Beruflich Dokumente

Kultur Dokumente

QS15 - Class Exercises Solution

Hochgeladen von

lyk0texCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

QS15 - Class Exercises Solution

Hochgeladen von

lyk0texCopyright:

Verfügbare Formate

Accounting 225 Quiz Section #15

Chapter 12-2 Class Exercises Solution

SPECIAL ORDERS

1. Julison Company produces a single product. The cost of producing and selling a single unit of

this product at the company's normal activity level of 60,000 units per month is as follows:

The normal selling price of the product is $79.80 per unit.

An order has been received from an overseas customer for 2,000 units to be delivered this month

at a special discounted price. This order would have no effect on the company's normal sales and

would not change the total amount of the company's fixed costs. The variable selling and

administrative expense would be $0.30 less per unit on this order than on normal sales. Direct

labor is a variable cost in this company.

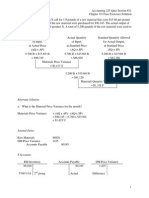

a) Suppose there is ample idle capacity to produce the units required by the overseas customer

and the special discounted price on the special order is $71.60 per unit. By how much would

this special order increase (decrease) the company's net operating income for the month?

Accounting 225 Quiz Section #15

Chapter 12-2 Class Exercises Solution

b) Suppose the company is already operating at capacity when the special order is received from

the overseas customer. What would be the opportunity cost of each unit delivered to the

overseas customer?

c) Suppose there is not enough idle capacity to produce all of the units for the overseas

customer and accepting the special order would require cutting back on production of 700

units for regular customers. What would be the minimum acceptable price per unit for the

special order?

Accounting 225 Quiz Section #15

Chapter 12-2 Class Exercises Solution

ULTILIZATION OF CONSTRAINED RESOURCES

2. Gloster Company makes three products in a single facility. These products have the following

unit product costs:

The mixing machines are potentially the constraint in the production facility. A total of 27,400

minutes are available per month on these machines. Direct labor is a variable cost in this

company.

a) How many minutes of mixing machine time would be required to satisfy demand for all three

products?

b. How much of each product should be produced to maximize net operating income? (Round off

to the nearest whole unit.)

Accounting 225 Quiz Section #15

Chapter 12-2 Class Exercises Solution

c. Up to how much should the company be willing to pay for one additional hour of mixing

machine time if the company has made the best use of the existing mixing machine capacity?

(Round off to the nearest whole cent.)

The company should be willing to pay up to the contribution margin per minute for the marginal

job, which is $4.59.

Accounting 225 Quiz Section #15

Chapter 12-2 Class Exercises Solution

SELL OR PROCESS FURTHER

3. Iacollia Company makes two products from a common input. Joint processing costs up to the

split-off point total $47,600 a year. The company allocates these costs to the joint products on the

basis of their total sales values at the split-off point. Each product may be sold at the split-off

point or processed further. Data concerning these products appear below:

a) What is the net monetary advantage (disadvantage) of processing Product X and Product Y

beyond the split-off point?

b) What is the minimum amount the company should accept for Product X and Product Y if it is

to be sold at the split-off point?

Das könnte Ihnen auch gefallen

- Practice 2Dokument2 SeitenPractice 2Ahmer ChaudhryNoch keine Bewertungen

- Practice 2 SolDokument9 SeitenPractice 2 SolAhmer ChaudhryNoch keine Bewertungen

- Sol Ass7Dokument6 SeitenSol Ass7marcus yapNoch keine Bewertungen

- Docx 1Dokument10 SeitenDocx 1Anna Marie AlferezNoch keine Bewertungen

- Tutorial - Differential Analysis - Decision MakingDokument5 SeitenTutorial - Differential Analysis - Decision MakingHarraz IyadNoch keine Bewertungen

- Case Study On Standard Costing and CVP AnalysisDokument3 SeitenCase Study On Standard Costing and CVP AnalysisEmmanuel VillafuerteNoch keine Bewertungen

- BUSI 354 - CHDokument4 SeitenBUSI 354 - CHBarbara SlavovNoch keine Bewertungen

- Exam161 10Dokument7 SeitenExam161 10Rabah ElmasriNoch keine Bewertungen

- SESSION 6 - Chapter 14Dokument8 SeitenSESSION 6 - Chapter 14Malefa TsoeneNoch keine Bewertungen

- Incremental Analysis 2Dokument12 SeitenIncremental Analysis 2enter_sas100% (1)

- Assignment 1Dokument5 SeitenAssignment 1kamrulkawserNoch keine Bewertungen

- 6e Brewer CH03 B EOCDokument10 Seiten6e Brewer CH03 B EOCLiyanCenNoch keine Bewertungen

