Beruflich Dokumente

Kultur Dokumente

The Long Case For LKQ Corporation

Hochgeladen von

Anonymous Ht0MIJCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

The Long Case For LKQ Corporation

Hochgeladen von

Anonymous Ht0MIJCopyright:

Verfügbare Formate

Stock: LKQ Corporation

Recommendation: Buy

Team 10

Ziv Israel

Owen Gilmore

Jerry Jiang

November 5-7, 2014

presented by

RECOMMENDATION: BUY

Summary Valuation

Current Price: 28.94

Target Price: 35.2

Est. Timing: 1-2 Years

Upside: 22%

Perpetuity Growth Method

Weighted average cost of capital:

Net present value of free cash flow

Terminal growth rate

Terminal value

EBITDA Multiple Method

8.0%

Weighted average cost of capital:

$691

4.0%

$8,405

Present value of the terminal value

Implied EBITDA multiple

Enterprise value

Plus: Net cash*

Equity value

$691

Terminal multiple

10.5x

Terminal value

$7,446

10.5x

$8,137

$2,458

$10,595

8.0%

Net present value of free cash flow

$8,405

Present value of the terminal value

7,446

4.0%

Implied perpetuity growth

Enterprise value

Plus: Net cash

$8,137

$2,458

Equity value

$10,595

Diluted shares:

300.8

Diluted shares:

300.8

Equity Value Per Share

$35.22

Equity Value Per Share

$35.22

Price Target

$35.20

Current share price:

$28.94

Implied upside

22%

| Page 1

Jack Ferraro, MBA

70

presented by

Company Description

LKQ provides replacement parts, components and systems

needed to repair cars and trucks. Buyers of vehicle replacement

products have the option to purchase from primarily five sources:

new products produced by original equipment manufacturers

("OEMs"); new products produced by companies other than the

OEMs, which are sometimes referred to as aftermarket products;

recycled products obtained from salvage vehicles; used products

that have been refurbished; and used products that have been

remanufactured.

Main customer body shops (collision and

mechanical repair shops), new and used car

dealerships, as well as to retail consumers (self

service)

Main Supplier aftermarket come from automotive

parts manufacturers and distributers. Recycled

come from purchasing salvage vehicles, typically

severely damaged in collisions, dismantling and

inventorying the parts. Also buy parts in auctions or

through trade ins.

| Page 2

Jack Ferraro, MBA

70

presented by

Value Proposition

Why buy alternative parts?

They are simply cheaper.

Historically, the distribution

channels for aftermarket and

refurbished products have been

distinct and separate from those

for recycled and

remanufactured products

despite serving the same

customer segment

LKQ offers an expansive distribution network, responsive service and quick

delivery. The breadth of their alternative parts offerings allows them to serve as a

"one-stop" solution for our customers looking for the most cost effective way to

provide quality repairs.

| Page 3

Jack Ferraro, MBA

70

presented by

Value Proposition Strategic Locations

| Page 4

Jack Ferraro, MBA

70

presented by

Addressable Market

| Page 5

Jack Ferraro, MBA

70

presented by

Strong Acquisition History

Throughout its history, LKQ has purchased

and successfully integrated more than 170

companies.

Management focuses on profitable businesses

with strong management trading at 4-5x

EBITDA.

In 2013 alone LKQ acquired Sator, plus an

additional 19 acquisitions, including 10

wholesale businesses in North America, 7

wholesale businesses in our European

segment and 2 self service operations.

| Page 6

Jack Ferraro, MBA

70

presented by

Strong Acquisition History

Sator

Keystone

Specialities

Euro Car Parts

ATK Vege

Transwheel

Bodymaster

Auto

Keystone

Automatic

Industries

LKQ

Metro

East

Salvage

| Page 7

Jack Ferraro, MBA

70

presented by

Strong Acquisition History

| Page 8

Jack Ferraro, MBA

70

presented by

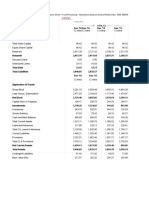

Important Financial Ratios

Ratios

12 months

Dec-31-2009

12 months

Dec-31-2010

12 months

Dec-31-2011

12 months

Dec-31-2012

12 months

Dec-31-2013

LTM

12 months

Sep-30-2014

Profitability

Return on Assets %

Return on Capital %

Return on Equity %

Return on Common Equity %

7.5%

8.4%

11.6%

11.6%

8.6%

9.8%

12.9%

12.9%

8.4%

10.0%

13.8%

13.8%

7.6%

9.3%

14.5%

14.5%

8.2%

10.0%

14.4%

14.4%

8.2%

10.0%

15.4%

15.4%

Margin Analysis

Gross Margin %

SG&A Margin %

EBITDA Margin %

EBITA Margin %

EBIT Margin %

Net Income Margin %

45.3%

32.2%

13.3%

11.6%

11.4%

6.2%

44.3%

30.6%

13.8%

12.3%

12.1%

6.8%

42.6%

29.8%

13.0%

11.5%

11.3%

6.4%

41.4%

29.6%

12.0%

10.5%

10.3%

6.3%

41.0%

28.7%

12.3%

10.9%

10.7%

6.2%

39.7%

27.8%

12.0%

10.7%

10.2%

5.9%

Short Term Liquidity

Current Ratio

Quick Ratio

Avg. Days Sales Out.

Avg. Days Inventory Out.

Avg. Days Payable Out.

