Beruflich Dokumente

Kultur Dokumente

Quarterly Result 20090731

Hochgeladen von

AzmiHafifiCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Quarterly Result 20090731

Hochgeladen von

AzmiHafifiCopyright:

Verfügbare Formate

GAMUDA BERHAD (29579-T)

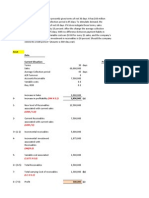

Condensed Consolidated Income Statement

INDIVIDUAL QUARTER

CUMULATIVE PERIOD

Preceding Year

Revenue

Operating expenses

Current Year

Comparative

Current Year

Quarter

Quarter

To Date

Corresponding

Period

31-Jul-09

31-Jul-08

31-Jul-09

31-Jul-08

RM'000

RM'000

RM'000

RM'000

942,241

851,299

2,727,302

2,403,660

(2,581,200)

(2,125,794)

(913,231)

(782,748)

Other income

15,667

19,392

37,679

44,436

Profit from operations

Finance costs

44,677

87,943

183,781

322,302

(8,627)

(9,021)

(44,834)

(24,940)

Share of results of

associated companies

Profit before tax

Income tax expense

Profit for the year

Attributable to :Equity holders of the Company

Minority interests

44,366

80,416

57,278

136,200

143,210

282,157

173,452

470,814

(33,335)

(61,224)

(78,003)

(131,886)

47,081

74,976

204,154

338,928

43,294

3,787

47,081

5%

70,203

4,773

74,976

10%

193,689

10,465

204,154

7%

325,078

13,850

338,928

13%

Earnings per share attributable

to equity holders of the Company

Basic earnings per share (sen)

2.16

3.50

9.65

16.27

Fully diluted earnings per share (sen)

2.15

3.49

9.62

16.17

The Condensed Consolidated Income Statements should be read in conjunction with the Audited Financial Statements for the year

ended 31 July 2008 and the accompanying explanatory notes attached to the interim financial statements.

GAMUDA BERHAD (29579-T)

Condensed Consolidated Balance Sheet

As at

As at

31 July 09

31 July 08

RM'000

RM'000

364,419

288,130

ASSETS

Non-current assets

Property, plant and equipment

Investment properties

2,648

3,288

Prepaid land lease payment

Land held for property development

Investment in associated companies

6,650

482,678

1,286,680

7,232

519,277

1,510,822

Motorway development expenditure

326,271

326,809

65,747

68,189

733

733

Concession and quarry rights

Other investments

Deferred tax assets

23,114

13,777

Receivables

40,306

42,433

2,599,246

2,780,690

Property development costs

440,186

388,513

Inventories

101,082

110,122

1,079,815

1,319,735

379,319

304,635

Current assets

Receivables

Amount due from customers for construction contracts

Tax recoverable

Marketable securities

Cash and bank balances

TOTAL ASSETS

24,114

4,996

100,668

20,000

1,154,029

845,610

3,279,213

2,993,611

5,878,459

5,774,301

2,009,257

2,005,016

EQUITY AND LIABILITIES

Equity attributable to equity holders of the Company

Share capital

Reserves

1,151,754

1,046,566

Shareholders' equity

3,161,011

3,051,582

46,763

45,901

3,207,774

3,097,483

Minority interests

Total equity

Non-current liabilities

Other payables

15,651

28,736

Deferred tax liabilities

17,083

17,549

Long term borrowings

1,210,500

1,036,500

1,243,234

1,082,785

Short term borrowings

328,165

782,253

Payables

690,980

768,264

Amount due to customers for construction contracts

Income tax payable

393,488

17,524

Current liabilities

14,818

25,992

1,427,451

1,594,033

Total liabilities

2,670,685

2,676,818

TOTAL EQUITY AND LIABILITIES

5,878,459

5,774,301

1.57

1.52

Net assets per share attributable to

equity holders of the Company (RM)

The Condensed Consolidated Balance Sheets should be read in conjunction with the Audited Financial

Statements for the year ended 31 July 2008 and the accompanying explanatory notes

- attached to the interim financial statements.

