Beruflich Dokumente

Kultur Dokumente

Daily Market Watch - 10 12 2014 PDF

Hochgeladen von

Randora LkOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Daily Market Watch - 10 12 2014 PDF

Hochgeladen von

Randora LkCopyright:

Verfügbare Formate

DAILY MARKET WATCH

First Capital Research

December 10, 2014

MARKET INDICES

ASPI

S&P SL20

7,260

7,250

7,240

7,230

7,220

7,210

7,200

7,190

4,090

4,080

Foreign - 24%

7,254.28

4,083.41

7,217.94

4,063.70

0.50%

0.49%

Turnover (LKR 'Mn)

1,060.78

790.66

34.16%

43.99

20.05

119.39%

3,082.61

3,067.16

0.50%

4,050

Market Cap. (USD 'Bn)

23.53

23.41

0.50%

206

217

-5.07%

Foreign Purchases (LKR 'Mn)

Foreign Sales (LKR 'Mn)

166.32

333.07

344.04

450.86

-51.66%

-26.13%

Net Foreign Inflow (LKR 'Mn)

-166.74

-106.82

-56.10%

120

Traded Companies

MTD Net Foreign Flow (LKR 'Mn)

1,200.55

YTD Net Foreign Flow (LKR 'Mn)

21,475.94

100

2,000

1,500

1,000

80

MARKET COMMENTARY

60

Despite a slow start to the day, the ASPI continued to rise, supported by gains

in large cap counters including JKH and Hemas to close at 7,254 (+36 points).

Market turnover recovered to LKR 1.0bn on improved volumes. Foreign

activity slowed for the second consecutive day with foreign selling falling 26%

and foreign buying activity declining by 52% resulting in net foreign outflow of

LKR 167mn. Janashakthi Insurance saw a crossing of 11.4mn shares at LKR

23.00 followed by a block trade of 2.0mn shares of Seylan Bank(X) at LKR

95.00.

40

500

20

Turnover

Volume

NET FOREIGN FLOW

ESTIMATED LARGEST FOREIGN FLOW

('Mn)

200

150

100

50

0

-50

-100

-150

-200

ASPI

S&P SL20

Market Cap. (LKR 'Bn)

Volume

2,500

Change (%)

Volume ('Mn)

S&P SL20

Domestic - 76%,

Previous

4,060

MARKET TURNOVER & VOLUME

Turnover ('Mn)

Today

4,070

4,040

ASPI

MARKET PERFORMANCE

JINS

HNB (X)

EXPO

SAMP

SEYB (X)

DIST

AEL

HHL

COMB

JKH

165

143

55

-107

-167

-262

-300

Net FII

TOP 5 GAINERS

RADIANT GEMS

AMANA TAKAFUL

SERENDIB ENG.GRP

MACKWOODS ENERGY

LANKA CEMENT

TOP 5 TURNOVER

-15

-4

-3

-3

7

10

11

23

76

-200

-100

100

Estimated Value (LKR 'Mn)

Today

Previous

54.90

49.00

2.00

1.80

93.80

86.50

6.60

6.10

7.00

Price

6.50

Change (%)

TOP 5 LOSERS

12.04% PC HOUSE

Today

Previous

Change (%)

0.20

0.30

-33.33%

116.60

129.90

-10.24%

8.44% SAMSON INTERNAT.

100.00

111.40

-10.23%

8.20% LANKA ALUMINIUM

52.00

57.90

-10.19%

11.11% MERC. SHIPPING

7.69% MULLERS

Volume

Turnover

('Mn)

('Mn)

TOP 5 VOLUME

1.60

Price

1.70

-5.88%

Volume

Turnover

('Mn)

('Mn)

JANASHAKTHI INS.

