Beruflich Dokumente

Kultur Dokumente

Massachusetts Lawmaker Says Proposed Amnesty Could Net Up To $20 Million 12-03-14

Hochgeladen von

masshousegopOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Massachusetts Lawmaker Says Proposed Amnesty Could Net Up To $20 Million 12-03-14

Hochgeladen von

masshousegopCopyright:

Verfügbare Formate

Doc 2014-28510 (2 pgs)

by Neil Downing

A corporate tax amnesty proposed by Massachusetts House Minority Leader

Bradley Jones Jr. (R) would be limited to two months during the current fiscal year and

would extend to C corporations, S corporations, and limited liability companies, Jones

said December 2.

Jones on November 21 proposed a stand-alone tax amnesty for the corporate

income tax -- technically known under Mass. Gen. Laws chapter 63, section 39 as the

corporate excise -- as a way to raise revenue to help offset a looming budget deficit

for fiscal 2015. (Prior coverage .)

On December 2 Jones provided some additional details of the plan. For example,

he estimated that the amnesty would raise between $15 million and $20 million. It would

be made available to businesses organized as corporations, including C corporations,

S corporations, financial institutions, and LLCs, Jones said in a statement. The amnesty

would presumably be extended only to those LLCs treated as corporations for tax

purposes, not as passthrough entities. If an entity paid what it owed, penalties would

be waived, he said.

Associated Industries of Massachusetts (AIM), which represents about 4,500

employers, said it supports the plan. "[AIM] starts with the belief that all businesses

have the responsibility to pay their tax obligations in a timely manner. At the same time,

a corporate tax amnesty holds the promise of helping Massachusetts" close a budget

shortfall without reducing aid to cities and towns, said AIM's Christopher Geehern.

"The proposal by Minority Leader Jones is particularly interesting because it would

affect many types of businesses," Geehern said in a statement to Tax Analysts on

December 2.

Joyce Mohr of the Massachusetts Society of Enrolled Agents said she also would

favor a corporate tax amnesty, if the tax itself isn't forgiven. "Although many individuals

and businesses have recovered or are recovering from the terrible economic times in

the recent past, many have still been carrying tax and other debt," she said.

The amnesty would provide an opportunity for some corporations "to do as some

of the individuals and small businesses were able to do -- get a fresh start and be

caught up," Mohr said, referring to a separate limited amnesty for other tax types that

recently ended. The proposed amnesty would also give the state additional funds "to

avoid at least some painful cuts" in its budget, she said.

(C) Tax Analysts 2014. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.

Massachusetts Lawmaker Says Proposed Amnesty Could Net Up to

$20 Million

Doc 2014-28510 (2 pgs)

In response, Jones said, "Cities and towns should be the last place state

government looks to cut costs." The corporate tax amnesty, if approved, would "not

only yield funds that may otherwise have been forgone, but also ensure that

municipalities around the Commonwealth will not be forced to unfairly bear the burden

of Governor Patrick's poor budgeting practices," he added.

Patrick attributed the deficit in part to a likely automatic reduction in the state's

broadest personal income tax rate starting in January 2015. He said the reduction in

the 5.2 percent rate, to 5.15 percent for tax year 2015 and later, will result in a $70

million drop in state revenue for fiscal 2015.

Patrick also said fees and reimbursements "are not achieving the levels forecast

in the budget" and that investments through recent economic development legislation

"were made with the expectation of even higher revenues than we have actually

experienced."

Jones's proposal would represent the second tax amnesty in the current fiscal

year. Massachusetts's recent limited two-month amnesty has raised $39 million from

49,000 participants, according to Department of Revenue figures released November

5. That amnesty, which ran through October 31, was limited to sales and use tax, the

meals tax, income withholding, passthrough entity withholding, and some other tax

types; the corporate excise was not included. (Prior coverage .)