GAMUDA BERHAD (29579-T)

Condensed Consolidated Statement of Changes in Equity

Attributable to equity holders of the Company

Current Year To date

At 1 August 2008

Share

Capital

Share

premium

Option

reserves

Other

reserves

Retained

profits

Total

Minority

Interests

Total

equity

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

RM'000

2,005,016

27,353

15,366

89,150

914,697

3,051,582

45,901

Currency translation differences

13,076

13,076

Share of capital reserve in an associated company

3,064

3,064

(988)

Net income/(expenses) recognised directly in equity

16,140

16,140

(988)

3,097,483

12,088

3,064

15,152

Profit for the year

193,689

193,689

10,465

204,154

Total recognised income and expense for the year

16,140

193,689

209,829

9,477

219,306

4,241

3,432

7,673

7,673

14,780

14,780

14,780

(3,467)

Exercise of Employees' Share Options ("ESOS")

Share options granted under ESOS

Share options exercised under ESOS

Dividends

Distribution of profit in unincorporated subsidiary

1,204

At 31 July 2009

(120,590)

-

(2,263)

(120,590)

-

(8,615)

(2,263)

(120,590)

(8,615)

2,009,257

31,989

26,679

105,290

987,796

3,161,011

46,763

3,207,774

981,528

955,688

6,454

42,349

959,931

2,945,950

48,433

2,994,383

Currency translation differences

13,985

13,985

Share of capital reserve in an associated company

32,816

32,816

Net income/(expenses) recognised directly in equity

46,801

46,801

(13,561)

Profit for the year

325,078

325,078

13,850

338,928

Total recognised income and expense for the year

46,801

325,078

371,879

289

372,168

At 1 August 2007

(13,561)

-

424

32,816

33,240

Exercise of Employees' Share Options ("ESOS")

17,667

30,675

48,342

48,342

Conversion of warrants

10,858

29,860

40,718

40,718

994,963

(994,963)

Acquisition of shares in a subsidiary

4,694

4,694

Share options granted under ESOS

14,003

14,003

14,003

Share options exercised under ESOS

6,093

(5,091)

1,002

1,002

Dividends

(370,312)

Dividend paid by subsidiaries to minority shareholders

2,005,016

27,353

15,366

89,150

914,697

Bonus Issue

At 31 July 2008

(370,312)

(7,515)

3,051,582

45,901

(370,312)

(7,515)

3,097,483

The Condensed Consolidated Statement of Changes in Equity should be read in conjunction with the Audited Financial Statements for the year ended 31 July 2008 and the

accompanying explanatory notes attached to the interim financial statements.

3

GAMUDA BERHAD (29579-T)

Condensed Consolidated Cash Flow Statement

12 months ended

31-Jul-09

RM'000

Cash Flows From Operating Activities

Profit before tax

Adjustments for non-cash items/non-operating items

Operating profit before changes in working capital

31-Jul-08

RM'000

282,157

(67,722)

214,435

470,814

(139,904)

330,910

Net change in current assets

159,502

(798,398)

Net change in current liabilities

216,102

44,516

590,039

(422,972)

Dividend received from associated companies

172,407

Tax paid

Others

Net cash generated from/(used in) operating activities

(106,231)

(44,929)

611,286

226,611

(99,768)

(25,022)

(321,151)

Cash Flows From Investing Activities

Purchase of property, plant and equipment

Proceeds on disposal of plant and equipment

Capital repayment from an associated company

(56,991)

10,072

213,953

(56,830)

4,382

-

Purchase of land held for property development

(42,032)

(38,311)

(Purchase)/proceeds on maturity of marketable securities

(80,668)

5,000

Investment in associated companies

(20,522)

(66,100)

26,401

24,623

4,694

Changes in working capital

Cash generated from/(used in) operations

Interest received

Proceeds from a minority shareholder for issuance of shares

in a subsidiary

Net cash generated from/(used in) investing activities

Cash Flows From Financing Activities

Net proceeds from issuance of shares

Net (repayment)/drawdown of borrowings

50,213

(122,542)

7,673

89,060

(297,059)

Dividend paid to shareholders

Dividend paid by subsidiaries to minority shareholders

Distribution of profit to minority partners of unincorporated

subsidiaries

Net cash (used in)/generated from financing activities

(60,185)

(8,615)

(358,186)

Net increase/(decrease) in cash and cash equivalents

Effects of exchange rate changes

Cash and cash equivalents at beginning of year

Cash and cash equivalents at end of year

303,313

5,106

845,610

1,154,029

602,430

(370,312)

(7,515)

313,663

(130,030)

(4,629)

980,269

845,610

The Condensed Consolidated Cash Flow Statement should be read in conjunction with the Audited

Financial Statements for the year ended 31 July 2008 and the accompanying explanatory notes attached

to the interim financial statements.

