are individual workers who are able to secure contracts for overseas

employment on their own efforts and representations without the assistance or participation of

any agency. Their hiring, nonetheless, shall pass through the POEA for processing purposes.

(Part III, Rule III of POEA Rules governing Overseas Employment, as amended in 2002)

Note: Any non-resident foreign corporation directly hiring Filipino workers is doing

business in the Philippines and may be sued in the Philippines.

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 16 of 30

WHAT ARE THE REASONS FOR THE BAN ON DIRECT-HIRING?

The reasons for the ban are as follows:

(a) to ensure full regulation of employment in order to avoid exploitation;

(b) to assure the best possible terms and conditions of work to the employee; and

(c) to assure the foreign employer that he hires only qualified Filipino workers.

ARE OFWS REQUIRED TO REMIT THEIR EARNINGS?

Yes. It shall be mandatory for all Filipino workers abroad to remit a portion of their

foreign exchange earnings to their families, dependents, and/or beneficiaries in the country in

accordance with the rules and regulations prescribed by the Secretary of Labor and Employment.

Thus, ALL OFWs are required to remit a portion of their foreign exchange earnings

ranging from 50% - 80% of their basic salary. Rule VIII, Book III of POEA Rules provide for the

following percentage:

(a) Seaman or mariners

80%

(b) Workers for Filipino contractors/construction co.

70%

(c) Professionals, Employment contracts which provide free lodging

70%

(d) Professional, without board & lodging

50%

(e) Domestic/other service workers

50%

WHO ARE EXEMPTED FROM MANDATORY REMITTANCE?

The following are exempted:

(1) Filipino servicemen working in UDS military installation;

(2) Immediate family members, dependents or beneficiaries who are residing with the

OFW abroad;

(3) Immigrants and Filipino professionals/employees working with UN agencies or

specialized bodies. (Resolution 1-83, Inter-Agency Committee Implementing EO 857)

WHAT ARE THE EFFECTS OF FAILURE TO REMIT?

Failure to remit produces effects on both worker and employer. The worker who fails to

comply with the mandatory remittance requirement shall be suspended or excluded from the list

of eligible workers for overseas employment. Subsequent violations shall warrant his

repatriation. Employers who fail to comply shall be excluded from the overseas employment

program. Private employment agencies or entities shall face cancellations or revocation of their

licenses or authority to recruit, without prejudice to other liabilities under existing laws and

regulations. (Sec. 9, EO 857, December 13, 1982)

IN RELATION TO LICENSING, WHAT ARE THE POWERS OF POEA?

POEA has the power to:

(a) suspend or cancel license; and

(b) order the refund or reimbursement of such illegally collected fees. (Eastern Assurance

and Surety Corp. v. Sec. of Labor, GR No. 79436-50, January 17, 1990)

WHAT ARE THE GROUND FOR SUSPENSION/CANCELLATION OF LICENSE?

The following are grounds for suspension/cancellation of license:

(a) Acts prohibited under Art. 34;

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 17 of 30

(b)

(c)

(d)

(e)

Charging a fee in excess of the authorized amount;

Doing recruitment in places outside its authorized area;

Deploying workers without processing through the POEA; and

Publishing job announcements without the POEAs prior approval (Sec. 4, Rule II,

Book IV of the POEA Rules)

WHO HAS JURISDICTION TO SUSPEND OR CANCEL A LICENSE?

The Labor Secretary (Art. 35, LCP) and the POEA administrator (Sec. 1, Rule II, Book VI,

New Rules on Overseas Employment) have CONCURRENT jurisdiction to suspend or cancel a

license. (Trans Overseas Corp. v. Sec. of Labor, GR No. 109583, September 5, 1997)

WHAT ISSUES ARE OUTSIDE POEA JURISDICTION?

The POEA has no jurisdiction over:

(a) enforcement of foreign judgments such a claim must be filed before regular courts.

(Pacific Asia Overseas Shipping Corp. v. NLRC, et al., GR No. 76595, May 6, 1988)

(b) torts for these fall under the provisions of the Civil Code.

WHAT ARE EXAMPLES OF INVALID SIDE AGREEMENTS?