The timing of Jones's proposal suggests that he will introduce a bill for consideration

in the coming legislative session, which begins in January 2015. It's unclear whether

Jones's proposed amnesty would be limited to the corporate excise or be broadened

to include trust fund taxes or other levies.

(C) Tax Analysts 2014. All rights reserved. Tax Analysts does not claim copyright in any public domain or third party content.

Jones's proposal came after Gov. Deval Patrick (D) on November 19 said

Massachusetts was facing a fiscal 2015 budget deficit of $329 million. In response,

Patrick proposed a round of budget cuts -- some of which would need legislative

approval -- including a reduction of about $26 million in state aid to cities and towns.

(Prior coverage .)

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- 2020 FF Pamphlet Info Flyer - FinalDokument2 Seiten2020 FF Pamphlet Info Flyer - FinalmasshousegopNoch keine Bewertungen

- 2018 EPO FlyerDokument2 Seiten2018 EPO FlyermasshousegopNoch keine Bewertungen

- Immigration Summit Media AdvisoryDokument1 SeiteImmigration Summit Media AdvisorymasshousegopNoch keine Bewertungen

- Immigration Detainee SummitDokument1 SeiteImmigration Detainee SummitmasshousegopNoch keine Bewertungen

- Big by Resignation Letter To GovernorDokument2 SeitenBig by Resignation Letter To GovernormasshousegopNoch keine Bewertungen

- Telegram&GazetteEditorial - Bigby Should GoDokument2 SeitenTelegram&GazetteEditorial - Bigby Should GomasshousegopNoch keine Bewertungen

- Statement On CWLA RecommendationsDokument1 SeiteStatement On CWLA RecommendationsmasshousegopNoch keine Bewertungen

- Tax Amnesty Signed Into LawDokument1 SeiteTax Amnesty Signed Into LawmasshousegopNoch keine Bewertungen

- Immigration Status Letter To GovernorDokument2 SeitenImmigration Status Letter To GovernormasshousegopNoch keine Bewertungen

- Governor Patrick Boston GlobeDokument6 SeitenGovernor Patrick Boston Globemasshousegop100% (1)

- 9 12 2012 Gender Reassignment Surgery Kosilek Appeal DOC LetterDokument5 Seiten9 12 2012 Gender Reassignment Surgery Kosilek Appeal DOC LettermasshousegopNoch keine Bewertungen

- FY13 Local Aid ResoDokument22 SeitenFY13 Local Aid ResomasshousegopNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1091)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Genealogy of Morals EssayDokument3 SeitenGenealogy of Morals EssaymgxipellNoch keine Bewertungen

- O'Reilly ResumeDokument2 SeitenO'Reilly ResumeDennis O'ReillyNoch keine Bewertungen

- New-flat-Template-ENGLISH OrangeDokument12 SeitenNew-flat-Template-ENGLISH OrangesusaineNoch keine Bewertungen

- The Dispute Between Philippines and China Concerning Territorial Claims in The West Philippine SeaDokument36 SeitenThe Dispute Between Philippines and China Concerning Territorial Claims in The West Philippine SeaFaye Cience Bohol100% (1)

- II. Pag-Unlad Sa Mababang Paaralan (Elementary School Progress)Dokument3 SeitenII. Pag-Unlad Sa Mababang Paaralan (Elementary School Progress)bokanegNoch keine Bewertungen

- New Jersey Libertarian Party: Open Government Advocacy ProjectDokument9 SeitenNew Jersey Libertarian Party: Open Government Advocacy ProjectRoselle Park NewsNoch keine Bewertungen

- Salas V Jarencio - DigestDokument1 SeiteSalas V Jarencio - DigestSol RoblesNoch keine Bewertungen

- Aquino V Enrile (September 17, 1974)Dokument17 SeitenAquino V Enrile (September 17, 1974)Ariel Maghirang100% (1)

