Beruflich Dokumente

Kultur Dokumente

Reseller Tax Guide

Hochgeladen von

weisscoCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Reseller Tax Guide

Hochgeladen von

weisscoCopyright:

Verfügbare Formate

Reseller Tax Guide

Please locate your state for form links and special instructions.

State

Form

Form Link

Special Instructions

Alabama

Multi Jurisdiction

Form

Alabama

Multiform

We need to file a copy of this form to set-up your

account as tax exempt for the state of Alabama.

Alaska

No Sales/Use Tax

N/A

N/A

Arizona

5000 Transaction

Exemption Cert

or Multi Form

Form 5000

If you are not registered in AZ you may indicate 'NO

NEXUS' in lieu of an AZ registration number.

ST391 Exemption

Cert or Multi

Form

Form ST391

BOE 230

Exemption Cert

or Multi Form

Form BOE 230

Colorado

Application for

Sales Tax

Exemption

Application for

Sales Tax

Exemption for

Colorado

Organizations

If you are not registered in CO you may indicate 'NO

NEXUS' in lieu of a CO registration number. Fill in your

home-state registration number or submit a copy of the

state issued form.

Connecticut

Sales & Use Tax

Resale Certificate

or Multi Form

Connecticut

State Form

Connecticut

Multiform

This form is only valid if it contains a CT registration

number per state regulations. You may not use your

home-state (bill-to state) registration number. If you are

not registered, the transaction is only exempt if the

ship-to customer submits their exemption certificate to

Dell.

Arkansas

California

Or

Arizona

Multiform

Or

If you are not registered in AR, please fill in your

NONRESIDENT PERMIT number.

Arkansas

Multiform

Or

California

Multiform

Or

This form is only valid if it contains a CA registration

number per state regulations. If you are not registered,

the transaction is only exempt if the ship-to is the US

Government.

Delaware

No Sales/Use Tax

N/A

N/A

District of

Columbia

OTR 368

Certificate of

Resale or Multi

Form

Washington DC

Multiform

This form is only valid if it contains a DC registration

number per state regulations. You may not use your

home-state (bill-to state) registration number.

Reseller Tax Guide

Please locate your state for form links and special instructions.

State

Form

Form Link

Special Instructions

Florida

DR-5 Annual

Resale Certificate

(Only State

Issued Form is

Valid)

See Special

Instructions

We are required to file a copy of the FL Annual Resale

Certificate (Form DR-5) signed and dated. For more

information please go to

http://dor.myflorida.com/dor/taxes/annual_resale

_certificate_sut.html

Georgia

ST 5 Resale

Certificate or

Multi Form

Form ST 5

If you are not registered in GA you may indicate 'NO

NEXUS' in lieu of a GA registration number.

Hawaii

G 17 Certificate

of Resale

Form G-17

This form is only valid if it contains a HI registration

number per state regulations.

Idaho

ST 101 Sales Tax

Resale Certificate

or Multi Form

Form ST 101

If you are not registered in ID you may indicate 'NO

NEXUS' in lieu of an ID registration number.

Illinois

CRT 61 Certificate

of Resale

Form CRT 61

This form is only valid if it contains an IL registration

number per state regulations.

Indiana

ST 105 General

Exemption

Certificate

Form ST 105

If you are not registered in IN you may indicate 'NO

NEXUS' in lieu of an IN registration number.

Iowa

31 014 Sales Tax

Exemption

Certificate or

Multi Form

Form 31 014

If you are not registered in IA you may indicate 'NO

NEXUS' in lieu of an IA registration number.

ST 28 Resale

Exemption

Certificate or

Multi Form

Form ST28

Form 51A105

Resale Certificate

Form 51A105

Kansas

Kentucky

Or

Georgia

Multiform

Or

Idaho Multiform

Or

Iowa Multiform

Or

If you are not registered in KS you may indicate 'NO

NEXUS' in lieu of a KS registration number.

Kansas

Multiform

If you are not registered in KY you may indicate 'NO

NEXUS' in lieu of a KY registration number.

Reseller Tax Guide

Please locate your state for form links and special instructions.