23.20

12.2

281.74 JANASHAKTHI INS.

23.20

12.2

281.74

SEYLAN BANK

93.20

2.1

195.77 AMANA TAKAFUL

2.00

10.8

20.74

JKH

254.20

0.4

108.90 ASIA ASSET

2.00

2.6

4.95

DISTILLERIES

205.50

0.3

51.41 PANASIAN POWER

2.80

2.3

6.38

SAMPATH

235.90

0.2

44.13 SEYLAN BANK

93.20

2.1

195.77

First Capital Equities (Pvt) Ltd

No.1, Lake Crescent,

Colombo 2

Sales Desk:

+94 11 2145 000

Fax:

+94 11 2145 050

HEAD OFFICE

BRANCHES

No.1, Lake Crescent,

Matara

Negombo

Colombo 2

No. 24, Mezzanine Floor,

No.72A, 2/1,

Sales Desk:

+94 11 2145 000 E.H. Cooray Building,

Old Chilaw Road,

Fax:

+94 11 2145 050 Anagarika Dharmapala Mw,

Negombo

Matara

Tel:

+94 41 2237 636

Tel:

Jaliya Wijeratne

+94 71 5329 602

Negombo

SALES

+94 31 2233 299

BRANCHES

CEO

Priyanka Anuruddha

+94 76 6910 035

Priyantha Wijesiri

+94 76 6910 036

Colombo

Nishantha Mudalige

+94 76 6910 041

Matara

Anushka Buddhika

+94 77 9553 613

Sumeda Jayawardana

+94 76 6910 038

Gamini Hettiarachchi

+94 76 6910 039

Thushara Abeyratne

+94 76 6910 037

Nishani Prasangi

+94 76 6910 033

Ishanka Wickramanayaka

+94 77 7611 200

RESEARCH

Dimantha Mathew

+94 11 2145 016

Reshan Wediwardana

+94 11 2145 017

Nandika Fonseka

+94 11 2145 018

FIRST CAPITAL GROUP

HEAD OFFICE

BRANCHES

No. 2, Deal Place,

Matara

Kurunegala

Kandy

Colombo 3

No. 24, Mezzanine Floor,

No. 6, 1st Floor,

No.213-215,

Tel:

E.H. Cooray Building,

Union Assurance Building,

Peradeniya Road,

Anagarika Dharmapala Mawatha,

Rajapihilla Mawatha,

Kandy

Matara

Kurunegala

+94 11 2576 878

Tel:

+94 41 2222 988

Tel:

+94 37 2222 930

Tel:

+94 81 2236 010

Disclaimer:

This Review is prepared and issued by First Capital Equities (Pvt) Ltd. based on information in the public domain, internally developed and other sources, believed to be

correct. Although all reasonable care has been taken to ensure the contents of the Review are accurate, First Capital Equities (Pvt) Ltd and/or its Directors,

employees, are not responsible for the correctness, usefulness, reliability of same. First Capital Equities (Pvt) Ltd may act as a Broker in the investments which are the

subject of this document or related investments and may have acted on or used the information contained in this document, or the research or analysis on which it is

based, before its publication. First Capital Equities (Pvt) Ltd and/or its principal, their respective Directors, or Employees may also have a position or be otherwise interested

in the investments referred to in this document. This is not an offer to sell or buy the investments referred to in this document. This Review may contain data which are

inaccurate and unreliable. You hereby waive irrevocably any rights or remedies in law or equity you have or may have against First Capital Equities (Pvt) Ltd with respect to

the Review and agree to indemnify and hold First Capital Equities (Pvt) Ltd and/or its principal, their respective directors and employees harmless to the fullest extent

allowed by law regarding all matters related to your use of this Review. No part of this document may be reproduced, distributed or published in whole or in part by any

means to any other person for any purpose without prior permission.

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Global Market Update - 04 09 2015 PDFDokument6 SeitenGlobal Market Update - 04 09 2015 PDFRandora LkNoch keine Bewertungen

- Weekly Update 04.09.2015 PDFDokument2 SeitenWeekly Update 04.09.2015 PDFRandora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDokument4 SeitenWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkNoch keine Bewertungen

- Wei 20150904 PDFDokument18 SeitenWei 20150904 PDFRandora LkNoch keine Bewertungen

- 03 September 2015 PDFDokument9 Seiten03 September 2015 PDFRandora LkNoch keine Bewertungen

- Press 20150831ebDokument2 SeitenPress 20150831ebRandora LkNoch keine Bewertungen

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDokument3 SeitenICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkNoch keine Bewertungen