- Gender Based Violence and Womens Economic Empowerment in Nyakayojo Sub County Mbarara DistrictinugandabyasasirajustusDokument72 SeitenGender Based Violence and Womens Economic Empowerment in Nyakayojo Sub County Mbarara DistrictinugandabyasasirajustusdennisNoch keine Bewertungen

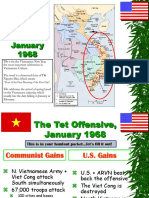

- Vietnam - Student Notes Presentation - 2 of 2Dokument21 SeitenVietnam - Student Notes Presentation - 2 of 2api-332186475Noch keine Bewertungen

- Pasay CityDokument4 SeitenPasay CityPaul Michael Camania JaramilloNoch keine Bewertungen

- Workforce Diversity in India at IBMDokument43 SeitenWorkforce Diversity in India at IBMAbhilash GargNoch keine Bewertungen

- GROUP5 ASSESMENT 8oraytDokument4 SeitenGROUP5 ASSESMENT 8oraytMonica RilveriaNoch keine Bewertungen

- XXX XXX XXX "XVIII. Urea Formaldehyde For The Manufacture of Plywood and Hardboard When Imported by and For The Exclusive Use of End-Users."Dokument3 SeitenXXX XXX XXX "XVIII. Urea Formaldehyde For The Manufacture of Plywood and Hardboard When Imported by and For The Exclusive Use of End-Users."mercy rodriguezNoch keine Bewertungen

- PD101 PrelimsDokument8 SeitenPD101 PrelimsRoshanlene ArellanoNoch keine Bewertungen

- Review of Unity, Support, CoherenceDokument13 SeitenReview of Unity, Support, CoherenceChristina Imanuel0% (1)

- Disorders, Otherwise Known Today As The Kerner Commission Report. This Summary of EventsDokument6 SeitenDisorders, Otherwise Known Today As The Kerner Commission Report. This Summary of Eventsapi-301520105Noch keine Bewertungen

- US v. HOLMESDokument3 SeitenUS v. HOLMESBrod LenamingNoch keine Bewertungen

- The Social Contract by Thomas HobbesDokument1 SeiteThe Social Contract by Thomas HobbesHazel Michaela CalijaNoch keine Bewertungen

- Mission Trip ApplicationDokument4 SeitenMission Trip ApplicationmarknoblinNoch keine Bewertungen

- Harmonized Gender and Development (HGDG) Guidelines: Cely M. Millado Master Teacher II DmcmesDokument33 SeitenHarmonized Gender and Development (HGDG) Guidelines: Cely M. Millado Master Teacher II DmcmesMa Christiane M. ProyaldeNoch keine Bewertungen

- Abstained Agogo HomisideDokument20 SeitenAbstained Agogo HomisideSpyros HytirisNoch keine Bewertungen

- Chapter 5 FINAL Inclusion For Peace, Democracy & DevelopmentDokument23 SeitenChapter 5 FINAL Inclusion For Peace, Democracy & Developmentelias ferhan100% (1)

- Marta Bashovski - MA Thesis Final Draft 2Dokument148 SeitenMarta Bashovski - MA Thesis Final Draft 2Colton McKeeNoch keine Bewertungen

- IB History Stalin NotesDokument10 SeitenIB History Stalin NotesNoah PeregrymNoch keine Bewertungen

- Patriarchy in MSNDDokument37 SeitenPatriarchy in MSNDHajer MrabetNoch keine Bewertungen

- Learners Needs, Progress and Achievement CardexDokument2 SeitenLearners Needs, Progress and Achievement CardexMa. Leonora B. Dela Cruz100% (2)

- The Development of The Social Work Profession in The PhilippinesDokument2 SeitenThe Development of The Social Work Profession in The Philippinessallete100% (3)

- City of Johannesburg v. MazibukoDokument37 SeitenCity of Johannesburg v. MazibukoKaloi GarciaNoch keine Bewertungen

- 31) Vancil v. BelmesDokument1 Seite31) Vancil v. BelmesPio Guieb AguilarNoch keine Bewertungen