(a) Signing satisfaction receipts is not a waiver. Any agreement to receive less

compensation that what the worker is entitled to recover is invalid. (MR Yard Crew

Union v. PNR, GR L-33621, 26 July 1976)

(b) Altering agreement that diminishes the workers pay and benefits as contained in a

POEA-approved contract is void, UNLESS, such subsequent agreement is approved

by POEA. (Chavez v. Bonto-Perez, GR No. 109808, March 1, 1995)

(c) A side agreement that authorizes the employer to deduct the US20 commission of

the OCWs manager is void, being against public policy, UNLESS approved by the

POEA. (ibid)

WHAT ARE THE MINIMUM/STANDARD CONDITIONS OF OVERSEAS EMPLOYMENT CONTRACT?

An overseas employment contract must contain:

(1)

(2)

(3)

(4)

(5)

(6)

(7)

(8)

Guaranteed wages for regular working hours and overtime pay;

Free transportation from point of hire to site of employment and return;

Free adequate board and lodging facilities or compensatory food allowance;

Free emergency medical and dental treatment facilities;

Just causes for termination of the services of OFW;

Workmens compensation benefits and war hazard protection;

Free repatriation of workers remains and properties in case of death; and

Assistance on remittance of workers salaries and allowances.

WHAT ARE THE SALIENT FEATURES OF RA 10022, AMENDING SECTION 10 OF RA 8042?

(a)

Any compromise/amicable settlement or voluntary agreement to be

paid/implemented within 30 days from approval [ previously 4 months] (Sec. 7)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 18 of 30

(b)

(c)

(d)

Automatic disqualification of foreign employer/principal from participating in

POEA Program and recruiting/hiring Filipino workers, in case of final and

executory judgment, until and unless it fully satisfies the judgment award; (ibid)

Performance of bond filed recruitment/placement agency shall be answerable for

all money claims or damages; (ibid)

Compulsory insurance coverage for agency-hired workers at no cost to the worker

deployed; valid/effective for the duration of the OEC; (Sec. 37-A)

WHAT IS ILLEGAL RECRUITMENT (IR)?

Illegal recruitment under Art. 38 formerly applies to both local and overseas

employment. Art. 38 provides that illegal recruitment may only be committed by a non-license or

authority holder who commits any acts of recruitment or any act the prohibited acts in Art. 38.

Thus, illegal recruitment under Art. 38

Illegal recruitment may be committed by any person or entity, whether licensees or non-licensees

or holders or non-holders of authority.

It is any act of canvassing, enlisting, contracting, transporting, utilizing, hiring or

procuring workers and includes contract services, referrals, or advertising, promising for

employment abroad, whether for profit or not, when undertaken by a non-licensee or non-holder

or authority: Provided, that any such non-licensee or non-holder who, in any manner, offers or

promises for a fee employment abroad to two or more persons shall be deemed as engaged in

such act. Also includes the act of reprocessing workers through a job order that pertains to nonexistent work, work different from the actual overseas work, or work with a different employer,

whether registered or not with the POEA. (Sec. 5, par. C as amended by RA 10022)

It shall likewise include the commission of the following prohibited acts whether

committed by a non-licensee or non-holder of authority or a license or holder of authority:

1. Those prohibited practices enumerated under Art. 34;

2. Failure to actually deploy without valid reason as determined by DOLE;

3. Failure to reimburse expenses incurred by the worker in connection with his

documentation and processing for purposes of deployment in cases where the

deployment does not actually take place without the workers fault; and

4. Recruitment and placement activities of agent or representatives appointed by a

licensee, whose appointments were not previously authorized by the POEA shall likewise

constitute IR. (Sec. 6, RA 8042)

WHAT ARE THE ELEMENTS OF ILLEGAL RECRUITMENT?

a. First element: recruitment and placement activities.

The offender undetakes either any recruitment activities defined under Art. 13 (b) or any

prohibited practices enumerated under Art. 34; and

b. Second element: Non-licensee or non-holder of authority.

The offender is a license/non-licensee or a holder/non-holder of authority engaged in

the recruitment and placement of workers. (people v. Sadiosa, GR No. 107084, May 15, 1998)

WHO ARE CONSIDERED AS NON-LICENSEE OR NON-HOLDER OF AUTHORITY?

Any person, corporation or entity which has not been issued a valid license or authority

to engage in recruitment and placement by the Secretary of Labor and Employment; or whose

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 19 of 30

license or authority has been suspended, revoked or cancelled by the POEA or the Secretary of

Labor and Employment.