- Daily 01 09 2015 PDFDokument4 SeitenDaily 01 09 2015 PDFRandora LkNoch keine Bewertungen

- Press 20150831ea PDFDokument1 SeitePress 20150831ea PDFRandora LkNoch keine Bewertungen

- Global Market Update - 04 09 2015 PDFDokument6 SeitenGlobal Market Update - 04 09 2015 PDFRandora LkNoch keine Bewertungen

- CCPI - Press Release - August2015 PDFDokument5 SeitenCCPI - Press Release - August2015 PDFRandora LkNoch keine Bewertungen

- Sri0Lanka000Re0ounting0and0auditing PDFDokument44 SeitenSri0Lanka000Re0ounting0and0auditing PDFRandora LkNoch keine Bewertungen

- Results Update Sector Summary - Jun 2015 PDFDokument2 SeitenResults Update Sector Summary - Jun 2015 PDFRandora LkNoch keine Bewertungen

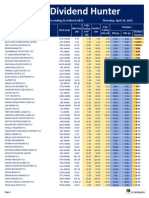

- Dividend Hunter - Apr 2015 PDFDokument7 SeitenDividend Hunter - Apr 2015 PDFRandora LkNoch keine Bewertungen

- Earnings & Market Returns Forecast - Jun 2015 PDFDokument4 SeitenEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkNoch keine Bewertungen

- Earnings Update March Quarter 2015 05 06 2015 PDFDokument24 SeitenEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkNoch keine Bewertungen

- BRS Monthly (March 2015 Edition) PDFDokument8 SeitenBRS Monthly (March 2015 Edition) PDFRandora LkNoch keine Bewertungen

- Results Update For All Companies - Jun 2015 PDFDokument9 SeitenResults Update For All Companies - Jun 2015 PDFRandora LkNoch keine Bewertungen

- Dividend Hunter - Mar 2015 PDFDokument7 SeitenDividend Hunter - Mar 2015 PDFRandora LkNoch keine Bewertungen

- Daily - 23 04 2015 PDFDokument4 SeitenDaily - 23 04 2015 PDFRandora LkNoch keine Bewertungen

- Dividend Hunter - Mar 2015 PDFDokument7 SeitenDividend Hunter - Mar 2015 PDFRandora LkNoch keine Bewertungen

- Microfinance Regulatory Model PDFDokument5 SeitenMicrofinance Regulatory Model PDFRandora LkNoch keine Bewertungen

- GIH Capital Monthly - Mar 2015 PDFDokument11 SeitenGIH Capital Monthly - Mar 2015 PDFRandora LkNoch keine Bewertungen

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDokument12 SeitenCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkNoch keine Bewertungen

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDokument9 SeitenJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkNoch keine Bewertungen

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Dokument5 SeitenN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkNoch keine Bewertungen

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDokument9 SeitenChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkNoch keine Bewertungen

- The Morality of Capitalism Sri LankiaDokument32 SeitenThe Morality of Capitalism Sri LankiaRandora LkNoch keine Bewertungen

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDokument4 SeitenWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkNoch keine Bewertungen

- Daily Stock Watch 08.04.2015 PDFDokument9 SeitenDaily Stock Watch 08.04.2015 PDFRandora LkNoch keine Bewertungen

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (890)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (587)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (265)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (119)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Summer Training Report On HCLDokument60 SeitenSummer Training Report On HCLAshwani BhallaNoch keine Bewertungen

- Rubrics For Lab Report For PC1 Lab, PC2 Lab, CIC LabDokument4 SeitenRubrics For Lab Report For PC1 Lab, PC2 Lab, CIC LabHunie PopNoch keine Bewertungen

- Ubaf 1Dokument6 SeitenUbaf 1ivecita27Noch keine Bewertungen

- Integrated Project Management in SAP With Noveco EPMDokument34 SeitenIntegrated Project Management in SAP With Noveco EPMrajesh_das3913Noch keine Bewertungen

- Capital Asset Pricing ModelDokument11 SeitenCapital Asset Pricing ModelrichaNoch keine Bewertungen