Avg. Cash Conversion Cycle

4.2x

1.6x

26.8

116.7

18.1

125.3

3.7x

1.3x

25.4

116.5

15.7

126.1

2.9x

0.8x

26.4

119.5

24.7

121.2

2.8x

0.8x

26.3

124.0

30.5

119.8

2.7x

0.9x

27.8

120.8

32.8

115.8

3.0x

1.1x

30.0

112.1

30.2

112.0

For the Fiscal Period Ending

| Page 9

Jack Ferraro, MBA

70

presented by

Investment Thesis

T

E

R

R

I

F

I

C

1) International Expansion

O

P

P

O

R

T

U

N

I

T

Y

3) Strong Moat From Advanced

Technology

2) Strong Industry Tailwinds

4) Attractive Entry Point

| Page 10

Jack Ferraro, MBA

70

presented by

Thesis #1 International Expansion

Entry into Europe was extremely profitable for LKQ

The UK market reached $70mil Revenue in under two

years with LKQs efforts driving APU growth by 28%

ECP achieved organic revenue growth of 10.4% in the

last 12 months

Unipart Automotive, ECPs

largest competitor in Europe

went into bankruptcy in 2014.

ECP bought 27 of its former

branches. Target of 190

branches total by year-end.

| Page 11

Jack Ferraro, MBA

70

presented by

Thesis #1 International Expansion

Currently, 3 Locations in France, compared to 60 in

Netherlands (going up to 75-80 by 2015)

In August 2013 went into agreement with Suncorp

Group, a leading general insurance group in Australia

and New Zealand.

Parts are 38% of US collision market, 9% in Europe.

The market is prime to adopt more alternative parts in

Europe, as the EU recently enacted a law prohibiting

automakers from voiding warranties if aftermarket

parts are used. LKQ is already prepared for this with

agreements with insurance companies.

| Page 12

Jack Ferraro, MBA

70

presented by

Thesis #2 Strong Industry Tailwinds

Sales of new vehicles have increased since 2010 and are projected

to continue to increase over the next five years, which should

result in a greater volume of salvage vehicles at auction. Higher

supply means that LKQ can purchase inventory for cheaper.

More miles are being

driven each year - means

more accidents, and more

business for LKQ

| Page 13

Jack Ferraro, MBA

70

presented by

Thesis #2 Strong Industry Tailwinds

In 2000, approximately 9% of accident claims resulted

in a total loss; by 2013, this percentage increased to

almost 14%.

Industry reports indicate that over half of claims paid

for by the top insurance companies in 2012 were paid

through a DRP, compared to 42% in 2009.

Recent market share gains by aggressive alternative

parts users Progressive and Geico.

| Page 14

Jack Ferraro, MBA

70

presented by

Industry Analysis (FIVE FORCES)

Bargaining Power of

Suppliers: Medium

In 2013, approximately

46% of LKQs

aftermarket purchases

were made from their

top five vendors, with

their largest vendor

providing approximately

12% of our inventory.

Threat of new Entrants: Low

Advanced IT systems are extremely

hard to copy

Supply Chain Management is critical

Regulation is high

LKQ buys all of their competitors

Rivalry Among Existing Firms:

Low

LKQ Controls the industry

The rest of the industry is

extremely fragmented

Bargaining Power of

Buyers: Low

No single customer

accounted for 2% or more

of revenue in 2013.

Threat of Substitute Products:

Medium

More advanced Accident

Prevention Systems, Self

driving cars

| Page 15

Jack Ferraro, MBA

70

presented by

Thesis #3 Strong Moat From Advanced

Technology

LKQ has long invested in proprietary information

technology systems which give it a strong and

sustainable moat

Inventory management systems (LKQX) assists salespeople with updated availability and pricing. Bidders in

auctions equipped with a proprietary software that

compares the vehicles at the salvage auctions to their

current inventory, historical demand and recent average

selling prices.

Utilizes proprietary information systems in identifying

high demand for a product and immediately make

purchase recommendations with inventory is running

low.

Importing takes 40 days, inventory management is key.

Automated systems estimate demand for their products by researching sales trends of cars and estimating

the parts needed as well as track new car designs.

DRP (Direct Repair Program) agreement between the bodyshops and the insurance companies.

Insurance companies demand quality, timeliness and cost.

LKQ offer our repair shop customers access to our proprietary system, Keyless, which provides a link

between their estimating systems and our inventory to identify the availability of alternative products for use

in their repair. This data also helps insurance companies monitor the body shops' compliance with its DRP

product.

| Page 16

Jack Ferraro, MBA

70

presented by

Thesis #4 Attractive Entry Point

The market is (as always) focused on the short term

Stock was hammered by a negative earnings surprise

earlier this year (Down 20% on a 7.14% negative

surprise)

Analysts focus on the recent decrease gross margin

(from 41% to 39.7%). Do not acknowledge that this is

due to purchase of new lower net margin, higher gross

margin businesses (Specialty Acquisitions)

New entry into Europe through acquisitions produces

integration costs which lower earnings in the short

term but will increase them in the long run

| Page 17

Jack Ferraro, MBA

70

presented by

Thesis #4 Attractive Entry Point

| Page 18

Jack Ferraro, MBA

70

presented by

Valuation Revenue Breakdown

Data

US

Number of Vehicles

3-10 years

3-7 years

New

Total (Mil)

LKQ Market Share

Number of Vehicles (LKQ Market Share)

Revenue (Bn)

Miles Driven (Bn)

Miles Driven % of LKQ Market Share

Revenue per Miles Driven

Miles Driven per Car * Market Share

LKQ US Revenue

Miles per car

Europe

Number of Vehicles

Miles Driven

TAM Revenue

LKQ Market Share

LKQ European Revenue

2013

2014

2015

2016

2017

97

48

16

161

37%

59.57

95

49

17

161

38%

61.18

94

54

17

165

39%

62.7

94

59

17

170

40%

64.6

98

63

18

179

41%

68.02

3,802.9

3020

1117.4

3.40

1.259248013

4,118.1

3080

1170.4

3.52

1.337049935

3130

1220.7

3180

1272

3200

1312

105

66

18

189 From Company Presentation

42%

71.82 From Company Presentation

From IBIS World

3240

1360.8

3,802.93

4,118.11

4,295.10

4,475.60

4,616.34

4,788.05

18.7578

19.1304

18.9697

18.7059

17.8771

17.1429

261

4896

16,662.91

7%

1,166.40

269

5046

17,173.42

9%

1,545.61

277

5196

17,683.93

13%

2,298.91

285

5346

18,194.43

16%

2,911.11

800

800

Speciality

Total Revenue

2018

796.4

4,969.33

6,460.15

7,394.01

8,186.71

294

303

5515

5684

18,769.60 19,344.77

20%

25% Requires Acquisitions

3,753.92

4,836.19

800

9,170.26

800

10,424.24

Jack Ferraro, MBA

70

| Page 19

presented by

Discounted Cash Flow

Historical

All Numbers in $ Millions

Revenues

Rev % Growth

EBIT Margin

EBIT

Taxes (Using historical rate of 34%)

