Beruflich Dokumente

Kultur Dokumente

Chap 3

Hochgeladen von

Veronica WeaverOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chap 3

Hochgeladen von

Veronica WeaverCopyright:

Verfügbare Formate

SOLUTIONS TO PROBLEMS

PROBLEM 3-1A

1.

2.

3.

4.

5.

6.

7.

8.

9.

Raw Materials Inventory ..................................

Accounts Payable .....................................

300,000

Work in ProcessMixing ................................

Work in ProcessPackaging ..........................

Raw Materials Inventory ...........................

210,000

45,000

Factory Labor ...................................................

Wages Payable..........................................

258,900

Work in ProcessMixing ................................

Work in ProcessPackaging ..........................

Factory Labor ............................................

182,500

76,400

Manufacturing Overhead .................................

Accounts Payable .....................................

810,000

Work in ProcessMixing (28,000 X $24) ........

Work in ProcessPackaging

(6,000 X $24) .................................................

Manufacturing Overhead..........................

672,000

300,000

255,000

258,900

258,900

810,000

144,000

816,000

Work in ProcessPackaging ..........................

Work in ProcessMixing .........................

979,000

Finished Goods Inventory ...............................

Work in ProcessPackaging ..................

1,315,000

Accounts Receivable .......................................

Sales Revenue ..........................................

2,500,000

Cost of Goods Sold ..........................................

Finished Goods Inventory ........................

1,604,000

979,000

1,315,000

2,500,000

1,604,000

PROBLEM 3-2A

(a) Physical units

Units to be accounted for

Work in process, June 1

Started into production

Total units

Units accounted for

Transferred out

Work in process, June 30

Total units

0

22,000

22,000

20,000

2,000

22,000

(b) Equivalent units

Units transferred out

Work in process, June 30

2,000 X 100%

2,000 X 40%

Total equivalent units

(c)

Materials

Conversion costs

Total unit cost

Materials

20,000

Conversion Costs

20,000

2,000

800

20,800

22,000

Unit Costs

$9.00 ($198,000 22,000)

$8.00 ($166,400* 20,800)

$17.00 ($9.00 + $8.00)

*$53,600 + $112,800

(d) Costs accounted for

Transferred out (20,000 X $17.00)

Work in process, June 30

Materials (2,000 X $9.00)

Conversion costs (800 X $8.00)

Total costs

$340,000

$18,000

6,400

24,400

$364,400

PROBLEM 3-2A (Continued)

(e)

ROSENTHAL COMPANY

Molding Department

Production Cost Report

For the Month Ended June 30, 2014

Quantities

Physical

Units

Equivalent Units

Conversion

Materials

Costs

(Step 1)

(Step 2)

Units to be accounted for

Work in process, June 1

Started into production

Total units

0

22,000

22,000

Units accounted for

Transferred out

Work in process, June 30

Total units

20,000

2,000

22,000

Costs

Unit costs (Step 3)

Total cost

Equivalent units

Unit costs (a) (b)

20,000

2,000

22,000

Materials

(a) $198,000

(b)

22,000

$9.00

20,000

800 (2,000 X 40%)

20,800

Conversion

Costs

$166,400

20,800

$8.00

Costs to be accounted for

Work in process, June 1

Started into production

Total costs

Total

$364,400

$17.00

$

0

364,400

$364,400

Cost Reconciliation Schedule (Step 4)

Costs accounted for

Transferred out (20,000 X $17.00)

Work in process, June 30

Materials (2,000 X $9.00)

Conversion costs (800 X $8.00)

Total costs

$340,000

$18,000

6,400

24,400

$364,400

PROBLEM 3-3A

(a) (1) Physical units

T12

Tables

C10

Chairs

Units to be accounted for

Work in process, July 1

Started into production

Total units

0

19,000

19,000

0

16,000

16,000

Units accounted for

Transferred out

Work in process, July 31

Total units

16,000

3,000

19,000

15,500

500

16,000

(2) Equivalent units

Units transferred out

Work in process, July 31

(3,000 X 100%)

(3,000 X 60%)

Total equivalent units

Units transferred out

Work in process, July 31

(500 X 100%)

(500 X 80%)

Total equivalent units

T12 Tables

Conversion

Materials

Costs

16,000

16,000

3,000

19,000

1,800

17,800

C10 Chairs

Conversion

Materials

Costs

15,500

15,500

500

16,000

400

15,900

PROBLEM 3-3A (Continued)

(3) Unit costs

Materials ($380,000 19,000)

($288,000 16,000)