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

1.

2.

Basis of Preparation

a)

The interim financial report is unaudited and has been prepared in accordance with Financial Reporting

Standard (FRS) 134: Interim Financial Reporting.

b)

The interim financial report should be read in conjunction with the audited financial statements of the

Group for the year ended 31 July 2008.

c)

The accounting policies and methods of computation adopted by the Group are consistent with those

adopted in the preparation of the financial statements for the year ended 31 July 2008.

Audit Report of Preceding Annual Financial Statements

The audit report of the Groups annual financial statements for the year ended 31 July 2008 was not subject to

any qualification.

3.

Seasonal or Cyclical Factors

The business operations of the Group are not affected by any significant seasonal or cyclical factors.

4.

Unusual Items

There are no unusual items affecting assets, liabilities, equity, net income or cash flows for the current quarter

under review.

5.

Changes in Estimates

There are no changes in estimates of amounts reported previously that have any material effect in the current

quarter under review.

6.

Changes in Debt and Equity Securities

There were no cancellations, repurchases, resale of equity securities during the financial year, except for the

issuance of 4,241,000 new ordinary shares of RM1 each, pursuant to the exercise of the Employees Share

Option.

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

7.

Segmental Analysis

Engineering

and Construction

Property

Development

Water related

and Expressway

Concessions

Intersegment

Elimination

Total

RM'000

RM'000

RM'000

RM'000

RM'000

12 months period

ended 31 July 2009

Revenue

External

Inter segment

2,219,518

7,445

407,364

-

100,420

-

2,226,963

407,364

100,420

81%

15%

4%

Percentage of segment revenue-external

(7,445)

2,727,302

-

(7,445)

2,727,302

Segment results

Profit from operations

Finance costs

63,150

70,173

50,717

(259)

183,781

(24,058)

(10,199)

(10,836)

259

(44,834)

Share of results of

associated companies

Profit before tax

14,147

129,063

143,210

39,092

74,121

168,944

282,157

14%

26%

60%

Percentage of segment results

Income tax expense

(78,003)

204,154

Profit for the year

Margin = PBT/Revenue*

2%

15%

27%

8%

Attributable to:Equity holders of the Company

193,689

Minority interests

10,465

204,154

12 months period

ended 31 July 2008

Revenue

External

1,825,161

472,810

105,689

2,403,660

Inter segment

26,203

1,851,364

472,810

105,689

(26,203)

(26,203)

2,403,660

76%

Percentage of segment revenue-external

20%

4%

Segment results

Profit from operations

142,896

57,177

(1,346)

322,302

Finance costs

Share of results of

associated companies

(13,350)

(2,136)

(10,800)

1,346

(24,940)

30,755

142,697

173,452

Profit before tax

129,546

152,194

189,074

470,814

28%

32%

40%

Percentage of segment results

123,575

Income tax expense

(131,886)

Profit for the year

338,928

Margin = PBT/Revenue*

7%

27%

Attributable to:Equity holders of the Company

Minority interests

32%

16%

325,078

13,850

338,928

*Revenue used in the calculation of margin includes share of associates' revenue

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

8.

Valuation of Property, Plant and Equipment

The valuation of land and buildings has been brought forward without amendment from the previous audited

financial statements.

9.

Material Events Subsequent to Balance Sheet Date

There are no material events subsequent to the end of the quarter under review.

10.

Changes in Composition of the Group

On 23 July 2009, Gamuda has acquired the entire issued and paid up capital of Klasik Mentari Sdn Bhd

(KMSB), comprising 2 ordinary shares of RM1.00 each for a cash consideration of RM2.00. KMSB was

incorporated on 23 June 2009 and is presently dormant.

11.

12.

Dividends

a)

The Board of Directors does not recommend the payment of any final dividend in respect of the financial

year ended 31 July 2009.

b)

The total dividend per share for the current financial year is 8.00 sen less 25% taxation. For the

preceding years corresponding period, a total dividend per share of 25.00 sen less 26% taxation was

declared.

