Beruflich Dokumente

Kultur Dokumente

RIFA Financials

Hochgeladen von

SouthsideCentralCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

RIFA Financials

Hochgeladen von

SouthsideCentralCopyright:

Verfügbare Formate

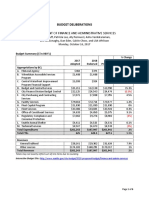

Danville - Pittsylvania Regional Industrial Facility

Authority

Financial Status

Table of Contents

A. $7.3 Million Bonds - Cane Creek Centre

B. General Expenditure for FY 2015

C. Mega Park Funding Other than Bond Funds

D. Berry Hill Mega Park Lot 4 Site Development

E. Rent, Interest, and Other Income Realized

F. Unaudited Financial Statements

18 of 26

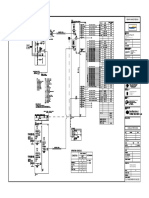

Danville-Pittsylvania Regional Industrial Facility Authority

$7,300,000 Bonds for Cane Creek Centre - Issued in August 2005

As of November 30, 2014

Funding

Funding

Funds from bond issuance

Issuance cost

Refunding cost 7

Bank fees

Interest earned to date

Cane Creek Parkway

Swedwood Drive

Budget / Contract

Amount

3,804,576.00

Financial Advisory Services

Dewberry contracts

Dewberry contracts not paid by 1.7 grant

4,5

72,335.00

53,878.70

9,900.00

9,900.00

69,582.50

69,582.50

71,881.00

21,529.12

Other expenditures

$

7,578,582.12

142,190.00

69,414.00

Legal fees

3,724,241.16

69,414.00

71,261.62

Demolition services

Total

Land

CCC - Lots 3 & 9 project - RIFA Local Share

Unexpended /

Unencumbered

Encumbered

7,300,000.00

(155,401.33)

(52,500.00)

(98.25)

486,581.70

Cane Creek Centre entrance

Expenditures

4,311,140.12

50,351.88

2,792,945.57

71,261.62

55,344.30

112,464.98

330,057.70

7,310,619.65

50,351.88

217,610.59

notes:

Dewberry Contracts consist of wetland, engineering, surveying and site preparation

2

Funds being used to cover City and County matching contributions for a VDOT grant for Swedwood Drive

3

Project completed under budget

*

In September 2008 the outstanding principal balance of $6,965,000 on the Series 2005 Cane Creek Project Revenue Bonds was tendered and not remarketed.

These bonds were converted to bank bonds and are now subject to the Credit and Reimbursement agreement the Authority has with Wachovia Bank. The

remarketing agent will continue its attempt to remarket these bonds in order to convert them back to Variable Rate Revenue Bonds. As a result, it is likely that the

City and County will have to contribute additional funds in order to make future interest payments on the letter of credit attached to these bonds.

4

These contracts were originally to be paid by the $1.7M Special Projects Grant, this grant has expired and the TIC did not issue an extension. The remaining

amounts of the contract will be paid using bond funds.

1

The budget amount decreased $71,279.61 from the September 30, 2010 reports. This amount represented the remaining budget amount carried from the $1.7 SP

grant upon its expiration for the following contracts: Wetland Delineation, Wetland Bank Plan Rev., Stream Concept Plan, & Stream Attribute Plan. Per Shawn

Harden of Dewberry, these contracts are complete and finished under budget. The only contract that remains open is for Wetland Monitoring and the budget,

expended, and encumbered amounts included here are only for this contract.

6

This line item represents the amount of expenditures on the "CCC - Lots 3 & 9" budget sheet that is covered by bond funds. RIFA's local share of 5% of these

project costs is being covered by these bond funds. Project finished under original budget.

7

The $7.3 million bonds were refunded on August 1, 2013 with the issuance of refunding bonds in the amount of $5,595,000.

Road Summary-Cane Creek Parkway:

English Contract-Construction

Change Orders

Expenditures over contract amount

(Less) County's Portion of Contract

(Less) Mobilization Allocated to County

Portion of English Contract Allocated to RIFA

Dewberry Contract-Engineering

Total Road Contract Allocated to RIFA

Funding Summary - Cane Creek Parkway

VDOT

Bonds

$

$

5,363,927.00

165,484.50

3,579.50

(935,207.00)

(9,718.00)

