Beruflich Dokumente

Kultur Dokumente

Overseas Bank of Manila

Hochgeladen von

Rubz Jean0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten1 Seitesdadsdfd

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldensdadsdfd

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten1 SeiteOverseas Bank of Manila

Hochgeladen von

Rubz Jeansdadsdfd

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

OVERSEAS BANK OF MANILA, petitioner, vs.

COURT OF APPEALS and NATIONAL WATERWORKS AND SEWERAGE

AUTHORITY, respondents.

Facts: BonifacioRegalado and NAWASA entered a in a contract of sale with installments for various materials which the latter agreed to

supply to the former. In relation to a contract of sale between NAWASA, as vendor and BonifacioRegalado, as vendee, the amount

corresponding to the first payment by Regalado was placed on a time deposit with the Overseas Bank by the NAWASA Treasurer for a

period of 6 months. A second payment having been made by Regalado, another time deposit was made by the NAWASA Treasurer with the

Overseas Bank, this time in the amount representing the balance of the purchase price due from Regalado. The period of this second deposit

was fixed 1 year. Subsequently, NAWASAs Acting General Manager wrote to the Overseas Bank advising that (1) as regards the first time

deposit which had already matured, NAWASA wished to withdraw it immediately, and (2) with respect to the second time deposit of, it

intended to withdraw it 60 days thereafter as authorized by the parties agreement set forth in the certificate of the deposit. Despite several

letter requests, nothing was heard from the Overseas Bank. It did however pay to NAWASA interest on its time deposits.

After maturity of the second time deposit and Overseas Bank not responding to the letter request of NAWASA for the remittance of the time

deposits, NAWASA then wrote to the Central Bank Governor about the matter. Apparently, even the Central Bank was ignored by Overseas

Bank. One last letter was written by NAWASA to the Overseas Bank, reiterating its demand for the return of its money. Again the letter went

unheeded. NAWASA thus brought suit to recover its deposits and damages. CFI Manila rendered judgment in favor of NAWASA and

ordered the bank to pay. CA affirmed the trial courts ruling. Hence this petition.

Overseas Bank: By reason of punitive action taken by the Central Bank, it had been prevented from undertaking banking operations which

would have generated funds to pay not only its depositors and creditors but likewise the interests due on the deposits.

Issue: Whether or not Overseas Bank is liable to pay.

Held: The banks contention that the punitive actions taken by the Central Bank prevented the bank from conducting its business is devoid

of merit. There is absolutely no evidence of these facts in the record. Moreover, the suspension of operations in 1968 could not possibly

excuse non-compliance with the obligations in question which matured in 1966. Again, the claim that the Central Bank, by suspending the

Overseas Banks banking operations, had made it impossible for the Overseas Bank to pay its debts, whatever validity might be accorded

thereto, or the further claim that it had fallen into a distressed financial situation, cannot in any sense excuse it from its obligation to the

NAWASA, which had nothing whatever to do with the Central Banks actuations or the events leading to the banks distressed state.

Das könnte Ihnen auch gefallen

- Nationwide IULDokument20 SeitenNationwide IULdjdazedNoch keine Bewertungen

- General Banking Law (Case Digest)Dokument22 SeitenGeneral Banking Law (Case Digest)Na AbdurahimNoch keine Bewertungen

- ASN Board AssessmentDokument4 SeitenASN Board AssessmentAgriSafeNoch keine Bewertungen

- Allied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Dokument19 SeitenAllied Bank vs. Lim Sio Wan, G.R. No. 133179march 27, 2008Aleiah Jean Libatique100% (1)

- Nego - Check CasesDokument3 SeitenNego - Check CasesRizel C. BarsabalNoch keine Bewertungen

- Direct Costs of WeldingDokument2 SeitenDirect Costs of WeldingGerson Suarez CastellonNoch keine Bewertungen

- Banking DigestsDokument9 SeitenBanking DigestsMiguel ManzanoNoch keine Bewertungen

- Penilla Vs AlcidDokument1 SeitePenilla Vs AlcidRubz JeanNoch keine Bewertungen

- Event GuideDokument58 SeitenEvent GuideBach Tran100% (2)

- Nego Cases - 091615: Is Marine National Bank Entitled To A Refund? YES. When It Made The Certification? Only TheDokument8 SeitenNego Cases - 091615: Is Marine National Bank Entitled To A Refund? YES. When It Made The Certification? Only TheKarla BeeNoch keine Bewertungen

- Banking Laws Case DigestDokument6 SeitenBanking Laws Case Digestjancelmido1Noch keine Bewertungen