- Delem: Installation Manual V3Dokument73 SeitenDelem: Installation Manual V3Marcus ChuaNoch keine Bewertungen

- JEdwards PaperDokument94 SeitenJEdwards PaperHassan Hitch Adamu LafiaNoch keine Bewertungen

- Social Vulnerability Index Helps Emergency ManagementDokument24 SeitenSocial Vulnerability Index Helps Emergency ManagementDeden IstiawanNoch keine Bewertungen

- Chap1 7Dokument292 SeitenChap1 7Zorez ShabkhezNoch keine Bewertungen

- Term Paper Mec 208Dokument20 SeitenTerm Paper Mec 208lksingh1987Noch keine Bewertungen

- Tutorial 2 EOPDokument3 SeitenTutorial 2 EOPammarNoch keine Bewertungen

- Math30.CA U1l1 PolynomialFunctionsDokument20 SeitenMath30.CA U1l1 PolynomialFunctionsUnozxcv Doszxc100% (1)

- Online and Payment SecurityDokument14 SeitenOnline and Payment SecurityVanezz UchihaNoch keine Bewertungen

- Day / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Dokument4 SeitenDay / Month / Year: Certificate of No Criminal Conviction Applicant Data Collection Form (LOCAL)Lhea RecenteNoch keine Bewertungen

- Infineon ICE3BXX65J DS v02 - 09 en PDFDokument28 SeitenInfineon ICE3BXX65J DS v02 - 09 en PDFcadizmabNoch keine Bewertungen

- AGE-WELL Annual Report 2021-2022Dokument31 SeitenAGE-WELL Annual Report 2021-2022Alexandra DanielleNoch keine Bewertungen

- Naoh Storage Tank Design Description:: Calculations For Tank VolumeDokument6 SeitenNaoh Storage Tank Design Description:: Calculations For Tank VolumeMaria Eloisa Angelie ArellanoNoch keine Bewertungen

- MatrikonOPC Server For Simulation Quick Start Guide PDFDokument2 SeitenMatrikonOPC Server For Simulation Quick Start Guide PDFJorge Perez CastañedaNoch keine Bewertungen

- Supplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDokument8 SeitenSupplement - 7 Procurement Manual: Democratic Socialist Republic of Sri LankaDinuka MalinthaNoch keine Bewertungen

- PROTON Preve 2012 On 4 DR Sal 1.6 Premium (CFE) AUTO 138Bhp (A) (04/12-)Dokument12 SeitenPROTON Preve 2012 On 4 DR Sal 1.6 Premium (CFE) AUTO 138Bhp (A) (04/12-)bluhound1Noch keine Bewertungen

- SS Corrosion SlidesDokument36 SeitenSS Corrosion SlidesNathanianNoch keine Bewertungen

- 2011 REV SAE Suspension Kiszco PDFDokument112 Seiten2011 REV SAE Suspension Kiszco PDFRushik KudaleNoch keine Bewertungen

- ENY1-03-0203-M UserDokument101 SeitenENY1-03-0203-M UserAnil KumarNoch keine Bewertungen

- Steam Turbine and Governor (SimPowerSystems)Dokument5 SeitenSteam Turbine and Governor (SimPowerSystems)hitmancuteadNoch keine Bewertungen

- Readiness of Barangay Masalukot During TyphoonsDokument34 SeitenReadiness of Barangay Masalukot During TyphoonsJerome AbrigoNoch keine Bewertungen

- Coronary artery diseases reviewDokument43 SeitenCoronary artery diseases reviewKeputrian FKUPNoch keine Bewertungen

- LogDokument85 SeitenLogJo NasNoch keine Bewertungen

- Potential Land Suitability For TeaDokument26 SeitenPotential Land Suitability For TeaGautam NatrajanNoch keine Bewertungen

- Offer Letter For Marketing ExecutivesDokument2 SeitenOffer Letter For Marketing ExecutivesRahul SinghNoch keine Bewertungen

- SM 2021 MBA Assignment Forecasting InstructionsDokument3 SeitenSM 2021 MBA Assignment Forecasting InstructionsAmit Anand KumarNoch keine Bewertungen