4,588,066.00

683,850.00

5,271,916.00

1,467,340.00

3,804,576.00

5,271,916.00

19 of 26

Danville-Pittsylvania Regional Industrial Facility Authority

General Expenditures for Fiscal Year 2015

As of November 30, 2014

Funding

Funding

City Contribution

County Contribution

Carryforward from FY2014

City Contribution - remaining FY2011 Allocation

County Contribution - remaining FY2011 Allocation

Budget

Expenditures

Encumbered

Unexpended /

Unencumbered

75,000.00

75,000.00

114,807.25

55,000.00

55,000.00

Contingency

Miscellaneous contingency items

Jones Lang LaSalle - Berry Hill Market Study Analysis

Jones Lang LaSalle - Berry Hill Economic Analysis

Dewberry Engineers, Inc. - Berry Hill

Total Contingency Budget

Legal

Accounting

31,403.90

95,000.00

12,000.00

108,603.35

247,007.25

192.00

95,000.00

108,603.35

203,795.35

100,000.00

7,825.00

19,600.00

11,500.00

12,000.00

12,000.00

31,211.90

12,000.00

31,211.90

92,175.00

8,100.00

Annual Bank Fees

600.00

600.00

Postage & Shipping

100.00

100.00

4,000.00

900.70

3,099.30

500.00

113.84

386.16

3,000.00

Meals

Utilities

3,000.00

Insurance

Total

374,807.25

374,807.25

224,134.89

20,100.00

130,572.36

20 of 26

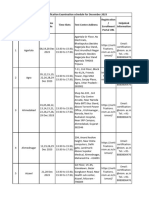

Danville-Pittsylvania Regional Industrial Facility Authority

Mega Park - Funding Other than Bond Funds

As of November 30, 2014

Funding

Funding

City contribution

County contribution

City advance for Klutz, Canter, & Shoffner property 1 , 4

Tobacco Commission FY09 SSED Allocation

Tobacco Commission FY10 SSED Allocation - Engineering Portion

Tobacco Commission FY10 SSED Allocation - Eng. Portion Deobligated

Local Match for TIC FY10 SSED Allocation - Engineering Portion 5

Additional funds allocated by RIFA Board on 1/14/2013 6

Budget / Contract

Amount

Other

Dewberry & Davis

Dewberry & Davis3

Consulting Services - McCallum Sweeney 7

8,394,553.50

1,200,000.00

37,308.00

5,843.00

1,384,961.08

201,148.00

1,872,896.25

28,965.00

990,850.00

115,000.00

Transfer available funds to "Berry Hill Mega Park - Lot 4 Site Development" Project 8

14,231,524.83

14,231,524.83

8,394,553.50

1,200,000.00

37,308.00

5,843.00

1,384,961.08

201,148.00

1,872,896.25

28,965.00

972,754.29

103,796.85

Unexpended /

Unencumbered

Encumbered

134,482.50

134,482.50

10,340,983.83

3,370,726.00

407,725.00

(244,797.00)

76,067.61

11,854.39

Land

Klutz property

Canter property 2

Adams property

Carter property

Jane Hairston property

Bill Hairston property

Shoffner Property

Total

Expenditures

18,095.71

-

11,203.15

$

14,213,429.12

18,095.71

(0.00)

This figure does not include the interest the City lost from the uninvested funds, which was paid to the City 1/3/2012 and totaled $144,150.41.

Settlement fees were drawn from bonds issued for the Berry Hill project 12/1/2011.

This contract was originally for $814,500, but has been amended to include a traffic impact analysis, and a cemetery survey. $740,000 was covered by the FY09 Tobacco Allocation. $162,928

was covered by the FY10 Tobacco Allocation. $87,922 will be covered with RIFA Funds.

2

3

RIFA paid the City back for all advances on 1/3/2012.

The RIFA Board approved to utilize the remaining funds from the Mega Park bond funds and approximately $65,000 of the 'Funds Available for Appropriation' towards the local match for the

engineering portion of Tobacco Commission grant #1916 for the Berry Hill Mega Park.

5

Due to the expiration of the Tobacco Comission FY10 SSED Allocation, the RIFA Board approved on 1/14/2013 to utilize $11,854.39 of the 'Funds Available for Appropriation' to cover the

funding shortfall for the budgeted Dewberry & Davis contract.

7

Unencumbered the remaining $11,203.15 due to termination of contract.

As approved by RIFA Board on 10/16/2014

21 of 26

Danville-Pittsylvania Regional Industrial Facility Authority

Berry Hill Mega Park - Lot 4 Site Development

As of November 30, 2014

Budget / Contract

Amount

Funding

Funding

Tobacco Commission FY12 Megasite Allocation

Local Match for TIC FY12 Megasite Allocation - County Portion 1

Local Match for TIC FY12 Megasite Allocation - City Portion 1

Local Match for TIC FY12 Megasite Allocation - RIFA Portion 2

Transfer in from "Mega Park - Funding Other than Bond Funds" Budget3

Total

Unexpended /

Unencumbered

Encumbered

6,208,153.00

750,000.00

750,000.00

181,000.00

11,203.15

Expenditures

Dewberry Engineers Inc.

Jones Lang LaSalle

Jones Lang LaSalle - Economic Analysis

VA Water Protection Permit Fee

Wetlands Studies and Solutions, Inc.

Transfers to "General Expenditures Fiscal Year 2015" Contingency

Dewberry Engineers Inc.