Conversion costs ($338,200(a) 17,800)

($206,700(b) 15,900)

Total

(a)

C10

Chairs

$18

19

$39

13

$31

$234,200 + $104,000

(b)

(4)

T12

Tables

$20

$110,000 + $96,700

T12 Tables

Costs accounted for

Transferred out (16,000 X $39)

Work in process

Materials (3,000 X $20)

Conversion costs (1,800 X $19)

Total costs

$624,000

$60,000

34,200

94,200

$718,200

C10 Chairs

Costs accounted for

Transferred out (15,500 X $31)

Work in process

Materials (500 X $18)

Conversion costs (400 X $13)

Total costs

$480,500

$9,000

5,200

14,200

$494,700

PROBLEM 3-3A (Continued)

(b)

SEAGREN INDUSTRIES INC.

Cutting DepartmentPlant 1

Production Cost Report

For the Month Ended July 31, 2014

Quantities

Physical

Units

Equivalent Units

Conversion

Materials

Costs

(Step 1)

(Step 2)

Units to be accounted for

Work in process, July 1

Started into production

Total units

0

19,000

19,000

Units accounted for

Transferred out

Work in process, July 31

Total units

16,000

3,000

19,000

Costs

Unit costs (Step 3)

Total cost

Equivalent units

Unit costs (a) (b)

16,000

3,000

19,000

Materials

(a) $380,000

(b)

19,000

$

20

16,000

1,800 (3,000 X 60%)

17,800

Conversion

Costs

$338,200

17,800

$

19

Costs to be accounted for

Work in process, July 1

Started into production

Total costs

Total

$718,200

$

39

0

718,200

$718,200

Cost Reconciliation Schedule (Step 4)

Costs accounted for

Transferred out (16,000 X $39)

Work in process, July 31

Materials (3,000 X $20)

Conversion costs (1,800 X $19)

Total costs

$624,400

$60,000

34,200

94,200

$718,200

PROBLEM 3-4A

(a)

Physical

Units

Units to be accounted for

Work in process, November 1

Started into production

Total units

35,000

660,000

695,000

Units accounted for

Transferred out

Work in process, November 30

Total units

670,000

25,000

695,000

Equivalent Units

Conversion

Materials

Costs

670,000

25,000

695,000

670,000

10,000*

680,000

*25,000 X 40%

Materials cost

Beginning work in

process

Added during month

Total

Equivalent units

Cost per unit

Conversion costs

79,000

1,589,000

$1,668,000

$ 48,150

563,850

$612,000

695,000

680,000

$2.40

$.90

($225,920 + $337,930)

(b) Costs accounted for

Transferred out (670,000 X $3.30)

Work in process, November 30

Materials (25,000 X $2.40)

Conversion costs (10,000 X $.90)

Total costs

$2,211,000

$60,000

9,000

69,000

$2,280,000

PROBLEM 3-4A (Continued)

(c)

RIVERA COMPANY

Assembly Department

Production Cost Report

For the Month Ended November 30, 2014

Quantities

Physical

Units

Equivalent Units

Conversion

Materials

Costs

(Step 1)

(Step 2)

Units to be accounted for

Work in process, November 1

Started into production

Total units

35,000

660,000

695,000

Units accounted for

Transferred out

Work in process, November 30

Total units

670,000

25,000

695,000

Costs

Unit costs (Step 3)

Total cost

Equivalent units

Unit costs (a) (b)

670,000

25,000

695,000

Materials

(a) $1,668,000

(b)

695,000

$2.40

670,000

10,000 (25,000 X 40%)

680,000

Conversion

Costs

$612,000

680,000

$.90

Costs to be accounted for

Work in process, November 1

Started into production

Total costs

Total

$2,280,000

$3.30

$ 127,150

2,152,850

$2,280,000

Cost Reconciliation Schedule (Step 4)

Costs accounted for

Transferred out (670,000 X $3.30)

Work in process, November 30

Materials (25,000 X $2.40)

Conversion costs

(10,000 X $.90)

Total costs

$2,211,000

$60,000

9,000

69,000

$2,280,000

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- CRM Project (Nestlé)Dokument15 SeitenCRM Project (Nestlé)805567% (9)

- Hydroponics Farm Business Plan 2Dokument29 SeitenHydroponics Farm Business Plan 2Prabath D Narayan100% (1)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Raheel Ahmad Mechanical Engineer Cover Letter For Saudi AramcoDokument1 SeiteRaheel Ahmad Mechanical Engineer Cover Letter For Saudi AramcoRaheel Neo AhmadNoch keine Bewertungen