Tax Adjusted EBIT

12/2009

12/2010

12/2011

12/2012

12/2013

2,048

2,470

3,270

4,123

5,063

20.6%

32.4%

26.1%

22.8%

11.72%

290

103

187

10.84%

354

126

229

10.69%

441

148

293

38

51

56

91

41

133

61

33

55

165

86

32

5.7%

17.9%

20.6%

21.9%

17.0%

30.6%

10.0%

-63.3%

11.7%

1.3%

35.6%

11.60%

238

78

159

Depr. & Amort. (Same rate as Rev)

Change in Op. Work. Cap.

Capital Expenditures (Historical rate of 8%)

Free Cash Flow

Growth Analysis

Revenues Growth

EBIT Growth

Tax Adjusted EBIT Growth

Working Capital (Operating) Growth

Capital Expenditures Growth

Free Cash Flow Growth

Margin Analysis

EBIT % of Revenues

Free Cash Flow % of Revenues

Tax Rate

Projected

-16.5%

11.6%

4.4%

32.9%

12/2014

12/2015

12/2016

12/2017

12/2018

6,460

7,394

8,187

9,170

10,424

27.6%

14.5%

10.7%

12.0%

13.7%

10.41%

527

164

363

10.5%

678

229

450

11.0%

822

277

545

11.5%

997

336

661

11.5%

1,209

408

801

11.5%

1,465

494

971

70

175

88

100

86

105

90

255

110

240

97

222

126

297

105

269

140

368

113

320

157

455

121

381

178

563

131

455

32.4%

22.4%

22.7%

28.9%

40.7%

-2.5%

26.1%

24.3%

27.8%

23.9%

2.1%

206.7%

22.8%

19.6%

24.0%

11.5%

2.2%

155.7%

27.6%

28.7%

23.9%

23.7%

7.7%

-12.6%

14.5%

21.2%

21.2%

23.7%

7.7%

21.1%

10.7%

21.2%

21.2%

23.7%

7.7%

18.8%

12.0%

21.2%

21.2%

23.7%

7.7%

19.1%

13.7%

21.2%

21.2%

23.7%

7.7%

19.5%

10.8%

1.0%

35.4%

10.7%

2.4%

33.6%

10.4%

5.0%

31.2%

10.5%

3.4%

33.7%

11.1%

3.6%

33.7%

12.2%

3.9%

33.7%

13.2%

4.2%

33.7%

14.1%

4.4%

33.7%

| Page 20

Jack Ferraro, MBA

70

presented by

Discounted Cash Flow Sensitivity Analysis

Disc. Rate

Upside/Downside Ratio is

approximately 6:1

(Asymmetric Return)

5.5%

7.0%

8.0%

9.0%

10.5%

Equity Value Per Share

8.50x

9.50x

10.50x

11.50x

12.50x

32.4

30.1

28.6

27.2

25.2

36.2

33.5

31.9

30.4

28.2

39.9

37.0

35.2

33.5

31.2

43.6

40.5

38.5

36.7

34.1

47.3

44.0

41.9

39.9

37.1

Disc. Rate

Upside

8.50x

9.50x 10.50x

11.50x

12.50x

5.5%

12%

25%

38%

51%

64%

7.0%

4%

16%

28%

40%

52%

8.0%

-1%

10%

22%

33%

45%

9.0%

-6%

5%

16%

27%

38%

10.5%

-13%

-3%

8%

18%

28%

| Page 21

Jack Ferraro, MBA

70

presented by

Relative Value (Car Parts Wholesale)

| Page 22

Jack Ferraro, MBA

70

presented by

Investment Catalysts

1) Future acquisitions will grab the markets attention

LKQ currently produces $255mil in Free Cash Flow

2) Rebound in EBIT margin and earnings after European

integration is complete

3) Entry into France and Germany, two huge markets

will increase revenues substantially

4) Rebound in scrap metal prices will increase revenue

from scrap sales

| Page 23

Jack Ferraro, MBA

70

presented by

Investment Summary

LKQs international expansion is just starting, and its going

strong

Strong industry tailwinds signals a bright future for LKQs core

business

Strong moat from advanced information technology systems

prevents new entrants from seizing market share

Attractive Entry Point provides the best opportunity for gains

Simply an Excellent Opportunity!

| Page 24

Jack Ferraro, MBA

70

presented by

Investment Risks / Mitigants

Risk: Technology Risk More advanced Accident Prevention Systems

(reduces collisions by up to 27% by NCAP estimates), Self driving cars

Mitigant: Will take considerable time to be implemented, negated by more

cars bought each year, more used cars used

Risk: Competition from Internet Based Vehicle Product Providers

Mitigant: Brand assurance is important, sites have to build trust

Risk: Metal Prices continue to deteriorate, Oil prices will bounce back

Mitigant: Hedging using futures mitigates some of the risk of oil, scrap sale is

a small part of the business

Risk: Increased Currency risk from international expansion

Mitigant: Keeping foreign currency and reinvesting overseas

Jack Ferraro, MBA

70

| Page 25

presented by

APPENDIX

LKQ Company

| Page 26

Jack Ferraro, MBA

70

presented by

MANAGEMENT TEAM

Name/Position

Robert L. Wagman

President & Chief Executive

Officer

John S. Quinn

Executive Vice President and

Chief Financial Officer

Victor M. Casini

Senior Vice President, General

Counsel

Background

Robert L. Wagman became our President and Chief Executive Officer

on January 1, 2012. He was elected to our Board of Directors on

November 7, 2011. Mr. Wagman was LKQs President and Co-Chief

Executive Officer from January 1, 2011 to January 1, 2012

John S. Quinn has been our Executive Vice President and Chief

Financial Officer since November 2009. Prior to joining our Company,

he was the Senior Vice President, Chief Financial Officer and Treasurer

of Casella Waste Systems, Inc., a company in the solid waste

management services industry from January 2009.