Jones Lang LaSalle - Market Analysis Study

Jones Lang LaSalle - Economic Analysis

Expenditures

1,268,487.00

95,000.00

12,000.00

57,840.00

141,996.00

593,249.40

95,000.00

57,840.00

54,631.57

675,237.60

12,000.00

87,364.43

(108,603.35)

(95,000.00)

-

(12,000.00)

(108,603.35)

(95,000.00)

(12,000.00)

$

7,900,356.15

1,359,719.65

597,117.62

762,602.03

6,540,636.50

$300,000 of this was received from each locality in June 2014. $450,000 received in August 2014. $450,000 received in September 2014.

The RIFA Board approved on 2/11/2013 to transfer the remaining funds of $175,316.17 from the "Funds Available for Appropriation" budget sheet and funds of $5,683.83 from the

"Rent, Interest, and Other Income Realized" budget sheet to use for the RIFA local match to Tobacco Commission grant #2491 for Berry Hill Mega Park Lot 4 Site Development.

2

As approved by RIFA Board on 10/16/2014

22 of 26

Danville-Pittsylvania Regional Industrial Facility Authority

Rent, Interest, and Other Income Realized

As of November 30, 2014

Source of Funds

Carryforward

from FY2014

Carryforward

$ 429,892.53

Current Lessees

Institute for Advanced Learning and Research (IALR) 1

Institute for Advanced Learning and Research (IALR)

Securitas

Guilford Whitetail Management

Mountain View Farms of Virginia, L.C.

Osborne Company of North Carolina, Inc.

Clodfelter Hunting Lease

Park

Cyberpark

Cyberpark

Cyberpark

Berry Hill

Berry Hill

Berry Hill

Berry Hill

Property

Hawkins Research Bldg. at 230 Slayton Ave.

IALR Building at 150 Slayton Ave.

Gilbert Building at 1260 South Boston Rd.

Kluttz Farm off State Rd. 863/U.S. 311

30 acre tract on Stateline Bridge Rd.

4380 Berry Hill Road Pastureland

371.13 acres off State Road 863

Total Rent

Interest Received

Funding

Receipts

Current

Month

Receipts

FY2015

6,673.24

300.00

-

$ 33,366.20

1,800.00

2,000.00

6,973.24

$ 37,166.20

96.99

$ 429,892.53

7,070.23

$ 37,626.68

26,692.96

26,692.96

1

Restricted

Unrestricted

1

Please note that rent proceeds must be used in accordance with the U.S. Economic Development Administration's (EDA) Standard Terms and Conditions

Please note that this is only interest received on RIFA's general money market account.

Unexpended /

Unencumbered

460.48

Expenditures

Hawkins Research Bldg. Property Mgmt. Fee

Totals

Expenditures

FY2015

440,826.25

$

$

364,064.30

76,761.95

23 of 26

Danville-Pittsylvania Regional Industrial Facility Authority

Statement of Net Position 1, 2

November 30, 2014*

Unaudited

FY 2015

Assets

Current assets

Cash - checking

Cash - money market

Total current assets

Noncurrent assets

Restricted cash - project fund CCC bonds

Restricted cash - debt service fund CCC bonds

Restricted cash - debt service fund Berry Hill bonds

Restricted cash - debt service reserve fund Berry Hill bonds

Capital assets not being depreciated

Capital assets being depreciated, net

Construction in progress

Total noncurrent assets

1,161,934

1,142,091

2,304,025

284,095

1,396,936

153

2,000,033

25,055,863

25,883,079

3,632,297

58,252,456

Total assets

60,556,481

Liabilities

Current liabilities

Bonds payable - current portion

Total current liabilities

1,108,450

1,108,450

Noncurrent liabilities

Bonds payable - less current portion

Total noncurrent liabilities

8,408,540

8,408,540

Total liabilities

9,516,990

Net Position

Net investment in capital assets

Restricted - debt reserves

Unrestricted

45,338,344

3,397,122

2,304,025

Total net position

51,039,491

Please note this balance sheet does not include the Due to/Due from between the County

and the City since it nets out and only changes at fiscal year-end.

2

Please note this balance sheet does not include all general accounts receivable or accounts

payable at the month-end date. This is because information regarding accrued

receivables/payables is not available at the time of statement preparation.

*Please note these statements are for the period ended November 30, 2014 as of November

25, 2014, the date of preparation. Due to statement preparation occurring in close proximity

to month-end, these statements may not include some pending adjustments for the period.

F

(Page 1 of 3)

24 of 26

Danville-Pittsylvania Regional Industrial Facility Authority

Statement of Revenues and Expenses and Changes in Fund Net Position

November 30, 2014*

Unaudited

FY 2015

Operating revenues

Virginia Tobacco Commission Grants

Rental income

Total operating revenues

42,716

42,716

Operating expenses 4

Mega Park expenses 3

Cane Creek Centre expenses 3

Cyber Park expenses 3

Professional fees

Insurance

Other operating expenses

Total operating expenses

158,244

18,915

26,693

17,559

2,416

1,014

224,841

Operating loss

(182,125)

Non-operating revenues (expenses)

Interest income

Interest expense

Total non-operating expenses, net

446

(67,182)

(66,736)

Net loss before capital contributions

(248,861)

Capital contributions

Contribution - City of Danville

Contribution - Pittsylvania County

Total capital contributions

1,119,246

1,119,246

2,238,492

Change in net position

1,989,631

Net position at July 1,

49,049,860

Net position at November 30,

3

51,039,491

A portion or all of these expenses may be capitalized at fiscal year-end.

