Beruflich Dokumente

Kultur Dokumente

RTGS Indian Overseas Bank

Hochgeladen von

anaga1982Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RTGS Indian Overseas Bank

Hochgeladen von

anaga1982Copyright:

Verfügbare Formate

INDIAN OVERSEAS BANK

Branch Name & Code

Where Applicable

To be filled by the Applicant in BLOCK LETTERS

APPLICATION FORM FOR FUNDS

TRANSFER UNDER RTGS

Please remit through RTGS a sum of Rs._____________ Rs.(in words)___________________________________ only

against Cheque Debit to my/our account with you/your______________________________________ Branch.

DETAILS OF APPLICANT(REMITTER)

DETAILS OF BENEFICIARY

Amount to be Remitted

Rs.

Centre :

Charges/Commission

Rs.

Bank :

Services Tax

Rs.

Branch :

Total Amount to be debited Rs.

IFSC :

Beneficiarys Name :

Type of Account

SB

CA

CC

Address :

Account No.(15 digit)____________________________

Type of Account :

Cheque Number_________________________________

Account No.

Cheque Date

Telephone/Mobile No.

_________________________________

SB

CA

CC

Remitters Name ________________________________

Address :

Sender to Receiver Message (Brief):

Mobile No.___________________________

(OR)

E-Mail ID :

I/We agree and abide by the Rules, that under the normal circumstances, the Beneficiary account would be credited by

Destination Bank/Branch on the same day at the Destination Centre subject to Terms & Conditions mentioned below &

RTGS Rules/Regulations enumerated by RBI.

Date :

(Applicants Signature)

FOR BANKS USE ONLY

Transactions entered as per details of Beneficiary as given

Applicants Signature Verified. Transaction Authorized &

above.

Funds Remitted through RTGS as per the details of

UTR No.

Beneficiary given above.

Txn No.

IFSC Code:

Time :

_________________________________

________________________

__________ ________

Authorised Official (Maker)

Authorized Official

Date

Time

TERMS & CONDITIONS FOR ACCEPTING THE REQUEST FOR FUNDS TRANSFER(FT)THROUGH RTGS

Funds Transfer shall be effected only when the Destination Bank/Branch is participating in RTGS.

Sufficient clear funds in the remitters account must be available.

The RTGS Customer/Applicant should verify the statement of account and confirm the correctness of remittance

made. In case of any discrepancy the customer/Applicant should intimate the bank immediately.

In Case of holidays at the destination branch the credit will be afforded on next working day.

Once the Account is debited and funds are remitted/RTGS transfer effected, the remitter cannot revoke the given

mandate.

The Remitting Branch/Bank shall not be liable for delay/non-payments to the beneficiary if :a) Incorrect and insufficient details of beneficiary are provided by the Applicant/Remitter.

b) Dislocation of work due to the circumstances beyond the control of Remitting/Destination Banks like nonfunctioning of Computer system, disruption of work due to natural calamities, strike,riot declared/undeclared

holidays, etc. or internal problems or other causes beyond the control of the Branch/Bank resulting in disruption of

communication.

c) All payment instructions should be checked carefully by the remitter. Bank shall not be liable for crediting

remittance amount to wrong beneficiary on account of incorrect information furnished by the customer in the

application form.

- - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -- CUT HERE - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - - -

INDIAN OVERSEAS BANK ______________________________ Branch

CUSTOMERS RECORD SLIP

Received from _________________________________________ by Cheque (No.____________)/ debit authority

SB/CA/CC Account No_______________________________ for Rs.________________Rs.(in words)_____________

_____________________ only on Date___________ at Time__________Hours for Fund Transfer under RTGS as

detailed below:

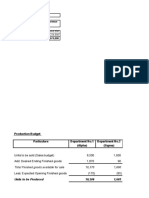

Remittance Amount

Beneficiary Name

Commission

IFSC

Service Tax

Bank

Type of Account

Branch & City

Account Number

Banks Seal

Authorised Signatory : ______________________________

Das könnte Ihnen auch gefallen

- Setup SEPA Direct Debit in AX 2012 R2Dokument15 SeitenSetup SEPA Direct Debit in AX 2012 R2KamarudinNoch keine Bewertungen

- Define Variant for Open and Close Posting Periods in SAPDokument3 SeitenDefine Variant for Open and Close Posting Periods in SAPIsrael A. GweteNoch keine Bewertungen