- Level I Ethics Quiz 1Dokument16 SeitenLevel I Ethics Quiz 1Shreshth Babbar100% (1)

- Job Order CostingDokument49 SeitenJob Order CostingKuroko71% (7)

- Citibank Vs SabenianoDokument5 SeitenCitibank Vs SabenianoMaria Margaret MacasaetNoch keine Bewertungen

- Firestone Vs CADokument2 SeitenFirestone Vs CAHoward TuanquiNoch keine Bewertungen

- 10 CasesDokument6 Seiten10 CasesMelfort Girme BayucanNoch keine Bewertungen

- Basic Quality ConceptDokument11 SeitenBasic Quality ConceptJer RyNoch keine Bewertungen

- GBL 12 21Dokument10 SeitenGBL 12 21Jay Mark Albis SantosNoch keine Bewertungen

- Overseas Bank of Manila vs. Court of Appeals - DIGESTEDDokument2 SeitenOverseas Bank of Manila vs. Court of Appeals - DIGESTEDVinz G. VizNoch keine Bewertungen

- Firestone Tire and Rubber Co Vs CADokument2 SeitenFirestone Tire and Rubber Co Vs CADario G. TorresNoch keine Bewertungen

- Firestone v. CADokument2 SeitenFirestone v. CAKaren Ryl Lozada BritoNoch keine Bewertungen

- Chapter 2: The Recording Process: Questions and AnswersDokument16 SeitenChapter 2: The Recording Process: Questions and AnswersKarim KhaledNoch keine Bewertungen

- Bank of America v. CA G.R. No. 103092Dokument6 SeitenBank of America v. CA G.R. No. 103092Jopan SJNoch keine Bewertungen

- Pa em TendenciaDokument21 SeitenPa em Tendenciasander10100% (1)

- Section 125 Digested CasesDokument6 SeitenSection 125 Digested CasesRobNoch keine Bewertungen

- Firestone Tire and Rubber Co. vs. CADokument3 SeitenFirestone Tire and Rubber Co. vs. CALJ Estrella BabatuanNoch keine Bewertungen

- BDO V BayugaDokument4 SeitenBDO V BayugaCarie LawyerrNoch keine Bewertungen

- Fog ComputingDokument301 SeitenFog Computingorhema oluga100% (2)

- The Overseas Bank Vs Court of AppealsDokument1 SeiteThe Overseas Bank Vs Court of AppealsKeyan MotolNoch keine Bewertungen

- Overseas Bank v. CADokument2 SeitenOverseas Bank v. CAseymourNoch keine Bewertungen

- Relation Between Bank and DepositorDokument4 SeitenRelation Between Bank and Depositoramber3117Noch keine Bewertungen

- NCBA 5 Overseas Bank of Manila V CADokument2 SeitenNCBA 5 Overseas Bank of Manila V CAgrego centillas100% (1)

- Republic Bank Vs CA and FNCB SMC (Drawer) Delgado (Payee and Indorser To) Republic (Indorser To) FNCB (Drawee) V FNCB (Drawee)Dokument7 SeitenRepublic Bank Vs CA and FNCB SMC (Drawer) Delgado (Payee and Indorser To) Republic (Indorser To) FNCB (Drawee) V FNCB (Drawee)John Fredrick BucuNoch keine Bewertungen

- Petitioner vs. vs. Respondents Rosales Perez & Associates Siguion Reyna Montecillo and OngsiakoDokument6 SeitenPetitioner vs. vs. Respondents Rosales Perez & Associates Siguion Reyna Montecillo and OngsiakoAndrei Anne PalomarNoch keine Bewertungen

- Republic Bank Vs CADokument2 SeitenRepublic Bank Vs CAboomonyouNoch keine Bewertungen

- Petitioner vs. vs. Respondents Lourdes C. Dorado Siguion Reyna, Montecillo & OngsiakoDokument5 SeitenPetitioner vs. vs. Respondents Lourdes C. Dorado Siguion Reyna, Montecillo & OngsiakoAcelojoNoch keine Bewertungen

- Petitioner vs. vs. Respondents Lourdes C. Dorado Siguion Reyna, Montecillo & OngsiakoDokument5 SeitenPetitioner vs. vs. Respondents Lourdes C. Dorado Siguion Reyna, Montecillo & OngsiakoAndrei Anne PalomarNoch keine Bewertungen

- Cesar Areza vs. Espress Savings BankDokument10 SeitenCesar Areza vs. Espress Savings BankFB0% (1)