Please note that most non-cash items, such as depreciation and amortization, are not

included here until year-end entries are made.

F

(Page 2 of 3)

25 of 26

Danville-Pittsylvania Regional Industrial Facility Authority

Statement of Cash Flows

November 30, 2014*

Unaudited

FY 2015

Operating activities

Receipts from grant reimbursement requests

Receipts from leases

Payments to suppliers for goods and services

Net cash used by operating activities

Capital and related financing activities

Capital contributions

Interest paid on bonds

Principal repayments on bonds

Net cash provided by capital and related financing activities

30,492

(596,621)

(566,129)

2,238,492

(144,566)

(750,000)

1,343,926

Investing activities

Interest received

Net cash provided by investing activities

446

446

Net increase in cash and cash equivalents

778,243

Cash and cash equivalents - beginning of year (including restricted cash)

5,206,999

Cash and cash equivalents - through November 30, 2014 (including restricted cash) $

5,985,242

Reconciliation of operating loss before capital

contributions to net cash used by operating activities:

Operating loss

Adjustments to reconcile operating loss to net cash

used by operating activities:

Non-cash operating in-kind expenses

Changes in assets and liabilities:

Change in prepaids

Change in due from other governments

Change in other receivables

Change in accounts payable

Change in unearned income

Net cash used by operating activities

Components of cash and cash equivalents at November 30, 2014:

American National - Checking

American National - General money market

Wells Fargo - $7.3M Bonds CCC Debt service fund

Wells Fargo - $7.3M Bonds CCC Project fund

US Bank - $11.25M Bonds Berry Hill Debt service fund

US Bank - $11.25M Bonds Berry Hill Debt service reserve fund

F

(Page 3 of 3)

(182,125)

2,624

2,500

(383,278)

(5,850)

(566,129)

1,161,934

1,142,091

1,396,936

284,095

153

2,000,033

5,985,242

26 of 26

Das könnte Ihnen auch gefallen

- Project Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityVon EverandProject Management Accounting: Budgeting, Tracking, and Reporting Costs and ProfitabilityBewertung: 4 von 5 Sternen4/5 (2)

- IrvingCC Agenda 2011-05-05Dokument10 SeitenIrvingCC Agenda 2011-05-05Irving BlogNoch keine Bewertungen

- FY 2023 Budget Presentation - Water Management - BF - FinalDokument11 SeitenFY 2023 Budget Presentation - Water Management - BF - FinalBrian GoodwinNoch keine Bewertungen

- January Presentation 2017Dokument666 SeitenJanuary Presentation 2017the kingfishNoch keine Bewertungen

- Amends 1Dokument2 SeitenAmends 1cmachongNoch keine Bewertungen

- IrvingCC Agenda 2010-07-08Dokument16 SeitenIrvingCC Agenda 2010-07-08Irving BlogNoch keine Bewertungen

- Stadium Financial Model For Regina - March 2014Dokument1 SeiteStadium Financial Model For Regina - March 2014Shawn KnoxNoch keine Bewertungen

- Auditor Report 18Dokument98 SeitenAuditor Report 18Jorge GarzaNoch keine Bewertungen

- Mayor of Oakland Letter To Susan Muranishi Re Howard Terminal With AttachmentsDokument11 SeitenMayor of Oakland Letter To Susan Muranishi Re Howard Terminal With AttachmentsZennie AbrahamNoch keine Bewertungen

- Paperless 201 RN1549Dokument53 SeitenPaperless 201 RN1549Tim ReedNoch keine Bewertungen

- Auditor Report 21Dokument98 SeitenAuditor Report 21Jorge GarzaNoch keine Bewertungen

- Auditor Report 19Dokument103 SeitenAuditor Report 19Jorge GarzaNoch keine Bewertungen

- Welland Council Report On Infrastructure Canada - Active Transportation FundDokument11 SeitenWelland Council Report On Infrastructure Canada - Active Transportation FundDave JohnsonNoch keine Bewertungen

- Fort Portal MC BFPDokument89 SeitenFort Portal MC BFPTim KarmaNoch keine Bewertungen

- Department of Finance and Administrative Services: Budget DeliberationsDokument11 SeitenDepartment of Finance and Administrative Services: Budget DeliberationsWestSeattleBlogNoch keine Bewertungen

- Proposed Final Budget 2010-11Dokument35 SeitenProposed Final Budget 2010-11prideandpromiseNoch keine Bewertungen