- Substitution Rule (User Exit) in FI - FB60 or Manage Supplier Invoices Apps For Partner Bank Type in SAP S4HANADokument47 SeitenSubstitution Rule (User Exit) in FI - FB60 or Manage Supplier Invoices Apps For Partner Bank Type in SAP S4HANARaju Raj RajNoch keine Bewertungen

- Sap Fi GlossaryDokument5 SeitenSap Fi GlossarydbedadaNoch keine Bewertungen

- Budget Carry ForwardDokument2 SeitenBudget Carry Forwardpednekar125Noch keine Bewertungen

- GSU788569420 Auth LetterDokument2 SeitenGSU788569420 Auth LetterRock RoseNoch keine Bewertungen

- Standard Bank - Payment ProofDokument1 SeiteStandard Bank - Payment ProofChequeNoch keine Bewertungen

- SAP Withholding Tax Configuration StepsDokument1 SeiteSAP Withholding Tax Configuration StepsNic NgNoch keine Bewertungen

- FBCJ Cash Journal PostingDokument13 SeitenFBCJ Cash Journal PostingKauam SantosNoch keine Bewertungen

- Try These Actual SAP C TFIN22 64 Questions PDFDokument8 SeitenTry These Actual SAP C TFIN22 64 Questions PDFVivek KovivallaNoch keine Bewertungen

- Profit Center Accounting ConfigurationDokument4 SeitenProfit Center Accounting ConfigurationSpandana SatyaNoch keine Bewertungen

- Z DP96ResourceRelatedBillCapProjDokument14 SeitenZ DP96ResourceRelatedBillCapProjmad13boyNoch keine Bewertungen

- Example Open Items Via Direct InputDokument8 SeitenExample Open Items Via Direct InputSri RamNoch keine Bewertungen

- Questionnaire Split Valuation en No ScenariosDokument15 SeitenQuestionnaire Split Valuation en No ScenariosPrasanna Kumar SethiNoch keine Bewertungen

- CK11N Create Material Cost EstimateDokument12 SeitenCK11N Create Material Cost Estimatevenky3105Noch keine Bewertungen

- 5 Steps to Understand Product Costing in SAP FICODokument7 Seiten5 Steps to Understand Product Costing in SAP FICOsreekumarNoch keine Bewertungen

- Aap With Partial PaymentDokument6 SeitenAap With Partial PaymentDas babuNoch keine Bewertungen

- FD10N Customer Account Balance DisplayDokument6 SeitenFD10N Customer Account Balance Displayhypnoticalstar8120Noch keine Bewertungen

- CK40N Costing RunDokument37 SeitenCK40N Costing RunTito TalesNoch keine Bewertungen

- SAP Voucher CodesDokument2 SeitenSAP Voucher CodesNiken Jobanputra100% (1)

- Cross-Company/Inter-company Transactions: Via MenusDokument11 SeitenCross-Company/Inter-company Transactions: Via MenusRajeev MenonNoch keine Bewertungen

- Pricing AuthorizationDokument4 SeitenPricing AuthorizationIrfan RashidNoch keine Bewertungen

- Overhead Cost Planning Using Costing SheetDokument15 SeitenOverhead Cost Planning Using Costing SheetBalanathan Virupasan100% (1)

- File Format Description of MT940Dokument8 SeitenFile Format Description of MT940fanoustNoch keine Bewertungen

- TCODE - 7KE1 Manual Profit Center PlanningDokument5 SeitenTCODE - 7KE1 Manual Profit Center PlanningrajdeeppawarNoch keine Bewertungen

- Q1Dokument7 SeitenQ1wajiha khalid100% (1)

- SAP FICO interview questionsDokument3 SeitenSAP FICO interview questionsAtul BhatnagarNoch keine Bewertungen

- The Condition Record For This Tax Code Has Been DeactivatedDokument14 SeitenThe Condition Record For This Tax Code Has Been DeactivatedlokwaderNoch keine Bewertungen

- Integration Layout TXT Suministrolr Aeat Sii v5Dokument53 SeitenIntegration Layout TXT Suministrolr Aeat Sii v5Murdum MurdumNoch keine Bewertungen

- POD - Series 1 POD - Series 2: RefurbishmentDokument3 SeitenPOD - Series 1 POD - Series 2: RefurbishmentshekarNoch keine Bewertungen

- GR&IR Clearing AccountDokument8 SeitenGR&IR Clearing AccountWupankNoch keine Bewertungen

- EHP7 Issues After Upgrade: Resolving MIRO Small Difference Rounding ErrorDokument11 SeitenEHP7 Issues After Upgrade: Resolving MIRO Small Difference Rounding Errorsawantamit777Noch keine Bewertungen