Dividends Paid

12 months ended

31 July

2009

RM000

For the year ended 31 July 2009: Interim dividend of 4.00 sen

less 25% taxation (2008 : Interim dividend of 25.00 sen less 26%

taxation)

60,185

2008

RM000

370,312

For the year ended 31 July 2009, an approved second interim dividend of 4.00 sen less 25% taxation was paid

on 18 Aug 2009, amounting to RM60,405,000.

13.

Changes in Contingent Liabilities or Contingent Assets

Performance and retention sum guarantees

31 July 2009

RM000

31 July 2008

RM000

842,307

1,013,329

The contingent liabilities mainly relate to advance payment guarantees and performance bonds for the

construction projects undertaken by the Group.

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

14.

Review of Performance

For the current quarter under review, the Group recorded revenue and profit before tax of RM942.2 million

and RM80.4 million respectively as compared to RM851.3 million and RM136.2 million respectively in the

corresponding preceding quarter. For the current year to date, the group recorded revenue and profit before tax

of RM2,727.3 million and RM282.2 million respectively as compared to RM2,403.7 milllion and RM470.8

million respectively in the corresponding preceding year. The decrease in profit before tax is primarily due to

lower contributions from all divisions arising from the challenging economic environment.

15.

Comparison with Immediate Preceding Quarters Results

For the current quarter under review, the Group recorded profit before tax of RM80.4 million, which is higher

than the immediate preceding quarters profit before tax of RM63.1 million. The higher profit before tax is

primarily due to the contract price adjustments from the New Doha International Airport Project (Qatar).

16.

Next Years Prospects

(a)

Construction Division

Electrified Double Tracking Railway Project

The work progress is slightly behind schedule due to late handover of land by the authorities. Under the terms

of the contract signed by the project company and the Government of Malaysia, all land should be handed

over to the project company early this year but, to-date, only 88% has been handed over. The progress is

expected to pick up pace in the next financial year when the balance of the land is handed over.

New Doha International Airport Project (Qatar)

On 30 July 2009, Sinohydro-Gamuda-WCT Joint Venture was awarded a sum of RM740 million as additional

works and settlement in respect of all the outstanding counter-proposals in respect of the variation orders,

contractors claims and scope changes. To-date the total contract value has now increased from the original

contract sum of RM1,750 million to RM3,272 million.

Yenso Park and Sewage Treatment Plant Projects (Vietnam)

Yenso Park and Sewage Treatment Plant projects are progressing well on schedule.

(b)

Property Division

The recent two quarters results have improved compared to the first two quarters of the financial year. The

property market is recovering well as product launches such as shop offices in Kota Kemuning and bungalows

in Valencia were fully taken up. Stabilized by an improving economic outlook and affordable interest rate

environment, the property sector is gaining momentum and is expected to perform better in the next financial

year.

(c)

Water-related Concession Division

Following the acceptance by Splash of Selangor State Government (SSG)s revised offer to take over its

water-related assets and operations for an estimated gross price of RM2,975 million, SPLASH is currently

waiting for the SSGs instruction to complete the transaction.

Overall prospects

Overall, the Groups performance is expected to improve in the next financial year.

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

17.

Variance from Profit Forecast and Profit Guarantee

This is not applicable to the Group.

18

Tax Expense

3 months ended

31 July

2009

2008

RM000

RM000

The taxation is derived as below:

Malaysia income tax

33,335

12 months ended

31 July

2009

2008

RM000

RM000

61,224

78,003

131,886

The Groups effective tax rate (excluding the results of associates which is equity accounted net of tax) for the

current period is higher than the statutory tax rate primarily due to certain expenses not being deductible for

tax purposes.

19.

Profits/(Losses) on Sale of Unquoted Investments/Properties

There is no sale of investments/properties for the current financial year under review.

20.

Quoted Investments

There were no transactions on quoted investments in the current financial year under review.

21.

Status of Corporate Proposal Announced

There is no corporate proposal announced but not completed at a date not earlier than 7 days from the issue of

this report.

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

22.