- Exam 21082011Dokument8 SeitenExam 21082011Rabah ElmasriNoch keine Bewertungen

- F2 MockDokument23 SeitenF2 MockH Hafiz Muhammad AbdullahNoch keine Bewertungen

- QS14 - Class Exercises SolutionDokument4 SeitenQS14 - Class Exercises Solutionlyk0tex100% (1)

- Week 3 Assignment 3 QuizDokument7 SeitenWeek 3 Assignment 3 QuizTonya Johnson Jenkins100% (1)

- CVP ProblemsDokument4 SeitenCVP ProblemsJosh KempNoch keine Bewertungen

- Revison Class StudentDokument11 SeitenRevison Class StudentÁi Mỹ DuyênNoch keine Bewertungen

- ABC QuestionsDokument14 SeitenABC QuestionsLara Lewis Achilles0% (1)

- Cost Accounting - Final Exam QuestionsDokument6 SeitenCost Accounting - Final Exam QuestionsBo RaeNoch keine Bewertungen

- 2 5370806713307890464 PDFDokument5 Seiten2 5370806713307890464 PDFMekuriawAbebawNoch keine Bewertungen

- HW 2.2 Afm SendDokument10 SeitenHW 2.2 Afm SendAbiodun OlokodanaNoch keine Bewertungen

- Mid Assignment - ACT 202Dokument4 SeitenMid Assignment - ACT 202ramisa tasrimNoch keine Bewertungen

- Coma Quiz 6 KeyDokument20 SeitenComa Quiz 6 KeyMD TARIQUE NOORNoch keine Bewertungen

- Relevant Costs For Decision Making: Topic Six & SevenDokument53 SeitenRelevant Costs For Decision Making: Topic Six & Sevendanial haziqNoch keine Bewertungen

- Additional FINAL ReviewDokument41 SeitenAdditional FINAL ReviewMandeep SinghNoch keine Bewertungen

- Day 17 Chap 10 Rev. FI5 Ex PRDokument13 SeitenDay 17 Chap 10 Rev. FI5 Ex PRFyaj Rohan100% (1)

- Break Even Analysis-20!1!222Dokument7 SeitenBreak Even Analysis-20!1!222Zubair JuttNoch keine Bewertungen

- Homework AssignmentDokument11 SeitenHomework AssignmentHenny DeWillisNoch keine Bewertungen

- Practice 3 SolDokument6 SeitenPractice 3 SolAhmer ChaudhryNoch keine Bewertungen

- QS02 - Class ExercisesDokument3 SeitenQS02 - Class Exerciseslyk0texNoch keine Bewertungen

- Cga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursDokument18 SeitenCga-Canada Management Accounting Fundamentals (Ma1) Examination March 2014 Marks Time: 3 HoursasNoch keine Bewertungen

- Chap-10-Relevant CostingDokument6 SeitenChap-10-Relevant CostingMd. Mostafijur RahmanNoch keine Bewertungen

- Extra Relevant Cost QuestionsDokument5 SeitenExtra Relevant Cost QuestionsΧριστόςκύριοςNoch keine Bewertungen

- Chapter 7 ProblemsDokument4 SeitenChapter 7 ProblemsZyraNoch keine Bewertungen

- Managerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Test Bank Full Chapter PDFDokument67 SeitenManagerial Accounting An Introduction To Concepts Methods and Uses 11Th Edition Maher Test Bank Full Chapter PDFKimberlyLinesrb100% (12)

- MAS UTd Practice Exam 3 PDFDokument15 SeitenMAS UTd Practice Exam 3 PDFJEP WalwalNoch keine Bewertungen

- Exam189 10Dokument6 SeitenExam189 10Rabah ElmasriNoch keine Bewertungen

- Exam 1 Review ProblemsDokument3 SeitenExam 1 Review ProblemsFredie LeeNoch keine Bewertungen

- Trắc NghiệmDokument50 SeitenTrắc NghiệmNGÂN CAO NGUYỄN HOÀNNoch keine Bewertungen

- CapacityDokument3 SeitenCapacityQuang Ta MinhNoch keine Bewertungen

- 3.7.3 Principal Budget FactorDokument4 Seiten3.7.3 Principal Budget Factorericmhike8Noch keine Bewertungen

- Chartered University College: Cat Paper 2Dokument17 SeitenChartered University College: Cat Paper 2Mohsena MunnaNoch keine Bewertungen

- 305 Final Exam Cram Question PackageDokument14 Seiten305 Final Exam Cram Question PackageGloriana FokNoch keine Bewertungen

- Exam161 10Dokument7 SeitenExam161 10patelp4026Noch keine Bewertungen

- Relevant Cost For Decision Making-ProblemDokument4 SeitenRelevant Cost For Decision Making-Problembiwithse7enNoch keine Bewertungen

- BADM 2010 Chapter 12 - Lecture Discussion Problem 1 - CLDokument3 SeitenBADM 2010 Chapter 12 - Lecture Discussion Problem 1 - CLKaviya KuganNoch keine Bewertungen

