Beruflich Dokumente

Kultur Dokumente

Userfiles Financial 2f

Hochgeladen von

Tejaswini SkumarOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Userfiles Financial 2f

Hochgeladen von

Tejaswini SkumarCopyright:

Verfügbare Formate

1/28/2014

www.vijayabank.com/Userfiles/Financial/2f.htm

Financial Reports

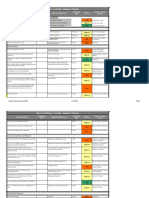

REVIEWED FINANCIAL RESULTS FOR THE QUARTER ENDED 31 TH MARCH, 2012

Sl.

No.

Rs. in Lakhs

Year ended

(Audited)

31.12.2011 31.03.2011 31.03.2012 31.03.2011

(Reviewed) (Audited)

205826

160878

798812

584406

156988

117693

605009

419190

47602

42609

187204

161101

32

61

31

126

Quarter ended

Particulars

01 Interest earned [(a)+(b)+(c)+(d)]

(a) Interest/discount on advances/bills

(b) Income from investments

(c) Interest on balances with Reserve Bank of India and other inter

bank funds

(d) Others

02 Other Income

03 TOTAL INCOME (1+2)

04 Interest Expended

05 Operating Expenses (i) + (ii)

(i) Employee costs

(ii) Other operating expenses

06 TOTAL EXPENDITURE (4+5) (Excluding provisions and

contingencies)

07 OPERATING PROFIT (3 6)

(Profit before provisions and contingencies)

08 Provisions (other than tax) and Contingencies

09 Exceptional items

10 Profit/(Loss) from Ordinary Activities before tax (7-8-9)

11 Tax Expenses

12 Net Profit/(Loss) from Ordinary Activities after tax (10-11)

31.03.2012

(Audited)

215223

164688

49135

(21)

1421

13813

229036

165968

36720

23482

13238

202688

1204

11566

217392

158366

28852

17045

11807

187218

515

14288

175166

113044

51126

38708

12418

164170

6568

52790

851602

608459

120096

73992

46104

728555

3989

53318

637724

389729

143328

101044

42284

533057

26348

30174

10996

123047

104667

8683

17665

(432)

18097

16724

13450

1023

12427

16159

(5163)

(10586)

58123

64924

6825

58099

43870

60797

8415

52382

18097

49554

12427

47267

5423

47267

58099

49554

52382

47267

327915

285050

285050

327915

285050

55.02

57.69

57.69

55.02

57.69

10.96

13.06

10.94

12.39

12.59

13.88

10.96

13.06

12.59

13.88

2.98

2.63

0.65

9.49

9.89

2.98

2.63

0.65

9.49

9.89

171846

99801

2.93

1.72

0.78

166717

99710

2.98

1.81

0.55

125919

74116

2.56

1.52

0.28

171846

99801

2.93

1.72

0.66

125919

74116

2.56

1.52

0.72

222872258 200000000 200000000 222872258

44.98

42.31

42.31

44.98

200000000

42.31

5423

13 Extraordinary Items (Net of Tax Expense)

14 Net Profit/(Loss) for the period (12-13)

15 Paid up equity share capital

(Face value of each share- ` 10/-)

16 Reserves excluding Revaluation Reserves (As per Balance Sheet of

previous accounting year)

17 Analytical Ratios

(i) Percentage of shares held by Government of India

(ii) Capital Adequacy Ratio (%)

Basel I

Basel II

(iii) Earnings per share (EPS) (Not annualized)

(a) Basic and Diluted EPS before Extraordinary Items (Net of Tax

Expenses

for the period, for the year to date and for the previous year)

(b) Basic and Diluted EPS after Extraordinary Items for the period,

for the

year to date and for the previous year

(iv) NPA Ratios

a) Amount of Gross Non Performing Assets

b) Amount of Net Non Performing Assets

c) Percentage of Gross Non Performing Assets

d) Percentage of Net Non Performing Assets

(v) Return on Assets (Annualised) (%)

18 Public share holding

- Number of shares

- Percentage of share holding

19 Promoters and Promoter Group Shareholding

a) Pledged / Encumbered

Number of Shares

Percentage of shares (as a percentage of total shareholding of

promoter and promoter group)

Percentage of shares (as a percentage of total share capital of the

company)

b) Non-encumbered

Number of Shares (in million)

Percentage of shares (as a percentage of total shareholding of

http://www.vijayabank.com/Userfiles/Financial/2f.htm

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

Nil

272.66

100.00

272.66

100.00

272.86

100.00

272.66

100.00

272.66

100.00

1/3

1/28/2014

www.vijayabank.com/Userfiles/Financial/2f.htm

Percentage of shares (as a percentage of total shareholding of

promoter and promoter group)

Percentage of shares (as a percentage of total share capital of the

company)

100.00

100.00

100.00

100.00

100.00

55.02

57.69

57.69

55.02

57.69

SEGMENT WISE RESULTS, ASSETS AND LIABILITIES FOR THE YEAR ENDED ON 31.03.2012

SUMMARISED BALANCE SHEET

Sl.

