Beruflich Dokumente

Kultur Dokumente

Financial Management

Hochgeladen von

mansha710 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

230 Ansichten4 SeitenFinancial Management

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenFinancial Management

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

230 Ansichten4 SeitenFinancial Management

Hochgeladen von

mansha71Financial Management

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 4

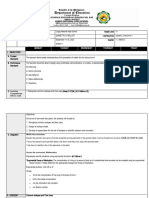

Sikkim manipal university

Authorized learning centre, Alwar LC code 03034

Practice Test- MB0041 Finance and Management Accounting

Max marks:

Time allowed:45 min

Answer the following questions carrying 1 mark each. All questions are compulsory

**** ***********************BEST OF LUCK***************************

1 . Double Entry book keeping was introduced

during ___________ century

a. 14th Century

b. 15th Century

c. 13th Century

2. The book of original entry is called

__________ .

a. Journal

b. Busing transactions

c. Original record of transactions

d. subsidiary transaction

3. When book keeping ends, ________________

commences.

a. Analytical

b. Accounting

c. Transactions

d. Repetitive

4 .Accounting principles are _______ , associated

with theory and practice of accounting

a. Doctrines

b. Convenience

c. Subjectivity

d. Practicability

5. Principles are classified as ________ and

________.

a. Concepts , control activities

b. Concepts , conventions

c. Fulfill a formality , control

activities

d. Concepts , Fulfill a formality

6. Business entity concept is also termed as

__________.

a. Separate business Unit

b. Accrual concept

c. Money measurement concept

d. Separate entity concept

7. Accrued items should be _________ to

compute profit or loss for the said period.

a. Divide

b. Added

c. Subtracted

d. Multiplied

8. All revenue expenses are charged against

.

a. No loss no profit

b. Loss

c. Profit

d. Profit or loss

9. Incomes and expenses for an accounting period

are considered to compute _____ .

a. No loss no profit

b. Loss

c. Profit

d. Profit or loss

10. When cash is received from debtors, debtors

account is ______ .

a. Credited

b. None

c. Debited

d. both a and b

11. Balance sheet is a

________________________ of affairs of a

business

a. Statement

b. Journal

c. Bank Pass Book

d. Journal Proper

12. Book of original entry is called

______________________________.

a. Cash Book

b. Journal

c. Bank Pass Book

d. Journal Proper

13. Every bill has ________ number of grace days

.

a.

b.

c.

d.

Five

Two

Four

Three

14.Cash discount allowed to customers appears an

____ side of cash book. Cash discount received

appears are ____ side of cash book.

a. Debit and Credit

b. Credit and Debit

c. Liability , Assets

d. Asset , Liability

15. Cash purchases are recorded on-_____________

side of cash book.

a. Debit

b. None

c. Credit

d. Bank Pass Book

16. Credit sales are entered in

____________________________ book.

a. Statement

b. Journal

c. Bank Pass Book

d. Sales Day

17. Ledger is also known as _____________.

a. Statement

b. Journal

c. Secondary book

d. Sales Day

18. Loss of goods as a result of fire accident is

transferred to ____ account.

a.

b.

c.

d.

Profit

Profit and loss

Loss

None

19. Ledger is regarded as

_______________________ book.

a. Secondary

b. Luxury

c. Primary

d. None

Ans: Secondary

20. Rent account is closed by debiting P & L

account and crediting ______account.

a. Personal

b. Real

c. Rent

d. Furniture

21.Trial balance is necessary to prepare

_________________________ .

a. Personal Account

b. Real Account

c. Rent Account

d. Final Account

22. Income received in advance in the current year

is ________ from the unearned item of income

received.

a. Deducted

b. None

c. Ignored

d. Added

23. Depreciation is for __________ of an asset.

a. Operating activity

b. Investing activity

c. Trading activity

d. Wear & tear/ Usage

24. Unrecovered debts are called ______.

a. Bad debts

b. Good debts

c. Worst debts

d. Unrecoverable debts

25. Gross profit is ______minus cost of goods sold.

a. Sales

b. Cost of sales

c. Cost of production

d. All

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- BC Match The FollowingDokument8 SeitenBC Match The Followingmansha71Noch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Aseap: Membership FormDokument2 SeitenAseap: Membership Formmansha71Noch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- Authorized Learning Centre, Alwar LC Code 03034 Practice Test-MB0043 Human Resource Management Max Marks: Time AllowedDokument3 SeitenAuthorized Learning Centre, Alwar LC Code 03034 Practice Test-MB0043 Human Resource Management Max Marks: Time Allowedmansha71Noch keine Bewertungen

- Employee Relations ManagementDokument12 SeitenEmployee Relations Managementmansha71Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Sakui, K., & Cowie, N. (2012) - The Dark Side of Motivation - Teachers' Perspectives On 'Unmotivation'. ELTJ, 66 (2), 205-213.Dokument9 SeitenSakui, K., & Cowie, N. (2012) - The Dark Side of Motivation - Teachers' Perspectives On 'Unmotivation'. ELTJ, 66 (2), 205-213.Robert HutchinsonNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- WAQF Podium Design Presentation 16 April 2018Dokument23 SeitenWAQF Podium Design Presentation 16 April 2018hoodqy99Noch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- In Flight Fuel Management and Declaring MINIMUM MAYDAY FUEL-1.0Dokument21 SeitenIn Flight Fuel Management and Declaring MINIMUM MAYDAY FUEL-1.0dahiya1988Noch keine Bewertungen