RELEVANT PRINCIPLES TO REMEMBER IN IR.

(a) Mere impression that recruiter is capable of providing work abroad is sufficient.

(b) Referral of recruits also constitutes recruitment activity.

(c) Absence of receipt to prove payment is not essential to prove recruitment.

(d) Only one person recruited is sufficient to constitute recruitment.

(e) Non-prosecution of another suspect is not material.

(f) Person convicted for illegal recruitment may still be convicted for estafa.

HOW IS SIMPLE ILLEGAL RECRUITMENT COMMITTED?

Simple illegal recruitment is committed where a person: (a) undertakes any recruitment

activity defined under Art. 13(b) or any prohibited practices enumerated under Art. 34 and Art.

38 of the Labor Code; and (b) does not have a license or authority to lawfully engage in the

recruitment and placement of workers.

WHEN IS ILLEGAL RECRUITMENT IN LARGE SCALE COMMITTED?

Illegal recruitment in large scale requires a third element, i.e. that it is committed against

three or more persons individually or as a group.

WHEN IS ILLEGAL RECRUITMENT CONSIDERED ECONOMIC SABOTAGE?

Illegal recruitment is considered economic sabotage when the commission is attended by

the qualifying circumstances as follows:

(a) By a syndicate if carried out by a group of 3 or more persons conspiring and

confederating with one another; or

(b) In a large scale if committed against 3 or more persons individually or as a group.

MAY A PERSON CONVICTED OF ILLEGAL RECRUITMENT BE CHARGED WITH ESTAFA?

Yes. A person may be charged and convicted for both illegal recruitment and estafa.

Illegal recruitment is malum prohibitum whereas estafa is malum in se meaning that the crime

intent of the accused is not necessary for conviction in the former but required in the latter.

WHAT ACT IN RELATION TO ILLEGAL RECRUITMENT CONSTITUTES ESTAFA?

The accused represented themselves to complainants to have the capacity to send

workers abroad, although they did not have any authority or license. It is by this representation

that they induced complainants to pay a placement fee. Such act constitutes estafa under Art. 315,

par. 2 of the RPC.

MAY AN EMPLOYEE OF A RECRUITMENT AGENCY BE CONSIDERED A PRINCIPAL IN ILLEGAL

RECRUITMENT?

An employee of a company/corporation engaged in illegal recruitment may be held

liable as PRINCIPAL together with his employer, if it is shown that he actively and consciously

participated in illegal recruitment. (People v. Cabasi, GR No. 129070, March 16, 2001)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 20 of 30

ARE OFWS ENTITLED TO THE RELIEFS UNDER ART. 279 OF THE LCP REGARDING MONEY

CLAIMS?

No. OFWs are not entitled to the reliefs under Art. 279. The proper basis for the monetary

awards of OFWs is section 10 of RA 8042 and not Article 279 of the Labor Code. Consequently,

the remedies provided for under Art. 279 such as reinstatement, or separation pay in lieu of

reinstatement or full backwages are not available to OFWs. This is so because the OFWs are

contractual employees whose rights and obligations are governed primarily by the Rules and

Regulations of the POEA and, more importantly, by RA No. 8042. (Gu-Miro v. Adorable, Gr No.

160952, August 20, 2004)

Section 10 of RA 8042 (Migrant Workers and Overseas Filipinos Act of 1995) provides:

In case of termination of overseas employment, without just, valid or

authorized cause as defined by law or contract, the worker shall be entitled to the

full reimbursement of his placement fee with interest at 12 per centum per

annum, plus his salaries for the unexpired portion of his employment contract or

for three (3) months for every year of the unexpired term, whichever is less.

Note: In Serrano v. Gallant Maritime et. al, Gr NO. 167614, March 24, 2009, the

Supreme Court declared unconstitutional the clause or for three months for

every year of the unexpired term, whichever is less provided in the fifth

paragraph of Sec. 10 of RA 8042, for being violative of the rights of the OFW to

equal protection clause of Sec. 3, Art. XIII of the 1987 Constitution.

WHAT ARE INCLUDED IN THE OFWS MONETARY AWARD?