- CO IM22 JPN Change Investment Program StructureDokument42 SeitenCO IM22 JPN Change Investment Program StructurenguyencaohuyNoch keine Bewertungen

- Paying Vendors With Multiple Bank AccountsDokument4 SeitenPaying Vendors With Multiple Bank Accountssneel.bw3636Noch keine Bewertungen

- Search String FunctionalityDokument4 SeitenSearch String FunctionalityKenisha KhatriNoch keine Bewertungen

- SAP - Premium.C TFIN52 67.by .VCEplus.96q-DEMO PDFDokument28 SeitenSAP - Premium.C TFIN52 67.by .VCEplus.96q-DEMO PDFShashank MallepulaNoch keine Bewertungen

- F To H Transaction CodesDokument50 SeitenF To H Transaction CodesVenkatNoch keine Bewertungen

- TP Technolgoies: Cross Company Code Configuration and TestingDokument11 SeitenTP Technolgoies: Cross Company Code Configuration and TestingKrushna SwainNoch keine Bewertungen

- Duplicate Invoice CheckDokument17 SeitenDuplicate Invoice CheckrajankunalNoch keine Bewertungen

- Search String Basics: Scenario-1: Trading Partner Update in Inter-Company GL AccountDokument6 SeitenSearch String Basics: Scenario-1: Trading Partner Update in Inter-Company GL AccountKenisha KhatriNoch keine Bewertungen

- Double Triple Tour DepreciationDokument6 SeitenDouble Triple Tour DepreciationRajeshNoch keine Bewertungen

- What Are Business Transaction EventsDokument20 SeitenWhat Are Business Transaction EventsSaket ShahiNoch keine Bewertungen

- Product Costing by ActivityDokument31 SeitenProduct Costing by Activitysachin nagpureNoch keine Bewertungen

- Integrator Portal DFEV3 Connector SAP 60 Manual enDokument34 SeitenIntegrator Portal DFEV3 Connector SAP 60 Manual enerustesNoch keine Bewertungen

- Sap Fico Interview Questions PreviewDokument26 SeitenSap Fico Interview Questions PreviewPriyanka SharmaNoch keine Bewertungen

- Bapi Statistical Key Figure Uplaod ReportDokument7 SeitenBapi Statistical Key Figure Uplaod ReportKabil RockyNoch keine Bewertungen

- Val and SubstitutionDokument5 SeitenVal and Substitutiontushar2001Noch keine Bewertungen

- Product costing made easyDokument40 SeitenProduct costing made easyMohan RajNoch keine Bewertungen

- Plan Reconciliation of Internal ActivitiesDokument7 SeitenPlan Reconciliation of Internal ActivitiesZakir ChowdhuryNoch keine Bewertungen

- LC PC ConfigurationDokument2 SeitenLC PC ConfigurationmoorthykemNoch keine Bewertungen

- Introduction To Document Splitting in New GLDokument8 SeitenIntroduction To Document Splitting in New GLvenkat6299Noch keine Bewertungen

- GST - E-InvoicingDokument17 SeitenGST - E-Invoicingnehal ajgaonkarNoch keine Bewertungen

- 20 FICO Tips - Series 3 - SAP BlogsDokument17 Seiten20 FICO Tips - Series 3 - SAP BlogsManish BalwaniNoch keine Bewertungen

- Different Way To Retrieve BSEG TableDokument7 SeitenDifferent Way To Retrieve BSEG TablenstomarNoch keine Bewertungen

- Addon Integration ModuleDokument19 SeitenAddon Integration ModuleRajib Bose100% (1)

- Posting Keys For AP: Jayanth MaydipalleDokument4 SeitenPosting Keys For AP: Jayanth MaydipalleKhanNoch keine Bewertungen

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsVon EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNoch keine Bewertungen

- Indian Overseas Bank RTGS Funds Transfer FormDokument2 SeitenIndian Overseas Bank RTGS Funds Transfer Formpsgnanaprakash8686Noch keine Bewertungen

- Indian Overseas Bank RTGS Funds Transfer FormDokument2 SeitenIndian Overseas Bank RTGS Funds Transfer FormApuri Rammohan Reddy100% (1)

- INDIAN OVERSEAS BANK NEFT APPLICATION FORMDokument2 SeitenINDIAN OVERSEAS BANK NEFT APPLICATION FORMmn_sundaraam100% (2)