- CT DOT 5-Year Cap Plan - Oct11 Update 11-17Dokument32 SeitenCT DOT 5-Year Cap Plan - Oct11 Update 11-17Patricia DillonNoch keine Bewertungen

- Bremerton 2010 Schedule 16 SAO Report Ar1006433Dokument3 SeitenBremerton 2010 Schedule 16 SAO Report Ar1006433Rose Jane EiltsNoch keine Bewertungen

- 7.C Budget 2015-2016Dokument57 Seiten7.C Budget 2015-2016L. A. PatersonNoch keine Bewertungen

- MPRWA Regular Meeting Agenda Packet 01-10-13Dokument54 SeitenMPRWA Regular Meeting Agenda Packet 01-10-13L. A. PatersonNoch keine Bewertungen

- Budget 20131118 AgendaDokument10 SeitenBudget 20131118 AgendaChs BlogNoch keine Bewertungen

- East Penn Long Range Fiscal and Capital Plan 03-13-2023Dokument54 SeitenEast Penn Long Range Fiscal and Capital Plan 03-13-2023Jay BradleyNoch keine Bewertungen

- IrvingCC Packet 2011-07-07Dokument91 SeitenIrvingCC Packet 2011-07-07Irving BlogNoch keine Bewertungen

- Finance RPTDokument2 SeitenFinance RPTRichard G. FimbresNoch keine Bewertungen

- City Countil AGENDA 8-19 PDFDokument2 SeitenCity Countil AGENDA 8-19 PDFAdam PhillipsNoch keine Bewertungen

- Chevalierltr (Final)Dokument4 SeitenChevalierltr (Final)tulocalpoliticsNoch keine Bewertungen

- DART BriefingDokument18 SeitenDART BriefingApril ToweryNoch keine Bewertungen

- Protecting The PresentDokument14 SeitenProtecting The Presentapi-237071663Noch keine Bewertungen

- 11-11-3 Memo From Susan Wright - Borrowing OrdersDokument2 Seiten11-11-3 Memo From Susan Wright - Borrowing OrdersOwenFDNoch keine Bewertungen

- 2024 Solid Waste Draft Budget - EnV-SWC-145Dokument4 Seiten2024 Solid Waste Draft Budget - EnV-SWC-145Tom SummerNoch keine Bewertungen

- Long Range Fiscal and Capital PlanDokument54 SeitenLong Range Fiscal and Capital PlanLVNewsdotcomNoch keine Bewertungen

- Finance RPTDokument2 SeitenFinance RPTRichard G. FimbresNoch keine Bewertungen

- 2014 Seattle City Council Green Sheet Ready For Notebook: Budget Action DescriptionDokument6 Seiten2014 Seattle City Council Green Sheet Ready For Notebook: Budget Action DescriptiontfooqNoch keine Bewertungen

- Sound Transit - Motion M2020-56Dokument6 SeitenSound Transit - Motion M2020-56The UrbanistNoch keine Bewertungen

- Apac BFP 2015-16Dokument202 SeitenApac BFP 2015-16derr barrNoch keine Bewertungen

- Resolution No. R2020-07Dokument3 SeitenResolution No. R2020-07The UrbanistNoch keine Bewertungen

- Epartment OF Inance: 2014 C C B S 25, 2013Dokument9 SeitenEpartment OF Inance: 2014 C C B S 25, 2013api-237071663Noch keine Bewertungen

- TOAV Parks and Rec RecommendationsDokument3 SeitenTOAV Parks and Rec RecommendationsGreg RavenNoch keine Bewertungen

- 2008-2012 Capital Improvements Program: City of MckinneyDokument53 Seiten2008-2012 Capital Improvements Program: City of Mckinneyanon-234783Noch keine Bewertungen

- Water Recycle GuidelinesDokument44 SeitenWater Recycle GuidelinesN V Sumanth VallabhaneniNoch keine Bewertungen

- Prelim BudgetDokument307 SeitenPrelim BudgetwinnipegsunNoch keine Bewertungen

- Solutions Images Bingham 11-02-2010Dokument46 SeitenSolutions Images Bingham 11-02-2010Nicky 'Zing' Nguyen100% (7)

- Douglas Place / Ambassador Hotel Public Hearing DocumentsDokument206 SeitenDouglas Place / Ambassador Hotel Public Hearing DocumentsBob WeeksNoch keine Bewertungen

- Department of Administrative Hearings (45) : Agency Plan: Mission, Goals and Budget SummaryDokument8 SeitenDepartment of Administrative Hearings (45) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNoch keine Bewertungen

- Mayor and Council Communication: City of Fort Worth, TexasDokument3 SeitenMayor and Council Communication: City of Fort Worth, TexasCBS 11 NewsNoch keine Bewertungen

- Wainfleet Development Charge ReportDokument129 SeitenWainfleet Development Charge ReportDave JohnsonNoch keine Bewertungen