State

Form

Form Link

Special Instructions

Louisiana

Tax refunded by

state not vendor;

only wholesalers

are tax exempt.

(CITY AND/OR

PARISH LETTER

MAY ALSO BE

NEEDED)

See Special

Instructions

Please go to

http://www.rev.state.la.us/sections/taxforms/defa

ult.aspx?code=SLS&year=2012 For a list of your current

tax forms and instructions.

Maine

Annual Resale

Certificate (State

Issued Form)

Maine

Multiform

If you are not registered in ME you may indicate 'NO

NEXUS' in lieu of a ME registration number.

Maryland

Blanket

Certificate or

Multi Form

See special

instructions

There is no form for Resale Certificates, but please use

the following link for instructions on how to purchase

items intended for resale.

http://taxes.marylandtaxes.com/Business_Taxes/Busin

ess_Tax_Types/Sales_and_Use_Tax/Sales_Records/Res

ale_Certificates.shtml

Massachusetts

ST-4 Resale

Certificate

Form ST-4

This form is only valid if it contains a MA registration

number per state regulations.

Michigan

3372 Certificate

of Exemption or

Multi Form

Form 3372

If you are not registered in MI you may indicate 'NO

NEXUS' in lieu of a MI registration number. Go to

http://michigan.gov/taxes/0,1607,7-238-43529155524--,00.html for Tax Exemption Requirements.

Minnesota

ST3 Certificate of

Exemption or

Multi Form

Form ST3

N/A

Mississippi

Copy of MS Tax

Permit (State

Issued)

See Special

Instructions

This form is only valid if it contains a MS registration

number per state regulations. For more information

about applying for a tax permit go to

http://www.dor.ms.gov/regist.html

Missouri

149 Exemption

Certificate or

Multi Form

Form 149

If you are not registered in MO you may indicate 'NO

NEXUS' in lieu of a MO registration number.

No Sales/Use Tax

N/A

Montana

Or

Michigan

Multiform

Or

Missouri

Multiform

N/A

Reseller Tax Guide

Please locate your state for form links and special instructions.

State

Form

Form Link

Special Instructions

Nebraska

Form 13 Resale

Certificate or

Multi Form

Form 13

If you are not registered in NE, fill in your FOREIGN

STATE SALES TAX number.

Nevada

F003 Streamlined

Sales and Use Tax

Certificate or

Multi Form

Resale

Certificate

N/A

New Hampshire

No Sales/Use Tax

N/A

N/A

New Jersey

ST-3 Exemption

Resale Certificate

or Multi Form

Form ST-3

If you are not registered in NJ you may indicate 'NO

NEXUS' in lieu of a NJ registration number.

ACD 31050

Nontaxable

Transaction

Certificate (State

Issued) or Multi

Form

Form ACD 31050

New York

ST-120 Resale

Certificate

Form ST-120

If you are not registered in NY, please complete part 2

as a non-NY State Purchaser.

North Carolina

E-595E

Streamlined Sales

and Use Tax

Certificate of

Exemption

Form E-595E

If you are not registered in NC, please fill in your homestate REGISTRATION/TAX ID NUMBER.

North Dakota

21950 Certificate

of Resale or Multi

Form

Form 21950

If you are not registered in ND you may indicate 'NO

NEXUS' in lieu of a ND registration number.

Blanket

Certificate of

Exemption

Ohio State Form

New Mexico

Ohio

Or

Nebraska

Multiform

Or

New Jersey

Multiform

Or

If you are not registered in NM you may indicate 'NO

NEXUS' in lieu of a NM registration number.

New Mexico

Multiform

Or

North Dakota

Multiform

If you are not registered in OH you may indicate 'NO

NEXUS' in lieu of an OH registration number.

Reseller Tax Guide

Please locate your state for form links and special instructions.

State

Form

Form Link

Special Instructions

Oklahoma

Resale Certificate

or Multi Form

Oklahoma State

Form

If you are not registered in OK you may indicate 'NO

NEXUS' in lieu of an OK registration number.