An OFW terminated without just, valid or authorized cause is entitled to:

(a) full reimbursement of his placement fee, which may include payment for the

repatriation of the worker and the transport of his personal belongings

these being the primary responsibilities of the agency which recruited or

deployed the overseas contract worker. All the costs attendant thereto

should be borne by the agency concerned and/or its principals. (Athena

International Manpower Agency Services, Inc. v. Villanos, GR No. 151303, April

15, 2005)

(b) payment of his salaries for the unexpired portion of his employment

contract.

DOES THE OPERATIVE FACT DOCTRINE FIND APPLICATION IN OEC DISPUTES?

In Claudio Yap v. Thenamaris Ship Management, GR No. 179532, May 30, 2011, the Supreme

Court held that this case should not be different from Serrano, thus:

As a general rule, an unconstitutional act is not a law; it confers no

rights; it imposes no duties; it afford no protection; it creates no office; it

is inoperative as if it has not been passed at all. The doctrine of operative

fact serves as an exception to the aforementioned general rule.

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 21 of 30

The doctrine of operative fact, as an exception to the general rule, applies

only as a matter of equity and fair play. It nullifies the effects of an

unconstitutional law by recognizing that the existence of a statute prior

to a determination of unconstitutionality is an operative fact and may

have consequences which cannot always be ignored. The past cannot

always be erased by a new judicial declaration.

The doctrine is applicable when a declaration of unconstitutionality will

impose an un undue burden on those who have relied on the invalid

law. Thus, it was applied to a criminal case when a declaration of

unconstitutionality would put the accused in double jeopardy or would

put in limbo the acts done by a municipality in reliance upon a law

creating it.

Following Serrano, we hold that this case should not be included in the

aforementioned exception. After all, it was not the fault of petitioner that he

lost his job due to an act of illegal dismissal committed by respondents. To rule

otherwise would be iniquitous to petitioner and other OFWs, and would

in effect, send a wrong signal that principals/employers and

recruitment/manning agencies may violate an OFWs security of tenure

which an employment contract embodies and actually profit form such

violation based on an unconstitutional provision of law.

WHAT IS THE THEORY OF IMPUTED KNOWLEDGE?

In Sunace International Management Services, Inc. v. NLRC and Divina Montehermozo,( GR

No. 161757, January 25, 2006), the Supreme Court held that the recruitment agency is not

solidarily liable for any money claims arising from the 2-year employment extension when the

principal extended the overseas employment contract of the workers without its knowledge.

As explained by the SC:

The theory of imputed knowledge ascribes the knowledge of the agent

to the principal employer, not the other way around. The knowledge of the

principal-foreign employer, cannot therefore, be imputed to its agent.

There being no substantial prooft that Surnace knew of and consented to

be bound under the 2-year employment contract extension, it cannot be said to

be privy thereto. As such, it and its owner cannot be held solidarily liable for any of

Divinas claims arising from the 2-year employment extension. As the NCC provides:

Contracts take effect only between parties, their assigns and heirs, except

in case where the rights and obligations arising from the contract are not

transmissible by their nature, or by stipulation or by provision of law. (Art. 1311,

NCC)

Furthermore, as Sunace correctly pointes out, there was an implied revocation of

its agency relationship with its foreign principal when, after the termination of

the original employment contract, the foreign principal directly negotiated with

Divina and entered into a new and separate employment contract in Taiwan. Art.

1924 provides that the agency is revoked if the principal directly manages the

business entrusted to the agent, dealing directly with the third persons.

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 22 of 30

WHAT IS THE NATURE OF THE LIABILITY OF LOCAL RECRUITMENT AGENCY AND FOREIGN

PRINCIPAL?

The local agency is solidarily liable with foreign principal for unpaid salaries.

Furthermore, the severance of relations between local agent and foreign principal does not affect

liability of local recruiter. The recruitment agency may still be sued even if the agency and the

principal is already severed if no notice of the termination was given to the employee based on

Art. 1921, NCC. (Catan vs. NLRC, GR No. 777297, April 15, 1988)

WHAT ARE THE INSTANCES WHEN THE LOCAL RECRUITMENT AGENCY IS EXEMPTED FROM

LIABILITY?

(a) Where the workers themselves insisted for the recruitment agency to send them back

to their foreign employer despite their knowledge of its inability to pay their wages.