Victor M. Casini has been our Vice President, General Counsel and

Corporate Secretary from our inception in February 1998. In March

2008, he was elected Senior Vice President. Mr. Casini was a member

of our Board of Directors from May 2010 until May 2012.

| Page 27

Jack Ferraro, MBA

70

presented by

Ownership Summary

| Page 28

Jack Ferraro, MBA

70

presented by

Quantifying the Downside

Data

US

Number of Vehicles

3-10 years

3-7 years

New

Total (Mil)

LKQ Market Share

Number of Vehicles (LKQ Market Share)

Revenue (Bn)

Miles Driven (Bn)

Miles Driven % of LKQ Market Share

Revenue per Miles Driven

Miles Driven per Car * Market Share

LKQ US Revenue

Miles per car

Europe

Number of Vehicles

Miles Driven

TAM Revenue

LKQ Market Share

LKQ European Revenue

2013

2014

2015

2016

2017

2018

97

48

16

161

37%

59.57

95

49

17

161

38%

61.18

94

54

17

165

39%

62.7

94

59

17

170

40%

64.6

98

63

18

179

41%

68.02

105

66

18

189

42%

71.82

3,802.9

3020

1117.4

3.40

1.259248013

4,118.1

3080

1170.4

3.52

1.337049935

3130

1220.7

3180

1272

3200

1312

3240

1360.8

3,802.93

4,118.11

4,295.10

4,475.60

4,616.34

4,788.05

18.7578

19.1304

18.9697

18.7059

17.8771

17.1429

261

4896

16,662.91

7%

1,166.40

269

5046

17,173.42

9%

1,545.61

277

5196

17,683.93

12%

2,122.07

285

5346

18,194.43

15%

2,729.16

800

800

Speciality

Total Revenue

796.4

4,969.33

6,460.15

7,217.17

8,004.76

294

303

5515

5684

18,769.60 19,344.77

17%

20%

3,190.83

3,868.95

800

8,607.17

Jack Ferraro, MBA

70

800

9,457.00

| Page 29

presented by

Quantifying the Downside

Disc. Rate

5.5%

7.0%

8.0%

9.0%

10.5%

Equity Value Per Share

8.50x

9.50x

10.50x

11.50x

12.50x

25.2

23.4

22.2

21.1

19.5

28.2

26.2

24.9

23.6

21.9

31.2

29.0

27.5

26.2

24.3

34.3

31.8

30.2

28.7

26.7

37.3

34.6

32.9

31.3

29.1

Disc. Rate

Downside

8.50x

9.50x 10.50x

11.50x

12.50x

5.5%

-13%

-2%

8%

18%

29%

7.0%

-19%

-10%

0%

10%

19%

8.0%

-23%

-14%

-5%

4%

14%

9.0%

-27%

-18%

-10%

-1%

8%

10.5%

-33%

-24%

-16%

-8%

0%

| Page 30

Jack Ferraro, MBA

70

presented by

Regional Distribution Improves Fulfillment

| Page 31

Jack Ferraro, MBA

70

presented by

Capitalization and Liquidity

| Page 32

Jack Ferraro, MBA

70

presented by

HISTORICAL MULTIPLES

| Page 33

Jack Ferraro, MBA

70

presented by

Earnings Estimates and Surprises

| Page 34

Jack Ferraro, MBA

70

presented by

Income Statement

12 m onths

Dec-31-2009

USD

12 m onths

Dec-31-2010

USD

12 m onths

Dec-31-2011

USD

12 m onths

Dec-31-2012

USD

12 m onths

Dec-31-2013

USD

LTM

12 m onths

Sep-30-2014

USD

Revenue

Other Revenue

Total Revenue

2,047.9

2,047.9

2,469.9

2,469.9

3,269.9

3,269.9

4,122.9

4,122.9

5,062.5

5,062.5

6,372.6

6,372.6

Cost Of Goods Sold

Gross Profit

1,120.1

927.8

1,376.4

1,093.5

1,877.9

1,392.0

2,416.7

1,706.2

2,987.1

2,075.4

3,839.6

2,533.0

659.7

34.1

-

756.9

38.0

-

973.0

49.9

-

1,219.3

64.1

-

1,454.1

81.0

-

1,769.7

110.3

-

Other Operating Exp., Total

693.8

794.9

1,022.9

1,283.4

1,535.0

1,880.0

Operating Incom e

234.0

298.5

369.1

422.8

540.4

653.0

Interest Expense

Interest and Invest. Income

Net Interest Exp.

(32.3)

1.4

(30.9)

(29.8)

1.4

(28.3)

(24.3)

1.9

(22.4)

(31.4)

0.2

(31.2)

(51.2)

0.4

(50.8)

(63.0)

0.4

(62.7)

Income Tax Expense

Earnings from Cont. Ops.

78.2

127.1

103.0

167.1

125.5

210.3

147.9

261.2

164.2

311.6

196.6

378.9

Earnings of Discontinued Ops.

Extraord. Item & Account. Change

Net Incom e to Com pany

0.4

127.5

2.0

169.1

210.3

261.2

311.6

378.9

Minority Int. in Earnings

Net Incom e

127.5

169.1

210.3

261.2

311.6

378.9

For the Fiscal Period Ending

Currency

Selling General & Admin Exp.

R & D Exp.

Depreciation & Amort.