Or

Oklahoma

Multiform

Oregon

No Sales/Use Tax

N/A

N/A

Pennsylvania

REV 1220 AS Tax

Exemption

Certificate or

Multi Form

Form REV1220

If you are not registered in PA, please fill in your homestate (bill-to state) registration number in lieu of a PA

registration number. Indicate under Step 7 'NO NEXUS'

if you are not required to register in PA.

Resale Certificate

or Multi Form

Rhode Island

State Form

Rhode Island

Or

Pennsylvania

Multiform

If you are not registered in RI you may indicate 'NO

NEXUS' in lieu of a SC registration number

Or

Rhode Island

Multiform

South Carolina

South Dakota

Tennessee

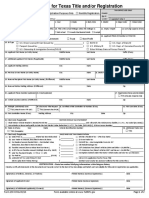

Texas

ST-8A Resale

Certificate or

Multi Form

Form ST-8A

SD Eform-1932

V10 Resale

Certificate or

Multi Form

Form SD EForm

1932 V10

RV F1300701

Blanket

Certificate of

Resale or Multi

Form

Tennessee State

Form

01-339 Resale

Certificate or

Multi Form

Form 01-339

Or

If you are not registered in SC you may indicate 'NO

NEXUS' in lieu of a SC registration number.

South Carolina

Multiform

Indicate if the exemption is for a SINGLE PURCHASE.

Please include your REGISTRATION/TAX ID NUMBER.

Or

South Dakota

Multiform

This form is only valid if it contains a TN registration

number per state regulations.

Or

Tennessee

Multiform

Or

Texas Multiform

If you are not registered in TX you may indicate 'NO

NEXUS' in lieu of a TX registration number.

Reseller Tax Guide

Please locate your state for form links and special instructions.

State

Form

Form Link

Special Instructions

Utah

TC-721

Exemption

Certificate or

Multi Form

Form TC-721

If you are not registered in UT fill in your home- state

(bill-to state) registration number in lieu of a UT

registration number.

S-3 Resale

Certificate or

Multi Form

Form S-3

ST-10 Cert of

Form ST-10

If you are not registered in VA fill in your home- state

(bill-to state) registration number in lieu of a VA

registration number.

Vermont

Virginia

Or

Utah Multiform

Or

If you are not registered in VT you may indicate 'NO

NEXUS' in lieu of a VT registration number.

Vermont

Multiform

Exemption

Washington

WA Dept. of

Revenue issued

permit

Washington

State Form

If you are not registered in WA you may indicate 'NO

NEXUS' in lieu of a WA registration number. You may

apply for a reseller permit online. For more information

got to

http://dor.wa.gov/Content/FindTaxesAndRates/RetailS

alesTax/ResellerPermit/default.aspx

West Virginia

F0003

Streamlined Sales

and Use Tax

Certificate

Form F0003

If you are not registered in WV you may indicate 'NO

NEXUS' in lieu of a WV registration number.

Wisconsin

S-211 Resale

Certificate or

Multi Form

Form S-211

This form is only valid if it contains a WI registration

number per state regulations.

F0003

Streamlined Sales

and Use Tax

Certificate

Wyoming

Exemption Form

Wyoming

Or

Wisconsin

Multiform

If you are not registered in WY, fill in your home- state

(bill-to state) registration number in lieu of a WY

registration number.

Das könnte Ihnen auch gefallen

- E595E Tax Exempt FormDokument4 SeitenE595E Tax Exempt FormstockfaceNoch keine Bewertungen

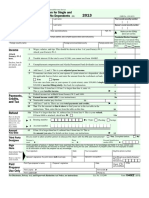

- 2012 Federal ReturnDokument1 Seite2012 Federal Return24male86Noch keine Bewertungen

- Attention:: WWW - Irs.gov/form1099Dokument8 SeitenAttention:: WWW - Irs.gov/form1099kmufti7Noch keine Bewertungen

- CRS 421019577252Dokument5 SeitenCRS 421019577252Saad KhanNoch keine Bewertungen

- 141121120000amiop CRS IndivisualDokument5 Seiten141121120000amiop CRS Indivisualdesignify101Noch keine Bewertungen