(Feagle Constrution v. Gayda, GR No. 82310, June 18, 1990)

(b) The worker persuaded the agency to send him abroad even if the agency already

refused since his pay and his job were not assured. The SC said he took a calculated

risk by signing the waiver and rendered the agency free from its liability. (Feagle

Construction v. Dorado, 196 SCRA 481 [1991])

WHAT IS THE RULE ON PREMATURE TERMINATION OF OEC?

If terminated on grounds other than those that are lawful and valid before the agreed

termination date, the employer will pay the workers their salaries corresponding to the

unexpired portion of the employment contract. (Vinta Martime Co. v. NLRC, GR No. 113911,

January 23, 1998)

WHAT IS THE EFFECT OF FAILURE TO DEPLOY?

The act of preventing petitioner from departing the port of Manila and boarding MSV

Seaspread constitutes a breach of contract, giving rise to petitioners cause of action. Respondent

unilaterally and unreasonably reneged on its obligation to deploy petitioner and must therefore

answer for the actual damages he suffered. (Paul Santiago v. CF Crew Management, GR No. 162419,

July 10, 2007)

WHO HAS JURISDICTION OVER CLAIMS FOR DEATH AND OTHER BENEFITS OF OFWS?

Labor arbiters have jurisdiction over claims for death, disability and other benefits

arising from employment of OFWs. Work-connection is required.

WHAT IS THE BASIS OF COMPENSATION FOR DEATH BENEFITS OF OFWS?

The basis for compensation for death generally is whichever is greater between

Philippine law or foreign law.

WHAT IS THE PRESCRIPTIVE PERIOD OF ILLEGAL RECRUITMENT CASES?

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 23 of 30

Under RA 8042, the prescriptive period of illegal recruitment cases is five (5) years,

except in illegal recruitment involving economic sabotage which prescribed in twenty (20) years.

WHAT ARE THE PENALTIES FOR ILLEGAL RECRUITMENT?

(a) Simple illegal recruitment is 12 20 years;

(b) IR constituting economic sabotage is life imprisonment;

(c) Fine for simple IR is P1-2M;

(d) Economic sabotage is P2 P5M.

WHAT ARE THE REQUIREMENTS BEFORE A NON-RESIDENT ALIEN MAY BE EMPLOYED IN THE

PHILIPPINES?

Any alien seeking admission to the Philippines for employment purpose and any

domestic or foreign employer who desires to engage an alien for employment in the Philippines

shall obtain an Alien Employment Permit (AEP) from the Department of Labor.

The alien employment permit may be issued to a non-resident alien or to the applicant

employer after a determination of the non-availability of a person in the Philippines who is

competent, able and willing at the time of application to perform the services for which the alien

is desired.

For an enterprise registered in preferred areas of investments, said employment permit

may be issued upon recommendation of the government agency charged with the supervision of

said registered enterprise.

WHO ARE EXEMPTED FROM SECURING AN AEP?

Categories of alien exempted from securing employment permit in order to work in the

Philippines:

(1) All members of the diplomatic services and foreign government officials accredited

by and with reciprocity arrangement with the Philippine government;

(2) Officers and staff of International organizations of which the Philippines is a

member, and their legitimate spouses desiring to work in the Philippines;

(3) Foreign nationals elected as members of the Governing board who do not occupy

any other position, but have only voting rights in the corporation;

(4) All foreign nationals granted exemption by law;

(5) Owners and representatives of foreign nationals whose companies are accredited by

the POEA who come to the Philippines for a limited period and solely for the

purpose of interviewing Filipino applicants for employment abroad;

(6) Foreign nationals who come to the Philippines to teach, present and/or conduct

research studies in Universities and Colleges as visiting exchange or adjunct

professors under formal agreements between the Universities or colleges in the

Philippines and foreign universities or colleges; or between the Philippine

government and foreign government; provided that the exemption is on a reciprocal

basis; and

(7) Resident foreign national (immigrants and/or resident aliens instead should obtain

an Alien Employment Registration Certificate). (DO No. 75-06, May 31, 2006)

MAY AN ALIEN EMPLOYEE TRANSFER HIS EMPLOYMENT AFTER ISSUANCE OF PERMIT?

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 24 of 30

After the issuance of an employment permit, the alien shall not transfer to another job or

change his employer without prior approval of the Secretary of Labor.

Non-resident alien shall not take up employment in violation of the provisions of the

Code. Violations of the aforementioned acts will subject the alien to the punishment of provided

in Arts. 289 and 290, LCP and to deportation after service of sentence.