- 106fex 2nd Sem 21 22Dokument9 Seiten106fex 2nd Sem 21 22Trine De LeonNoch keine Bewertungen

- Chapter 7. KeyDokument8 SeitenChapter 7. KeyHuy Hoàng PhanNoch keine Bewertungen

- Battle Creek Storage Systems Budgeted The Following Factory OverDokument1 SeiteBattle Creek Storage Systems Budgeted The Following Factory OverAmit PandeyNoch keine Bewertungen

- General Instructions: Provide The Answer For Each of The Following QuestionsDokument3 SeitenGeneral Instructions: Provide The Answer For Each of The Following QuestionsShe Rae PalmaNoch keine Bewertungen

- Incremental Costing ProblemDokument8 SeitenIncremental Costing ProblemJessica Faith Ignacio EstacioNoch keine Bewertungen

- CVP AnalysisDokument5 SeitenCVP AnalysisAnne BacolodNoch keine Bewertungen

- MA2 (100 QS)Dokument30 SeitenMA2 (100 QS)Alina NaeemNoch keine Bewertungen

- Productivity CompressDokument10 SeitenProductivity CompresstayerNoch keine Bewertungen

- Mock 1Dokument12 SeitenMock 1Mohsena MunnaNoch keine Bewertungen

- Exam 19111Dokument6 SeitenExam 19111atallah97Noch keine Bewertungen

- Cost & Managerial Accounting II EssentialsVon EverandCost & Managerial Accounting II EssentialsBewertung: 4 von 5 Sternen4/5 (1)

- Takt Time: A Guide to the Very Basic Lean CalculationVon EverandTakt Time: A Guide to the Very Basic Lean CalculationBewertung: 5 von 5 Sternen5/5 (2)

- QS14 - Class ExercisesDokument4 SeitenQS14 - Class Exerciseslyk0texNoch keine Bewertungen

- QS17 - Class ExercisesDokument4 SeitenQS17 - Class Exerciseslyk0texNoch keine Bewertungen

- QS16 - Class Exercises SolutionDokument5 SeitenQS16 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS16 - Class ExercisesDokument5 SeitenQS16 - Class Exerciseslyk0texNoch keine Bewertungen

- QS15 - Class ExercisesDokument4 SeitenQS15 - Class Exerciseslyk0texNoch keine Bewertungen

- QS17 - Class Exercises SolutionDokument4 SeitenQS17 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS12 - Class ExercisesDokument2 SeitenQS12 - Class Exerciseslyk0texNoch keine Bewertungen

- QS13 - Class ExercisesDokument2 SeitenQS13 - Class Exerciseslyk0texNoch keine Bewertungen

- QS14 - Class Exercises SolutionDokument4 SeitenQS14 - Class Exercises Solutionlyk0tex100% (1)

- QS12 - Midterm 2 ReviewDokument5 SeitenQS12 - Midterm 2 Reviewlyk0texNoch keine Bewertungen

- QS12 - Midterm 2 Review SolutionDokument7 SeitenQS12 - Midterm 2 Review Solutionlyk0tex0% (1)

- QS06 - Class ExercisesDokument3 SeitenQS06 - Class Exerciseslyk0texNoch keine Bewertungen

- QS13 - Class Exercises SolutionDokument2 SeitenQS13 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS11 - Class ExercisesDokument5 SeitenQS11 - Class Exerciseslyk0texNoch keine Bewertungen

- QS08 - Class Exercises SolutionDokument5 SeitenQS08 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS10 - Class ExercisesDokument1 SeiteQS10 - Class Exerciseslyk0texNoch keine Bewertungen

- QS12 - Class Exercises SolutionDokument2 SeitenQS12 - Class Exercises Solutionlyk0tex100% (1)

- QS08 - Class ExercisesDokument4 SeitenQS08 - Class Exerciseslyk0texNoch keine Bewertungen

- QS10 - Class Exercises SolutionDokument2 SeitenQS10 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS09 - Class ExercisesDokument4 SeitenQS09 - Class Exerciseslyk0texNoch keine Bewertungen

- QS07 - Class ExercisesDokument8 SeitenQS07 - Class Exerciseslyk0texNoch keine Bewertungen

- QS07 - Class Exercises SolutionDokument8 SeitenQS07 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS09 - Class Exercises SolutionDokument4 SeitenQS09 - Class Exercises Solutionlyk0tex100% (1)

- QS11 - Class Exercises SolutionDokument8 SeitenQS11 - Class Exercises Solutionlyk0tex100% (2)

- QS06 - Class Exercises SolutionDokument2 SeitenQS06 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS05 - Class ExercisesDokument2 SeitenQS05 - Class Exerciseslyk0texNoch keine Bewertungen