Group Borrowings and Debt Securities

The details of the Groups borrowings as at end of current quarter are as follows:

Note

Short Term Borrowings

Revolving Credits:

- denominated in US Dollar (USD)

Commercial Papers (Horizon Hills)

Term Loan (Gamuda Water)

Foreign

Currency

000

At 31 July 09

RM

Equivalent

000

75,550

268,165

35,000

25,000

328,165

Long Term Borrowings

Medium Term Notes (Bandar Botanic)

Medium Term Notes (Horizon Hills)

Medium Term Notes (Gamuda Berhad)

Term Loan (Smart Project)

Term Loan (Jade Homes)

300,000

100,000

480,000

161,500

169,000

1,210,500

1,538,665

Total

Note:

1. The term loan for Smart Project was obtained by a jointly controlled entity, Syarikat Mengurus Air Banjir &

Terowong Sdn Bhd in relation to the motorway development of the Stormwater Channel and Motorway

Works. The term loan is secured on the Smart Project and is on a non-recourse basis to Gamuda Group.

The term loan is consolidated into Gamuda Groups borrowings as a result of the Groups adoption of the

revised FRS 131-Interests in Joint Ventures, whereby the interests in the jointly controlled entities are

proportionately consolidated.

23.

Off Balance Sheet Financial Instruments

The Group has entered into forward foreign currency contracts to limit its exposure to potential changes in

foreign exchange rates with respect to estimated receipts and payments denominated in foreign currency.

The details of the outstanding forward foreign currency contracts are as follows:

Forwards used to hedge receivables in USD

Contract amount

Maturity period

USD 13.06mil

Oct 2009 Mar 2010

There is minimal credit and market risk as the contracts are entered with a reputable bank.

10

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

24.

Material Litigations

1) W&F filed the Writ of Summons and a Statement of Claim (the Court Action) against the JV for interalia, a court declaration that the JV is in breach of the sub-contract dated 16th April 2003 (the SubContract) by failing to make payment for the sum of RM102,366,880.42 awarded by the Dispute

Adjudication Board (DAB) to W&F in respect of various claims arising out of the Sub-Contract and for

damages of the same amount.

2) On 15th May 2009, the Court allowed the JVs application for stay of proceedings of the Court Action and

unconditionally stayed the Court Action initiated by W&F.

3) On 1st June 2009, W&F filed an appeal against the Courts decision to stay the proceedings.

4) The hearing date for W&Fs application for summary judgment and appeal against the stay of

proceedings has been fixed for hearing on 30th October 2009.

5) On 17th December 2008, in accordance with the terms of the Sub-Contract, the JV commenced arbitration

proceedings by serving on W&F a notice of arbitration. W&F also commenced arbitration proceedings by

filing its Notice of Arbitration on 15th January 2009. A preliminary meeting between the Arbitral Tribunal

members and the parties respective solicitors was held on 17th September 2009 for the purpose of setting

down time lines and directions for the conduct of the arbitration. The time lines and directions are now

pending finalization.

Other than the above litigation, there is no other material litigation since the last annual balance sheet date

to a date not earlier than seven (7) days from the date of issue of this report.

11

Gamuda Berhad (29579-T)

Quarterly Report On Consolidated Results

For The Financial Quarter Ended 31 July 2009

Notes To The Financial Statements

25.

Earnings Per Share

Current

Quarter

31 July

2009

Current

Year To Date

31 July

2009

43,294

193,689

Number of ordinary shares in issue as at 1 August 2008 (000)

Effect of shares issued during the period (000)

2,005,016

3,032

2,005,016

1,642

Weighted average number of ordinary shares in issue (000)

2,008,048

2,006,658

2.16

9.65

43,294

193,689

2,008,048

10,103

2,006,658

6,044

2,018,151

2,012,702

2.15

9.62

Basic

Net profit attributable to shareholders (RM000)

Basic earnings per ordinary share (sen)

Diluted

Net profit attributable to shareholders (RM000)

Weighted average number of ordinary shares in issue (000)

Assumed shares issued from exercise of ESOS (000)

Adjusted weighted average number of ordinary shares

for calculating diluted earnings per ordinary share (000)

Fully diluted earnings per ordinary share (sen)

12

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Laplace Transform ODE SolverDokument1 SeiteLaplace Transform ODE SolverAzmiHafifiNoch keine Bewertungen

- W2 PID STDDokument12 SeitenW2 PID STDAzmiHafifiNoch keine Bewertungen

- Faculty of Chemical and Natural Resources Engineering: Research Proposal (20%)Dokument2 SeitenFaculty of Chemical and Natural Resources Engineering: Research Proposal (20%)AzmiHafifiNoch keine Bewertungen