Book Two

HUMAN RESOURCES

Training and Employment of Special Workers

WHAT IS AN APPRENTICESHIP?

Apprenticeship means any practical training on the job supplemented by related

theoretical instruction involving apprenticeable occupations and trades as may be approved by the

Secretary of Labor, for a period of not less than 3 months but not more than 6 months.

WHAT ARE APPRENTICEABLE OCCUPATION?

An apprenticeable occupation is an occupation endorsed by a tripartite body and

approved for apprenticeship by the Technical Education Skills Development Authority (TESDA).

It is TESDA who approves apprenticeable occupation and no longer by the Sec. of Labor.

(Sec. 4[m], RA 7796)

DEFINE ON THE JOB TRAINING.

On-the-Job training is pratical work experience through actual participation in

productive activities given to or acquired by an apprentice.

WHAT ARE HIGHLY TECHNICAL INDUSTRIES?

Highly technical industries are trade businesses, enterprises, industries or other activities

which are engaged in the application of advanced technology.

WHO IS AN APPRENTICE?

An apprentice is a worker who is covered by a written apprenticeship agreement with

an employer. A person undergoing training for an approve apprenticeable occupation during an

established period assured by an apprenticeable agreement. (Sec. 4, RA 7796, TESDA Law of 1994)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 25 of 30

WHAT ARE THE QUALIFICATIONS OF AN APPRENTICE?

An apprentice must:

(a) Be at least fifteen (15) years of age, provided those who are at least fifteen years of

age but less than 18 may be eligible for apprenticeship only in non-hazardous

occupation;

(b) Be physically fit for the occupation in which he desires to be trained;

(c) Possess vocational aptitude and capacity for the particular occupation as established

through appropriate tests; and

(d) Possess the ability to comprehend and follow oral and written instructions.

WHAT ARE THE IMPORTANT PRINCIPLES RELATED TO APPRENTICESHIP?

(a) Wage rate of apprentices 75% of the statutory minimum wage.

(b) Apprentices become regular employees if program is not approved by DOLE.

(c) Ratio of theoretical instructions and on-the-job training must be: 100 hours of

theoretical instructions for ever 2,000 hours of practical training.

WHEN MAY APPRENTICES BE WITHOUT COMPENSATION?

Art. 72, LCP provides that apprentices may be hired without compensation whre the onthe-job training is:

(a) required by the school/training program curriculum as a requisite for graduation;

(b) a requisite for board examination. (Sec. 40, Rule VI, Book II, Implementing the Labor

Code)

WHO ARE LEARNERS?

A learner is a person hired as a trainee in industrial occupations which are nonapprenticeable and which may be learned through practical training on the job for a period not

exceeding three (3) months, whether or not such practical training is supplemented by theoretical

instructions.

Wage rate of learners is 75% of the statutory minimum wage.

WHAT ARE THE PRE-REQUISITES BEFORE LEARNERS MAY BE HIRED?

The pre-requisites before learners may be validly employed are:

(a) when no experienced workers are available;

(b) when the employment of learners is necessary to prevent curtailment of employment

opportunities; and

(c) the employment does not create unfair competition in terms of labor costs or impair

or lower working standards.

WHEN MAY A LEARNER BE CONSIDERED A REGULAR EMPLOYEE?

A learner who has worked during the first two (2) months shall be deemed as a regular

employee if training is terminated by the employer before the end of the stipulated period

though no fault of the learner. (Sec. 4, Rule VII, Book II, supra)

MAY MINORS BE EMPLOYED AS LEARNERS?

A minor below 15 years of age shall not be eligible for employment as learner. Those

below 18 years of age may ONLY be employed in non-hazardous occupations. (Sec. 6, Rule VII,

Rules Implementing the Labor Code)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 26 of 30

WHO IS A HANDICAPPED WORKER?

A handicapped worker is one whose earning capacity is impaired;

(a) by age; or

(b) physical deficiency; or

(c) mental deficiency; or

(d) injury; or

(e) illness or disease

Note: If disability is not related to the work for which he was hired, he should not be so

considered as handicapped worker. He may have a disability but since the same is not related to

his work, he cannot be considered a handicapped worker insofar as that particular work is

concerned.