Other Operating Expense/(Income)

| Page 35

Jack Ferraro, MBA

70

presented by

Balance Sheet

Balance Sheet as of:

Dec-31-2009

USD

Dec-31-2010

USD

Dec-31-2011

USD

Dec-31-2012

USD

Dec-31-2013

USD

Sep-30-2014

USD

108.9

108.9

95.7

95.7

48.2

48.2

59.8

59.8

150.5

150.5

244.6

244.6

Accounts Receivable

Total Receivables

152.4

152.4

191.1

191.1

281.8

281.8

311.8

311.8

458.1

458.1

609.4

609.4

Inventory

Prepaid Exp.

Deferred Tax Assets, Curr.

Other Current Assets

Total Current Assets

385.7

9.6

31.8

14.4

702.9

492.7

14.0

32.5

10.9

836.9

736.8

19.6

45.7

17.6

1,149.7

900.8

28.9

53.5

29.5

1,384.4

1,077.0

42.3

63.9

8.1

1,799.8

1,341.3

76.1

74.0

2,345.5

Gross Property, Plant & Equipment

Accumulated Depreciation

Net Property, Plant & Equipm ent

397.9

(108.0)

289.9

473.7

(142.4)

331.3

604.0

(180.0)

424.1

725.5

(231.1)

494.4

840.8

(294.2)

546.7

612.3

Long-term Investments

Goodw ill

Other Intangibles

Deferred Tax Assets, LT

Deferred Charges, LT

Other Long-Term Assets

Total Assets

938.8

67.2

21.3

2,020.1

4.8

1,033.0

69.3

24.2

2,299.5

1,476.1

108.9

40.9

3,199.7

1,690.3

106.7

0.2

0.3

47.3

3,723.5

8.9

1,937.4

153.7

1.5

15.8

54.9

4,518.8

9.5

2,257.2

221.0

89.0

5,534.6

LIABILITIES

Accounts Payable

Accrued Exp.

Curr. Port. of LT Debt

Curr. Income Taxes Payable

Unearned Revenue, Current

Def. Tax Liability, Curr.

Other Current Liabilities

Total Current Liabilities

51.3

89.0

15.1

9.3

3.8

168.5

76.4

82.1

54.3

12.5

225.3

210.9

131.0

29.5

7.3

1.6

17.4

397.7

219.3

134.1

72.4

2.7

0.0

59.3

487.9

349.1

177.0

41.5

17.4

3.4

89.6

678.0

403.6

261.0

72.9

33.9

771.4

Long-Term Debt

Def. Tax Liability, Non-Curr.

Other Non-Current Liabilities

Total Liabilities

598.2

52.2

21.8

840.7

548.1

66.1

45.9

885.3

937.2

88.8

132.0

1,555.6

1,061.7

102.3

107.4

1,759.4

1,272.7

133.8

83.5

2,168.0

1,830.7

159.3

105.5

2,866.9

Common Stock

Additional Paid In Capital

Retained Earnings

Treasury Stock

Comprehensive Inc. and Other

Total Com m on Equity

1.4

816.0

369.5

(7.4)

1,179.4

1.5

869.8

538.5

4.4

1,414.2

2.9

901.3

748.8

(9.0)

1,644.1

3.0

950.3

1,010.0

0.8

1,964.1

3.0

1,006.1

1,321.6

20.0

2,350.7

3.0

1,044.0

1,622.7

(2.0)

2,667.7

Total Equity

1,179.4

1,414.2

1,644.1

1,964.1

2,350.7

2,667.7

Total Liabilities And Equity

2,020.1

2,299.5

3,199.7

3,723.5

4,518.8

5,534.6

Currency

ASSETS

Cash And Equivalents

Total Cash & ST Investm ents

Jack Ferraro, MBA

70

| Page 36

presented by

Cash Flow

Reclassified

12 m onths

Dec-31-2009

USD

12 m onths

Dec-31-2010

USD

12 m onths

Dec-31-2011

USD

12 m onths

Dec-31-2012

USD

12 m onths

Dec-31-2013

USD

LTM

12 m onths

Sep-30-2014

USD

Net Incom e

Depreciation & Amort.

Amort. of Goodw ill and Intangibles

Depreciation & Am ort., Total

127.5

34.0

4.1

38.1

169.1

37.2

4.2

41.4

210.3

46.6

7.9

54.5

261.2

60.7

9.5

70.2

311.6

72.7

11.1

83.7

378.9

86.0

26.5

112.5

Other Amortization

Asset Writedow n & Restructuring Costs

Stock-Based Compensation

Tax Benefit from Stock Options

Net Cash From Discontinued Ops.

Other Operating Activities

Change in Acc. Receivable

Change In Inventories

Change in Acc. Payable

Change in Unearned Rev.

Change in Inc. Taxes

Change in Other Net Operating Assets

Cash from Ops.

2.5

(4.3)

7.3

(9.6)

(0.4)

6.6

(0.4)

(20.4)

(18.1)

1.4

24.1

9.9

164.0

10.0

(15.0)

8.9

(12.3)

(67.8)

10.2

7.5

7.3

159.2

13.1

(8.0)

15.9

(18.1)

(90.1)

28.6

2.3

3.3

211.8

15.6

(15.7)

8.7

(12.8)

(95.0)

(15.1)

(0.8)

(10.1)

206.2

2.7

22.0

(18.3)

13.9

(44.7)

(69.2)

49.6

50.0

26.6

428.1

2.7

22.7

(16.8)

9.9

(79.1)

(106.3)

49.4

30.3

5.4

409.8

Capital Expenditure

Sale of Property, Plant, and Equipment

Cash Acquisitions

Divestitures

Invest. in Marketable & Equity Securt.