- Ch6 SolutionsDokument9 SeitenCh6 SolutionsKiều Thảo AnhNoch keine Bewertungen

- 2020 Presentation Mary May T. Antonio BSA-2A: Budget ProposalDokument12 Seiten2020 Presentation Mary May T. Antonio BSA-2A: Budget ProposalTineTine TamayoNoch keine Bewertungen

- City Council Final Agenda 9-2-14Dokument3 SeitenCity Council Final Agenda 9-2-14Adam PhillipsNoch keine Bewertungen

- Plano Hall Farm Land DealDokument36 SeitenPlano Hall Farm Land DealDallas Morning News Plano BlogNoch keine Bewertungen

- EB 10-11 General Services - StampedDokument29 SeitenEB 10-11 General Services - StampedMatt HampelNoch keine Bewertungen

- WATER (41) : Agency Plan: Mission, Goals and Budget SummaryDokument61 SeitenWATER (41) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNoch keine Bewertungen

- BUDGET (12) : Agency Plan: Mission, Goals and Budget SummaryDokument7 SeitenBUDGET (12) : Agency Plan: Mission, Goals and Budget SummaryMatt HampelNoch keine Bewertungen

- Amendments To Professional Services Agreements 11-30-15Dokument11 SeitenAmendments To Professional Services Agreements 11-30-15L. A. PatersonNoch keine Bewertungen

- Sample of RFPDokument70 SeitenSample of RFPFayyaz Ahmad KhanNoch keine Bewertungen

- Resolution Accepting A Grant Award From The Monterey Peninsula Regional Park District 12-03-13Dokument10 SeitenResolution Accepting A Grant Award From The Monterey Peninsula Regional Park District 12-03-13L. A. PatersonNoch keine Bewertungen

- Attachment 4163Dokument3 SeitenAttachment 4163Mark ReinhardtNoch keine Bewertungen

- Arena UpdateDokument10 SeitenArena UpdatedarnellbrandonNoch keine Bewertungen

- TRC News and Notes 1-19-12Dokument2 SeitenTRC News and Notes 1-19-12James Van BruggenNoch keine Bewertungen

- Kane County Board AgendaDokument138 SeitenKane County Board AgendacherylwaityNoch keine Bewertungen

- DRF 2014 GrantsDokument1 SeiteDRF 2014 GrantsSouthsideCentralNoch keine Bewertungen

- GW Police ReportDokument3 SeitenGW Police ReportSouthsideCentralNoch keine Bewertungen

- RDF2015 Entertainment PosterDokument1 SeiteRDF2015 Entertainment PosterSouthsideCentralNoch keine Bewertungen

- Sutherlin Mansion Expenses-February 2016Dokument1 SeiteSutherlin Mansion Expenses-February 2016SouthsideCentralNoch keine Bewertungen

- RDF2015 General PosterDokument1 SeiteRDF2015 General PosterSouthsideCentralNoch keine Bewertungen

- EcomNets Indictment Filed and DocketedDokument27 SeitenEcomNets Indictment Filed and DocketedSouthsideCentral100% (1)

- Superintendent Employment Agreement (Signed)Dokument15 SeitenSuperintendent Employment Agreement (Signed)SouthsideCentralNoch keine Bewertungen

- June RIFA Agenda - Page 11-13Dokument3 SeitenJune RIFA Agenda - Page 11-13SouthsideCentralNoch keine Bewertungen

- Dps 2015 StatsDokument1 SeiteDps 2015 StatsSouthsideCentralNoch keine Bewertungen

- 2014-2015 RetireesDokument1 Seite2014-2015 RetireesSouthsideCentralNoch keine Bewertungen

- Public Safety LetterDokument3 SeitenPublic Safety LetterSouthsideCentralNoch keine Bewertungen

- Seizure WarrantDokument2 SeitenSeizure WarrantSouthsideCentralNoch keine Bewertungen

- Norhurst RepaymentDokument6 SeitenNorhurst RepaymentSouthsideCentralNoch keine Bewertungen

- Final School Board BudgetDokument1 SeiteFinal School Board BudgetSouthsideCentralNoch keine Bewertungen

- DPSMeningitis LetterDokument1 SeiteDPSMeningitis LetterSouthsideCentralNoch keine Bewertungen

- Nascar TripDokument1 SeiteNascar TripSouthsideCentralNoch keine Bewertungen

- Superintendent Employment Agreement (Signed)Dokument15 SeitenSuperintendent Employment Agreement (Signed)SouthsideCentralNoch keine Bewertungen

- Discipline Data Comparison ReportDokument1 SeiteDiscipline Data Comparison ReportSouthsideCentralNoch keine Bewertungen

- Danville-Pittsylvania Regional Industrial Facility AuthorityDokument26 SeitenDanville-Pittsylvania Regional Industrial Facility AuthoritySouthsideCentralNoch keine Bewertungen