No.

Particulars

a) Segment

Revenue #

i) Treasury

Operations

ii) Whole Sale

Banking

iii) Retail

Banking

iv) Other

Banking

Operations

Quarter

Quarter

Quarter

Year

Year CAPITAL AND LIABILITIES As at 31.03.2012

As at

Ended

Ended

Ended

Ended

Ended

31.03.2011

31.03.2012 31.12.2011 31.03.2011 31.03.2012 31.03.2011

(Audited) (Reviewed) (Audited) (Audited) (Audited)

Capital

169554

167267

53932

51727

46859

206433

179960 Reserves and surplus

109816

107319

70685

402693

243710 Deposits

54829

49866

47108

202645

175795 Borrowings

10459

8480

10514

39831

229036

217392

175166

851602

(12423)

1354

10847

(7328)

17885

6872

(19087)

48343

iii) Retail

Banking

iv) Other

Banking

Operations

Total

13693

15582

13936

8504

7190

27659

c) Unallocated

Expenses

d) Operating

Profit

e) Provisions &

Contingencies

f) Tax Expenses

Total

b) Segment

Result

i) Treasury

Operations

ii) Whole Sale

Banking

38259 Other Liabilities and

Provisions

637724 Total

ASSETS

355668

314433

8305551

7324832

541840

202537

203788

192268

9576401

8201337

186032

488184

86449

52725

35843 Cash and Balances with

Reserve Bank of India

2721 Balances with Banks and

Money at Call and Short

Notice

40573 Investments

2864380

2513858

6653

33303

21138 Advances

5790374

4871863

30998

12349

127043

100275 Fixed Assets

48695

48599

1311

824

1353

3994

4612 Other Assets

232666

192385

26348

30174

10996

123047

9576401

8201337

8683

16724

16159

58123

43870

(432)

1023

(10586)

6825

8415

18097

12427

5423

58099

i) Treasury

Operations

3239941

2999787

2805238

3239941

ii) Whole Sale

Banking

4240464

4072775

3431345

4240464

iii) Retail

Banking

1920338

1891204

1813436

1920338

23531

24361

33277

23531

152127

139186

118041

152127

g) Extraordinary

Profit

h) Net Profit

i) Other

Information

j) Segment

Assets

iv) Other

Banking

Operations

v) Unallocated

Assets

http://www.vijayabank.com/Userfiles/Financial/2f.htm

104667 Total

454254

NOTES :

1. The above financial results have been approved by the

- Board of Directors of the Bank at its meeting held on 30th

April 2012.

52382 2. There has been no change in the Accounting Policies

and Practices in preparation of these financial statements as

compared to those followed in the preceding financial year

ended on 31st March 2011.

3. The Board has recommended a dividend of `. 2.5 per

equity share.

4. The above financial results have been subjected to

2805238 audit by the Statutory Central Auditors of the Bank in terms of

3431345 RBI guidelines and SEBI Listing Agreement.

5. Working results for year ended on 31st March 2012

have been arrived at after making necessary provisions for

Income Tax, provision for depreciation, provision for

Employee Benefits, provisions for NPAs, Standard Assets

1813436 and Depreciation on Investment on the basis of prudential

norms issued by the Reserve Bank of India.

6. RBI vide circular no. DBOD.BP.BC.94/21.048/2011-12

33277 dated 18.05.2011 has enhanced the minimum provisioning

rates for non-performing advances and restructured standard

advances. Provision for NPAs for the year ended on 31st

March 2012 has been made in compliance with the above

118041 referred circular. Accordingly an additional provision of `.

121.73 crore has been made on NPAs for the year ended on

2/3

1/28/2014

www.vijayabank.com/Userfiles/Financial/2f.htm

Assets

Total Assets

9576401

9127313

8201337

9576401

i) Treasury

Operations

3254770

2927107

2738250

3254770

ii) Whole Sale

Banking

3992749

3878656

3279015

3992749

iii) Retail

Banking

1796751

1800972

1701869

1796751

116

100

504

116

v) Unallocated

Liabilities

532015

520478

481699

532015

Total Liabilities

9576401

9127313

8201337

9576401

k) Segment

Liabilities

iv) Other

Banking

Operations.

121.73 crore has been made on NPAs for the year ended on

31st March 2012.

8201337 7. Employee cost for the year ended 31st March 2012

includes an amount of `. 119 crore (previous year `. 119

crore) being the amortization of expenses as per the

guidelines of Reserve Bank of India vide circular no.