- Identification of Account Holder: PARTDokument2 SeitenIdentification of Account Holder: PARTMuhammad HarisNoch keine Bewertungen

- Cra (2) DddaDokument14 SeitenCra (2) DddadulmasterNoch keine Bewertungen

- Filing Taxes Nonresident AlienDokument5 SeitenFiling Taxes Nonresident AlienshotorbariNoch keine Bewertungen

- ECWANDC Funding - Vendor W9 FormDokument1 SeiteECWANDC Funding - Vendor W9 FormEmpowerment Congress West Area Neighborhood Development CouncilNoch keine Bewertungen

- Jaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Dokument8 SeitenJaleica Coding and Billing LLC.: 437 Melissa Circle Romeoville IL.60446Julius MasiganNoch keine Bewertungen

- Sec - gov-EIN Formation BylawsDokument4 SeitenSec - gov-EIN Formation BylawsДмитрий КалиненкоNoch keine Bewertungen

- 2012 Instructions For Schedule C: Profit or Loss From BusinessDokument13 Seiten2012 Instructions For Schedule C: Profit or Loss From BusinessDunk7Noch keine Bewertungen

- VTR 130 SofDokument2 SeitenVTR 130 Softfour2000Noch keine Bewertungen

- Locate Real Estate LLC EinDokument2 SeitenLocate Real Estate LLC Einapi-32562269Noch keine Bewertungen

- Colorado Feedlot Horses Fein PapersDokument3 SeitenColorado Feedlot Horses Fein Papersapi-270147093Noch keine Bewertungen

- Cp575notice 1353009329267Dokument2 SeitenCp575notice 1353009329267api-198173331Noch keine Bewertungen

- Business EINDokument2 SeitenBusiness EINMrz Garrett100% (1)

- CP575 1369930125343Dokument3 SeitenCP575 1369930125343Luc BookNoch keine Bewertungen

- Bank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyDokument2 SeitenBank AL Habib Limited: CRS Individual / Proprietorship Tax ResidencyMitti da PalwaanNoch keine Bewertungen

- Charles Schwab Account Opening FormDokument16 SeitenCharles Schwab Account Opening FormJeremie100% (1)

- Income Tax Return For Single and Joint Filers With No DependentsDokument2 SeitenIncome Tax Return For Single and Joint Filers With No DependentsmarahmaneNoch keine Bewertungen

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Dokument2 SeitenJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- NA Form 08-2011Dokument2 SeitenNA Form 08-2011PITA44Noch keine Bewertungen

- AlaAL ZAALIG2011Dokument5 SeitenAlaAL ZAALIG2011Ala AlzaaligNoch keine Bewertungen

- Chase 1099int 2013Dokument2 SeitenChase 1099int 2013Srikala Venkatesan100% (1)

- Beta 1040 EzDokument2 SeitenBeta 1040 EzLeonard RosentholNoch keine Bewertungen

- W-8BEN Form - Frequently Asked QuestionsDokument2 SeitenW-8BEN Form - Frequently Asked QuestionsAnkit ChhabraNoch keine Bewertungen

- BMI-Africa IRS EIN #Dokument3 SeitenBMI-Africa IRS EIN #Joseph VillarosaNoch keine Bewertungen

- DocumentDokument1 SeiteDocumentMulletHawkSunshyneBrownNoch keine Bewertungen

- Read This First: Estimated Taxes PaidDokument7 SeitenRead This First: Estimated Taxes PaidDan HuntingtonNoch keine Bewertungen

- Glacier Tax User GuideDokument5 SeitenGlacier Tax User Guideinter4ever77Noch keine Bewertungen

- Form W-8BEN Rev 920Dokument2 SeitenForm W-8BEN Rev 920alejandroguitierrazxxx100% (3)

- F1040ez PDFDokument2 SeitenF1040ez PDFjc75aNoch keine Bewertungen

- Irs Instructions Residency FormDokument4 SeitenIrs Instructions Residency FormmaxpendriskyNoch keine Bewertungen