Net (Inc.) Dec. in Loans Originated/Sold

Other Investing Activities

Cash from Investing

(55.9)

1.1

(65.2)

17.5

(102.5)

(61.4)

1.4

(143.6)

12.0

(191.6)

(86.4)

1.7

(486.9)

(571.6)

(88.3)

1.1

(265.3)

(352.5)

(90.2)

2.1

(408.4)

(9.1)

(505.6)

(129.3)

3.8

(663.0)

(2.2)

(790.7)

2.3

2.3

(53.0)

(53.0)

(7.5)

(7.5)

1,361.4

1,361.4

(1,058.8)

(1,058.8)

1,025.1

1,025.1

(896.9)

(896.9)

1,113.5

1,113.5

(931.5)

(931.5)

1,428.3

(883.8)

8.2

14.0

11.9

17.7

15.4

8.3

9.3

(33.2)

12.5

19.0

(3.1)

311.4

11.2

157.1

(31.5)

165.9

(32.8)

520.0

1.5

29.8

0.2

(13.2)

1.0

(47.4)

0.8

11.5

2.3

90.7

(1.8)

137.3

For the Fiscal Period Ending

Currency

Short Term Debt Issued

Long-Term Debt Issued

Total Debt Issued

Short Term Debt Repaid

Long-Term Debt Repaid

Total Debt Repaid

Issuance of Common Stock

Total Dividends Paid

Special Dividend Paid

Other Financing Activities

Cash from Financing

Foreign Exchange Rate Adj.

Net Change in Cash

Jack Ferraro, MBA

70

| Page 37

Das könnte Ihnen auch gefallen

- Case 2 Template For Brookstone OB - Gyn - CompleteDokument9 SeitenCase 2 Template For Brookstone OB - Gyn - Completeaklank_218105100% (1)

- Reviewer Mas 2Dokument56 SeitenReviewer Mas 2Siena Farne0% (2)

- Productivity and Reliability-Based Maintenance Management, Second EditionVon EverandProductivity and Reliability-Based Maintenance Management, Second EditionNoch keine Bewertungen

- AC517Dokument11 SeitenAC517Inaia ScottNoch keine Bewertungen

- Operations Management Assignment - EPGDM - Term 3Dokument4 SeitenOperations Management Assignment - EPGDM - Term 3Kiara S0% (2)

- Best Selction Practice ToyotaDokument3 SeitenBest Selction Practice ToyotaManpreet Singh BhatiaNoch keine Bewertungen

- The Finance BookDokument361 SeitenThe Finance BookHannah Denise Batallang100% (2)

- Solutions in AppendixDokument13 SeitenSolutions in Appendixtfytf70% (2)

- Brembo Profile PDFDokument25 SeitenBrembo Profile PDFNakanakanaknakNoch keine Bewertungen

- 10 Best Practices For Increasing Hospital ProfitabilityDokument8 Seiten10 Best Practices For Increasing Hospital ProfitabilitySarita BhattaraiNoch keine Bewertungen

- Performance Management: Dr. Setyo Riyanto, SE, MM, CPM (ASIA)Dokument43 SeitenPerformance Management: Dr. Setyo Riyanto, SE, MM, CPM (ASIA)Marida SinagaNoch keine Bewertungen

- MV - Multiple RegressionDokument19 SeitenMV - Multiple RegressionRochana RamanayakaNoch keine Bewertungen

- Cahnnel of Distribution: (Nestle)Dokument15 SeitenCahnnel of Distribution: (Nestle)patriotankurNoch keine Bewertungen

- 2012 Healthcare GuideDokument144 Seiten2012 Healthcare GuideSubhani ShaikNoch keine Bewertungen

- Service Operation v2Dokument15 SeitenService Operation v2seowshengNoch keine Bewertungen

- KOMATSU Case SolutionDokument6 SeitenKOMATSU Case SolutionSujeeth BharadwajNoch keine Bewertungen

- TQM Case AnalysisDokument3 SeitenTQM Case AnalysisMikoto Mpap KujouNoch keine Bewertungen

- RSB FinalDokument103 SeitenRSB FinalKomal KorishettiNoch keine Bewertungen

- TQM at TVS MotorsDokument11 SeitenTQM at TVS MotorsBhawna Dagar100% (1)

- After Sales Service of SHS in BangladeshDokument8 SeitenAfter Sales Service of SHS in BangladeshAntora HoqueNoch keine Bewertungen

- Project Management Group-1 Individual Assignment-2: Case Analysis Pert MustangDokument9 SeitenProject Management Group-1 Individual Assignment-2: Case Analysis Pert MustangANKIT GUPTANoch keine Bewertungen

- ERP Investment - Business Impact and Productivity MeasuresDokument37 SeitenERP Investment - Business Impact and Productivity MeasureshanyNoch keine Bewertungen

- Chap 6 - Quantitative Method For Quality ManagementDokument52 SeitenChap 6 - Quantitative Method For Quality Managementphannarith100% (3)

- 1898 Ford Operations ManagementDokument8 Seiten1898 Ford Operations ManagementSanthoshAnvekarNoch keine Bewertungen

- Protiviti PDFDokument3 SeitenProtiviti PDFAnuradha SharmaNoch keine Bewertungen

- Searle Company Ratio Analysis 2010 2011 2012Dokument63 SeitenSearle Company Ratio Analysis 2010 2011 2012Kaleb VargasNoch keine Bewertungen

- JCB ReportDokument7 SeitenJCB ReportSalman ShafiqueNoch keine Bewertungen

- Using Services Marketing To Develop and Deliver Integrated Solutions at Caterpillar in Latin AmericaDokument55 SeitenUsing Services Marketing To Develop and Deliver Integrated Solutions at Caterpillar in Latin AmericammmagdNoch keine Bewertungen

- Sales Final ReportDokument18 SeitenSales Final ReportHashim MamsaNoch keine Bewertungen

- Videocon Industries ProjectDokument84 SeitenVideocon Industries ProjectPallavi MaliNoch keine Bewertungen

- PestleDokument17 SeitenPestleyatin rajputNoch keine Bewertungen

- Keda ERP Implementation Case SolutionDokument12 SeitenKeda ERP Implementation Case SolutionPraveen Kumar67% (3)

- Mantrac Egypt ProfileDokument9 SeitenMantrac Egypt ProfilenabilredascribdNoch keine Bewertungen

- VRIODokument1 SeiteVRIOrahul_mahajan100% (1)