- Membership Application FormDokument5 SeitenMembership Application Formanaga1982Noch keine Bewertungen

- FCRA Online ServicesDokument3 SeitenFCRA Online ServicespranayreshmaNoch keine Bewertungen

- SNAP 2010 Question Paper and Ans KeyDokument19 SeitenSNAP 2010 Question Paper and Ans Keyanaga1982Noch keine Bewertungen

- App ADP AVDokument6 SeitenApp ADP AVanaga1982Noch keine Bewertungen

- SSC Combined Graduate Level Tier 1 Exam 2010 Set 1 Solved Question PaperDokument18 SeitenSSC Combined Graduate Level Tier 1 Exam 2010 Set 1 Solved Question PaperVenkatesh PatelNoch keine Bewertungen

- (WWW - Entrance-Exam - Net) - IAS Prelims Sample Paper 1Dokument56 Seiten(WWW - Entrance-Exam - Net) - IAS Prelims Sample Paper 1Ashish JainNoch keine Bewertungen

- FCRA Online ServicesDokument3 SeitenFCRA Online ServicespranayreshmaNoch keine Bewertungen

- Registration ApplicationDokument2 SeitenRegistration Applicationanaga1982Noch keine Bewertungen

- Passport ApplicationDokument6 SeitenPassport Applicationapi-272533854Noch keine Bewertungen

- Request For Advisory Evalution of Foreign Credentials Personal InformationDokument4 SeitenRequest For Advisory Evalution of Foreign Credentials Personal InformationqeulkiteNoch keine Bewertungen

- (See Rule 12 (2) ) : (At The Time ofDokument2 Seiten(See Rule 12 (2) ) : (At The Time ofanaga1982Noch keine Bewertungen

- Anc Mebership FormDokument1 SeiteAnc Mebership FormManqoba Matenjwa100% (1)

- Ec 2010Dokument16 SeitenEc 2010Shubham KaushikNoch keine Bewertungen

- App ADP AVDokument6 SeitenApp ADP AVanaga1982Noch keine Bewertungen

- SNAP 2010 Question Paper and Ans KeyDokument19 SeitenSNAP 2010 Question Paper and Ans Keyanaga1982Noch keine Bewertungen

- Nest 10Dokument30 SeitenNest 10Koyal GuptaNoch keine Bewertungen

- Class IX - 2012-13 - Problem Solving Assessment - Sample Paper - CBSEDokument21 SeitenClass IX - 2012-13 - Problem Solving Assessment - Sample Paper - CBSESulekha Rani.R.Noch keine Bewertungen

- AIBE Model Paper 1 Answers and ExplanationsDokument10 SeitenAIBE Model Paper 1 Answers and ExplanationsameypatwardhanNoch keine Bewertungen

- Acquaint Yourself With Recruitment Tests For Selection of Apprentice Development Officers (13.06.2010)Dokument13 SeitenAcquaint Yourself With Recruitment Tests For Selection of Apprentice Development Officers (13.06.2010)dattatray_chaudhariNoch keine Bewertungen

- Model QuestionsDokument27 SeitenModel Questionskalyan555Noch keine Bewertungen

- Bat Sample QuestionsfgdfgDokument36 SeitenBat Sample Questionsfgdfglefter_ioanNoch keine Bewertungen

- Questions Using Blooms TaxonomyDokument2 SeitenQuestions Using Blooms TaxonomyPriscilla Ruiz100% (1)

- Sample Questions UPSCDokument20 SeitenSample Questions UPSCsarora_usNoch keine Bewertungen

- B CDokument34 SeitenB CvicksaumNoch keine Bewertungen

- 2ndsemmodemaeng PDFDokument13 Seiten2ndsemmodemaeng PDFanaga1982Noch keine Bewertungen

- CSWA Exam Practice QuestionsDokument26 SeitenCSWA Exam Practice QuestionsManuel Norberto Montoya Quezada100% (1)

- Term - 1 - Class - X Communicative English - 2010Dokument27 SeitenTerm - 1 - Class - X Communicative English - 2010Nitin GargNoch keine Bewertungen

- CSWA Exam Practice QuestionsDokument26 SeitenCSWA Exam Practice QuestionsManuel Norberto Montoya Quezada100% (1)

- MeDokument16 SeitenMearavindanNoch keine Bewertungen

- AutomobileDokument30 SeitenAutomobileKarthi NarashimavarathanNoch keine Bewertungen