- 05-Spouses Ong Vs BPI Family Savings Bank (JAE)Dokument10 Seiten05-Spouses Ong Vs BPI Family Savings Bank (JAE)thelawanditscomplexitiesNoch keine Bewertungen

- Associated Bank vs. TanDokument17 SeitenAssociated Bank vs. Tanpoiuytrewq9115Noch keine Bewertungen

- Metropolitan Bank and Trust Company, Petitioner, The First National City Bank and The Court of AppealsDokument2 SeitenMetropolitan Bank and Trust Company, Petitioner, The First National City Bank and The Court of AppealsrdNoch keine Bewertungen

- Ariza Vs Express Savings Bank PDFDokument13 SeitenAriza Vs Express Savings Bank PDFHeintje NopraNoch keine Bewertungen

- Areza vs. Express Savings BankDokument3 SeitenAreza vs. Express Savings BankJerry SantosNoch keine Bewertungen

- Tan Tiong Tick Vs American ApothecariesDokument10 SeitenTan Tiong Tick Vs American ApothecariesNovo FarmsNoch keine Bewertungen

- PBC Vs CADokument5 SeitenPBC Vs CANic NalpenNoch keine Bewertungen

- Credit Transactions Digested CasesDokument9 SeitenCredit Transactions Digested CasesEstelaBenegildoNoch keine Bewertungen

- SPCL Part 1 PDFDokument24 SeitenSPCL Part 1 PDFSnow White M VillanuevaNoch keine Bewertungen

- FIRESTONE Vs CADokument2 SeitenFIRESTONE Vs CAJoel MilanNoch keine Bewertungen

- Cases Digest BankingDokument10 SeitenCases Digest BankingKarlNoch keine Bewertungen

- Banking Cases Week 1Dokument5 SeitenBanking Cases Week 1Katrina PerezNoch keine Bewertungen

- Banko Filipino vs. DiazDokument16 SeitenBanko Filipino vs. DiazSherwin Anoba CabutijaNoch keine Bewertungen

- REPUBLIC BANK V CA, First Nat'l City BankDokument2 SeitenREPUBLIC BANK V CA, First Nat'l City BankKevin HernandezNoch keine Bewertungen

- (FT) Hernandez - v. - Rural - Bank - of - Lucena - Inc.20190114-5466-131v8lg PDFDokument11 Seiten(FT) Hernandez - v. - Rural - Bank - of - Lucena - Inc.20190114-5466-131v8lg PDFAmiel Gian Mario ZapantaNoch keine Bewertungen

- Republic Bank V CA and FNCBDokument3 SeitenRepublic Bank V CA and FNCBAnonymous mv3Y0KgNoch keine Bewertungen

- Ong v. BPI Family Savings Bank, Inc., GR No. 208638, January 24, 2018Dokument6 SeitenOng v. BPI Family Savings Bank, Inc., GR No. 208638, January 24, 2018Cza PeñaNoch keine Bewertungen

- Louh v. BPIDokument38 SeitenLouh v. BPIChloe SyGalitaNoch keine Bewertungen

- Louh v. BPIDokument38 SeitenLouh v. BPIKylie GavinneNoch keine Bewertungen

- REPUBLIC BANK NegoDokument2 SeitenREPUBLIC BANK NegoChoystel Mae ArtigasNoch keine Bewertungen

- Opposition To The Motion For Reconsideration Comment/ArgumentsDokument3 SeitenOpposition To The Motion For Reconsideration Comment/ArgumentsAngie DouglasNoch keine Bewertungen

- Equitable Pcibank, Petitioner, vs. Spouses Maximo and Soledad Lacson and Marietta F. Yuching, Respondents.Dokument5 SeitenEquitable Pcibank, Petitioner, vs. Spouses Maximo and Soledad Lacson and Marietta F. Yuching, Respondents.bowbingNoch keine Bewertungen

- Nature of Funds Deposited - Qualified Theft 1Dokument47 SeitenNature of Funds Deposited - Qualified Theft 1April Elenor JucoNoch keine Bewertungen

- 11 Ong vs. BPI SavingsDokument2 Seiten11 Ong vs. BPI SavingsBay NazarenoNoch keine Bewertungen

- Jai-Alai Corporation of The Philippines, Petitioner, V. Bank of The Philippine Island, RespondentDokument67 SeitenJai-Alai Corporation of The Philippines, Petitioner, V. Bank of The Philippine Island, RespondentPatricia RodriguezNoch keine Bewertungen