- QS05 - Class Exercises SolutionDokument3 SeitenQS05 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS04 - Class Exercises SolutionDokument3 SeitenQS04 - Class Exercises Solutionlyk0texNoch keine Bewertungen

- QS04 - Class ExercisesDokument3 SeitenQS04 - Class Exerciseslyk0texNoch keine Bewertungen

- Group Assignment For EconometricsDokument2 SeitenGroup Assignment For EconometricsAmanuel Genet100% (2)

- The IS - LM CurveDokument28 SeitenThe IS - LM CurveVikku AgarwalNoch keine Bewertungen

- CRM Strategy-1Dokument12 SeitenCRM Strategy-1Adnan AhmedNoch keine Bewertungen

- Air India: Directors' ReportDokument8 SeitenAir India: Directors' ReportSachin NarayankarNoch keine Bewertungen

- Production of Bioplastic Products. Biodegradable and Bio-Plastics Products Manufacturing Business. Glasses, Plates and Bags Manufacturing Project.-207549 PDFDokument71 SeitenProduction of Bioplastic Products. Biodegradable and Bio-Plastics Products Manufacturing Business. Glasses, Plates and Bags Manufacturing Project.-207549 PDFPravin DixitNoch keine Bewertungen

- Forex MarketDokument33 SeitenForex MarketRiad TalukderNoch keine Bewertungen

- The Seminal Academic Paper On CarryDokument65 SeitenThe Seminal Academic Paper On CarryzorronguyenNoch keine Bewertungen

- Stigler-Economics of InformationDokument14 SeitenStigler-Economics of InformationMarcelo Mardones OsorioNoch keine Bewertungen

- Branch Accounting - ICMAIDokument51 SeitenBranch Accounting - ICMAIdbNoch keine Bewertungen

- Are Short Sellers Necessary?: MoneyDokument2 SeitenAre Short Sellers Necessary?: Moneynestor santamariaNoch keine Bewertungen

- Branch Less BankingDokument20 SeitenBranch Less BankingBinay KumarNoch keine Bewertungen

- RasnaDokument2 SeitenRasnaG S SreekiranNoch keine Bewertungen

- Olympic Inc. Variable Costing Income Statement For Year Ended August 31, 20Dokument6 SeitenOlympic Inc. Variable Costing Income Statement For Year Ended August 31, 20mohitgaba19Noch keine Bewertungen

- 99 SpeedDokument18 Seiten99 Speedhddanker0% (3)

- MAE 301: Applied Experimental StatisticsDokument10 SeitenMAE 301: Applied Experimental StatisticsmatthewNoch keine Bewertungen

- Accounting For DerivativesDokument42 SeitenAccounting For DerivativesSanath Fernando100% (1)

- Analysis of Financial StatementsDokument18 SeitenAnalysis of Financial StatementsnrsiddiquiNoch keine Bewertungen

- Business PlanDokument55 SeitenBusiness Plannazren700100% (2)

- Title 5 - Tourism Demand 2021Dokument36 SeitenTitle 5 - Tourism Demand 2021RAZIMIE BIN ASNUH -Noch keine Bewertungen

- Segmenting Cruise Passengers With Price Sensitivity: Article in PressDokument10 SeitenSegmenting Cruise Passengers With Price Sensitivity: Article in Pressnihat123Noch keine Bewertungen

- Salary Matrix... Compensation ManagementDokument2 SeitenSalary Matrix... Compensation ManagementUttara Shetye100% (2)

- No Demand: ServicesDokument2 SeitenNo Demand: ServicesJamilaNoch keine Bewertungen

- L FinancialinstrumentsDokument38 SeitenL FinancialinstrumentsManraj LidharNoch keine Bewertungen

- 17.-GCRO Top250 PG March2019Dokument214 Seiten17.-GCRO Top250 PG March2019Mikee Baliguat Tan100% (1)

- Al Barkat Flour Mill: Estimated Cost of LandDokument35 SeitenAl Barkat Flour Mill: Estimated Cost of LandSheIkh AbdullAhNoch keine Bewertungen

- Sample Aom - Bloated ABC-non-compliance With IRR ProvisionsDokument4 SeitenSample Aom - Bloated ABC-non-compliance With IRR Provisionsjaymark camacho100% (1)

- MAS PreweekDokument46 SeitenMAS PreweekJoy Bernadette GruesoNoch keine Bewertungen

- May 2021 Money LetterDokument26 SeitenMay 2021 Money LetterSoren K. GroupNoch keine Bewertungen

- The General EnvironmentDokument5 SeitenThe General EnvironmentLawal Idris AdesholaNoch keine Bewertungen

- Summary Guide For Chapter 11 Foundations of Australian Law: Fourth EditionDokument7 SeitenSummary Guide For Chapter 11 Foundations of Australian Law: Fourth EditionRishabhMishraNoch keine Bewertungen