- Activity 2 Fundamentals of AccountingDokument25 SeitenActivity 2 Fundamentals of AccountingLaiza Cristella SarayNoch keine Bewertungen

- Obangede Process FlowDokument4 SeitenObangede Process Flowdexter schmithNoch keine Bewertungen

- Fulfill Every Wish: Smart Income PlusDokument7 SeitenFulfill Every Wish: Smart Income PlusArindam PandayNoch keine Bewertungen

- CA Foundation Accounts Theory Question Bank Dec 2021 Attempt NotesDokument142 SeitenCA Foundation Accounts Theory Question Bank Dec 2021 Attempt NotesRakesh Roshan100% (1)

- General Banking Law CODALDokument13 SeitenGeneral Banking Law CODALLeo Balante Escalante Jr.Noch keine Bewertungen

- RBI Regulatory Framework for Co-op BanksDokument19 SeitenRBI Regulatory Framework for Co-op BanksGaurav GehlotNoch keine Bewertungen

- Practice Questions and Answers in AccounDokument100 SeitenPractice Questions and Answers in Accounwalidabdo274Noch keine Bewertungen

- Lending Charge Documents EditedDokument30 SeitenLending Charge Documents EditedFaixan HashmeeNoch keine Bewertungen

- This Study Resource Was Shared ViaDokument4 SeitenThis Study Resource Was Shared Viamisssunshine112Noch keine Bewertungen

- Auditing Theory: (1 Point)Dokument9 SeitenAuditing Theory: (1 Point)Kyla de SilvaNoch keine Bewertungen

- Account Details Form ADF Sole Proprietorship I Business As of 08.2020Dokument1 SeiteAccount Details Form ADF Sole Proprietorship I Business As of 08.2020Cristopher NacinoNoch keine Bewertungen

- Rashid Riaz: A Proficient Account and Finance ProfessionalDokument1 SeiteRashid Riaz: A Proficient Account and Finance ProfessionalRashid RiazNoch keine Bewertungen

- Consignment Account Doc 2Dokument13 SeitenConsignment Account Doc 2subhankar fcNoch keine Bewertungen

- CLD - BAO3404 TUTORIAL GUIDE WordDokument49 SeitenCLD - BAO3404 TUTORIAL GUIDE WordShi MingNoch keine Bewertungen

- Fa1 Day One ACCA Introduction ClassDokument11 SeitenFa1 Day One ACCA Introduction Classasad khanNoch keine Bewertungen

- DIY Discharge Debt GuideDokument4 SeitenDIY Discharge Debt GuideAnthony VinsonNoch keine Bewertungen

- Extra Exercises ErrorsDokument6 SeitenExtra Exercises ErrorsMohd Rafi Jasman100% (1)

- SPWP 61Dokument34 SeitenSPWP 61Loo Lik HoNoch keine Bewertungen

- Module 1 - Non-Financial LiabilitiesDokument12 SeitenModule 1 - Non-Financial LiabilitiesKim EllaNoch keine Bewertungen

- Trust-Accounts-Guide For Real Estate Agents QLDDokument52 SeitenTrust-Accounts-Guide For Real Estate Agents QLDtania_allen_8Noch keine Bewertungen

- IDBI Federal AR 2019-20 FINAL FILE PDFDokument220 SeitenIDBI Federal AR 2019-20 FINAL FILE PDFpramod_kmr73Noch keine Bewertungen

- N5 Financial Accounting June 2018Dokument18 SeitenN5 Financial Accounting June 2018Anil HarichandreNoch keine Bewertungen

- Colin - BookDokument15 SeitenColin - BookrizwanNoch keine Bewertungen

- Invoice No.: 10068722081506745011 Invoice No.: 10068722081506745011Dokument1 SeiteInvoice No.: 10068722081506745011 Invoice No.: 10068722081506745011Pak LandNoch keine Bewertungen

- Exploration For and Evaluation of Mineral Resources: Ifrs 6Dokument12 SeitenExploration For and Evaluation of Mineral Resources: Ifrs 6Saad Abu AlhaijaNoch keine Bewertungen

- TGF Guarantee and WarrantyDokument1 SeiteTGF Guarantee and WarrantyCHI KIN LEUNGNoch keine Bewertungen

- Far510 - PPE 1Dokument19 SeitenFar510 - PPE 1intanNoch keine Bewertungen

- MAPUA - EngEconLesson2 - Time Value of MoneyDokument39 SeitenMAPUA - EngEconLesson2 - Time Value of MoneyRick SanchezNoch keine Bewertungen