- Issue: WON The Rehabilitation Court Sitting As Such, Act in Excess of Its Authority or JurisdictionDokument3 SeitenIssue: WON The Rehabilitation Court Sitting As Such, Act in Excess of Its Authority or JurisdictionWD NNoch keine Bewertungen

- NIL Digests - DefensesDokument13 SeitenNIL Digests - DefensesJulie Anne GarciaNoch keine Bewertungen

- CASE #1 Firestone v. CADokument2 SeitenCASE #1 Firestone v. CApistekayawaNoch keine Bewertungen

- Banking Laws DigestsDokument16 SeitenBanking Laws DigestsDaniel Anthony CabreraNoch keine Bewertungen

- Republic V CA and CuaycongDokument3 SeitenRepublic V CA and CuaycongApril DiolataNoch keine Bewertungen

- Digest FinalDokument27 SeitenDigest FinalLee YouNoch keine Bewertungen

- Central Bank Vs FloresDokument3 SeitenCentral Bank Vs FloreschrystelNoch keine Bewertungen

- The Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944Von EverandThe Fireside Chats of Franklin Delano Roosevelt Radio Addresses to the American People Broadcast Between 1933 and 1944Noch keine Bewertungen

- The Assailed Court of Appeals Decision Is AFFIRMED. No Costs. So OrderedDokument1 SeiteThe Assailed Court of Appeals Decision Is AFFIRMED. No Costs. So OrderedRubz JeanNoch keine Bewertungen

- I. The Honorable Court of Appeals Erred in Finding That The Joint Agreement Should Be Approved by The Probate CourtDokument1 SeiteI. The Honorable Court of Appeals Erred in Finding That The Joint Agreement Should Be Approved by The Probate CourtRubz JeanNoch keine Bewertungen

- LawDokument1 SeiteLawRubz JeanNoch keine Bewertungen

- R 138Dokument1 SeiteR 138Rubz JeanNoch keine Bewertungen

- Lawyer's OathDokument1 SeiteLawyer's OathRubz JeanNoch keine Bewertungen

- Sec 433Dokument1 SeiteSec 433Rubz JeanNoch keine Bewertungen

- II. The Court of Appeals Erred in Finding That There Can Be No Valid Partition Among The Heirs of The Late Efraim Santibañez Until After The Will Has Been ProbatedDokument1 SeiteII. The Court of Appeals Erred in Finding That There Can Be No Valid Partition Among The Heirs of The Late Efraim Santibañez Until After The Will Has Been ProbatedRubz JeanNoch keine Bewertungen

- VDokument1 SeiteVRubz JeanNoch keine Bewertungen

- IVDokument1 SeiteIVRubz JeanNoch keine Bewertungen

- II. The Court of Appeals Erred in Finding That There Can Be No Valid Partition Among The Heirs of The Late Efraim Santibañez Until After The Will Has Been ProbatedDokument1 SeiteII. The Court of Appeals Erred in Finding That There Can Be No Valid Partition Among The Heirs of The Late Efraim Santibañez Until After The Will Has Been ProbatedRubz JeanNoch keine Bewertungen

- UncitralDokument16 SeitenUncitralRubz JeanNoch keine Bewertungen

- Loss Borne by Proximate Source of NegligenceDokument1 SeiteLoss Borne by Proximate Source of NegligenceRubz JeanNoch keine Bewertungen

- BBBDokument1 SeiteBBBRubz JeanNoch keine Bewertungen

- RoleDokument1 SeiteRoleRubz JeanNoch keine Bewertungen

- Fare LESS 5.00 Fare LESS 5.00Dokument2 SeitenFare LESS 5.00 Fare LESS 5.00Rubz JeanNoch keine Bewertungen

- Art 1210Dokument1 SeiteArt 1210Rubz JeanNoch keine Bewertungen

- CasaDokument1 SeiteCasaRubz JeanNoch keine Bewertungen

- VVVDokument1 SeiteVVVRubz JeanNoch keine Bewertungen

- ShouldersDokument1 SeiteShouldersRubz JeanNoch keine Bewertungen

- 1 W 1 SDHDokument6 Seiten1 W 1 SDHRubz JeanNoch keine Bewertungen

- FactsDokument2 SeitenFactsamber3117Noch keine Bewertungen

- Brown Sugar Glazed Pork ChopDokument1 SeiteBrown Sugar Glazed Pork ChopRubz JeanNoch keine Bewertungen