- Runway BrochureDokument20 SeitenRunway BrochureVivek SinghNoch keine Bewertungen

- IA 2 Chapter 5 ActivitiesDokument12 SeitenIA 2 Chapter 5 ActivitiesShaina TorraineNoch keine Bewertungen

- Value Chain Anlysis & Development 3,4&5 PPDokument102 SeitenValue Chain Anlysis & Development 3,4&5 PPLemma Deme ResearcherNoch keine Bewertungen

- Activity-Based Management - Chapter05.ab - AzDokument27 SeitenActivity-Based Management - Chapter05.ab - AzAnggi MeilaniNoch keine Bewertungen

- Task 11: Industry Analysis & Insurance ProductsDokument8 SeitenTask 11: Industry Analysis & Insurance ProductsVidhi SanchetiNoch keine Bewertungen

- New Chandigarh CaseDokument96 SeitenNew Chandigarh CaseOjaswa PathakNoch keine Bewertungen

- Ppap Check List: Lear Automotive India Pvt. Ltd.,NasikDokument73 SeitenPpap Check List: Lear Automotive India Pvt. Ltd.,Nasikrajesh sharma100% (1)

- The Textile Industry in The Contemporary Market Is A Global IndustryDokument3 SeitenThe Textile Industry in The Contemporary Market Is A Global IndustryUtkarsh ShahNoch keine Bewertungen

- Total Amount Processed $167,731.48: Our Card Processing StatementDokument8 SeitenTotal Amount Processed $167,731.48: Our Card Processing StatementJuan Pablo Marin100% (1)

- R2003D10581013 Assignment 1 - Business Methods and ProceduresDokument24 SeitenR2003D10581013 Assignment 1 - Business Methods and ProceduresMandy Nyaradzo MangomaNoch keine Bewertungen

- Company Driver - SOPDokument7 SeitenCompany Driver - SOPareeya lintagNoch keine Bewertungen

- Petcoke For Cement IndustryDokument39 SeitenPetcoke For Cement Industryrsvasanrss100% (2)

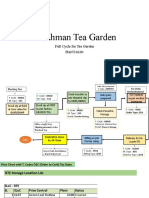

- Tea Garden Process Flow - SAPDokument3 SeitenTea Garden Process Flow - SAPMahmoodNoch keine Bewertungen

- Revue Num7 Article5 ArDokument22 SeitenRevue Num7 Article5 AraliamertehammyNoch keine Bewertungen

- Chayote Production PlannDokument1 SeiteChayote Production PlannAntonio Jr TanNoch keine Bewertungen

- Electronic Ticket Receipt: Galicia, Christian JaddDokument2 SeitenElectronic Ticket Receipt: Galicia, Christian JaddMark Byncent Mejorada BayugaNoch keine Bewertungen

- MSCDokument34 SeitenMSCdwieandreyNoch keine Bewertungen

- EntrepreneurPastIssuesPDF 336648 PDFDokument36 SeitenEntrepreneurPastIssuesPDF 336648 PDFPrabhat Kumar PrustyNoch keine Bewertungen

- Premier Lathe Manufacturing CompanyDokument4 SeitenPremier Lathe Manufacturing Companykanani_shivNoch keine Bewertungen

- Food Security Comms ToolkitDokument192 SeitenFood Security Comms ToolkitOana CarciuNoch keine Bewertungen

- Section 6Dokument114 SeitenSection 6Uday kumar100% (1)

- Floor Ground FloorDokument1 SeiteFloor Ground FloorDwicky AdimastaNoch keine Bewertungen

- Market Report January 2023Dokument36 SeitenMarket Report January 2023Iker Lasagabaster Izagorba100% (1)

- Grain and Feed Annual - Kuala Lumpur - Malaysia - 3-20-2019Dokument6 SeitenGrain and Feed Annual - Kuala Lumpur - Malaysia - 3-20-2019beng LEENoch keine Bewertungen

- Unit 1 Introduction & Forms of Business OrganizationDokument33 SeitenUnit 1 Introduction & Forms of Business OrganizationDr. Nuzhath KhatoonNoch keine Bewertungen

- Kletz, TrevorDokument9 SeitenKletz, TrevoradelsukerNoch keine Bewertungen

- Chapter 2 Resume AMP Strategic Cost Managemen - Adri Istambul LGDokument7 SeitenChapter 2 Resume AMP Strategic Cost Managemen - Adri Istambul LGAdri Istambul Lingga GayoNoch keine Bewertungen