- Summer Training Report MbaDokument34 SeitenSummer Training Report Mbaumanggg50% (2)

- Inventing The Professional Association of The Future: Strategic Plan - 2017Dokument28 SeitenInventing The Professional Association of The Future: Strategic Plan - 2017Iván Lech Villaseca DziekonskiNoch keine Bewertungen

- Porter Worksheet - Pontier E-CigarettesDokument4 SeitenPorter Worksheet - Pontier E-CigarettesCharlesPontier100% (1)

- AutozoneDokument19 SeitenAutozoneSakshi GargNoch keine Bewertungen

- Taleo ArchitectureDokument2 SeitenTaleo Architecturesridhar_eeNoch keine Bewertungen

- The Core QuestionsDokument616 SeitenThe Core QuestionsbortycanNoch keine Bewertungen

- Rane NSKDokument19 SeitenRane NSKkoolmanojsainiNoch keine Bewertungen

- 2017 AASA Top Automotive Aftermarket Suppliers ListDokument32 Seiten2017 AASA Top Automotive Aftermarket Suppliers Listhumbertopinto32Noch keine Bewertungen

- Dell Case Study - G02Dokument3 SeitenDell Case Study - G02Miniteca Mega Rumba0% (1)

- 6 Sigma Projects PresentationDokument31 Seiten6 Sigma Projects Presentationbellbesh0% (1)

- Supply Chain - Summary v09Dokument21 SeitenSupply Chain - Summary v09CaterpillarNoch keine Bewertungen

- Management: A Global and Entrepreneurial Perspective by Weihrich, Cannice, and KoontzDokument18 SeitenManagement: A Global and Entrepreneurial Perspective by Weihrich, Cannice, and KoontzAbrar Fahim SayeefNoch keine Bewertungen

- FPDieselNov PDFDokument5 SeitenFPDieselNov PDFRobert HutapeaNoch keine Bewertungen

- Corporate ExcellenceDokument21 SeitenCorporate ExcellenceSachin MethreeNoch keine Bewertungen

- Pritha@xlri - Ac.in: To Immediate Cancellation of The ExaminationDokument5 SeitenPritha@xlri - Ac.in: To Immediate Cancellation of The ExaminationPradnya Nikam bj21158Noch keine Bewertungen

- CadburyDokument11 SeitenCadburyPriya NotInterested SolankiNoch keine Bewertungen

- What Are The 5 P's of Strategy?Dokument3 SeitenWhat Are The 5 P's of Strategy?Faheem KhanNoch keine Bewertungen

- Private Label 2013Dokument26 SeitenPrivate Label 2013Priya JainNoch keine Bewertungen

- Sap Strategy at ColgateDokument6 SeitenSap Strategy at ColgateTanushree RoyNoch keine Bewertungen

- Al Ain Farms Company ProjectDokument6 SeitenAl Ain Farms Company ProjectMohammad NaumanNoch keine Bewertungen

- Organisational Structure of NHPCDokument1 SeiteOrganisational Structure of NHPCrichasinghal12100% (1)

- This Document Is Strategic Plan Text. It Is Part of The Supporting Assessment Resources For Assessment Task 2 of BSADM506Dokument4 SeitenThis Document Is Strategic Plan Text. It Is Part of The Supporting Assessment Resources For Assessment Task 2 of BSADM506Fasih DawoodNoch keine Bewertungen

- Inventory-Management - Theory & DIDokument102 SeitenInventory-Management - Theory & DIAnil Kumar SinghNoch keine Bewertungen

- PrefaceDokument49 SeitenPrefaceManish RajakNoch keine Bewertungen

- Project Lean Six SigmaDokument54 SeitenProject Lean Six SigmaAral RodriguesNoch keine Bewertungen

- The Seven Domains Model - JabDokument27 SeitenThe Seven Domains Model - JabpruthirajpNoch keine Bewertungen

- Market Entry StrategyDokument13 SeitenMarket Entry StrategygauravpdalviNoch keine Bewertungen

- Caterpillar CompititorDokument2 SeitenCaterpillar CompititorA.Rahman SalahNoch keine Bewertungen

- Operations Intelligence Complete Self-Assessment GuideVon EverandOperations Intelligence Complete Self-Assessment GuideNoch keine Bewertungen

- As 061818Dokument4 SeitenAs 061818Anonymous Ht0MIJNoch keine Bewertungen

- ISGZSGDokument16 SeitenISGZSGAnonymous Ht0MIJNoch keine Bewertungen

- NetflixDokument4 SeitenNetflixAnonymous Ht0MIJNoch keine Bewertungen

- Fitbit From Fad To FutureDokument11 SeitenFitbit From Fad To FutureAnonymous Ht0MIJNoch keine Bewertungen

- Factsheet Global Allocation EnglishDokument5 SeitenFactsheet Global Allocation EnglishAnonymous Ht0MIJNoch keine Bewertungen

- The Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleDokument18 SeitenThe Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleAnonymous Ht0MIJNoch keine Bewertungen

- Citron SnapDokument7 SeitenCitron SnapAnonymous Ht0MIJNoch keine Bewertungen

- Inogen CitronDokument8 SeitenInogen CitronAnonymous Ht0MIJNoch keine Bewertungen

- Fpa Capital Fund Commentary 2017 q4Dokument12 SeitenFpa Capital Fund Commentary 2017 q4Anonymous Ht0MIJNoch keine Bewertungen

- IP Capital Partners CommentaryDokument15 SeitenIP Capital Partners CommentaryAnonymous Ht0MIJNoch keine Bewertungen

- 2018 02 24berkshireletterDokument148 Seiten2018 02 24berkshireletterZerohedgeNoch keine Bewertungen

- The Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleDokument18 SeitenThe Evolution of Vanguard Advisor's Alpha: From Portfolios To PeopleAnonymous Ht0MIJNoch keine Bewertungen