- Link GoldDokument1 SeiteLink GoldAzmiHafifiNoch keine Bewertungen

- BKG 3433 Transmission & DistributionDokument3 SeitenBKG 3433 Transmission & DistributionAzmiHafifiNoch keine Bewertungen

- Link GoldDokument1 SeiteLink GoldAzmiHafifiNoch keine Bewertungen

- A) T-Xy Diagram For The Water-Methanol System at 1 AtmDokument2 SeitenA) T-Xy Diagram For The Water-Methanol System at 1 AtmAzmiHafifiNoch keine Bewertungen

- ABSTARCT Exp5Dokument1 SeiteABSTARCT Exp5AzmiHafifiNoch keine Bewertungen

- Schedule of PD 1 Workshop - Aspen & SuperProDokument1 SeiteSchedule of PD 1 Workshop - Aspen & SuperProAzmiHafifiNoch keine Bewertungen

- (A) Generate A Txy Diagram For The Water-Methanol System at 1 AtmDokument4 Seiten(A) Generate A Txy Diagram For The Water-Methanol System at 1 AtmAzmiHafifiNoch keine Bewertungen

- (Selasa) : BIL Nama No. Matrik Alamat KolejDokument2 Seiten(Selasa) : BIL Nama No. Matrik Alamat KolejAzmiHafifiNoch keine Bewertungen

- Minor Report From Proposal PresentationDokument2 SeitenMinor Report From Proposal PresentationAzmiHafifiNoch keine Bewertungen

- Buku Log Briged Siswa (UQB1011) Semester 1 Sesi 2011/2012Dokument1 SeiteBuku Log Briged Siswa (UQB1011) Semester 1 Sesi 2011/2012AzmiHafifiNoch keine Bewertungen

- IntroductionDokument4 SeitenIntroductionAzmiHafifiNoch keine Bewertungen

- IntroductionDokument7 SeitenIntroductionAzmiHafifiNoch keine Bewertungen

- Moringa Oil CharacteristicsDokument13 SeitenMoringa Oil CharacteristicsAzmiHafifiNoch keine Bewertungen

- ConclusionsDokument2 SeitenConclusionsAzmiHafifiNoch keine Bewertungen

- Roles of engineers in herbal industry and Warisan Kundur ResourcesDokument2 SeitenRoles of engineers in herbal industry and Warisan Kundur ResourcesAzmiHafifiNoch keine Bewertungen

- Section 4: Chemical Reaction Engineering IiDokument1 SeiteSection 4: Chemical Reaction Engineering IiAzmiHafifiNoch keine Bewertungen

- Front PageDokument3 SeitenFront PageAzmiHafifiNoch keine Bewertungen

- Industrial training report on process engineering at ABC Sdn BhdDokument18 SeitenIndustrial training report on process engineering at ABC Sdn BhdAzmiHafifiNoch keine Bewertungen

- #Design Equation D (X) /D (W) (-Raprime) / Fao X (0) 0 X (F) 0.70 W (0) 0Dokument2 Seiten#Design Equation D (X) /D (W) (-Raprime) / Fao X (0) 0 X (F) 0.70 W (0) 0AzmiHafifiNoch keine Bewertungen

- Exp 1 DLTDokument5 SeitenExp 1 DLTSurenthran SundarNoch keine Bewertungen

- #Design Equation D (X) /D (W) (-Raprime) / Fao X (0) 0 X (F) 0.70 W (0) 0Dokument2 Seiten#Design Equation D (X) /D (W) (-Raprime) / Fao X (0) 0 X (F) 0.70 W (0) 0AzmiHafifiNoch keine Bewertungen

- Industrial training report on process engineering at ABC Sdn BhdDokument18 SeitenIndustrial training report on process engineering at ABC Sdn BhdAzmiHafifiNoch keine Bewertungen

- Curve Fitting TechniquesDokument185 SeitenCurve Fitting TechniquesAzmiHafifiNoch keine Bewertungen

- File LapDokument1 SeiteFile LapAzmiHafifiNoch keine Bewertungen

- Exp 1 DLTDokument5 SeitenExp 1 DLTSurenthran SundarNoch keine Bewertungen

- Chapter 1 - Modelling, Computers and Error AnalysisDokument35 SeitenChapter 1 - Modelling, Computers and Error AnalysisAzmiHafifiNoch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Report of The OAG Zambia 2012Dokument311 SeitenReport of The OAG Zambia 2012Chola MukangaNoch keine Bewertungen