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- C2 - Conveyors Diagram: Peso de Faja Longitud de CargaDokument1 SeiteC2 - Conveyors Diagram: Peso de Faja Longitud de CargaIvan CruzNoch keine Bewertungen

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Obligatoire: Connectez-Vous Pour ContinuerDokument2 SeitenObligatoire: Connectez-Vous Pour ContinuerRaja Shekhar ChinnaNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- Canon Powershot S50 Repair Manual (CHAPTER 4. PARTS CATALOG) PDFDokument13 SeitenCanon Powershot S50 Repair Manual (CHAPTER 4. PARTS CATALOG) PDFRita CaselliNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Week-3-Q1-Gen Chem-Sep-11-15-DllDokument12 SeitenWeek-3-Q1-Gen Chem-Sep-11-15-DllJennette BelliotNoch keine Bewertungen

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Executive Summary-P-5 181.450 To 222Dokument14 SeitenExecutive Summary-P-5 181.450 To 222sat palNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Julia Dito ResumeDokument3 SeitenJulia Dito Resumeapi-253713289Noch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Lesson 6 - Vibration ControlDokument62 SeitenLesson 6 - Vibration ControlIzzat IkramNoch keine Bewertungen

- MultiLoadII Mobile Quick Start PDFDokument10 SeitenMultiLoadII Mobile Quick Start PDFAndrés ColmenaresNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- 50114a Isolemfi 50114a MonoDokument2 Seiten50114a Isolemfi 50114a MonoUsama AwadNoch keine Bewertungen

- Department of Education: Republic of The PhilippinesDokument1 SeiteDepartment of Education: Republic of The PhilippinesJonathan CayatNoch keine Bewertungen

- Development Developmental Biology EmbryologyDokument6 SeitenDevelopment Developmental Biology EmbryologyBiju ThomasNoch keine Bewertungen

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Astm B19Dokument6 SeitenAstm B19Davor IbarraNoch keine Bewertungen

- Advanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsDokument74 SeitenAdvanced Chemical Engineering Thermodynamics (Cheg6121) : Review of Basic ThermodynamicsetayhailuNoch keine Bewertungen

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Catify To Satisfy - Simple Solutions For Creating A Cat-Friendly Home (PDFDrive)Dokument315 SeitenCatify To Satisfy - Simple Solutions For Creating A Cat-Friendly Home (PDFDrive)Paz Libros100% (2)

- IMCI Chart BookletDokument43 SeitenIMCI Chart Bookletmysticeyes_17100% (1)

- Resume: Mr. Shubham Mohan Deokar E-MailDokument2 SeitenResume: Mr. Shubham Mohan Deokar E-MailAdv Ranjit Shedge PatilNoch keine Bewertungen

- Recitation Math 001 - Term 221 (26166)Dokument36 SeitenRecitation Math 001 - Term 221 (26166)Ma NaNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Cambridge IGCSE™: Information and Communication Technology 0417/13 May/June 2022Dokument15 SeitenCambridge IGCSE™: Information and Communication Technology 0417/13 May/June 2022ilovefettuccineNoch keine Bewertungen

- Quarter 1 - Module 1Dokument31 SeitenQuarter 1 - Module 1Roger Santos Peña75% (4)

- What's New in CAESAR II: Piping and Equipment CodesDokument1 SeiteWhat's New in CAESAR II: Piping and Equipment CodeslnacerNoch keine Bewertungen

- Evs ProjectDokument19 SeitenEvs ProjectSaloni KariyaNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- A Survey On Security and Privacy Issues of Bitcoin-1Dokument39 SeitenA Survey On Security and Privacy Issues of Bitcoin-1Ramineni HarshaNoch keine Bewertungen

- Acute Appendicitis in Children - Diagnostic Imaging - UpToDateDokument28 SeitenAcute Appendicitis in Children - Diagnostic Imaging - UpToDateHafiz Hari NugrahaNoch keine Bewertungen

- Tesco True Results Casing Running in China Results in Total Depth PDFDokument2 SeitenTesco True Results Casing Running in China Results in Total Depth PDF123456ccNoch keine Bewertungen

- Jackson V AEGLive - May 10 Transcripts, of Karen Faye-Michael Jackson - Make-up/HairDokument65 SeitenJackson V AEGLive - May 10 Transcripts, of Karen Faye-Michael Jackson - Make-up/HairTeamMichael100% (2)

- 1 in 8.5 60KG PSC Sleepers TurnoutDokument9 Seiten1 in 8.5 60KG PSC Sleepers Turnoutrailway maintenanceNoch keine Bewertungen

- 01 托福基础课程Dokument57 Seiten01 托福基础课程ZhaoNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)