DBOD.BP.BC.80/2104.018/2010-11 dated 09th February

2738250 2011 relating to second option for pension for serving

employees and enhancement in ceiling of Gratuity.

3279015 8. During the quarter ended 31st March 2012, the bank

has made a preferential allotment of 2,28,72,258 equity

shares of `. 10/- each at a premium of `. 54.27 per share

1701869 amounting to `. 147 crore to LIC of India.

9. The figures of the previous period have been regrouped

/ rearranged, wherever necessary.

504 10. Provision Coverage Ratio (PCR) is 62.40% as on 31st

March 2012.

11. The number of investor complaints pending in the

beginning of the quarter is Nil. Number of complaints

481699 received and resolved during the quarter is 874.

8201337

# The Bank operates only in domestic segment.

Place: Bangalore

Date: 31st March, 2012

SHUBHALAKSHMI PANSE

H. S. UPENDRA KAMATH

Executive Director

Chairman & Managing Director

Copyright 2012 Vijaya Bank. All rights reserved.

http://www.vijayabank.com/Userfiles/Financial/2f.htm

3/3

Das könnte Ihnen auch gefallen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Global Currency Reset - Revaluation of Currencies - Historical OverviewDokument20 SeitenGlobal Currency Reset - Revaluation of Currencies - Historical Overviewenerchi111196% (28)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- NON Negotiable Unlimited Private BondDokument2 SeitenNON Negotiable Unlimited Private Bonddbush277886% (14)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Electronic New Government Accounting SystemDokument61 SeitenElectronic New Government Accounting SystemJoseph PamaongNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Insurance Law Key ConceptsDokument5 SeitenInsurance Law Key ConceptsMarc GelacioNoch keine Bewertungen

- FIDIC Contracts Claims Management Dispute ResolutionDokument3 SeitenFIDIC Contracts Claims Management Dispute ResolutionadamcyzNoch keine Bewertungen

- Discover StatementDokument6 SeitenDiscover StatementhzNoch keine Bewertungen

- Example Coding QuestionsDokument5 SeitenExample Coding QuestionsTejaswini SkumarNoch keine Bewertungen

- DW Assignment1Dokument11 SeitenDW Assignment1Tejaswini Skumar100% (4)

- Acme Home Improvements Employee SchedulingDokument3 SeitenAcme Home Improvements Employee SchedulingTejaswini Skumar0% (2)

- Microsoft_Azure_Dp_203_cert_notes_�_1712494873Dokument151 SeitenMicrosoft_Azure_Dp_203_cert_notes_�_1712494873Tejaswini SkumarNoch keine Bewertungen

- Artificial Neural NetworkDokument2 SeitenArtificial Neural NetworkTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 3fDokument3 SeitenUserfiles Financial 3fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 13fDokument2 SeitenUserfiles Financial 13fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 14fDokument3 SeitenUserfiles Financial 14fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 9fDokument2 SeitenUserfiles Financial 9fTejaswini SkumarNoch keine Bewertungen

- Question 1Dokument2 SeitenQuestion 1Tejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 11fDokument3 SeitenUserfiles Financial 11fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 12fDokument3 SeitenUserfiles Financial 12fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 5fDokument2 SeitenUserfiles Financial 5fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 5fDokument2 SeitenUserfiles Financial 5fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 6fDokument2 SeitenUserfiles Financial 6fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 4fDokument3 SeitenUserfiles Financial 4fTejaswini SkumarNoch keine Bewertungen

- GRE Vocabulary Flash Cards01Dokument2 SeitenGRE Vocabulary Flash Cards01telecom_numl8233Noch keine Bewertungen

- Userfiles Financial 7fDokument3 SeitenUserfiles Financial 7fTejaswini SkumarNoch keine Bewertungen

- Automatic Control of Engine Speeds of Hydraulic Excavator (Repaired)Dokument4 SeitenAutomatic Control of Engine Speeds of Hydraulic Excavator (Repaired)Tejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 1fDokument3 SeitenUserfiles Financial 1fTejaswini SkumarNoch keine Bewertungen

- Userfiles Financial 3fDokument3 SeitenUserfiles Financial 3fTejaswini SkumarNoch keine Bewertungen

- MySQL tutorial covers database, table, and query basicsDokument18 SeitenMySQL tutorial covers database, table, and query basicsRefat NafiuNoch keine Bewertungen

- 0 000 0 0embedded System 8th Sem E& C Notes Written by Arunkumar G, Lecturer, STJIT, RanebennurDokument1 Seite0 000 0 0embedded System 8th Sem E& C Notes Written by Arunkumar G, Lecturer, STJIT, RanebennurTejaswini Skumar100% (1)

- #Include : (For Both Circuits)Dokument1 Seite#Include : (For Both Circuits)Tejaswini SkumarNoch keine Bewertungen