- Ramon A. Gonzales For Petitioner.: CRUZ, J.Dokument1 SeiteRamon A. Gonzales For Petitioner.: CRUZ, J.Rubz JeanNoch keine Bewertungen

- Deed of Sale With Pacto de Retro This Deed of Sale With Pacto de Retro Made and Executed by and BetweenDokument1 SeiteDeed of Sale With Pacto de Retro This Deed of Sale With Pacto de Retro Made and Executed by and BetweenRubz JeanNoch keine Bewertungen

- Title Vii - Commercial Contracts For TransportationDokument4 SeitenTitle Vii - Commercial Contracts For TransportationRubz JeanNoch keine Bewertungen

- PPPDokument1 SeitePPPRubz JeanNoch keine Bewertungen

- The Undersigned, Upon Sworn Complaint Filed by The Offended Party, Copy of Which Is Attached Hereto, AccusesDokument1 SeiteThe Undersigned, Upon Sworn Complaint Filed by The Offended Party, Copy of Which Is Attached Hereto, AccusesRubz JeanNoch keine Bewertungen

- IIIDokument1 SeiteIIIRubz JeanNoch keine Bewertungen

- FFFFFDokument1 SeiteFFFFFRubz JeanNoch keine Bewertungen

- Checking Accounts Pp. 470-483Dokument42 SeitenChecking Accounts Pp. 470-483Ehab HosnyNoch keine Bewertungen

- Hipster Economy Presentation 2Dokument16 SeitenHipster Economy Presentation 2Ibsar BBA A Y 21 24Noch keine Bewertungen

- NAKAMURA LACQUER COMPANY 1 VerticleDokument10 SeitenNAKAMURA LACQUER COMPANY 1 Verticlevinay tembhurneNoch keine Bewertungen

- Wolfgang Fritz Haug Critique of Commodity Aesthetics vs. "Unconditional Affirmation" (Wyss)Dokument6 SeitenWolfgang Fritz Haug Critique of Commodity Aesthetics vs. "Unconditional Affirmation" (Wyss)Dan ScatmanNoch keine Bewertungen

- Limited Liability Partnership 01111Dokument20 SeitenLimited Liability Partnership 01111Akhil khannaNoch keine Bewertungen

- Shipping & Billing Address: Neha Singh: Date: 23/02/2024Dokument2 SeitenShipping & Billing Address: Neha Singh: Date: 23/02/2024tyrainternationalNoch keine Bewertungen

- Chapter 1 Answer KeyDokument18 SeitenChapter 1 Answer KeyZohaib SiddiqueNoch keine Bewertungen

- Swot Analysis R&D: NPD Stages and ExplanationDokument3 SeitenSwot Analysis R&D: NPD Stages and ExplanationHarshdeep BhatiaNoch keine Bewertungen

- Top 25 Lean ToolsDokument15 SeitenTop 25 Lean ToolsYohanes Richard100% (1)

- Hershey v. LBB ImportsDokument50 SeitenHershey v. LBB ImportsMark JaffeNoch keine Bewertungen

- Individual Assignment 26june 2017Dokument6 SeitenIndividual Assignment 26june 2017Eileen OngNoch keine Bewertungen

- Rev.1 - Conciliation of RevenuessDokument101 SeitenRev.1 - Conciliation of RevenuessMirandaNoch keine Bewertungen

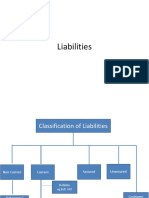

- LiabilitiesDokument21 SeitenLiabilitiesdharmendra kumarNoch keine Bewertungen

- TDS CompalintDokument46 SeitenTDS CompalintScott Dauenhauer, CFP, MSFP, AIFNoch keine Bewertungen

- International Business The Challenges of Globalization 5th Edition Wild Test BankDokument25 SeitenInternational Business The Challenges of Globalization 5th Edition Wild Test BankStephenBowenbxtm100% (52)

- EC1301 Semester 1 Tutorial 2 Short Answer QuestionsDokument2 SeitenEC1301 Semester 1 Tutorial 2 Short Answer QuestionsShuMuKongNoch keine Bewertungen

- Growth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From MorningstarDokument2 SeitenGrowth, Profitability, and Financial Ratios For Starbucks Corp (SBUX) From Morningstaraboubakr soultanNoch keine Bewertungen

- Certificat Iso 9001-Romana PDFDokument1 SeiteCertificat Iso 9001-Romana PDFAmy VinehouseNoch keine Bewertungen

- Case Study - PescanovaDokument17 SeitenCase Study - PescanovaAngus SadpetNoch keine Bewertungen