- Attention:: Order Information Returns and Employer Returns OnlineDokument6 SeitenAttention:: Order Information Returns and Employer Returns OnlineRa ElNoch keine Bewertungen

- Attention:: Order Information Returns and Employer Returns OnlineDokument6 SeitenAttention:: Order Information Returns and Employer Returns Onlinepdizypdizy0% (1)

- How To Fill-Out BIR Form 1905Dokument11 SeitenHow To Fill-Out BIR Form 1905Jhon Michael VillafloresNoch keine Bewertungen

- Midwest Protouch CleaningDokument3 SeitenMidwest Protouch CleaningalisellsrealestateNoch keine Bewertungen

- W-9 FormDokument2 SeitenW-9 FormTrish HitNoch keine Bewertungen

- FW 9Dokument1 SeiteFW 9Alfredo NavaNoch keine Bewertungen

- FATCA-CRS Individual Self Certification - TradeZero - Dec 2018Dokument2 SeitenFATCA-CRS Individual Self Certification - TradeZero - Dec 2018Kahchoon ChinNoch keine Bewertungen

- Verification of Reported IncomeDokument3 SeitenVerification of Reported IncomepdizypdizyNoch keine Bewertungen

- 5 XVFPSVKDokument1 Seite5 XVFPSVKIrma AsaroNoch keine Bewertungen

- Submitting Your U.S. Tax Documents: Print, Sign, MailDokument5 SeitenSubmitting Your U.S. Tax Documents: Print, Sign, MailGia Han100% (1)

- F1040ez 2008Dokument2 SeitenF1040ez 2008jonathandeauxNoch keine Bewertungen

- 130 U 3Dokument2 Seiten130 U 3Juan Escobar JuncalNoch keine Bewertungen

- Request For Certification of Tax Filings: Office Use OnlyDokument2 SeitenRequest For Certification of Tax Filings: Office Use OnlyBenjamin SalmeronNoch keine Bewertungen

- Preview W8 W9 PDFDokument1 SeitePreview W8 W9 PDFEugene ChoiNoch keine Bewertungen

- Tax Information InterviewDokument2 SeitenTax Information InterviewKIPA TV Pringsewu LampungNoch keine Bewertungen

- Connecticut W-4 Form Explains Codes For Withholding RatesDokument4 SeitenConnecticut W-4 Form Explains Codes For Withholding RatesestannardNoch keine Bewertungen

- FEIN Assignment LetterDokument2 SeitenFEIN Assignment LetterKealamākia Foundation0% (1)

- Doing Your Own Taxes is as Easy as 1, 2, 3.Von EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Bewertung: 1 von 5 Sternen1/5 (1)

- J.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleVon EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2010: Your Complete Guide to Everything DeductibleBewertung: 3 von 5 Sternen3/5 (1)

- J.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2009: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- WindowsServer2012VirtualTech VLBriefDokument15 SeitenWindowsServer2012VirtualTech VLBriefDavi Sadaseeven SaminadenNoch keine Bewertungen

- Windows 2012 LicensingDokument16 SeitenWindows 2012 Licensingionut_ciocirlieNoch keine Bewertungen

- WS2012 Licensing-Pricing DatasheetDokument5 SeitenWS2012 Licensing-Pricing DatasheetAmit ChaubalNoch keine Bewertungen

- LHM FaqDokument20 SeitenLHM FaqweisscoNoch keine Bewertungen

- WindowsServer2012VirtualTech VLBriefDokument15 SeitenWindowsServer2012VirtualTech VLBriefDavi Sadaseeven SaminadenNoch keine Bewertungen

- SonicWALL PRO 2040 FAQDokument16 SeitenSonicWALL PRO 2040 FAQweisscoNoch keine Bewertungen

- TE1HPHDokument2 SeitenTE1HPHKarthikeya MandavaNoch keine Bewertungen

- GST - HSLDokument24 SeitenGST - HSLFharook SyedNoch keine Bewertungen

- T1 - Introduction To Malaysian Tax & Resident Status (A)Dokument7 SeitenT1 - Introduction To Malaysian Tax & Resident Status (A)Vincent ChenNoch keine Bewertungen