- Audit of ExpensesDokument18 SeitenAudit of Expenseseequals mcsquaredNoch keine Bewertungen

- Income Statement and Related Information: Chapter Learning ObjectivesDokument53 SeitenIncome Statement and Related Information: Chapter Learning Objectivesheyhey100% (1)

- 15 ManagementDokument69 Seiten15 ManagementBelista25% (4)

- PrefaceDokument98 SeitenPrefaceviralNoch keine Bewertungen

- Jumpstart Adventures: Final Project Entrepreneurship & Sme ManagementDokument25 SeitenJumpstart Adventures: Final Project Entrepreneurship & Sme Managementmabf89100% (2)

- Chapter 12Dokument17 SeitenChapter 12Jemaicah AmatiagaNoch keine Bewertungen

- Omair Masood: AS Level MCQs MadnessDokument75 SeitenOmair Masood: AS Level MCQs MadnessAli Qazi100% (11)

- Advanced FinDokument15 SeitenAdvanced FinAliyaaaahNoch keine Bewertungen

- Sample Digital Marketing Business PlanDokument28 SeitenSample Digital Marketing Business PlanAakif AhmadNoch keine Bewertungen

- Accounting Practices of Al - Arafah Islami Bank Limited, Chawkbazar Branch BranchDokument61 SeitenAccounting Practices of Al - Arafah Islami Bank Limited, Chawkbazar Branch BranchBishal Islam100% (1)

- Understanding Client Situation & Strategic Asset AllocationDokument20 SeitenUnderstanding Client Situation & Strategic Asset AllocationAbhijeet PatilNoch keine Bewertungen

- Amazon SCM Finance DataDokument2 SeitenAmazon SCM Finance DataSagar KansalNoch keine Bewertungen

- Boi Questionairre For Loans Above N 10 MillionDokument21 SeitenBoi Questionairre For Loans Above N 10 MillionAdegboyega AdeyemiNoch keine Bewertungen

- FaysalbankDokument268 SeitenFaysalbankMalik MiranNoch keine Bewertungen

- Income Tax On Partnerships - QuestionsDokument9 SeitenIncome Tax On Partnerships - QuestionsJembrain CanubasNoch keine Bewertungen

- Balance Sheet..Dokument8 SeitenBalance Sheet..Sehar AsgharNoch keine Bewertungen

- ITM PPT - Mumbai UniveristyDokument38 SeitenITM PPT - Mumbai UniveristyanaghmahajanNoch keine Bewertungen

- Financial Statements Analysis for Improved Decision MakingDokument19 SeitenFinancial Statements Analysis for Improved Decision MakingRizza Joy Comodero Ballesteros100% (1)

- 2003 Annual Financial StatementDokument11 Seiten2003 Annual Financial Statementvenga1932Noch keine Bewertungen

- Chapter 4 - Completing The Accounting CycleDokument142 SeitenChapter 4 - Completing The Accounting CycleCooper89100% (3)

- TCS ViewReportDokument8 SeitenTCS ViewReportRahul PandeyNoch keine Bewertungen

- SAP BPC QuestionsDokument5 SeitenSAP BPC Questionskusumastuti_wiratnaningtyasNoch keine Bewertungen

- 15 Progressive Development V QCDokument11 Seiten15 Progressive Development V QCrgtan3Noch keine Bewertungen

- REVENUE VS GAINS TITLE FOR PAS 18 DOCUMENTDokument40 SeitenREVENUE VS GAINS TITLE FOR PAS 18 DOCUMENTjose amoresNoch keine Bewertungen

- Adjusting Entries QuizzerDokument6 SeitenAdjusting Entries QuizzerErvin GonzalesNoch keine Bewertungen

- 2nd Quarter Exam-1Dokument7 Seiten2nd Quarter Exam-1Alona Nay Calumpit AgcaoiliNoch keine Bewertungen

- In This Document: Purpose Questions and AnswersDokument11 SeitenIn This Document: Purpose Questions and AnswersSsnathan Hai100% (1)

- TOA Sample QuestionDokument14 SeitenTOA Sample QuestionConstantine MarangaNoch keine Bewertungen

- Your Project Should Include Following PointsDokument3 SeitenYour Project Should Include Following Pointsyash patraNoch keine Bewertungen