- Optimised The Engine Speed To Suit Working Conditions and NeedsDokument3 SeitenOptimised The Engine Speed To Suit Working Conditions and NeedsTejaswini SkumarNoch keine Bewertungen

- NetworkingDokument10 SeitenNetworkingTejaswini Skumar100% (1)

- Screen Capture BaisicsDokument27 SeitenScreen Capture BaisicsTejaswini SkumarNoch keine Bewertungen

- 634124997373765000Dokument18 Seiten634124997373765000Tejaswini SkumarNoch keine Bewertungen

- Secondary Burst Cache Design Using The Idt71024 (As Cache-Data Srams and The Cache-Tag Sram)Dokument2 SeitenSecondary Burst Cache Design Using The Idt71024 (As Cache-Data Srams and The Cache-Tag Sram)Tejaswini SkumarNoch keine Bewertungen

- Mahusay Acc227 Module 4Dokument4 SeitenMahusay Acc227 Module 4Jeth MahusayNoch keine Bewertungen

- Mergers, Acquisitions and RestructuringDokument34 SeitenMergers, Acquisitions and RestructuringMunna JiNoch keine Bewertungen

- Financial Management Part 3 UpdatedDokument65 SeitenFinancial Management Part 3 UpdatedMarielle Ace Gole CruzNoch keine Bewertungen

- FM Final ProjectDokument20 SeitenFM Final ProjectNuman RoxNoch keine Bewertungen

- Presentation of Capital BudgetingDokument45 SeitenPresentation of Capital BudgetingIsmail UmerNoch keine Bewertungen

- This Study Resource Was: Pre-QE ExaminationDokument8 SeitenThis Study Resource Was: Pre-QE ExaminationMarcus MonocayNoch keine Bewertungen

- India Warehousing Report - Knight Frank PDFDokument59 SeitenIndia Warehousing Report - Knight Frank PDFdeepakmukhiNoch keine Bewertungen

- Aeropostale Checkout ConfirmationDokument3 SeitenAeropostale Checkout ConfirmationBladimilPujOlsChalasNoch keine Bewertungen

- DOF HandoverChecklistDokument4 SeitenDOF HandoverChecklistRamy AmirNoch keine Bewertungen

- Ozark S01e03Dokument59 SeitenOzark S01e03SpeedyGonsalesNoch keine Bewertungen

- Eros Sampoornam New Phase PL W.E.F 16.06.2020Dokument1 SeiteEros Sampoornam New Phase PL W.E.F 16.06.2020Gaurav SinghNoch keine Bewertungen

- Peer Review Report Phase 1 CuraçaoDokument91 SeitenPeer Review Report Phase 1 CuraçaoOECD: Organisation for Economic Co-operation and DevelopmentNoch keine Bewertungen

- CLEANSING PROCESS FOR DIVIDENDS AND GAINSDokument2 SeitenCLEANSING PROCESS FOR DIVIDENDS AND GAINSAbdul Aziz MuhammadNoch keine Bewertungen

- FORM 10-K: United States Securities and Exchange CommissionDokument55 SeitenFORM 10-K: United States Securities and Exchange CommissionJerome PadillaNoch keine Bewertungen

- Accounting For Decision Making or Management AU Question Paper'sDokument41 SeitenAccounting For Decision Making or Management AU Question Paper'sAdhithiya dhanasekarNoch keine Bewertungen

- Banking Industry Adopts Augmented RealityDokument50 SeitenBanking Industry Adopts Augmented RealityAkash KatiyarNoch keine Bewertungen

- ICICI Balanced Advantage Fund - One PagerDokument2 SeitenICICI Balanced Advantage Fund - One PagerjoycoolNoch keine Bewertungen

- Personal Finance Time Value of MoneyDokument24 SeitenPersonal Finance Time Value of MoneyLeo PanesNoch keine Bewertungen

- Final Order - Case No 38 of 2014Dokument148 SeitenFinal Order - Case No 38 of 2014sachinoilNoch keine Bewertungen

- Equity Methods - ECIB - Tax Settlement ForecastingDokument13 SeitenEquity Methods - ECIB - Tax Settlement ForecastingmzurzdcoNoch keine Bewertungen

- Notification No. 15/2021-Central Tax (Rate)Dokument2 SeitenNotification No. 15/2021-Central Tax (Rate)santanu sanyalNoch keine Bewertungen

- Tax Sheltered SchemesDokument13 SeitenTax Sheltered SchemesVivek DwivediNoch keine Bewertungen

- Lazy Lagoon Sarovar Portico Suites: Hotel Confirmation VoucherDokument2 SeitenLazy Lagoon Sarovar Portico Suites: Hotel Confirmation VoucherHimanshu WadaskarNoch keine Bewertungen