- MCQ Income Taxation Chapter 13docx PDF FreeDokument14 SeitenMCQ Income Taxation Chapter 13docx PDF FreeMichael Brian TorresNoch keine Bewertungen

- RMC No 65-2012 VATDokument3 SeitenRMC No 65-2012 VATSpecforcNoch keine Bewertungen

- Cir Vs BurroughsDokument2 SeitenCir Vs BurroughsLove Lee Hallarsis FabiconNoch keine Bewertungen

- Payroll Training PresentationDokument47 SeitenPayroll Training PresentationMarkandeya ChitturiNoch keine Bewertungen

- Dec 2010Dokument1 SeiteDec 2010S Kalu SivalingamNoch keine Bewertungen

- 1901 Jul 2021 ENCS FinalDokument4 Seiten1901 Jul 2021 ENCS FinalJed Baylosis (JBL)Noch keine Bewertungen

- Research Paper On Tax ReformDokument5 SeitenResearch Paper On Tax Reformc9k7jjfk100% (1)

- View Certi If CateDokument1 SeiteView Certi If CateMahfuzur Rahman0% (3)

- Wage Type Request Form Overview 102011vs2Dokument2 SeitenWage Type Request Form Overview 102011vs2Singh 10Noch keine Bewertungen

- Income Tax On CorporationDokument53 SeitenIncome Tax On CorporationLyka Mae Palarca IrangNoch keine Bewertungen

- MWP & KeymanDokument11 SeitenMWP & KeymanEnnsignn Advisory Services P LtdNoch keine Bewertungen

- Seminar 2-3Dokument8 SeitenSeminar 2-3Nguyen Hien0% (1)

- General Marking Criteria Short Answer QuestionsDokument12 SeitenGeneral Marking Criteria Short Answer QuestionsMuhammad Ramiz AminNoch keine Bewertungen

- Actual Money Involve 62M: Projected IncomeDokument3 SeitenActual Money Involve 62M: Projected IncomeJohnvic ViernesNoch keine Bewertungen

- Tax Revalida NotesDokument36 SeitenTax Revalida NotesRehina DaligdigNoch keine Bewertungen

- 6 - Availing Interest Free Loan-FormatDokument3 Seiten6 - Availing Interest Free Loan-FormatSridhara babu. N - ಶ್ರೀಧರ ಬಾಬು. ಎನ್100% (1)

- Payslip Sep 2022Dokument1 SeitePayslip Sep 2022GloryNoch keine Bewertungen

- 2833 8369 1 SPDokument7 Seiten2833 8369 1 SPSenni JuniartiNoch keine Bewertungen

- LEGT2751 Lecture 1Dokument14 SeitenLEGT2751 Lecture 1reflecti0nNoch keine Bewertungen

- LPC Saima SadiqDokument2 SeitenLPC Saima Sadiqlatestever28Noch keine Bewertungen

- History of Indirect TaxDokument5 SeitenHistory of Indirect Taxambikaagarwal1934Noch keine Bewertungen

- EFBS - Glossary - UNIT 22 GOVERNMENT & TAXATIONDokument5 SeitenEFBS - Glossary - UNIT 22 GOVERNMENT & TAXATIONHÀO TIẾT VĨNoch keine Bewertungen

- Invoice PDFDokument1 SeiteInvoice PDFShreya AgarwalNoch keine Bewertungen

- Riph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Dokument2 SeitenRiph - Unit 5 - The 1987 Constitution - Synthesis - Domingo, Ma. Eau Claire A.Eau Claire DomingoNoch keine Bewertungen

- Maple LeafDokument1 SeiteMaple LeafHenry KimNoch keine Bewertungen

- Statutory Checklist-Tds OthersDokument15 SeitenStatutory Checklist-Tds OthersGaurav KumarNoch keine Bewertungen

- Nepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsDokument7 SeitenNepal Income Tax Slab Rates 2077-78 (2020-21), Provisions and Concessions For IndividualsSajjal GhimireNoch keine Bewertungen