- SlidesDokument70 SeitenSlidesAnonymous Ht0MIJNoch keine Bewertungen

- l0284 NB Solving For 2018Dokument28 Seitenl0284 NB Solving For 2018Anonymous Ht0MIJNoch keine Bewertungen

- Vltava Fund Dopis Letter To Shareholders 2017Dokument7 SeitenVltava Fund Dopis Letter To Shareholders 2017Anonymous Ht0MIJNoch keine Bewertungen

- Q4 Letter Dec. 17 Final 1Dokument4 SeitenQ4 Letter Dec. 17 Final 1Anonymous Ht0MIJNoch keine Bewertungen

- As 010818Dokument5 SeitenAs 010818Anonymous Ht0MIJNoch keine Bewertungen

- SlidesDokument70 SeitenSlidesAnonymous Ht0MIJNoch keine Bewertungen

- Where Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerDokument1 SeiteWhere Are We in The Credit Cycle?: Gene Tannuzzo, Senior Portfolio ManagerAnonymous Ht0MIJNoch keine Bewertungen

- Broadleaf Partners Fourth Quarter 2017 CommentaryDokument4 SeitenBroadleaf Partners Fourth Quarter 2017 CommentaryAnonymous Ht0MIJNoch keine Bewertungen

- Gmo Quarterly LetterDokument22 SeitenGmo Quarterly LetterAnonymous Ht0MIJNoch keine Bewertungen

- Municipal Bond Market CommentaryDokument8 SeitenMunicipal Bond Market CommentaryAnonymous Ht0MIJNoch keine Bewertungen

- Technical Review and OutlookDokument7 SeitenTechnical Review and OutlookAnonymous Ht0MIJNoch keine Bewertungen

- Bittles Market NotesDokument4 SeitenBittles Market NotesAnonymous Ht0MIJNoch keine Bewertungen

- Bittles Market Notes PDFDokument3 SeitenBittles Market Notes PDFAnonymous Ht0MIJNoch keine Bewertungen

- Master Investor Magazine Issue 33 High Res Microsoft and Coca ColaDokument6 SeitenMaster Investor Magazine Issue 33 High Res Microsoft and Coca ColaKishok Paul100% (2)

- Fixed Income Weekly CommentaryDokument3 SeitenFixed Income Weekly CommentaryAnonymous Ht0MIJNoch keine Bewertungen

- Ffir Us B M 20171130 TRDokument12 SeitenFfir Us B M 20171130 TRAnonymous Ht0MIJNoch keine Bewertungen

- Tami Q3 2017Dokument7 SeitenTami Q3 2017Anonymous Ht0MIJ100% (1)

- As 121117Dokument4 SeitenAs 121117Anonymous Ht0MIJNoch keine Bewertungen

- Bus MathsDokument22 SeitenBus MathsReal JoyNoch keine Bewertungen

- Practical AccountingDokument13 SeitenPractical AccountingDecereen Pineda RodriguezaNoch keine Bewertungen

- Assessment Review - Corporate Finance Institute-21-40Dokument27 SeitenAssessment Review - Corporate Finance Institute-21-40刘宝英Noch keine Bewertungen

- Corporate Financial Management 5th Edition Glen Arnold Test BankDokument25 SeitenCorporate Financial Management 5th Edition Glen Arnold Test BankMelissaBakerijgd100% (58)

- Project Report: and Finance Under The University of Calcutta)Dokument15 SeitenProject Report: and Finance Under The University of Calcutta)Amit SinghNoch keine Bewertungen

- Financial Accounting Reviewer - Chapter 59Dokument10 SeitenFinancial Accounting Reviewer - Chapter 59Coursehero PremiumNoch keine Bewertungen

- ProjectionDokument38 SeitenProjectionamanciocecilia11Noch keine Bewertungen

- Cost of FinanceDokument6 SeitenCost of Financeblue benzNoch keine Bewertungen

- Cashflow (MK)Dokument2 SeitenCashflow (MK)Karisma DeviNoch keine Bewertungen

- Shynara Banania FAR Module 02 The Accounting CycleDokument7 SeitenShynara Banania FAR Module 02 The Accounting CycleElisa Ferrer Ramos0% (1)

- Chapter 15 - AnswerDokument11 SeitenChapter 15 - Answerwynellamae100% (2)

- Fundamentals of Accountancy Business and Management II Module 2Dokument5 SeitenFundamentals of Accountancy Business and Management II Module 2Rafael RetubisNoch keine Bewertungen

- Lec 10 Capital Budgeting TechniquesDokument22 SeitenLec 10 Capital Budgeting TechniquesAnikk HassanNoch keine Bewertungen

- Cost CurveDokument2 SeitenCost CurveShaya BadieNoch keine Bewertungen

- Cost & Management AccountingDokument181 SeitenCost & Management AccountingBikash Kumar Nayak100% (1)

- CV ContohDokument1 SeiteCV ContohFikriNoch keine Bewertungen

- NestleDokument2 SeitenNestleMd WasimNoch keine Bewertungen

- Finance Interview QuestionsDokument17 SeitenFinance Interview Questionsfilmy.photographyNoch keine Bewertungen

- CORPORATIONDokument14 SeitenCORPORATIONcpacpacpaNoch keine Bewertungen

- FIN2004 A+ CheatsheetDokument79 SeitenFIN2004 A+ CheatsheetXinyuZhangNoch keine Bewertungen

- A222 Tutorial 2QDokument4 SeitenA222 Tutorial 2Qnur afrinaNoch keine Bewertungen

- Activity 2 - Alaska Company - ADEVA, MKADokument3 SeitenActivity 2 - Alaska Company - ADEVA, MKAMaria Kathreena Andrea AdevaNoch keine Bewertungen

- Ppe ProblemDokument3 SeitenPpe ProblemJanuary Ann BeteNoch keine Bewertungen

- Daulat FinalDokument88 SeitenDaulat FinalBhola ThNoch keine Bewertungen

- Test 3 QPDokument7 SeitenTest 3 QPDharmateja ChakriNoch keine Bewertungen