- SSED GrantsDokument1 SeiteSSED GrantsSouthsideCentralNoch keine Bewertungen

- School Discipline Report - August 11-29, 2014Dokument1 SeiteSchool Discipline Report - August 11-29, 2014SouthsideCentralNoch keine Bewertungen

- Danville - General FundDokument3 SeitenDanville - General FundSouthsideCentralNoch keine Bewertungen

- Discipline Data Comparison ReportDokument1 SeiteDiscipline Data Comparison ReportSouthsideCentralNoch keine Bewertungen

- Search Warrant - GrantedDokument2 SeitenSearch Warrant - GrantedSouthsideCentralNoch keine Bewertungen

- Search Warrant - August 2013Dokument24 SeitenSearch Warrant - August 2013SouthsideCentralNoch keine Bewertungen

- Ed Newsome's DPS ContractDokument6 SeitenEd Newsome's DPS ContractSouthsideCentralNoch keine Bewertungen

- HCPS Pay ScalesDokument1 SeiteHCPS Pay ScalesSouthsideCentralNoch keine Bewertungen

- Merle Rutledge Gets Enjoined.Dokument18 SeitenMerle Rutledge Gets Enjoined.SouthsideCentralNoch keine Bewertungen

- Bunga Engeline BR Siagian - Tugas 23.19 Dan 23.21 Week 13Dokument5 SeitenBunga Engeline BR Siagian - Tugas 23.19 Dan 23.21 Week 13bunga engeline br siagianNoch keine Bewertungen

- FHA 203-k Loan - Questions & Answers Rehab Loan ProgramDokument6 SeitenFHA 203-k Loan - Questions & Answers Rehab Loan ProgramJudy LeonettiNoch keine Bewertungen

- United States Court of Appeals, Seventh CircuitDokument9 SeitenUnited States Court of Appeals, Seventh CircuitScribd Government DocsNoch keine Bewertungen

- RMC 35-06Dokument18 SeitenRMC 35-06Aris Basco DuroyNoch keine Bewertungen

- Assured Savings Plan 1Dokument12 SeitenAssured Savings Plan 1DnGNoch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument3 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceGirithar M SundaramNoch keine Bewertungen

- ZZZZDokument109 SeitenZZZZnikhils88Noch keine Bewertungen

- Second Edition (Re-Print)Dokument262 SeitenSecond Edition (Re-Print)Deepak DubeyNoch keine Bewertungen

- BCD 4 Design and Build With Schedule of Contract AmendmentsDokument45 SeitenBCD 4 Design and Build With Schedule of Contract AmendmentstsuakNoch keine Bewertungen

- Personal Accident Insurance - POLMBKBA82EFIJBDokument3 SeitenPersonal Accident Insurance - POLMBKBA82EFIJBGiridharan VenkateshNoch keine Bewertungen

- Articles of AgreementDokument2 SeitenArticles of AgreementMd Rajikul IslamNoch keine Bewertungen

- Kalviseithi - 6,7,8 Lesson Plan Term 2 - All Subject PDFDokument220 SeitenKalviseithi - 6,7,8 Lesson Plan Term 2 - All Subject PDFJalagandeeswaran KalimuthuNoch keine Bewertungen

- Difference Between Bill of Exchange and Cheque - CheckDokument2 SeitenDifference Between Bill of Exchange and Cheque - Checkksumukh86Noch keine Bewertungen

- Negotiable Instrument Case DigestsDokument47 SeitenNegotiable Instrument Case DigestsJerick Bambi SadernasNoch keine Bewertungen

- Mortgage - S. 58 TPADokument3 SeitenMortgage - S. 58 TPAAbhinav SrivastavNoch keine Bewertungen

- Card Holder Dispute FormDokument1 SeiteCard Holder Dispute Formcool3420Noch keine Bewertungen

- Avenir 022011monthlyreportDokument2 SeitenAvenir 022011monthlyreportchicku76Noch keine Bewertungen

- Accounting Fraud: A Study On Sonali Bank Limited (Hallmark) ScamDokument42 SeitenAccounting Fraud: A Study On Sonali Bank Limited (Hallmark) Scammunatasneem94% (17)

- Ethics Jamuna BankDokument25 SeitenEthics Jamuna BankAl HasanNoch keine Bewertungen

- Nationwide Junior ISA Ts and CsDokument4 SeitenNationwide Junior ISA Ts and CsSpartacus UkinNoch keine Bewertungen

- ICICI Prudential Life Insurance CompanyDokument6 SeitenICICI Prudential Life Insurance CompanyRamandeep Singh ThindNoch keine Bewertungen

- Financial Control of Public FundsDokument136 SeitenFinancial Control of Public FundsDavid Abbam AdjeiNoch keine Bewertungen

- EL-1104 Wiring Diagram PTM, PUTR PKG.R2Dokument1 SeiteEL-1104 Wiring Diagram PTM, PUTR PKG.R2Muh FarhanNoch keine Bewertungen