HOW MUCH ARE HANDICAPPED WORKERS ENTITLED TO AS COMPENSATION?

Art. 80 of the LPC provide that workers are entitled to at least 75% of the statutory

minimum wage.

Note: However, with the enactment of the Magna Carta for Disabled persons,

handicapped persons are entitled to the same terms and conditions of employment as a qualified

able-bodied person. Thus, a qualified disabled employee is entitled to 100% of the minimum

wage.

WHO ARE HANDICAPPED PERSONS?

Handicapped persons are those who are suffering from restriction or different disabilities

as a result of a mental, physical, or sensory impairment to perform an activity in the manner or

within the range considered normal for a human being. (RA 7277, Magna Carta for Disabled

Persons, as amended by RA 9442)

Note: Handicapped workers may become regular employees. The noble objectives of the

Magna Carta for Disabled Persons are not based merely on charity or accommodation, but on

justice and equal treatment of qualified employees, disabled or not. After the disabled employees

had shown their fitness for the work assigned to them, they should be treated and granted the

same rights like any other regular employees.

ARE HANDICAPPED WORKERS ELIGIBLE FOR EMPLOYMENT AS APPRENTICESHIP OR

LEARNERSHIP?

Yes. Handicapped workers are eligible for employment as apprentices or learners if their

handicap is such that it does not impede the performance of job operations in the particular trade

or occupation which is the subject of the apprenticeship or learnership program.

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 27 of 30

Book Three

LAW ON LABOR STANDARDS

Preliminary

In relation to the first situation as discussed above with respect to the doctor and

secretary that is: there is no ER-EE relationship between them since Karen is a member of the

family dependent on the employer for support are excluded from the provision of the labor standards law.

How about in the instant case of a son (Robert) suing his father (Don Caloy). Robert was

made an overseer-manager of the plantation/hacienda owned by Don Juan in Guimaras. He did

well in the first year and afterwards, he got married. After his marriage, he builds a house in

Bacolod. One day, he got sick so that he was not compensated. He wrote his father Don Caloy

but the latter did not pay him. Thus, he sued his father.

It was held that this case is not covered by the exception because what is operative in the

exception is that the employee who is a member of the family of the employer must be dependent

on him for support. In other words, mere relationship (paternity and filiation) is not enough.

Robert is entitled to labor standard benefits.

To reiterate, Labor Standards Law deals with the minimum requirement prescribed by

law, rules and regulations on wages, hours of work, cost of living allowance and other monetary

and welfare benefits, including OSHS; or the minimum terms, conditions and benefits that

employers must provide their employees which they are entitled as a matter of right.

WHAT ARE THESE LABOR STANDARDS?

Labor Standards include:

1. Minimum wage (RA 6727)

2. Holiday pay

3. Premium pay

4. Overtime pay

5. Night shift differential pay

6. 13th month pay (PD 851)

Altiora Peto

Q&A on Labor Standards | S. Bance

Page 28 of 30

7.

8.

9.

10.

11.

12.

13.

14.

15.

16.

17.

Termination pay

Retirement pay (RA 7641/RA 8588)

Service incentive leave

Maternity leave

Paternity leave

SSS (RA 1161 as amended by RA 8282)

ECC (PD 626)

Medicare (RA 7875 as amended RA 8282)

PagIBIG (RA 7742)

Medical/Dental Service (Art. 185, LCP)

Battered Woman Leave (RA 9262)

WHAT ARE THE PROVISIONS OF THE LABOR CODE ON WORKING CONDITIONS?

The following provisions are covered under Book III of the Labor Code:

Article 83 Normal hours of work;

Article 84 Hours worked;

Article 85 Meals period;

Article 86 Night shift differential

Article 87 Overtime work

Article 88 Undertime not offset by overtime

Article 89 Emergency overtime work

Article 90 Computation of additional compensation

Article 91 Right to weekly rest period

Article 92 When employer may require work on a rest day

Article 93 Compensation for rest day, Sunday or holiday work

Article 94 Right to holiday pay

Article 95 Right to service incentive leave; and

Article 96 Service charges.

WHO ARE COVERED BY THE PROVISIONS ON WORKING CONDITIONS? WHO ARE NOT

COVERED?

These provisions are applicable to all employees in all establishment whether operated

for profit or not.

Employees NOT covered include:

(a) Government employees;