- Member List Derivatives NYSE LiffeDokument15 SeitenMember List Derivatives NYSE LiffeNathan FergusonNoch keine Bewertungen

- Merchant BankingDokument43 SeitenMerchant BankingAbhishek Sanghvi100% (1)

- Employment Offer 'Salahudin'Dokument6 SeitenEmployment Offer 'Salahudin'knight1729Noch keine Bewertungen

- Loro Parque Killer Whale Facility Service & Loan Agreement - Formerly ConfidentialDokument41 SeitenLoro Parque Killer Whale Facility Service & Loan Agreement - Formerly ConfidentialJeffrey Ventre MD DC100% (1)

- December 2023 1Dokument41 SeitenDecember 2023 1rs5002595Noch keine Bewertungen

- Chapter 10Dokument32 SeitenChapter 10Josua Mondol80% (5)

- Bank ReconciliationDokument3 SeitenBank ReconciliationBianca Jane GaayonNoch keine Bewertungen

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyVon EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyBewertung: 5 von 5 Sternen5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantVon EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantBewertung: 4 von 5 Sternen4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Von EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Bewertung: 5 von 5 Sternen5/5 (89)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassVon EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNoch keine Bewertungen

- Happy Go Money: Spend Smart, Save Right and Enjoy LifeVon EverandHappy Go Money: Spend Smart, Save Right and Enjoy LifeBewertung: 5 von 5 Sternen5/5 (4)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsVon EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNoch keine Bewertungen

- How to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsVon EverandHow to Pay Zero Taxes, 2020-2021: Your Guide to Every Tax Break the IRS AllowsNoch keine Bewertungen

- The Best Team Wins: The New Science of High PerformanceVon EverandThe Best Team Wins: The New Science of High PerformanceBewertung: 4.5 von 5 Sternen4.5/5 (31)

- How To Budget And Manage Your Money In 7 Simple StepsVon EverandHow To Budget And Manage Your Money In 7 Simple StepsBewertung: 5 von 5 Sternen5/5 (4)

- Money Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasVon EverandMoney Management: An Essential Guide on How to Get out of Debt and Start Building Financial Wealth, Including Budgeting and Investing Tips, Ways to Save and Frugal Living IdeasBewertung: 3 von 5 Sternen3/5 (1)

- Improve Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouVon EverandImprove Money Management by Learning the Steps to a Minimalist Budget: Learn How To Save Money, Control Your Personal Finances, Avoid Consumerism, Invest Wisely And Spend On What Matters To YouBewertung: 5 von 5 Sternen5/5 (5)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationVon EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationBewertung: 4.5 von 5 Sternen4.5/5 (18)

- Summary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamVon EverandSummary of You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You Want by Jesse MechamBewertung: 5 von 5 Sternen5/5 (1)

- Sacred Success: A Course in Financial MiraclesVon EverandSacred Success: A Course in Financial MiraclesBewertung: 5 von 5 Sternen5/5 (15)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Von EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Bewertung: 3.5 von 5 Sternen3.5/5 (9)

- Smart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestVon EverandSmart, Not Spoiled: The 7 Money Skills Kids Must Master Before Leaving the NestBewertung: 5 von 5 Sternen5/5 (1)

- The New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningVon EverandThe New York Times Pocket MBA Series: Forecasting Budgets: 25 Keys to Successful PlanningBewertung: 4.5 von 5 Sternen4.5/5 (8)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsVon EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsBewertung: 4 von 5 Sternen4/5 (4)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesVon EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesBewertung: 4.5 von 5 Sternen4.5/5 (30)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Von EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Bewertung: 4 von 5 Sternen4/5 (34)

- Buy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeVon EverandBuy the Milk First: ... and Other Secrets to Financial Prosperity, Regardless of Your IncomeNoch keine Bewertungen

- Money Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayVon EverandMoney Management: The Ultimate Guide to Budgeting, Frugal Living, Getting out of Debt, Credit Repair, and Managing Your Personal Finances in a Stress-Free WayBewertung: 3.5 von 5 Sternen3.5/5 (2)

- How to Save Money: 100 Ways to Live a Frugal LifeVon EverandHow to Save Money: 100 Ways to Live a Frugal LifeBewertung: 5 von 5 Sternen5/5 (1)

- Altcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesVon EverandAltcoins Coins The Future is Now Enjin Dogecoin Polygon Matic Ada: blockchain technology seriesBewertung: 5 von 5 Sternen5/5 (1)

- Bitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyVon EverandBitcoin Secrets Revealed - The Complete Bitcoin Guide To Buying, Selling, Mining, Investing And Exchange Trading In Bitcoin CurrencyBewertung: 4 von 5 Sternen4/5 (4)

- 109 Personal Finance Tips: Things you Should Have Learned in High SchoolVon Everand109 Personal Finance Tips: Things you Should Have Learned in High SchoolNoch keine Bewertungen